In 2021, the employer pays the employee temporary disability benefits for the first 3 days of illness, a funeral benefit for a family member of the deceased employee, and also pays 4 additional days off for the parent employee to care for a disabled child. The employee receives all other benefits (sickness starting from the 4th day, pregnancy and childbirth, child care up to 1.5 years, disability due to an industrial injury, etc.) from the Social Insurance Fund.

For how long is sick leave paid by the employer? From the day the employee submitted the certificate of incapacity for work to the accounting department, the employer has 10 calendar days to assign his part of the benefit. And it must be paid on the nearest payday after the granting of benefits, established in the organization (Part 1, Article 15 of the Law of December 29, 2006 N 255-FZ).

Example

. Employee Petrov M.N. I was sick from February 25 to March 2, 2021. He went to work on March 3 and on the same day handed over a certificate of incapacity for work to the accounting department. In accordance with local regulations, salaries to employees of the organization are paid no later than the 22nd of the current month and no later than the 7th of the next month.

In this case, the last day for assigning temporary disability benefits to an employee is March 12, 2021. And it must be paid along with wages no later than March 22, 2021.

We figured out how long sick leave is paid for. But in addition to the period when the company must pay sick leave, Law 255-FZ also determines the period when the employee must submit this sick leave to his employer. The employee must submit sick leave to the accounting department within 6 months after restoration of working capacity, the end of the period of release from work in connection with caring for a family member or determination of disability (Part 1 of Article 12 of the Law of December 29, 2006 N 255-FZ).

What benefits will the FSS transfer?

The Social Insurance Fund will pay the following benefits:

- for temporary disability (including due to an accident at work and (or) occupational disease);

- for pregnancy and childbirth;

- a one-time benefit for women who registered in the early stages of pregnancy;

- lump sum benefit for the birth of a child;

- monthly child care allowance.

Under the direct payment system, additional leave will be paid to an employee injured at work.

Sick leave on vacation: how is it paid?

Getting sick while on vacation is a very unpleasant event. The fact that the illness fell on vacation days is not an obstacle to obtaining a sick leave certificate. Moreover, if you fall ill after going on regular leave, its duration will be increased by days of illness, and during the illness, disability benefits will be paid in the usual manner.

There are situations when the employer is given a certificate of incapacity for work, issued during vacation, after the employee has returned to work. In this case, vacation days that coincide with sick days should be rescheduled. It is necessary to request a transfer application from the employee, agreeing on the terms in which vacation days will be taken in the future.

Deadlines for preparation and transmission of documents, payment of benefits

The accounting department of the organization, in accordance with Resolution No. 294, must receive an application and supporting documents from the employee no later than 5 calendar days

from the date of receipt, send them to the territorial body of the Fund with information for the appointment and payment of the appropriate benefit. That is, documents are sent to the fund in the form of an electronic register.

If the accounting department does not transfer all documents to the Fund or the information is incomplete, the territorial body of the Fund will send a notice within 5 working days about the need to provide the missing information.

Missing documents or information must be transferred to the fund within 5 working days from the date of receipt of the notice.

Payment of benefits to employees is carried out by the territorial branch of the Social Insurance Fund within 10 calendar days

from the date of receipt of the application and documents necessary for the assignment and payment of benefits.

Payment of benefits to employees is made:

- by transferring benefits to the bank account specified in the application or in the information register,

- through the federal postal service organization,

- through another organization at the request of the employee (his authorized representative).

Procedure for registration and closure of sick leave

If the certificate of incapacity for work is submitted on time, the employee will be assigned and paid benefits for days of absence due to illness, injuries, the prenatal period of pregnancy and after childbirth.

Medical organizations that have the appropriate licenses, upon recovery of the person seeking help, fill out a unified form of a certificate of incapacity for work, which provides for the doctor to indicate:

- period of treatment and periodic examinations;

- discharge dates.

The attending physician can conduct a course of treatment for up to 15 calendar days. If a person is not yet ready to return to work due to health reasons, the decision to extend sick leave is made by a medical commission.

When closing the certificate of incapacity for work, they indicate the date when the person can begin performing his work duties.

Speaking about the deadline for submitting sick leave to the employer, you need to take into account that, first of all, the submitted document will confirm the presence of good reasons why the employee was absent. As a rule, immediately after returning to work, sick leave is taken.

Transferable benefits for child care up to 1.5 years

If the company, as of January 1, 2021, has female employees on maternity leave and receiving benefits, the last time they need to pay benefits is for December 2020. In fact, this payment is made on the day of payment of wages to employees for December.

Then, you need to get an application and documents about the birth of the child from the employee. All documents must be submitted to the FSS. The fund will pay benefits for an employee on maternity leave for January.

The accountant’s task is to receive the child’s application and birth certificate on time, so as not to leave the employee without money.

For how long is sick leave paid?

The procedure for issuing sheets for personal illness or caring for a family member (Order of the Ministry of Health and Social Development No. 624n dated June 29, 2011) sets the maximum duration of sick leave at 12 months.

All employee sick days are paid. If the employee cared for a family member, payment is made in the following order:

- for an adult or if a child is over 15 years old - no more than 30 days per year and no more than 7 days in one case;

- for a child from 7 to 15 - no more than 45 days per year and no more than 15 days in one case;

- if the child is under 7 years old - no more than 60 days per year (in exceptional cases - 90);

- for a disabled child - no more than 120 calendar days per year.

How does the organization submit information: electronically or on paper?

Companies whose average number of employees for the previous billing period exceeds 25 people submit to the Social Insurance Fund at the place of registration the information necessary for the appointment and payment of benefits in electronic form in the formats established by the Fund.

Companies with an average number of employees of 25 people or less have the right to provide information on paper to the Social Insurance Fund.

When does the Social Insurance Fund pay benefits under the direct payment system?

How will the transition to direct payments from the Social Insurance Fund affect the work of an accountant in 2021?

Who pays the benefit

The timing of payment of sick leave in 2021 depends on who will accrue and pay out funds.

In general, the payment is made by the employer. For the first 3 days, the benefit is accrued from the employer’s funds, the further period is paid by the Social Insurance Fund, reimbursing the employer for the amounts paid to the employee. In some cases (for example, maternity benefits), the benefit is fully paid for by social insurance.

If the employer is unable to pay the benefit, the Social Insurance Fund decides to transfer the funds due to the person entitled to the benefit and makes the payment. The reasons for this decision are (clause 4 of article 13 of law No. 255-FZ):

- termination of activities by the employing company;

- lack of funds in the company’s accounts, taking into account the established order of payments;

- lack of funds and property at the expense of which a court decision to pay for sick leave can be executed;

- bankruptcy.

The terms for paying sick leave in such cases, as a rule, increase - in particular, while collecting the necessary documents confirming the impossibility of receiving funds.

In addition, in most regions, in 2021, there is a Social Insurance pilot project (based on Government Decree No. 294 dated April 21, 2011), according to which benefits accrued from Social Insurance funds are not reimbursed to the employer (he only pays for the first 3 days of sick leave), and directly transferred to the employee’s personal account.

A package of documents for submission to the Social Insurance Fund for direct payments

The list of documents that must be submitted to the Social Insurance Fund for the calculation of direct payments depends on the type of benefit.

To calculate a one-time benefit for a woman who registered for pregnancy in the early stages

, the employer must send to the Social Insurance Fund:

- application in any form;

- a certificate from the antenatal clinic with the seal of the medical institution and the signature of the doctor.

To calculate maternity benefits

on sick leave for 140 days or more, the accountant is required to send to the regional office of the Social Insurance Fund:

- application in any form;

- certificate of incapacity for work;

- certificate of earnings for the pay period.

It is worth noting that if the sick leave was issued electronically, the accountant must redirect it to the Social Insurance Fund.

At the birth of a child, one of the parents is entitled to a lump sum benefit,

the amount of which from 02/01/2020 is 18,004 rubles 12 kopecks (indexed annually). To appoint him, the accountant sends the following documents to the regional office of the Social Insurance Fund:

- application in any form;

- a copy of a certificate from the registry office about the birth of a child or another document confirming the birth of a child, provided that the birth took place in another country;

- a copy of a document confirming that the child’s second parent did not apply for a one-time benefit at the birth of the child (issued by the employer or the social security department, provided that the second parent is unemployed).

Provided that the marriage of the child’s parents was dissolved

, the accountant must request from the applicant for a one-time benefit upon the birth of a child and additionally submit to the Social Insurance Fund:

- a copy of the divorce certificate;

- a certificate confirming the fact of cohabitation with the child.

After the maternity sick leave expires, the employer sends a package of documents to the Social Insurance Fund for calculating child care benefits for children up to 1.5 years old.

, which includes:

- an application, the form of which was approved by Order of the Federal Social Insurance Fund of the Russian Federation dated November 24, 2017 No. 578;

- a copy of the child's birth certificate;

- copies of birth or death certificates of previous children (if available);

- certificate of earnings for the billing period;

- a document from the second parent’s place of work confirming the fact of non-receipt of child care benefits for a child under 1.5 years of age.

If the applicant works in several jobs, then it is additionally necessary to submit documents confirming that he did not submit a similar application for child care benefits for children up to 1.5 years old from other employers

(for example, if the employee works part-time somewhere else).

The package of documents for receiving child care benefits does not change depending on who will apply for the benefits: mother, father or grandmother

.

To calculate temporary disability benefits

, the accountant will have to send to the regional office of the Social Insurance Fund:

- an application, the form of which was approved by Order of the Federal Social Insurance Fund of the Russian Federation dated November 24, 2017 No. 578;

- a copy of the certificate of temporary incapacity for work (or electronic sick leave);

- certificate of earnings for the pay period.

Provided that the employee was injured at work, then in addition to the above documents, a copy of the accident report or copies of all materials from the production investigation are sent to the Social Insurance Fund, provided that the case has not yet been completed.

To calculate payment for additional leave for treatment

employee, the employer sends to the Social Insurance Fund:

- a copy of the application for the provision and payment of leave;

- a copy of the leave order;

- a certificate calculating the amount of vacation pay, the form of which was approved by Order of the Federal Social Insurance Fund of the Russian Federation dated November 24, 2017 No. 578.

It is worth noting that in the application for any type of benefit it is necessary to indicate the method of receiving the payment. This could be a bank account or postal order. If the applicant plans to receive payments to a bank card, then in the application you can indicate the current account of any card (not necessarily a salary card) of any payment system. But from October 1, 2021, all benefits will be accrued only to bank cards of the MIR payment system.

How to reflect benefits in the calculation of insurance premiums

The calculation of insurance premiums was approved by Order of the Federal Tax Service dated September 18, 2019 No. ММВ-7-11/ [email protected] Fill it out as usual. Prepare Appendix No. 2 to Section 1 taking into account the following features:

- in field 001 “Payer tariff code”, enter code “1”;

- enter zeros on pages 070 and 080.

Do not include Schedules 3 and 4 to Section 1 unless the policyholder paid the benefit before participating in the pilot project. For example, if the region in which the employer is registered joins the project in the middle of the year or the company registered in the region participating in the project after moving. In this case, complete Appendices 3 and 4 only for the benefit costs incurred prior to participating in the pilot project.

Useful information from Consultant+

Question: The organization participating in the pilot project of the Federal Social Insurance Fund of the Russian Federation is in the process of liquidation. One of the employees is disabled and will continue to be sick after dismissal and liquidation of the organization. How can such an employee receive temporary disability benefits? How much is this benefit paid? See the answer here.

Sick leave for part-time work

An employee has the right to receive benefits for each place of work if, at the time of issuing sick leave, he works simultaneously for different employers and in the previous two calendar years he worked for them or for others.

Since the place of work is not filled out on the electronic sick leave and a part-time job is not marked, a part-time employee can be issued one electronic certificate of incapacity for work for all of his employers. The employee reports the sick leave number for each place of work in any convenient way - in person, by phone or via instant messengers.

But in order to do this, employers must have an exchange of electronic sick leave with social insurance. If there is no agreement with the fund, then the employee needs to issue paper certificates of incapacity for work for each place of work.

If an external part-time worker had other employers in the two calendar years preceding the illness, he will receive one sick leave - in electronic or paper form. It must be provided at one of the last places of employment of your choice.

Who is required to provide payment?

Features of calculating benefits

enshrined in

Article 3 of Federal Law No. 255 of December 29, 2006

. In accordance with the provisions of the regulatory legal act, compensation insurance payments are distributed as follows:

- The first 3 days are at the expense of the company

. - The rest of the period is compensated from the Social Insurance Fund

.

Only citizens who have transferred all necessary contributions to the extra-budgetary fund have the right to receive payments. If a person is hired by an officially registered organization, the employer assumes the responsibility for paying the necessary amounts to the Social Insurance Fund. If the reason for the inability to perform professional duties is caring for a child or an incapacitated relative, payment is made entirely from the Social Insurance Fund budget.

In accordance with Article 7 of Federal Law No. 255 of December 29, 2011

, the slip can be paid even after dismissal, if the period of temporary incapacity for work occurs within 30 days from the date of termination of cooperation with the company.

In this situation, the payment amount will be 60%

. The length of work experience is not taken into account.

Pilot project

The pilot project is a large-scale experiment by the Social Insurance Fund aimed at improving the functioning of the entire social insurance system. It was started in 2011, the first regions were the Nizhny Novgorod region and the Karachay-Cherkess Republic. Its difference lies in the mechanism for paying benefits.

Typically, the intermediary between the Fund and the employee is the employer, who makes insurance payments. Then the Social Insurance Fund pays the employer the money spent. The more elements in the system, the higher the costs.

To reduce them, the FSS decided to gradually introduce a system of direct payments. This means excluding the employer from the payment chain. Payment for sick leave at the expense of the Social Insurance Fund is transferred directly from the Fund to the employee.

At the moment, the pilot project covers 14 regions; in the summer of 2016, six more will join the experiment. Now the Belgorod, Novosibirsk, Rostov, Samara regions and some others are participating in it.

A complete list of regions can be found on the official website of the FSS. The Republic of Crimea and the city of Sevastopol are also participating in the project.

There are great hopes for this large-scale experiment. It should benefit insured citizens, employers, the Fund itself, as well as medical institutions.

For employees, the result should be a reduction in conflict situations with the employer, as well as the opportunity to choose the method of receiving money (bank/post) . Problems with delayed payments should be eliminated.

For employers, modernization will reduce the costs associated with calculating benefits. The FSS takes over this function. For the Social Insurance Fund and medical institutions, a significant increase in operational efficiency is expected, as well as a reduction in bureaucratic costs.

Innovations

For employees, the procedure for obtaining sick leave will remain the same. Sick leave is submitted to the administration at the place of work. The most important difference is the change in the payment mechanism. The money is transferred by the Social Insurance Fund directly to the employee.

The employer is excluded from the chain, so the employee receives sick leave at the expense of the Social Insurance Fund, and not at the expense of the employer. The benefit can be received on a bank card or at a post office. The fund must begin paying benefits no later than ten calendar days (from submission of the application).

As part of the project, a new form of certificate of incapacity for work was developed for employers (insurers). Another innovation is the calculation of payments. Now it is produced by the Social Insurance Fund department, and accordingly the bureaucratic burden on the enterprise is reduced.

The employer is obliged to submit a package of documents to the Fund branch or the Internet gateway for sending sick leave to the Social Insurance Fund within five calendar days. Since the program is aimed at increasing efficiency, the transition to electronic accounting methods is being introduced. If a company employs more than 25 people, submission must be done electronically.

The register of sick leaves in the Social Insurance Fund is still under development. At the moment, there is an xls file created by the Foundation. It can be found on the official website of the FSS.

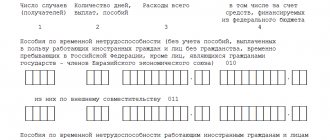

The photo shows a sample register of sick leave for reimbursement to the Social Insurance Fund:

The Foundation allows the use of “homemade” and commercial solutions. The main requirement when compiling a register is its suitability for computer processing. Some companies offer ready-made solutions for compiling a register, for example, the 1C program.

Let's sum it up

- Starting from 2021, the rules of the FSS pilot project, which provided for the application of social benefit payments directly from the fund, apply to the entire territory of Russia. This entails the actual abolition of the offset mechanism for determining the amount of contributions actually transferred to the fund.

- The fund is given the right to pay all social benefits, except for that part of the disability benefit that is paid from the employer’s funds. Funeral benefits, social payments from the federal budget in excess of those provided for by the legislation on compulsory social insurance, and payments for additional days off provided to care for a disabled child remain reimbursed for the employer (according to the application submitted by him to the Social Insurance Fund).

- In terms of benefits, the payment of which is transferred to the fund, employers become an intermediate link between the insured person (employee) and the Social Insurance Fund. Their functions are limited to collecting and transmitting to the fund the data necessary for calculating benefits, storing documents containing this data, timely informing the fund about the loss of the right to benefits, and advising their employees regarding the rights to payments.

- The procedure for applying for benefits will not change for the employee. He will still submit an application and a set of documents confirming his right to benefits to the employer. But the fund will review these documents, make decisions on them, calculate benefits and pay them to the employee.

When sick leave is paid at a later date

In the event that the sick leave is not submitted immediately after its expiration date, the payment deadlines are postponed, but not more than by 6 months. If the sick leave is submitted after this period, by law the insured loses the right to receive benefits (Part 1, Article 12 of the Federal Law No. 255).

The legislator has established not only how long sick leave is paid, but also responsibility for delays in payment. For each day of delay in payment of sick leave benefits, the insured is entitled to compensation (Article 236 of the Labor Code of the Russian Federation).

We are ready to answer any questions you may have - ask them in the comments

Missing a sick leave deadline

The law obliges working citizens to submit documents for the calculation of social insurance payments within 6 months from the day when:

- the attending physician has made a decision about the person’s ability to return to work;

- a specially created medical commission established permanent disability and recognized a working or non-working disability group, recommending light work in special conditions.

But what to do if the deadline is missed and the employer does not accept documents for payment?

For a good reason

The list of grounds that can be considered valid in case of missing time for taking sick leave is approved by Order of the Ministry of Health and Social Development No. 74, current as amended on October 5, 2009. These include:

- unforeseen circumstances that cannot be prevented (natural disasters such as earthquakes, hurricanes, floods, fires, etc.);

- if the course of treatment of an illness or rehabilitation after injuries took a longer period than 6 months;

- relocation of the interested person to a new place of residence;

- recognized illegal dismissal of an employee or removal from his position, as a result of which he was forced to be absent from work;

- loss of loved ones due to death or the need to provide outside care for them due to deteriorating health;

- circumstances recognized by a court decision as preventing the provision of documents for payment.

If there are documents confirming the presence of any of these factors that prevented a timely application when the employer must pay sick leave, an application with originals or copies attached is submitted to the territorial Social Insurance Fund (FSS).

For no good reason

If the applicant cannot explain in any way the reason for the delay in submitting documents from a medical institution confirming the completion of treatment or rehabilitation, he will be denied social benefits.

An interested person has the right to challenge the decision of the employer or the Social Insurance Fund through the court or the territorial labor inspectorate.

What to do if sick leave payment has not been received

The Social Insurance Fund pays sickness benefits to the citizen’s bank card, the details of which are provided by the employer along with the certificate of incapacity for work. In the absence of a bank card, the transfer is carried out by mail to the residence address of the benefit recipient. Why is the Social Insurance Fund delaying payment of sick leave in 2021? There may be several reasons for this:

- Errors in the certificate of incapacity for work that prevent the accrual of benefits.

- The certificate of incapacity for work was not transferred by the employer to the Fund.

- Incorrect details of the benefit recipient.

- The technical error.

Each employee has the right to monitor the status of his sick leave if he is registered on the State Services portal. Information about all electronic certificates of incapacity for work of a citizen is available in the personal account on the Foundation’s website. To enter it, enter the login and password of your registration record on State Services.

In addition, in order to determine where to call for sick leave payment and find out the reasons for non-payment of benefits, we suggest following the following algorithm:

- Contact your employer with a request to transfer information to the Social Insurance Fund.

- If the employer confirms that all information has been transferred to the Social Insurance Fund, contact the Fund with a request using a single number. Contacts of the regional office are listed on the main page of the RO FSS website of your region. To check the information you will need SNILS and the number of the certificate of incapacity for work.

New issuance procedure

The previous procedure for issuance and registration is replaced by Order of the Ministry of Health No. 925n dated September 1, 2021. Now the rules are prescribed for electronic certificates of incapacity for work.

In order for a medical institution to issue sick leave electronically, the patient must give written consent, show a passport (or other identification document) and SNILS. For the paper version, a passport is sufficient. When applying for electronic sick leave to care for sick family members, you will need their SNILS (if any).

If the certificate of incapacity for work has a continuation, it can be obtained in paper or electronic form. It does not matter in what format the primary sheet was issued.

Only those employers who have entered into an agreement on information interaction with the regional department of social insurance and have acquired an enhanced qualified electronic signature (ECES) can accept electronic sick leave.

The list of those entitled to sick leave has become longer. They added:

- managers who are listed as the only participants (founders, property owners) of their organization;

- convicts who are serving imprisonment and involved in paid work.

Information has appeared about whom a certificate of incapacity for work will be issued only in paper form:

- for the unemployed, to confirm a valid reason for failure to appear at government employment offices;

- women dismissed due to the liquidation of an organization if they became pregnant within 12 months before they registered at the labor exchange as unemployed.

Terms and procedure for payment of electronic sick leave

An electronic certificate of incapacity for work, or, as it is also called, an electronic sick leave certificate, has become officially operational in Russia since mid-2021. At the request of the insured person and with his written permission, a document indicating temporary disability can be issued by a medical organization in electronic form. Electronic sick leave is recognized as equivalent to paper sick leave, and the amount of its payment does not depend on the chosen form.

The technology for processing and issuing electronic sick leave does not require either printing the document or sending it directly from the medical organization to the employer. The interaction between the employee, the employer and the medical institution occurs through the FSS information system - UIIS "Sotsstrakh". It stores the electronic sick leave from creation to closure.

Not only public clinics and hospitals can create a sick leave certificate electronically, but also private ones, for example, clinics connected under VHI.

Electronic sick leave: how to apply for an employee

What steps must an employee go through to receive sick leave in a paperless format?

As mentioned at the beginning, electronic sick leave can only be issued by workers after submitting a written application to the medical institution. The attending physician must give the employee a form for such an application, and he, in turn, must fill it out. The sick person informs the medical organization about SNILS.

After the doctor “closes” the sick leave sheet (as he “discharges” the patient), the medical organization will create an electronic sick leave sheet in the Social Insurance Unified Information System and fill out its part in it. The doctor will give the employee a special coupon, which will contain the number of the electronic sick leave certificate. The employee does not need to receive anything else from the medical institution - no stamps, no signatures.

All that is then required from the employee is to transfer the electronic sick leave number to the employer - to the appropriate service, usually human resources. You do not need to provide the ticket itself.

Electronic sick leave: what an employer must do to start working

The transition to electronic certificates of incapacity for work is voluntary for the employer; no sanctions are provided for working with these documents only in paper form.

We will consider the procedure for connecting electronic sick leave certificates below.

The first thing that needs to be done is to conclude an agreement with the FSS to begin information interaction.

The second necessary and mandatory action is to buy an enhanced qualified electronic signature. Then install an electronic sick leave verification program at the workplaces of employees who will work with electronic sick leave technology.

Taxcom Certification Center offers various electronic signatures, including for B2G document flow and reporting to government agencies.

The third step is to purchase software from which the organization's employees will work with this electronic document. You can use both software provided by the state (for example, the personal account of an FSS policyholder) and special accounting programs and services. Such software is provided by many EDF operators. We’ll talk about Taxcom’s solutions for exchanging data and documents with the Social Insurance Fund in the field of electronic sick leave below.

The final step is to inform all employees of the organization that they can start requesting sick leave from a doctor electronically.

An electronic sick leave number has been received from an employee: what to do next?

After the employer has received the number of the electronic sick leave sheet, he must use the above-mentioned specialized software to find the sheet in the Social Insurance Unified Information System.

After a successful search for sick leave, it is requested from the FSS. In the document, fill in all the columns in the “To be completed by the employer” section. The electronic version of the sick leave sheet contains the same columns as the printed one.

After filling out, you need to put an electronic signature on the document and save it. The data will be automatically sent to the Social Insurance Fund and the employer will be able to make sick leave payments. This procedure applies to regions that have not yet switched to direct payments from the Social Insurance Fund under the pilot project.

Who should pay sick leave

Sick leave is paid by both the employer and the Social Insurance Fund. Depends on whether the first one is on direct payments or works on a credit basis.

In the first case, the first 3 days of incapacity are paid by the employer, the remaining days by the Social Insurance Fund.

In the second case, when using the credit system, the sick leave is paid by the organization in full, and the Social Insurance Fund will reimburse its expenses afterwards.

How electronic sick leave is paid: terms

Payment for an electronic sick leave is the same as for a paper one; the selected option does not affect the assignment of benefits.

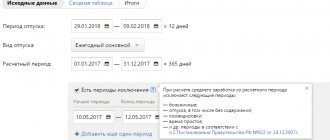

The procedure for paying for electronic sick leave is as follows. If the organization is located in a region of the Russian Federation in which the “Direct Payments” pilot project is not being implemented, then within 10 days from receiving the sick leave number from the employee, the employer assigns a benefit. He calculates the amount of the benefit and indicates it in certain columns of the document. The payments themselves for electronic sick leave are made with the next salary - that is, similar to the procedure for paying sick leave on paper.

If the employer is located in a region participating in the FSS pilot project, then the payment procedure changes slightly. Within up to 5 days, the employer is obliged to transfer information about the employee to the Social Insurance Fund, and within up to 10 days, the Social Insurance Fund must pay sick leave.

Payment for electronic sick leave: how the payment is calculated

In addition to the fact that you need to understand how sick leave is paid, you also need to know how to pay for electronic sick leave, what formulas to use? Let us remind you that both electronic and paper sick leave are paid exactly the same.

Sick leave payments depend on the minimum wage established in the country. The minimum cost of a sick day starts from this amount.

For those employees who have an official total work experience of more than eight years, sick leave is paid according to the standard formula: average employee earnings X 24 months / 730 days = the cost of one day of earnings. It turns out that the payment is made as for the day worked, that is, 100 percent.

To calculate the total amount of payment, it is enough to multiply the average daily income received by the number of days indicated on sick leave.

If the employee’s work experience is less than eight years, then special coefficients will help in calculating payments for electronic sick leave.

With experience up to six months

The cost of one day of sick leave will be calculated based on the minimum wage established for the year.

With experience from six months to five years

the entire amount of sick leave payments will be calculated as 60% of the calculated average cost of one day.

With five to eight years

the entire amount of sick leave payments will be calculated as 80% of the calculated average cost of one day.

What is important: if sick leave is issued to an employee due to an occupational disease, work injury or pregnancy and childbirth, then the above coefficients do not apply. Sick leave in such situations is paid at 100 percent.

Average earnings are calculated for the two years preceding the employee receiving sick leave.

What Taxcom offers for working with electronic sick leave certificates

Document flow for electronic sick leave is available in all Taxcom reporting solutions, but we will focus on the simplest and most lightweight web account, Online Sprinter. It does not require the installation of additional programs; all work takes place online in the browser via a secure connection.

Working with electronic sick leave in the service is not at all difficult. Go to “Create reports and documents”, select “FSS”, “Sick leave”.

The sprinter will issue all forms of documents for working with electronic sick leave certificates. When filling out, the service will indicate the fields that are required. The error checking system will indicate incorrectly completed or missing fields, and the user will be able to return to the document to correct them before sending it to the regulatory authority.

In addition to reporting, Sprinter has functionality for electronic document management with counterparties (B2B).

Reporting to HR

Electronic sick leave document flow is part of the personnel document flow in an enterprise. Often, HR officers have to work not only with sick leave, but also with other reporting - for example, to the Pension Fund. Not long ago, a new form for reporting to this regulatory body appeared - SZV-TD.

Taxcom offers the “Personnel” tariff, which, in addition to the exchange of electronic documents with the Social Insurance Fund (for filling out electronic certificates of incapacity for work), includes an exchange with the Pension Fund of the Russian Federation (for submitting SZV-TD reports on electronic work books). The kit also includes a CEP.

You can find out more about personnel reporting and order a tariff in a special section of the Taksky website.

Other solutions

In addition to cloud solutions, the functionality of electronic sick leave is also available in Taxcom software solutions. A dockliner is software that is installed on a computer. Among the advantages of this software is a multi-user mode with differentiated access rights.

You can send reports and exchange documents with the Social Insurance Fund and directly from the interface of your usual accounting system thanks to the solution ]1C: Electronic reporting[/anchor]. It also allows multiple users to work simultaneously in the system.

electronic sick leave electronic sick leave

Send

Stammer

Tweet

Share

Share

Responsibility for failure to provide information for calculating benefits to the Social Insurance Fund

For late submission of documents for calculating benefits to the Social Insurance Fund, the employer may be held administratively liable in the form of a fine in the amount of 300 to 500 rubles.

Provided that the employer sends a package of documents with errors or incomplete information to the Social Insurance Fund, the Social Insurance Fund branch will send a notice to the organization about the need to make corrections. Consequently, the employee will receive benefits with a delay.

It is worth noting that if the employer provides inaccurate information that directly affects the amount of the benefit, the organization will have to reimburse the excess expenses incurred by the Social Insurance Fund.

This situation may occur if the employer does not promptly submit information to the Social Insurance Fund about the termination of the accrual of benefits in relation to the employee.

. The FSS department will calculate and pay benefits for which the payment period has already ended. The employer will have to reimburse the overpaid benefit amount, since the Social Insurance Fund does not have the right to make deductions from the insured person’s wages.

A similar situation can occur if the employer knowingly provides information according to which the employee will be entitled to an increased amount of benefits (unreliable indication of the amount of wages, actual time worked or the period of official employment). After identifying inaccurate information, the FSS department will issue a claim for reimbursement of excessive expenses to the general director.

The Ministry of Labor has currently prepared a draft Federal Law providing for stricter liability of employers for failure to provide data or inaccurate information

in the package of documents. It should be noted that this draft Federal Law has not yet been submitted to the State Duma for consideration; it is at the stage of general discussion.

It provides for the following types of employer liability:

- a fine of 200 rubles for each document not submitted if the employer refuses to send the required documents;

- full reimbursement of excessively incurred expenses for payment of benefits, provided that the employer did not promptly inform the Social Insurance Fund about the termination of payment of benefits or provided distorted data for the accrual of sick leave and maternity leave;

- a penalty of 20% of the amount of excess expenses incurred for the payment of benefits in the amount of no less than 1,000 rubles and no more than 5,000 rubles if false data is provided or if the Social Insurance Fund office is not notified in a timely manner about the termination of accrual and payment of benefits;

- a fine of 5,000 rubles if the deadline for submitting a package of documents necessary for calculating benefits is violated.

What are the requirements for filling out and general appearance of a sick leave certificate?

In accordance with the existing legislation of Russia, a document on a citizen’s incapacity for work must be drawn up in accordance with existing rules, such rules include:

- The format of the sheet on which the necessary fillings are made must correspond to A4 dimensions.

- Availability of FSS watermarks confirming the authenticity of the document.

- Presence of yellow and blue colors.

- The sheet contains a special barcode containing the number of the document being issued.

- There are requirements that also apply to the handwriting used to fill out a sick leave form. It must be in printed form and must be readable.

- In addition, according to business standards, any kind of corrections in the certificate are not allowed.

Note!

All payment calculations in accordance with the law are made using the 1C electronic system, as well as on the official website of the Federal Insurance Service.

Further, after filling out the sheet, it is sent to the place of demand. According to the legislation of the Russian Federation, the employer has the right to verify the authenticity of the document provided.

This is important to know: How sick leave is paid without experience