In June 2021, the Federal Tax Service published industry average tax burden indicators - data for 2021 were brought together.

It is these indicators that companies need to focus on when calculating their tax burden.

Why do companies need to know the industry average tax burden, how to correctly calculate the tax burden - we will answer these and other questions in this article.

Tax burden – changes in numbers.

The tax burden on Russian business is growing.

10.8% is the average market tax burden for 2017 in the Russian Federation.

11.2% is the average market tax burden for 2019 in the Russian Federation.

The tax burden is a cumulative indicator of all taxes and fees that a company must transfer to the state budget. According to “fresh” figures, the tax burden on business in Russia continues to grow. Over the past couple of years, the tax burden has demonstrated noticeable dynamics in the mining market, in construction, in the real estate management market, in the leather industry; the tax burden has increased for hotels, catering organizations, telecom operators and many others. To be fair, it should be noted that for a small list of activities, the tax burden has decreased over the past two years, for example, for the production of food, cigarettes, and drinks, the industry average tax decreased from 28.2% to 20.9%, for the production of petroleum products - from 5, 1% to 4.2%. As a result, the industry average tax burden in the Russian Federation is 11.2%, the burden on insurance premiums is 3.7%. Why do companies need to know the industry average tax burden, how to correctly calculate the tax burden - read the answers to these and other questions below.

Tax burden by industry. Data for 2021.

Composition of activities

Traditionally, indicators of the tax burden by type of economic activity are fixed in Appendix No. 3 to the mentioned order. Now - for 2021 (the Federal Tax Service updates them annually). The document deals with enlarged areas of activity according to the OKVED-2 classifier. Look for the one that best suits your field.

Also see “On-site tax audit period: what they will come to see.”

Tax burden for specific taxes.

For legal entities:

- For income tax:

Tax burden = Income tax / (sales income + non-operating income).

- For VAT (option 1):

Tax burden = VAT / tax base determined according to Section 3 of the VAT return (Russian market).

- For VAT (option 2):

Tax burden = VAT / tax base, defined as the sum of the tax bases reflected in sections 3 and 4 of the VAT return (Russian market + exports).

For individual entrepreneurs:

- For personal income tax:

Tax burden = personal income tax according to the declaration / income according to the 3-personal income tax declaration.

- According to the simplified tax system:

Tax burden = Tax according to the simplified tax system / Income according to the simplified tax system.

- According to the Unified Agricultural Tax:

Tax burden = Tax under Unified Agricultural Tax / Income under Unified Agricultural Tax.

- According to OSNO:

Tax burden = VAT + Profit tax/revenue excluding VAT.

Types of indicators

Note that the tax burden coefficients by type of economic activity in the Concept of on-site inspections of the Federal Tax Service are always presented in tabular form. And there are 2 types of them:

- just the tax burden;

- and for reference – the fiscal burden on insurance premiums.

Please note that the tax burden by type of economic activity for 2021 is shown as a percentage.

The tax burden is the ratio of taxes (including personal income tax) and fees according to the official statistical reporting of the Federal Tax Service of Russia to the turnover of organizations according to Rosstat, multiplied by 100%.

Below is a complete official list of tax burden indicators by type of economic activity for 2021 for the period 2021.

| Type of economic activity (according to OKVED-2) | Period 2021 | |

| The tax burden, % | For reference: fiscal burden for the North, % | |

| TOTAL | 10,8 | 3,6 |

| Agriculture, forestry, hunting, fishing, fish farming - total | 4,3 | 5,5 |

| crop and livestock farming, hunting and provision of related services in these areas | 3,5 | 5,4 |

| forestry and logging | 7,5 | 6,8 |

| fishing, fish farming | 7,9 | 5,5 |

| Mining - total | 36,7 | 1,8 |

| extraction of fuel and energy minerals - total | 45,4 | 1,0 |

| extraction of mineral resources, except fuel and energy | 18,8 | 4,1 |

| Manufacturing industries – total | 8,2 | 2,2 |

| production of food, beverages, tobacco products | 28,2 | 2,4 |

| production of textiles, clothing | 8,1 | 4,2 |

| production of leather and leather products | 7,9 | 4,7 |

| wood processing and production of wood and cork products, except furniture, production of straw products and wicker materials | 2,0 | 3,6 |

| production of paper and paper products | 4,4 | 1,8 |

| printing and copying activities | 9,2 | 4,3 |

| production of coke and petroleum products | 5,1 | 0,2 |

| production of chemicals and chemical products | 1,9 | 2,4 |

| production of medicines and materials used for medical purposes | 6,9 | 3,0 |

| production of rubber and plastic products | 6,3 | 2,6 |

| production of other non-metallic mineral products | 8,9 | 3,5 |

| metallurgical production and production of finished metal products, except machinery and equipment | 4,4 | 2,4 |

| production of machinery and equipment, not included in other groups | 8,8 | 3,9 |

| production of electrical equipment, production of computers, electronic and optical products | 9,9 | 4,3 |

| production of computers, electronic and optical products | 12,5 | 5,3 |

| production of electrical equipment | 6,7 | 3,0 |

| production of other vehicles and equipment | 4,7 | 4,8 |

| production of motor vehicles, trailers and semi-trailers | 5,1 | 1,7 |

| Providing electricity, gas and steam; air conditioning – total | 6,8 | 2,4 |

| generation, transmission and distribution of electricity | 8,1 | 2,2 |

| production and distribution of gaseous fuels | 1,3 | 1,4 |

| production, transmission and distribution of steam and hot water; air conditioning | 6,5 | 4,5 |

| Water supply, sanitation, organization of waste collection and disposal, activities and elimination of pollution - total | 8,4 | 4,8 |

| Construction | 10,2 | 4,3 |

| Wholesale and retail trade; repair of vehicles and motorcycles – total | 3,2 | 1,2 |

| Wholesale and retail trade in motor vehicles and motorcycles and their repair | 2,7 | 1,1 |

| wholesale trade, except wholesale trade of motor vehicles and motorcycles | 3,1 | 0,9 |

| retail trade, except trade in motor vehicles and motorcycles | 3,6 | 2,2 |

| Activities of hotels and catering establishments – total | 9,5 | 5,7 |

| Transportation and storage – total | 6,8 | 4,8 |

| railway transport activities: intercity and international passenger and freight transportation | 8,5 | 6,8 |

| pipeline transport activities | 4,5 | 2,1 |

| water transport activities | 9,3 | 4,1 |

| air and space transport activities | neg. | 3,0 |

| postal and courier activities | 14,4 | 11,6 |

| Activities in the field of information and communication - total | 16,4 | 5,2 |

| Real estate activities | 21,3 | 6,3 |

| Administrative activities and related additional services | 15,4 | 9,2 |

The source of information on the tax burden by type of economic activity for 2021 is the official website of the Federal Tax Service of Russia.

You can download free of charge indicators of the tax burden by type of economic activity for 2021 from our website via a direct link here.

Read also

17.05.2018

What is it for

To help taxpayers assess the likelihood of including on-site tax audits in the plan, the Federal Tax Service of Russia published industry average indicators by type of economic activity for 2017. Based on this information in 2021, accountants can compare their financial performance against publicly available tax risk criteria.

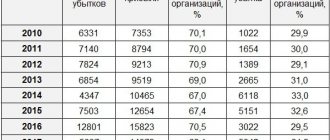

The table shows data on the tax burden, profitability of goods sold, products, works, services and return on assets of organizations by type of economic activity that characterizes the financial and economic activities of taxpayers.

Risk assessment and clarification of tax obligations can significantly reduce the likelihood of a taxpayer being included in the on-site tax audit plan.

In recent years, the approach to organizing the control work of tax authorities has changed. The emphasis is on a comprehensive analysis of the financial and economic activities of the taxpayer, and, as a result, the abandonment of total control and the transition to control based on risk criteria.

In connection with this, the Federal Tax Service has developed and approved the Concept for planning on-site tax audits, which provides for a new approach to building a system for selecting objects for conducting on-site tax audits.

According to the Concept, planning on-site tax audits is an open process based on the selection of taxpayers for on-site control based on publicly available criteria for the risk of committing a tax offense. This process is open. A taxpayer who meets these criteria will most likely be included in the on-site tax audit plan.

The Federal Tax Service strives to strengthen the analytical component of the control work of tax authorities in order to encourage taxpayers to voluntarily clarify their tax obligations.

Other criteria

The simultaneous presence of the following circumstances further increases such risks:

- a counterparty having the above characteristics acts as an intermediary;

- the presence in contracts of conditions that differ from the existing rules (customs) of business transactions (for example, long deferred payments, delivery of large quantities of goods without advance payment or guarantee of payment, incommensurable with the consequences of violation of contracts by the parties with penalties, settlements through third parties, settlements with bills, etc.); P.);

- absence of obvious evidence (for example, copies of documents confirming that the counterparty has production facilities, necessary licenses, qualified personnel, property, etc.) of the possibility of the counterparty actually fulfilling the terms of the agreement, as well as the existence of reasonable doubts about the possibility of the counterparty actually fulfilling the terms of the agreement, taking into account the time required for delivery or production of goods, performance of work or provision of services;

- acquisition through intermediaries of goods, the production and procurement of which are traditionally carried out by individuals who are not entrepreneurs (agricultural products, secondary raw materials (including scrap metal), craft products, etc.);

- absence of real actions by the payer (or his counterparty) to collect the debt. An increase in the debt of the payer (or its counterparty) against the backdrop of continued delivery of large quantities of goods or significant volumes of work (services) to the debtor;

- issuance, purchase/sale by counterparties of bills of exchange, the liquidity of which is not obvious or has not been investigated, as well as issuance/receipt of loans without collateral. At the same time, the negativity of this attribute is aggravated by the absence of conditions on interest on debt obligations of any type, as well as the repayment terms of these debt obligations for more than three years;

- a significant share of the costs of a transaction with “problem” counterparties in the total amount of expenses of the taxpayer, while there is no economic justification for the feasibility of such a transaction and at the same time there is no positive economic effect from its implementation, etc.

Accordingly, the more of the above signs are simultaneously present in the taxpayer’s relationships with counterparties, the higher the degree of his tax risks.

The nature of relationships with counterparties

When assessing tax risks that may be associated with the nature of relationships with certain counterparties, the taxpayer is recommended to examine the following signs:

- lack of personal contacts between the management (authorized officials) of the supplier company and the management (authorized officials) of the buyer company when discussing the terms of delivery, as well as when signing contracts;

- lack of documentary evidence of the authority of the head of the counterparty company, copies of his identity document;

- lack of documentary evidence of the authority of the counterparty's representative, copies of his identity document;

- lack of information about the actual location of the counterparty, as well as the location of warehouse and/or production and/or retail space;

- lack of information about the method of obtaining information about the counterparty (no advertising in the media, no recommendations from partners or other persons, no website of the counterparty, etc.). Moreover, the negativity of this attribute is aggravated by the presence of available information (for example, in the media, outdoor advertising, Internet sites, etc.) about other market participants (including manufacturers) of identical (similar) goods (works, services), including number of those offering their goods (works, services) at lower prices;

- lack of information about the state registration of the counterparty in the Unified State Register of Legal Entities (public access, official website of the Federal Tax Service of Russia www.nalog.ru).

The presence of such signs indicates a high degree of risk of classifying such a counterparty by the tax authorities as problematic (or “fly-by-night”), and transactions made with such a counterparty are questionable.