Drawing up a Statement of Reconciliation of Mutual Settlements is usually necessary in the case when two legal entities need to certify transfers made between each other. Most often, such reconciliations are made for specific contracts or invoices; reconciliations are also possible for contracts for a certain time period. It is worth noting that despite the fact that this document is not binding and is created only by mutual agreement of the parties, it is widespread in all areas of activity and is used by most organizations.

- Form and sample

- Free download

- Online viewing

- Expert tested

FILES

How is reconciliation carried out?

This procedure can be carried out only for one of the following items: name or number of the product, contract, specific delivery, certain period of time. For this document to be reliable, it should be drawn up either after the last transfer or from the moment of delivery. In addition, it is convenient to carry out reconciliation during the annual inventory of the company’s funds and property. Quite often, the results of such checks reveal debts: receivables or payables. If such facts are confirmed, you need to immediately make a reconciliation report and send it to the partner organization.

Optimal timing of reconciliation

The period for clarifying mutual settlements is determined by the need for accounting or management.

Although the statement is drawn up for a certain period, the debt in favor of one of the parties is indicated on a certain date (often the first and last day of the reconciliation period). The easiest way to perform reconciliation is:

- for the reporting year (from 01.01 to 31.12);

- for a certain calendar period, at the end of which the accountant reports to the owners of the enterprise (usually a quarter);

- during the period of validity of a specific contract.

You can watch the video to generate a document in the 1C:Enterprise program:

Rules for drawing up the act

There is no unified, standard form for drawing up an act, so it can be written in free form or according to a template developed at the enterprise. A regular A4 sheet is suitable for filling.

The act must be printed in two copies - one for each of the interested parties.

Both signed and completed copies are sent to the counterparty, whose specialists compare the information from the sent report with the data they have. If there are no objections to the financial transfers specified in the act, all the information matches, then the counterparty signs the documents and returns one copy and keeps the second one.

If necessary, the act can be certified with a seal, but since 2021, the presence of a seal for legal entities is not a legal requirement (however, without a seal, in the event of legal proceedings, the document may be considered invalid).

To ensure that the process of signing the reconciliation report does not drag on, when sending the document you should indicate the time frame within which it must be returned.

How to reconcile with counterparties and draw up a report

Documents, no matter how you keep track of them, sometimes get lost. They don't reach your customers or you don't have supplier documents. And this leads to different amounts of debt in the accounting of organizations. Reconciliation of debts with counterparties helps to identify such disagreements.

There is nothing complicated about this procedure. Only she is distinguished by a large amount of work. The frequency of reconciliation of calculations depends on your desire and capabilities. But once a year ─ during the annual inventory ─ it is mandatory. Thus, the balance of the settlement accounts is confirmed.

How :

- make reconciliations with counterparties

- resolve disagreements in the statement of reconciliation of accounts

- pay the debt according to the reconciliation report

read this article.

The content of the article:

1. What is a reconciliation report and an example of filling it out

2. Can an accountant sign a reconciliation report?

3. Who should do the reconciliation report?

4. Disagreements in the settlement reconciliation report

5. What should an accountant do if the documents are not in the records of his organization?

6. What should an accountant do if the documents are not in the counterparty’s records?

7. Payment of debt according to the reconciliation report

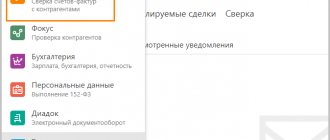

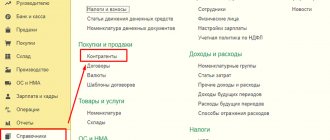

8. Reconciliation with counterparties in 1C version 8.3

So, let's go in order.

What is a reconciliation report and an example of how to fill it out

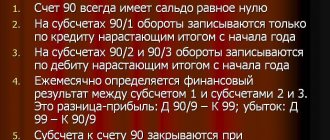

A reconciliation report is a document that reflects settlements between organizations for a certain period. The seller in such an act shows the formation of the buyer’s receivables and the payment received from him. And the buyer ─ his accounts payable to the supplier, with whom he reconciles settlements and repays them.

The reconciliation report is signed and sealed by both organizations (if any).

There is no approved form for the reconciliation report. Moreover, it is not a primary document. Therefore, when developing the form, you can use the details of the primary document, which are established by paragraph 2 of Article 9 of the Federal Law “On Accounting” dated December 6, 2011 No. 402-FZ. Here is an article about paperwork in accounting.

And understand that the reconciliation act, like any other act between organizations, is two-sided. This means you need to provide appropriate fields for signatures.

Typically, the reconciliation report is signed by the chief accountant and the manager.

You can fill out the act by listing business transactions for each organization, but it is more convenient to do this in the context of contracts. Then, in case of discrepancies, it will be immediately clear under which agreement the turnover does not converge.

Fill out the reconciliation report only in money.

An example of filling out a reconciliation report. Metel LLC, the fabric supplier, compiled a reconciliation report with the Vyuga LLC atelier as of March 31, 2018.

The person responsible for drawing up the reconciliation report at Metel LLC filled it out in two copies, signed it with the director and chief accountant and sent it to Vesna LLC.

Vesna LLC checked the turnover, filled out both copies of the act on their part, signed and sent one completed act to Metel LLC. After entering the credentials in both organizations, the reconciliation act looks like this.

In this example, both organizations confirm that Vesna LLC has a debt to Metel LLC in the amount of 150,000 rubles.

Can an accountant sign a reconciliation report?

In organizations that have many counterparties and regularly reconcile accounts with them, the chief accountant and manager have to spend a lot of time signing reconciliation reports.

To free up time, a power of attorney is issued to one of the accountants. Thanks to this, he can sign any reconciliation report. At the same time, he can also check the correctness of the drafting of acts by his colleagues.

Who should do the reconciliation report?

The initiator of debt reconciliation with the counterparty can be any party to the transaction. The regulations do not stipulate the obligation to conduct reconciliation between organizations. This is the right of companies. Therefore, it is possible and necessary to regulate the procedure and frequency of reconciliation of payments in contracts.

In companies, the accounting department is not always involved in drawing up reconciliation reports and sending them to counterparties. By order of management, these may include other employees ─ those who directly work with customers and suppliers.

In many accounting programs, including 1C, accounting of settlements with the counterparty is organized on separate sub-accounts ─ cards. Therefore, if all documents are entered into the system in a timely manner, unloading turnover on a specific card is not difficult. And the question: “Who should do the reconciliation report” does not cause much controversy.

The end result ─ the completed reconciliation report must necessarily “reach” the accounting department and be verified. By the way, reconciliation can be considered as one of the components of inventory. more about conducting an inventory here .

The result of the reconciliation can be:

- an act signed by the counterparty in which there are no disagreements

- deed of disagreement

Reconciliation without disagreement is the most optimal and simplest for an accountant. What to do when there are disagreements?

Disagreements in the settlement reconciliation report

The main reason for disagreement in the statement of reconciliation of payments is the reflection of documents in the accounting of one organization and the failure to reflect the same documents in the accounting of another.

This is possible if:

- documents did not reach the counterparty

- within the company, the documents were not transferred to the accountant for inclusion in accounting

- postings according to documents in the first company were made in one period, and in the second - a period earlier or later

Moreover, there may be no documents:

- in your company's accounting

- in counterparty accounting

When checking the settlement reconciliation report, which was provided by the counterparty, it is immediately clear in which documents there are disagreements.

What should an accountant do if the documents are not in the records of his organization?

Situation 1 : company ─ buyer of material assets

Step one . It is necessary to check whether these documents were posted in another period, for example, following the reconciliation period. If you do not have documents regarding which there are disagreements in the accounting reconciliation report, then proceed to step 2.

Step two . Find out from the responsible employee of the company who works with the counterparty whether he forgot to transfer the procurement documents to the accounting department. If you forgot, then urgently pick up the documents and check their compliance with what the counterparty indicated in the reconciliation report and register them.

If there are no documents, then move on.

Step three . Request duplicates of documents not reflected in accounting from the counterparty. Receive, check them and record them.

At each of these steps, you may encounter one of the following options:

- the counterparty recognized your receivables prematurely. For example, according to the terms of the contract, the transfer of ownership ─ during acceptance of the goods by the buyer. Your company's employees accepted the goods in the month following the reconciliation. You can sign a statement indicating the discrepancies and indicating the reason

- documents were reflected later than it should have been done. Sign the document provided by your supplier.

Situation 2: the company is a buyer of services.

You need to follow the same steps as in the case of purchasing material assets. But we must remember the main difference ─ the date of provision of services, and therefore the date of appearance of receivables ─ the number with which the certificate of completion of work was signed in your organization.

An exception is utilities, the cost of which is determined based on meter readings. In this case, the date of the act is equal to the date of provision of the service. Accounting for utility costs is covered here.

What should an accountant do if the documents are not in the counterparty’s records?

Situation 1 ─ your company sells products, but the reconciliation report sent by the counterparty does not reflect your documents on shipments to them.

In this case, you need to ensure that you record revenue and receivables in accordance with the terms of the contract. If everything is in order with this, check whether the documents were sent to the counterparty.

When everything is done correctly on the part of your organization, add the unrecorded document to the reconciliation report and sign it with disagreements.

If there are problems on your side, then you need to solve them first. And then either include the document for which there are discrepancies in the reconciliation report, or agree with the buyer’s amounts.

Situation 2 ─ your company has completed the work, but its purchase is not reflected in the reconciliation report sent by the buyer.

Algorithm of actions:

- check the signature date on the work completion certificate from the customer

- Didn’t you find a copy of the act that was signed on both sides? Then find out whether the document was sent to the buyer

- Based on the results of the “investigation”, you draw conclusions. And either add more language to the buyer’s reconciliation report and sign it in this form, with disagreements, or agree with the counterparty’s figures

The examples do not show all situations that can lead to discrepancies in settlement reconciliation reports. But it is already clear that the reasons why some documents are not included in the reconciliation report may be different. From misinterpretation of contract terms to employee forgetfulness. Moreover, from any of the counterparties.

Payment of debt according to the reconciliation report

During reconciliation, it may be revealed that one organization has a debt to another; this can happen for the following reasons:

- The primary document is not reflected in the debtor’s accounting

- there are errors in calculations, for example, when converting currency into rubles

The debtor's records do not contain the required document. In this case, the company that is owed payment sends duplicates of the primary documents to the debtor organization. After they are carried out, a debt will appear in the accounting, which can be paid in the usual way. In the payment order, in the basis field, you need to indicate an invoice, act or other document ─ the reason for the debt.

Errors in calculations can be corrected by drawing up an accounting certificate and reflecting it in accounting. Once the debt is generated, it can be paid. In this case, you can pay the debt according to the reconciliation report, indicating it as the basis in the payment order.

If you find an error in your accounting, you need to correct it. In this case, an article about correcting accounting errors .

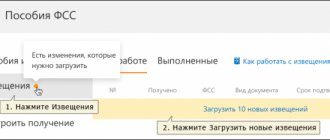

How to reconcile with counterparties in 1C version 8.3

How to make a reconciliation with counterparties using the 1C: Accounting 8 edition 3.0 program, see the video.

The reconciliation report is a very important and necessary document, the formation or verification of which sometimes requires a lot of labor. Therefore, it is better to carry out reconciliation with companies with which you have large turnover in terms of money and/or product items regularly, maybe even monthly.

It must be remembered that the reconciliation report is not a primary document; any figure in it appeared after an accounting entry, which, in turn, was made on the basis of the corresponding primary document.

In case of discrepancies, you need to look for the reason ─ an extra or unrecorded document, and use it to clarify the situation.

What difficulties do you encounter during reconciliation? If you have questions about how to reconcile with counterparties, ask them in the comments!

How to reconcile with counterparties and draw up a report

Purpose of drawing up the act

If the information in the document drawn up by the initiator of the reconciliation does not coincide with that available from its counterparty, then the existing discrepancies should be recorded at the end of the document. The same applies to debts: if such facts are revealed, it is necessary to indicate the period during which they should be repaid. Otherwise, the court, if a claim arises, will not be able to take into account the argument regarding the violation of the terms of money transfers.

According to the law, an act of reconciliation of mutual settlements may be grounds for interrupting the three-year limitation period. That is, in cases where the debtor signs a reconciliation report within three years, he is considered to have recognized his debt obligations and is obliged to repay them within the established time frame.

It happens that during the period that has elapsed since the signing of the contract and the fulfillment of obligations, the counterparty has been declared bankrupt. In such situations, accounts payable after a certain time can be written off as expenses of the organization.

Document form

Each enterprise can develop and approve its own form of reconciliation report, which will suit all interested parties and will allow the inspection to be carried out correctly. Regulatory acts do not provide for a unified form of this document. But, since it is primary, when drawing it up, all the requirements imposed by law for the preparation of this type of documentation must be taken into account. In particular, the reconciliation report must have the following details:

1. Name.

2. Date of its formation.

3. Information about the compiler.

4. Brief summary of the operation performed.

5. Meters of the specified business transactions.

6. Indication of the positions of persons responsible for recording business transactions and documenting them.

7. Handwritten signatures of the indicated officials.

Instructions for filling out the reconciliation report

In the “header” you need to enter information about the period for which the reconciliation report is being carried out, and also indicate the agreement that served as the basis for the creation of this document. Here you should enter the name of the companies in accordance with the constituent documents (you can without such details as KPP, INN, OGRN, etc.).

The second part of the document includes a table in which each party enters information contained in its accounting records for transfers under the agreement in question or for a certain period of time. They must match completely. Under the table, each company enters its existing debt. This data must also be the same. If there are no debts, this must be noted in writing.

In conclusion, the document must be signed by the heads of the enterprises, with the obligatory indication of positions and a transcript of the signatures. A document drawn up in accordance with all the rules of office work, if signed by the directors of the enterprises, acquires legal force.

Coordination

Reconciliation of all data should be done through the “Advanced” tab. It provides the necessary parameters for customizing the final printed version of the contract. To generate the document as correctly as possible, you should check the appropriate boxes. This will allow:

- when drawing up an act for all calculations, break down the data according to contracts;

- issue invoices;

- configure the indication of document names.

After all manipulations are completed, a reconciliation is performed by both parties to the contract. When this happens, the organization and the counterparty must sign the document. After this, it is important to check the corresponding “Reconciliation agreed” box. This way, you will no longer be able to edit the document. The reconciliation act will be protected from accidental manipulation, and the document itself will not perform any movements.

Filling procedure

The main part of the reconciliation report, which contains information about business transactions carried out by counterparties, is a table. It consists of two parts. On the left, as a rule, the activities of the organization that compiled the document are reflected. It includes four columns. The first of them indicates the serial number of the entry, the second - a brief content of the business transaction, the third and fourth - its monetary value by debit or credit. The right side of the table remains blank; The data is recorded there by the counterparty when he performs reconciliation. Thus, the act in question contains, in chronological order, records of all operations carried out by the organization, with the participation of a specific counterparty, for a certain period. After that, debit and credit turnovers are calculated, and the ending balance is determined for the required date.

Making a payment

Based on the document, the two parties understand who owes what to whom. After this, mutual settlements are usually made: one party makes additional payments, the second ships inventory, etc.

Attention:

the purpose of payment for debts may not be “based on an agreement”, but “based on a reconciliation report”. The tax office has no problem considering such transactions and recognizes their legitimacy.

If inaccuracies are identified when filling out, both parties must determine what exactly caused the discrepancy and repay the resulting debts within the agreed time frame, without going to court. Typically, discrepancies arise due to confusion: double payment or shipment, accidental cancellations of transactions, forgetfulness of responsible persons, etc. Under contracts, not only debts, but also overpayments can arise, so counterparties can pay in the opposite direction by generating payment orders and other primary paper.

Types of documents and nuances of their execution

We wrote above that any employee (for example, an accountant) can draw up an act, but only the manager or chief accountant must sign it. Otherwise, the document will be for informational purposes only and will not become evidence in court. When compiling, you need to consider the following nuances:

- When registering an act, it is necessary to give it an internal number, which must go through the continuous numbering of existing accounting documents. That is, it must be prepared in exactly the same way as the rest of the primary or accounting documentation.

- If managers or chief accountants are not at the workplace, then the act can be signed either by persons who have a power of attorney, or the signing is postponed for up to 10 days (if the signing does not take place, then a new reconciliation must be carried out after 10 days).

Both parties must fill out the form

There are several types of reconciliation statements that are filled out depending on the current situation. A document on mutual settlements is considered traditional, which is drawn up in a short form and is used to check whether the obligations of counterparties to each other have been repaid . The following acts also apply:

- Reconciliation of debts, which is issued in text form.

- Tax liability reconciliations. She has a standard form, which can be obtained from the tax office. It is unacceptable to change it: everything is filled out in strict accordance with the form.

- Reconciliations between the Social Insurance Fund and the Pension Fund. They also have a strict form; they must be filled out according to the sample, without deviating from generally accepted requirements.

- Reconciliations of counterparty relations. Usually filled out in cases where several parties or departments work under one agreement. The form contains appropriate clarifications on the topic of who owes whom and what exactly.

- Reconciliations of disagreements. It is created in a standard form, but after manual calculations, explanations are made that discrepancies were found in the figures.

- The Rosprirodnadzor act is filled out in accordance with the accepted form, allowing for an inventory of calculations for payments for environmental impact.

- With suppliers. In this case, the data is taken from count 60, and filling is done in the traditional form.

What is it needed for?

There are a number of cases in which it is necessary to draw up this document. We list the main ones:

- in case of purchase by one of the enterprises of products without making an advance payment or with installment payments for it;

- the enterprise’s activities are of a massive nature, and it has a large number of contractors supplying a wide range of products;

- particularly valuable goods are sold or purchased;

- before signing new agreements that expand the areas of cooperation between organizations;

- after a long period of constant cooperation.

If carrying out such procedures and drawing up contracts is necessary for effective management activities, this clause can be written down in the contract. You can specify the frequency of these checks, as well as the amount of penalties for failure to fulfill assigned obligations, both on one side and on the other.

The agreement must indicate the period within which the signed reconciliation acts must be returned.

Although this document is accepted during legal proceedings, when proceedings are underway regarding the fulfillment of the terms of the contract, you should not rely heavily on it, since the domestic “themis” does not always clearly accept the act of reconciliation of mutual settlements as evidence. It all depends on the individual case.

When the counterparty refuses to sign

Reconciliation of calculations records the existing situation and serves as confirmation for both parties that everything is reflected correctly in the accounting. If the counterparty evades drawing up reconciliation reports, then formally he does not violate anything (if such an obligation is not provided for in the contract), but there is a possibility that he wants to hide something. In this case, we recommend carefully checking all transactions with the counterparty, and in the future, perhaps, abandoning relations with him.

Alexander Lavrov, certified auditor