You have received a request from the tax office to provide explanations regarding the loss in your income tax return. What to do with such a request? How to answer it? What might such requests lead to? And was it worth showing this loss at all?

The income tax return is under the control of tax inspectors. If a declaration is unprofitable for an organization, it will not go unnoticed by the tax authorities, who have the right to:

- demand clarification on such (unprofitable) declarations,

- call for a loss-making commission,

- include the organization in the on-site inspection plan.

There is definitely little pleasant in every event. Therefore, we will try to tell the manager what to do if at the end of the year after calculation there is a loss, whether to reflect it in the declaration or not, what explanations to give to the tax office, how to explain the loss and what risks there may be.

How to respond to a demand

The time limit for a response is counted from the date of receipt of the request for clarification . If the company reports on paper, the demand will be sent to it by mail. The date of its receipt is considered to be the sixth day from the date of sending the registered letter (paragraph 3, paragraph 4, article 4 of the Tax Code of the Russian Federation).

If an organization or individual entrepreneur is required to report electronically, the requirement from the tax office will be sent to them through the operator. In this case, the deadline for responding to the request is counted from the date of sending the acceptance receipt. But it will not be possible to confirm receipt later in order to gain time: the Tax Code gives the same 6 working days for sending the receipt (clause 5.1 of Art. Tax Code of the Russian Federation). If you do not send the receipt on time, within the next 10 working days the tax authorities may block the taxpayer’s account (clause 2, clause 3, article of the Tax Code of the Russian Federation).

After sending the receipt, the taxpayer has 5 working days to send explanations or an updated declaration (Clause 3 of Article of the Tax Code of the Russian Federation). For being late in responding to a request, the taxpayer may be fined 5,000 rubles, and for a repeated violation within a year - 20,000 rubles (Article 129.1 of the Tax Code of the Russian Federation). The liability of citizens and officials is up to a fine of up to 1,000 or up to 4,000 rubles, respectively (Clause 1 of Article 19.4 of the Code of Administrative Offenses of the Russian Federation).

Extern notifies if the client is threatened with account blocking or a fine, or helps to rectify the situation

Finally, if you ignore the requirement of the Federal Tax Service, this may attract unwanted attention from tax authorities to the organization, up to the appointment of an on-site audit.

We’ll tell you how to proceed further depending on what you decide to do: file an updated declaration or justify losses.

What indicators do tax authorities pay attention to when auditing an unprofitable company?

- On the ratio of debt and equity capital. It is considered acceptable if the amount of equity capital is greater than borrowed capital. In this case, it will be better if the growth rate of borrowed capital is lower.

- On the growth rate of current assets. It is considered normal if this indicator is greater than the growth rate of non-current assets.

- On the growth rate of accounts receivable and accounts payable. These indicators should be almost the same. Tax officials may be interested in the reason for the increase or decrease in these indicators.

Option 2. Send explanations

If you are not going to revise the declaration, you need to draw up a convincing justification for the amount of losses. It is drawn up in any form, indicating the reasons that resulted in the losses.

Let's look at typical situations in which the tax office requests clarification and provide sample responses to the request.

Based on the results of the reporting (tax) period, a loss was received

This often happens with newly registered businesses or organizations that are developing a new direction and investing a lot of money in the purchase of equipment, real estate, materials, etc.

“Oldies” are also not insured against losses. The reason may be a seasonal drop in demand, a large one-time expenditure, bankruptcy of a counterparty, changes in contract terms, etc.

If the loss was incurred due to coronavirus and the self-isolation regime, there are no specific explanations. The lack of income is understandable, since many companies could not work, but still paid wages, rent, utilities, etc. In the explanation, describe the circumstances and refer to decisions of federal, regional and local authorities, for example, Presidential decrees on non-working days dated March 25. 2020 No. 206, dated 04/02/2020 No. 239.

Loss from the sale of purchased goods

Explanations may also be requested when the loss in the declaration is shown only on the sale of purchased goods. In this case, the tax authorities suspect that the company violated the rules for accounting for expenses when selling goods (Article 268 of the Tax Code of the Russian Federation) or incorrectly distributed expenses into direct and indirect (Article 320 of the Tax Code of the Russian Federation).

First of all, check whether you really sold the goods for less than you bought. If you find an error, please correct it. If everything in the declaration is correct, prepare an explanation.

Reducing the tax base due to losses from previous years

When checking a profitable declaration, the tax office may also require an explanation of losses. This happens if the tax base is reduced in the report due to losses from previous years. This right of tax authorities is not directly stated in the law, but arbitration practice shows that courts can support the desire of tax authorities to interpret clause 3 of Art. The Tax Code of the Russian Federation is expansive (Resolution of the Arbitration Court of the Eastern Military District dated January 18, 2016 N F01-1806/2015 in case No. A11-372/2015).

Report on profits and other taxes via Extern for free

Checking the due date for accounts payable

Not only property, but also debts are subject to inventory. When overdue debts are identified, a manager's order to write off is issued.

This option is used in accordance with clause 18,250 of the Tax Code, clause 78 of the Regulations on maintaining reporting and accounting, approved by order of the Ministry of Finance No. 34n of 1998.

Can the tax office require documents to confirm losses?

Along with explanations, tax authorities often require additional information: an itemized breakdown of costs, accounts payable broken down by counterparty, indicating the time and reason for their occurrence, accounting and tax registers, primary documents, and even sometimes a business plan for making a profit. Is the taxpayer obligated to comply with such requirements?

When giving explanations, including regarding losses, the taxpayer has the right to additionally submit to the tax authority extracts from tax and accounting registers and other documents confirming the accuracy of the data included in the tax return (Clause 4 of Article of the Tax Code of the Russian Federation). At the same time, tax authorities do not have the right to request from the taxpayer additional information and documents not provided for in the article of the Tax Code of the Russian Federation (clause 7 of Article of the Tax Code of the Russian Federation).

The law clearly states that the taxpayer may submit additional documents, but is not required to do so. The official website of the Federal Tax Service states: “On this basis, we will consider it proven that within the framework of the procedure for requesting explanations in accordance with paragraph 3 of Art. Tax authorities of the Russian Federation do not have the right to demand the provision of any documents.”

Nevertheless, clause 8.3 of Art. The Tax Code of the Russian Federation establishes the right of the tax authority to request primary documents and tax accounting registers during a desk audit of an updated declaration filed two years after the deadline for filing the declaration, if it reduces the amount of tax or increases the amount of loss.

Let's summarize

- If you are very afraid of questions and do not want to butt heads with the tax office, do not declare a loss in your reporting. It is your right. Immediately - in the initial reporting - show the profit.

- If, nevertheless, “under pressure” from the controllers, you decide to “remove” the loss and submit an updated declaration, proceed with caution: if the profit in the declaration is insignificant, firstly, you will be required to explain its origin (reasons for adjusting the declaration), and secondly, problems will arise questions based on another criterion – low tax burden. Prepare yourself.

- Advice to an accountant: Print out the correct report and give it to the director for approval (signature). If you need to change it, keep the correct copy of the statements. It is clear that you are unlikely to receive written instructions for adjustments.)) Then, on a copy of the correct report, write down the required amendments yourself by hand (written down from the words. And the date). Save it for yourself. Like insurance. Let it be.

Good luck, friends! And a calm declaration campaign!

There are many well-known tax pitfalls, secret depths and invisible connections, pulling on which can seriously doubt the authenticity of your loss, and even charge additional taxes. And even for such a seemingly understandable tax – income tax. But more about this, my dear colleagues, next time.

What happens if the explanations do not seem convincing to the tax authorities?

In this situation there are three options:

- The taxpayer's official will be called to the “loss commission” (clause 4, clause 1, article of the Tax Code of the Russian Federation).

- Based on the results of the desk audit, additional taxes will be assessed.

- They will come to the taxpayer with an on-site inspection. An audit can be scheduled even after one unprofitable declaration, despite the fact that in the “Concept of the planning system for on-site tax audits” the criterion for assigning an audit in connection with losses is the reflection of losses in the reporting over several tax periods. But such a development is unlikely.

Relevance of the issue

Tax authorities often pay increased attention to unprofitable enterprises. The occurrence of a negative difference between revenues and expenses is regarded by control authorities as a sign of the commission of certain tax offenses: from evasion of mandatory payments to deliberate bankruptcy and fraud.

Recommendations

Of the options presented above for solving the problem, some methods are less risky, others are more risky, some relate exclusively to tax accounting information, others increase income from financial statements. However, in any case, it is necessary to make an informed decision and coordinate it with management.

Meanwhile, lawyers do not recommend adjusting receipts, but reflecting information in accordance with the real state of affairs. Reliable and timely information is of particular practical importance for management accounting. Based on this information, the management of the enterprise can analyze real indicators related to profit not only within one specific period, but also between them.

In addition, any commercial activity involves risk: no one is immune from losses. Accordingly, the Federal Tax Service cannot apply any sanctions to an enterprise for losses incurred if they are justified and not related to illegal actions. In such situations, the main thing is not to shy away from answering the tax authorities’ requests, to give them a breakdown of the company’s indirect and direct costs.

Adjustment of expenses

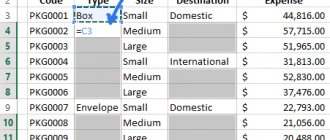

For convenience, the most common options are shown in the table:

| Way | Explanations | Link to normative act |

| Elimination of questionable expenses. | Using this option will not have any impact on your VAT deduction. In addition, the accuracy of the information in the declaration will be maintained. | |

| Identify costs that can be taken into account later. | The company may refuse increasing factors and bonus depreciation. | Articles 258 (clauses 91, 13) and 259.3 of the Tax Code. |

| Recognition of part of expenses as expenses of future periods. | In this case, the company will overpay the tax. In this case, there will be a permanent difference between tax and accounting. | Article 272, paragraph 1. |

Responsibility

Business entities that fail to submit a declaration in a timely manner may be subject to a fine:

- 1 thousand rub. – if the report was not submitted by the head, but the tax was deducted on time, or if the “zero” declaration was not submitted on time.

- 5% of the amount that should be credited to the budget for each month of non-payment, but not more than 30% and not less than 1 thousand rubles.

- 200 rub. – if the calculation (declaration) is not submitted on time at the end of the reporting period.

It should be said that declarations submitted at the end of the year are, in fact, considered tax calculations. Accordingly, the control body cannot impose a fine on a business entity under Article 119 of the Tax Code if it has not been provided with a profit tax calculation. A monetary penalty may be imposed exclusively in accordance with norm 126 of the Code.

Balance Reformation

The final stage after registration of the transfer of losses received during the tax period is Balance Sheet Reformation.

Produced through the Month Closing for December.

Before posting the Balance Reformation , the Repost Documents for a Month operation should not be run; you must skip it. PDF

If this is not done, then the document Loss Transfer Operation of the Month Closing , and the financial result must be calculated without taking into account the specified document.

Final operation Balance Reformation :

- right-click to open the menu and select Perform operation .

Postings according to the document

As a result of the document Reformation of the balance sheet , an accounting entry is generated:

- Dt 84.02 Kt 99.01.1 - losses incurred in the current year are transferred to an account where losses to be covered are accumulated for the entire period of operation of the organization.

The posting for closing account 99.01.1 is not generated in tax accounting, since the loss from this account was transferred earlier using the Transaction document entered manually to account 97.21.

Algorithm for transferring losses received during the year

The registration of the loss transfer operation in 1C 8.3 is carried out on December 31 after the procedure for closing the tax period in which the loss was incurred.

It is important to follow the sequence of actions:

- re-processing of documents for December;

- partial closure of the month, skipping the link Reformation of the balance sheet ;

- loss carry forward operation;

- carrying out the document Reformation of the balance sheet .

Let's take a closer look at the procedure for preparing and conducting documents related to the transfer of losses in 1C 8.3.