Registration of labor relations in the proper form plays a significant role in the further process of labor activity. And if for employers shadow employment, along with risks, also has advantages - they save on taxes and contributions, simplify reporting, ignore the guarantees provided for by the Labor Code of the Russian Federation, then for workers informal employment is more associated with adverse consequences than with advantages.

By agreeing to such working conditions, a person may forget about paid leave, receiving payments during illness, or dismissal with severance pay. And even if the employer promises the applicant to respect his labor rights properly, despite the lack of official documentation, in most cases these assurances are unfounded.

Thus, legal employment is a guarantee of the employee’s financial stability in any life situations, since the Labor Code of the Russian Federation obliges employers to pay employees the average salary when certain circumstances occur.

The average salary indicator is needed to pay employees for periods of absence from the office, as well as to calculate a number of accruals. This value is used to calculate vacation pay, sick leave, payment for absence from the workplace due to a business trip or medical examination, for dismissal payments when staff are reduced, and also to calculate maternity benefits. But in order to make payments correctly, the accountant needs to know how to make calculations and what to take into account for these purposes.

The rules for calculating the average monthly salary in situations established by the Labor Code of the Russian Federation are unified (Article 139 of the Labor Code of the Russian Federation). Average daily earnings are used in calculations. However, depending on the situation, there may be special features, for example, when recording working hours in aggregate.

The specifics of the procedure for calculating the average salary are provided for by the regulation of the same name, approved by Resolution of the Cabinet of Ministers of the Russian Federation of December 24, 2007 No. 922 (hereinafter referred to as Regulation No. 922).

To calculate the average monthly accruals for paying sick leave and maternity leave, a different procedure is applied, approved by Resolution No. 375 of June 15, 2007 (hereinafter referred to as Regulation No. 375).

In what cases is an employee entitled to an average monthly salary?

The list of situations when payments to an employee are calculated based on the calculation of the average amount of earnings is determined by the Labor Code of the Russian Federation. Among the most common and most often encountered situations in the activities of an ordinary organization that require the calculation of average earnings include:

- payment of vacation pay (Article 114 of the Labor Code of the Russian Federation);

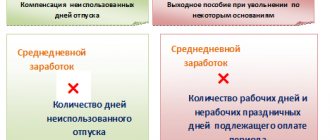

- issuance of compensation for unused vacation - upon dismissal or for part of the vacation over 28 calendar days (Articles 126, 127 of the Labor Code of the Russian Federation);

- employee going on a business trip (Article 167 of the Labor Code of the Russian Federation);

- payment to employees for periods of training while away from work (Articles 173–176, 187 of the Labor Code of the Russian Federation);

- payment of severance pay (Article 178 of the Labor Code of the Russian Federation).

In addition, based on the average monthly salary, the following categories of employees are calculated:

| Employees | Article of the Labor Code of the Russian Federation |

| Those engaged in collective negotiations or preparing a draft collective agreement (agreement) with exemption from their main job. At the same time, the average earnings for such workers can last up to 3 months. | 39 |

| Temporarily transferred to a job other than that provided for in the employment contract | 72.2 |

| Those forced to terminate an employment contract due to non-compliance with the rules for its conclusion (if the violations were not the fault of the employee) - in this case, severance pay is due in the amount of the average monthly salary | 84 |

| Failure to comply with labor standards and labor duties due to the fault of the employer | 155 |

| Forced to remain idle due to the fault of the employer - in such a situation at least 2/3 of the average salary is paid | 157 |

| Members of labor dispute commissions | 171 |

| The manager, his deputy or the chief accountant, dismissed upon change of ownership in the amount of 3 times the average monthly salary | 181 |

| Transferred to lower paid work due to health reasons | 182 |

| Sent for mandatory medical examinations | 185 |

| Employees undergoing medical examination (from 01/01/2019) | 185.1 |

| Donors | 186 |

| Employees during suspension of the organization's activities | 220 |

| Pregnant women and women with children under 1.5 years of age transferred to another job | 254 |

| Women breastfeeding – when paying for breastfeeding breaks | 258 |

| Parents of disabled children when paying for additional days off and in some other cases | 262 |

You will need to calculate your average earnings when filling out an unemployment certificate. ConsultantPlus experts told us what formula to use to calculate benefits and how to fill out such a certificate correctly. Get a free trial access to the system and see recommendations.

Why is the monthly average number of calendar days always equal to 29.3

This figure represents the number of calendar days in a year, reduced by the number of non-working holidays and divided by 12 months.

According to Article 112 of the Labor Code of the Russian Federation, 14 non-working holidays are officially established in Russia: January 1, 2, 3, 4, 5, 6 and 8 (New Year holidays), January 7 (Christmas Day), February 23 (Defender of the Fatherland Day), 8 March (International Women's Day), May 1 (Spring and Labor Day), May 9 (Victory Day), June 12 (Russia Day) and November 4 (National Unity Day).

Thus, to find the average monthly number of calendar days, you need to subtract 14 days from 365 (or 366) days, and divide the resulting result by 12 months. After rounding, the final value is 29.3.

How to calculate average monthly earnings: general procedure

The general and uniform procedure for calculating average earnings for all these cases is enshrined in Art. 139 Labor Code of the Russian Federation. The main rule: in any mode of work, the average salary is calculated based on the earnings actually accrued to the employee and the time actually worked by him for the 12 calendar months that have elapsed before the period in which the calculation of the average monthly salary is required. These 12 months are called the billing period.

The calculation procedure is spelled out in more detail in the regulation “On the specifics of the procedure for calculating the average salary,” which was approved by Decree of the Government of the Russian Federation dated December 24, 2007 No. 922. We will tell you in more detail about how to calculate the average monthly salary. The latest changes to this document were made in 2021, so you need to rely on it when calculating average earnings in 2021.

For information on how to calculate the average number of employees, read the article “How to calculate the average number of employees?” .

How to use the calculator

Instructions for using the average salary calculator

- Specify the calculation period - any number of months preceding the calculation date.

- Indicate the date on which the calculation is made, the method of recording working hours, and the days excluded.

- Enter wages and bonuses for the selected months. When you pay your salary for the first month, for convenience, the data is automatically entered for all the following months.

- Click "CALCULATE". You will receive data on your average daily earnings with all the calculation details.

Calculation of average earnings: formula

Calculation of average earnings for certain payments is always done based on average daily earnings.

The general formula for calculating average earnings can be presented as follows:

SmZ = SdZ × N,

Where:

SMZ - average monthly salary;

SDZ - average daily earnings;

N is the number of days to be paid according to average earnings.

For more information on how to calculate average daily earnings in different situations, read the following articles:

- “Average daily earnings for calculating vacation pay”;

- “Calculation of average earnings for a business trip”.

Example 1

Manager Ivanov A.V. goes on vacation for two weeks from January 14, 2019. In 2021, he was on sick leave from October 1 to October 14. The employee's total income for 2021 (excluding sick leave) amounted to 580 thousand rubles.

First, we determine the number of days that need to be taken into account for an “incomplete” month, i.e. for October.

DNP = 29.3 / 31 x (31-14) = 16

Now let's calculate the total number of days per year that need to be included in the calculation:

CD = 29.3 x 11 + 16 = 338.3

Hence,

SDZ = 580,000 / 338.3 = 1714.45 rubles.

Amount of vacation pay for 14 calendar days

O = 14 x 1714.45 = 24,002.36 rubles.

Features of calculating average daily earnings

The main feature of calculating average earnings per day is that different rules for its calculation have been established:

- for payment of vacation pay and compensation for unused vacations;

- all other cases.

Calculation of average earnings (except for vacation situations):

SD = salary for the billing period / days actually worked in the billing period.

The billing period is 12 months (Article 139 of the Labor Code of the Russian Federation). If the employee worked for less than 12 months, then the calculation period is equal to the actual period of work.

When paying for vacations, including unused ones, which are provided in calendar days:

SDZ = salary for the billing period / 12 / 29.3.

If some months out of 12 were not fully worked out or there were periods that need to be excluded from the calculation (we will talk about them below), the average daily earnings are calculated as follows:

SDZ = salary / (29.3 × full calendar months + worked, calendar days in incomplete calendar months).

The number of calendar days in incomplete calendar months is determined as follows:

29.3 / number of calendar days in a month × calendar days worked.

Example

Let's say the employee was sick from October 17 to October 31, 2021. Then the number of days in partially worked October: 29.3 / 31 (calendar days of October) × 12 (calendar days worked for the period from October 1 to October 16) = 11 days.

Let’s assume that for 12 months from November 2021 to October 2020, the employee was credited with 494,600 rubles. He worked all the remaining 11 billing months in full. Then the average daily earnings in November is:

494,600 / (29.3 × 11 + 11) = 1,483.95 rubles.

If vacation is provided in working days, the calculation of average earnings for vacation pay is calculated as follows:

SDZ = salary / per number of working days according to the calendar of a 6-day working week.

How to prepare documents for vacation pay

1. Vacation schedule.

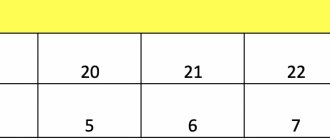

It is drawn up at least two weeks before the start of the calendar year, based on the wishes of employees, legal requirements and the interests of the employer. Both the employer (organization or individual entrepreneur) and employees are required to comply with the schedule (Article 123 of the Labor Code of the Russian Federation. There is a unified form No. T-7. It, among other things, contains columns 8 and 9. They must be filled out if the originally planned vacation was subsequently transferred. Keep personnel records for free in the web service

2. Employee statement. It is written when you need to go on vacation outside of your schedule. If the schedule is followed, then you can do without an application.

The employee must submit an application in advance so that the accounting department has time to calculate and pay vacation pay no later than three days before the start of the vacation.

Application example

General Director of LLC "ChOP "CheKa"

Mr. Dubinin I.O.

from security guard A.A. Simonov

Please provide me with annual paid leave for a period of 14 calendar days from November 1, 2021 to November 14, 2021.

October 29, 2021

______________/Simonov A.A./

3. Notification of the start of vacation. It is necessary if a person will rest according to a schedule. At least two weeks before the start of the vacation, personnel officers must notify the employee about this against signature (see “Rostrud reported whether it is necessary to notify employees about vacations that coincide with the schedule”). If the basis is not a schedule, but a statement, it is not necessary to notify the employee.

4. Order (instruction). It is needed both in case of going on scheduled leave and in case of filing an application. There are unified forms: No. T-6 (for one employee) and No. T-6a (for several employees).

Compose HR documents using ready-made templates for free

5. Note-calculation. Form No. T-60 is usually used. The first side contains the start, end, and rest dates. On the second side there are payment details.

6. Personal card. In the form No. T-2 there is a section VIII intended for information about leave.

7. Time sheet. The corresponding days should be indicated by a letter or numeric code (for annual basic paid leave these are “FROM” and “09”

Keep timesheets for free in an accounting web service

ATTENTION. Previously, organizations and entrepreneurs were required to use unified forms of personnel documents, in particular, forms No. T-2, T-6, T-6a, T-7, T-12, T-13 and T-60 (approved by resolution of the State Statistics Committee dated 01/05/04 No. 1). But now employers can do this voluntarily, or develop their own forms (information from the Ministry of Finance dated 12/04/12 No. PZ-10/2012).

Payments that are taken into account when calculating average earnings

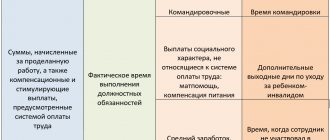

The calculation of average earnings takes into account all payments provided for by the organization’s remuneration system, including:

- wages - time-based, piece-rate, as a percentage of revenue, paid in cash or in kind;

- various incentive bonuses and additional payments, as well as all payments for working conditions - read more about them here;

- bonuses and other similar rewards;

- other payments applied by the employer (clause 2 of regulation No. 922).

At the same time, the calculation of average earnings does not include social payments, such as financial assistance, payment for food, travel, utilities, etc.

What does the SZP consist of?

The calculation of the SWP includes all types of payments used at the enterprise, which are provided for by local regulations:

- Salary according to the staffing schedule, or payment for hours of work (according to the tariff);

- Allowances for working at night, as well as on weekends and holidays;

- Bonuses and allowances for combining job responsibilities and expanding service areas;

- Payment according to orders for piecework;

- Incentive payments;

- Long service allowances;

- Allowances for working with information containing government documents. secret;

- Bonuses for having a certificate of honor or an academic degree;

- Payment for checking notebooks and written work;

- Payments to state and municipal employees;

- Regional coefficient, northern allowances;

- Payment in kind.

The following are not included in the calculation of the SWP:

- Sickness benefit;

- Payment of vacation pay;

- Vacation payments for the time you are on a business trip;

- Bonuses paid at the end of the year (it should be noted that the annual bonus is included in the calculation of the average salary, in proportion to the number of months worked);

- Payment for maternity leave;

- Material aid;

- Payment for meals during a business trip;

- Payment for utilities;

- Payment for training and advanced training.

Periods excluded from the calculation period

We have already said that the billing period is 12 calendar months preceding the period in which average earnings are calculated. However, individual periods, as well as the amounts accrued for them, are excluded in the calculation. These are the periods when:

- the employee retained his average earnings (only breaks for feeding the child are not excluded);

- the employee was paid sick leave or maternity benefits;

- the employee did not work due to downtime for which the employer was to blame, or for reasons beyond the control of the employer and employee;

- the employee did not participate in the strike, but did not work because of it;

- the employee was given days off to care for a disabled child;

- in other cases, the employee was released from work with full or partial retention of wages or without it (clause 5 of Regulation No. 922).

Average salary: concept and calculation rules.

A number of articles in the Labor Code of the Russian Federation indicate the employer’s obligation to pay the employee during a certain period not the usual wage, but the so-called average wage. In particular, the following cases can be specified:

- when providing paid leave, including educational leave (Articles 114, 116, 173 - 175 of the Labor Code of the Russian Federation);

— when paying severance pay (Articles 84, 178, 296 of the Labor Code of the Russian Federation) and compensation to management employees upon dismissal (Article 181 of the Labor Code of the Russian Federation);

- while maintaining wages for the period of employment (Articles 178, 318, 375 of the Labor Code of the Russian Federation);

— when sending an employee on a business trip (Article 167 of the Labor Code of the Russian Federation);

— when sending an employee for advanced training while taking time away from work (Article 187 of the Labor Code of the Russian Federation);

— when sending an employee for a mandatory medical examination (Article 185 of the Labor Code of the Russian Federation).

Let us note that there are other situations (not mentioned in the Labor Code of the Russian Federation) when the law obliges the employer to maintain the average salary for the employee, for example, for the duration of a medical examination, medical examination or treatment, as well as for the duration of the employee’s performance of other duties related to military registration, compulsory preparation for military service, conscription or voluntary enrollment in military service and conscription for military training (Clause 1, Article 6 of the Federal Law of March 28, 1998 No. 53-FZ “On Military Duty and Military Service”), and in others cases.

pen

The procedure for calculating average earnings in all of these cases is determined by Art. 139 of the Labor Code of the Russian Federation, which provides for a unified procedure for calculating average wages, and the Regulations on the specifics of the procedure for calculating average wages (Resolution of the Government of the Russian Federation of December 24, 2007 No. 922 “On the specifics of the procedure for calculating average wages” (as amended on October 15, 2014 d.) To calculate average earnings, all types of payments provided for by the remuneration system that are used by the relevant employer are taken into account, regardless of the sources of these payments.

In any mode of operation, the average salary of an employee is calculated based on the salary actually accrued to him and the time he actually worked for the 12 calendar months preceding the period during which the employee retains his average salary. In this case, a calendar month is considered to be the period from the 1st to the 30th (31st) day of the corresponding month inclusive (in February - to the 28th (29th) day inclusive).

Average daily earnings for vacation pay and compensation for unused vacations are calculated for the last 12 calendar months by dividing the amount of accrued wages by 12 and by 29.4 (the average monthly number of calendar days).

? Let us pay special attention to the consideration of incentive payments when calculating vacation pay. Since incentive payments are part of the salary, they must be taken into account by the employer and included in the calculation of vacation. Very often there is a situation when incentive payments that are paid before going on vacation are not included in the calculation of vacation funds due to the fact that the employer first calculates and pays money for vacation, and during the ensuing vacation period accrues and pays incentive payments. It follows from this that the average salary, which will be taken into account when calculating vacation funds for the current year, will not take into account incentive payments; they will be included in the vacation calculation for the next period. This is done for various reasons, including to save money in the current financial year (next year, taking into account inflation, these will be different funds).

In accordance with the Letter of the Ministry of Health and Social Development dated October 13, 2011 No. 22–2/377012–772, all types of bonuses are included in the calculation, including holidays, memorable dates, anniversaries, provided that their payment is provided for by the employer’s internal regulations on payment (bonuses) ) labor of workers. In this regard, it is very important for the head of an educational organization to pay attention to the wording of the names of orders on employee remuneration! An analysis of the Regulations on remuneration of educational organizations shows that the employer does not indicate the types of bonuses, or, conversely, provides bonuses for holidays, but at the same time prescribes “Bonus for March 8th”. This means that in this organization it is not possible to issue a bonus for other holidays, since an exhaustive list is given - only for the holiday of March 8 (the list does not include the category “other holidays”).

Educational organizations provide paid educational services. The general provision regarding payments included in the calculation when determining average earnings is established by Article 139 of the Labor Code. According to this norm, “to calculate the average salary, all types of payments provided for by the remuneration system and applied by the relevant employer are taken into account, regardless of the sources of these payments .” If an employee is engaged in the provision of paid educational services under an employment contract , then these payments are also taken into account in calculating the average salary.

Please note: that social payments and other payments not related to wages (material assistance, payment for the cost of food, travel, training, utilities, recreation, etc.) are not taken into account when calculating average earnings. Thus, payment of the cost of training and meals does not apply to remuneration, including in the case when it is provided for in the employment contract. Consequently, it is not taken into account when calculating average earnings.

When calculating average earnings time is excluded from the calculation period , as well as amounts accrued during this time, if:

a) the employee retained his average earnings in accordance with the legislation of the Russian Federation, with the exception of breaks for feeding the child provided for by the labor legislation of the Russian Federation;

b) the employee received temporary disability benefits or maternity benefits;

c) the employee did not work due to downtime due to the fault of the employer or for reasons beyond the control of the employer and employee;

d) the employee did not participate in the strike, but due to this strike he was not able to perform his work;

e) the employee was provided with additional paid days off to care for disabled children and people with disabilities since childhood;

f) the employee in other cases was released from work with full or partial retention of wages or without payment in accordance with the legislation of the Russian Federation.

If the employee did not have actually accrued wages or actually worked days for the pay period or for a period exceeding the pay period, or this period consisted of time excluded from the pay period, the average earnings are determined based on the amount of wages actually accrued for the previous period equal to the calculated one. If the employee did not have actually accrued wages or actually worked days for the billing period and before the start of the billing period, the average earnings are determined based on the amount of wages actually accrued for the days actually worked by the employee in the month of occurrence of the event that is associated with maintaining the average earnings . If the employee did not have actually accrued wages or actually worked days for the billing period, before the start of the billing period and before the occurrence of an event that is associated with the preservation of average earnings, the average earnings are determined based on the tariff rate established for him, salary (official salary).

When tariff rates, salaries (official salaries), and monetary remuneration increase in an organization (branch, structural unit), the average earnings of employees increase in the following order:

- if the increase occurred during the billing period, - payments taken into account when determining average earnings and accrued in the billing period for the period of time preceding the increase are increased by coefficients that are calculated by dividing the tariff rate, salary (official salary), monetary remuneration established in the month the last increase in tariff rates, salaries (official salaries), monetary remuneration, by tariff rates, salaries (official salaries), monetary remuneration established in each month of the billing period;

- if the increase occurred after the billing period before the occurrence of an event that is associated with maintaining the average earnings, the average earnings calculated for the billing period increase;

- if the increase occurred during the period of maintaining average earnings - part of the average earnings increases from the date of increase in the tariff rate, salary (official salary), monetary remuneration until the end of the specified period.

If, when an organization (branch, structural unit) increases tariff rates, salaries (official salaries), monetary remuneration, the list of monthly payments to tariff rates, salaries (official salaries), monetary remuneration and (or) their amounts changes, average earnings increase by coefficients that are calculated by dividing the newly established tariff rates, salaries (official salaries), monetary remuneration and monthly payments by the previously established tariff rates, salaries (official salaries), monetary remuneration and monthly payments.

When increasing average earnings, tariff rates, salaries (official salaries), monetary remuneration and payments established to tariff rates, salaries (official salaries), monetary remuneration in a fixed amount (interest, multiple), with the exception of payments established to tariff rates, are taken into account. salaries (official salaries), monetary remuneration in a range of values (percentage, multiple).

When average earnings increase, payments taken into account when determining average earnings, established in absolute amounts, do not increase. The average earnings determined to pay for the time of forced absence are subject to increase by a coefficient calculated by dividing the tariff rate, salary (official salary), monetary remuneration established for the employee from the date of actual start of work after his restoration to his previous job, by the tariff rate, salary ( official salary), monetary remuneration established in the billing period, if during the forced absence in the organization (branch, structural unit) tariff rates, salaries (official salaries), and monetary remuneration increased.

In all cases, the average monthly earnings of an employee who has worked the entire standard working time during the billing period and fulfilled labor standards (job duties) cannot be less than the minimum wage established by federal law.

- Author - Zvyagin Alexander Sergeevich

- 01.09.2015

- All consultations by the author

Situations when there was no salary in the billing period

If the employee’s salary was not accrued during the billing period, the calculation of average earnings is based on the salary accrued for the previous 12 months. In the case where the employee does not have a salary (time worked) before the start of the billing period, but has one in the month of calculation, the average earnings are determined by the amounts accrued for this month. If there is no salary in the month of calculation, the average salary is calculated based on the assigned tariff rate or salary.

Find out more about unpaid leave in the material “How to take unpaid leave.”

Calculation basis

Please note that not all types of accruals are taken into account when calculating the average. You cannot include social payments, all types of financial assistance, certain categories of compensation in favor of the employee (compensation for the cost of food, travel, rest, vouchers, travel to vacation spots, travel expenses, etc.).

In the base for calculating the average salary, include all types of accruals that are provided for by the regulations on remuneration in the organization. For example, include:

- official salary;

- incentive bonuses;

- bonuses;

- additional payments for overtime, night work;

- payments for combining positions;

- territorial and district allowances;

- other types of payments within the framework of remuneration for labor provided for by the current system of remuneration.

How is the average salary calculated? To do this, you need to divide the calculation base by the number of days in the calculation period. It is worth noting that, for example, for vacation pay the procedure is somewhat different from the generally established one.

General calculation formula:

If you need to calculate average earnings, an online calculator will help you do this easily.

Special rules for accounting for bonuses

When calculating the average monthly salary, different bonuses are taken into account differently, depending on the period for which they were accrued (clause 15 of Regulation No. 922).

When paying monthly bonuses, the calculation includes no more than 1 bonus per month for each bonus indicator, for example, 1 bonus for the number of attracted clients and 1 bonus for sales volume. As a result, no more than 12 bonuses of each type can be taken into account during the billing period.

If bonuses are accrued for a period of more than a month, but less than the calculation period, for example, for a quarter or half a year, they are taken into account in the amount actually accrued for each indicator. And if the duration of the period for which they are accrued exceeds the duration of the billing period - in the amount of the monthly part for each month of the billing period.

Annual bonuses and one-time remuneration for length of service (work experience) are taken into account in full, regardless of the time of their accrual.

In a billing period that is not fully worked, bonuses are taken into account in proportion to the time worked. Bonuses accrued for actual time worked are taken into account in full.

What is the procedure for paying sick leave?

In 2021, employers will partially pay for sick leave.

They only take the first three days. The rest is compensated from the Social Insurance Fund. In some cases, payment is received from the budget, which consists of insurance contributions for workers. If a worker went on sick leave before immediate dismissal or within 30 days (month) after dismissal, sick leave benefits will be paid to him in the amount of 60% of the average salary. The figure is taken for the past 2 years. The law established some restrictions on receiving payment to an employee who went on sick leave. The benefit should not exceed four deductions for the insurance portion. This year, the maximum amount of sick leave per month is calculated using the formula: 61,375 × 4 = 245,500.

Cases when wages increased

An increase in wages in an organization also affects the average monthly salary of an employee. It is important in what period the salary growth occurs:

- If the increase occurs during the billing period, all payments for the time preceding the increase are indexed. The indexation coefficient is calculated by dividing the new tariff rate, salary, etc. by the tariff rates, salaries that were in effect in each of the 12 billing months.

- If the salary increases after the billing period, but before the occurrence of the event for which the average earnings need to be calculated, the average earnings itself increases. The correction factor here is the ratio of the new wage to the previous one.

- If the increase is carried out already during the period of maintaining average earnings, only part of it increases from the date of the increase until the end of this period. The indexing coefficient is calculated in the same way as in the second case.

See also “Salary indexation in 2021: how, by how much and what is the fine.”

About the average salary calculator

The average salary calculator will be useful for independent calculations, as well as for checking the accuracy of the calculations made by the accounting department. Calculation of wages based on average earnings may be required to calculate wages for the periods:

- suspension of the enterprise's activities;

- long downtime;

- the employee is on a business trip;

- downtime during a strike (letter of the Ministry of Finance of the Russian Federation No. 149KV dated January 23, 1996).

In addition, based on average earnings, severance benefits are calculated for employees upon their dismissal as a result of liquidation of an enterprise or reduction of staff.

For your information! Any event that entailed the need to use average indicators for calculating wages will be called the moment the right to maintain average earnings arises.

The calculator is not used to calculate payments and benefits for vacations, sick leave and periods of maternity leave. These payments, although made on the basis of average earnings, are actually calculated using a different methodology, which includes the calculation of payments that are not included in wages.

Rules for calculating average earnings for payment of benefits

In conclusion, we would like to draw the reader’s attention to the following. The concept of average earnings is used not only by labor legislation, but also by social security legislation. Thus, sick leave, maternity and child benefits are paid based on average earnings. However, this earnings are considered differently - in the manner established by the law “On compulsory social insurance in case of temporary disability and in connection with maternity” dated December 29, 2006 No. 255-FZ.

Since 2021, all regions have switched to “Direct payments from the Social Insurance Fund”. This means that the first 3 days of sick leave are calculated and paid by the employer, and the subsequent days of sick leave are paid directly by the Social Insurance Fund to the employee.

Our reminder will help you avoid getting confused in the calculations. Go to the material and study this material for free.

Read more about calculating average earnings for social benefits in the following articles on our website:

- for sick leave - here ;

- for child care benefits - here ;

- for maternity payments - here .

If you need to calculate the average daily earnings for payment of severance pay, use the explanations of ConsultantPlus experts. Get trial access and proceed to the calculation example for free.

Deadlines for payment of vacation pay

According to Article 136 of the Labor Code of the Russian Federation, payment for vacation is made no later than three days before its start. The countdown is carried out in calendar days (Article of the Labor Code of the Russian Federation). So, if the start of the vacation falls on Monday, the money must be paid no later than Thursday of the previous week (letter of the Ministry of Labor dated 09/05/18 No. 14-1/OOG-7157; see “Vacation starts on Monday: when should vacation pay be paid?”).

ATTENTION. The law does not establish the earliest date when an employer is required to pay vacation pay. This means that a company or individual entrepreneur can issue money four, five or more days before the start of the vacation, and this will not be a violation.

Compensation for unused vacation must be issued on the day of dismissal, or no later than the next day after the request for payment is submitted (Article 140 of the Labor Code of the Russian Federation).

Results

The rules for calculating average earnings (average monthly wages), described by us above, apply exclusively to the cases listed at the beginning of the article, including when calculating average earnings when an employee is laid off to pay him severance pay, and social benefits and unemployment benefits do not apply .

You can find out more about social payments in our “Benefits” .

Sources:

- Labor Code of the Russian Federation

- Federal Law of December 29, 2006 No. 255-FZ

- Decree of the Government of the Russian Federation dated December 24, 2007 No. 922

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Example 2

Now suppose that Ivanov A.V. sent on a two-week business trip from January 14, 2019. In this case, we need to determine the number of days worked by him in the billing period. The total number of working days in 2021 according to the five-day calendar is 247. Sick leave from October 1 to October 14 accounts for 10 working days. Hence:

SDZ = 580,000 / (247 - 10) = 2,447.26 rubles.

A business trip from January 14 to January 27, 2021 requires 10 working days. Therefore, Ivanov will be accrued for this time

Z = 2,447.26 x 10 = 24,472.6 rubles.

As the examples show, despite different calculation methods, the amount of payments differs slightly (the difference is less than 2%).

Thus, regardless of the reason why an employee is transferred to “average” pay, he can count on comparable remuneration.

Example 3

Let's use the conditions of the previous examples and assume that Ivanov A.V. I was on sick leave from January 14 to January 27, 2021. The calculation period in this case will consist of 2021 and 2021. The income of Ivanov A.V., subject to contributions to the Social Insurance Fund, in 2021 amounted to 580 thousand rubles, and in 2021 - 500 thousand rubles.

Then:

SDZ = (580,000 + 500,000) / 730 = 1,479.45 rubles.

Now you need to check whether the calculated amount does not exceed the maximum possible benefit amount.

The maximum base for contributions to the Social Insurance Fund in 2021 and 2021 will be RUB 755,000, respectively. and 815,000 rub.

Therefore, the maximum SDZ for sick leave in 2021 will be

SDZm = (750,000 + 815,000) / 730 = 2,150.68 rubles.

Estimated amount for Ivanov A.V. It “fits” well into this limit, so it can be used. If a specialist’s work experience exceeds 8 years, then he has the right to 100% sick pay, and the accrued amount will be:

B = 1479.45 x 14 = 20,712.30

The example shows that the employee will receive significantly less money on sick leave than he would have been paid in the form of vacation pay for the same time. This is due to the fact that the average salary for sick leave is not recalculated when wages increase in the billing period.