What it is?

Repatriation of foreign exchange earnings is the return by a resident of foreign exchange earnings that he received as a result of concluding a foreign economic transaction. It should be noted that the legislator obliges to do this in relation to both foreign and national currencies. Repatriation is very important in maintaining the volume of material wealth in the state.

Its essence is that economic agents participating in international trade relations should not leave the proceeds received in the country of the counterparty.

If material goods in the form of, for example, goods have left their native country, then the financial resources paid for them should also come here. The basic rules governing the procedure for repatriation of foreign and foreign exchange earnings are reflected in Article 19 of the Federal Law of the Russian Federation “On Currency Regulation and Currency Control”.

Repatriation must be carried out when two types of legal relations arise:

- They constitute relationships in which, under certain agreements, residents transfer goods, information, exclusive intellectual property rights to non-residents, and also provide services.

- Relationships in which obligations are not fulfilled properly. These are cases when a resident paid a non-resident foreign currency for goods, works, services, results of intellectual property and exclusive rights to them specified in the agreement, and the foreign counterparty did not fulfill its obligation to import these goods into the territory of the Russian Federation. This block of relationships is very important, as it is often a means of fraud.

Important! The legislator deliberately included them in the law in order to exclude the deliberate export of currency from the country.

The quantitative ratio adopted for the conversion of foreign currency earnings received by enterprises for export-import operations into rubles (or vice versa, rubles into foreign currency) is determined taking into account the purchasing power of currencies (see “Exchange rate” [K 188]).

[p.140] Control figures reflect public needs for the products produced by the enterprise, as well as the minimum level of production efficiency. Control figures include the indicator of production in value terms for concluding contracts, profit (self-supporting income), foreign exchange earnings, the most important general indicators of scientific and technological progress and indicators of social development. [p.115] Such indicators were far from even the most radical intentions of Libya regarding the conservation of its hydrocarbon resources. According to some estimates, with the average physical volume of foreign trade transactions for 1981-1982. and the downward trend in pricing in the liquid fuel market, foreign exchange earnings are barely sufficient to cover current payment obligations without taking into account imported inflation and increased capital allocations under the development plan. As in the middle of the last decade, the level of exports was partially restored in 1982, mainly through national pricing policies and other incentive methods. The analogy between the two periods is also complemented by a very noticeable reduction in Libyan foreign exchange reserves in 1981-1982. [p.115]

The procedure for the mandatory sale of part of foreign currency earnings. [p.70]

The procedure for the mandatory sale of part of foreign currency earnings by enterprises. [p.70]

The procedure for accounting for revenue from the export of goods, works, services and results of intellectual activity, recognition of income in foreign currency, accounting for transactions for the mandatory sale of part of foreign currency proceeds. [p.459]

Instruction of the Central Bank of the Russian Federation dated June 29, 1992 No. 7 On the procedure for the mandatory sale by enterprises, associations, organizations of part of foreign exchange earnings through authorized banks and conducting operations on the domestic foreign exchange market of the Russian Federation (as amended by Instructions of the Central Bank of the Russian Federation dated June 18, 1999 No. 580-U), approved by Order of the Central Bank of the Russian Federation dated June 29, 1992 No. 02-104 A. [p.461]

The control figures include the indicator of production of products (works, services) in value terms (calculated) for concluding contracts, profit (income), foreign exchange earnings, the most important general indicators of scientific and technological progress and indicators of social development. In the twelfth five-year plan, the control figures can be included also include indicators of labor productivity and material intensity of products. [p.18]

Foreign exchange earnings Formation of an investment development fund with a list [p.76]

The benchmark figures for their activities also include foreign exchange earnings, the most important indicators of scientific and technological progress - the national economic effect, the share of fundamentally new developments that correspond to or exceed the world level and are made on the basis of inventions, discoveries, etc. the total volume of research and development work and other types works in value terms (calculated) for concluding contracts. [p.252]

The relative results of the work of the divisions under consideration are found as quotients by dividing the absolute results for each indicator by 100 thousand rubles. planned annual expenses of the organization or the number of employees of the organization. Thus, indicators are widely used that evaluate the number of types of introduced and developed products, the economic efficiency of completed developments, foreign exchange earnings, etc., per employee. [p.252]

Control figures include the indicator of production of products (works, services) in value terms (calculated) for concluding contracts, profit (income), foreign exchange earnings, the most important general indicators of scientific and technological progress and indicators of development of the social sphere. [p.137]

Various methods can be used to determine revenue from sales of products, and this method (any) in market conditions depends on the terms of the contract and on business conditions. So, for example, foreign currency earnings, which remain at the disposal of the enterprise after sale, are transferred to the enterprise’s foreign currency account, and then converted into rubles at the Central Bank rate. [p.120]

Secondly, the portion of the remaining foreign exchange earnings remaining at the exporter's disposal increased to 50%. [p.150]

The largest decline in production occurred in the basic logging industry. The scale of these losses is very significant, but is not due to the depletion of forest reserves. This is clearly seen in the example of Russia’s northern neighbor, Finland. Forest reserves in this small country are 42 times less than those of Russia. At the same time, foreign exchange earnings from the sale of products made using wood are 10 times greater. This comparison, in our opinion, indicates the enormous capabilities of the timber industry complex of our country. This is confirmed by the following data: the annual increase in wood reserves is more than 800 million cubic meters. m, and the actual volume of logging barely exceeds 100 million cubic meters. m. [p.64]

The line of strengthening the latter in the economy is actually carried out by the federal executive power after the events of August 1998. This is the concentration in the hands of the state of controlling stakes in large (systemically important) commercial banks for stabilization loans, tightening control over foreign currency earnings (with the forced sale by exporters of 75% of it on the stock exchange) and for its export abroad, a positive reaction to the desire of a number of corporate production and financial structures to move, by selling controlling stakes, under the tutelage of the state, directing the flow of state budgetary funds primarily through the treasury system and ousting commercial banks from their sphere of service, etc. [c .215]

From the mid-70s to the mid-80s, developed countries actively used petrodollars to pay off the deficit of their balance of payments by recycling (redistributing) foreign exchange earnings of oil-producing countries from oil exports. [p.161]

Monetary and financial factors. The instability of leading currencies, in particular the US dollar, and prices increases the instability of the balance of payments of developing countries. Two devaluations of the dollar in 1971 and 1973 and periodic depreciation of its exchange rate brought them additional losses, devaluing foreign exchange earnings. Due to the appreciation of the dollar in the first half of the 1980s, developing countries suffered losses as importers and debtors, since it cost them more to purchase US currency to pay off international obligations. The depreciation of the yen in the second half of the 90s significantly worsened the monetary and financial situation of a number of Southeast Asian countries, in particular Indonesia, Thailand, and the Philippines. As a result, the latter were forced to carry out significant devaluations of their monetary units. Devaluation of the national currency of developing countries, in principle, encourages exports and discourages imports of goods. But the export potential and competitiveness of goods of most of these countries are small, and the import needs are huge, which reduces the positive impact of devaluation on their balance of payments. [p.172]

Currency restrictions produce short-term positive results. Thus, if the abolition of currency restrictions in September 1968 facilitated the flight of 15 billion French. fr. from France, then after their restoration the outflow of capital decreased sharply and the balance of short-term capital movements became positive. Ultimately, foreign exchange restrictions have a negative impact on the IEO as a whole, in particular hampering the development of exports. Exporters, not having confidence in receiving foreign currency, seek to avoid handing over foreign currency earnings to foreign exchange banks at the unfavorable official rate of the national currency by [p.199]

The exporter, after dispatching the goods, instructs his bank to receive from the importer a certain amount of currency on the terms specified in the collection order containing complete and accurate instructions. There are two main types of collection orders: a) documents are issued to the payer against payment (D/P) and b) against acceptance (D/A). It is sometimes practiced to issue documents to the importer without payment against his written obligation to make payment within a specified period of time. Using such conditions, the importer has the opportunity to sell the purchased goods, receive the proceeds and then pay collection to the exporter. In order to speed up the receipt of foreign currency earnings by the exporter, the bank can take into account drafts or provide a loan against commercial documents. Thus, the collection form of payments is associated with credit relations. Collection is the main form of payment under contracts on commercial credit terms. In this case, the exporter issues a draft for collection for acceptance by the payer, as a rule, against the delivery of commercial documents to him (documentary collection); when the payment deadline arrives, the accepted bills are sent for payment for collection (clean collection). [p.224]

However, the collection form of payment has significant disadvantages for the exporter. Firstly, the exporter bears the risk associated with the importer’s possible refusal to pay, which may be due to a deterioration in market conditions or the financial situation of the payer. Therefore, the condition for the collection form of payment is the exporter’s trust in the importer’s solvency and his integrity. Secondly, there is a significant time gap between the receipt of foreign currency earnings from collection and the shipment of goods, especially during long-term transportation of goods. To eliminate these shortcomings of collection, additional conditions are applied in practice [p.224]

A characteristic feature of currency clearing is the replacement of foreign exchange turnover with foreign countries by settlements in national currency with clearing banks, which carry out the final settlement of mutual claims and obligations. Post-war currency clearings differed from pre-war ones in that clearing banks did not control every transaction, but only accepted national currency from importers and seized foreign exchange earnings from exporters in exchange for national currency. Mutual offset of demands and obligations did not ensure equalization of mutual supplies. Therefore, bilateral clearing was associated with an increase in loan debt, which hampered the development of foreign trade in Western Europe. [p.230]

Currency clearings have a dual impact on foreign trade. On the one hand, they mitigate the negative consequences of foreign exchange restrictions, allowing exporters to use foreign exchange earnings. On the other hand, it is necessary to regulate foreign trade turnover with each country separately, and foreign exchange earnings can only be used in the country with which a clearing agreement has been concluded. Therefore, currency clearing is unprofitable for exporters. In addition, instead of revenue in convertible currency, they receive national currency. Therefore, exporters are looking for ways to bypass currency clearing. These include manipulation of prices in the form of understating the contract price in the invoice (double contract) so that part of the foreign exchange proceeds is at the free disposal of the exporter, bypassing the exchange control authorities; shipment of goods to countries with which a clearing agreement has not been concluded; lending to a foreign buyer for the period calculated for termination of the clearing agreement. [p.232]

According to Keynes, the quota was supposed to serve as a tool for regulating the country's debt in relation to the ISS, which acts as both a creditor and a debtor. The main idea of the ISS project is simply that the foreign exchange earnings of one country should be used by another country, but the ways of its implementation proposed by Keynes are complex. [p.236]

Export and import licenses (quotas) Temporary (until loan repayment) exemption of the borrower from mandatory payments (withholding part of foreign currency earnings), tax and other benefits [p.296]

From the mid-70s until 1982, interstate regulation of the movement of loan capital through the recycling of petrodollars from oil-producing countries was actively practiced. Regional recycling was carried out by OPEC member countries by using foreign exchange earnings from oil exports for the development of the national economy, assistance to other developing countries, and profitable investments in developed countries. Developed countries recycled petrodollars in their own interests to 1) cover the balance of payments deficit 2) redistribute petrodollars through banks in favor of developing oil importing countries in order to expand national exports to these countries 3) accumulate these funds in international monetary and financial organizations ( for their subsequent use in their own interests). For this purpose, special funds were created, in particular the IMF Oil Fund. [p.301]

One of the ways to insure currency risk is forward transactions with the payment currency. For example, an exporter, selling goods for a certain currency, simultaneously enters into a foreign exchange transaction for a period, realizing future foreign exchange earnings. The importer, on the contrary, resorts to a forward transaction to purchase the currency of payment in advance if its exchange rate is expected to appreciate by the time of payment under the contract. Since the 70s, currency futures have been used to insure currency risk - trading standard contracts. To protect the bank portfolio of securities that bring fixed income, interest rate futures are used. The use of forward currency transactions and swap transactions to insure currency risk is partly due to government control over the balance sheets of banks, since these transactions are recorded in off-balance sheet accounts. [p.409]

According to the Regulations of the Bank of Russia dated September 28, 1998, a special morning trading session was introduced on the currency exchanges, during which currency trading took place related to a certain range of operations. Currency offers were made by authorized banks, mainly on behalf of exporters, who were required to sell 50% (since the beginning of 1999 - 75%) of their foreign currency earnings. Currency could be purchased by banks on behalf of clients for the following purposes: payment for concluded import contracts, payment of dividends on shares in the authorized capital, repayment of financial loans by resident legal entities. In addition, banks could buy currency to make payments in foreign currency to individuals on deposits they opened. The Central Bank of the Russian Federation also took part in these sessions as a buyer and seller of currency. During the daytime sessions, currency was traded between commercial banks for financial and investment transactions and other purposes. [p.509]

Market for urgent transactions. The main reason for the emergence of this segment of the foreign exchange market was the desire of banks and their clients to use the possibilities of insuring foreign exchange transactions and making profitable speculative transactions. The services of the forward market are mainly used either by exporters expecting to receive foreign exchange earnings, or by importers intending to make payments for imports. Participants in the futures market are banks and non-banking organizations seeking to earn income as a result of changes in exchange rates. [p.510]

Control figures include the production of products, works and services in value terms (calculated) for concluding contracts, profit (income), foreign exchange earnings, the most important general indicators of scientific and technological progress, including the depth of oil refining 15 period of new development. economic mechanism and To complete the transition to full economic accounting, self-sufficiency and self-financing, indicators of labor productivity and material intensity can be used. [p.49]

Settlements using bills and checks. In international payments, bills of exchange are used, issued by the exporter to the importer. Draft is a document drawn up in the form prescribed by law and containing an unconditional order from the creditor (drawee) to the borrower (drawee) to pay within a specified period of time a certain amount of money to a third party (remitee) or bearer named in the bill. The acceptor, who is the importer or the bank, is responsible for paying the bill. Drafts accepted by banks can easily be converted into cash by accounting. The form, details, conditions for issuing and paying drafts are regulated by bill of exchange legislation, which is based on the Uniform Bill of Exchange Law adopted by the Geneva Bill of Exchange Convention of 1930. The prototype of drafts was those that appeared in the 12th-13th centuries. covering letters requesting payment to the submitter (usually the merchant) of the appropriate amount in local currency. With the development of commodity-money relations and the globalization of economic relations, the bill has become a universal credit and settlement document. The use of a draft in addition to collection and letter of credit gives the right to receive credit and foreign exchange earnings. [p.227]

Opening an escrow account for crediting the client’s foreign currency earnings with agreement on the account regime and its monitoring by the guarantor [p.296]

Since June 1996, Russia has officially accepted in full the obligations imposed on IMF member countries by Article VIII (sections 2, 3, 4) of the Fund's charter. This article requires member countries to eliminate currency restrictions and introduce the convertibility of national currencies for international current transactions, not to resort to the practice of multiple exchange rates, and not to participate in discriminatory currency agreements. Russia's accession to Article VIII implies the extension of the ruble convertibility for current transactions to non-residents. At the same time, Russian exporters are required to sell part (50%, from the beginning of 1999 - 75%) of foreign exchange earnings on the domestic foreign exchange market at the market rate. [p.499]

How is it happening?

There are three parties involved in this process. Resident, non-resident and resident bank.

- Having concluded a foreign economic agreement, an economic agent must notify the authorized bank about:

- the deadline after which the resident’s current account will receive money from the foreign counterparty in accordance with the conditions specified in the agreement;

- the deadline after which the non-resident will transfer goods, perform work, or provide services.

- Next, you need to issue a transaction passport at the bank. The procedure for its registration is established by Instruction No. 138-I dated June 4, 2012, approved by the Central Bank of the Russian Federation.

- After receipt of foreign currency earnings to the resident’s account, he must bring the corresponding certificate to the authorized bank to remove control of this transaction. The deadline for providing this certificate varies depending on the type of currency transaction. They are also set out in the above-mentioned Instructions.

- If the counterparty has not fulfilled its repatriation obligations, the resident must ensure that insurance payments for the repatriation risk under the insurance contract are credited to his bank account. Only in this case will the repatriation obligations be considered fulfilled by the resident.

- The obligation to repatriate may pass to another person (factor) if the right to demand the fulfillment of obligations under the concluded agreement is assigned to him.

Attention! When funds are received into the factor’s account from abroad, he is obliged to notify the person who assigned him the right of claim within 5 working days.

On our website you will find other useful publications by experts on the following topics:

- How does revenue differ from turnover, cost, income and profit, and what is gross revenue?

- What does sales revenue mean and how is it calculated?

- Why and how is factor analysis used?

- What formulas are used to calculate revenue and how to find out its annual volume?

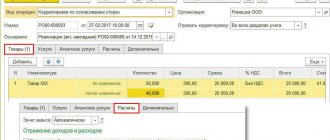

How to set up currency revaluation in 1s 8.3. Revaluation of foreign currency

Let us first turn to the Russian Federation.

In it we will see that according to PBU 3/2006, if the value of assets and liabilities is expressed in foreign currency, then for reflection in accounting this value is recalculated into rubles on the date of the transaction in foreign currency and on, that is, the last day of the month. Main menu - Settings - Functionality: It is also necessary in the Currencies directory: add the foreign currencies required to work in 1C 8.3: and ensure timely and regular updating of currency exchange rates in the information register of the same name: If the enterprise has a foreign currency bank account, data about it must be entered in the directory Bank accounts of an organization: To conduct currency transactions in the 1C 8.3 Enterprise Accounting 3.0 program, in the chart of accounts there are special accounts that have the attribute of currency accounting:

When is it not required?

It is a general rule to return proceeds to your home country. However, there are exceptions to every rule. So, residents may not credit national and foreign currency earnings if the earnings:

- Credited to the account of a resident legal entity in a foreign bank to fulfill its obligations under credit or debt obligations to government agents of other countries, as well as residents of OECD or FATF member states for a period of more than two years.

- Associated with the resident’s expenses for the construction of structures in a foreign country, but only for the duration of construction.

- Received from holding exhibitions, sports, cultural and other events outside the Russian Federation, and is used to cover the costs of holding them, but for the period of these events.

- It is a mutual offset for the obligations of agents in the fishing and transport industries, for reinsurance obligations, for obligations in the gas industry, including those related to gas transit.

- Credited to transport organizations in their foreign accounts, but only for the purposes of performing their functions outside the Russian Federation.

Receipt from buyer in transaction currency example

Currency exchange rate The exchange rate difference is the difference between the ruble valuation of the corresponding asset or liability, the value of which is expressed in foreign currency, calculated at the rate of the Central Bank of the Russian Federation, on the date of use of payment obligations or the reporting date of preparation of financial statements, and the ruble valuation of these assets and liabilities, calculated at the exchange rate of the Central Bank of the Russian Federation on the date of their acceptance for accounting or the reporting date of preparation of financial statements for the previous reporting period.

In order to be able to maintain currency accounting in the 1C 8.3 program when starting operation, you need to configure the Functionality that allows.

Amount differences arise as a result of the practical application of the provisions of Article 317 of the Civil Code of the Russian Federation, which grants the right to provide in the contract for the fulfillment of an obligation in rubles in an amount equivalent to the exchange rate of any foreign currency on that date. Contents: Purchase and sale of foreign currency - accounting This procedure follows from paragraph 12 of PBU 9/99 and the Instructions for the chart of accounts (accounts 52, 62, 90-1).

In what time frame should it be completed?

According to paragraph 1 of Article 19 of the Federal Law of the Russian Federation “On Currency Regulation and Currency Control,” repatriation must be carried out within the time limits established by foreign economic contracts. The legislator has established such a streamlined norm due to the fact that each contractual relationship is individual.

For some, payment is made in a lump sum, for others in installments (for example, quarterly). For some, payment is made upon delivery of the product, for others only by advance payment. Thus, when concluding a foreign economic agreement, pay special attention to the clauses on repatriation, in order to be able to comply with the requirements of the current legislation in this part.

Accounting for transactions on a current currency account

Let's look at accounting of transactions using an example. as of January 8 of the current year, she had 2 thousand US dollars in her account, purchased on December 20, 2017. Further, on January 8, the company put up $1 thousand for sale. And on January 10, the bank purchased them at the rate of 57.0 rubles, after which it transferred the proceeds to the company.

The dollar exchange rate during the specified period was:

- 20.12 - 60.90884 rub.

- 08.01 - 60.6569 rub.

- 10.01 - 59.8961 rub.

These transactions are reflected in the transactions as follows:

| Dt | CT | Amounts in rubles | Description |

| 57,22 | 52 | 60 656,90 | Currency transfer |

| 91,02 | 52 | 251,50 | Exchange difference |

| 91,01 | 57,22 | 760,80 | Revaluation amount |

| 51 | 91,01 | 57 | Enrollment rate on account |

| 91,02 | 51 | 59 896,10 | Sales cost USD |

| 91,02 | 57,22 | 2896,10 | Exchange rate difference between sale and value of securities |

| — | NOT.04 | 57 | Profit from the sale of currency |

| HE.01.9 | — | 60 656,90 | Currency price on the day of debit |

Liability and fines

The following liability is established for failure to comply with the requirements of currency legislation in the field of repatriation.

| Failure to fulfill the obligation to receive foreign currency earnings to the resident’s account under a foreign economic contract (clause 4.1 of Article 15.25 of the Code of Administrative Offenses of the Russian Federation) | Failure to fulfill the obligation to return the paid currency for imported goods, services provided, work performed (Clause 5 of Article 15.25 of the Code of Administrative Offenses of the Russian Federation) | |

| Officials | 4000-5000 rub. | one hundred and fiftieth of the refinancing rate of the Central Bank of the Russian Federation of the amount of funds returned to the Russian Federation in violation of the established deadline, for each day of delay in the return of such funds to the Russian Federation and (or) from 3/4 to 1 of the amount of funds not returned to the Russian Federation. |

| Legal entities | 40,000-50,000 rub. |

The institution of repatriation of foreign exchange earnings plays a big role in the financial processes of the state. On the one hand, it ensures the retention of material wealth in the state, on the other hand, it provides the homeland with foreign currency. There is an opinion that this obligation limits the freedom of economic agents entering into civil agreements.

However, the state first of all needs to think about the welfare of the state.

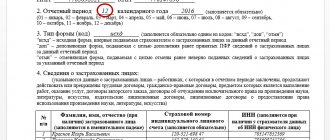

Tax and accounting for foreign currency accounts

For accounting of currency transactions, account 52 is used. Tax accounting is also conducted on its basis. As part of the instructions of the Ministry of Finance on the chart of accounts for individual entrepreneurs and legal entities. persons in the reporting special accounts are provided:

- 51.1 - for Russian financial institutions.

- 52.2 - in case of opening a bank account in foreign banks.

All transaction amounts, balances, etc. are reflected in the accounting documentation, which is submitted to the Federal Tax Service at the end of each reporting period.

Within the framework of these accounts, entrepreneurs can clarify the indicators of subaccounts, for example:

- 52.1.1 - for analytical accounting of currency transactions for all accounts.

- 52.1.2 - to summarize data on transit accounts.

What is the basis for the proposal of the deputies?

In December 2014, deputies from the A Just Russia faction introduced a bill for consideration. According to it, the procedure for introducing the mandatory sale of foreign currency income in the amount of 50 percent is being considered.

This article of the bill was in force in the Russian Federation since 2004 and was repealed. The proposed measures are aimed at strengthening and supporting the national currency by increasing it in the domestic market. The possibility of selling proceeds within seven days from the moment it arrived in the resident’s bank account is being considered. Control over deadlines and precise standards were supposed to be placed under the control of the Central Bank.

What is the rationale for rejecting the project in 2021?

The project was rejected; moreover, the government and the Central Bank believe that a return to the system of mandatory sales in such a volume could significantly reduce the possible prospects for investing foreign capital in the Russian economy. They will also lead to a depreciation of the domestic currency, since residents of the Russian Federation will be frightened by possible measures to strengthen control over capital investments.

According to State Duma deputies, the introduction of such measures will stimulate inflation, make it difficult for business entities to access funds, and destabilize the country's investment policy. All this will lead to destabilization of the economic situation in the country, while market stability must be ensured by adequate actions, including in the sphere of economics and monetary policy.

In addition, as experts note, the exchange rate of the domestic currency has already passed the critical point of its lower value. It is now unlikely that prices for petroleum products will fall much, and therefore it is clear that the ruble will not fall lower. It is inappropriate to use this bill to fight inflation and rising prices; the economy is stabilizing and the ruble is on a growth path.