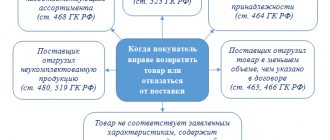

Let's consider the situation with returns. These operations always raise many questions. Return is the transfer of goods from the buyer to the seller if facts of improper fulfillment by the seller of their obligations under the purchase and sale agreement listed in the Civil Code of the Russian Federation are revealed.

These are the following cases:

- approval of the order, the seller’s obligation to transfer the goods free from the rights of third parties was violated (Article 460 of the Civil Code of the Russian Federation);

- the seller’s obligation to transfer accessories or documents related to the goods within the period established by the contract has been violated (Article 464 of the Civil Code of the Russian Federation);

- the conditions regarding the quantity of goods were violated (Article 466 of the Civil Code of the Russian Federation);

- the conditions regarding the assortment of goods were violated (clauses 1 and 2 of Article 468 of the Civil Code of the Russian Federation);

- goods of inadequate quality were transferred (clause 2 of Article 475 of the Civil Code of the Russian Federation);

- the packaging of the goods has been violated (clause 2 of Article 480 of the Civil Code of the Russian Federation);

- the conditions for containers and/or packaging of goods were violated (Article 482 of the Civil Code of the Russian Federation).

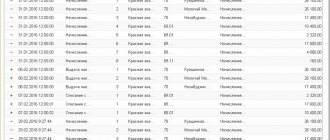

If the buyer, when returning, does not make any claims to the seller (for quality, suitability, etc.), in accordance with the above-mentioned violations, then this return should be considered a normal sale. And in this case, the buyer needs to issue an invoice for the shipment of goods received from him in the TORG-12 form.