The DVAM Legal Center offers services for excluding buildings and premises from those subject to property tax based on cadastral value (Resolution No. 700-PP).

In particular, we will challenge the inclusion in this list of objects that are not actually used for retail and office purposes included in the list of permitted use of the site (based on the Resolution of the Constitutional Court of November 12, 2021 N 46-P).

We will also help you justify that the actual use of the premises does not meet the tax criteria. We will find options to avoid paying tax in other controversial situations.

Our services include:

- Exclusion by court of buildings from the list of objects in respect of which the tax base is determined as their cadastral value (for the current and previous periods, up to three years, not counting the year of circulation);

- Refund of tax paid for periods when the object was unreasonably included in the list.

- Legal support of activities for inspection (including re-inspection) of buildings for their actual use by the State Inspectorate for Real Estate of Moscow;

- Extrajudicial measures aimed at minimizing the tax burden (Changing the VRI of land plots, their division, etc.)

- Representation of interests in courts in various land disputes;

- Preparation of comprehensive legal opinions on optimization of the tax burden and other issues of land and urban planning legislation.

What is cadastral value tax and what is its essence?

This is one of the types of mandatory payments to the state, which is based on an established tariff. A tax is generated and must be paid in a number of transactions with a house, apartment, etc. or at the end of the period.

The fixed tax on the cadastral value includes the determination of the latter - the price that is formed as a result of an independent assessment of the property. When calculating the total amount of the duty, the price is taken into account, which is formed according to methods approved by local authorities.

Important! To pay the correct fee, you need to obtain a certificate from the Unified State Register of Real Estate about the cadastral value (to order, follow the link).

When paying taxes based on the cadastral value, data from the unified register is taken into account. If they are not available, an independent initial assessment must be ordered.

How to calculate income tax on the purchase and sale of an apartment

Property tax is not the only tax that property owners pay. If you carry out transactions with housing and make a profit, by law it is subject to a one-time income tax of 13% for residents of the Russian Federation (for non-residents - 30%). This applies to sellers who have owned the property for less than five years, and those who receive, for example, an apartment or a plot of land in St. Petersburg and the Leningrad Region under a gift agreement and are not a close relative of the donor.

Income tax, unlike property tax, is paid once. The taxpayer independently calculates its amount, fills out a tax return and submits it to the tax authorities at the place of residence no later than April 30. The amount must be transferred no later than July 15 in the year of filing the declaration. Failure to pay is subject to administrative and criminal liability.

Example of calculating property tax

Calculations are also carried out for land plots. The norm is prescribed in Article 389. NK of Russia. For the basic price, in order to calculate the tax, information is taken from the unified register. If changes have been made to the land plot, then the cadastral value of the plot is taken into account - the land tax on the date of the changes.

Note: increasing the size of the collection is not a popular measure, but is sometimes used to fill the treasury. In the Russian Federation, a rule has been established that it is not the tax itself that is actually revised, but the cadastral valuation once every 5 years.

Important! Don't fall for scammers. If you need an objective assessment of real estate, contact us through the official website.

Look at the example of tax calculation, understanding what exactly is included in the formula.

According to the rules, when making a preliminary calculation, allocate 0.1% of the indicator for further payment to the treasury. This applies to residential premises, outbuildings, no more than 50 sq.m., and subsidiary plots.

Increased cadastral value, interest - tax will be higher and, according to analysts, can reach up to 20%.

Property tax for legal entities. persons

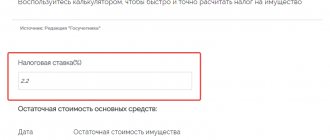

When researching in advance what the tax is based on the cadastral value, check out the local collection rates.

The current size for companies changed at the beginning of 2021. According to Art. 2 and 4 of Law No. 302-FZ dated August 3, 2018, when calculating this payment on the property of organizations, it is no longer necessary to take into account movable property. The exceptions are:

- spaceships;

- monuments as architectural objects;

- natural and water resources.

Property tax is regional and its amount varies between regions. Benefits are determined by local authorities and the Code.

Calculation of tax based on the cadastral value of real estate

You need to make a preliminary calculation, then you should follow these step-by-step instructions:

- select a subject of the Russian Federation on the map;

- select a suitable municipal entity;

- indicate the type of duty and period;

- Click on the “find” button.

An online service to find out the real estate tax by cadastral value and what the fee will be saves time. As a result, you get a table indicating interest rates, because the tax in each region is different. You can also find out in advance the tax on the cadastral value of an apartment or any other real estate, for example, a house, outbuildings on a plot, and calculate it for a land plot.

Property tax calculation

All enterprises that pay property tax calculate the tax base for real estate tax, which is reflected on the institution’s balance sheet in the fixed assets section. As for movable property, there are special conditions when it will be subject to taxation. If the property belongs to the first and second depreciation groups, then you do not need to pay property tax for it. The rest of the movable property will be subject to taxation, but in most cases you can count on receiving benefits on it.

Therefore, regarding movable assets, we can conclude that most of them will be exempt from property tax, which cannot be said about immovable objects. Tax must be charged on all fixed assets that appear on the balance sheet. This also applies to those transferred for temporary use or disposal to third parties.

Exceptions to accrual

Exemptions from taxation of land plots, as well as other environmental management facilities, are common for all subjects of the country. In addition, taxes will not be charged on those funds that are displayed in the first and second depreciation groups.

Law firms and bureaus, as well as other legal consultations, will also not be subject to property tax in 2017. In addition, some specialized medical institutions will be an exception.

In each specific region, the local government can establish its own additional preferential categories.

How to calculate land tax based on cadastral value

Organizations carry out tax calculations independently. In order to find out in advance what the tax will be for individuals, use online services or trusted agencies.

We do the calculations ourselves. To do this, we multiply the cadastral valuation by the product of the area of the object minus the deduction, and multiply by the appropriate rate. We recommend paying the fee on time and in full to avoid problems with the law.

The calculation rules are simple, the main thing is to know the formula. Multiply the data and find out how much you need to pay for the whole year. For example, in one region of the Russian Federation, when calculating for a residential building, a coefficient of 0.3% is used, in the capital region it reaches 0.4%. As an example: the tax on the cadastral value of an apartment is 0.1%; for “luxury options” it can be increased up to 1%. To find out the price per 1 sq. m, before making the calculation, divide the indicator by the entire area.

A fundamental nuance: the duty is not paid on the entire area, but only on that which is subject to taxation. Now you understand how simple, accurate and competent it is to calculate property taxes on your own.

What you need to find out what the apartment tax is

For the calculation, you will need the cadastral and inventory value of the property, as well as the tax rate. The latter is 0.1% for most objects (may increase, but not more than 0.3%); 0.5% – for those that are not included in the list of property of the first group and are classified as “other”; 2% – for expensive housing.

You can find out the cadastral value of your apartment in St. Petersburg or another city at the regional cadastral chamber. If you have a passport and application, a certificate will be issued free of charge in five working days. You can also obtain the same information on the Rosreestr website in the “electronic services” section, if there is no need for a paper document.

The inventory price is calculated in the BTI. Experts take into account the so-called replacement cost of the building, take into account the area, type of foundation and walls, number of windows and doors, the presence of an elevator, number of floors, maintenance of utility networks and other factors.

Deductions and their sizes

Before calculating the tax, keep in mind: the deduction applies to all residential properties owned. When determining the cost of the duty, the deduction is not tied to the number of owners. The tax is calculated based on the cadastral value, taking into account the type and area of the property. There is a rule for how to calculate taking into account the area of the object (in m2):

- room: up to 10;

- apartment is 2 times larger;

- for home, agricultural buildings no more than 50.

The criterion directly determines what the tax will be, and the indicator determines how many “squares” are ready to be “forgiven.”

You can order an electronic extract of the cadastral value from Rosreestr, signed with an electronic digital signature, on this page of our website.

Who gets benefits?

Citizens defined in Art. 399 and 407 of the relevant Code. The document determines that the fee may not be paid by certain persons at the federal and regional level. Such a tax at the federal level is not interesting for such categories as:

- WWII veterans;

- Heroes of the Soviet Union and the Russian Federation;

- disabled children, 1st, 2nd groups;

- liquidators of a number of emergency situations;

- military personnel and their families.

Pensioners do not have to worry about additional expenses - they are exempt from payment. You need to pay and pre-calculate the amount of the fee in the case where, for example, there are 2 apartments or a large plot of land. Benefit for only 1 property in the category

It is not necessary to calculate the tax in advance based on the cadastral value for persons whose building is less than 50 square meters. You may not find out what the amount of payment is for a number of other persons who have benefits from local governments. Large families do not pay the fee.

The tax does not provide a benefit if the object is above 300 million rubles.

If he is not paid according to the benefit, the person independently informs the service about this, providing documents for proof.

How is the tax base calculated?

It is necessary to independently calculate the tax base and the amount of final payments, as well as submit the corresponding declarations to the Federal Tax Service.

It is defined as the average annual value of the property that should be taxed. In some cases, it can be determined as the cadastral value. Information about this can be requested from Roskadastre. Ready-made calculations are submitted to the tax service, and all calculations must be carried out independently.

The calculation of the tax base will depend on the chosen management system, as well as on the presence of certain amendments and innovations in local legislation.

In what case is it necessary to take into account the initial cost of objects:

- if they are located directly at the place of registration of the company;

- for separate companies that are identified on the balance sheet of the main enterprise;

- When objects are included in the general gas supply system;

- When an enterprise uses different tax rates to calculate tax payments.

It is required that calculations be made on every first day of the month following the reporting month. The total amount is divided by the entire number of months that were taken into account. One more is added to these.

If a real estate property is subject to taxation, but it is not located on the territory of one region, but, for example, in different regions, then in each individual region the tax base will be determined separately. The calculation will be made precisely for the share of property that is on the balance sheet of the enterprise in a specific subject of the Federation. This is due to the fact that this tax is regional, and each individual region may have its own rules for its calculation and payment procedure.

Based on the data in Chapter 30 of the Tax Code, all taxpayers individually determine the tax base for their property.