Accounting for settlements with accountable persons - postings

The requirements for the execution of cash transactions, including the issuance of accountable amounts, are established by the instruction of the Central Bank of the Russian Federation dated March 11, 2014 No. 3210-U (hereinafter referred to as instruction No. 3210-U).

Directive 3210-U was amended by Bank of Russia directive No. 5587-U dated October 5, 2020, which entered into force on November 30, 2020. For example, the requirement for a 3-day period for submitting an advance report from November 30, 2020 is excluded.

ConsultantPlus experts told us what other innovations in the procedure for recording cash transactions came into effect on November 30, 2020. Get trial access to the K+ system and go to the review material for free.

Accountable persons are persons who have received funds from an enterprise or individual entrepreneur for certain economic (target) needs and are obliged to report on the expenditure of such funds within a specified period of time (or return the balance if not all funds have been spent).

The following may be accountable:

- persons working at an enterprise or individual entrepreneur on a permanent basis;

- part-time workers;

- persons with whom civil contracts have been concluded (clause 5 of Directive No. 3210-U).

For more details, see “Is it possible to report to a non-employee?”

Can an accountable person transfer accountable amounts to another person? You will find the answer to this question in ConsultantPlus. You can get trial access to the legal system for free.

The company's funds are reported to:

- in cash:

- from the cash register of the enterprise;

- in non-cash form:

- to the card of the accountable person;

- to the corporate card of the enterprise, to which the accountable person has received access.

See also: “Purpose of payment when transferring to an accountable person.”

Accounting for accountable transactions has a wide range of possible entries. The most frequently used transactions in settlements with accountable persons are presented in the table:

| Dt | CT | Operation description | Source documents |

| 71 | 50 | Issuing money on account from the company's cash desk | Account cash warrant |

| 20, 23, 25, 26, 44 | 71 | Write-off of costs as enterprise expenses according to the submitted advance report | Advance report, checks, invoices, acceptance certificates for services or work, other documents confirming expenses incurred |

| 10, 15, 41, 07, 08, 11 | 71 | Assets were capitalized based on the advance report | Sales receipts, cash receipts, invoices, and other documents confirming the material expenses of the accountable person |

| 28 | 71 | Means aimed at eliminating manufacturing defects or warranty (post-warranty) service | Warranty service agreement, warranty card, certificate of completion of work, receipt, other documents |

| 68 | 71 | Payment of tax payments through an accountable person | Checks, payment receipts, bank payment documents |

| 91 | 71 | Reflection of other expenses of the enterprise paid by the accountable person | Primary documents confirming expenses |

| 50 | 71 | Return of unused funds by the accountant to the enterprise's cash desk | Receipt cash order, advance report with calculation of the amount of the balance of funds to be returned to the cash desk |

You can learn how to correctly draw up a cash receipt or debit order from the following articles:

- “How is a cash receipt order (PKO) filled out?”;

- “How is an expense cash order (RKO) filled out?”

Advance report

The accountable person is obliged, within a period not exceeding 3 working days after the expiration date for which cash was issued on account, or from the day he returns to work after a business trip, to submit to the accounting department an advance report with attached supporting documents (paragraph 2, paragraph. 6.3 Instructions of the Central Bank of the Russian Federation N 3210-U).

Advance report is a document in which the employee reports for the use of the advance payment issued to fulfill the organization’s instructions. The advance report refers to primary accounting documents (PUD). The advance report form AO-1 is not mandatory for use. The organization in its Accounting Policy is obliged to approve the form of the report on the use of imprest amounts. This can be AO-1 or an independently developed form, which must contain the mandatory details of the PUD.

More details about the Details of the primary accounting document

A report on issued monetary documents is submitted by the accountable person in the same manner as for monetary funds. The report form can be similar to the expense report or developed separately.

In 1C, for reporting on issued accountable amounts and monetary documents, the AO-1 form approved by the State Statistics Committee of the Russian Federation is used (Resolution of the State Statistics Committee of the Russian Federation dated August 1, 2001 N 55). It meets all the requirements of Law N 402-FZ, and it will be convenient for the organization to approve it.

Examples with postings for settlements with accountable persons

Example 1. Receiving money on account for the purchase of goods and materials:

| date | Accounts | Amount, rub. | Operation description | Source documents | |

| Dt | CT | ||||

| 09.21.20ХХ | 71 | 50 | 1 500 | Cash was issued on account to I. I. Ivanov for the purchase of motor oil | Statement by Ivanov I.I., RKO No. 253 dated 09/21/20XX |

| 09.22.20ХХ | 10 | 71 | 1 500 | Motor oil "MOBIL" was received at the warehouse from I. I. Ivanov. | Advance report, sales receipt, cash receipt for RUB 1,500. |

Example 2

Postings with accountable persons sent on business trips.

| date | Accounts | Amount, rub. | Operation description | Source documents | |

| Dt | CT | ||||

| 12.09.20ХХ | 71 | 50 | 3 000 | Cash was issued for reporting to I. I. Ivanov, sent on a business trip | Order on sending on a business trip, RKO No. 243 dated 09/12/20XX |

| 15.09.20ХХ | 44 | 71 | 2 500 | The expenses for the business trip of I. I. Ivanov (sales manager) are reflected in the business expenses of the enterprise | Advance report (check from the hotel for 1,500 rubles, daily allowance for 1,000 rubles), order to establish the amount of daily expenses |

| 15.09.20ХХ | 50 | 71 | 500 | Return by Ivanov I.I. of unused accountable funds to the cash desk | PKO No. 214 dated 09/15/20XX |

See also:

- “What to do if the accountable person has spent his money?”;

- “The accountable person has lost the cash receipt - what to do.”

Power of attorney

An employee whose authority is confirmed by a power of attorney can receive purchased goods or accept work or services.

It can be written out using standardized forms No. M-2 or No. M-2a. They were approved by Decree of the State Statistics Committee of Russia dated October 30, 1997 No. 71a. The forms of these powers of attorney are essentially the same, the only difference is that form No. M-2 has a spine. It is needed to record powers of attorney in the registration journal. Whether to keep such a journal or not is up to everyone to decide for themselves. If you don’t, then it’s easier to use form No. M-2a.

Situation: is it possible to issue an M-2 power of attorney to a citizen who is not an employee of the organization?

Answer: yes, you can.

The instructions approved by Resolution of the State Statistics Committee of Russia dated October 30, 1997 No. 71a provide that a power of attorney in form No. M-2 can only be issued to employees of the organization. However, the Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated August 13, 1996 No. 1792/96 states: from the moment the first part of the Civil Code of the Russian Federation came into force (from January 1, 1995), powers of attorney on behalf of a legal entity are drawn up taking into account the requirements of Article 185 of the Civil Code of the Russian Federation. This norm allows the right to issue a power of attorney to any person, and not just an employee (clause 1 of Article 185 of the Civil Code of the Russian Federation).

In addition, there is no prohibition on giving cash on account to a person working under a civil contract. And the accountant needs a power of attorney to receive goods and materials.

Thus, current legislation allows the issuance of a power of attorney to receive goods and materials to people who are not employees of the organization.

Similar conclusions follow from the decision of the Supreme Court of the Russian Federation dated June 6, 2011 No. GKPI11-617.

Instead of standardized ones, you can also use forms developed independently. The main thing is that the document contains all the necessary details. Whatever form you use, it is first approved by the manager with an order to the accounting policy.

This is provided for by Part 2 of Article 9 of the Law of December 6, 2011 No. 402-FZ and paragraph 4 of PBU 1/2008.

Set the validity period of the power of attorney depending on the possibility of receiving and exporting the relevant valuables according to the order, invoice, invoice or other document replacing them. However, the maximum and minimum terms of validity of a power of attorney are not established by law. If this period is not specified in the power of attorney, then it will be valid for one year from the date of issue (clause 1 of Article 186 of the Civil Code of the Russian Federation).

Situation: is it necessary to issue a power of attorney to an accountable person in order for him to act on behalf of the organization?

Answer: no, not necessarily. The legislation does not contain such a requirement.

However, if you do not issue a power of attorney to the employee, the organization may have problems receiving an invoice. It is this document that serves as the basis for deducting VAT on goods (work, services) purchased through an employee (clause 1 of Article 172 of the Tax Code of the Russian Federation).

Difficulty in obtaining an invoice may arise because when selling for cash, retailers have the right not to issue invoices, but to limit themselves to cash receipts (Clause 7, Article 168 of the Tax Code of the Russian Federation). Acting without a power of attorney, an employee of an organization acts as an ordinary person purchasing things for personal use. Therefore, the seller is not obliged to issue him an invoice.

But if the employee presents a power of attorney from the organization, the supplier will have to issue an invoice. In this case, the employee will act on behalf of the organization, and the seller will have the obligation to issue the required document (Clause 3 of Article 168 of the Tax Code of the Russian Federation).

This position is set out in the letter of the Ministry of Taxes and Taxes of Russia dated October 10, 2003 No. 03-1-08/2963/11-AL268.

Results

This article shows the most common entries for accounting for settlements with accountable persons.

The main regulatory document regulating the rules for processing the issuance and return of accountable funds through the cash desk is the instruction of the Central Bank of the Russian Federation No. 3210-U. For other options for issuing funds to accountable persons, it is necessary to be guided by the provisions of the Law “On Accounting” dated December 6, 2011 No. 402-FZ, Russian accounting standards, and internal administrative documents of the enterprise. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Accounting

Expenses incurred through an accountable person should be reflected in accounting on the day the advance report is approved. At this moment, the employee who received the money on account is written off his debt (instructions approved by Resolution of the State Statistics Committee of Russia dated August 1, 2001 No. 55).

Depending on the purposes for which the money was spent, write off the costs to different accounts.

If an employee only paid the organization’s expenses (without receiving the property itself), for example, made an advance payment for communication services, reflect it like this:

Debit 60 Credit 71

– prepayment for goods (work, services) has been made through an accountable person.

An example of making an advance payment through an accountable person

On April 3, the manager of Alpha CJSC A.S. Kondratyev was given 4,000 rubles. to make an advance payment at the corporate rate for cellular communication services.

On April 5, Kondratyev paid money to the mobile operator and provided an advance report to the accounting department. On the same day, the head of Alpha approved the report.

Alpha's accountant made the following entries in accounting.

April 3:

Debit 71 Credit 50 – 4000 rub. - money was issued for reporting to Kondratiev.

5th of April:

Debit 60 Credit 71 – 4000 rub. – prepayment for cellular communication services was made through an accountable person.

If an employee purchased property for the organization (fixed assets, materials, goods), then reflect its value by posting:

Debit 08 (10, 41) Credit 71

– property acquired through an accountable person has been capitalized.

Example of purchasing goods through an accountable person

On April 3, the secretary of Alfa CJSC E.V. Ivanova was given 2,000 rubles. for the purchase of stationery for the organization.

On April 5, Ivanova bought stationery for this entire amount. (The purchase was not subject to VAT, since the seller applied a simplified procedure.) On the same day, the head of Alpha approved the employee’s advance report, and the accountant accepted the received materials for accounting.

Alpha's accountant made the following entries in accounting.

April 3:

Debit 71 Credit 50 – 2000 rub. – money was issued against Ivanova’s report.

5th of April:

Debit 10 Credit 71 – 2000 rub. – stationery purchased through an employee has been received.

If the accountable person accepted work or services (for example, an employee repaired a company car), then make the following entry for their cost:

Debit 20 (23, 25, 26, 29, 44) Credit 71

– services were provided (work performed) purchased through an accountable entity.

If the accountable person paid for work (services) of a non-productive nature, then document it with the following entry:

Debit 91-2 Credit 71

– non-production expenses are reflected.

Payments to suppliers in cash

Fill in the required fields in the input form:

•Operation—payment operation is selected from the drop-down list. In this case, you should select Issue from the cash register.

•The date of the document (cash order) is specified manually.

•Number—the serial number of the cash receipt order is entered automatically, but can be changed manually.

•This advance payment to the supplier is indicated if the payment is made in advance (prepayment for goods not yet delivered/services not yet provided).

•The recipient's account is selected from the chart of accounts. There can be almost any account here: supplier (60th, 76th, etc.), employee (71st, 70th, 73rd, etc.), etc.

•The recipient is filled in automatically after selecting the account.

•The basis of payment is selected from the list, but it can be specified manually.

•Amount—the document amount is entered manually.

•VAT rate - specified manually, used only when paying the supplier.

•VAT amount—the VAT amount from the total payment amount is calculated automatically.

•Attachment - the corresponding column of the cash receipt order, can be selected from the list.

•Through, Document cert. personal received

Step-by-step instruction

May 10 Ivanov A.P. received funds on the corporate card for the purchase of fuel and lubricants in the amount of 5,000 rubles.

On May 11, the amount of 2,400 rubles was paid on the card.

On May 15, the amount of 2,400 rubles was paid on the card.

On May 16, Ivanov presented an advance report, according to which he refueled a Ford Mondeo with AI-95 gasoline:

- On May 11, a cash receipt for (60 l.) in the amount of 2,400 rubles. (including VAT 20%);

- On May 15, a cash receipt for (60 l.) in the amount of 2,400 rubles. (including VAT 20%).

Cash receipts with allocated VAT confirming expenses for fuel and lubricants are attached to the advance report.

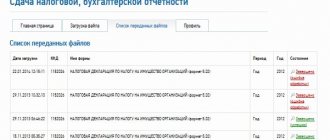

Let's look at step-by-step instructions on how to make a payment using a corporate card in 1C. PDF

| date | Debit | Credit | Accounting amount | Amount NU | the name of the operation | Documents (reports) in 1C | |

| Dt | CT | ||||||

| Transfer to a corporate card | |||||||

| May 10 | 55.04 | 51 | 5 000 | Transfer to a corporate card | Debit from current account - Transfer to another account of the organization | ||

| Payment to the supplier from a corporate card | |||||||

| May 11 | 71.01 | 55.04 | 2 400 | 2 400 | Transfer of payment to the supplier | Debiting from a current account - Transfer to an accountable person | |

| Payment to the supplier from a corporate card | |||||||

| May 15 | 71.01 | 55.04 | 2 400 | 2 400 | Transfer of payment to the supplier | Debiting from a current account - Transfer to an accountable person | |

| Employee advance report for the purchase of fuel and lubricants | |||||||

| 16th of May | 10.03.1 | 71.01 | 4 000 | 4 000 | 4 000 | Acceptance of materials for accounting | Advance report - Products tab |

| 19.03 | 71.01 | 800 | 800 | Acceptance for VAT accounting | |||

| 91.02 | 19.03 | 800 | VAT write-off | ||||

| HE.01.9 | — | 800 | Reflection of expenses not taken into account in tax accounting | ||||

In what cases is it more practical to pay through accountable persons?

Cash is used when it is necessary to quickly purchase goods or transfers from the organization’s current account are impossible. For example, an employee bought something at his own expense and needs to reimburse the expenses incurred.

The main purposes of expenses through accountable entities:

- Travel expenses including travel and accommodation.

- Purchase of materials (raw materials for production, office supplies, spare parts for vehicles, consumables for office equipment, etc.).

- Payment for services (mobile communications, translator or notary services, minor repairs of office equipment or transport, and others).

- Payment of state fees to various authorities (courts of all jurisdictions, Gostekhnadzor, traffic police and others).

Transfer to a corporate card

Settlements on the corporate card are accounted for in account 55.04 “Other special accounts” (chart of accounts 1C).

To replenish a corporate current account, complete the document Write-off from the current account transaction type Transfer to another account of the organization in the Bank and cash desk section - Bank statements - Write-off button.

Let's look at the features of filling out the document Write-off from a current account using this example.

A corporate card that is not linked to a current account is entered in the Bank Accounts .

Postings according to the document

The document generates transactions:

- Dt 55.04 Kt - transfer of funds to a corporate card.

Peculiarities of documenting the purchase of goods through an accountable person from private individuals

Purchasing goods from private individuals is typical for public catering organizations. Quite often, such organizations purchase agricultural products from the population at markets.

To formalize the purchase of agricultural products from the population, a procurement act of form N OP-5, approved by Resolution of the State Statistics Committee of Russia dated December 25, 1998 N 132, is used.

In accordance with this Resolution, the procurement act (form N OP-5) is drawn up in two copies at the time of purchase of agricultural products from the population (seller) by a representative of the organization. The act is signed by the person who purchased the products and the seller, approved by the head of the organization. One copy of the purchase act is given to the seller, the second remains with the buyer.

When paying an individual income in the form of the cost of vegetables, the question arises about the need to withhold the appropriate tax. However, in accordance with paragraph 13 of Article 217 of the Tax Code of the Russian Federation, taxpayers’ income received from the sale of crop products grown on private farms located on the territory of the Russian Federation is not subject to taxation. The specified income is exempt from taxation provided that the taxpayer submits a document issued by the relevant local government body, the boards of gardening and gardening partnerships, confirming that the products sold were produced by the taxpayer on a plot of land owned by him or his family members, used for running personal subsidiary plots, dachas construction, gardening and vegetable gardening.

Yu.N.Talalaeva

Spend accountable amounts only for permitted purposes.

Previously, it was prohibited to spend cash received at the cash desk, except for individual transactions. Now there is no list of exceptions. But there is a list of permitted operations.

This means that the accountable person also has the right to spend the amount of accountable funds issued from the cash register only for permitted purposes, in particular, to pay for goods (except for securities), works, and services.

For example, you cannot issue a loan from the accountable amount unless you are a specialized organization (microfinance or consumer cooperative). For such a violation you can be fined up to 50,000 rubles.