How to get property and social deductions in one year

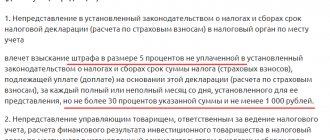

Often, within one year, a personal income tax payer can spend significant amounts of money on the purchase of residential real estate and treatment or education for himself or his child. When such a situation arises, a citizen begins to wonder whether it is legal to simultaneously demand a property and social tax deduction, which would reduce the tax base for personal income tax and allow him to return part of the money spent. Tax legislation does not prohibit such a measure of compensation for costs incurred, however, certain restrictions are imposed on the taxpayer.

Is it possible to get a deduction for an apartment and for treatment at the same time?

Thus, a citizen is “exempt” from paying personal income tax on his own and children’s education in the amount of up to 120 thousand rubles, 50 thousand rubles for relatives. Treatment Now let’s talk about how many times you can get a tax deduction for treatment. This benefit, like training, is a social benefit.

His salary is 50 thousand rubles. per month. The annual personal income tax amount will be: (50 x 12) x 13% = 78 thousand. Therefore, the deduction will be 78 thousand per year. The remaining amount (2000,000 - 78,000) 1 million 922 thousand rubles is transferred to the next one. Until the benefit is spent. How to calculate the tax benefit for a house purchased using a certificate for maternity capital. From the cost of housing, it is necessary to subtract the amount that was provided for by maternity capital. And for the rest, a limited lifetime benefit is provided. No deductions are provided for budget targeted funds for the purchase of housing and the amount of maternity certificates. Car transactions Many people are also interested in the question of how many times they can get a tax deduction for a car. There are no benefits provided when purchasing.

We recommend reading: What Pregnant Women Should Do in the Moscow Region 2021 Dairy Kitchen

Is it possible to get two tax deductions: social in one year?

Employees, from whose earnings the amount of personal income tax is withheld at a 13% rate, have the right to demand several social deductions at once in the same year, if during this year they simultaneously incurred expenses for treatment, training, voluntary contributions towards a future pension, or charity .

Of course, there is a limitation on the amount of the deduction - all social deductions in total cannot exceed 120 thousand rubles per year. The taxpayer can decide for himself what costs and in what amounts should be taken into account within the maximum amount of social deduction in the tax period. Tax laws also allow a citizen to file a return within 3 years of the end of the year in which he incurred the expenses.

Is it possible to get a property deduction if the apartment is sold?

- room, apartment or part thereof;

- private house or part;

- the land plot on which construction or part thereof is being carried out;

- a plot of land on which a private house is located;

- a plot of land with a house in which there is a share of ownership or it is fully owned.

Documents such as a decision on the division of compensation may be needed if the property was acquired during marriage or in shares. You may also need a certificate of birth of the child and his right to own part or all of the housing if the return is issued for a minor owner.

How to get two types of property deductions at the same time

In practice, most often the sale of a residential property is immediately followed by the purchase of a new home to replace the one sold. And then the question arises whether it is possible to demand two property deductions at once, one from the sale of property, the other from the purchase of a new apartment or house. The Ministry of Finance and tax authorities allow you to receive a deduction twice, but provided that the purchase and sale transactions took place within the same calendar year. At the same time, the standard requirements for obtaining a property deduction must be met, and all documents confirming the fact of transactions must be presented.

It must be remembered that a property deduction for the sale of housing can be applied several times, but a tax deduction for the purchase of residential real estate is possible only once in a lifetime and for only one piece of property. Therefore, if a citizen has already submitted an application for a personal income tax deduction from purchased housing, he does not have the right to receive it again.

Is it possible for spouses to receive a deduction for an apartment at the same time?

After receiving the notification, the citizen gives it to the employer and writes a corresponding statement. and the employer, on the basis of the submitted documents, stops deducting personal income tax from his salary - until the citizen’s salary does not exceed the amount of the property deduction. If it turns out that the employer did not provide the deduction in full or did not provide it at all, the citizen has the right to apply for a deduction to the Federal Tax Service.

That is, with a maximum of 2 million you can claim 260 thousand rubles. “Now the property tax deduction is tied not to the property, but to the subject, that is, to the person, the owner,” Tatyana Priezzhikh, head of the department for working with taxpayers of the Federal Tax Service of Russia for the Amur Region, commented to the AP. — You can receive a property deduction not once in your life, as it was before January 1, 2014, but many times, but in the amount of actual expenses incurred, the maximum amount of which is 2 million rubles.

How to get a tax deduction again

Since 2009, it has become possible to demand an additional tax deduction until the maximum amount established by law is reached (today it is 2 million rubles). You can apply for it within 3 years from the end of the tax period in which the right to the deduction arose. In the same way, you can get a double tax deduction, but only once in relation to one piece of property.

Changes in tax legislation were due to unequal conditions for various social strata of the population - citizens earning small amounts and purchasing inexpensive housing could not claim a refund of significant amounts, unlike wealthy personal income tax payers. In this regard, it was decided to allow an unlimited number of deductions to be issued until together they reach the maximum possible amount.

If the housing was purchased with a mortgage, the employee is required to bring reports from the banking institution (original and copy) to the place of work or to the Federal Tax Service office. If you purchased property with your own funds, you can submit the missing documents for re-deduction and fill out a statement stating that other papers were presented earlier.

How to fill out standard deductions in 3-NDFL

Standard tax deductions are provided to certain categories of individuals (“Chernobyl survivors”, disabled people since childhood, parents and guardians depending on the number of children, etc.).

Find out more about standard deductions here.

ATTENTION! Starting from 2021, the size of standard deductions is planned to increase. For details, see the material “Increasing the amount of the child tax deduction from 2021.”

In 3-NDFL, information about standard deductions is provided from the data in the 2-NDFL certificate and is necessary for the correct calculation of the amount of personal income tax (its refundable part or paid to the budget).

A line-by-line algorithm for reflecting standard deductions in 3-NDFL can be found in ConsultantPlus. Get trial access to the system for free and proceed to the material.

Let's look at filling out information in 3-NDFL about standard tax deductions using an example.

Example 1

Stepanov Ivan Andreevich bought an apartment in 2021 and decided to return part of the personal income tax. To do this, he filled out 3-NDFL using the “Declaration 2019” program posted on the Federal Tax Service website.

To enter information into 3-NDFL after filling out the initial data (about the type of declaration, the Federal Tax Service code, personal data and other mandatory information), in the “Deductions” section, I. A. Stepanov ticked the following boxes:

- “provide standard deductions”;

- “there is neither 104 nor 105 deduction” (which means that Stepanov I.A. has no right to a deduction of 500 or 3,000 rubles per month provided to the categories of persons specified in paragraph 1 of Article 218 of the Tax Code of the Russian Federation);

- “the number of children per year did not change and amounted to” - from the list Stepanov I.A. chose the number “1”, which means that he has an only child.

For the Ministry of Finance’s opinion on “children’s” deductions, see the message “Child from a first marriage + child of a spouse + common: how many deductions is an employee entitled to?”.

What the “Deductions” section looks like after filling out, see the figure:

In order for the program to calculate the amount of standard deductions and generate the necessary sheets in 3-NDFL, Stepanov filled out another section - “Income received in the Russian Federation” - as follows:

As a result of filling out these sections in the declaration, the program generated Appendix 5 with information about the total amount of standard tax deductions provided to Stepanov I.A. at his place of work. The program calculated the total amount of deductions taking into account the limit established by the Tax Code of the Russian Federation on the amount of income within which standard “children’s” deductions are provided.

A fragment of completed Appendix 5 with information on the total amount of standard deductions and the number of months of their provision, see below:

Explanation of information in Appendix 5:

- deductions for 1 child in the amount of 7,000 rubles. (RUB 1,400/month × 5 months);

- deductions are provided for 5 months. — the period from January to May 2019 (until the cumulative income from the beginning of the year did not exceed 350,000 rubles).

“Sample of filling out a 3-NDFL tax return” will tell you about the nuances of registering .

How to get a tax deduction from two employers at once

The law allows an employee who combines two jobs to apply for a property tax deduction from both employers or only from one of them, at the discretion of the taxpayer. And the responsibilities of both employers as tax agents include providing such an opportunity with a previous verification of documents.

When the personal income tax payer has already submitted an application for a property deduction to the manager or accountant at the first place of work, he must present to the second employer the appropriate document issued by the tax service, which would indicate the amount of the deduction to which the employee is entitled, taking into account the fact that part he had already received the deduction from another employer.

You will have to wait about a month until the tax service issues you the required number of notifications (according to the number of places of work) about your rights to receive a property deduction for personal income tax.

Results

A tax deduction in the 3-NDFL declaration is reflected if the taxpayer has income taxed at a rate of 13% and he belongs to the categories of persons specified in the Tax Code of the Russian Federation who are entitled to receive a deduction.

Deductions in 3-NDFL are reflected on special sheets depending on the type (standard, social, property, etc.). A program posted on the Federal Tax Service website will help you fill out the declaration without errors, identifying errors and calculating the tax to be refunded or paid.

Sources:

- tax code of the Russian Federation

- Order of the Federal Tax Service dated October 7, 2019 No. ММВ-7-11/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Legislative acts on the topic

Legislative acts are represented by the following documents:

| Art. 210 Tax Code of the Russian Federation | On reducing the tax base for personal income tax by the amount of social and property deductions |

| pp. 2 p. 1 art. 219 Tax Code of the Russian Federation | On the right of a taxpayer to receive a social tax deduction in the amount actually paid by him in the tax period for training |

| clause 2 art. 219 Tax Code of the Russian Federation | On receiving social deductions in the amount of no more than 120,000 rubles in the tax period |

| Order of the Federal Tax Service of the Russian Federation dated December 25, 2009 No. MM-7-3/ [email protected] | Approval of the notification form for property tax deduction |

| Letter of the Ministry of Finance dated April 10, 2012 No. 03-04-05/7-477, Letter of the Federal Tax Service dated September 1, 2009 No. 3-5-04/1363 | On receiving two property deductions at once when buying and selling an apartment within one year |

| Letter of the Ministry of Finance dated 04.06.10 No. 03-04-05/9-311 | On receiving only a property deduction when selling housing if the sale and purchase of residential premises were made in different years |

| Letter of the Ministry of Finance dated February 25, 2010 No. 03-04-05/7-68 | On the possibility of repeatedly receiving a property deduction for the sale of housing |

| para. 27 subp. 2 p. 1 art. 220 NK | About receiving a property deduction for purchasing a home only once in your life |

| para. 3 clause 8 art. 220 Tax Code of the Russian Federation | The right of a taxpayer to receive property tax deductions from one or more tax agents of his choice |

Reflection of social deductions in 3-NDFL (together with standard deductions)

The Tax Code of the Russian Federation provides for 5 types of social tax deductions (see diagram):

Let's change the conditions of the example (while maintaining the data on income and standard deductions entered into the program) described in the previous section to clarify the rules for filling out social deductions in 3-NDFL.

A line-by-line algorithm for reflecting social benefits for treatment in 3-NDFL can be found in ConsultantPlus, having received free trial access to the system.

Example 2

Stepanov I.A. paid for his advanced training courses in 2019 in the amount of 45,000 rubles. In the 3-NDFL declaration, he declared his right to a personal income tax refund in the amount of 5,850 rubles. (RUB 45,000 × 13%).

To reflect the social deduction in 3-NDFL, Stepanov I.A. filled out the “Deductions” section in the following order:

- checked the box “Provide social tax deductions”;

- in the subsection “Amounts spent on your training” indicated the amount of 45,000 rubles;

- I left the remaining fields blank.

After entering the data, the completed “Deductions” section in the program began to look like this:

Dedicated to social and standard deductions, Appendix 5 of the 3-NDFL declaration began to look like this (reflecting the amount of standard and tax deductions):

For new tax deduction codes, see the article “Tax deduction codes for personal income tax - table for 2021 - 2020” .

Common mistakes

Error No. 1: An employee of an enterprise submitted a second application for a property deduction for the purchase of a house.

Comment: A property deduction for the purchase of residential premises can be provided only once; receiving a deduction twice is prohibited by law.

Error No. 2: A company employee waits until the end of the tax period to apply for a social deduction for personal income tax.

Comment: Since 2009, the law allows you to apply for a social deduction during the year, without waiting for its end.

Is it possible for spouses to receive a deduction for an apartment at the same time?

After receiving the notification, the citizen gives it to the employer and writes a corresponding statement. and the employer, on the basis of the submitted documents, stops deducting personal income tax from his salary - until the citizen’s salary does not exceed the amount of the property deduction.

The new version of Article 220 of the Tax Code of the Russian Federation does not contain provisions on the distribution of property deductions for the costs of purchasing housing between co-owners when purchasing real estate in common shared or common joint ownership, therefore each of the co-owners has the right to receive the specified deduction within the limit of 2,000,000 rubles, while the application for there is no need to write about the distribution of the deduction (if housing was purchased after 01/01/2014).

Answers to common questions

Question No. 1: A citizen forgot to submit an application for a deduction, has he lost the right to receive it?

Answer: No, you are given 3 years to claim a tax deduction from the moment when you actually incurred certain expenses, only the lost amounts of social deductions are not carried over to future years, which is why you should ask for a social deduction in the first place.

Question No. 2: What documents do I need to prepare if I want to receive a property deduction from two employers at the same time?

Answer: You will need to fill out an application to provide you with a property deduction, collect documents about the transaction with property and obtain from the tax authority a document where a Federal Tax Service employee will indicate the amount of the tax deduction minus the deduction provided to you by the first employer.

Is it possible to get a deduction for an apartment and for treatment at the same time?

Is it possible to get a tax deduction for treatment and for purchasing an apartment? Attention Thus, Nikolenko’s salary will be: 35,000 – 4134 = 30,866 rubles. If the secretary had not applied for the benefit, her personal income tax would have been: 35 thousand x 13 = 4,550 rubles instead of 4,134 rubles.

We recommend reading: How much does it cost to replace a passport at 45 years old?

The amount may be increased when purchasing housing with a mortgage. Property deduction is not provided for the purchase of housing from close relatives or other persons, the purchase and sale between whom was for the purpose of obtaining benefits, using maternity capital or other targeted budget funds (Program “Affordable Housing”, “Young Family”, etc.).

Is it possible to get a deduction when buying an apartment again?

Thus, according to the scheme reflected in paragraph 1, a citizen can apply for a deduction regarding the cost of an apartment - only for one apartment. In terms of interest - also only for one apartment, or “transfer” this interest to register a deduction for real estate purchased after 01/01/2014.

The fact is that until 2001, citizens of the Russian Federation could apply for tax deductions for housing according to the norms of another source of law - Law of the Russian Federation No. 1998-1, adopted, in fact, back in the USSR - on December 7, 1991. In 2001, this law lost force - deductions began to be provided based on the norms of the Tax Code.

Accelerated camera and return

The application will be verified within 30 days. Let us remind you that the tax authorities have been holding back the 3-NDFL declaration for 3 months.

In the case of an application, the cameral can also take up to 3 months, but only if the tax authorities have suspicions of violating the laws on taxes and fees.

In addition, the process of returning money after verification will also speed up.

3 days after the end of the inspection, a decision on tax refund will be made. 10 days it must be executed within 5 days

If the deadline for the return of personal income tax in connection with the provision of a tax deduction is violated, counting from the 20th day after the decision to grant the deduction is made, interest is accrued based on the Central Bank rate in effect on the days the return deadline was violated.

Deduction for training

The deduction is provided in the amount paid by the taxpayer during a calendar year for his own education, education of his children under the age of 24, education of children under guardianship under the age of 18, education of siblings under the age of 24, in organizations carrying out educational activities. These organizations include not only institutes and universities, as many people think, but also colleges, driving schools, advanced training courses, foreign language schools, etc. The main thing is that the organization or individual entrepreneur has an official license for educational activities.

The deduction is provided in a fixed amount, 120 thousand rubles for your education and the education of your brothers and sisters, 50 thousand rubles for the education of your children and children under guardianship (for each child). There is also one caveat when receiving a deduction not for your own training. The training agreement, all additional agreements, payment receipts must be issued in the name of the person who will use the deduction. These documents should indicate, for example, the following wording: “The agreement was concluded with Ivanov for Petrov’s training,” “Ivanov is the payer for Petrov’s training.”

Example.

Ivanova paid in 2021:

- your training at a driving school in the amount of 30 thousand rubles;

- education of one child at the university in the amount of 80 thousand rubles;

- education of the second child at a foreign language school in the amount of 40 thousand rubles.

Taxable income for 2021 amounted to 450 thousand rubles, the amount of personal income tax was 58,500 rubles (450,000 × 13 percent). The deduction that Ivanova can use is 120 thousand rubles (30,000 50,000 40,000) The tax to be refunded will be 15,600 rubles (450,000 - 120,000 = 330,000; 330,000 × 13 percent = 42,900; 58,500 - 42 900 = 15,600).

The deduction can be used in three ways:

1. At the place of work, providing the employer with an application and notification confirming the deduction issued by the Federal Tax Service. To receive such a notification, you must submit an application for a deduction, originals and copies of the following documents to the inspectorate at the place of registration, originals and copies of the following documents: training agreement, additional agreements to the agreement, payment receipts, license of an educational organization or individual entrepreneur, birth certificates of children, if payment is being made for their education, documents confirming kinship, if payment is made for the education of brothers or sisters.

2. By contacting the tax office at the place of registration and filling out a declaration in form 3-NDFL and an application for a tax refund. Copies of the following documents must be attached to the declaration: certificate of income in form 2-NDFL, training agreement, additional agreements to the agreement, payment receipt, license of an educational organization or individual entrepreneur, birth certificates of children, documents confirming kinship. When checking the declaration, if errors are detected, the tax office may request the originals of the above documents.

3. Through the personal account (PA) of an individual taxpayer. In your personal account you must fill out 3-NDFL (the program for filling out the declaration and instructions are in the Personal Account). You can also receive an electronic signature in your personal account. Sign the declaration with an electronic signature. Submit the declaration to the inspectorate for verification. It is also necessary to send scanned copies of documents: a training contract, additional agreements to the contract, payment receipts, licenses of an educational organization or individual entrepreneur, birth certificates of children, documents to confirm kinship. There is no need to send a 2-NDFL certificate, since all information about your income is in the personal account. If errors are detected in the declaration, the inspection may request the originals of the above documents. After the inspection is completed (the end date of the inspection and its result will be indicated in the Personal Account), you must fill out a tax refund application, sign it with an electronic signature and send it to the Federal Tax Service.

There are too many deductions

When citizens receive income taxed with personal income tax at a rate of 13%, the tax base is determined as the monetary value of such income, reduced by the amount of tax deductions provided, in particular, by the following articles of the Tax Code: 218 (standard deductions), 219 (social deductions), 220 (property deductions) and 221 (professional deductions).

Typically, taxpayers believe: there are no such thing as too many benefits; the more, the better. But in connection with the procedure for providing tax deductions, a situation may arise when it will be difficult to fully successfully use the entire amount of benefits allowed by tax legislation.

In the commented Letter N 03-04-05/7-879, financiers emphasized that the property tax deduction is provided by reducing income subject to taxation. Therefore, it is not possible to provide it in a larger amount than the amount of income received in the corresponding tax period. This conclusion is valid not only for property, but also for any property listed in Art. Art. 218 - 221 of the Tax Code of the Russian Federation for deductions, as well as for their combinations, if the rights to benefits arose in the same tax period (for personal income tax this period is equal to a year (Article 216 of the Tax Code of the Russian Federation)).

If a taxpayer has the right to several personal income tax deductions of different categories, they can be maneuvered to make the most complete use of their amount. What matters is the difference in the sources of their provision (tax authority or employer), which can also be combined in a certain way, as well as the right to transfer the property deduction to the next year and the absence of such a right when receiving other deductions.

Everything about tax deductions: who and how can return money from the state

Every Russian who works officially and pays taxes has the right to receive a tax deduction - this is the amount of income that is not taxed, or a refund of part of the personal income tax (NDFL) already paid in connection with some expenses incurred. The types of these expenses are defined by the Tax Code of the Russian Federation - these are expenses for treatment, education, purchasing real estate or investing in the stock market. What tax deductions are there and how to get them?

Any citizen of the Russian Federation or a foreign citizen can receive a tax deduction if he lives in Russia for more than 183 days a year and pays tax on income received at a rate of 13%.

There are five types of personal income tax deductions:

- - standard (for children, veterans of the Great Patriotic War, disabled people, Chernobyl survivors, “Afghans”, heroes of the USSR and Russia who have state awards);

- — social (for charity, training, treatment, pension contributions to non-state pension funds, additional insurance contributions for funded pension);

- — property (for sale, purchase, construction of housing, acquisition of land);

- — professional (for royalties, income of individual entrepreneurs, persons engaged in private practice);

- — investment (for the sale of securities).

It is possible to receive a tax deduction for a specific year in several categories simultaneously. For example, get it immediately for children, treatment, charity and sale of home. It is important that the amount of tax paid cannot exceed the amount of tax deduction.

A service called the taxpayer’s personal account helps you conveniently and quickly process a tax deduction. To register it, you will either have to visit the Federal Tax Service office once, or use your access to the government services portal (your account must be confirmed).

Property deduction

Property deduction is the most popular and significant in terms of amount. We are talking here specifically about housing - that is, it does not matter whether a person builds housing or purchases a ready-made one, whether it is an apartment, a house or a plot of land purchased for individual construction. The deduction includes finishing the apartment, laying communications and even developing a project. But all work must be officially paid for, that is, in order to submit documents to the tax office, you will need to provide documents confirming the fact of payment.

When purchasing real estate, the tax base for deduction is limited to 2 million rubles. Thus, the maximum tax benefit is 260 thousand rubles. Every citizen has the right to a benefit of up to 2 million rubles. Moreover, if it was fully used when purchasing the first home, then when purchasing a second property, the benefit will not be provided.

The property deduction can be used to repay interest on a mortgage loan. In this case, the deduction limit is limited to 390 thousand rubles.

This deduction has no statute of limitations. This means that you can make a deduction at any time after purchasing a home, even after 20 years. But the deduction will be calculated only on income received over the previous three years.

What documents will be needed?

In addition to the declaration in Form 3 of personal income tax, it is necessary to provide a certain package of documents, including: confirmation of ownership of the purchased apartment, confirmation of the purchase of housing and related expenses (extract from the Unified State Register of Real Estate, purchase and sale agreement, acceptance certificate of the premises, loan agreement , bank receipt, check, receipt). You also need a document confirming the payment of personal income tax for the previous year (certificate in form 2-NDFL, it is obtained from the accounting department at your place of work). It is important not to forget to provide the bank details to which your income tax refund will be transferred.

In what cases can you not receive a deduction?

If the purchase and sale agreement is concluded between relatives: spouses, parents, children, brothers or sisters, you will not be able to receive a deduction. In addition, if you invested maternity capital funds in the purchase of real estate, then you cannot receive a deduction for the amount of state assistance. If part of the money for the purchase of an apartment was contributed with personal money, then the amount of maternal capital will be deducted from the cost of the apartment and a deduction will be issued for the remainder.

Child deduction

To receive a “children’s” deduction, it is not necessary to go to the tax office: it is enough to contact the accounting department at your place of work with a corresponding application. Usually the employer is asked to apply for this deduction from the beginning of the year, but you can also take it “retroactively” through the Federal Tax Service.

- — A deduction for a child (children) is provided until the month in which the taxpayer’s income, taxed at a rate of 13% and calculated on an accrual basis from the beginning of the year, exceeded 350 thousand rubles. The deduction is canceled from the month when the employee’s income exceeds this amount.

- — For the first and second child, a deduction of 1,400 rubles is due; for the third and each subsequent child - 3,000 rubles. A common child in the presence of two children from previous marriages will be considered the third.

- - For each disabled child under 18 years of age or a full-time student, graduate student, resident, intern, student under the age of 24, if he is a disabled person of group I or II - 12,000 rubles. parents and adoptive parents (RUB 6,000 for guardians and trustees).

What documents will be needed:

- - a written application addressed to your employer with a request for a tax deduction for the child (children);

- - birth certificate of the child (or children). This also applies to adopted children; here you need a copy of the adoption certificate;

- — certificates of child disability, if the child is one;

- — certificates from the child’s place of education (subject to receiving a deduction for a child over 18 years of age studying full-time at an educational institution);

- - Marriage certificate.

Social tax deductions

Deduction for training

You can get a deduction for your own education and the education of your children, brothers and sisters if they are under 24 years of age. For yourself, the maximum deduction amount is limited to 120,000 rubles, for children and relatives - 50,000 rubles. You can receive a deduction for yourself only if you are studying full-time; there is no such condition for relatives - you can apply for a deduction if they are studying part-time or evening. An educational institution must have a license to carry out educational activities.

The standard package for applying for a tax deduction for education includes:

- — a copy of the Russian passport;

- — tax return in form 3-NDFL;

- — a certificate of income for all places of work in the reporting year where the employer paid income tax for you (form 2-NDFL), issued by the accounting department of the organization where you worked;

- — a copy of the agreement with the educational institution addressed to the payer;

- — a copy of the license of the educational organization, certified by its seal (if there is information about the license in the contract, this copy does not need to be attached);

- — copies of receipts, checks or other payments confirming payment for educational services;

- — an application to the Federal Tax Service with a request to return the tax amount and details where it should be transferred.

Deduction for treatment

If a person was treated himself or treated his loved ones, or bought prescription drugs with his own money, he has the right to a tax deduction. If he bought medications and received treatment for budget money, no. If your VHI policy is paid for by your employer, you will not be able to receive a deduction. The maximum amount of these deductions is 120,000 rubles. This means that you will be able to return no more than 15,600 rubles (13%). Some types of treatment are considered expensive, and the costs for them are calculated in full, without a limit, for example, with IVF or organ transplantation.

What documents will be needed:

- — a copy of the Russian passport;

- — tax return in form 3-NDFL (filled out by the taxpayer);

- — certificate of income from the main place of work (form 2-NDFL), certificates of part-time income (if any, issued by employers);

- — an application to the Federal Tax Service with details (on bank letterhead with a stamp) to which the tax will be refunded.

When treated in a hospital or clinic:

- - an agreement with a medical institution (there must be an exact amount paid for treatment) - original and copy;

- — a certificate from the hospital/clinic/medical center confirming payment under the contract (must contain the patient’s medical card number and TIN, as well as the treatment category code: “1” - ordinary, “2” - expensive);

- — a copy of the medical institution’s license.

When purchasing medications:

- — original prescription with a stamp “For tax authorities”, issued by a doctor or the administration of a medical institution;

- — checks, receipts, payment orders confirming payment for drugs;

- - if the patient purchased expensive medications necessary for treatment because they were not available in the medical institution, a certificate about this must be drawn up from the administration of the medical organization.

When concluding a voluntary health insurance agreement by an individual:

- — a copy of the voluntary insurance agreement;

- — a copy of the insurance company’s license;

- - receipt for payment of insurance premium.

Important!

All of the above social deductions are subject to a limit on the amount of expenses - 120 thousand rubles per year.

Investment tax deductions

When investing in securities, Russians have the right to apply for a tax deduction. To do this, you need to open an individual investment account or IIS - this is a special type of brokerage account that gives its owner tax benefits. Today, the state has provided two options for tax deductions for IIS owners.

Type A deduction - return of 13% of the amount invested in IIS for the year - within 400 thousand rubles, not more than the amount of personal income tax paid for the same year. This type is the most popular, since it is the one that guarantees income. It turns out that if the official income for the year is equal to or higher than 400 thousand rubles, then when you invest the same amount in an individual investment account, you return 52 thousand rubles. We can say that the owner receives additional guaranteed income. Why additionally - all the money that is invested in IIS can be invested in securities and also receive income from them.

Less popular is the Type B deduction, when income from transactions with securities is not subject to income tax of 13%. This type is suitable for those who do not have official income, who plan to invest for a long time, who plan to receive a high income, or who can invest more than 400 thousand rubles per year into an account. The maximum investment amount today is 1 million rubles per year. Perhaps legislators will soon raise this threshold.

You can use this deduction every year; to do this, you need to annually deposit money into an IIS. But there is a nuance: such an account must exist for at least three years. If an investor received a deduction for two years and closed his account in the third year, the money received will have to be returned.

Which type of deduction to choose depends on how actively you plan to invest.

How to get tax deductions. All tax deductions have several general rules.

- 1. You can only get them for the last three years. For example, in 2021 it will be possible to return money for 2021, 2021 and 2021, but there are exceptions.

- 2. Only officially employed people who pay personal income tax can receive a deduction. Unemployed people receiving unemployment benefits, individual entrepreneurs on the simplified tax system of 6% or 15%, as well as self-employed citizens cannot receive a deduction.

- 3. You must be a tax resident, that is, stay in Russia for at least 183 calendar days within 12 months.

4. If the deduction is issued through the employer before the end of the year, you must first submit a tax notice that confirms the right to receive the deduction. And then take it to the accounting department of the enterprise along with all the documents.

Documents for deduction can be sent by mail with a notification and an inventory, or submitted in person to the tax office, but the most convenient way to do this is online on the tax office website through the taxpayer’s personal account. From the moment you submit your documents until the money is credited to your account, a maximum of four months can pass—three months of a desk audit at the tax office and a month to transfer the money.

The material was prepared within the framework of the Ministry of Finance program “Increasing the level of financial literacy of residents of the Kaliningrad region.” For additional information, call the financial literacy hotline (toll-free) or visit the website fingram39.ru.

Affiliate material

Education abroad

It will be possible to receive a deduction for training only if the educational organization has a license issued in accordance with the legislation of the Russian Federation.

Let us remind you that the Tax Code now stipulates a rule about a foreign organization - it must have a document confirming the status of an organization carrying out educational activities.

As for payment for training to an individual entrepreneur, nothing changes here - you can rely on the information in the Unified State Register of Entrepreneurs.