Documents for a supply contract from Russia to Kazakhstan, Belarus, Kyrgyzstan and Armenia

A contract for the supply of goods is an agreement between the supplier and the buyer on two main issues: the product and its transportation. Therefore, the execution of a supply contract is accompanied by the execution of two types of documents: 1) commodity, and 2) transport.

The preparation of documents for domestic Russian supplies of goods is regulated by the legislation of the Russian Federation. How to arrange the transportation of goods from Russia to Kazakhstan or another state party to the agreement “On the Eurasian Economic Union” signed on May 19, 2014. (hereinafter referred to as the “EAEU Treaty”)?

Transport documents for the transportation of goods from Russia to Kazakhstan and the EAEU countries

Waybill

Conditions:

Supply contract from Russia to Kazakhstan (or another state party to the EAEU treaty).

Transportation by road.

Start of transportation of goods (place of shipment): Russia.

Decor:

When transporting goods by road, the driver is required to have documents for the cargo (clause 2 of the Road Traffic Rules of the Russian Federation). The rules do not disclose what documents these are, but in essence they are documents confirming the legality of the driver’s possession of the cargo being transported.

Delivery of cargo under a supply agreement is possible by the supplier or buyer. In both cases, it is possible to use your own transport or hired carriers.

Situation 1: Under the supply agreement, delivery is included in the price of the goods and is organized by the supplier (Russian exporter) with the involvement of a carrier

The carriage of goods is formalized by a contract of carriage between the supplier and the carrier.

The existence of a contract of carriage is confirmed by the waybill (Article 785 of the Civil Code of the Russian Federation). Regardless of who, under the supply agreement, enters into a transportation agreement (supplier or buyer), draws up a waybill and transfers it to the carrier, the shipper (Articles 2 and 8 of the Charter of Road Transport, paragraph 6 of the Rules for the Transportation of Goods by Road).

In situation 1, the shipper is a Russian supplier, and he is obliged to issue a waybill and hand it over to the carrier.

The consignment note not only confirms the fact of concluding a transportation contract, but also records the volume of transport services provided by the carrier and the price of these services. The consignment note is the basis for settlements between the transportation customer and the carrier for services rendered.

Do not confuse the waybill and the goods transport bill (TTN).

For domestic Russian transportation, a unified form TTN 1-T was developed and used until 2013 as the primary accounting document (for accounting and tax purposes) to account for services for the transportation of goods by road. The consignment note is given to the driver along with the accompanying documents for the cargo.

Russian exporters of goods to the countries participating in the EAEU Treaty (Kazakhstan, Belarus, Kyrgyzstan and Armenia) should take into account that the EAEU Treaty abolished customs clearance for the movement of goods between participating countries and simplified the transportation of goods, but the participating states remained sovereign .

Under these conditions, the transportation of goods from Russia to Kazakhstan, and similarly transportation between other states, is recognized as international transportation of goods , since it involves the movement of cargo from the territory of one state to the territory of another (Article 2 of the Law of the Russian Federation “On State Control of International Road Transport”).

The existence of a contract for the international carriage of goods is confirmed by an international consignment note and is drawn up in the CMR form (Convention on the Contract for the International Carriage of Goods by Road, Geneva, May 19, 1956) indicating the relevant details and attaching a set of documents.

According to the rules of international transportation of goods, the following is attached to the CMR consignment note:

- shipping specification,

- invoice - specification,

- quality certificate,

- quarantine and veterinary certificates or certificates

(clause 6 of the List of documents approved by the Ministry of Transport of Russia on October 27, 1998).

Conclusion:

Transportation of goods by road between the states parties to the Treaty on the EAEU is formalized by an international consignment note (CMR) indicating the relevant details and attaching a set of documents. When exporting from Russia, documents according to the List approved by the Ministry of Transport of Russia on October 27, 1998 are attached to the CMR. The documents are prepared and handed over to the carrier by the shipper (supplier).

We recommend: In the interests of the supplier, primarily in the event of tax disputes regarding VAT refunds as well as disputes with the buyer and the carrier, we recommend that after loading the driver enter the following entry in the CMR in his own hand: “The goods have been loaded. Pinned. There are no comments." When transporting by road, the cargo may shift, fastenings will break, body boards will break, etc.

In addition, in order to create an archive, which can also be used in the future in disputes, when shipping the goods, obtain a copy of the driver’s driver’s license and his passport, the accuracy of the copies of which must be certified by the corresponding records of the owner - the driver. “A copy of the driver’s license No. _____, issued by ______ is correct. I have certified the accuracy of the copy - last name, first name, patronymic, resident at the address: ______, date, signature.” Passport is the same.

Situation 2: Delivery is included in the price of the goods and is carried out by the supplier’s own transport

According to Russian legislation, in situation 2 there is no contract of carriage since the supplier transports the goods using its own transport. Therefore, there are no grounds for issuing a consignment note. Transportation is carried out by the supplier's employee in a car owned by the supplier (own transport). The driver confirms the accounting of delivery costs and the legality of ownership of the car with a waybill, and the legality of ownership of the goods - with a consignment note in the TORG-12 form.

Filling out waybills in Russia is carried out in accordance with Order of the Ministry of Transport of the Russian Federation dated September 18, 2008 N 152 “On approval of mandatory details and the procedure for filling out waybills”, according to which the waybill contains information about the validity period of the waybill; information about the owner (holder) of the vehicle; information about the vehicle; driver information.

The owner (owner) of the vehicle issues a waybill.

The invoice form TORG-12 has been developed and used in the Russian Federation as a primary accounting document for registering the sale (release) of commodity and material assets to a third party (Resolution of the State Statistics Committee of the Russian Federation dated December 25, 1998 N 132).

TORG-12 is drawn up in two copies. The first copy remains with the supplier of goods and materials, and is the basis for their write-off. The second copy is transferred to the buyer and is the basis for the recording of these valuables.

IMPORTANT: Buyers from Kazakhstan, Belarus and other EAEU countries must take into account:

Since 2013, Russian organizations have the right to use their own forms of primary accounting documents and not to use unified forms, including not to use invoices in the TORG-12 form.

Invoices issued by Russian suppliers may not comply with the requirements of the legislation of the state parties to the EAEU agreement.

In contracts for the supply of goods from Russia, it is advisable for buyers from the EAEU countries to agree with Russian suppliers-exporters on the forms of documents for goods and for the transportation of goods and the procedure for filling them out and transferring them.

Situation 3: Delivery of goods is carried out at the warehouse of a Russian supplier, delivery of goods is carried out by the buyer’s own transport.

The situation is similar to situation 2 described above: According to Russian legislation, there is no contract of carriage between the carrier and the supplier (Russian exporter), since under the terms of the supply contract, the transportation of goods is carried out by the buyer’s transport.

The buyer keeps track of his expenses for the delivery of goods using a waybill (fuel and lubricant costs, mileage, depreciation, wages, etc.). The goods are transferred by proxy to the buyer's representative by signing a copy of the TORG-12 consignment note issued by the Russian supplier.

At the same time, taking into account that the buyer is an economic entity in Kazakhstan or another state party to the EAEU treaty, it is important for him to correctly draw up transportation documents in accordance with the legislation of the relevant state. It is the buyer who bears the risk of document violations and the associated consequences. It is the buyer who has an interest in ensuring that shipping costs incurred are properly accounted for.

*When concluding a supply contract, it is recommended to draw the buyer’s attention to the specifics of drawing up transportation documents and agree on the relevant provisions in the contract.

For example, when making deliveries from Russia to Kazakhstan, in similar situations under 3 contract conditions, Kazakhstan tax authorities recommend that Russian suppliers issue and transfer a CMR invoice to Kazakhstan buyers.

Situation 4: Delivery of goods is carried out at the warehouse of a Russian supplier, delivery of goods is carried out by the buyer by an engaged carrier.

According to Russian rules (Charter of Motor Transport of the Russian Federation, Rules for the Transportation of Goods in the Russian Federation), a waybill is drawn up by the shipper to confirm the contract of carriage.

In the described situation of delivery of goods, the contract for the carriage of goods is drawn up by the buyer of the goods, since the obligation of transportation is assigned to the buyer by the delivery contract.

The buyer (registered not in Russia but in another state party to the agreement on the EAEU) before receiving the goods in Russia from the Russian supplier draws up an agreement for the international carriage of goods with the involved carrier.

Ownership of the goods passes to the buyer in Russia at the time of shipment at the warehouse of the Russian exporter. The shipper is the buyer. He also fills out the CMR invoice.

Please note: according to the rules of the Road Transport Charter of the Russian Federation, when executing a transportation contract, loading goods into vehicles is the responsibility of the shipper. Under the conditions of situation 4, delivery is carried out at the supplier’s warehouse in Russia. We recommend that the buyer agree in the supply contract on the supplier’s obligation to load the goods into the vehicle.

After loading the goods, the carrier puts a mark and stamp on the CMR consignment note. As part of the shipping documents, the supplier gives the buyer one copy of TORG-12 (or an invoice drawn up in another form agreed upon by the parties), on the second the carrier puts a mark (by proxy) on receipt of the goods.

Documents for goods when exported from Russia to Kazakhstan, Belarus, Kyrgyzstan or Armenia

Conditions:

Agreement for the supply of goods from Russia to Kazakhstan. Registration of transportation of goods from Russia to other states, with the exception of Armenia, is carried out in a similar way.

The transfer of goods between the supplier and the buyer, for the purpose of accounting for trade operations in the Russian Federation, is documented in primary accounting documents (RF Law “On Accounting”). Since 2013 in the Russian Federation, the use of unified forms of primary accounting documents is not mandatory. On the territory of Kazakhstan, goods received from Russia are accepted for accounting on the basis of the legislation of the Republic of Kazakhstan.

When concluding an export supply contract, it is advisable for economic entities in Russia and Kazakhstan to agree on and secure the types and forms of documents that will be drawn up during the execution of the contract. Including transport invoices, consignment notes, which will be used to formalize the transportation and transfer of goods. According to existing practice, operations for the transfer of goods by business entities from Russia to Kazakhstan are documented with a consignment note in the unified form TORG-12 (Approved by Resolution of the State Statistics Committee of Russia dated December 25, 1998 N 132).

The consignment note is drawn up in two copies. The first copy remains with the Russian supplier of the exporter, and is the basis for writing off the goods. The second copy is transferred to the buyer and is the basis for the receipt of goods.

International transport bill of lading (CMR)

The international consignment note (CMR) confirms the movement of goods from the territory of one state to the territory of another. The consignment note-CMR is drawn up by the shipper in at least six copies. The CMR consignment note contains information about the shipper, consignee, carrier and their locations, information about the vehicle, loading address and destination - unloading place.

In cases where the export of goods from the territory of Russia is carried out by Kazakhstani carriers, transport documents can be prepared in accordance with the legislation of Kazakhstan. It is necessary to carefully fill out information about the place of loading and place of unloading; they must be located in Russia and Kazakhstan, respectively.

The goods part of the CMR consignment note contains information about the cargo. If there is a large list of goods, if the CMR consignment note form is not enough to enter them, it is allowed to attach a list of goods and their description to the consignment note.

Unlike the “internal” waybill, when exporting from Russia to Kazakhstan, column 10 of the CMR invoice must be filled in - “product code”, in accordance with the unified Commodity Nomenclature of Foreign Economic Activity of the Customs Union.

From July 2021, for Russian exporters, filling out the “product code” information is mandatory for invoices, since for raw materials and non-commodity goods, from July 2021, input VAT is deducted differently.

The CMR invoice is issued on printed forms in a foreign language or a foreign and Russian language. There are not isolated cases of tax claims arising when CMR invoices are presented to justify the right to a VAT tax rate of 0 percent without attaching a translation into Russian.

When sending cargo, the CMR waybill is signed by the shipper and the carrier. One of the copies of the CMR consignment note remains with the shipper, the remaining copies accompany the cargo.

Upon receipt of the cargo, the consignee fills out at least three pages of the CMR invoice on receipt of the cargo, indicating the date, time of receipt of the cargo, signature of the financially responsible person and seal. One page of the consignment note remains with the consignee, two pages of the CMR consignment note with the signatures and seals (stamps) of the consignor and consignee, respectively, are transferred by the carrier to the transportation customer along with the invoice for transportation.

Two copies of the CMR consignment note are intended for customs purposes.

Calculation base:

Currently in Kazakhstan there is a single VAT rate of 12% , regardless of the taxation regime in force in a particular organization. In addition, according to the law, VAT is paid not only on imported goods, but also on work performed or services provided.

In order to calculate the amount of value added tax, it is important to correctly determine the base for the calculation, which is calculated using the following formula:

Tax base = contract value of goods + import duty + excise tax

VAT calculation formula: tax base*12%

Thus, the tax will be calculated not only from the direct cost of the goods, but also taking into account all duties and excise taxes.

Customs documents for export from Russia to Kazakhstan, Belarus, Kyrgyzstan and Armenia

Since January 2015 Declaration has been canceled when moving goods between Russia, Kazakhstan, Belarus and other states of the economic union (Article 25 of the Treaty “On the Eurasian Economic Union” dated May 29, 2014), therefore, goods moved between Russia, Kazakhstan, Belarus are not processed in customs terms and CMR invoices are not transferred to customs authorities.

At the same time, as noted at the beginning of the article, Russia and Armenia do not have a common border and vehicles can only deliver goods in transit through Georgia or Azerbaijan.

In connection with the above, shipments from Russia to Armenia must be cleared in customs terms for transit through the territory of neighboring states.

The status of transportation of goods from Russia to Kazakhstan, to Belarus and other countries of the economic union as international transportation of goods has not been changed by the international treaty of the EAEU. Economic entities of the states parties to the treaty, when transporting goods from the territory of one state party to the treaty to the territory of another, are required to comply with the requirements of the legislation on the international transport of goods.

TRANSPORTATION (SHIPPING) DOCUMENTS to confirm the right to 0 VAT rate

From January 2015, on the basis of clause 1 of Art. 7 of the Tax Code of the Russian Federation, taxation of the export of goods from the territory of Russia to the territory of Kazakhstan, Belarus and other states parties to the treaty is carried out according to the rules of Art. 72 of the Treaty on the Eurasian Economic Union (signed in Astana on May 29, 2014) and not according to the rules of the Tax Code of the Russian Federation.

The direct procedure for collecting indirect taxes (including VAT) and the mechanism for monitoring their payment when exporting and importing goods is regulated by Appendix No. 18 to the Treaty (Protocol on the procedure for collecting indirect taxes and the mechanism for monitoring their payment when exporting and importing goods, performing work, provision of services (hereinafter referred to as the Protocol)).

Also since January 2015. sales of goods for export from the territory of Russia to the territory of Kazakhstan are carried out at a VAT tax rate of zero percent. To confirm the right to apply the VAT tax rate of zero percent, among others, the exporter submits transport (shipping) and (or) other documents provided for by the legislation of the member state, confirming the movement of goods from the territory of Russia to the territory of Kazakhstan.

Taking into account the above provisions of Russian legislation, in the case of transportation of goods by an engaged carrier, the Russian supplier-exporter submits as supporting documents:

1) Transport documents: international consignment note CMR , which indicates the place of loading - the territory of Russia, and the place of unloading must be indicated on the territory of the Republic of Kazakhstan and the corresponding mark of the carrier must be affixed, and the consignment note form TORG-12.

2) Shipping documents: waybill (for example TORG-12), shipping specification, invoice - specification, quality certificate, quarantine and veterinary certificates or certificates. Since economic entities of the member states of the EurAsEC Treaty are exempt from sanitary and veterinary control, when moving goods across the borders of the member states, appropriate certificates and certificates are not required.

At the same time, in the opinion of the Ministry of Finance of the Russian Federation and the Ministry of Transport of the Russian Federation, it is allowed to confirm the export of goods from the territory of Russia to the states parties to the Eurasian Economic Community treaty using a transport and consignment note (Form 1-T) or one waybill in Form 1-T. (Ministry of Transport of the Russian Federation Letter dated May 24, 2010 N OB-16/5460).

The position of the regulators is justified by the presence of two parts in the invoice form 1-T: commodity and transport. The latter contains enough information to confirm the contract of carriage.

We recommend that our clients coordinate the issue of document preparation with the counterparty. The fiscal authorities of Kazakhstan require that when registering the transportation of cargo from the territory of Russia by a Kazakh carrier, the international transport bill of lading CMR must be presented.

Russian legislation does not contain prohibitions for processing transportation in a similar manner.

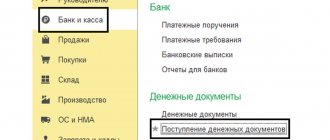

Filling out a VAT return

If the package is collected within 180 calendar days from the date of shipment, data on the export transaction (sale) and the amount of VAT to be reimbursed on it are reflected in section 4 of the VAT return for the next reporting period (no additional declarations are required during the inter-payment period). On the line with code 1010403, column 1 indicates the amount of the transaction (sale), column 2 indicates the amount of VAT to be reimbursed (for an export transaction).

If you did not manage to collect the package of documents within 180 calendar days from the date of shipment, you need to charge VAT on the transaction amount at the usual rate and indicate data on the unconfirmed transaction in section 6 of the VAT return (on line with code 1010403).

Once a package of documents has been collected for an unconfirmed transaction, your right to a VAT refund will be restored.

LIST OF DOCUMENTS FOR EXPORT TO KAZAKHSTAN

The composition of the documents required for the shipment of goods for export is determined by the direction of export (EAEU countries, export outside the Customs Union), the contract (delivery, commission, transportation, etc.), the terms of the contract (which buyer requires the composition of documents, delivery method, storage, etc.), goods (require certificates, customs declarations - DT, etc.).

Since state control during the movement of goods, works, and services between the states of the EAEU has significant features, and at the same time, each state has its own characteristics, each time when concluding an agreement for the supply of goods from Russia to Kazakhstan, Belarus, Armenia and Kyrgyzstan, it is necessary to clarify (form ) an up-to-date list of required documents, and distribute the responsibilities for preparing the necessary documents between the supplier and the buyer.

For example, if a Russian supplier-exporter delivers to a buyer’s warehouse in Kazakhstan, the preparation of transport and shipping documents is the responsibility of the Russian supplier-exporter. If the goods are picked up by a Kazakhstani buyer from the supplier’s warehouse in Russia, the transport documents are prepared by the buyer.

Documents for exporting goods to Kazakhstan include:

- Goods (invoices, certificates, if the goods are from foreign countries - customs declarations (CD), etc.)

- Settlement (Documents for payment for goods - payment orders, etc.)

- Transport (consignment notes, waybills)

- Tax (Invoices, invoices, applications for the import of goods and payment of indirect taxes and excise taxes, etc.)

The list of documents for export can be read here.

How to Confirm export to Kazakhstan, Belarus, Armenia and Kyrgyzstan, read here

Read new publications:

How to fill out an international CMR consignment note

Return of imports from Kazakhstan, Belarus - VAT registration

06/09/2016

Moscow

Tax Lawyer Gordon Andrey Eduardovich

Related material:

Read the specifics of the agreement for export to Kazakhstan, Belarus, Kyrgyzstan and Armenia here

Still have questions?

OUR ADVANTAGES

COMFORTABLE

A personal account allows you to carry out most procedures without personal presence, from unloading documents to monitoring the progress of customs clearance. The declaration for goods is submitted to customs through a secure channel using Electronic Declaration technology (ED-2).

FAST

Thanks to our extensive experience in interacting with customs, we have created clearly defined rules of interaction that allow you to complete the customs clearance procedure with the least amount of time.

PROFITABLE

Our clients receive an Export Declaration and transport documents at a single price specified in the Agreement, with no additional costs.