The Social Insurance Fund sets rates for insurers to charge premiums for “injuries” annually. The tariff is determined depending on the pro-free class - the higher it is, the higher the tariff will be applied. In order for the FSS to find out what type of business was a priority for the company based on the results of the previous year, to be able to determine the class of pro-free insurance and set a tariff for 2021, it needs information confirming the type of main activity.

How confirmation of an economic activity takes place in 2018, are there any innovations in this procedure, what forms should be filled out - we will talk about all this in our article.

Introductory information

Since 2021, pension and health insurance contributions have come under the control of the Federal Tax Service. However, insurance premiums for insurance against accidents and occupational diseases (that is, “injury” contributions) remained under the control of the Social Insurance Fund. This state of affairs remains in 2021. Also in 2021, the requirement for annual confirmation of the main type of activity of organizations remained. Accordingly, it is also necessary to confirm the main type of economic activity in 2021. Let us recall that the rate of insurance premiums “for injuries” directly depends on the main type of activity of organizations and entrepreneurs. And the more dangerous the activity from the point of view of labor protection, the higher the insurance rate. See “Insurance premium rates for injuries will not change in 2021.”

What is occupational hazard

Occupational risk is the likelihood of injury at work or chronic diseases arising from working conditions. The classification of professions by risk groups is given in Order of the Ministry of Labor of Russia dated December 30, 2016 No. 851n.

For example, minimal professional risk (Class I) for such activities as newspaper printing, trade, courier activities. And the maximum (XXXII class) is for coal mining, ore mining, and hunting.

The higher the occupational risk, the higher the insurance premium rate for workers for injuries and occupational diseases. So, for trade it will be only 0.2%, and for coal mining 8.5% of the amount of payments to the employee. In order for the Social Insurance Fund to know at what rate to calculate contributions in accordance with the class of professional risk, employers must submit a certificate confirming the type of activity.

Who must confirm the type of activity in 2018

To begin with, we will tell you which of the organizations and individual entrepreneurs must confirm the main type of their business with the Social Insurance Fund.

Organizations

All organizations registered in 2021 and earlier must confirm their main activity in 2021. Moreover, this also applies to those organizations that did not have any income in 2021, as well as those that ran only one type of business.

If an organization is registered (opened) in 2021, then it does not need to confirm its main activity. The new company will pay contributions “for injuries” during 2021 based on the main type of activity declared when registering the company and indicated in the Unified State Register of Legal Entities as the main one (clause 6 of the Procedure approved by order of the Ministry of Health and Social Development of Russia dated January 31, 2006 No. 55, hereinafter - Order).

Individual entrepreneurs

Individual entrepreneurs are not required to confirm their established “injury” contribution rate every year. Individual entrepreneurs choose their main activity only once – upon registration. This type of activity is listed in the Unified State Register of Individual Entrepreneurs and according to it, controllers from the Social Insurance Fund set the entrepreneur the rate of contributions for insurance against accidents and occupational diseases. The entrepreneur does not need to confirm this type of activity annually. This is directly stated in paragraph 10 of the Rules, approved by the Decree of the Government of the Russian Federation of 01.12. 2005 No. 713. Therefore, in 2021, individual entrepreneurs, as before, may worry about this procedure.

Let us remind you that in 2021, as before, contributions “for injury” to individual entrepreneurs must be paid from the earnings of employees working under employment contracts. If the individual entrepreneur has entered into a civil contract with the “physicist,” then it is necessary to pay contributions “for injuries” only if such an obligation has been specified by the parties in the contract (Clause 1, Article 20.1 of the Federal Law of July 24, 1998 No. 125-FZ). And individual entrepreneurs without employees pay “injury” contributions “for themselves” only on a voluntary basis.

If an individual entrepreneur, on his own initiative, changes the main type of his activity in the Unified State Register of Individual Entrepreneurs, then he should be set a new rate of contributions “for injuries”, corresponding to the new class of professional risk. In such a situation, it is better for an entrepreneur to confirm his new type of activity for 2021. After all, the new tariff may be less than the previous one. The FSS of Russia will not take into account the changes on its own and will maintain the maximum tariff established earlier.

Who provides?

Not all business entities are required to provide confirmation. The obligation to transfer information applies to organizations registered before 2021, including those that:

- did not actually work last year and did not have financial transactions in this reporting period;

- have only one type of activity.

But enterprises that appeared only in 2021 will not have to provide data to the regional Social Insurance Fund at all. They already have all the information, because the registration was carried out in the same reporting period. Moreover, the calculation of the Social Insurance Fund will be made in accordance with the type of activity that was registered as the main one during registration and the Unified State Register of Legal Entities. Confirmation of the type of activity once a year for organizations that officially began operating this year will be mandatory starting in 2021.

Individual entrepreneurs, regardless of how long ago they were opened, are exempt from submitting reports to the Social Insurance Fund. They indicate the corresponding codes during registration; on their basis, the Social Insurance Fund calculates contributions “for injuries.” Their payment must be made by the individual entrepreneur in the following cases:

- if an employment contract has been concluded with the employee;

- if a GPA is concluded between the parties and the need to pay contributions is defined in the agreement;

- for yourself - at will.

For absolutely any individual entrepreneur (whether there are employees or not), confirmation of the type of activity in the Social Insurance Fund in 2021 is a voluntary procedure. It is worth resorting to it only if a private entrepreneur has changed the format of his activities, and for the new type he is entitled to lower tariffs. Without an appeal, the calculation will be made according to the old parameters (the Social Insurance Fund is not obliged to independently take into account the changes), that is, an overpayment will occur.

Deadline for confirming the type of activity in 2018

Organizations are required to confirm their main type of economic activity in 2021 no later than April 15, 2021 (clause 3 of the Procedure, approved by order of the Ministry of Health and Social Development of Russia dated January 31, 2006 No. 55). However, April 15 in 2021 falls on a Sunday. On this day, FSS units do not work.

Please note that to confirm the main type of activity, it is not expressly provided for the transfer of the deadline to the first working day if the reporting date falls on a weekend or non-working holiday. Therefore, the confirmation deadline for April 16, 2021 (Monday) will not be postponed. At least, according to our information, this is what some specialists from the FSS departments believe. They believe that in 2021 the deadline to confirm the type of activity in the Social Insurance Fund is April 13 (Friday).

However, we note that there is another point of view. Some lawyers are confident that if you confirm your main activity on April 16, 2021 (Monday), this will not constitute a violation of the deadline. They refer to Article 193 of the Civil Code of the Russian Federation, which establishes a general rule for transferring deadlines from non-working days to working days. If you are guided by this article, then submitting documents to the Social Insurance Fund on April 16 is the timely fulfillment of the obligation to confirm the main type of activity.

Local controllers from the Social Insurance Fund may not agree with the postponement of the deadline for confirming the type of economic activity to April 16, 2018 (Monday). And then the organization will most likely need to defend its case in court. It’s good that there is positive judicial practice (for example, resolution of the Federal Antimonopoly Service of the Volga District dated April 24, 2007 No. A12-14483/06). However, in our opinion, it is better for organizations not to take risks and submit all documents before April 15, 2021. Then there will be no disputes within the fund.

Document submission method

Based on the current Regulations, the step-by-step instructions for confirming the type of activity in the Social Insurance Fund highlight the following methods for submitting the listed documents (can be an authorized representative of the policyholder):

- personal appearance for an appointment with FSS employees;

- by regular mail (with the condition that you can then confirm the fact and day of departure);

- electronically through the government services website (www.gosuslugi.ru) - here you can fill out a special form online and send an application with a package of documents, signed with an enhanced qualified digital signature in electronic form, and then monitor the progress and results of submitting documents in your personal account.

The FSS reports that for 2021, the technical ability to submit documents to confirm the main type of activity and receive results in electronic form is fully operational only on the government services website.

How to confirm the type of activity in 2018: step-by-step instructions

Next, we present to your attention step-by-step instructions on the procedure for confirming the main type of activity in 2021. The instructions, in particular, contain samples of all the necessary documents.

Step 1. Determine your main activity

Determine the basis for the type of activity of the organization or individual entrepreneur based on the results of 2017 (clause 11 of the Rules, approved by Decree of the Government of the Russian Federation of December 1, 2005 No. 713). To do this, calculate how much income from the sale of products (works, services) for each type of activity was in 2021. After this, determine the share of each type of activity in the total amount of income from sold products (works, services). The formula will help you with this:

The activities that have the largest share will be considered core for 2021. However, keep in mind that several types of activities listed in the Unified State Register of Legal Entities may have the same share at the end of 2021. And then the main activity should be considered an activity that corresponds to a higher class of professional risk (according to the Classification, approved by Order of the Ministry of Labor of Russia dated December 25, 2012 No. 625n).

If in 2021 an organization was engaged in only one type of business, then this type will be the main one. Moreover, regardless of what types of activities were indicated in the Unified State Register of Legal Entities when registering an LLC or JSC.

Let's give an example of calculating the definition of the main type of activity of an organization in 2021.

Example. Cosmos LLC uses a simplified approach. In 2017, the company was engaged in wholesale and retail trade in products. According to accounting data for 2021, the company received income in the total amount of 7 million rubles, including from wholesale trade - 5.2 million rubles, from retail trade - 1.8 million rubles. The accountant of Cosmos LLC calculated the share for each type of activity. For wholesale trade, the share was 74% (RUB 5,200,000 / RUB 7,000,000 × 100%), for retail – 26% (RUB 1,800,000 / RUB 7,000,000 × 100%). Thus, the main activity for Cosmos LLC will be wholesale trade, since the share of this type of activity is greater. It must be confirmed no later than April 16, 2021.

Step 2: Prepare your documents

Based on the above calculations, generate documents for submission to the territorial office of the Social Insurance Fund no later than April 16, 2021, namely:

- certificate confirming the main type of economic activity;

- statement confirming the main type of economic activity.

In addition, if the organization is not small, additionally prepare a copy of the explanatory note for the balance sheet for 2021. Arrange it in any form - in tabular or text form. If the company is a small enterprise, a copy of the note is not needed. See “Criteria for small businesses from August 1, 2021: what has changed”, “Register of small entrepreneurs”.

Help confirmation: sample

A certificate confirming the main type of economic activity must be filled out in the form specified in Appendix No. 2 to the Procedure, approved. By Order of the Ministry of Health and Social Development of Russia dated January 31, 2006 No. 55. A new form of certificate was not developed or approved. Therefore, the indicated form should be used in 2021. . You can also .

Application for confirmation of the main type of economic activity: sample

An application for confirmation of the main type of economic activity must be filled out in the form specified in Appendix No. 1 to the Procedure, approved. by order of the Ministry of Health and Social Development of Russia dated January 31. 2006 No. 55. A new application form for 2021 has not been approved, so the above form must be used to fill it out. . Download and review the sample application to be submitted to the Social Insurance Fund no later than April 16, 2021.

Which OKVED code should be indicated in the documents?

You can determine which class your activity belongs to using the Classification approved by Order of the Ministry of Labor of Russia dated December 30, 2021 No. 851n. It lists the types of activities and their corresponding OKVED codes. Activities are grouped into 32 occupational risk classes

Step 4. Submit documents to the Social Insurance Fund

Submit the prepared documents to the FSS department no later than April 16, 2021. Documents can be submitted “on paper” (in person or by mail). Also, documents in 2021 can be transmitted electronically through a single portal of public services. For these purposes, we recommend that you familiarize yourself with the information on the FSS website.

In order to submit documents electronically through the government services portal, the organization must have an enhanced qualified electronic signature on a physical medium (for example, on a USB). You can obtain it from one of the certification centers accredited by the Russian Ministry of Telecom and Mass Communications. Also, a cryptoprovider program must be installed on the computer from which documents will be sent.

Step 5. Get the FSS decision

Based on the documents received no later than April 16, 2021, the Social Insurance Fund division will assign the “injury” contribution rate for 2021. The applicant will have to be notified of this within two weeks from the date of submission of the package of documents. That is, until the end of April 2021 (clause 4 of the Procedure, approved by Order of the Ministry of Health and Social Development of Russia dated January 31, 2006 No. 55). If you send documents through the unified portal of public services, then you can view the notification of the assigned tariff for 2021 in the personal account of the legal entity.

Until a notification has been received from the Social Insurance Fund about setting the tariff for 2018, contributions “for injuries” should be calculated at the rate that you used in 2021. If the Social Insurance Fund establishes an increased class of professional risk for 2021, then you will need to recalculate contributions for 2021 at the new rate and pay the arrears (without penalties and fines). If the tariff turns out to be lower, an overpayment will occur. And it can be offset against future payments or returned. In this case, you will need to submit an updated calculation of 4-FSS for the 1st quarter of 2021.

Sample of filling out the certificate

First, let's look at how to fill out a certificate confirming the type of activity. Using the information specified in it, an application will then be drawn up.

After the designation of the document with which the form was entered, the date of preparation of the certificate is recorded.

Further, after the title of the form, information about the enterprise is indicated line by line: full name, date of registration, start date of activity, full name. responsible persons and others. All lines are numbered from 1 to 8 and contain a description of what information to record.

In lines 1-7 you must indicate information according to the constituent documents:

- Company name and tax identification number.

- Registration date.

- Start date of business.

- Legal address of the company.

- Information about the director and chief accountant.

You might be interested in:

Form 6-NDFL: deadlines, instructions for filling

In line 8 you need to indicate the average number of employees for the reporting year.

Then comes a table in which you need to break down income by type of activity:

- Column 1 indicates the code of the activity type, and column 2 indicates its text name.

- Column 3 records revenue for this type for the past year excluding VAT.

- In column 4 you need to enter the amounts of target revenue for each type, if any.

- Column 5 indicates the share of revenue for this type of the total amount as a percentage.

- Column 6 should only be completed by non-profit organizations.

After filling out the table, the result is summed up - the total amount of revenue, which will be 100%.

Attention! Based on this data, line 10 records the name and code of the type for which the greatest revenue was received. If two or more species have the same share, then the organization itself can choose which OKVED to indicate.

The certificate is signed by the manager and chief accountant. If there is a seal, you need to put its imprint on the document.

If documents are not submitted

If the organization does not submit documents on the main type of activity to the Social Insurance Fund within the prescribed period, the fund will independently determine the main type of activity of the policyholder for 2018. In such a situation, the FSS has the right to assign the highest risk class of all OKVED codes in the Unified State Register of Legal Entities. This right is officially assigned to the FSS in connection with the entry into force of Decree of the Government of the Russian Federation dated June 17, 2016 No. 551 on January 1, 2021. Note that the FSS bodies acted this way until 2021. However, this caused a lot of litigation. The judges believed that the fund does not have the right to choose the most “risky” type of activity arbitrarily from all the types specified in the Unified State Register of Legal Entities. When setting the FSS tariff, according to the judges, the FSS should take into account only those types of activities that the organization actually engaged in in the previous year (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated July 5, 2011 No. 14943/10). As of 2021, this approach will no longer be applied. If supporting documents are not submitted no later than April 16, 2021, the fund will increase the rate of contributions “for injuries” to the maximum possible from the Unified State Register of Legal Entities. It does not matter whether the organization actually conducts this activity or not. And it is apparently useless to argue with this in court. There are no separate monetary fines for failure to submit documents to the Social Insurance Fund.

In a similar manner, in 2021 it is necessary to determine and confirm the main type of activity of each separate division at the location of which the organization is registered with the Social Insurance Fund. That is, each separate unit that the organization has identified as an independent classification unit, as well as an OP, in respect of which the following conditions are simultaneously met (clause 8 of the Procedure, approved by Order of the Ministry of Health and Social Development dated January 31, 2006 No. 55):

- the division is allocated to a separate balance sheet;

- a current account has been opened for the division;

- The division independently calculates payments in favor of employees.

Receiving a response from the FSS

The law gives the fund 2 weeks from the date of submission of the appropriate package of documents to issue a notice of the contribution rate indicating the main type of economic activity and the OKVED2 code.

The policyholder himself decides how to receive this notification:

- on paper in person;

- on paper by mail;

- in the form of an electronic document with an enhanced qualified electronic signature of the Social Insurance Fund (subject to the submission of all documents electronically through the government services website).

Also see: Personal Injury Premiums in 2021: An Up-to-Date Review.

Read also

15.05.2017

Discounts and surcharges in the tariff

Discounts

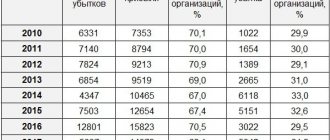

The FSS of Russia can set a tariff for an organization taking into account a discount or surcharge. To do this, labor safety indicators in the organization are compared with industry average values. Industry averages for 2021 were approved by Resolution of the Federal Social Insurance Fund of Russia dated May 31, 2021 No. 67. Specialists from the Social Insurance Fund take into account (clause 3 of the Rules approved by Resolution of the Government of the Russian Federation dated May 30, 2012 No. 524):

- the ratio of the expenses of the Federal Social Insurance Fund of Russia for the payment of all types of provisions for all insured events with the employer and the total amount of accrued contributions for insurance against accidents and occupational diseases;

- number of insurance cases per 1000 employees;

- number of days of temporary disability per insured event.

In addition to the main indicators specified in paragraph 3 of the Rules, approved by Decree of the Government of the Russian Federation of May 30, 2012 No. 524, when determining the amount of a discount or allowance, the results of a special assessment of working conditions are also taken into account.

The discount amount is calculated based on the results of the organization’s work over three years.

Allowances

The Federal Social Insurance Fund of Russia can independently establish a tariff premium if the employer’s injury rate over the previous three years was higher than the industry average (Clause 1, Article 22 of Law No. 125-FZ of July 24, 1998).

The FSS also establishes a premium if the policyholder in the previous year had a group accident (2 people or more) with a fatal outcome not due to the fault of third parties. The FSS calculates the bonus for the next year taking into account the number of deaths. This is provided for in paragraphs 6 and 6.1 of the Rules, approved by Decree of the Government of the Russian Federation of May 30, 2012 No. 524.

The premium cannot exceed 40 percent of the tariff established for the employer (paragraph 2, paragraph 1, article 22 of the Law of July 24, 1998 No. 125-FZ).

Read also

24.12.2018