Closing a bank account is the termination of the relationship between the client and the banking institution for placing the client’s funds in a specific account.

Closing a current account (c/c) means withdrawing all funds from it and canceling the account in the bank’s registers. After this, all operations on the account become impossible: storing funds, receiving and sending payments, depositing and withdrawing cash from the account.

Reasons for closing a bank account

Sometimes a current account has to be closed. The reasons for such actions may be different, the most common option is receiving a more advantageous service offer from another financial institution.

Let's look at why clients close their current account. The reasons for this may be:

- reorganization or liquidation, including during bankruptcy proceedings;

- dissatisfaction with the quality of service;

- lack of normal Internet banking or its unsatisfactory operation;

- inconvenient location of branches of a financial organization combined with the inability to resolve issues remotely;

- doubt about the stable financial position of the bank.

This list does not include all possible reasons for closing an account. For example, when issuing a loan to a legal entity, many banks insist on completely refusing to work with other financial institutions. And although the requirement is unspoken, if it is not met, it can be quite difficult to get a loan.

Why did the bank close the current account unilaterally?

Sometimes the bank terminates the cash settlement agreement and closes the account unilaterally. But for a banking organization this is far from the simplest situation. Previously, a credit institution could terminate a cash settlement agreement only after receiving a court decision, but the situation changed somewhat in 2005.

Let's consider when a bank can, on its own initiative, close a current account without going to court:

- there have been no transactions on the account for more than two years;

- violation of laws related to anti-money laundering and combating financial terrorism;

- to comply with the requirements of the FATCA law.

The bank can terminate the agreement unilaterally without trial if the client does not use it. In this case, three conditions must be met simultaneously:

- The client's account has a zero balance for two years.

- The client has not performed a single transaction on the account for more than two years.

- The bank sent a warning to the client 2 months before the expected date of termination of the contract.

Note . It does not matter whether the account owner received the notification or not, the main thing for the bank is to have confirmation of the fact of sending. For this reason, the bank is still forced to send a letter of declared value or registered letter with notification.

According to 115-FZ, the bank is obliged to stop even attempts to perform dubious transactions and request documents from the client, and then figure out how legal a particular transfer of funds was. According to the same Federal Law, if a bank blocked questionable transactions twice in a year, then it can terminate the cash settlement agreement with the client unilaterally.

We advise you to read: Blocking an account by a bank under Federal Law 115 - what the dangers are, the consequences

Alas, there are virtually no clear regulations for the application of 115-FZ, and the recommendations of the Central Bank do not take into account the characteristics of many categories of business. At the same time, the training of responsible bank employees is often more formal in nature. As a result, legitimate transactions often appear suspicious to the credit institution.

In theory, the bank should ask the client to provide supporting documents and, if everything is fine during the check, then continue working with him. In practice, most often they offer to terminate the contract at the client’s initiative and even provide a sample of the corresponding application. In this case, the money is offered to be transferred to another bank, often with the deduction of a significant commission.

Important ! According to Russian laws, a taxpayer is required to report income to the tax service, as well as pay taxes and fees in the prescribed amount. If you violate these requirements, then the bank’s refusal of service with reference to the norms of 115-FZ will not take long.

Finding yourself in such a situation, it is you who will have to decide whether you agree to leave a particular bank or whether you will continue to fight to defend your interests. It should be borne in mind that at present, organizations and individual entrepreneurs who were asked to close an account and go to another bank are automatically blacklisted, and they are reluctant to open a new account.

If you know that all transactions were legal, and there is confirmation of them, then it makes sense to seek protection of interests through the court, without terminating the agreement with the original bank.

We advise you to read: Blocking of a current account by a bank: reasons, how to unblock it

Foreign organizations may lose their current account if they did not provide the necessary information, in particular, did not report that they are foreign taxpayers, did not respond to the bank’s request within 15 days, did not provide consent to transfer data to a foreign tax authority, etc. d.

Documentation

Often all the necessary documents are already at the bank’s disposal, because the organization or entrepreneur was serviced by it and transferred all the required papers when opening a current account. However, often the situation may turn out to be non-standard, and additional documents will be required.

A pre-prepared package of documents, which includes:

- an order to close an account indicating the person entitled to perform this operation;

- an extract from the legal register received less than 30 days ago. persons;

- protocol/decision of the founders (if necessary);

- documents confirming changes in the constituent documents, if they have not previously been submitted;

- applicant's passport;

- checkbook (card).

If the account is closed when the organization’s activities cease due to bankruptcy, then the bankruptcy trustee will handle this. He will be required to provide a passport and a copy of the act confirming his appointment to the position.

An individual entrepreneur only needs to submit an application in person to the office of a financial institution and hand over a checkbook or card.

Letter on closing a current account

An application for closing an account can be filled out directly at the bank office or prepared in advance using the prescribed form. Often a sample document can also be found on the official website of the financial institution. Using standard forms allows you to minimize inaccuracies and errors.

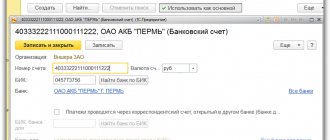

The document must contain the following information:

- name of the organization or full name entrepreneur;

- details of the account that needs to be closed;

- reference to the number and date of the cash settlement agreement;

- checkbook information (if issued);

- details for refund or instructions to issue the balance in cash;

- signature of an authorized person and seal (if available).

Card with sample signatures

Compile a card with samples of signatures and seal imprints according to form No. 0401026, approved by Bank of Russia Instruction No. 153-I dated May 30, 2014.

Card forms can be produced either by the organization or by the bank independently (clause 7.4 of the Bank of Russia Instruction No. 153-I dated May 30, 2014). Check with your bank to see if it provides card forms to clients.

You can fill out the card:

- on a typewriter or computer in black font;

- a pen with black, blue or purple paste (ink).

You cannot use a facsimile signature to fill out the fields of the card.

This is stated in paragraph 7.2 of Bank of Russia Instruction No. 153-I dated May 30, 2014.

The procedure for filling out the card is given in Appendix 2 to Bank of Russia Instruction No. 153-I dated May 30, 2014.

On the front of the card please indicate:

- in the “Client (account holder)” field – the full name of the organization in accordance with the constituent documents. If an organization opens an account for a separate division, then after the name of the organization, separate by a comma, enter the name of the separate division. The name of the unit must match the name indicated in the regulations on its opening;

- in the “Location (place of residence)” field – the actual address of the organization (separate division). If powers have been transferred to a management company or manager, enter their actual address;

- in the “tel. No. – one or more telephone numbers of an organization (separate division);

- in the “Bank” field – the full or abbreviated name of the bank in which the organization opens a current account.

The “O” fields are filled in by bank employees.

On the back of the card write:

- in the field “Abbreviated name of the client (account holder)” – the abbreviated name of the organization (separate division) in accordance with the constituent documents (regulations on the separate division). You can indicate the abbreviated name in Latin letters without interlinear translation into Russian. If there is no abbreviated name, indicate the full name of the organization (separate division);

- in the field “Last name, first name, patronymic” - surnames, first names, patronymics of persons authorized to sign;

- in the “Sample signature” field – handwritten signatures of persons authorized to sign (opposite their last name);

- in the “Date of filling out” field – the day, month and year of filling out the card;

- in the field “Signature of the client (account owner)” - the handwritten signature of the head of the organization. If a current account is opened by a representative of an organization under a power of attorney, then in this field you must enter the signature of the person acting under the power of attorney, as well as the date and number of the power of attorney;

- in the “Sample of seal imprint” field – a clear example of the organization’s seal imprint. The print must not exceed the boundaries of this field.

The fields “Account number”, “Term of office” and “Cash checks issued” are filled in by bank employees.

The field “Place for a certification inscription attesting the authenticity of signatures” is filled in by a notary certifying the signatures of persons authorized to sign.

The card does not need to be certified by a notary. A bank specialist himself can certify the signatures and powers of the organization’s employees on the basis of documents confirming the identities of the employees, as well as the organization’s constituent and administrative documents. This procedure is established by clause 7.10 of Bank of Russia Instruction No. 153-I dated May 30, 2014.

You cannot change the number and location of fields on the card. An arbitrary number of lines in the fields is allowed:

- “Client (account holder)”;

- “Cash checks issued”;

- "Other marks";

- “Last name, first name, patronymic” and “Sample signature”;

- “Account number” (if several accounts are opened and the persons authorized to sign are the same).

This is stated in paragraph 7.4 of Bank of Russia Instruction No. 153-I dated May 30, 2014.

Procedure for closing a current account

There are usually no problems with closing a current account. This is a fairly standard operation. If possible, you should withdraw balances to other accounts in advance, leaving only the amount to pay the commission (if any).

Important ! If you have a debt for the services of a financial institution, you will not be able to close your current account; you will first have to pay off the debt.

Let's consider the general procedure for closing a current account:

- Submitting an application to close the account and terminate the contract.

- Repayment of debts for the services of a credit institution (if any).

- Return of check books and issued cards.

- Withdrawal of the remaining funds if this has not been done in advance.

- Receipt of a document confirming account closure.

conclusions

Closing an account, as well as opening it, is carried out in a strict manner prescribed by the norms of current legislation and the rules of the financial institution.

Termination of the relevant agreement can be initiated by both the client and the servicing bank. The rights of the parties in such situations are determined by specific provisions of civil law.

Typically, the interests of the owner of the closed account are given obvious priority - the client can terminate cooperation at any convenient time and for any reason.

The client’s preparation of the application and the availability of the necessary documentation are of particular importance for the correct execution of the procedure.

Fees and deadlines for closing a current account

You can find out how much it costs to close a current account in the tariffs of the credit institution or by calling the contact center. Usually this procedure is free. However, some banks want to make money on everything or introduce quite significant commissions for such an operation.

According to current legislation, the period for closing a bank account is 7 days. An entry on the closure of a current account in the internal documents of the credit institution is made no later than the next business day after the termination of the cash settlement agreement. If there are no balances on the account and it is closed at the client’s initiative, then this takes very little time.

The increase in the time it takes to close an account during liquidation is due to the need to repay all debts to creditors.

Causes

The legislation provides for the following grounds for terminating a banking service agreement and, as a consequence, closing a current bank account:

- unilateral refusal of the bank or account holder from the concluded agreement;

- judicial procedure for terminating a contract at the initiative of any of its parties (client, bank);

- termination of contractual relations upon achievement of mutual agreement by both parties;

- legal requirement of authorized representatives of regulatory structures (for example, the tax service);

- compliance with the relevant norms of current legislation.

Balance of funds upon closing the current account

The answer to the question whether it is possible to close an account with a positive balance will definitely be negative. This is your organization's money and needs to be taken. In the application for closing an account, you can instruct the bank to transfer the balance to the details in any bank or do it yourself by issuing a payment order. It is possible to receive the balance in cash, but only if it is insignificant.

Advice . If you have made an unambiguous decision to close your account, then leave on it an amount sufficient to pay commissions, and transfer the rest to another account yourself. This will speed up the procedure.

The situation is much more complicated if there is a balance on the account, but the bank insists on closing it, hiding behind the norms of Federal Law 115. Such situations are not at all uncommon lately, especially in small regional banks. However, a transfer to another bank usually involves a considerable commission. If you have fulfilled all the requirements for submitting documents and are not engaged in cash withdrawal, then you can try to get the continuation of the service or at least cancel the commission in court.

How to restore transaction history

The law requires storing documents for at least four years, and accounting rules say even five years. It makes sense to take care of saving all statements in advance. But even after taking all the necessary actions, sometimes data can be lost. In this case, you will have to restore all data through the bank.

It is enough for an individual entrepreneur to personally submit an application for issuing a statement of a closed account by contacting a bank branch with a passport. No problems with obtaining the document arise regardless of whether the activity as an individual entrepreneur continues or it has been terminated.

We advise you to read: Is it possible for an individual entrepreneur to work without a current account and is it needed to conduct business?

If the organization continues to operate, then receiving a statement of a closed account is also not a problem for it. But in case of liquidation there may be problems. If the company was reorganized by merging with another, then you can still try to get an extract by submitting the relevant documents to the bank. In the event of liquidation, for example, bankruptcy, the bank does not have the right to open the data, and it can only be obtained at the request of the court.

Notice of closing a current account in 2021

At the moment, the question of how to notify the tax office about the closure of an account has lost its relevance. In the past, organizations and entrepreneurs were required to send information about opening an account to the Federal Tax Service, Pension Fund and insurance funds. Moreover, only a few days were allotted for this.

From mid-2014, any bank will independently send a notification to the tax office and other government agencies.

If the organization or entrepreneur continues to operate, then it is worth notifying counterparties about changes in details. This is not a requirement, but is highly recommended as it helps avoid mistakes and confusion. But even if someone sends a payment using the old details, where the liquidated account is indicated, nothing bad will happen. The money will be returned to the sender within five days.

How to pay taxes if your current account is closed

Individual entrepreneurs are not required to have bank accounts. This allows them to pay their taxes in cash and the closed account situation is not a problem for them. It is more difficult for organizations. The position of the Ministry of Finance is that they cannot pay taxes in cash.

If the funds were issued on account, and subsequently the organization received an advance report from an authorized employee (and all the necessary details were indicated in the payment document), then it is permissible to pay taxes in cash through a representative of the company. This is evidenced by some decisions of arbitration courts, as well as instructions of the Constitutional Court. But problems with crediting funds with such payment cannot be avoided. Therefore, it is better to think in advance when the LLC will close its account during liquidation, and not to rush too much.

If the account is closed by proxy

Closing an account by power of attorney is a common situation, especially if the bank’s client is a legal entity. An individual entrepreneur can close an account only with a notarized power of attorney. In the case of legal It is not necessary for a person to certify a power of attorney with a notary.

The power of attorney must clearly state the authority of the representative to close the account. Bank requirements for a power of attorney sometimes vary, so it is better to find out in advance what data should be indicated in it.

Power of attorney

The bank refuses to close a current account: is it legal?

In fact, the bank does not have the opportunity to refuse to close the account. But in practice, this procedure can be suspended if government agencies have frozen transactions on the account or it has been seized. Usually, account closure becomes possible the next day after debts to the state are paid off and a decision is made to cancel the seizure or suspend the operation.

Before closing the account, the debts must be paid in full, otherwise the account will not be closed. The situation is even more complicated if the bank has an existing loan. It can be drawn up in a separate agreement or as an annex to the general RKO agreement. In any situation, the credit institution will insist on full repayment of the debt before closing the account, even if the loan and cash settlement agreements are not interrelated. The fact is that if there is turnover, the bank receives additional opportunities to collect funds from incoming payments.

Some banks are trying to retain customers by introducing various commissions. In this case, we can only advise you to carefully study the contract and all appendices to it.

How to close a current account for an LLC

If a company decides to close its current account, then usually no problems will arise provided there are no debts to the bank. It is enough to submit a complete set of documents and an application to the department. There is no need to notify anyone.

Sometimes an LLC cannot close a current account without a decision from the founders. This feature may be provided for in the company's Charter, and will need to be observed. Another feature is the ability to withdraw the balance only for certain needs, for example, salary, household needs, etc. In practice, it is often easier to transfer balances to another account, even if they are very small.

How and when to close an account during LLC liquidation

When a company is liquidated, the head of the organization is deprived of the right to dispose of funds and close accounts. If the liquidation is voluntary, then these powers will pass to the liquidator or liquidation commission, which the founders must appoint by decision. If liquidation occurs during bankruptcy, then the authority to manage the accounts passes to a bankruptcy trustee appointed by the court.

Additionally, when closing the account of a company that is in the process of liquidation, one of the following documents must be attached:

- minutes of the general meeting of founders or the decision of the sole participant to appoint a liquidator (commission);

- court decision on the appointment of a bankruptcy trustee.

Typically, a bank account should be closed after the liquidation balance sheet is submitted, but before the liquidation of the organization is recorded in the state register. However, the legislation does not regulate this point, and often accounts are closed much earlier, and then they are faced with the problem of paying taxes.

Income tax return

The written-off debt is reflected in the income tax return:

- Sheet 02 Appendix No. 2: PDF page 302 “Amounts of bad debts...”.

If you are a subscriber to the BukhExpert8: Rubricator 1C Accounting system, then read additional material on the topic:

- From January 1, 2019, does deposit insurance for small businesses apply only to deposits or to funds in a current account as well?

- Debt adjustment in 1C 8.3: writing off debt and postings

If you haven't subscribed yet:

Activate demo access for free →

or

Subscribe to Rubricator →

After subscribing, you will have access to all materials on 1C Accounting, recordings of supporting broadcasts, and you will be able to ask any questions about 1C.

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

How to close an individual entrepreneur's current account

According to the law, an entrepreneur is not required to have an account. Closing it if necessary will not be difficult. It is enough to submit the appropriate application to the branch and withdraw the remaining cash. Do not forget to return the issued cards and checkbooks to the bank.

There is no need to notify the tax or other government agencies. This is the responsibility of banks, and they will definitely fulfill it. But just in case, you should remember to receive a notice of account closure.

Important ! In some banks, the procedure for closing an account may differ slightly from the standard one, for example, you may need to submit a fresh extract from the Unified State Register of Individual Entrepreneurs, etc. You can clarify this point by reviewing the cash settlement agreement or contacting the manager of the credit institution.

How to close a bank account if there is an outstanding loan

An individual entrepreneur is an individual. Typically, banks can allow you to close a current account even if you have an unpaid loan. Often the loan agreement does not even state whether a particular citizen is an individual entrepreneur. But exceptions are possible.

The bank may insist on full repayment of the loan, for example, if it was issued for certain purposes. This point should be clarified in advance with the employees of the credit institution.

How to close by power of attorney

It is possible to close the account of an individual entrepreneur using a power of attorney, but only if it is notarized and contains instructions on such powers. In this case, the person closing the account will also need his own passport.

Banks really don’t like opening and closing accounts by proxy. In most cases, significantly increased tariffs are provided for such operations. They are associated with the need to verify the power of attorney and possible problems for the bank, the number of which increases significantly when conducting an operation without the personal presence of an individual entrepreneur.

Features for individual entrepreneurs and legal entities

If there is an outstanding loan, writs of execution, etc., closing the account may not go so smoothly. It all depends on the type of account, and, for example, if it is needed to make payment for a loan, it will not be closed until the date of full repayment of the debt.

Some banks provide a commission for closing an account or an increased rate for transferring funds in connection with termination of the contract. These conditions are usually negotiated at the beginning of cooperation.

The company or individual entrepreneur has 60 days to receive its funds from the account. If the money is not received within this time, it will be sent to a special account at the Central Bank of the Russian Federation.

Also read: How to withdraw money from an LLC current account: grounds, methods and procedure