The status in the payment order in 2021 is information about the payer to the Russian budget. The accountant must fill out field 101 without errors for the correct crediting of money. From October 2, 2017, new requirements apply, which you can learn about from the article. The status in the payment order in 2021 is information about the payer to the Russian budget. The specialist must indicate it accurately for the correct transfer of money. If the details are incorrectly indicated, the payment will be classified as unclear by the treasury, and it will take time to clarify it. The latest changes to this procedure, which came into force on October 2, 2021, were made by Order of the Ministry of Finance of Russia dated April 5, 2017 No. 58n “On amendments to the Order of the Ministry of Finance dated November 12, 2013 No. 107n.” The document makes amendments to the procedure for filling out payment orders when transferring money to the budget.

IMPORTANT!

Clarification of payments administered by the Tax Service is carried out in the manner prescribed by Art. 45 of the Tax Code of the Russian Federation and Order of the Ministry of Finance of Russia dated December 18, 2013 No. 125n.

Sample payment order form

Payer status: what to indicate in 2021 on payments for contributions and taxes

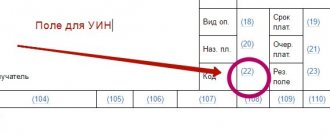

When filling out a payment order for paying taxes and insurance premiums, the payer indicates his status (code) in field 101.

Order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n approved the list of payer status codes.

Code 08 is no longer indicated

Previously, when transferring any type of insurance premiums, the code “08” was indicated in field 101, which means: “payer-legal entity (notary engaged in private practice; lawyer; individual entrepreneur; head of a peasant/farm enterprise) transferring funds to pay insurance premiums and other payments to the budget system of the Russian Federation.”

Now these are the rules. In payment slips for contributions, enter code 01 when paying contributions to the Federal Tax Service for pension, medical and social insurance. When paying contributions for themselves, individual entrepreneurs set the status to 09.

Enter code 08 only when paying contributions for injuries.

State duty - what do we pay for?

State duty is a federal fee, the payment of which is established by the Tax Code of the Russian Federation. Payment is made on the basis of a person’s application to various state and municipal structures to resolve certain legal issues and actions.

State duty calculator for courts of general jurisdiction

The payment for the state duty is drawn up according to the general principle of filling out, but it is very important to fill out line 104 correctly, that is, reflect the BCC code of the organization to which the funds are sent. It is indicated depending on the action for which the amount of state duty was charged. When filing a lawsuit, payment of the state fee is sent to the details of the court hearing the case.

Sample payment slip indicating the status indicator (field 101)

Next, see a sample of filling out the status indicator in field 101 of the payment:

Due to the fact that from 2021 the payment of insurance premiums is administered by the tax office, the payer must indicate code “01” in the payment order.

Thus, now issuing a payment order for the transfer of insurance premiums is identical to a payment order for the payment of taxes. The difference is in the BCC and the purpose of payment.

There is an opportunity to repay your debt to the budget at the expense of third parties. This is directly indicated by paragraph 1 of Art. 45 of the Tax Code of the Russian Federation. In this regard, the list of codes for field 101 has been supplemented.

Here is an updated list of payer status codes for 2020.

Questions and answers

- An error was made when filling out field 101. What consequences does this have for us?

Answer: The payment order may be returned from the bank unexecuted. To avoid troubles, carefully check the document provided to the bank.

- When paying personal income tax for employees, I indicated code 09 in field 101, because I am an individual entrepreneur. The other day I received a letter from the tax office demanding that I pay personal income tax, taking into account the fine. I paid everything, I have a payment order. Why such a requirement?

Answer: When paying personal income tax for employees, an individual entrepreneur acts as a person making payments to individuals. In this regard, it is necessary to indicate code 14 in field 101, because make deductions for employees.

Payer status codes for 2021

| Decoding | Code |

| Taxpayer (payer of fees, insurance premiums) – legal entity | 01 |

| Tax agent (when paying personal income tax for employees) | 02 |

| Participant in foreign economic activity – legal entity | 06 |

| An organization (individual entrepreneur) that transfers other obligatory payments to the budget | 08 |

| Taxpayer (payer of fees) – individual entrepreneur | 09 |

| Taxpayer (payer of fees) – notary engaged in private practice | 10 |

| Taxpayer (payer of fees) – a lawyer who has established a law office | 11 |

| Taxpayer (payer of fees) – head of a peasant (farm) enterprise | 12 |

| Taxpayer (payer of fees) - another individual - bank client (account holder) | 13 |

| Participant in foreign economic activity – individual | 16 |

| Participant in foreign economic activity - individual entrepreneur | 17 |

| A payer of customs duties who is not a declarant, who is obligated by Russian legislation to pay customs duties | 18 |

| Organizations and their branches that withheld funds from the salary (income) of a debtor - an individual to repay debts on payments to the budget on the basis of a writ of execution | 19 |

| Responsible participant of a consolidated group of taxpayers | 21 |

| Member of a consolidated group of taxpayers | 22 |

| Payer – an individual who transfers other obligatory payments to the budget | 24 |

| Founders (participants) of the debtor, owners of the property of the debtor - a unitary enterprise or third parties who have drawn up an order for the transfer of funds to repay claims against the debtor for the payment of mandatory payments included in the register of creditors' claims during the procedures applied in a bankruptcy case | 26 |

| Credit organizations (branches of credit organizations) that have drawn up an order for the transfer of funds transferred from the budget system, not credited to the recipient and subject to return to the budget system | 27 |

| Legal or authorized representative of the taxpayer | 28 |

| Other organizations | 29 |

| Other individuals | 30 |

Consolidated group of taxpayers

The consolidated group of taxpayers in Appendix 5 to Order No. 107n includes 2 meanings:

- 21 – responsible participant of the consolidated group of taxpayers (CGT);

- 22 – participant of the KGN.

In accordance with clause 4 of the rules for indicating information in payment documents (Appendix 1 to Order No. 107n), taxes are paid by the responsible participant on behalf of the group. This means that the payroll of the organization - the responsible participant should contain indicator 21.

If organizations that are members of the CGN fill out settlement documents for the responsible participant, then they use code 22.

Taxpayer status when paying a trademark registration fee

Changes to the Regulations on Duties: clarifications on the payment of duties

- How to correctly fill out a payment document for paying a patent fee?

- What is KBC?

- What to do if the payer forgot to indicate or incorrectly indicated the KBK in the payment document?

- Is it necessary to notify Rospatent about payment of the fee?

- How are the roles of Rospatent and FIPS distributed in the process of receiving fees and recording them?

- What should be indicated in the payment document in the “Purpose of payment” column?

- Is it possible to pay the fee using one payment document for several applications or documents of protection at once?

- Where are fields 61, 103, 104, etc. located?

Federal Service for Intellectual Property (Rospatent)

Important Zen enlightens accountants Mmmaximmm 6 hours ago, Moscow ToT, you wrote: Let's create a trade union, at least start. Ours... How 2.7 million of the company's tax debts were recovered from a freelance accountant-pensioner as a "subsidy" Well, yes, if you put a gun in your mouth, then you will also give the keys to the apartment and tell you where... How scammers are stealing money from people in a new way bank cards And why give links to a non-working telegram? It may not work for you. And others have a slave... Zen enlightens accountants And why give links to a non-working telegram? or did I miss something and it works? Zen enlightens accountants So here everyone is right. can you justify it?

Source: https://redtailer.ru/status-nalogoplatelshhika-pri-uplate-poshliny-za-registratsiyu-tovarnogo-znaka/

How to pay an administrative fine from the FAS

Customers and procurement participants bear responsibility, including administrative responsibility, for non-compliance with legislation and other regulations of the contract system (Part 1 of Article 107 No. 44-FZ).

After consideration of the case of such an offense and the necessary checks by the control body (FAS), an administrative fine is imposed.

And the violator is faced with two questions: how much time is given to pay the administrative fine and how to fill out the payment form.

As an example, consider the Resolution on the imposition of a fine in case No. 220-гз/17. The document considers a case where the customer changed the essential terms of the contract, which relate to the payment procedure for the supplier’s work. From the content you can find out all the stages that preceded the imposition of an administrative fine:

- Conclusion of 4 contracts for cleaning areas based on the results of auctions.

- Conclusion of additional agreements to amend clause 8 of the contracts (procedure for payment for work).

- Prosecutor's inspection to ensure the customer's compliance with the provisions of No. 44-FZ.

- Initiation and consideration of an administrative violation case dated November 9, 2017 against an official of the customer.

- Receipt of written explanations from the defendant’s defense attorney with arguments about the latter’s lack of guilt.

- Recognizing the defense's arguments as untenable.

- Identification of violations by the customer of Part 2 of Art. 34 and part 1 art. 95 No. 44-FZ.

As a result, an administrative fine of 20,000 rubles was imposed. according to Part 4 of Art. 7.32 Code of Administrative Offenses of the Russian Federation. When assigning the amount, the circumstances of the case and the arguments of the customer’s representative were taken into account. There were no mitigating circumstances in the case that would have helped avoid an administrative fine.

When to pay

Here is how many days are given to pay the administrative fine:

- The violator has 10 days from the date of receipt of the decision to appeal the decision to impose a fine. After this period, the FAS decision comes into force and you will have to pay a fine in any case.

- From this moment on, the money in the amount of the fine must be transferred to the budget within 60 days. This period is established by Part 1 of Art. 32.2 Code of Administrative Offences.

If the fine is provided for by installments or deferment, then it must be paid no later than 60 days after the expiration of their period (Article 31.5 of the Administrative Code). That is, you won’t be able to avoid paying your administrative fine for a year or two with impunity: there is liability for this.

After paying the fine, the payer must provide the control authority with a document confirming the fact of the transfer of money.

Download the Decree

It is on the basis of this FAS Resolution that fines for administrative offenses in the field of public procurement are paid.

Download

Where to get payment details

At the end of the Resolution, they must also indicate the details to which money should be transferred towards the administrative fine. You will need to indicate:

- name of the recipient (for example, Novgorod Department of the Federal Antimonopoly Service of Russia);

- TIN and checkpoint;

- personal account (if necessary);

- budget classification code (KBK);

- OKTMO;

- the name and city of the bank to which the administrative fine will be received;

- BIC;

- checking account.

The purpose of payment for the fine must also be specified in the form of a supporting document (FAS Resolution with number and date).

How to pay through Sberbank online

One of the most convenient ways to pay off debts to the Federal Antimonopoly Service, so as not to miss the deadline for paying an administrative fine.

Here everything is done literally on the go, and you don’t need to delve into details for a long time to understand the algorithm. And then you will be able to make payments without hesitation.

Be sure to double-check all entered data: whether everything is written correctly, whether numbers are missing.

To make a payment using this method, you need to:

- have a Sberbank plastic card;

- install the Sberbank Online application on your smartphone or go to the bank’s website;

- have a receipt in hand;

- Instead of a ticket, a copy of the punishment protocol will do.

Once you are sure that you have all this, you can begin to pay the administrative fine. There are several ways here. Let's look at one of them step by step.

Step 1. Register or log into your personal account.

Step 2. Find in the menu in the gray field at the very bottom of the screen the item called “Payments”.

Step 3. Oh.

Step 4. Find the fine that needs to be paid off.

Step 5. Fill in all the necessary details using the prompts.

Step 6. Now it’s time to check your data entry.

Step 7. If everything is correct, it’s time to pay the fine and complete the transaction.

There is a simpler method, especially for those who always have their documents at hand. They can do it differently: you can find your fine using your personal tax identification number. For this method you will need:

- log in;

- go to the “Payments” section;

- at the top of the screen in the gray search field, enter your TIN;

- Unpaid fines that were issued to you will appear, then, in the same way as in the previous instructions, fill out the fields and make payment.

Additionally, Sberbank Online provides the opportunity to pay a fine through “Government Services”. This is done like this:

- after authorization, go to the “Payments” section;

- then select the item “Staff Police, taxes, duties, budget payments”;

- then you will see a list, and the first line will be the “Public Services” item. Choose it;

- you will be given a choice: you will be asked to enter the receipt number for an administrative fine or check for fines using the government services portal.

Paying fines through the app takes 5 minutes and is free. That is, no commission is charged.

How to pay through the State Services website

Government services also do not charge any fees for paying a fine online.

Step 1. Registration on the site. You will need to prepare your passport, SNILS, remember your email address and contact phone number.

Step 2. If you have already registered on the site, you just need to log into your personal account.

Step 3. At the top of the screen, find the “Payment” button, click on it, and then click on the “Pay by receipt number” button. You can do this: on the right side of the screen, find the “Payment by receipt” button, it is located in the blue field.

Step 4. In the empty field, enter the number from the fine receipt, if necessary, fill in all the necessary fields (the system provides hints automatically, you cannot miss anything).

Step 5. Pay your administrative fine.

To pay fines, you can use a bank card or electronic wallet.

You can pay the receipt through “State Services” by logging not into the website or application, but through Sberbank Online. This doesn’t make much sense if you have both applications installed, but paying through Sberbank will be somewhat easier.

How to pay a fine through the terminal

Another way to pay the fine is at a terminal or ATM. This method has its advantages, for example, you will not need the Internet, you will not need to go to a bank branch and fill out a payment form for a fine.

But there is also a minus, and a significant one: a commission is charged for paying through an ATM.

Therefore, you will only need to take a plastic card or cash with you, taking into account the fact that you will have to pay more than what is written on the fine receipt.

The procedure is as follows:

- Insert your card and enter your PIN.

- In the menu that appears, find the item “Payment of taxes, duties, traffic police, budget payments.”

- Find and select the type of fine you need.

- Enter the details (this is done on the receipt, and it is better to double-check all the information).

- Manually enter the amount of the administrative fine.

- Check again that the data has been entered correctly and click on the confirmation button.

- Take a receipt that will confirm payment of the fine. Don't lose or throw it away.

The commission will be 2% of the payment amount. For comparison, if you deposit the entire amount of an administrative fine at the bank’s cash desk, the commission will be about 40-50 rubles for each paid receipt. You have the right to choose a more profitable option.

How to fill out a payment order

The payment document must be filled out in accordance with the details specified in the FAS Resolution.

It is necessary to enter KBK and OKTMO in the fields above the purpose of payment (104 and 105).

What happens if you don't pay the fine?

In the absence of paper that confirms the transfer of money to repay an administrative fine, the official, body, judge (court) that made the decision on sanctions must send a resolution to the bailiff with a note that the debtor’s obligations have not been fulfilled (Part. 5 Article 32.2 of the Administrative Code).

The person who has examined the case of the offense draws up a protocol (Part 1 of Article 20.25 of the Administrative Code), according to which the amount of the fine is doubled or an arrest of up to 15 days or 50 hours of compulsory labor is imposed.

How to make sure the payment went through

Delay will result in a fine, so after payment a logical question arises: how to check payment of a fine for an administrative offense:

- on the main page of the FSSP website;

- in your personal account on the State Services website.

Money is credited within 5-7 days.

Payment to the authorities is confirmed by payment documents. For example, a payment order with a bank note indicating payment of a fine or a check from an ATM or terminal. Keep them until you are sure that the money has been credited.

Source: https://goskontract.ru/tender/kak-oplatit-administrativnyy-shtraf-fas