A simplified version of financial statements for small businesses was developed in accordance with the principles of accounting regulation regulated by Federal Law No. 402-FZ “On Accounting”. In particular, these include simplification of accounting methods and the content of accounting reporting forms for small businesses.

It can be stated that in recent years in Russia there have been significant changes in the structure and content of financial reporting forms. They are associated with changes in balance sheet items, financial performance statements, cash flow statements, and individual explanations thereto. One of the innovations in 2012 is a change in the forms of accounting reporting for small businesses [8]. At the same time, the new simplified reporting forms do not apply to medium-sized businesses. Tables 1 and 2 present the forms of balance sheet and income statement recommended by the Ministry of Finance of the Russian Federation for small businesses.

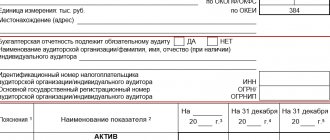

Table 1. Balance sheet form for small businesses, thousand rubles.

| Index | Code | As of 12/31/2012 | As of 12/31/2011 |

| Assets | |||

| Tangible non-current assets | 1150 | 2 029 | 2 182 |

| Intangible, financial and other non-current assets | 1110 | 130 | 134 |

| Reserves | 1210 | 7 549 | 8 455 |

| Cash and cash equivalents | 1250 | 2 952 | 2 45 |

| Financial and other current assets | 1230 | 910 | 356 |

| Balance | 1600 | 13 570 | 13 586 |

| Passive | |||

| Capital and reserves | 1300 | 9 120 | 8 500 |

| Long-term borrowed funds | 1410 | — | — |

| Other long-term liabilities | 1450 | — | — |

| Short-term borrowed funds | 1510 | 2 056 | 2 589 |

| Accounts payable | 1520 | 2 394 | 2 497 |

| Other current liabilities | 1550 | — | — |

| Balance | 1700 | 13 570 | 13 586 |

Table 2. Form of financial results report for small businesses, thousand rubles.

| Index | Code | 2012 | 2011 |

| Revenue | 2110 | 19 200 | 17 292 |

| Expenses for ordinary activities | 2120* | -14 568 | -16 121 |

| Percentage to be paid | 2330 | -110 | (-) |

| Other income | 2340 | 258 | 2 130 |

| other expenses | 2350 | -1 925 | -944 |

| Profit taxes (income) | 2410 | -571 | -471 |

| Net income (loss) | 2400 | 2 284 | 1 886 |

*The line code is indicated by the indicator that has the largest share in the aggregated indicator [5].

An analysis of table No. 1 shows that in the new form of balance sheet for small enterprises there are no standard sections of assets and liabilities, indicators of accounts receivable, intangible assets, capital and financial investments are not separated. The income statement (see Table 2) does not contain items of commercial and administrative expenses, gross profit, interim results of profit (loss) from sales, profit (loss) before tax, reference information on individual income and expenses, the overall financial result of the period and etc.

When carefully reading the regulatory document related to the preparation of financial statements, you should pay attention to the fact that if, when preparing financial statements, insufficient data is revealed to form a complete picture of the financial position, financial results of the company and changes in its financial position, then the accounting reporting includes relevant additional indicators and explanations [8].

Since only two main forms are included in the financial statements of small businesses, to analyze the income, expenses and profits of these organizations, it can be recommended to present the corresponding indicators for three years in the financial results statement: the reporting year, the previous one and the one preceding the previous one, as in the balance sheet. According to the financial results statement (see Table 2), the formation of net profit can be presented as:

- Revenue (line 2110) – Expenses for ordinary activities (line 2120) = Profit (loss) from ordinary activities

- Profit (loss) from ordinary activities + Interest payable (line 2330) + Other income (line 2340) – Other expenses (line 2350) = Profit (loss) before tax

- Profit (loss) before tax – Income taxes (line 2410) = Net profit (loss) (line 2400)

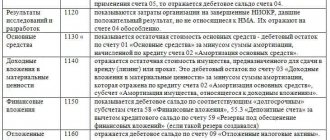

A comparison of the aggregated indicators presented in the simplified form of the balance sheet of a small enterprise with the indicators of the generally accepted form for asset items is given in Table 3.

Table 3. Formation of asset indicators of the balance sheet of a small enterprise

| Item in the asset balance sheet of a simplified form | Balance of accounting accounts that are accounted for under this item | The corresponding asset item of the balance sheet in the generally accepted form | Line code |

| Tangible non-current assets | Account 08 (according to the corresponding subaccounts) + Account 01 + Account 03 - Account 02 | Fixed assets | 1150 |

| Unfinished capital investments | 1155 | ||

| Profitable investments in material assets | 1160 | ||

| Material prospecting assets | 1140 | ||

| Intangible, financial and other non-current assets | Account 08 (according to the corresponding subaccounts) + Account 04 - Account 05 + Account 58 + Account 55, subaccount “Deposit accounts” - Account 59 + Account 09 (if applicable), etc. | Intangible assets | 1110 |

| Research and development results | 1120 | ||

| Intangible search assets | 1130 | ||

| Financial investments | 1170 | ||

| Deferred tax assets | 1180 | ||

| Other noncurrent assets | 1190 | ||

| Reserves | Account 10 + Account 11 + Account 15 +/- Account 16 + Account 20 + Account 21 + Account 23 + Account 28 + Account 29 + Account 41 – Account 42 + Account 43 – Account 14 + Account 44 + Account 45 + Account 97 | Reserves | 1210 |

| Cash and cash equivalents | Account 50 + Account 51 + Account 52 + Account 55 (except for time deposits) + Account 57 | Cash and cash equivalents | 1250 |

| Financial and other current assets | Account 58 + Account 55, sub-account “Deposits” - Account 59 + Account 19 + debit Accounts 60, 62, 68, 69, 70, 71, 73, 75, 76 - Account 63 | Accounts receivable | 1230 |

| Financial investments (excluding cash equivalents) | 1240 | ||

| Other current assets | 1260 |

In the liabilities side of the balance sheet, the aggregated indicators generally correspond to the final sections of the balance sheet, highlighting accounts payable and summarizing the indicators of equity and borrowed capital. If aggregated indicators that include several indicators (without their detail) are included in the financial statements of certain categories of organizations, the line code is indicated by the indicator that has the largest share in the aggregated indicator [8].

When filling out financial statements in a simplified form, it is necessary to take into account the recognition conditions and classification of the relevant accounting objects and their economic essence. The working chart of accounts for the accounting of organizations is approved as part of the accounting policy along with reporting forms, accounting forms, internal control systems, methods and options for recording the facts of economic life, document flow procedures and taxation regimes. The information presented in the financial statements must meet the requirements of completeness, reliability, comparability, materiality, neutrality, objectivity, and consistency [9].

The completeness and reliability of the reporting indicators of small enterprises is influenced by a number of factors:

- irregular maintenance of records, if accounting is carried out by an outside specialist who is not on the staff of the organization;

- the impossibility of dividing responsibilities and powers in various areas of accounting and tax accounting if there are one or two accountants in the organization;

- the use of one or two computers with a simplified accounting program, which allows you to enter transactions into the system retroactively or carry out transactions that are not approved in the prescribed manner, etc.

In this regard, the requirements of the new Law No. 402-FZ on the creation in each organization of an effective internal control system, thanks to which unwanted risks of business development and distortions in accounting (financial) statements are prevented, are relevant.

The need to improve control and analysis of the activities of small enterprises is confirmed by the presence of various types of research by modern economists. In the literature on the analysis of the financial condition of enterprises, a distinction is made between the assessment of solvency and financial stability [1, 2]. Concepts for identifying stages of enterprise life cycles are presented in the works of N.P. Lyubushina, L.E. Basovsky, I.A. Blanka

etc. The methodology for analyzing and monitoring the activities of small business entities, based on the grouped stages of the enterprise life cycle, allows you to develop plans for the development of the organization for the long and short term, identify the main areas that require special attention from management, i.e. internal users of accounting and economic information [10].

Indicators of the financial and economic activity of a small enterprise may be of interest not only to internal users (owners and managers), but also to external users - creditors, potential investors, suppliers and contractors, credit organizations, etc. These organizations are mainly interested in the issue of the solvency of this enterprise and its business activity. The assessment of the financial condition and solvency of a small enterprise is carried out, as a rule, on the basis of financial statements.

Financial condition refers to the ability of an organization to finance its activities. In order to develop in a market economy and prevent bankruptcy, you need to know how to manage finances, what the capital structure should be in terms of composition and sources of education, what share should be taken by own funds and what by borrowed funds [2]. The overall financial condition of a small enterprise can be assessed based on the following indicators:

- structure and dynamics of property and sources of financing;

- liquidity and solvency;

- financial stability;

- financial performance results.

Let's consider what information can be extracted from the reporting that is currently recommended for small businesses.

Simplified balance sheet

At the same time, small businesses can choose the form for preparing financial statements independently. They can provide reporting using both general and simplified forms. The composition of the reporting will depend on this. Thus, for small enterprises, special forms of simplified financial statements have been approved, given in Appendix 5 of Order No. 66n of the Ministry of Finance of Russia dated July 2, 2010. The composition of simplified financial statements is as follows:

- Balance sheet;

- Income statement.

If an enterprise needs to provide any additional information, and the simplified reporting forms do not contain the required columns, then general reporting forms can be used.

Thus, small businesses decide on their own which forms to submit financial statements. The main thing is that the decision made is reflected in the accounting policy.

Small Business Criteria for 2020-2021

Every company is required to prepare a balance sheet.

But not everyone has the right to choose the form - traditional or simplified - for this report. In particular, small enterprises have this opportunity (subclause 1, clause 4, article 6 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ). The criteria for small enterprises are specified in the law “On the development of small and medium-sized enterprises...” dated July 24, 2007 No. 209-FZ. For 2020-2021, the criteria for a small enterprise are set as follows:

| № | Criteria for recognition as a small business entity | Limit value |

| 1 | Total share of participation in the authorized capital of an organization of the Russian Federation, constituent entities of the Russian Federation, municipalities, public, religious organizations, foundations | 25% |

| 2 | Total share of participation in the authorized capital of foreign organizations | 49% |

| 3 | Total share of participation in the authorized capital of other organizations that are not small and medium-sized businesses | 49% |

| 4 | Average number of employees for the previous calendar year | 100 people |

| 5 | Income received from business activities for the previous calendar year, which is determined in the manner established by the legislation of the Russian Federation on taxes and fees | 800 million rub. |

Read more about the criteria in the material “Small enterprise - criteria for inclusion in 2021 - 2021”.

Requirements for filling out a simplified balance sheet

The annual balance sheet must contain data on the assets and liabilities that the organization has at the end of the reporting year, that is, as of December 31. Additionally, information on previous years is entered into the balance sheet, that is, as of December 31 of last year and as of December 31 of the year before. For example, the balance sheet prepared by an enterprise for 2021 must contain data as of December 31, 2017, December 31, 2021 and December 31, 2015.

The financial results report for the year must contain information on income and expenses that were recognized in the company’s accounting in the reporting and last year (

Analysis of the structure and dynamics of property and sources of financing

An assessment of the structure and dynamics of property (assets) gives an idea of the ratio of fixed and working capital, the share of inventories in current assets, as well as changes in their value for the analyzed period.

The structure and dynamics of sources of financing (liabilities) shows the shares of own, borrowed and borrowed funds, as well as their changes over the analyzed period, which is a well-known technique for analyzing financial statements.

However, this information is not particularly important when assessing the activities of a small enterprise. The authorized capital of a small enterprise is usually small. They carry out their current activities mainly from their own funds and accounts payable. Trade and purchasing activities and settlement operations, as a rule, are carried out on an advance payment basis or through obtaining a commercial (commodity) loan. Therefore, a very important factor is maintaining liquidity and solvency, which characterize the ability of an enterprise to timely and fully make payments on current obligations.

The procedure for filling out a simplified statement of financial results

| Report line | Accounting account |

| 2110 "Revenue" | Difference of indicators: · Turnover on the credit of the “Revenue” subaccount to the “Sales” account · Turnover by debit of the “VAT” subaccount to the “Sales” account |

| 2120 “Expenses for ordinary activities” | Amount by debit of subaccounts to account 90 “Sales”, on which accounting is kept: · Cost of sales · Business expenses · Administrative expenses The indicator is indicated in brackets, no minus sign is used. |

| 2330 “Interest payable” | The amount of accrued interest on loans for the current year is indicated. The indicator is indicated in brackets, no minus sign is used. |

| 2340 “Other income” | Difference of indicators: · Turnover on the credit of the subaccount “Other income” to account 91 “Other income and expenses” · Turnover on the debit of the “VAT” subaccount to account 91 “Other income and expenses” |

| 2350 “Other expenses” | Difference of indicators: · Turnover on the debit of the subaccount “Other expenses” to account 91 “Other income and expenses” · Indicator for line 2330 “Interest payable” The indicator is indicated in brackets, no minus sign is used. |

| 2410 “Profit taxes (income)” | · If an organization pays income tax, then the value of line 180 of sheet 02 of the income tax declaration is recorded · If the organization is on the simplified tax system (income), then indicate the difference in indicators on lines 133 and 143 of section 2.1.1 of the declaration according to the simplified tax system · If the organization is on the simplified tax system (income minus expenses), then indicate the indicator on line 273 of section 2.2 of the declaration under the simplified tax system. When paying the minimum tax, the indicator is indicated on line 280 of section 2.2 of the declaration according to the simplified tax system. · If the organization is on UTII, then the amount of UTII for all quarters is indicated. The indicator is indicated in brackets, no minus sign is used. |

| 2400 “Net profit (loss)” | Calculate the value as follows: page 2110 – page 2120 – page 2330 + page 2340 – page 2350 – page 2410 |

If the resulting result of “Net profit (loss)” comes out with a minus sign, then it must be written down in the report, in brackets; the minus is not indicated. If the resulting value is positive, then there is no need to put it in brackets.

Calculation of coefficients characterizing financial stability

To assess financial stability, the following relative indicators can be used to characterize the state of working capital, the structure of funding sources, and the financial independence of the enterprise:

| Name | Recommended value | Formula |

| Coefficient of provision of current assets with own working capital (Kss) | greater than or equal to 1.0 | Kss = SOS/OA, SOS = Capital and reserves - Non-current assets; |

| Coefficient of provision of inventories with own working capital (Kmz) | from 0.6 to 0.8 | Kmz = SOS/W |

| Equity capital agility ratio (Kmsk) | 0,5 | Kmsk = SOS/KR |

| Long-term borrowing ratio (Kdz) | less than or equal to 1.0 | Kdz = Long-term borrowed funds / Equity funds |

| Autonomy coefficient (Ka) | greater than or equal to 0.5 | Ka = SC/WB |

| Financial activity ratio (financial leverage) (Kfa) | Kfa = (DZS+KZS)/KR | |

| Financial stability coefficient (share of long-term sources of financing in assets) (Kfu) | from 0.5 to 0.7 | Kfu = (KR+DZS)/VB |

| where, SOS - own working capital; OA - current assets; Z - reserves; KR - capital and reserves; SK - equity capital; VB - balance sheet currency (total cost of funding sources); DZS - long-term borrowed funds; KZS - short-term borrowed funds | ||

Let us summarize the procedure for calculating the considered coefficients using the corresponding balance sheet line codes:

Kss = (line 1300-(line 1150+line 1110)) / (line 1210+line 1250+line 1230) Kmz = (line 1300-(line 1150+line 1110)) / line .1210 Kmsk = (p.1300-(p.1150+p.1110)) / p.1300 Kdz = p.1400 / p.1300 Ka = p.1300 / p.1700 Kfa = (p.1410+p. 1510) / line 1300 Cfu = (line 1300+line 1410) / line 1700

When using the indicated indicators of financial stability in analytical practice, it is necessary to keep in mind that they reflect the financial condition as of a date that has already passed. Therefore, it is advisable to consider them in dynamics over several reporting periods, which will indicate a certain consistency in the activities of the enterprise. In addition, the recommended values of these coefficients are conditional and depend on the characteristics of financial and economic activities, on internal and external economic factors.

Doubtful debts

In the BB it is also necessary to note a reserve for doubtful debts. Such obligations face any enterprise.

The provision for doubtful debts is reflected in the document accordingly. However, in order to correctly display such a reserve, it is necessary to understand what is meant by doubtful debts. The doubtful debts that this reserve includes include debts owed to the company, the repayment of which is unlikely to occur.

Signals for doubtful debts are as follows:

- violation of deadlines for paying off debts;

- availability of information about the presence of financial problems;

- lack of additional guarantees (for example, collateral), etc.

It is worth noting that the allowance for doubtful debts may include debt that is shown as a debit on various accounting accounts.

The debt that is included in the reserve for doubtful debts is calculated based on the results of the inventory carried out at the enterprise. To correctly display such debt, a reserve for doubtful debts is created. It serves as an estimate in financial statements.

Definition and types of fixed assets

The balance sheet always reflects fixed assets. Therefore, you should know what fixed assets are.

In the description of the sections, the concept of “fixed assets” includes the definition of non-current assets. The categorical concept of “fixed assets” should be understood as means of labor that are involved in the main activities of the organization. This means that the list of “fixed assets” includes transport, property (land, buildings), inventory and equipment, pets, etc.

Fixed assets may also include expenses that went towards rent. It is necessary to determine fixed assets taking into account depreciation. This parameter depends on the maximum service life.

Fixed assets are entered in lines specially designated for them. At the same time, fixed assets have their own code for reflection in the BB.

Balance changes

Every day, companies carry out various business operations that affect the parameters of asset values, as well as their order of formation. When changing only BB assets, the equation is used: A + X - X = P, where:

- A – asset;

- P - passive;

- X - changes.

If a regrouping of the enterprise’s obligations occurs, then the following formula is used to display the changes: A = P + X - X.

In the case of an increase in the value of assets, a slightly different equation A + X = P + X is taken to reflect the change. And if there is a decrease in assets, then the equation is taken to look like this: A - X = P - X.

Step by step filling

Let's look at the algorithm for creating a balance sheet using the example of Uproshchenets LLC. The organization has been operating since January 1, 2017 and applies the simplified tax system. In the process of preparing financial statements for 2017, the company’s accountant must perform the following actions.

Create a balance sheet as of December 31, 2017; account balances are to be posted across balance sheet lines.

| Check | Balance | Check | Balance | Check | Balance |

| Dt 01 | 599900 | Dt 43 | 85000 | Kt 69 | 80000 |

| Kt 02 | 20140 | Dt 50 | 10000 | Kt 70 | 259000 |

| Dt 04 | 100340 | Dt 51 | 255000 | Kt 80 | 55000 |

| Kt 05 | 3000 | Dt 58 | 150000 | Kt 82 | 15000 |

| Dt 10 | 22000 | Kt 60 | 155000 | Kt 84 | 140000 |

| Dt 19 | 6000 | Kt 62/advance | 500620 |

Based on the balance sheet balance, determine the asset indicators taking into account the following rules:

- line 1150 is defined as the difference between the value of non-current assets and the depreciation accrued on them: Dt 01 - Kt 02 = 580 thousand rubles;

- line 1170 includes the amount of intangible assets minus depreciation and the amount of financial investments: (Dt 04 - Kt 05) + Dt 58 = 247 thousand rubles;

- line 1210. It should reflect the cost of the enterprise’s material assets and finished products produced: Dt 10 + Dt 43 = 107 thousand rubles;

- line 1230 contains the amount of VAT paid when purchasing goods, works, services from the supplier: Dt 19 = 6 thousand rubles;

- line 1250 is formed by summing the funds at the cash desk and in current bank accounts: Dt 50 + Dt 51 = 265 thousand rubles;

- line 1600, according to which the book value of current and non-current assets amounted to 1205 thousand rubles;

Determination of indicators of the passive section of the balance sheet:

- line 1370 includes the amount of authorized and reserve capital, as well as the organization’s retained earnings: Kt 80 + Kt 82 + Kt 84 = 210 thousand rubles. (the line code is determined by the indicator that has the largest share in the group of items - retained earnings);

- line 1520 contains the remaining account balances - the amount of accounts payable to suppliers and employees, advances received from customers, as well as obligations to pay insurance premiums: Kt 60 + Kt 62/advances + Kt 69 + Kt 70 = 995 thousand rubles;

Comparison of data in lines 1600 and 1700: the asset and liability of Uproshchenets LLC is equal to 1205 thousand rubles, which means the balance is correct.

Since Uproshchenets LLC was registered in 2021, the balance sheet columns for the previous 2 years will not be filled in. Empty cells should be filled with dashes. Subsequently, when filling out these columns, the data should be taken from previous reporting forms adopted by regulatory authorities.

The simplified balance sheet visually looks like this:

Documents for download (free)

- Simplified balance sheet

- Sample simplified balance sheet

No revaluation, no estimates

Strictly in theory, the company's financial statements will not be reliable without more or less regular revaluation of fixed assets and intangible assets. Only in this way will the reporting reflect the real financial position of the company. The Ministry of Finance allows small enterprises not to carry out revaluation. However, in fairness, we note that PBU, in principle, does not oblige anyone to deal with it (Clause 7 of the Information; clause 15 PBU 6/01; clause 17 PBU 14/2007). But before you take advantage of this opportunity, you need to consider how profitable it is. Let's say, if you have real estate that is only getting more expensive, and in the near future you will need a loan, it is not very correct to refuse revaluation. Yes, the property tax base will increase, but the investment attractiveness of the company will also increase. Also, small business organizations are freed from thinking about whether they have estimated liabilities, contingent assets and liabilities, and what their value is. The consequence of this is, in particular, the possibility of not creating a reserve for paying employees’ vacations and other “guarantee” reserves (Clause 11 of the Information; clause 3 of PBU 8/01).

Financial investments: it couldn’t be easier

Small businesses account for all financial investments (for example, shares, shares, bills, loans issued) at their original cost: how much they spent was reflected in transactions; the amount will no longer change. But ordinary firms have to divide financial investments into those that have a market value and those that do not. The former at the end of the year must be listed on the balance sheet at the market price, for which during the year the initial cost must be adjusted monthly or quarterly (Clause 19, 20 PBU 19/02). These are not all benefits for financial investments. If you believe the explanations of the Ministry of Finance, small businesses have the right not to reflect the depreciation of financial investments and not to create a reserve for this in cases where it is difficult to calculate the amount of depreciation (Clause 10 of the Information). And this applies to almost all investments that are not traded on the organized market. For example, how can you find out whether a bill has fallen in price, and if it has fallen in price, then by how much? A small business accountant can safely not answer this question. However, it should be noted that this benefit is not directly stated in the PBU; this is a broad interpretation of the rules from the financial department (Clause 10 of the Information).

Changing accounting policies and correcting errors without looking back at the past

When might changes to accounting policies be necessary? PBU 1/2008 establishes three reasons for this (Clause 10 PBU 1/2008): - changes in legislation (for example, since 2011, deferred expenses in their usual sense have disappeared); — development of a new, more efficient accounting method. Let's say you consider that the FIFO method for valuing goods is more fair than the average cost method, since the assessment of inventory balances in the balance sheet will be closer to reality; — a significant change in business conditions (for example, they stopped trading and focused on services). What do ordinary organizations have to do when they change their accounting policies? In most cases, they are forced to recalculate reporting indicators for at least 2 years preceding the reporting year. Recalculate as if the changes occurred not now, but even then, in the past (Clause 14, 15 PBU 1/2008). The situation is similar with the correction of errors found after the approval of the annual financial statements. Medium and large organizations correct them using account 84 “Retained earnings (uncovered loss)”, and then recalculate the indicators of previous reporting as if there was no error. Adjustments are reflected in the statement of changes in capital for the year of correction and do not affect the current financial indicators of the year (Clause 9 of PBU 22/2010). Small businesses are exempt from all this. They apply the updated accounting policy from scratch, or rather, from the beginning of the year in which the changes occurred; they do not recalculate past indicators (Clause 15.1 of PBU 1/2008). It's the same with errors. Found, corrected using account 91 “Other income and expenses” (or 99, if account 91 was abandoned), and there is nothing more to worry about. Reporting for the year the error was corrected will be generated correctly automatically, and the indicators of previous reporting will remain the same (Clause 9, 14 of PBU 22/2010).

Down with PBU 18/02!

This PBU is perhaps the most disliked for its excessive complexity. Moreover, the value of the information obtained from scrupulously following the standard is often not commensurate with the time spent. Ordinary companies have to resort to various tricks, say, refer to the requirement of rationality, in order to somehow simplify accounting under PBU 18/02 (Clause 6 of PBU 1/2008). This is especially true for deferred tax assets and liabilities (ONA and ONO, respectively). Imagine: the amount of direct costs in accounting and tax accounting does not match. Either the list is different, or the initial cost of production OS is not the same. Then reflecting the change in SHE and IT in the part attributable to production costs is hellish work, since part of the costs ends up in work in progress, part in finished products in the warehouse and part in sold products. PBU 18/02 seriously requires us to show SHE or IT only in the share that accounted for the products sold. And these are kilometers of calculations and tables (Clause 3, 14, 15, 17, 18 PBU 18/02). Small businesses have complete freedom here. If you want, apply PBU 18/02; if you want, don’t apply it (Clause 2 of PBU 18/02). It’s not difficult to guess what the choice will be: 99% of accountants will push the standard to the back shelf. This, in particular, means this: - income tax in accounting is immediately reflected in the amount from the declaration. There is no conditional tax that can be “refined” to a real one only through adjustments; — from the balance sheet and income statement, you can exclude lines that indicate permanent and deferred tax assets and liabilities. Or you can simply not fill them out.