Business lawyer > Accounting > Primary documents > Sample order for commissioning of equipment, commissioning procedure

A detailed sample order for commissioning of equipment will allow you to document the readiness of the equipment to begin operation. Reflecting the nuances of tax and accounting will help you avoid penalties and fines that are unpleasant for the entrepreneur. A complete template will only facilitate the quick preparation of an order, regardless of the type of fixed assets (FPE).

Order on commissioning of fixed assets sample

A selection of the most important documents upon request Order on commissioning of fixed assets sample

(regulatory legal acts, forms, articles, expert consultations and much more).

Articles, comments, answers to questions: Order on commissioning of fixed assets sample

The document is available: in the commercial version of ConsultantPlus

The document is available: in the commercial version of ConsultantPlus

Document forms: Order on commissioning of fixed assets sample

The document is available: in the commercial version of ConsultantPlus

The document is available: in the commercial version of ConsultantPlus

When is it issued?

Fixed assets are accepted for accounting from the date of their commissioning (No. 157n, p. 38).

Commissioning of an object is documented by local documentation of the enterprise - an order from the manager and an act of acceptance of property.

Identified defects are reflected using a report in form OS-16.

For acceptance and transfer of fixed assets, a standard form of transfer and acceptance act is usually used :

- OS-1a - when accepting buildings and structures for accounting;

OS-1 - upon acceptance of a single fixed asset item.

Approximate form of an order for commissioning of a fixed asset (prepared by experts)

Order on commissioning of a fixed asset

[ day month Year ]

N [enter as required]

In connection with the acquisition by an organization (enterprise) of [insert the name of a fixed asset], in accordance with Resolution of the State Statistics Committee of the Russian Federation dated January 21, 2003 No. 7 “On approval of unified forms of primary documentation for accounting of fixed assets,” I order:

1. Put the fixed asset [name] into operation on [day, month, year].

2. Accept [name of fixed asset] for accounting as part of fixed assets with an initial cost of [specify amount].

3. Determine the useful life of [name of fixed asset] during [enter as required].

4. Assign an inventory number to the fixed asset [enter the required one].

5. Appoint [position, full name] as the financially responsible person for the fixed asset.

6. Entrust control over the execution of the order to [position] [full name. ].

[job title] [signature] [F. AND ABOUT. ]

I have read the order:

[job title] [signature] [F. AND ABOUT. ]

The current version of the document you are interested in is available only in the commercial version of the GARANT system. You can purchase a document for 54 rubles or get full access to the GARANT system free of charge for 3 days.

If you are a user of the Internet version of the GARANT system, you can open this document right now or request it via the Hotline in the system.

Sample form of an order for commissioning of a fixed asset

Developed: March 2009

Operations required to place an order

To use the equipment in the future, it is necessary to officially confirm the commissioning. The procedure can be performed by issuing an appropriate local order and an act of acceptance and transfer of property, which will be the legal basis for registering the asset.

Before signing such an order, it is necessary to create a special commission that can determine the readiness of the OS to begin operation. The composition of the commission is at least 3 persons who are directly related to this type of equipment and must, as experienced specialists, evaluate:

- quality and general condition of the OS (they must correspond to the passport data of the object)

- as a result of a visual inspection, identify possible problems and malfunctions (or record their absence)

- It is imperative to start up the equipment, working out the time specified in the contractual obligations

- analyze the conditions where the OS will be used

In some cases, the execution of the above documents allows you to bypass the signing of the commissioning act.

When installing equipment to replace worn-out and obsolete equipment, it is accepted by a commission appointed by the enterprise and consisting of plant specialists.

When introducing new technologies, when mastering new products, when increasing production volumes, equipment is put into operation as part of construction and reconstruction projects in accordance with the procedure for accepting completed construction projects approved by standards.

Write-off of fixed assets: sample orders

The registration, movement and disposal of fixed assets is regulated in accounting PBU 6/01 “Accounting for fixed assets” (Order of the Ministry of Finance 26n dated 30.03.01) and Guidelines for accounting of fixed assets (Fixed Assets) (Order of the Ministry of Finance 91n dated 13.10.03 ).

The value of property is written off when it is disposed of or is unable to generate economic benefits in the future. An object may be disposed of in the following cases:

- sales;

- donations;

- termination of use due to moral or physical wear and tear;

- emergency response;

- identifying shortages during inventory;

- transfers in the form of a contribution to the authorized capital of another company;

- in other cases.

In order to establish the safety of property, organizations conduct an inventory. The procedure for its implementation is regulated by the Methodological Instructions approved by Order of the Ministry of Finance No. 49 of June 13, 1995.

Inventory is also necessary to identify fixed assets that are unsuitable for use, or whose further use in the company’s activities is impractical. A sample order for an inventory of fixed assets can be downloaded at the end of the article.

Conducting an inspection can be mandatory and proactive. Inventory is required in the following cases (clause 1.5 of the Guidelines):

- preparation of annual reports (an inventory of fixed assets is allowed once every three years);

- change of financially responsible person;

- identification of facts of damage and theft of property;

- natural Disasters.

To carry out the inventory, the company's management appoints a commission. It is advisable to include representatives of the administration, employees of engineering and technical services, and financial employees. The inspection is carried out in the presence of the person responsible for the safety of the property.

If obsolete or damaged equipment is identified, the commission may decide to repair, restore the OS, or liquidate it.

Sample order for inventory of fixed assets

Grounds for refusal to register a car

A vehicle cannot be registered with the traffic police (according to paragraph 3 of the rules) if:

The vehicle can be registered only after all identified deficiencies have been eliminated.

Repair, modernization and reconstruction

In order for the OS to be used for a long period, it must be repaired. During repairs, the characteristics of the object are not improved, but only its viability is maintained. Repair costs are considered expenses of the current period in both accounting and tax accounting (clause 1 of Article 260 of the Tax Code of the Russian Federation).

Modernization or reconstruction of equipment is carried out in order to improve its performance, power, increase its useful life or change its purpose. The costs of such work are taken into account as capital investments and increase the cost of the facility being modernized (clause 27 of PBU 6/01, clause 2 of Article 257 of the Tax Code of the Russian Federation).

Depreciation on reconstructed or modernized equipment continues to accrue throughout the entire period of work. But if modernization and reconstruction work continues for more than 12 months, then depreciation should be stopped until the work is completed (clause 2 of Article 322 of the Tax Code of the Russian Federation).

Sample order for modernization of fixed assets

During downtime, the OS can be put into storage. This procedure includes a set of measures to preserve the integrity and serviceability of the property until it begins to be used in business again.

The procedure for conservation of objects is developed and approved by the organization independently. It should be borne in mind that the transfer of idle equipment to mothballing is not the responsibility of the company; such a decision is made by the company’s management.

See also: Haven’t entered into an inheritance for 20 years

The costs of conservation and removal of equipment from it are included in the enterprise’s expenses in the current period. When transferring to conservation, you should keep in mind that the property will not be exempt from property tax for this period. But the calculation of depreciation should be suspended when the object is mothballed for a period of more than three months (clause 2 of Article 322 of the Tax Code of the Russian Federation).

Sample order on conservation of fixed assets

To determine the possibility of further use of the property, by decision of the company management, a commission is created, which includes persons responsible for the safety of the property, technical specialists, financial workers (clause 77 of Order of the Ministry of Finance 91n dated 10/13/03).

The commission is entrusted with the responsibility of inspecting the facility, making a decision on its liquidation, identifying the reasons for the impossibility of further operation and the persons responsible for this, as well as drawing up a decommissioning act. The write-off act can be developed by the organization independently, or one of the unified forms can be used: OS-4, OS-4a, OS-4b (Resolution of the State Statistics Committee of the Russian Federation 7 of 01.21.03). Based on the act, the object is written off from the register and a mark of disposal is placed on its inventory card.

The residual value of the written-off object is reflected in non-operating expenses in both accounting and tax accounting on the date of the write-off act. Also, non-operating expenses should reflect the costs of dismantling, removal and other actions related to the liquidation of the facility.

The components of the liquidated object, suitable for further use, are accounted for at the current market value, reflected in non-operating income.

Procedure for registering a vehicle by a legal entity

A vehicle that a company or enterprise registers with the State Traffic Safety Inspectorate can be purchased under a sales contract, received as a gift from an individual or other legal entity, or won through a competition. In any case, the purchaser should not demand that the car be deregistered with the traffic police by the previous owner, since this happens automatically.

The new rules for re-registration can be found in the article “Removing a car from registration.”

Upon completion of registration of transport ownership, an official procedure is carried out - registration of the car with the State Traffic Safety Inspectorate by a legal entity. The following deadlines have been established for it:

It should be noted that this year transit numbers are issued only to legal entities and individual entrepreneurs.

Having decided on the deadlines, the company or enterprise sends its employee to the traffic police department, who must have with him the entire package of necessary documents.

A legal entity has the right to choose a branch of the State Traffic Inspectorate to register a car at its discretion, regardless of its location.

Next, registration of a vehicle by a legal entity is carried out in accordance with the established procedure in compliance with the temporary regulations:

Required documents

Preparing all the necessary documents to register a car as a legal entity is a long and difficult process. Ultimately, the traffic police department must be provided with:

- a document confirming registration with the tax office;

In addition, it is mandatory that the representative of the legal entity have a power of attorney, which gives him the right to carry out such actions.

To register some types of transport, additional documents from Gostekhnadzor are required, for example, if you need to register a truck crane.

For others, a preliminary technical inspection is scheduled at a special diagnostic station OTOR-2, for example, for vehicles of the “collection” and “fuel tanker” types.

Payment of state duty

The state duty when registering a car for a legal entity is paid by bank transfer; copies of payment orders are presented to the State Traffic Inspectorate office.

In total, several fees must be paid:

The amounts of state duty are established depending on the region in which the legal entity is registered.

The prices can be found in the article “State duty for car registration”.

>How to register cars with the traffic police: Video

avtozakony.ru

What is commissioning of fixed assets

Not every asset can and should be recognized as a company’s main asset. The key characteristics of objects and other material assets that can be considered as fixed assets are regulated in the Accounting Rules PBU 6/01 and Art. 256 Tax Code of the Russian Federation:

- the intended purpose of the asset should be to use it for one’s own production or management functions, as well as to transfer it to third parties on a paid basis for temporary use;

- the expected service life must be at least one year;

- the assets were not acquired for the purpose of subsequent resale to third parties;

- material assets will bring direct or indirect income to the company in the course of current activities.

To recognize an asset as a fixed asset, the method of its acquisition does not matter. A company can receive material assets in the form of a contribution to the authorized capital, as a result of civil transactions, as a result of the creation of a new facility (for example, the construction of a new building), etc.

After registration, for further use of assets, they must be officially put into operation. This procedure is formalized by internal documents of the company - an administrative act of the manager and an acceptance certificate.

Commissioning of fixed assets and intangible assets - the topic of the video below:

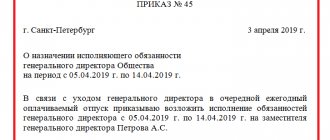

Cases of transfer of responsibility when changing employees' positions

If you have any questions, you can consult for free via chat with a lawyer at the bottom of the screen or call by phone (consultation is free), we work around the clock.

The employer requires the transfer of material assets from one employee to another, if this is provided for by their positions.

Positions that may be held by employees from whom this procedure is required :

- Director.

- Chief Accountant.

- HR department employee.

- Department head.

- An employee who bears financial responsibility (for example, chief cashier, warehouse manager).

The reason for changing the financially responsible person may be:

- Dismissal.

- Long-term sick leave care.

- Going on a business trip or going on vacation.

- The previous employee failed in his duties.

Commissioning certificate

For accounting purposes, issuing an order to put a fixed asset into operation is not enough; it is necessary to issue an acceptance certificate. These acts will differ in form for immovable objects (structures, buildings, etc.), for other types of assets, as well as for the commissioning of a group of objects at the same time.

The rules for drawing up transfer and acceptance acts for accounting purposes are regulated in PBU 6/01. The specified document will be the basis for the transfer of material assets and assets to the structural divisions of the company for further use. If the registered object is not planned to be used, the company is not obliged to draw up these acts; the assets can remain out of operation for an unlimited time, provided that depreciation rates are calculated in a timely manner.

The main list of requirements for the form and content of acts can be found in PBU 6/01, or you can download a standard sample of these documents on our website. The act must be drawn up by the internal Commissioning Commission, the composition of which is approved by the company’s management.

Compilation rules

When drawing up an act, you must follow a certain algorithm of actions and rules for filling out the document.

- The legal basis for putting fixed assets into operation will be an order from the head of the company, after which the corresponding mark is affixed in the OS-1 act.

- Another option would be to draw up an independent act of commissioning fixed assets or an order of similar content; all members of the Commission must sign these documents.

The contents of the act indicate the main parameters of the transferred object, the date of its registration, as well as a list of persons responsible for the safety of the object during operation. Until the transfer of the object into operation, it is reflected in the accounting information under account 08 (non-current assets), and after drawing up the act - under account 01 (fixed assets). Simultaneously with the preparation of the act, the initial cost characteristics of the transferred object are determined, which is necessary for subsequent depreciation calculations.

The standard sample act offered on our website must be filled out taking into account the characteristics of the object being put into operation. Although this document is drawn up in any form, it is advisable to familiarize yourself in detail with the requirements of PBU 6/01 in order to avoid adverse consequences.

How is OS compiled when registering in connection with an acquisition?

In most cases, drawing up an order to accept a fixed asset for accounting eliminates the need to draw up a separate act of entering assets for direct use.

Accounting provisions 6/01 allow the addition of the OS-1 act form with information about the date of commencement of operation of the property. The order for the capitalization of an item of fixed assets must indicate the exact date of the start of use of material assets.

A signed order for entry into the balance sheet is not the only document for registering property.

Acts may vary in form depending on the form of real estate and the number of objects. They are compiled by an internal commission for the enterprise (for commissioning), approved by the head of the company. The contents of the act record the main indicators of the transferred object, a list of employees responsible for the safety of the object.

In the case when an object is registered without planning further operation, the company does not draw up an act. Assets can be stored for a long period of time (without limitation) without being put into operation, provided that depreciation rates are calculated in a timely manner.

The key parameters in the order and the act of acceptance and transfer of fixed assets are: the date the assets were accepted onto the balance sheet and put into operation and their initial cost .

These indicators are the basis for calculating depreciation charges.

- Legislative regulations do not define the boundaries for putting material assets into operation; the decision remains with the head of the company.

- OS-14 - for equipment that is accepted into the warehouse for further installation;

- OS-1b - when groups of objects arrive;

- name of the document (possible names: on the commissioning of a certain object, on acceptance for accounting, on putting on the balance sheet or on capitalization);

- details of the purchase and sale agreement, the act of acceptance and transfer of fixed assets;

- date of putting the property into operation with recording of its brand (if any);

- initial cost for accounting and tax purposes;

- designation of the depreciation group to which the fixed asset belongs;

- assignment of property to a specific group of fixed assets;

- determining the method of calculating depreciation for tax and accounting purposes;

- assets are accepted into the authorized capital of the company as a contribution, they must be valued in monetary terms in accordance with the decision of the owners of the organization;

- valuables accepted free of charge are accepted based on market value as of the date of registration;

- own production of property is assessed based on the total amount of actual costs.

If documents confirming the date of commissioning of a fixed asset are not presented during an audit by the tax authorities, accrued depreciation may be excluded from expenses when calculating the total amounts for income tax.

To record the date of commissioning, the column “date of commissioning” is added to the unified act forms; an additional line is recorded in the company’s accounting policy.

This form is one of the components of documenting the transaction; it is drawn up in any form and approved by the director of the company.

Various property assets received by an organization as a result of purchase or gift must be accompanied by their registration as a fixed asset. New property can be used only if the necessary data is entered into the accounting documentation.

One of the documents that is drawn up when an object is accepted onto the balance sheet is an order from the manager, who orders the acquisition of fixed assets and capitalization of it.

For accounting and tax accounting, fixed assets are considered to be property used by an enterprise for its economic activities for a long period of time over 1 year (neither goods, nor raw materials or supplies), generating income (direct or indirect) in current activities.

Receipt of the object to the enterprise is possible:

The degree of readiness of an object is determined by members of a special commission of the company to resolve issues of receipt and disposal of assets.

To recognize an asset as a fixed asset and register it, the method of its acquisition will not affect the process in any way.

The act must reflect the decision of the special commission on the technical readiness of the object or on the presence of defects that require elimination.

An order for acceptance for accounting and placement on the balance sheet is issued on the company's letterhead , which indicates the name of the company, its legal address, contact numbers, and email.

The order for acceptance of fixed assets upon admission to the organization contains information :

The document is the basis for directing property to the company's structural divisions in order to use assets as fixed assets.

Nuances of filling

The initial cost is determined taking into account certain criteria:

Tax accounting is carried out only from the date of commissioning.

In tax accounting, unlike accounting, depreciation is calculated from the month following the month the property was put into operation. As a result, fines and penalties are assessed for the identified arrears.

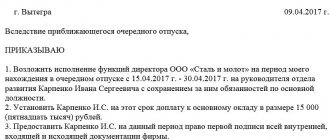

An alternative to entering additional details into the approved form is to issue an order from the head of the company indicating a specific date for putting the property into operation.

Capitalization of fixed assets

Order dated January 30, 2010 N 4

In connection with the purchase of a ZIL-433362 car

1. Put into operation the ZIL-433362 car (hereinafter referred to as the Object) with the initial cost:

- in the amount of 368,760 rubles. in accounting;

See also: General powers of a judge

- in the amount of 365,700 rubles. in tax accounting.

2. Assign inventory number 010 to the Object.

3. Establish the useful life of the Object for accounting and tax accounting purposes - 7 years (84 months). For tax accounting purposes, include the Property in the 4th depreciation group.

Assign the Object to the group of fixed assets “Vehicles”.

5. Determine the method of calculating depreciation in accounting - linear, the method of calculating depreciation in tax accounting - non-linear.

6. Chief accountant N.I. Pavlova put the Object on the balance sheet as part of fixed assets.

General Director Nikolaev V.S.

Source: “Fixed assets: accounting and taxation”, “Tax Bulletin”

Pages: …2122232425…| Table of contents

OS concept

For accounting and tax accounting, fixed assets are considered to be property used by an enterprise for its economic activities for a long period of time over 1 year (neither goods, nor raw materials or supplies), generating income (direct or indirect) in current activities.

The cost of property in this category (initial) must be more than 40 thousand rubles. or equal to this amount, while the period of use of the object (useful) is more than 1 year.

Property that does not meet these criteria is not registered and depreciation is not charged.

It is possible for an object to arrive at the enterprise:

CHAPTER 4. Accounting for fixed assets

Fixed assets are non-current assets that meet certain criteria and have a material structure. Fixed assets are part of the property used as instruments of labor in the production of products, performance of work or provision of services or for the management of an organization for a period exceeding 12 months, or the normal operating cycle if it exceeds 12 months. Items with a useful life of less than 12 months are not considered fixed assets and are taken into account as assets in circulation, regardless of their cost.

Fixed assets in the organization include: buildings, structures, working and power machines and equipment, measuring and control instruments and devices, computer equipment, vehicles, tools, production and household equipment and supplies, working, productive and breeding livestock, perennial plantings, on-farm roads and other relevant facilities. The composition of fixed assets also takes into account capital investments for radical improvement of land (drainage, irrigation and other reclamation works), capital investments in leased fixed assets, land plots, environmental management objects (water, subsoil and other natural resources).

An object of fixed assets owned by two or more organizations is reflected by each organization as part of fixed assets in proportion to its share in the common property.

Order on commissioning of fixed assets

ON THE ORGANIZATION'S LETTERHEAD!

on commissioning of fixed assets

Moscow "__" ___________June 2021

In connection with the acquisition (completion of construction, receipt as a contribution to the authorized capital, contribution to property) ______________________

1. Put into operation ______________________ (hereinafter referred to as the Object) at the initial cost:

— in the amount of __________________ rub. in accounting;

— in the amount of __________________ rub. in tax accounting.

2. Assign the Object an inventory number ______________.

3. Establish the useful life of the Object for accounting and tax accounting purposes - ____ years (_________ months). For tax accounting purposes, include the Object in the ______ depreciation group.

5. Determine the method of calculating depreciation in accounting - linear, the method of calculating depreciation in tax accounting - linear.

6. The chief accountant _______________ accept the Object for accounting as part of fixed assets.

CEO: ---- /______________/

Other publications:

- Order of the Ministry of Emergency Situations code of honor of the Ministry of Emergency Situations of Russia Order of the Ministry of Emergency Situations of the Russian Federation dated July 7, 2011 N 354 “On approval of the Code of Ethics and Official Conduct of Civil Servants of the Ministry of the Russian Federation for Civil Defense, Emergencies and Elimination of Consequences of Natural […]

- Order of the Ministry of Health 308 as amended Automotive safety - Safe car Order of the Ministry of Health of the Russian Federation No. 308 Registered with the Ministry of Justice of the Russian Federation on July 21, 2003 N 4913 MINISTRY OF HEALTH OF THE RUSSIAN FEDERATION ORDER dated July 14, 2003 N 308 ON MEDICAL […]

- Labor Code of the Russian Federation temperature in the workplace SanPiN for office workers Requirements for temperature and humidity, illumination of office space, and sometimes even furniture are strictly regulated. So, if the average daily temperature outside is above 10°C, the office should be […]

- Order 437 of JSC Russian Railways Order of Roszheldor dated December 3, 2018 N 437 “On railway stations” MINISTRY OF TRANSPORT OF THE RUSSIAN FEDERATION FEDERAL AGENCY OF RAILWAY TRANSPORT dated December 3, 2021 N 437 ON RAILWAY STATIONS YAH In accordance with […]

- A sample order to begin construction using an economic method. How to register and record the construction (manufacturing) of fixed assets using an economic method. One of the ways to receive fixed assets into an organization is their construction (manufacturing). An organization can build […]

- Is it possible to travel abroad without parents at the age of 16? Is it possible to travel to Kazakhstan at the age of 16 and do you need parental permission for this? Hello! I am 16 years old and I want to go to Kazakhstan on my own. Is this possible and do I need permission from my parents? Answers from lawyers (1) In accordance with […]

Order on accounting of fixed assets sample

In what account is the state duty for registering a vehicle taken into account?

Quote: “Transport services: accounting and taxation”, 2012, N 1

STATE FEES FOR VEHICLE REGISTRATION

Accounting and taxation

When recording payments for registration (re-registration) of vehicles, the main question that the accountant needs to answer is whether or not to include these payments in the initial cost of the vehicle. The first thing that comes to mind is that government fees paid for obtaining license plates, registration certificates, and PTS are the actual costs associated with purchasing a car and putting it into operation. Supporters of this position note that, as a rule, the purchase and registration of a car occur almost simultaneously and the accountant receives documents for the car along with papers confirming payment of the state registration fee. But this, of course, is not the main argument. Clause 8 of PBU 6/01 “Accounting for fixed assets” is more convincing. It says that the amount of actual costs included in the cost of fixed assets includes, among other things, the state duty paid in connection with the acquisition of a fixed asset. However, in relation to a vehicle, the state duty is not associated with its acquisition (this occurs when purchasing real estate), but with its commissioning (obtaining the right to participate in road traffic). Registration of vehicles as objects of movable property is necessary not for the purpose of registration (emergence, change, termination) of the property rights of the owners to them, but to allow the vehicle to participate in road traffic and ensure technical accounting and control over the operation of the vehicle on the territory of the Russian Federation. At the same time, in the absence of a title, registration certificate, or state license plates, the vehicle will not be allowed to operate, which means the carrier will not receive income from its use. What kind of OS is it then, if there are no economic benefits from it? Consequently, the state duty for vehicle registration is an integral payment, which will be “covered” by income throughout the entire life of the registered vehicle. True, the amount of state duty is insignificant compared to the cost of the vehicle, and the effect of writing off duties through depreciation is small. But this is a question of the appropriateness of the chosen method of reflecting the transaction, and not of the accounting methodology. Before making a final conclusion in favor of including state duty in the cost of a vehicle, let us turn to other legal acts, for example, IAS 16 “Fixed Assets”. It states that the cost of an asset includes any costs directly attributable to delivering the asset to its required location and bringing it into a condition that ensures its functioning in accordance with the intentions of the organization's management. From these positions, payment of the state duty upon registration can be safely attributed to the costs that ensure the functioning (operation) of the car as an OS object in accordance with the intentions of the management of the transport organization. This position was expressed in Letter of the Ministry of Finance of Russia dated September 29, 2009 N 03-05-05-04/61.

We have to admit that in the industry documents - the Instructions for accounting for income and expenses in road transport and the Instructions for calculating the cost of transportation - not a word is said about the costs of a transport organization for paying state duties, but there is a mention of the costs of state registration of a vehicle. They are included in the cost of transportation (work, services) of road transport as the cost of commissioning new (entered into the balance of the enterprise) rolling stock of road transport. If we consider the wording in the context of the above rules, then the costs of registering vehicles should be capitalized in their cost, written off through depreciation. Approved by Order of the Ministry of Transport of Russia dated June 24, 2003 N 153. Approved by the Ministry of Transport on August 29, 1995.

For tax purposes, the initial cost of a fixed asset is defined as the sum of expenses for its acquisition, construction, production, delivery and bringing it to a state in which it is suitable for use (excluding VAT and excise taxes). Payment of the state fee for vehicle registration is not an exception, so these costs can be taken into account in the initial cost of the car, which is depreciable property. This will help bring taxation closer to accounting. However, there are other options for tax accounting for the costs of registering a vehicle with the traffic police. There is an opinion that such registration does not mean bringing the vehicle to a state of suitability for use. The absence or presence of registration in itself does not in any way affect the readiness of the purchased car for work. From this point of view, registration costs do not participate in the formation of the initial cost of vehicles and can be taken into account at a time when calculating income tax as part of other expenses associated with production and sales (Resolution of the Federal Antimonopoly Service UO dated January 19, 2010 N F09-10766/09 -C2, dated November 25, 2008 N F09-8694/08-C3). But this position is fraught with tax risks.

Example 1. An organization purchased a car by paying a state fee for obtaining license plates (1,500 rubles), issuing a registration certificate (300 rubles) and issuing a title (500 rubles). The organization is a payer of income tax, for the calculation of which it included the duty in the cost of this depreciable property. The car purchase price is RUB 590,000. (including VAT - 90,000 rubles). When choosing an account for accounting for payments of state fees for registration, you need to remember that the fee refers to fees, and account 68 is intended for accounting for taxes and fees (see Instructions for using the Chart of Accounts). However, unlike taxes, duty is not a periodic, but a one-time payment, so accounting for it along with taxes overloads the account with 68 information. We believe that you can choose another account to record settlements of state duty, for example 76 “Settlements with different debtors and creditors.” The following entries will be made in the organization's accounting:

Note! The beginning of depreciation on a vehicle is associated with the date of its commissioning, but does not directly depend on the date of its registration with the State Traffic Safety Inspectorate (Resolution of the Federal Antimonopoly Service of the Moscow Region dated September 7, 2010 N KA-A40/10331-10). However, if you start operating a vehicle (for example, a self-propelled car) that is not registered with Rostechnadzor, this will become the basis for filing claims regarding the validity of depreciation for such vehicles (Resolution of the Federal Antimonopoly Service ZSO dated June 18, 2010 N A27-19317/2009).

The accounting and taxation procedure discussed above applies to the costs of paying state fees for registration associated with the initial registration of a vehicle and its commissioning as part of a fixed asset. Payment of state fees in other situations, for example, for the temporary registration of a car in another region, issuance of lost license plates, PTS, registration certificates, deregistration of a car, refers to current costs both for accounting purposes and from a taxation perspective.