Despite the fact that insurance premiums will come under the control of the tax service from 2021, contributions for “injuries” remain under the jurisdiction of the Social Insurance Fund. Every year, the Social Insurance Fund sets the rate of insurance premiums for organizations to insure against accidents at work, as well as occupational diseases. Data for determining the tariff are provided to the Fund by the organizations themselves in the form of a certificate confirming the main type of activity. Individual entrepreneurs do not have to submit such a certificate, but insurers are required to do this starting from the next year after their state registration.

In this article we will talk about how to fill out a confirmation certificate from the Social Insurance Fund, what additional documents need to be attached to it, and what awaits policyholders who have not provided confirmation of their main type of activity.

Who must confirm the type of activity in 2021

Before talking about who must confirm the type of activity, it is necessary to note once again that not all types of insurance premiums remain under the control of the FSS, but only those related to insurance against occupational diseases and injuries. Each organization that was registered before 2021 inclusive must confirm the type of activity. Even if there was no income last year, confirmation is required. All other companies will be guided when paying fees for the activities that were specified at the time of registration.

In relation to Individual Entrepreneurs, the law is more loyal. They do not need to confirm the type of activity. They are guided by the option specified in the Unified State Register of Individual Entrepreneurs. Of course, in the event of a change in the type of activity and information in the Unified State Register of Individual Entrepreneurs, the Individual Entrepreneur revises the tariff associated with insurance against industrial injuries.

Results

All policyholders who pay contributions to the Social Insurance Fund, with the exception of individual entrepreneurs, are required to confirm their main type of work every year by submitting the appropriate certificate to the social insurance department at the place of registration. The sample, form, as well as the algorithm for filling out the document are discussed in detail in the material.

Sources:

- Decree of the Government of the Russian Federation dated December 1, 2005 N 713

- Order of the Ministry of Health and Social Development dated January 31, 2006 No. 55

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How to confirm the type of activity

In order to correctly complete the procedure, you must first determine the type of activity, then collect a package of documents, submit it to the Social Insurance Fund and wait for a response. The specialists' decision will be to assign a tariff in accordance with the type of activity.

Online cash registers are a technique that is recommended for all entrepreneurs to switch to. Of course, this transition should not be carried out immediately, but gradually. In order for the phased transition to be implemented correctly, a date was announced that can be considered the deadline - July 1, 2021.

Entrepreneurs who supply alcohol belong to a separate category, to which the Legislation has treated more strictly, in terms of the period allocated for the transition. The deadline for such organizations is March 31 of the current year.

If you have any additional questions related to the transition to online cash registers, please contact our company right now. This issue is quite serious, since it is regulated by the legislation of the Russian Federation, and requires a careful approach. Our company's accounting specialists offer a wide range of services, which includes advisory and service assistance. Call us right now and we will answer additional questions and help you find the right way out of any current situation.

Example of defining the main type of work

The main type of entrepreneurial activity is determined by the legal entity independently. It depends on the VD with the highest share for commercial entities or on the VD with the maximum number of employees for non-profit structures. If a company maintains several VCs, and the specific weight as a result of the calculation is the same, then the highest class of profrisk is selected. Let's look at the algorithm for choosing the main OKVED using an example.

Example

Assorti LLC carries out the following internal activities:

| Type of work | OKVED code | Sales volume for 2021 (RUB) | Income level (%) | Profrisk class |

| Production of alcoholic beverages | 11.01.1 | 7 550 000 | 40 | II |

| Wholesale trade of alcohol | 46.34.2 | 7 550 000 | 40 | I |

| Retail sale of alcohol in specialized stores | 47.25.1 | 3 740 000 | 20 | I |

| Total | 18 840 000 | 100 |

To determine the rate of “unfortunate” contributions, we select the indicator with the highest share of income. In the example conditions, this is the wholesale trade of alcohol and its production. Since the indicators are equal, we choose a higher profit class, which includes the production of alcoholic beverages, that is, II. The rate of “unfortunate” contributions corresponding to risk class II is 0.3%.

UTII and PSN: are they subject to the requirement?

Cash register or cash register equipment must be used by sellers of any alcoholic beverages from March 31 of the current year. This requirement is regulated by the Legislation of the Russian Federation (in particular, Federal Law No. 261, Article No. 1). What drinks can be classified as alcoholic beverages? To answer this question, you should also pay attention to the laws. You can find the answer to most questions in the Legislation if you study the information in detail and interpret it correctly. So, in accordance with Law No. 171 (Article 2), there are 4 types of alcoholic products:

- Vodka

- Cognac products

- Wines and all types of wine drinks

- Beer, as well as cider, mead and poiret

If you try to find information in Law No. 171 about certain types of taxation and their impact on the use of cash registers, you will fail, since there are no clauses in this regard. However, there is Federal Law No. 54, which also contains information about the need to switch to online cash registers for all organizations, except for companies on UTII and PSN, as well as entrepreneurs providing services to the public. This law exempts them from using the online system until February 1 of the following year.

If such inconsistencies are detected, it is necessary to seek additional information. The laws we are talking about are different: one relates to the regulation of the sale of alcohol, and the second, to the use of cash registers. A special rule is always more significant than a general one. In this case, we can conclude that special requirements are contained in Law No. 171. Thus, we understand that all companies, regardless of the tax system, must switch to online cash registers before March 31 of this year.

If your situation is non-standard and you need any clarification on the current law, we are waiting for your requests. Professionals will help you solve any issue and find a competent solution to the problem.

Where can I find a sample of filling out the OKVED confirmation certificate?

The algorithm for confirming the main VD is regulated by Order of the Ministry of Health and Social Development dated January 31, 2006 No. 55, and the certificate form is enshrined in Appendix 2 to this regulatory legal act.

The certificate in question contains information:

- about the policyholder (name, INN and Unified State Register of Legal Entities codes, address, names of the manager and chief accountant, as well as the number of employees);

- distribution of income across the company’s main internal activities;

- selected VD.

The form and sample of filling out the OKVED confirmation certificate can be downloaded on our website using the links below:

OKVED confirmation form:

Sample of filling out the certificate:

You can submit documents to the Social Insurance Fund, MFC or through the government services portal .

Confirmation deadlines

Based on the submission procedure, confirmation of the main activity must be made every calendar year before April 15. However, in 2021 this date falls on a Sunday, that is, a non-working day for the FSS. Therefore, you need to submit information before April 13, 2021 (this will be Friday).

A shift to a later date is not provided, since this is not directly regulated by law. However, from a legal point of view, submitting documents on April 16, 2021 will not be a violation, if we take into account Art. 193 of the Civil Code of the Russian Federation on the general rule of shifting reporting deadlines.

The FSS does not support the point of view of postponing the deadline to April 16, so it is better for organizations to provide confirmation before April 13, so as not to receive a fine and not have to defend their point of view later in court.

How are tariffs set?

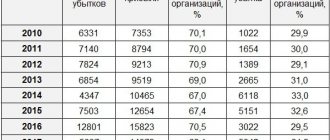

Contributions paid to the Social Insurance Fund by organizations may vary significantly. This is due to the fact that the level of danger of occupational diseases, injuries and accidents at enterprises differs significantly depending on their type of activity.

Thus, tariffs depend on the class of professional risk, i.e. The higher the possibility of emergency situations, employee injuries, etc., the more one or another company has to pay.

Types of activities are determined according to the OKVED lists, and the class of professional risks is also prescribed there.

If an organization is engaged in different directions in parallel, the main one is considered to be the one that brings the greatest income in total revenue excluding VAT.

And if, for example, two different areas of business bring equal profits, then the one in which there are more professional risks becomes priority and it is based on the tariffs for which contributions to the Social Insurance Fund will be calculated.

In addition, companies must take into account that in cases where they operate in several areas, the risk class is assessed separately for the policyholders themselves and their branches and separate divisions.

How many reports are needed if there are separate divisions?

Sometimes a company has one or more separate divisions. Regarding the OP, information must be provided to the regional divisions of the FSS at their location. Their activity codes and gross revenue must be calculated separately. That is, if a company has 5 EP, then there should be 5 reports to the Social Insurance Fund, not counting the report on the parent company. At the same time, the separate units themselves must satisfy a number of requirements:

- there is a separate balance;

- presence of a separate account;

- Payments to employees are made by the OP independently.

When to send a document

The deadline for filing an application is strictly regulated by law. The end date is April 15 of the year following the reporting year (if this date falls on a weekend, then on the following Monday or other first working day).

After receiving the application, the Fund's employees are obliged to notify the policyholder within a two-week period about what specific professional risk class he has been assigned and at what rates he is obliged to pay contributions.

Until this notification is received, all accruals are made on the basis of last year’s figures, but after the notification reaches the addressee, they must be recalculated based on new indicators (penalties and fines are not charged for such recalculation).

Responsibility for failure to provide certificates and applications

There are no specific penalties for failure to submit a certificate confirming the type of activity to the Social Insurance Fund.

However, if this is not done, the Fund will establish the highest contribution rate based on all types of activities specified in the Unified State Register of Legal Entities. Having determined the tariff, the Social Insurance Fund will notify the organization in writing.

To send your reports on time, save a link to your accountant’s calendar.

Sample of filling out a confirmation certificate for 2021

Kamaz LLC is engaged in trade in goods and cargo transportation. In 2021, revenue from the sale of goods and services amounted to 5,896,000 rubles (excluding VAT), including from the sale of goods - 3,784,000 rubles, from cargo handling activities - 2,112,000 rubles.

Based on these data, the Company's accountant prepared an application and a certificate confirming the main type of economic activity.

Please note that when filling out the application, the accountant indicated only a confirmation certificate. He deleted the line about the explanatory note, since Kamaz LLC is a small enterprise and may not prepare an explanatory note for the balance sheet.

The main type of activity, on the basis of which the insurance tariff will be determined, is “Wholesale trade of non-food consumer goods”, since it was from this type that the revenue amounted to 64.18% of the total amount (3,784,000/5,896,000 x 100%).