A social tax deduction (STD) is provided to a citizen who, using personal funds, paid contributions under a voluntary life insurance agreement:

- in your favor;

- in favor of their close relatives: spouse (including widows, widowers), children* (including adopted children and wards), parents (adoptive parents).

* Please note: the age of the taxpayer’s children in this case does not matter, i.e., you can receive a deduction for the costs of life insurance for children who have reached the age of majority.

In what cases can you get a tax deduction for life insurance?

You can take advantage of the social tax deduction for life insurance and get part of your expenses back under the following conditions:

1. A voluntary life insurance contract is concluded with an insurance organization for a period of at least five years.

Example: In 2021 Dorogina S.V. entered into a life insurance contract for a period of 1 year. Due to the fact that the contract was concluded for a period of less than 5 years, S.V. Dorogina received a social deduction for the costs of paying insurance premiums. will not be able to use it.

Example: Platonov G.A. entered into a life insurance contract in 2021 for a period of 7 years. For insurance premiums that Platonov G.A. pays annually, he will be able to receive a tax deduction.

2. The contract was concluded to insure one’s own life or the following relatives:

- spouse (including widows, widowers),

- parents (including adoptive parents),

- children (including adopted children under guardianship (trusteeship)).

Please note: unlike the deduction for treatment/education, there are no restrictions on the age of children, that is, a deduction can be obtained even for the costs of life insurance for your adult children.

3. You officially work and pay income tax. At its core, a tax deduction is the portion of income that is not subject to tax. Therefore, you cannot get back more money than you transferred to the income tax budget. This is about 13% of the official salary. If you do not officially work and do not pay income tax, then you will not be able to take advantage of the deduction.

Refund amount

The final tax compensation depends on the cost of life insurance and the income tax paid by the employer, but should not exceed 13% of the insurance amount. However, a citizen cannot receive more than 120 thousand rubles for personal income tax return from life insurance.

When deciding on a tax refund, data starting from 2015 is taken into account; the date of conclusion of the agreement does not matter. Until this time, legislation did not give citizens the right to receive compensation.

When using a deduction, a citizen of the Russian Federation must use the policy in the future. If this requirement is not met, a reverse calculation will be carried out, unless the contract is terminated for reasons that could not be influenced by the will and desire of the parties.

It turns out that in order to receive a tax refund for life insurance, it is necessary to comply with the initial conditions and renew the contract in a timely manner.

Amount of tax deduction for life insurance

The amount of tax deduction for life insurance is calculated for the calendar year and is determined by the following factors:

1. You can return up to 13% of the costs of insurance premiums , but not more than 15,600 rubles . This is due to the restriction on the maximum deduction amount of 120,000 rubles (120,000 rubles * 13% = 15,600 rubles).

Example : In 2021 Savelyev O.A. entered into a life insurance agreement with an insurance company for 5 years. In 2020, the amount of insurance premiums was 75,000 rubles. For 2021 Savelyev O.A. earned 400,000 rubles and paid income tax of 52,000 rubles. Thus, for 2021 he will be able to return 9,750 rubles (75,000 * 13%).

Moreover, the limit of 15,600 rubles applies not only to the deduction for life insurance, but to all social deductions. The amount of all social deductions (training, treatment, medicines, pension contributions) should not exceed 120 thousand rubles, that is, you can return a maximum of 15,600 rubles for all deductions. In other words, the maximum limit of 120,000 rubles limits the total aggregate amount of all types of social deductions.

Example : In 2021 Belkina A.A. entered into a life insurance agreement with an insurance company for a period of 5 years. In 2020, she paid insurance premiums in the amount of 45,000 rubles. Also in 2021 Belkina A.A. paid for her own training in the amount of 100,000 rubles. For 2021 Belkina A.A. earned 600,000 rubles and paid income tax of 78,000 rubles. Since in total for all types of social deductions the maximum limit is 120,000 rubles, then Belkin A.A. will be able to claim only 120,000 rubles. Thus, for 2021 she will be able to return 15,600 rubles (120,000 * 13%).

2. You cannot get back more money than you transferred to the income tax budget (about 13% of the official salary).

Example : In 2021 Zaitseva O.A. entered into a life insurance agreement with an insurance company for 5 years. In 2020, the amount of insurance premiums was 60,000 rubles. In 2021 Zaitseva O.A. worked for one month (due to maternity leave), and her salary was 40,000 rubles, from which 5,200 rubles of income tax were withheld. Thus, for 2020, O.A. Zaitseva will be able to return only 5,200 rubles (40,000 * 13%) despite the fact that insurance premiums were paid in the amount of 60,000 rubles. The balance of the tax deduction cannot be carried forward to subsequent years and will expire.

3. Receiving a deduction is possible only for life insurance premiums. When concluding a combined contract, which includes, in addition to voluntary life insurance and insurance against accidents and illnesses, a social tax deduction in accordance with paragraphs. 4 paragraphs 1 art. 219 of the Tax Code of the Russian Federation can be provided under such an agreement only in the amount of insurance premiums related to voluntary life insurance. More details below.

Insurance cost

The cost of insurance can be anything - it all depends on your financial capabilities. The amount of the tax deduction is affected proportionally by the amount of insurance, but within the limits of the maximum amount that limits the total amount of social benefits.

Example: Your policy costs 50,000 rubles, and the state can reimburse you 13% of this amount. This means that after filing the declaration you will receive 6,500 rubles. If your policy costs 185,000 rubles (more than one hundred and twenty thousand), then you will receive 24,050 rubles, that is, 13% of the maximum amount of social benefits.

Is it possible to get a deduction for insurance when lending?

When applying for a mortgage, one of the conditions of the lending bank is often the conclusion of a mixed insurance agreement, including insurance of life, health, and property interests for the period of repayment of the mortgage. According to paragraph 4 of paragraph 1 of Article 219 of the Tax Code of the Russian Federation, when paying premiums under a life insurance contract (if it is concluded for a period of 5 years or more), you can receive a tax deduction. In this regard, the question arose: is it possible to receive a deduction in such a case? Some taxpayers have even already received a deduction for life insurance costs under such contracts.

However, the Ministry of Finance of the Russian Federation in its letter dated August 17, 2016 N 03-04-05/48235 clarified that when concluding this type of agreement, the deduction cannot be used, since the beneficiary is the bank, and not the persons who paid the insurance premiums.

Example: In 2021 Novikov A.V. To purchase an apartment, a mortgage loan agreement was drawn up, and at the request of the creditor bank, a mixed insurance agreement was concluded, including life insurance, health insurance, property interests and title insurance. Due to the fact that, in accordance with the terms of the insurance contract, the beneficiary of the amount of the insurance payment is the bank, receive a tax deduction for life insurance expenses Novikov A.V. can not.

Borrowers' life insurance

If the taxpayer took out a policy because the bank required it when applying for a loan, for example, a mortgage, then a deduction for the insurance is not provided. This is due to the fact that the beneficiary under the terms of the agreement is the credit institution that issued the loan. The policy is also issued indicating such insured events as disability of 1-2 groups and death as a result of an accident. This type of agreement (if it is not combined) does not provide for savings that can be received at the end of a certain period.

Documents required to apply for a tax deduction for life insurance

The Tax Code of the Russian Federation does not provide a list of these documents. However, they can be identified based on the available explanations from regulatory authorities:

- declaration 3-NDFL;

- voluntary life insurance contract;

- payment documents confirming payment of insurance premiums;

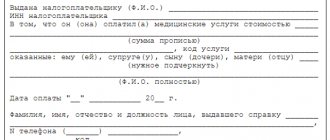

- documents confirming the paid income tax (certificate 2-NDFL).

You can view the full list of documents here: Documents for tax deductions for life insurance

What it is

An income tax refund refers to a situation where a taxpayer who has paid personal income tax to the federal budget on income is refunded part of the tax paid through a tax agent (employer) or by transferring funds directly from the tax authorities.

For example, a citizen paid 30 thousand rubles in personal income tax in 2018. Some article of the Tax Code of the Russian Federation states that he has the authority to make such and such a deduction in the amount of actual monetary expenses incurred for such and such a purpose (treatment, training, charity, etc.). This means that these actual expenses need to be multiplied by 13% - the resulting value will be the amount due for return from the state budget.

When and for what period can I receive a tax deduction?

You can only get your life insurance money back for those years in which you directly paid the premiums . Let us note that the right to deduct the amount of insurance premiums under voluntary life insurance contracts has been granted to taxpayers since January 1, 2015 (clause 4, clause 1, article 219 of the Tax Code of the Russian Federation).

However, you can submit a declaration and return the money only in the year following the year of payment . For example, if you paid insurance premiums in 2021, you can return the money in 2021.

Procedure for receiving a deduction

A taxpayer has the right to apply for START:

1. To the tax authorities at the place of residence (electronically through the portal of the Federal Tax Service or State Services, through Russian Post).

List of documents:

- declaration in form 3-NDFL (in addition to the deduction amount, the form must include information from the certificate of income and the amount of accrued and withheld tax received from the employer, and the certificate itself must be attached to the declaration);

Note:

1. Currently, a certificate in form 2-NDFL for past tax periods can be obtained through the Federal Tax Service portal (State Services) without contacting the employer.

2. Copies of the following documents are attached to the declaration as attachments, and the originals are presented to the inspector only for verification and remain in the hands of the taxpayer.

3. Citizens who submit a declaration solely for the purpose of obtaining a deduction (i.e., are not required to independently declare their income) are not tied to the reporting deadlines established by the Tax Code of the Russian Federation. At the same time, you need to remember that you can apply for START no later than 3 years from the end of the tax period in which the right to a deduction arose (for example: you need to claim a deduction for expenses on insurance premiums paid in 2017 no later than 2021).

- insurance contract with additional agreements to it (insurance policy);

- payment documents confirming payment of the insurance premium (contributions under the contract): checks, statements, receipts;

- a document confirming the degree of relationship of the applicant with the family member for whom the insurance is issued (birth (adoption) certificate of the child, act establishing guardianship of the child, birth certificate of the taxpayer himself, marriage certificate);

- death certificate of the policyholder spouse (if necessary);

- application for a personal income tax refund in the form approved by order of the Federal Tax Service of Russia dated February 14, 2017 No. ММВ-7-8/ [email protected] (Appendix No. 8).

The tax office must check the submitted documents and make a decision within a period not exceeding 3 months from the date of receipt of the declaration. If everything is in order with the documentation, then the funds will be transferred at a time to the taxpayer’s personal account specified in the personal income tax refund application within 30 days.

2. To the employer , having previously confirmed the right to a deduction with the inspectorate.

List of documents to apply to the Federal Tax Service:

- application for receipt of notification in the recommended form given in the letter of the Federal Tax Service of Russia dated January 16, 2017 No. BS-4-11/ [email protected] ;

- the documents listed in the previous paragraph confirming the right to deduction (the 3-NDFL declaration is not submitted).

After 30 days, the tax authority will issue a notice of eligibility for START.

List of documents for the employer:

- application for the provision of strategic offensive arms in any form;

- notification of the right to apply a deduction received from the Federal Tax Service.

The employer does not return the money to the employee, but gives him wages taking into account the deduction (that is, he does not withhold personal income tax in the amount of 13%) from the month following the month of filing the application.

Requirements for insurance documentation

To receive a refund, it is necessary that an agreement with the insurer or non-state pension fund be concluded in accordance with the requirements contained in tax legislation:

- the contract must provide for the procedure, amount and timing of payment of the insurance premium (insurance contributions);

- To receive a tax refund on life insurance, the term of the agreement must be at least 5 years, for other types - any;

- the insurer or non-state pension fund must have the legal right to conclude the relevant agreement, that is, have a license.