The Federal Tax Service of the Russian Federation annually determines the level of profitability for various types of economic activity, that is, by industry. This is done partly in order to determine the indicator for selecting objects and enterprises that will subsequently be subject to tax audit. Partly in order to have an idea of which sectors are the most promising and should invest certain budget funds or attract investors.

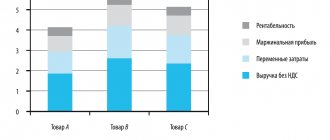

In fact, profitability is an indicator of the financial profitability of various transactions and projects, determined by the ratio to revenue or cost.

What types of activities are included?

Appendix No. 4 to the said order traditionally establishes the profitability of ordinary activities. Now - for 2021 (updated every year). Ask why only ordinary ones? The fact is that, purely physically, tax authorities are not able to cover all types of activities mentioned in OKVED-2.

Also, tax authorities, of course, are primarily interested in the profitability of the main activity as a criterion for inclusion in the field department’s plan.

Also see “On-site tax audit period: what they will come to see.”

How to calculate the tax burden

First of all, you need to understand what exactly to take for calculation. According to the latest instructions from tax authorities:

- revenue is taken without excise duties and VAT;

- insurance premiums are excluded from the calculation;

- income is taken from line 2110 of the annual income statement;

- The amount of taxes includes the personal income tax paid.

The tax burden coefficient is calculated using the formula:

Tax burden = Amount of taxes paid ÷ Income × 100.

Calculation example

From the tax return of the machine-building enterprise it follows that the company paid taxes in the amount of 850,000 rubles last year. At the same time, insurance premiums amounted to 330,000 rubles. The company's revenue is 9.5 million rubles (excluding VAT). Let's calculate the existing tax burden:

850 000 ÷ 9 500 000 × 100 = 8,94.

The burden of insurance premiums is equal to:

330 000 ÷ 9 500 000 × 100 = 3,47.

Now we need to compare the obtained values with the industry averages for 2021. For mechanical engineering, the total burden is 9.9, and for insurance premiums - 4.4. We can summarize that this company pays less taxes than the average company in this industry. Therefore, the business is under the close attention of the fiscal authorities - the enterprise may be included in the plan of on-site tax audits or an explanation from the Federal Tax Service will be required.