Changes in 2021

There were no fundamental changes in the timing of reporting, tax payment and the procedure for its calculation in 2021. But the indicator of the deflator coefficient K1, which forms the amount of tax, has changed. From January 1, 2021 it is equal to 1.868.

In addition, from July 1, 2021, LLCs and individual entrepreneurs (with hired staff) engaged in retail trade and catering are required to install online cash registers. The remaining UTII payers (including individual entrepreneurs without staff, working in the field of trade or catering) received a deferment for a year, i.e. they have the right to install a cash register from July 1, 2021.

In connection with the obligation to install an online cash register, legislators have introduced a benefit for individual entrepreneurs on the “imputation” - a tax deduction for the purchase of a cash register and its maintenance in the amount of 18,000 rubles. per unit of equipment. The form of the declaration form is also being revised. It will have to contain lines intended to reflect information on cash registers, but for now entrepreneurs will attach an explanatory note to confirm the deduction.

What and when does an individual entrepreneur submit to the Federal Tax Service on a single tax?

The main obligation of an entrepreneur using UTII is to submit a UTII declaration to the Federal Tax Service on a quarterly basis; the accounting statements of individual entrepreneurs for UTII are not provided for by law. All individuals with entrepreneurial status are not required to keep accounting records and submit a balance sheet and accompanying financial statements at the end of the year. Only legal entities do this.

If an entrepreneur has employees, the list of his reporting is supplemented by calculations for insurance premiums and 6-NDFL. What additional reporting does an individual entrepreneur submit on UTII without employees in 2021? Reports to Rosstat, but only if it was included in the statistical sample of respondents for the reporting period.

If an individual entrepreneur combines UTII with other taxation systems, he submits reports on them to the Federal Tax Service, but this does not intersect with reporting on the single tax. Let's look at the obligation to report in more detail.

Tax returns for UTII

Individual entrepreneurs submit single tax declarations to the tax inspectorate at the place of registration every quarter. The deadlines for submission are specified in the Tax Code:

| Reporting period | Deadlines for submitting reports for individual entrepreneurs on “imputation” |

| 1st quarter 2020 | 20.04.2020 |

| 2 sq. 2020 | 20.07.2020 |

| 3 sq. 2020 | 20.10.2020 |

| 4 sq. 2020 | 20.01.2021 |

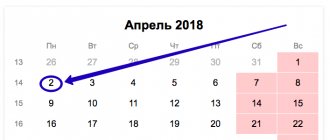

If the deadline coincides with a Saturday, Sunday or non-working holiday, it is postponed to the first working day.

For the reporting period 2021, the declaration form approved by Order of the Federal Tax Service No. ММВ-7-3/414 dated June 26, 2018 is used. Its title page looks like this:

After submitting the declaration, the obligation to pay tax for the past quarter arises. The deadline is until the 25th of the first month of the next quarter, but due to weekends the deadlines are postponed to the first working day. This year advance payments include:

- for 1 sq. — until 04/27/2020;

- for 2 sq. — until July 27, 2020;

- for 3 sq. — until October 26, 2020;

- for 4 sq. - until January 25, 2021.

There are no separate forms for informing about advance payments; this information is indicated in the declaration.

IMPORTANT!

The Tax Code and other legislative acts do not provide for the maintenance of KUDiR for individual entrepreneurs on UTII. Any demands from the Federal Tax Service to provide are illegal, since the “imposed” pay a fixed tax and do not keep records of income and expenses.

Reports when combining tax regimes

Entrepreneurs who combine the single tax with other taxation regimes, in addition to the UTII declaration, are required to report on them too. The deadlines and set of forms differ depending on the additional system:

- simplified taxation system (STS);

- general taxation system (OSNO).

IMPORTANT!

If an individual entrepreneur has declared in the Unified State Register of Individual Entrepreneurs only those types of businesses that are subject to UTII, there is no need to submit additional reporting under the simplified regime or OSNO (letter from the Ministry of Finance dated 01.06.2012 No. 03-11-09/41, dated 07.08.2015 No. 03-11- 06/3/45834).

Entrepreneurs on UTII are exempt from paying VAT, but in a number of cases they declare themselves as payers or tax agents, and then they need to report VAT. This happens if the individual entrepreneur:

- registered as a tax agent;

- carries out import operations;

- issues invoices to customers with allocated VAT.

When combining a single tax with other regimes, the entrepreneur is required to keep separate records.

Detailed guidance from ConsultantPlus experts will help you calculate, pay and report taxes. The instructions have been compiled for all entrepreneurs, not just those on UTII.

Deadlines for paying UTII in 2021:

| During the period | Last day for payment |

| 4 sq. 2017 | 25.01.2018 |

| 1 sq. 2018 | 25.04.2018 |

| 2 sq. 2018 | 25.07.2018 |

| 3 sq. 2018 | 25.10.2018 |

| 4 sq. 2018 | 25.01.2019 |

In case of non-payment of tax, the fine established by Article 122 of the Tax Code of the Russian Federation will be 20% of the tax amount. In case of intentional non-payment, the fine will double to 40%. If the tax is paid but late, only penalties will be charged for each day of delay.

Reporting of individual entrepreneurs on “imputation” with hired employees

If a single tax entrepreneur has employees to whom he pays wages, he has an obligation to report to the Federal Tax Service:

- for insurance premiums - calculation of the DAM;

- for personal income tax - form 6-NDFL and certificate 2-NDFL.

Additionally, you will have to submit monthly reports SZV-M and SZV-TD to the Pension Fund of Russia; the SZV-STAZH form is submitted once a year. Entrepreneurs with hired employees report to the Social Insurance Fund (SIF) on contributions from industrial accidents and occupational diseases in Form 4-FSS quarterly.

The deadlines for delivery are as follows:

| Report title | Due date for 1st quarter | For the 2nd quarter | For the 3rd quarter | For 4 quarters or a year | Per month |

| SZV-M | Until the 15th | ||||

| SZV-TD | Before the 15th or within 3 days after the employee is hired or fired | ||||

| SZV-STAZH | No later than March 1 following the reporting period | ||||

| Calculation of insurance premiums | April 30 | July 30 | October 30 | January 30 | |

| 6-NDFL | April 30 | July 31 | October 31 | No later than April 1 following the expired tax period | |

| 2-NDFL | No later than April 1 following the reporting period | ||||

| 4-FSS | Until April 20 (on paper), until April 25 (electronically). | Until July 20 (on paper), until July 25 (electronically). | Until October 20 (on paper), until October 25 (electronically). | Until January 20 (on paper), until January 25 (electronically). |

Every year, individual entrepreneurs using hired labor will have to submit to the tax service information about the average number of employees for the previous calendar year. Deadline: January 20 of the current period.

Title page

This “title” section contains general information about the taxpayer. Its form and rules for filling out have not changed compared to the “old” declaration.

- TIN and KPP codes are indicated in accordance with the tax registration certificate. Because The TIN of an individual contains 2 characters more than that of a legal entity, then for enterprises, dashes are entered in the corresponding field in two cells on the right.

- The correction number has the format 0–, 1–, etc. It shows the “version” of the report – original or modified.

- The tax period is coded in accordance with Appendix No. 1 to the Procedure for filling out, attached to the letter dated July 25, 2018 No. SD-4-3 / [email protected] (hereinafter referred to as the Procedure). For the third quarter - code 23.

- Reporting year – 2021.

- Tax office code in accordance with the certificate.

- Code of the place of submission of the report from Appendix 3 to the Procedure (at the location/residence, activity, etc.).

- Full name of the organization or full name of the entrepreneur.

- The reorganization code and TIN/KPP of the reorganized organization are filled in if the report is submitted by the legal successor.

- The contact telephone number is indicated with the country and city code, without spaces, dashes or other characters.

- The number of sheets of the declaration itself and supporting documents.

- Name (full name) of the taxpayer or his representative, as well as the signature of the responsible person. If the report is submitted by a representative, then you must indicate the details of the power of attorney.

- Information about the receipt of the report is filled out by an employee of the Federal Tax Service. It includes information about the form for submitting the report, the number of sheets, registration number, date and signature of the specialist.

Section 1 and example of tax calculation for the 3rd quarter

Completing this section completes the declaration. It contains information about the amounts of tax payable to the budget and consists of several blocks of lines 010 and 020. Each block corresponds to the OKTMO code.

Line 010 indicates this code.

Line 020 – tax amount. If the declaration contains information on several OKTMO codes, then the amount for line 020 is determined as the share corresponding to a specific code. To do this, the total amount of tax payable (line 050 of section 3) is multiplied by the quotient of dividing the amount of accrued tax for a specific code (the sum of lines 110 of section 2 by code) by the total amount of accrued tax (line 010 of section 3). If a businessman operates within one municipality, then the indicator of line 050 of section 3 is simply transferred to this line without any adjustments.

Combine UTII with simplified tax system, patent or OSNO

UTII can be combined with any other tax system (see “Taxes for an individual entrepreneur or LLC: how to choose a “profitable” tax system”).

A common situation is that you trade through a brick-and-mortar store and online. For a stationary point, you use UTII, and the online store has been transferred to the simplified tax system. In this situation, it is necessary to keep separate records - income under the simplified tax system should be taken into account separately from income on UTII.

Keep records under the simplified tax system, submit reports via the Internet (for new individual entrepreneurs - a year free of charge)

Who can apply UTII

There are many more conditions for using UTII than when using the simplified taxation system (see “Simplified taxation system for individual entrepreneurs: why it is beneficial and how to use it”). And this is, perhaps, the main inconvenience of “imputation”. The main limitation is that it can only be applied to certain types of activities, which are listed in paragraph 2 of Article 346.26 of the Tax Code of the Russian Federation. In particular, these are:

- retail trade through a small store - with a sales area of up to 150 sq. m (online stores do not have the right to apply UTII);

- public catering, if the area of the customer service hall is no more than 150 square meters. m;

- domestic services;

- transportation of people and goods, if the taxpayer owns no more than 20 units of relevant vehicles;

- repair, maintenance and car wash;

- veterinary services;

- rental of parking spaces;

- placement of outdoor advertising on advertising structures - billboards, stands, displays and vehicles;

- rental housing, if the total area of premises for temporary accommodation and residence is no more than 500 square meters. m;

- leasing of land for trade and catering.

- rental of retail space in a market or shopping complex, tents, trays, as well as catering outlets without customer service areas.

Local authorities (at the municipal level) can introduce UTII in relation to activities from the list above.

You also need to remember that UTII does not have the right to apply to those entrepreneurs whose number of employees exceeds 100 people.

Zero declaration on UTII

Even if the company/individual entrepreneur did not conduct any activity in the reporting quarter, it is not worth handing over an empty (zero) UTII. You will still be charged tax, but for the last period when there was non-zero reporting.

The fact is that the tax is calculated based on physical indicators, not actual income. The absence of physical indicators is a reason to deregister, and not to refuse to pay tax. Even if the payer has not worked under UTII for some time, he must submit a declaration indicating the amount of tax calculated on the basis of the physical indicator and the rate of return.

Where to send payments for imputation

In 2021, pay UTII according to the details of the Federal Tax Service, which has jurisdiction over the territory where the “imputed” activity is carried out. In this case, the organization must be registered by the Federal Tax Service as a payer of UTII (clause 2 of Article 346.28, clause 3 of Article 346.32 of the Tax Code of the Russian Federation). However, if there are certain types of business that these rules do not apply to, namely:

- delivery and distribution trade;

- advertising on vehicles;

- provision of services for the transportation of passengers and cargo.

For these types of businesses, organizations do not register as UTII payers at the place of business. Therefore, UTII will be listed at the location of the head office.

What other changes have affected the updated UTII declaration form?

1) In the newly adopted UTII declaration form, the barcodes of the report pages have changed

| Structural parts of the declaration form | Barcodes of the declaration form | |

| Order of the Federal Tax Service No. MMV-7-3/232 dated July 4, 2014. | Order of the Federal Tax Service dated June 26, 2021. No. ММВ-7-3/ [email protected] | |

| Front page | 02914015 | 02915012 |

| Section No. 1 | 02914022 | 02915029 |

| Section No. 2 | 02914039 | 02915036 |

| Section No. 3 | 02914046 | 02915043 |

2) The new form provides for the opportunity, starting from 2021, to reduce the size of the quarterly payment by the amount of insurance premiums that were paid by the individual entrepreneur for employees. At the same time, the size of the single tax can be reduced only by 50.0%.

Length of the tax period for UTII

The tax period for tax on imputed income is defined as equal to a quarter (Article 346.30 of the Tax Code of the Russian Federation). This definition does not indicate:

- for a period of one year;

- counting time intervals for reporting from the beginning of the year;

- division of the period into reporting periods.

What does this mean? The fact that a quarter turns out to be that finite period of time:

- upon completion of which final (not interim) tax reporting will be generated;

- for which data should be taken to calculate tax.

Thus, the establishment of a tax period for the corresponding quarter predetermines only quarterly and only quarterly formation of tax UTII reporting. It does not provide for the inclusion of data with a volume counted from the beginning of the year. This means that there is no basis for separating the periods covered by the reports for periods of time corresponding to several quarters simultaneously. That is, tax periods for UTII will be 1st, 2nd, 3rd and 4th quarters, but not half a year, not 9 months or a year. Therefore, the imputed tax reporting submitted at the end of the next year will only be the report for the 4th quarter.

IMPORTANT! The UTII declaration for the 4th quarter of 2020 is being submitted for the last time. Since January 2021, the special regime has been canceled throughout Russia.

Find out what taxpayers should do in connection with the abolition of the special regime in the Typical Situation from ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.