Deductions

One of the important amendments to the Tax Code comes into force on January 1, 2021

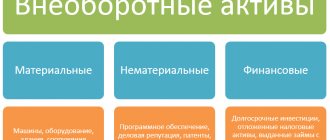

Every company has assets, which may include money, equipment, and other

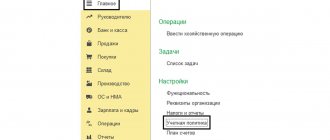

Let’s look at setting up and reflecting VAT, the most “popular” tax, in the 1C: Accounting program and let’s get started

Home / Medical Law Back Published: 09/28/2020 Reading time: 5 min 0 150

Where does the calculation of vacation pay begin? First of all, it is necessary to determine which period will be the calculation period.

A work book is a mandatory document for an employee. It must be filled out by the employer and kept by him.

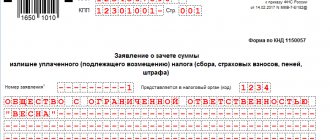

Settlement procedure The main conditions for offset are contained in the Civil Code of the Russian Federation. These include:

In this article I was going to show how to make a balance sheet from SALT. However, estimating

Documents for a supply contract from Russia to Kazakhstan, Belarus, Kyrgyzstan and Armenia Supply contract

A simplified version of financial statements for small businesses was developed in accordance with regulatory principles