The only reporting period established by Federal Law No. 402-FZ dated December 6, 2011 “On Accounting” is the calendar year (clause 1, article 15). It is used to prepare annual financial statements.

The reporting period always begins on January 1st. And it lasts until the reporting date inclusive (clause 6 of Law 402-FZ). For annual reporting, the reporting date is December 31.

A special procedure for determining reporting periods applies to companies created, reorganized or liquidated in the reporting year. But we will not dwell on them.

What's happened

The reporting date is a specific date from which future reporting should begin. Each accountant is given a certain time period necessary to collect data and record it in tables. It doesn’t matter whether we are talking about the formation of a balance sheet or a transport tax, the reporting period can only mean the time that contains the facts of economic activity. The main reference point is the year, and the intermediate ones are the month and quarter.

Reporting period and date

The time period from January 1 to December 31 is a calendar reporting period. If the dates are different, then such reporting is called a financial year. If we talk about accounting standards, then the formation should occur quarterly, and annual reports should be compiled from the final balance sheet, which will contain indicators: finances, cash and capital flows, property assets. Also, we must not forget about the forms of interim accounting. They must duplicate the final indicators. An exception in this case may be audit certificates.

The chief accountant in an organization must prepare quarterly reports, that is, balance the balance sheet every three months. It is important to understand that the first report, after the company has registered with the tax authorities, will be: registration date - end of the year. That is, if a company began to engage in commercial activities on September 1, then reporting will have to be prepared from this date to December 31 and submitted to the Federal Tax Service.

On a note! The tax period is covered by Article No. 285 of the Tax Code of the Russian Federation.

Differences from the billing period

The reporting period is a quarter, half a year and a year, and the estimated time period implies the interval between these positions, when the accountant has the opportunity to “tweak” the balance and make adjustments. The difference is that if reporting has a strict framework, then the calculation period means the entire time period that contains a specific report. The reporting year is regulated by the Federal Law “On Accounting”, Article No. 14.

Periods, both settlement and reporting, are directly related to insurance and the Pension Fund. Article No. 10 of the Federal Law “On Insurance Contributions to the Pension Fund” mentions that calculations for insurance transfers must be carried out for the entire period of the calendar year.

Difference

Differences from tax

The reporting year is the calendar period from January 1 to December 31. During this period of time, the accounting department must submit an income tax return. Most organizations strive to submit their reports before the new year, but the Tax Services provide some deferral time. Submission after December 31st will not be considered a violation. It all depends on what specific tax is meant. Examples:

- Income tax is due in the first quarter, then in the middle of the month and for the quarter before the last date - December 31.

- If we talk about private individuals who calculate monthly advance payments based on the actual profit received, a month, two months, three months, and so on until the end of the calendar year are recognized.

- At the end of each time period, advance payments must be made.

On a note! In some cases, monthly periods apply.

Monthly reporting is not prepared

The norm on the preparation of interim reporting was introduced into Law 402-FZ by Federal Law No. 251-FZ of July 23, 2013 and came into force on September 1, 2013. It freed companies from the need to prepare monthly reports. Therefore, “automatically”, without special grounds, the last day of the calendar month is not considered the reporting date.

As a result, most companies do not generate interim reporting on a legal basis. And the reporting period for them by default, by force of law, is the calendar year.

Meanwhile, the term “reporting period” appears in all accounting standards without exception. How can we understand it? Let's think together.

What are the reporting periods in financial statements?

The reporting date of financial statements is the time period established at the legislative level: January 1 - December 31. Exceptional moments are considered: creation, reorganization or liquidation of a legal entity. The need to provide accounting reports is prescribed by law, but there are intervals for its preparation. Clause No. 6, Article No. 15 of Federal Law-402 defines the code in the financial statements as number 34.

Variations:

- The interval can be exactly a year, but if it does not start on January 1, then it is usually called financial.

- Interim or intra-annual may include a month or a quarter. It is most often used for monthly and quarterly registers.

- If we talk about the Tax Authority, then a citizen or an accountant of an enterprise must submit a report there within three months after the start of the new year.

Types of OP

Based on the third point, the reporting period is 365 days. To understand how much time is available for filing documents, it is worth revisiting the law. Reporting on profits and expenses must be submitted to tax inspectors by the end of March; the 30th or 31st is considered the last day. After this, penalties will be charged for each day of delay. That is, after the year is completed, the accounting department is given a full three months to balance the balance sheet and prepare the report.

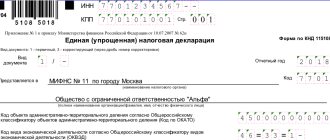

Codes of reporting periods of financial statements

The reporting year provides special coding for documents and periods. In the process of forming accounting records, tables, graphs and application forms are compiled. There is a lot of data, and so that accounting workers can process information more quickly, a special encoding was introduced. The State Duma developed appendix number three to the order of the Federal Tax Service of Russia dated October 29, 2014, which was later edited. It is there that the codes are written that all employees of the accounting departments are required to use. Basic designations:

- 21 - first quarter;

- 31 - 6 months (six months);

- 33 - 9 months;

- 34 - year;

- 50 is the last reporting period.

The last code applies only if the organization undergoes global changes or reorganization. Also, in the event of a company being declared bankrupt or an object being liquidated, the last reporting time period must also be generated and submitted in the form of a report to the Tax Authorities.

On a note! When preparing a report, it is important to check the final figures. They must match, otherwise it will become clear to the auditors that there were errors during the recording of information and the balance sheet.

Codes for the balance sheet

The procedure for approving annual reports in a joint-stock company

A different system for approving financial statements has been developed for joint-stock companies; it consists of several stages and is regulated by the provisions of Law No. 208-FZ of December 26, 1995 “On Joint-Stock Companies.” The deadline for approval of the balance sheet is set in the range of 2 and no later than 6 months after the end of the reporting year, i.e. from March 1 to June 30. First, the accuracy of the data in the reports is confirmed by the audit commission, then (30 days before the day of convening the meeting of shareholders) the reporting package is approved by the board of directors.

If there is no such body in the JSC, the reporting is approved by the head of the company. And only after completion of all the listed stages is a general meeting of shareholders convened. True, approval of reporting may also fall within the competence of the board of directors if such a provision is enshrined in the company’s Charter (Article of Law No. 208-FZ).

For both LLC and JSC, approval of reporting is documented in the minutes of the general meeting.

The conditions for the duration of the period for convening a meeting of shareholders were adjusted in 2021 by the above-mentioned legislative norms, i.e. the deadline for approving the balance sheet and reporting of the joint-stock company has been increased and falls on the period from March 1 to September 30.

How to prepare this report

Before examining the reporting rules, it is worth highlighting the edited parts. Below are the main changes that every employee in the accounting department should be aware of:

- The unit of measurement has become thousands of rubles; you cannot fill out reports in millions.

- OKVED has been replaced by OKVED2.

- A new line has been added in which the inspector specifies whether a particular organization requires an audit or not, as well as full information about the auditor.

The accountant can remove or add items himself, despite the fact that the full form of the balance sheet recommends highlighting it in the appropriate sections of the balance sheet. The more amendments and comments an employee provides when preparing a report, the higher the reliability of the prepared reporting. There is a simplified form in which small entrepreneurs work, in which some articles are interconnected. This greatly facilitates the work of the compiler and the reviewer. When drawing up a balance, you must follow a number of rules:

- the source of information for drawing up the balance sheet is accounting data;

- accounting data must be generated according to the rules of the current accounting regulations and in accordance with the accounting policies adopted by the enterprise;

- credentials must meet the requirements of completeness and reliability;

- an enterprise that has branches draws up a single balance sheet for the organization;

- the data reflected in the balance sheet must be;

- the allocation of items in sections of the balance sheet is carried out according to the principle of materiality;

- the reporting period for the balance sheet is a calendar year;

- assets and liabilities reflected in the balance sheet should be divided into short-term and long-term;

- offset between items of assets and liabilities is not made if it is not provided for by the PBU;

- property is valued at its “net” value (less regulatory items);

- The accounting data of the annual report must be confirmed by the inventory.

Important! Make comparisons with data from previous periods and check the status of indicators at the time of drawing up the report.

Form

Monetary measurement of accounting objects

The norms of the 2011 Law, which determine the mandatory monetary valuation of accounting items, are characterized by the same brevity. Here, Article 12 of the Law highlights three key points, determined by three consecutive rules:

"1. Accounting objects are subject to monetary measurement.

2. Monetary measurement of accounting objects is carried out in the currency of the Russian Federation.

3. Unless otherwise established by the legislation of the Russian Federation, the cost of accounting items expressed in foreign currency is subject to conversion into the currency of the Russian Federation.”

How to submit a reporting period

Sometimes an organization has to submit reports not for a quarter, half a year or year, but for one month. In this case, you can use a simplified form. The reporting month is the same time period for which you need to provide a consolidated balance sheet for profits, expenses and tax deductions. This document should be drawn up only on the basis of verified information and official papers.

As stated below, such accounting reports must be submitted by March 30-31 of each year. Each accountant must send the completed form not only to the Tax Service, to the Statistics Committee, but also to other government agencies. If audit activities were carried out during the reporting period, then a copy of the report must also be sent to the State Committee. The accountant has the right to provide documentation ahead of schedule, because deadlines for delivery are not established by current legislation. The main thing is that this happens before the end of March. Basic moments:

- You can send the report by email, through your personal account at the Federal Tax Service or by registered letter.

- The form must be signed not only by the chief accountant, but also by the head of the financial department and the director.

- If the balance does not add up, there is no need to send raw numbers. You should report any inconsistencies to the inspector who supervises the organization and ask for assistance.

On a note! Approximate figures will lead to the fact that the balance will not add up and the tax inspector will want to conduct an audit for the entire life of the organization.

Generating, uploading, sending a report

Problems of innovation

For an accountant, solutions that bring together accounting and tax accounting are always relevant. As is known, for profit tax purposes, reporting periods are formed quarterly or monthly. Accordingly, it makes sense to establish reporting periods in accounting.

Reference

The definitions given in PBU 4/99 (clause 4) still apply:

•

reporting period - the period for which the company must prepare financial statements;

•

reporting date – the date as of which the company must prepare financial statements.

Another problem is the need for balance sheets for decision-making in business companies. For example, when classifying large transactions or to determine the amount of payments to a retiring LLC member. And to pay interim dividends (quarterly or semi-annually), an interim report on financial results will be required. After all, these payments are possible only if there is current net profit (clause 1, article 28 of Law 14-FZ, clause 1 and clause 2, article 42 of Law 208-FZ). It is advisable to fix reporting dates for all such situations in advance in the charter. If you have not done this, you will need a decision of the general meeting of participants (shareholders) to determine the reporting date. When the reporting period was considered a month, such a need did not arise.

So, take note: the “reporting period” is under control!

Elena Dirkova,

for the magazine "Practical Accounting"

Examples of filling out reporting forms

Berator “Accounting Reports” contains all the information for error-free completion of any reporting form with line-by-line comments for each form with examples of completion. Find out more >>

What is the responsibility for violating the deadlines for submitting these reports?

Having found out how a report should be prepared, what a reporting and billing period is and what the difference is, you need to clarify the issue of responsibility. Any violation: failure to submit accounting reports, delay or provision of false information is punishable by law. If a company delays delivery without a valid reason, then according to paragraph No. 1, Article No. 119 of the Tax Code of the Russian Federation, penalties are equal to 5% of the amount of tax or contribution. Even if the transfer amount is small, the fine cannot be less than 1 thousand rubles. There are limitations to this issue. Penalties cannot exceed 30% of the unpaid amount.

Article No. 116 states that inspectors have the right to impose fines if accountants provide false or inaccurate information. There, prices already depend on the severity of non-connections. If there is no 2-NDFL certificate, then for each form that is not provided you will have to pay two hundred rubles. In the absence of 6-NDFL, the penalty for each certificate is already one thousand rubles. In addition, the inspector can block current accounts, which will affect the operation of the entire enterprise. This right of inspection is provided for in paragraph No. 3, Article No. 76 of the Tax Code of the Russian Federation.

Responsibility

The reporting tax period is a time period during which all taxpayers are required to submit declarations and reports. This issue is regulated by the Tax Code, Article No. 393. There are certain forms that every accountant must follow when drawing up documents. The structure was edited several times, but in the end the balance sheet form was approved by order No. 61n dated April 19, 2019.

Internal control

Concluding our review of the new Law, let us dwell on the requirements of Article 19 “Internal Control”.

The concept of internal control is also new. This is an audit practice term. In particular, the concept of an internal control system of organizations is disclosed in the Federal Rules (Standards) of Auditing, approved. Decree of the Government of the Russian Federation dated September 23, 2002 No. 696.

In the content of the provisions of Article 19 of the 2011 Law, it is noteworthy that the Law separates the concepts of internal control of the facts of economic life and internal control of accounting.

Regarding the first, the Law establishes that “an economic entity is obliged to organize and carry out internal control of the ongoing facts of economic life” (clause 1 of Article 19).

In terms of internal control over the functioning of the company’s accounting system, paragraph 2 of Article 19 of the Law determines that “an economic entity whose accounting (financial) statements are subject to mandatory audit is obliged to organize and exercise internal control over accounting and preparation of accounting (financial) statements (with the exception of cases when its manager has assumed the responsibility for maintaining accounting records).

* * *

So, we have examined the content of the sections of the new Law “On Accounting”, which define the basic requirements for its maintenance by economic entities. An independent chapter of the Federal Law dated December 6, 2011 No. 402-FZ is devoted to issues of accounting regulation. And although it cannot be said that its norms affect the everyday activities of our colleagues, they should also be taken into account, because they determine the directions for the development of accounting practice in Russia - our future, dear readers. Our next article is about this.

Why is interim reporting needed?

A calendar year is a very long period. During such a time, very serious changes can occur in the company. Naturally, owners want to receive information about their business more often.

In addition to owners, other users may be interested in receiving interim reporting:

- Banks. When applying for a loan, the company usually provides its statements for analysis. Further, in the process of debt servicing, banks also regularly request the borrower’s accounting reports, including interim reporting.

- Counterparties. When working on large and long-term contracts, the company’s partners usually also want to regularly receive information about the status of their counterparty.

Composition of financial statements

Which reporting forms will need to be submitted depends on whether the enterprise is commercial, budget-funded, or whether it is a small business entity (SMB).

A commercial organization submits the following package of reporting forms:

- Balance sheet;

- Income statement;

- Attachments (statement of changes in equity, statement of cash flows and an appendix with a breakdown of the main lines of the balance sheet and income statement).

SMEs that are not subject to mandatory audit criteria have the right to provide simplified financial statements. It is distinguished by aggregated indicators grouped by articles and the absence of detailed transcripts. It is necessary to understand that this opportunity exists regardless of the taxation system. That is, both organizations using the simplified tax system may be required to submit basic detailed forms, and enterprises using the simplified tax system may provide simplified reporting. In addition, those who submit a balance sheet should remember that providing it in a simplified form is a right, not an obligation. And if necessary, you can always submit the main report.

For non-profit enterprises, the reporting includes a report on the intended use of funds instead of a report on financial results.

Advice: Every year before submitting the balance sheet, you should check whether the reporting forms have changed.

The form of the accounting report and appendices was approved by Order of the Ministry of Finance 66n dated 07/02/2010 and when writing the accounting policy, it can be supplemented, if necessary, with any number of lines, but it is not allowed to exclude any information from the established forms. When finalizing the form of the document, we must not forget that the financial statements must be:

- Reliable;

- Informative for users of the report in order to make economic decisions based on the data obtained;

- Compiled on the basis of data from accounting registers.

Remembering that the balance sheet is not only a report for regulatory authorities, but also an opportunity to check the state of accounting and assess the economic stability of the enterprise, drawing up such a document no longer seems like a burden.