Documentation of a business trip

To send an employee on a business trip, you first need to issue an appropriate order.

To do this, it is better to use the unified form No. T-9. Drawing up an order in free form is also possible (on this matter, see letters from Rostrud dated January 23, 2013 No. PG/10659-6-1, dated February 14, 2013 No. PG/1487-6-1), but in practice it may raise questions from inspectors. But a travel certificate, official assignment and report on its implementation from 01/08/2015 are not mandatory. The regulation on the specifics of sending employees on business trips, approved by Decree of the Government of the Russian Federation of October 13, 2008 No. 749 (hereinafter referred to as Regulation No. 749), no longer contains instructions on the mandatory execution of these documents. Let's figure out whether it is possible to completely abandon them.

Even if the company issues a travel certificate, the person to whom the employee is sent may not put a mark on the certificate, since such an obligation also no longer exists. The sole purpose of a travel certificate is to confirm that the employee was actually where he was sent. But this can also be confirmed directly by documents indicating the fulfillment of the purpose of the trip. For example, if an engineer was sent to a client to repair equipment, then he must bring a certificate of completion of work signed by the client. If you are attending a seminar - materials from this seminar. It turns out that a travel certificate in most situations does not contain valuable data and does not need to be issued.

The same can be said about the official task and the report on its implementation. After all, the purpose of the trip is directly reflected in the order to send the employee on a business trip, and the completion of the task can also be confirmed by other documents. And the manager will not approve the expense report if the task is not completed.

Thus, it appears that both documents can be completely safely abandoned. In this case, it is necessary to make changes to the regulations on business trips or other local regulations that determine the procedure for sending employees on business trips. Since the forms of primary accounting documents are approved simultaneously with the accounting policy (clause 4 of PBU 1/2008 “Accounting Policy of the Organization”), it is also necessary to make changes to the approved list of forms and exclude the travel certificate and official assignment from it.

If the organization does not refuse to issue a travel certificate and official assignment, the obligation to issue them must also be enshrined in a local regulatory act. Because previously they were issued by virtue of direct instructions in Regulation No. 749, but now there is no such instruction.

Let us remind you that upon returning from a business trip, the employee is obliged to submit an advance report and make a final payment for the advance payment issued to him for travel expenses (clause 26 of Regulation No. 749).

Contributions from industrial accidents and occupational diseases

Contributions for accidents at work and occupational diseases are calculated on the income of employees. An exception is the payments listed in the List of payments for which insurance contributions to the Social Insurance Fund of the Russian Federation are not calculated, approved by Decree of the Government of the Russian Federation of July 7, 1999 N 765 (hereinafter referred to as the List of Payments).

According to clause 10 of the List of Payments, contributions are not accrued on amounts paid in the form of reimbursement and compensation within the limits established by the legislation of the Russian Federation:

— daily allowances within the limits established by law;

- payment of housing rental costs;

— compensation for the cost of tickets;

— reimbursement of other expenses related to the employee’s performance of work duties.

As is known, from January 1, 2009, the daily allowance norm established by law is 100 rubles. (Resolution of the Government of the Russian Federation dated 02/08/2002 N 93), canceled on the basis of Decree of the Government of the Russian Federation dated 29/12/2008 N 1043.

Therefore, insurance premiums for insurance against industrial accidents and occupational diseases should only be calculated for daily allowance amounts that exceed the daily allowance established by a collective agreement or local regulations. This is stated in the Letter of the FSS of the Russian Federation dated March 18, 2009 N 02-18/07-2165.

If an organization pays daily allowances to posted employees in the amount established by a collective agreement or local regulations, insurance premiums for insurance against industrial accidents and occupational diseases should not be charged.

VAT deduction on travel expenses

According to paragraph 7 of Art. 171 of the Tax Code of the Russian Federation, VAT deduction is allowed only for those travel expenses that are accepted for profit tax purposes. And this restriction applies not only to part of the standardized expenses (this provision was canceled as of 01/01/2015), but in general to any reasons why certain expenses may not be accepted in tax accounting.

However, there are no rules regarding travel expenses for calculating income tax. That is, if expenses are actually incurred (for activities aimed at generating income subject to VAT) and are documented, then they are recognized when taxing profits, and the corresponding VAT is deducted in the general manner.

Thus, for living expenses, the basis for deduction is, as a rule, an invoice. But you don't need an invoice to deduct travel expenses. After all, tickets, itinerary receipts for electronic air tickets or control coupons for railway electronic tickets are strict reporting forms; they themselves are the basis for a deduction. This is indicated in clause 18 of the Rules for maintaining a purchase book (approved by Decree of the Government of the Russian Federation of December 26, 2011 No. 1137).

If the tax is not highlighted on the ticket, but is highlighted on a separately issued invoice, then from 10/01/2014 it can also be deducted. After all, clause 18 of the Rules for maintaining a purchase book now allows you to register in the book not only a strict reporting form or a copy thereof, but also an invoice. Let us recall that previously tax authorities objected to deductions on invoices in such a situation (letters from the Federal Tax Service of Russia for Moscow dated August 31, 2009 No. 16-15/090448.1, dated January 10, 2008 No. 19-11/603).

The tax is accepted for deduction after the use of the ticket and approval of the advance report in which this ticket will be reflected. Until this moment, it is impossible to confirm that transportation services have actually been provided and accepted for accounting. Well, VAT in relation to intermediary services is accepted for deduction in the general manner: on an invoice, after these services are accepted for accounting.

How to calculate business trip days for which you need to pay daily allowance

Payment of daily allowances for business trips in 2021 must be made for the entire period, starting from the day the business trip begins, which is considered the day of departure, until the day of arrival, inclusive. Including if departure and arrival fall on weekends and holidays. Travel documents are used to confirm the location of the traveler at the destination.

If, in order to complete a management assignment, after returning from one business trip, an employee goes on another on the same day, then compensation for that day is made for one of the trips. If the organization’s internal regulations provide for compensation for both trips of a business traveler at once, then this is not a violation; such expenses are recognized as justified.

When calculating compensation amounts, it is necessary to take into account that the day of departure is the day of departure of the vehicle in which the employee travels to the destination from the locality where his place of work is located. And the day of arrival is the day of arrival from a business trip, i.e. returning back to the place of main work.

Cost calculation example

When sending a vehicle before 00 o'clock, the day of departure is considered the current day, in case of departure after 00 o'clock - the next day. Payments for the day of departure are made in full. The employee's arrival day is also calculated. If the arrival occurred before 00 o'clock, then the day of arrival is determined by the current day, if after 00 o'clock, then the next one. Payment is also made in full. For example, if an employee was sent on a business trip by management on 12/31/2019 at 23:58, and arrived on 01/14/2019 at 00:15, then the day of departure is considered to be December 31, and the day of arrival is January 14, and payment for these days is made in full. The total duration of the trip was 15 days, for which payment must be made.

Tickets: how to reflect them in accounting

To complete the employer’s task, the employee must travel to and return from the business trip. The employer must either compensate the employee for travel expenses or pay for them himself.

It’s easiest for an accountant when an employee purchases tickets on his own. Then they are indicated in the advance report, and their cost, after approval of the advance report, is included in travel expenses. In accounting, in this case, only expenses are reflected on the basis of the advance report.

However, if employees travel regularly on business, it is cheaper for the company to purchase tickets on its own behalf. The accounting procedure in this situation changes. A purchased ticket is a monetary document, which must be reflected in the organization’s records at the time of receipt. At the same time, its cost cannot be immediately attributed to expenses: paying for a ticket is actually an advance payment to the carrier for a trip in the future.

To make a trip, a ticket is issued to an employee. In accounting at this point, the cost of the ticket must be included in settlements with the employee as an accountable person, since the ticket is also issued to the employee for reporting, and after returning from a business trip it is included in the advance report. In this case, expenses are recognized on the date of approval of advance accounting (including in tax accounting).

This scheme also applies to electronic tickets. After all, these are also documents confirming the passenger’s right to travel. Moreover, the route receipt and control coupon are strict reporting forms (part “a”, paragraph 2, paragraph 1 of the appendix to the Order of the Ministry of Transport of Russia dated November 8, 2006 No. 134; paragraph 2 of the Order of the Ministry of Transport of Russia dated August 21, 2012 No. 322) .

Will anything change if the ticket is purchased through an intermediary? In this case, the accounting for the ticket itself remains the same as described above. But the costs of paying the intermediary’s commission, if they are paid separately from the cost of the ticket, can be written off immediately after receiving the relevant documents from the intermediary.

Since the cost of a ticket is a payment under the contract of carriage, it cannot be included in expenses before the carriage has taken place. And the services of the agent through whom the ticket was purchased will be considered fully provided at the time of receipt of the ticket, which means that his remuneration can be immediately included as an expense in both accounting and tax accounting.

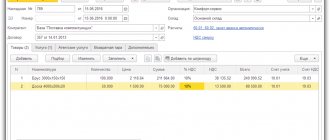

Let's look at an example.

The employee was sent on a business trip from April 6 to April 9. To do this, the employer (trade organization) purchased electronic air tickets through an intermediary at a cost of 11,800 rubles. (including VAT 1,800 rubles), which he received on March 30 and handed over to the employee on the same day. The agent's remuneration was 590 rubles. (including VAT 90 rubles), the agent’s report is approved simultaneously with receipt of tickets. VAT is highlighted in the itinerary receipt of each ticket as a separate line, and an invoice for his fee was received from the agent. The advance report was approved on April 10.

How to reflect the situation in accounting, see the table. In tax accounting, travel expenses are recognized on April 10 (the date of approval of advance accounting), and expenses in the form of agent remuneration are recognized on March 30 (the date of provision of his services).

What are daily allowances and what are they used for?

To make it easier to understand payments, we will try to answer the question: daily allowance and travel allowance - what is the difference? According to Art. 167 Labor Code of the Russian Federation:

- travel allowance is a cash advance up to the amount due for necessary expenses. What is included in travel expenses? Accommodation, travel, meals. This payment is accountable;

- daily expenses are compensation to an employee for the time he or she is on a business trip (calendar days). What does the daily cost for a business trip include? Spending on additional services or goods without prior approval from the employer. With this money you will not have to submit accounting reports.

IMPORTANT!

Please note: the question “what is included in daily travel expenses?” essentially incorrect. Daily allowance is part of travel expenses along with travel expenses, rental of accommodation, travel costs, etc. The employee must report for them within 3 days of arrival, providing supporting documents and drawing up an advance report.

Clause 11 of the Regulations on Business Travel, approved by Decree of the Government of the Russian Federation of October 13, 2008 No. 749, regulates payment for time spent on a work trip. According to this document, daily allowances are paid not only for working days, but also for weekends, holidays, time spent on travel, possible stops and delays along the way. In this case, the employee is required to pay the average salary.

An employee rests at the location of a business trip

Let’s say an employee spends some time at the place of business trip, using it for recreation: he stays for vacation after the business trip or, conversely, first uses vacation, and then performs an official task in the same place. In this case, is it possible to recognize travel expenses for an employee in tax accounting and is it necessary to withhold personal income tax from the amount of such expenses?

According to the financial department, if the period of stay at the place of business trip significantly exceeds the period established by the order on sending on a business trip, then in fact travel is paid not to or from a business trip, but to or from vacation. In this case, the cost of travel is recognized as the employee’s income for personal income tax purposes (letters of the Ministry of Finance of Russia dated July 30, 2014 No. 03-04-06/37503, dated September 12, 2013 No. 03-04-08/37693).

At the same time, the Ministry of Finance’s explanations regarding travel expenses are contradictory. In some letters, officials indicate that expenses cannot be recognized in tax accounting (letters from the Ministry of Finance of Russia dated November 20, 2014 No. 03-03-06/1/58868, dated November 8, 2013 No. 03-03-06/1/47813). In others, such expenses can be taken into account, but only if the delay or earlier departure occurred with the permission of the manager, who confirms the expediency of the expenses. After all, the expenses would still have been incurred regardless of the date of their implementation (letters dated August 11, 2014 No. 03-03-10/39800 (clause 2), dated July 30, 2014 No. 03-04-06/37503 (clause 2) and etc.).

But if an employee stays at the place of a business trip (or goes on a business trip in advance) for the weekend, expenses can be taken into account in any case (letter of the Ministry of Finance of Russia dated November 20, 2014 No. 03-03-06/1/58868), and the employee’s income for personal income tax purposes costs travel is not recognized (letter of the Ministry of Finance of Russia dated August 11, 2014 No. 03-03-10/39800).

Also read about how to calculate payments during business trips and how to confirm a business order.

simplified tax system

Simplified organizations that pay a single tax on the difference between income and expenses, when calculating the single tax, documented expenses for renting housing during a business trip are recognized in the actual amount. This procedure also applies if an internal document of the organization establishes a standard (limit) for reimbursement, but in fact the documented living expenses exceeded this value. This follows from the provisions of paragraph 1 of Article 252, subparagraphs 8, 13 of paragraph 1, paragraph 2 of Article 346.16 of the Tax Code of the Russian Federation and is confirmed by letter of the Ministry of Finance of Russia dated July 4, 2012 No. 03-04-06/6-204. Although this letter is addressed to income tax payers, the conclusions drawn in it are also relevant for simplified organizations (the object “income minus expenses”). The composition of travel expenses that are taken into account for taxation is defined in the same way in subparagraph 13 of paragraph 1 of Article 346.16 and subparagraph 12 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation.

Travel expenses can be written off only after confirmation of their payment (clause 2 of Article 346.17 of the Tax Code of the Russian Federation).

Expenses that are not confirmed by primary documents do not reduce taxable income. Similar explanations are given in the letter of the Ministry of Finance of Russia dated April 28, 2010 No. 03-03-06/4/51. Despite the fact that the letter is devoted to taking into account the costs of renting housing when calculating income tax, the conclusions drawn in it are also valid for taking into account such costs in the case of applying a simplification (clause 2 of Article 346.16, clause 1 of Article 252 of the Tax Code of the Russian Federation).

If a simplified organization pays a single tax on income, then the costs of renting residential premises do not reduce the tax base. When calculating the single tax, such organizations do not take into account any expenses at all (clause 1 of Article 346.14, clause 1 of Article 346.18 of the Tax Code of the Russian Federation).

An example of how expenses for renting residential premises are reflected in taxation. The organization applies simplification. Object of taxation – the difference between income and expenses

Alpha LLC applies a simplified tax system and pays a single tax on the difference between income and expenses.

Alfa manager A.S. Kondratyev was on a business trip to Chelyabinsk from March 16 to 18.

On March 19, the head of Alpha approved the advance report submitted by Kondratyev.

Along with the expense report, Kondratyev submitted to the accounting department all the documents that confirm his expenses. They include a hotel bill in the amount of 5310 rubles. (including VAT – 810 rubles).

When calculating the advance payment for the single tax for the first quarter, Alpha’s accountant included in the costs compensation for rental housing costs in the amount of 5,310 rubles.

Situation: how to take into account when calculating the single tax when simplifying the payment for renting apartments for the accommodation of seconded employees?

Include as expenses only that part of the rent that was paid during the period the employee actually lived in the apartment.

If an organization rents private housing on a permanent basis, a long-term rental agreement can be concluded with its owner. The amount of rent in the contract can be specified for any period. However, when calculating the single tax, it will not be possible to take into account the entire amount of expenses. Rent for the period when the rented property was empty cannot be included in expenses. After all, rent for the period when the organization does not use the apartment is recognized as economically unjustified (clause 1 of article 252, clause 2 of article 346.16 of the Tax Code of the Russian Federation).

It is possible to justify expenses only for those days when a seconded employee lives in the rented apartment (subclause 8, 13 clause 1 of article 346.16 of the Tax Code of the Russian Federation). To do this, the organization has the right to use documents that indirectly confirm the fact of residence (for example, travel documents, business trip orders, etc.) (paragraph 4, paragraph 1, article 252, paragraph 2, article 346.16 of the Tax Code of the Russian Federation). For more information about documenting expenses for rental housing, see How to reimburse travel expenses for rental housing.

A similar conclusion is contained in letters of the Ministry of Finance of Russia dated March 25, 2010 No. 03-03-06/1/178, dated June 20, 2006 No. 03-03-04/1/533 and dated January 25, 2006 No. 03- 03-04/1/58. Although these letters are addressed to organizations under the general tax regime, the conclusions given in them are also relevant for organizations under the simplified tax regime (clause 2 of Article 346.16, clause 1 of Article 252 of the Tax Code of the Russian Federation).

Advice: if you justify the costs, you can take into account, when calculating the single tax, the costs of renting an apartment in another city in the full amount, regardless of the actual residence of seconded employees in it.

Expenses for renting an apartment, regardless of the fact that an employee is staying in it, can be considered economically justified (clause 1 of article 252, clause 2 of article 346.16 of the Tax Code of the Russian Federation). Firstly, in another city over the same period of time, the average cost of renting an apartment may be less than the average cost of a hotel room. Secondly, expenses can be taken into account as payments for leased property under subclause 4 of clause 1 of Article 346.16 of the Tax Code of the Russian Federation, and not as expenses for business trips (subclause 13 of clause 1 of Article 346.16 of the Tax Code of the Russian Federation).

Any rental property may not be used every day. But this does not mean that rental payments can be considered economically justified only in the part that relates to days of use (see, for example, the resolution of the Federal Antimonopoly Service of the Moscow District dated February 11, 2009 No. KA-A40/325-09).

At the same time, if an organization decides to take into account the costs of apartments rented for business travelers without taking into account their actual use, it will most likely have to defend this point of view in court.

An example of accounting for the costs of renting a private apartment for business travelers. The organization applies a simplification (object “income minus expenses”)

Alpha LLC, located in Moscow, pays a single tax on the difference between income and expenses. The organization has a production branch in Tver. To coordinate work on the implementation of new technologies, Alpha employees are systematically sent to the branch. For their accommodation, the organization rents a private apartment in Tver. According to the agreement with its owner, the rent is 6,000 rubles. per month. On a monthly basis, the parties pay under the agreement and sign an act for the provision of rental services.

The owner of the apartment is not an individual entrepreneur. Therefore, when transferring rent, Alpha’s accountant withholds personal income tax from it at a rate of 13 percent. The organization maintains accounting in full.

In March, the following people who were sent on a business trip lived in a rented apartment:

- manager of the organization A.S. Kondratiev (5 days);

- General Director A.V. Lviv (10 days).

The following entries were made in Alpha's accounting:

Debit 26 Credit 76 – 6000 rub. – the rent for an apartment for accommodation of seconded employees is taken into account;

Debit 76 Credit 68 subaccount “Personal Income Tax Payments” – 780 rubles. (RUB 6,000 × 13%) – personal income tax is withheld from the apartment landlord;

Debit 76 Credit 51 – 5220 rub. (6000 rub. – 780 rub.) – rent is listed.

When calculating the single tax, Alpha's accountant included rent for the actual days of residence in expenses. The amount of expenses was: 6000 rubles. : 31 days × (5 days + 10 days) = 2903 rub.

Situation: how to take into account when calculating the single tax when simplifying the cost of renting a living space if during a business trip the employee lived with relatives?

The cost of living can be included as an expense when calculating the single tax.

If during a business trip an employee lived with relatives and was charged for housing, the organization can take into account these expenses (subclause 8, 13 clause 1 of article 346.16 of the Tax Code of the Russian Federation). But only under one condition: if the amount of costs is confirmed by a primary document (clause 1 of article 252, clause 2 of article 346.16 of the Tax Code of the Russian Federation). Such a document, in particular, may be an act on the provision of services, drawn up in any form (see, for example, Resolution of the Federal Antimonopoly Service of the North-Western District dated February 26, 2008 No. A26-1621/2007). It must contain all the mandatory details provided for in Part 2 of Article 9 of the Law of December 6, 2011 No. 402-FZ. For more information on documenting expenses for renting housing from private individuals, see How to reimburse travel expenses for renting housing.