Author: Ivan Ivanov

Overpayment of insurance premiums may occur in the event of an incorrect calculation or indication of an inappropriate amount in the payment order. To regulate such issues, the following regulations are provided:

- Federal Law of July 24, 2009 No. 212-FZ;

- Articles 18-23 and 25-27 No. 212-FZ.

Article 26 of the Federal Law states that overpayments for insurance premiums for compulsory health insurance, compulsory medical insurance, in the event of maternity, an accident at work or temporary disability, as well as penalties to the state budget, are subject to offset against future insurance accruals, repayment of debts for fines or refund in cash equivalent.

Thus, forms 21 and 22 are used to return an overpayment on a legal basis or take it into account for the purpose of paying future contributions. In addition, you need to understand how the credit is made and what the requirements for the forms are.

Reconciliation with the Pension Fund of Russia

To return the accrual, reconciliations with the fund are always required.

To do this, the head of the organization is recommended to contact the insurance premium administrator working at the Pension Fund, then the presence of arrears and the imposition of fines will be excluded. This reconciliation by the administrator is necessary for high-quality preparation of a report on the results of the year and mutual settlements with the Pension Fund. Payments are verified with the data of the Pension Fund in order to generate annual financial statements. This condition is a mandatory requirement for mutual settlements with him.

Before reconciling the contribution of the overpaid amount to the Pension Fund and the fund details, the insurer will need to request from this body either a certificate or information about the status of the settlement. Their difference lies in the fact that information about the status of the settlement includes a breakdown of incoming charges with a full breakdown of each contribution for a certain time period. The certificate and information about the account status contain information about the final indicators for calculations.

The essence of the project

The FSS pilot project was introduced by Decree of the Government of the Russian Federation dated April 21, 2011 No. 294 . It started in the Karachay-Cherkess Republic and the Nizhny Novgorod region, and now 33 regions are participating in it.

The essence of the Direct Payments project is as follows. Employers provide territorial branches of the Social Insurance Fund with registers of information that are necessary for calculating benefits. Payments to employees are made directly from the fund .

If the policyholder has 25 or more people, he is required to submit the register electronically using the TKS . Employers with fewer employees may also use this option. It is more convenient, since all changes to forms are reflected automatically in reporting services, and checks are also carried out using control ratios.

Thus, before sending the register via TKS, you can be sure that the document is submitted in the current format and has passed logical control.

How to check via the Internet

The traditional way to submit a request to the fund is to apply in person. At the Pension Fund of the Russian Federation, the head of the organization draws up a statement, the text of which states a request to provide one of the documents.

You can quickly obtain a certificate or information about your account status via the Internet. You can request a statement of contributions using an electronic digital signature (EDS). Then the required document in electronic form will be provided within 24 hours or the next business day if the request was sent on a weekend or holiday.

You can also request a document through your personal account on the official website of the Pension Fund. This requires registration. Having gained access to the history of their insurance premiums, the payer requests a document, which will also be received electronically during the business day.

After receiving the document and detecting overpayments or arrears, they begin a reconciliation carried out by the policyholder together with the insurer. As a result, a reconciliation act is formed, regulated by Federal Law No. 212-FZ. This document records information about accrued payments.

Why do you need an extract from the EIS?

The Pension Fund of Russia is the operator of the Unified Information System about the labor activity of citizens, which is the same electronic work books. Information in the UIS is formed on the basis of employers' reporting submitted to the PFR information system in the SZV-TD form for reporting periods starting from 01/01/2020. They are formed in reference mode not only in relation to those citizens who have announced the transition to electronic books, but also in relation to all other working citizens.

Information from this UIS is issued to citizens upon their request in the form of a special extract. The form is a complete document about work experience. Most often, it is required to present the STD-PFR when applying for a job, but it is also used for other purposes if it is necessary to confirm work experience for a certain period, for example, to register disability, receive benefits and other events where reliable information about work is necessary. Most of all, such data is needed by those citizens who have abandoned paper work experience books.

Offset of overpayment

After the Pension Fund employees receive an application for offset or return of the amount of money, as well as upon completion of the reconciliation and signature of the act, the offset period begins. The decision on a refund or credit is made within 10 working days from the date of:

- signing the reconciliation report;

- if this has not been carried out, receive an application for credit.

If the fund makes a positive decision, based on Articles 26 and 27 of Law No. 212-FZ, the amount is credited within 30 calendar days. If, after approving the application, the PRF has not returned the overpaid amount 30 days later, it will be possible to recover interest from this body, accrued daily at a refinancing rate of 1/300.

Also, upon approval of the application for offset, the enterprise can recover from the Pension Fund an amount in the amount of excess penalties and fines with interest at the same refinancing rate (1/300). But if a company has debts on these fines, it will first have to pay them, and then the Pension Fund of Russia will return the excess amount.

There may also be a case in an organization when an accountant made an error in the details, discovered it, compiled and paid for the correct report and submitted a letter to the bank. Then the organization overpays, and Social Insurance becomes a debtor.

The FSS informs the debtor of the discovery of an error after the expiration of the payment period for insurance payments within 10 working days. But it would be much better for the insurer not to wait for the fund to discover the error, but to independently contact the authorities and request a reconciliation.

When reconciliation is required

In 2021, mandatory reconciliation with the Federal Tax Service on taxes and insurance premiums is carried out in the following situations:

- when an organization or individual entrepreneur transfers from one Federal Tax Service Inspectorate to another;

- during liquidation (reorganization);

- at the initiative of an organization or individual entrepreneur;

- quarterly by commercial organizations - the largest taxpayers.

If the reconciliation is initiated by the tax authority, then for you participation in it is a right, not an obligation (clause 5.1, clause 1, article 21 of the Tax Code of the Russian Federation). We recommend that you accept the tax authority's offer to conduct a reconciliation. After all, reconciliation allows you to timely identify and dispose of overpayments, as well as detect errors and data discrepancies that otherwise may go unnoticed. Moreover, it is advisable to carry out reconciliation annually - at the end of the next year.

Test Rules

Each billing period is a calendar year, within which the offset is made.

For previous offsets in the current billing period, overpaid amounts are not refunded. Article 10 No. 212-FZ indicates the timing of the reporting and billing periods. One calculation report consists of four reports - not quarterly, but for 1 quarter, half a year, 9 months and a year. Interim reports are submitted to the FSS of the Russian Federation and the Pension Fund on a quarterly basis. If, after repaying the debt in the next quarter, the policyholder becomes the debtor, then the settlement period may extend until the end of the current year.

The amount of money is fully returned only after the policyholder has paid off all debts on fines and penalties. Money from the Social Insurance Fund is also returned by the territorial authority within 10 working days from the date of submission of the full package of documents, which is established by Article 4.6 No. 255-FZ. The amount is indicated in column 7 of Table 3 of the 4-FSS reporting.

Registration of results: act form

The tax office documents the results of the reconciliation with a special reconciliation act. For example, in 2021, the form of the act approved by order of the Federal Tax Service of Russia dated August 20, 2007 No. MM-3-25/494 was in force. This form consisted of a title page and two sections. The first section was intended for a brief reconciliation, and the second section for more specific information.

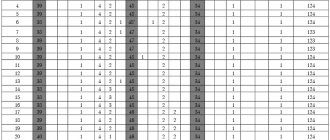

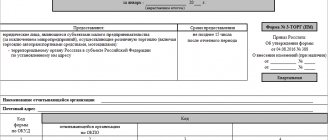

However, Order of the Federal Tax Service of Russia dated December 16, 2016 No. ММВ-7-17/685 approved a new form of the act of joint reconciliation of calculations for taxes, fees, insurance premiums, penalties, fines, and interest. The new form of the act is applied from January 27, 2021. After this date, tax authorities no longer have the right to issue a reconciliation report using the old form. The new form of the 2021 reconciliation report has the following composition:

- title page;

- section 1 (general data);

- section 2 (more detailed information based on the results of verification with the transcript).

This form continues to apply in 2021. No changes were made to it in 2021.

It was necessary to approve a new form of the reconciliation report due to the fact that from January 1, 2021, the tax authorities were transferred powers to administer insurance premiums. Therefore, in the reconciliation report form, a mention was made of insurance premiums, penalties and fines for them. Using the previous form of the act, it would simply be impossible to document the results of the reconciliation of contributions.

Below we present the officially approved form of the reconciliation report, using which in 2021 tax inspectorates are required to formalize the results of the reconciliation. Of course, it is not possible to provide a single and unified sample of a completed reconciliation report, since the data on taxes and contributions will be different in each specific case.

Requirements for forms

If a desk inspection report is required, its form is determined by the regulatory authorities. There are a number of requirements for it:

- the act is drawn up in Form 17-FSS;

- blots and corrections are not allowed in it;

- consists of introductory, descriptive and summary parts;

- details of the introductory part - number and date of drawing up the document, full name of the person who carried out the inspection, name of the regulatory body, insurer's organization or full name of the entrepreneur, registration number, Taxpayer Identification Number/KPP, address where the enterprise is located, period of the desk inspection, start and end date and list of provided documentation;

- in the descriptive part, information about the arrears and confirmation of a violation of the law during the inspection is recorded;

- the final report contains the conclusion of the supervisory authority, proposals for paying premiums or holding the insurer liable, changes in accounting documentation;

- signed by the insurer and the fund employees who conducted the inspection;

- each party receives 1 copy of the act;

- the fund has the right to group violations on the part of the insurer into tables, statements and other documents attached to the act.

There is no unified application form today, but each fund has a template according to which these documents are drawn up. If you do not know this, you can submit an application in any form.

A 4-FSS report is attached to the application, but the fund may require other documents depending on the type of benefit. In case of temporary disability, you will need a corresponding certificate from a medical institution.

List of policyholder documents required by the fund in case of pregnancy and childbirth:

- certificate of incapacity for work;

- application for leave due to pregnancy and childbirth;

- order;

- a one-time benefit for a woman registered in a maternity hospital or other medical center during pregnancy up to 3 months;

- child's birth certificate;

- certificate from the spouse’s place of work;

- EDV for child care.

How to fill out form 22-PFR yourself - in this video.

About the SP-21 form

The unified form SP-21 was compiled by the state for the milk production register. It was approved by Decree of the State Statistics Committee of September 29, 1997 No. 68. Since 2013, the form has become recommended for use, and before that it was mandatory. The new norm was introduced by Federal Law No. 402 “On Accounting” dated December 6, 2011. Companies have received the right to draw up forms of primary accounting documents to suit their needs, but they do not need to forget about the presence of mandatory primary details. They are listed in paragraph 2 of Art. 9 Federal Law No. 402-FZ.

For your information! In its accounting policy, the organization must specify what forms it will use in its work. This local norm must be reinforced by a special order from management.

With such freedom of choice, many companies and enterprises prefer to use unified forms. They are familiar to inspection authorities and contain all the necessary information for most organizations.

Filling samples

Some policyholders do not know how to fill out an application for a credit or refund of the overpaid amount. To understand how to do this, two cases should be considered:

- When the amount is offset by the policyholder, the company submits an application in Form 22-FSS.

- To return the overpayment of insurance premiums, an application is submitted in Form 23-FSS. Based on this document, a refund is made within 30 months from the date of submission.

Documents for download (free)

- Form 21-PFR

- Form 22-PFR

- Form 22-FSS

- Form 23-FSS

- Sample of filling out form 21-PFR

- Sample of filling out form 22-PFR

To simplify the process of resolving the issue of offset or return, the pension fund has developed and published samples of filling out the act and application.

Why do we need an act of joint reconciliation of calculations for insurance contributions to the Social Insurance Fund?

The reconciliation report for insurance premiums reflects the debt or overpayment, penalties and fines as of the date of reconciliation. It also indicates the amounts debited from the organization’s account, but not credited to the fund, and outstanding payments.

If discrepancies arise based on the results of the reconciliation, their reasons must be clarified. If the organization agrees with the differences, you can sign a reconciliation report for calculations of insurance premiums without disagreement and adjust the data in the accounting. If you do not agree, you should make a note in the act.

The debt that was discovered as a result of the reconciliation of insurance premiums should be repaid as soon as possible. Otherwise, penalties will be charged for each day of delay. But, if there are actually no arrears, they can be canceled.

For example, due to an incorrect BCC, payments were stuck in the unknown. The payment should be clarified, and if the fund does not reset the penalty, a recalculation can be achieved in court (resolution of the Ninth Arbitration Court of Appeal dated March 6, 2014 No. A14-9859 /2013).

Time frame for preparing the reconciliation report

The legislation does not establish specific deadlines within which Pension Fund employees must prepare a reconciliation report. Having received the reconciliation report from the Pension Fund employee, the company representative must indicate the date of actual receipt of the document. In addition, you should indicate the method in which the act was sent, for example, by mail or by personally receiving the form at the Pension Fund office.

Important! If the director of the company is not able to personally receive the act, then he can send one of his employees to the fund. To do this, he will need to properly issue a power of attorney.

After the company representative checks the document, he must sign two copies of this document. The first one remains with the company, and the second one returns to the PRF. Only after the act is signed will it be given legal force. Based on such a document, the company will be able to return the overpayment or offset the overpaid funds against future obligations.

Step-by-step instructions for filling out the act in form TORG-21

- The place and conditions of storage of fruits and vegetables are indicated.

- The number of vegetables and fruits sent for sorting (processing) is indicated. The quantity will be determined by weighing.

- After the procedure is completed, the amount of vegetables and fruits remaining after sorting (processing) and the amount of waste are indicated. These data are indicated separately (More details about waste inventory).

- Data on waste removal are noted (vehicle number and invoice parameters).

- The method of waste disposal is prescribed.

- The processing results are certified by the signatures of 3 responsible persons.

- The act is signed by the person responsible for the further storage of the crops remaining after sorting (processing). Such a person may be a storekeeper, a foreman, or another financially responsible person in the organization.

- The act is submitted to the manager for approval.

- After approval of the act, one copy is transferred to the organization’s accounting department, the second to the person responsible for further storage of the goods.