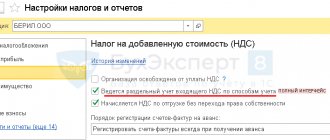

Deductions

Purchasing goods from individuals is not such a rare occurrence. Companies often buy

General concepts A part-time worker is an employee who works part-time in his free time from his main job.

Yes, these are not working professions, they are not characterized by physically hard work, they do not perform

You can clarify the traffic police details for paying a fine in a variety of ways. Some of them work

Using the unified form MX-3, an act on the return of inventory items deposited is filled out. Form

How to get property and social deductions in one year Often within one year

A fine for the driver not having a permit is one of the types of punishments provided for in Art.

The need to work part-time while the woman continues to be in

Home / Taxes / What is VAT and when does it increase to 20 percent?

Medium and large manufacturing enterprises that use the services of a large number of suppliers often face the problem of: