You can clarify the traffic police details for paying a fine in a variety of ways. Some of them work online, and some only offline. If the payment form issued by the inspector is lost, then this is not a reason not to pay the fine, since it can be restored. What to do if the resolution was lost?

Board options

You can pay off your debt either online, without leaving your home, or through a payment terminal. In order to understand how to find out the bank details of the traffic police to pay a fine by resolution number, you will need the Internet. All you need to do is go to the State Services website. In the system, you will need to enter the vehicle license number and license number in the provided fields. You will see a list of debts that require repayment. You can either rewrite the necessary information or print a receipt.

To be a full-fledged user of the portal, you need to create a personal account there. Drivers who want to quickly pay off their debt have another option available.

Almost every bank provides a service to find a fine based on the data of the car or its owner and pay it off immediately. Therefore, you can use any terminal to receive details for paying a traffic police fine and the amount that needs to be paid.

The advantage of this option is that in addition to the decree number, you can also use passport data (if a pedestrian pays), license number and car number. Banks have developed a service for tracking debts online and repaying them using bank cards.

Is it possible to pay without details?

To transfer funds to the recipient's account through a bank, payment details are always required, so they must be fully specified in the payment receipt. If you do not want to enter them yourself, choose a payment method through online banking, electronic wallets or other services that allow you to find unpaid fines based on your driver’s license and vehicle registration certificate. In this case, the necessary details will be automatically filled in based on the data received from the GIS GMP system, and you will only have to confirm the transaction.

If there is no receipt or order

If you don’t have a receipt and a resolution, but need to find out what details to use to pay a traffic fine in Moscow, then don’t worry - there’s nothing complicated here. In this situation, the online services of banks and the State Health Service portal already under consideration will also come to the rescue.

You can also find out the purpose of payment about paying a traffic police fine on the traffic police website. To obtain information about the list of debts, the exact amount and details, you need to know the driver's license details and the vehicle number.

Name of the payee's bank

The name of the payee's bank consists of the type (that is, legal form) and the name of the bank itself.

For example, the Moscow Main Territorial Administration (Moscow GTU) of the Bank of Russia, the Branch of the Main Cash Settlement Center of the Main Directorate of the Bank of Russia (GRKTs GU Bank of Russia for a particular subject of Russia).

Traffic police fines are payable specifically to various structural divisions of the Bank of Russia . Because these bodies provide settlement and cash services to the federal treasury bodies of the Ministry of Finance (the departments of the Federal Treasury that are recipients of payments for traffic police fines).

If there is no internet

Almost every person has access to the Internet, but there are also those who do not. What should such drivers do? It’s simple - you need to go to the nearest savings bank and ask the employees the name of the recipient of the traffic police fine. If you doubt that you can fill out the receipt correctly, you can ask a branch employee to do this for a fee. The service is available in many branches; you only need to indicate the required amount, and everything else will be done for you. It is very comfortable.

If you contact the department of the department whose employee issued you a fine, you can ask for photocopies of the materials on your case. This is appropriate if the corresponding OKTM when paying a traffic fine is indicated in the receipt. True, you will need to wait some time - from 2-3 to 7 days.

Administrative offenses

Administrative violations are illegal actions in relation to laws and the charter of the Code of Administrative Offenses of the Russian Federation Federal Law No. 195 of December 30, 2001 (as amended on December 27, 2018). According to ch. 2 of the Code of Administrative Offenses of the Russian Federation, both individuals and legal entities, including foreigners, are held administratively liable.

The legislation of the Russian Federation provides a list of illegal acts for which citizens and legal entities are held accountable before the law and pay penalties. A complete list is provided in section II of the Code of Administrative Offenses of the Russian Federation. The amounts of fines are approved in Art. 3.5 Ch. 3 Code of Administrative Offenses of the Russian Federation.

If it so happens that an individual entrepreneur, an organization or a citizen committed any of the listed acts and were subject to sanctions, then when paying penalties in the payment order, you must indicate to the KBC the administrative fine.

Payment

KBK

Violations of taxes and fees provided for by the Code of Administrative Offenses of the Russian Federation (federal government agencies, the Central Bank, management bodies of state extra-budgetary funds of the Russian Federation)

182 1 1600 140

Violation of the legislation of the Russian Federation on administrative offenses provided for in Article 20.25 of the Code of Administrative Offenses of the Russian Federation (federal bodies, the Central Bank, management bodies of state extra-budgetary funds of the Russian Federation)

182 1 1600 140

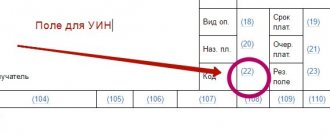

UIN - what is it?

To pay off a debt, you need to know your personal UIN. This is an identifier assigned to the document with which finances are sent to the treasury. UIN is used in those departments in which there is a very large flow of finances - tax and traffic police.

This code began to be used recently; it began to be actively used in 2014.

If you don’t know how to find the UIN for paying a traffic police fine, you can see this 12-digit number on the receipt. In addition, this digital value is on the check order, the supporting document PD4 and the check.

The UIN is used to simplify the work of the tax office when accounting for budgetary finances, storing data and exchanging them during financial transactions between different government agencies and individuals. Drivers are aware that if they fail to pay a fine, they may be given the status of “restricted to travel.” So it is important to pay everything on time.

Thanks to the UIN, fast communication between different government agencies is guaranteed. The funds you deposit are credited to the designated account in a timely manner.

This code makes it possible to minimize the number of unexplained cash transfers to customs, the tax department and other government agencies.

Violation of legislation on taxes and fees

Sometimes citizens and legal entities evade paying fees, do not deposit tax funds on time, or violate other laws of the tax legislation of the Russian Federation. For these actions, Federal Tax Service employees impose penalties on the culprit, which are paid indicating the corresponding codes classifying the payment in the receipt.

Payment

KBK

Violation of legislation on taxes and fees

182 1 1600 140

Violation of the legislation on taxes and fees, provided for in Articles 116, 1191, 1192, clauses 1 and 2 of Art. 120, art. 125. 126, 1261, 128. 129, 1291, 1294, 132, 133, 134. 135, 1351, 1352 Tax Code of the Russian Federation

182 1 1600 140

Evasion of taxes and/or fees, concealment of funds or property of an organization or individual entrepreneur, at the expense of which taxes and/or fees should be collected, for failure to fulfill the duty of a tax agent (federal government bodies, the Central Bank, management bodies of state extra-budgetary funds of the Russian Federation)

182 1 1600 140

Violation of the legislation on taxes and fees provided for in Art. 129.6 of the Tax Code of the Russian Federation (federal state bodies, the Central Bank, management bodies of state extra-budgetary funds of the Russian Federation)

182 1 1600 140

UIN - how it is formed

In reality, the payer often does not have to know exactly, for example, what a UIN is when paying a traffic fine through Sberbank online or other online resources. Typically, this data is required by bank and treasury employees. Sometimes this value is indicated together with “0”, but paying debts requires entering this code in its entirety.

It is not difficult to understand how to find out the UIN of a traffic police fine by the number of the resolution. This:

- No. and series of the protocol;

- Composition number.

Now let’s look at each digit of this code:

- The first 3 digits are the code assigned by the revenue manager. In the traffic police it is 188.

- This is followed by a number indicating the service number where the payment should be credited. In this case – 1;

- The next number is the payment type. Penalties are received according to No. 1

- The next two digits are the date of the protocol;

- From 8th to 19th – series and number;

- The very last digit is needed so that, due to inattention, 2 identical protocols are not made.

basic information

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

8 (800) 700 95 53

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

State Traffic Inspectorate employees are required to provide correct payment details. This will allow the offender to make the payment correctly and on time. Otherwise, additional penalties will be charged for delay.

If the protocol contains all the necessary information, and the information about the payer is indicated correctly, then no problems with the translation will arise. At the moment there are quite a few ways to make payments.

Checking traffic police fines by UIN number

In 2021, you can search for traffic police fines by UIN online on the traffic police website. There is nothing complicated in this matter. You should decide on the appropriate option for depositing funds, enter the necessary information and click on the “check” icon. You will be given information regarding the traffic police fine according to the UIN in the resolution. You can also pay off your debt here.

The most important thing is to be very careful when entering data. If the code is entered incorrectly, the money will be returned to your card. The system will ask you to enter information about the region where the fine was imposed, its amount, date of assignment, BCC, type and document on which the payment is made, full name, email address where the payment will be sent.

After entering all this data, you will be able to complete the transaction. In general, if you work with the service correctly, then you will not have any problems with how to pay the traffic police fine according to your UIN.

Everything needs to be done in a timely manner; 60 days are given for payment. If you pay off the debt within the first 20 days, you can get a discount. If payment is late, there will be additional punishment, either in the form of a fine, or in the form of administrative arrest or correctional labor.

A little more about paying fines and monetary penalties

Fines for violation of laws on taxes and fees

Fines are issued for violations of federal legislation on taxes and fees, as well as for administrative violations. A complete list of violations that entail a fine is contained in the Tax and Criminal Code of the Russian Federation.

Each type of offense punishable by a fine is regulated by government agencies at various levels, so the recipients of the fine will be different. This is why it is so important to indicate the correct BCC in the payment order when paying a fine.

- For violation of budget legislation at the federal level 1 1600 140. For arrears to the Pension Fund - 1 16 20010 06 0000 140.

- For failure to pay contributions to the Social Insurance Fund on time - 1 16 20020 07 0000 140.

- For non-payment of contributions to the FFOMS - 1 1600 140.

- The fine for violations of cash handling, cash transactions, and the use of special bank accounts identified by the inspection (if this was due to the requirements) is 1,1600,140.

- For violations related to the use of currency 1 16 05000 01 0000 140.

Other fines

- 18811643000016000140 – for administrative violations. 18811690010016000140 – compensation for damage to the federal budget.

- 18811690050056000140 – compensation for damage to the budgets of municipal districts.

Payment of traffic fines

The most widespread type of fines. The accrued fine must be paid on time (within 2 months), otherwise there is a new offense, which in turn is also punishable by a fine and additional unpleasant measures against the defaulter.

The 60 days provided for payment begin to count from the issuance of a receipt for a fine or after receiving a letter of receipt issued according to the recording cameras.

Innovations adopted in 2021 threaten non-payers of traffic police fines with the following penalties:

- Late payment will result in a double fine;

- a persistent defaulter may be arrested for 15 days;

- You may be forced to perform community service for up to 50 hours.

Everything depends on the decision of the judge, who takes into account, first of all, the seriousness of the committed traffic violation.

Payment details

If you have received a notice of a fine from the traffic police, you must pay it using the correct details. Please note that the budget classification codes for this type of fine are the same for all regions of the Russian Federation; they depend on what kind of car you have and what exactly you violated with it. Look for the CBC you need among those listed below.

- 18811630020016000140 – for administrative offenses in the field of traffic.

- 18811630010016000140 – for violating the rules for transporting large and heavy cargo on public roads:

- 18811630011016000140 – for the same violation that occurred on a federal road;

- 18811630012016000140 – if the road was of regional or intermunicipal importance;

- 18811630013016000140 – public road of local importance for urban districts;

- 18811630014016000140 – public road of local significance in municipal districts;

- 18811630015016000140 – public road of local significance for settlements.

- 18811625050016000140 – for violation of legislation in the field of environmental protection.

- 18811626000016000140 – for violating the legislation on advertising on vehicles;

- 18811629000016000140 – for violations in the field of international transportation (federal budget).

- 18811630030016000140 – for all other fines imposed by a municipal body, federal city, urban district.

What is KBK

It was said above that you will have to enter data in the KBK column. This is a budget classification code that has a 20-digit numerical value. There is a KBK for an administrative fine from the traffic police in 2020.

This code is used to control and sort funds that go into the state treasury. As a result, an analysis of the purpose of the proceeds and their purpose is carried out. Each service is assigned a personal number. For example, motorists should know in 2021 which BCC to indicate when paying a fine to the traffic police for speeding, and which for committing other traffic violations.

New budget classification codes approved

This year the budget classification codes have changed. Let's figure out what codes and in what situations we now need to use.

In 2021, budget classification codes (BCCs) need to be written in a new way. The new BCCs were approved by two regulatory legal acts:

- Order of the Ministry of Finance dated November 29, 2019 No. 207n “On approval of codes (lists of codes) of the budget classification of the Russian Federation related to the federal budget and budgets of state extra-budgetary funds of the Russian Federation.”

- Order of the Ministry of Finance dated 06.06.19 No. 85n “On the procedure for the formation and application of budget classification codes of the Russian Federation, their structure and principles of purpose.”

The changes affected those codes that are used to pay fines imposed under Chapter 16 of the Tax Code of the Russian Federation. If in 2021 all sanctions were recorded under the common code 182 1 16 03010 01 6000 140, this year different sanctions are assigned to different BCCs.

- Submission by a tax agent of documents that contain false information – 182 1 1608 140

- Failure to provide information necessary for tax control – 182 1 1607 14

- Violation of the rules for accounting for income and expenses and objects of taxation, the basis for calculating insurance premiums - 182 1 16 05160 01 0005 140

- Violation of the method of submitting a tax return – 182 1 16 05160 01 0003 140

- Failure to submit a tax return or calculation of insurance premiums – 182 1 1602 140

Despite the changes, some payments must use the same codes as in 2021. This includes payment of taxes, fees, insurance premiums and penalties. The same rule applies to fines assessed for non-payment of taxes.

In addition, changes affected the BCC for administrative fines imposed for tax-related violations. Previously, there was one code for all types of violations – 182 1 1600 140.

- Violation of deadlines for submitting a tax return, calculating insurance premiums – 182 1 1605 140

- Failure to provide information necessary for tax control – 182 1 1606 140

- Violation of the deadline for registration with the tax authority - 182 1 1603 140

Regardless of the period to which the payment relates, BCCs for 2019 are considered obsolete and cannot be used.

Read more about changes in budget classification codes in the Glavbukh system

Get free demo access

OKTMO/OKATO

The concept stands for a public classifier of municipal territories. This is a new concept that previously existed in the form of OKATO. Now this is a mandatory detail to be included in the payment document.

The information simplifies the process of processing statistical data, and also improves the process of tracking all payments received by the specified public service. The code contains 8 digits. Previously, the location of the legal entity was indicated. Depending on the territory, the number of characters in OKTMO also depends.

Payment bills may indicate both OKTMO and OKATO. This will not be considered an error when making payments.

checkpoint

Almost all payment cards have such a concept as checkpoint. In other words, this is the reason for setting code. The concept consists of 9 digits, which is a specific identifier of a legal entity. Similar in importance to an individual tax number.

In fact, the code consists of several parts:

- information about the division of the tax number – 1–4 digits of the concept;

- The installation reason code is included in the 5th–6th digit;

- the serial number in a special register is 7–9 digits.

Information about the checkpoint is also available on the official website of the Federal Tax Service. It is free to demand, so each person has the right to believe such information independently.