Organizations have the right to independently qualify income, taking into account its nature, conditions of receipt, as well as the direction of the business. According to the Accounting Regulations “Income of the Organization” PBU 9/99, approved by Order of the Ministry of Finance dated May 6, 1999 No. 32n, they recognize an increase in economic benefits as a result of the receipt of assets (money or other property) and (or) repayment of liabilities, leading to an increase capital of the organization. At the same time, contributions from property owners do not count as income.

Meanwhile, not all funds and property received by the organization are income. The following are not considered by them: amounts of VAT, excise taxes, export duties, etc.; payments under commission agreements, agency and other similar agreements; advance payment for products, goods, works, services; advances; makings; payments under collateral, credit, loan agreements.

The criteria for classifying receipts as income from ordinary activities must be fixed in the company’s accounting policies. As a rule, they are amounts received from the main type of activity. This is revenue from the sale of goods, works or services. If a company has several lines of business, then the so-called “materiality threshold” of “ordinary” income is used; as a rule, it is 5 percent.

Conditions of recognition

Paragraph 12 of PBU 9/99 establishes five conditions, under the simultaneous fulfillment of which revenue is recognized in accounting: the organization has the right to receive it, the company’s revenue is obtained from a specific agreement or is confirmed in another appropriate manner; its amount can be determined; there is confidence that as a result of a specific transaction there will be an increase in the economic benefits of the organization; the right of ownership (possession, use and disposal) of the product (goods) has passed from the company to the buyer or the work has been accepted by the customer (service provided); the costs of the operation can be determined.

If at least one of the above conditions is not met for the money and other assets received by the company, not revenue is recognized in accounting, but accounts payable.

Amounts from the provision for temporary use of company assets for a fee, rights arising from patents for inventions, industrial designs and other types of intellectual property and from participation in the authorized capital of other organizations are recognized as income if only three conditions are simultaneously met: the company has the right to receive proceeds , arising from a specific contract or otherwise confirmed in an appropriate manner; the amount of earnings can be determined; there is confidence that a particular transaction will result in an increase in the economic benefits of the organization.

Profit as the main goal of a commercial organization

For any organization, regardless of its activities and volume, the main goal is to make a profit , which serves as a source of income for the owners.

Every owner is interested in growing his wealth, and this can only be achieved by expanding his activities. It is this motivation that is the main driving force for the sustainable development of the organization.

The normal functioning of a business entity depends on maintaining the required level of profitability.

A systematic lack of profit and its unsatisfactory dynamics indicate the inefficiency and riskiness of the organization’s activities, which is one of the main internal reasons for an unstable financial position and bankruptcy.

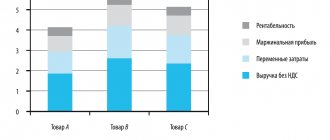

Thus, profit is the most important evaluation indicator of an organization’s activities. It is calculated as the difference between revenue from the sale of products (works, services) and the costs associated with its production. Therefore, to obtain the greatest profit, it is necessary to increase revenue and reduce costs.

Increasing revenue volumes is a complex process due to problems arising in business activities such as a decrease in demand for products and an increase in accounts receivable.

Cost reduction can be achieved in many ways, one of which is reducing labor and material intensity.

"Regular" accounting

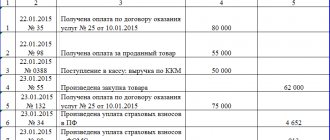

Information about “ordinary” income and expenses, as well as the financial result for them, is reflected in account 90 “Sales” in correspondence with the debit of account 62 “Settlements with buyers and customers”. Subaccount 90-1 “Revenue” is intended for revenue accounting.

EXAMPLE An organization received revenue in the amount of 1,770,000 rubles (including VAT - 270,000 rubles).

The cost of goods sold was 900,000 rubles, the cost of their sale was 255,000 rubles. The following entries must be made in accounting: DEBIT 62 CREDIT 90-1

– 1,770,000 rubles – revenue from the sale of goods is reflected;

DEBIT 90-3 CREDIT 68, subaccount “Calculations for VAT”

– 270,000 rubles – VAT charged;

DEBIT 90-2 CREDIT 41

– 900,000 rubles – cost of goods sold is written off;

DEBIT 90-2 CREDIT 44

– 255,000 rubles – sales expenses are written off;

DEBIT 90-9 CREDIT 99

– 345,000 rubles (1,770,000 – 270,000 – 900,000 – 255,000) – profit from sales is reflected.

How is accounting carried out?

The accounting entries for expenses for ordinary activities will be as follows:

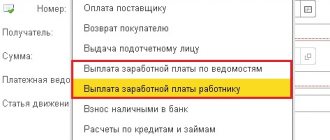

- D20 - K70 - payroll for employees who are engaged in the main production.

- D25 – K02 – depreciation calculation for special equipment of the workshop.

- D26 – K69 – calculation of insurance premiums for the salaries of management employees.

- D20 – K10 – write-off of materials for the manufacture of goods.

- D44 – K60 – accounting for the costs of transporting products to customers.

- D90 – K41 – write-off of the cost of products sold.

Other income

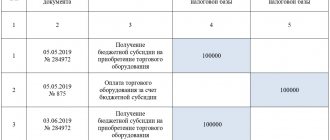

The list of other income is fixed in paragraph 7 of PBU 9/99 and is open. These include: revenues associated with the provision of the organization's assets for temporary use for a fee; fines, penalties, penalties for violation of contract terms; profit of previous years identified in the reporting year; exchange differences.

To summarize information on other income and expenses, account 91 “Other income and expenses” is intended (Chart of accounts for accounting financial and economic activities of organizations, approved by Order of the Ministry of Finance dated October 31, 2000 No. 94n).

There are subaccounts: 91-1, 91-2 “Other expenses”, 91-9 “Balance of other income and expenses”. I recommend opening them too.

Accounting in account 91 is carried out cumulatively, that is, during the reporting year, entries are made in subaccounts 91-1 and 91-2. Every month you need to determine the balance of other income and expenses. At the end of the reporting year, subaccounts (with the exception of subaccount 91-9) are closed.

The procedure for recognizing other income in accounting is prescribed in paragraph 16 of PBU 9/99. If all five conditions that I have already described above are met, other income is recognized in accounting in the following order. With regard to amounts from the sale of fixed assets and other non-monetary assets, products, goods, interest for the provision of funds for use, as well as income from participation in the authorized capital of other companies, a procedure similar to that provided for in paragraph 12 of PBU 9/99 applies. Fines, penalties, penalties for violation of the terms of agreements, as well as compensation for losses caused to the organization, are recognized in the reporting period in which the court made a decision to collect them or in which they were recognized by the debtor. The amounts of accounts payable and depositors must be taken into account in the reporting period in which the statute of limitations has expired; the amount of revaluation of assets - in the reporting period to which the date as of which the revaluation was made; other receipts - as they are formed (identified).