VAT restoration is a reduction in the amount of tax accepted for deduction .

The Tax Code does not contain any direct indications that VAT restoration in the event of a shortage is mandatory. In Art. 170 of the Tax Code of the Russian Federation describes all situations in which VAT is subject to mandatory recovery, and this list does not indicate shortages of inventory items. The taxpayer must independently decide whether he will restore VAT in the event of a shortage. The courts on this issue are of the opinion that it is not necessary to restore VAT, and tax inspectors during audits calculate the VAT subject to restoration based on the provisions of tax legislation.

Restoration of VAT previously accepted for deduction - what is it?

When purchasing goods (works, services), the buyer-taxpayer takes the VAT presented as a deduction.

However, input VAT must be reinstated under certain conditions. What is VAT recovery? Restoration of VAT previously accepted for deduction is an operation in which VAT previously accepted for deduction must be restored, that is, paid to the budget.

Note that cases in which VAT restoration is necessary are regulated by law (clause 3 of Article 170 of the Tax Code of the Russian Federation).

For details, see the material “When to restore VAT” .

See also “The list of grounds for VAT restoration has been adjusted .

How to restore VAT in 1C 8.3 Accounting 3.0

In the 1C 8.3 Accounting 3.0 program there are two options for VAT recovery.

- Reinstatement of VAT that was paid earlier. In this case, the VAT amount is returned to the account of the payer organization.

- Restoration, when the payer organization must pay the tax that the budget has submitted for reimbursement.

Both options have the same term, but the meaning is opposite. You can see the difference by analyzing the VAT on advances when we receive them and when we transfer them. When receiving an advance from a counterparty, obligations arise to pay VAT on the transferred amount.

Also, the obligation to pay VAT arises from the sale of goods upon sale. A VAT refund is provided for the received advance payment upon presentation for reimbursement (recovery).

When transferring an advance payment to the supplier, it is also possible to recover VAT from the specified amount; on this basis, the total amount of tax is reduced. Subsequently, after receiving the goods, you will need to transfer VAT to the budget (so that the refund does not repeat).

We propose to analyze in detail how VAT is restored from the received advance payment, which was transferred by the buyer counterparty.

The program will automatically recognize the received payment as an advance payment and generate the necessary transactions:

Please note that VAT accounting transactions are created by the “Invoice” document. It can be generated either when an advance is received on the account, or through special processing at the end of the accounting period (month).

Let's create an invoice issued based on receipt to the bank account:

Let's check the wiring:

When creating the “Realization” document, the advance payment should be automatically reversed. You can check using the implementation transactions:

The “Invoice” document itself, created upon implementation, does not create any postings, but reflects the movement of VAT in other important accounting registers.

The VAT recovery process is reflected through the document “Creating purchase ledger entries”:

In this case, filling out the “Received Advances” tab in 1C occurs automatically. All amounts for received advance payments that can be submitted for VAT recovery are reflected here:

Checking the wiring:

You can track the results of routine VAT accounting operations by generating the “Sales Book” and “Purchases Book” reports:

If you go to the “Sales Book” report, then for one counterparty-buyer there will be two records reflected for the accounting period (month) for the received advance and the created sales:

If you look at the “Purchases Book” report, the same counterparty will appear here, and the entry for it will compensate for the advance payment in the sales book.

The same amount will be reflected in all entries. It follows from this that payment of VAT to the budget will be one-time. By generating the “Turnover balance sheet” report, you can check the closure of account 76. AB (VAT on advances and prepayments):

With advance payments from suppliers, VAT recovery in the 1C 8.3 program occurs in a similar way. In this case, documents must be generated in the following order:

- Debiting from the current account.

- Invoice for advance payment received from the supplier.

- Purchase Invoice.

- Invoice against delivery note.

The only difference from the previous option is that VAT is restored according to the document “Creating sales book entries”.

The document “Purchase Book” will reflect the records of the advance payment and receipt:

And in the “Sales Book” an entry about VAT restoration will be displayed:

VAT on advance payments to suppliers is accounted for in account 76.VA (VAT on advances and prepayments issued), the movement of which can be viewed in the balance sheet:

A few more nuances when VAT can be restored:

- When selling products at retail (excluding VAT), intended for sale at a rate of 18%. In this case, it is necessary to restore (return to the budget) the VAT on the material used in production.

- If the tax office recognizes the supplier’s “Invoice” document as invalid or lost.

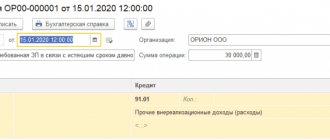

There are also reverse situations when an organization can restore previously paid VAT. For reflection in the 1C program there is a standard document “VAT Restoration”:

This document, in fact, is a corrective document for the purchase book and sales book, depending on the purpose of VAT recovery. For example, the amount of recovered VAT can be written off to the expense account:

In this case, the restored VAT will be reflected in the “Sales Book” document as an entry on an additional sheet.

Source: https://scloud.ru/ask_question/uchet-nds/kak-vosstanovit-nds-v-1s-8-3-bukhgalteriya-3-0/

Restoration of VAT on goods (works, services, property rights) when their value decreases

If after the acquisition of goods (work, services, property rights) there is a decrease in value, quantity, tariff, then the VAT previously accepted for deduction for this transaction must be restored (clause 4, clause 3, article 170 of the Tax Code of the Russian Federation). Restoration must be made to the earliest date:

- the date of receipt of the adjustment invoice for the reduction in the cost of goods (work, services, property rights);

For details, see the material “What is an adjustment invoice and when is it needed?”

- the date of receipt of primary documents confirming the decrease in the value of goods (work, services, property rights).

In this case, the difference between the VAT amounts before and after the change in value is restored (paragraph 2, paragraph 4, paragraph 3, Article 170 of the Tax Code of the Russian Federation).

Features of accounting for surplus goods or property

After the inventory, surpluses can be recorded. An employee of the accounting department must necessarily capitalize them. First, you should calculate the cost of the goods. Secondly, draw up a certificate containing one of the wiring diagrams:

Debit the inventory account (there are different numbers for different categories of goods - 01, 07, 10, 41, 43) to the Credit of account 91.1 “Other income”.

Surplus goods or property will be included in the company's turnover. They can continue to be used.

In the event that the surplus is cash, then it will be considered non-operating. According to Article 250 of the Tax Code of the Russian Federation, they cannot be used. The surplus should be written off to production, the cost of the surplus should be recorded in the debit of the account.

Please note that you can use capitalized surpluses, for example, on April 28, only from the beginning of the new month - from May 1. Until this time, all goods or property must be in the warehouse.

Restoration of VAT on goods (works, services) used in transactions taxed at a rate of 0%

From 01/01/2015, the norm was excluded from the Tax Code of the Russian Federation, according to which previously, when using goods, works, services, fixed assets and intangible assets in transactions subject to VAT at a rate of 0%, tax restoration was required (clause 3 of Article 170 of the Tax Code of the Russian Federation) .

At the same time, input tax on goods, works, services and property rights that are involved in the production of a new product, taxed at a zero tax rate, must be deducted according to special rules. The deduction occurs at the time the tax base is determined in accordance with Art. 167 of the Tax Code of the Russian Federation, subject to the conditions of paragraph 3 of Art. 172 of the Tax Code of the Russian Federation.

If, when purchasing goods (works, services, property rights) involved in transactions taxed at a zero rate, VAT was accepted for deduction, then such tax, according to officials, will have to be restored and accepted for deduction later (letter from the Ministry of Finance of Russia dated February 13, 2015 No. 03-07-08/6693). The restored VAT must be accepted for deduction at the time of determining the tax base in accordance with Art. 167 Tax Code of the Russian Federation.

Approaches to writing off shortages

The shortage is written off from the valuables account (10, 41, 43...) to the debit of account 94 “Shortages and losses from damage to valuables.”

Then, depending on the reasons for the shortage, costs are written off from credit 94 of account “Shortages and losses from damage to valuables”:

The amount of the shortage within the established norms of natural loss is written off as production or sales costs;

The culprit of the shortage has been identified - debiting to the culprit’s account and reimbursement from the culprit’s salary or by the culprit depositing the amount of the shortage into the cash register;

The culprit has not been identified (including due to the court’s refusal to recognize him) and is written off as other expenses.

On the credit of account 94 the same amounts are posted that were debited to this account.

Write-off of shortages during storage and transportation of valuables within the limits of natural loss norms is equated to material expenses and must be taken into account when calculating the tax base for income tax.

Restoration of VAT on property contributed as a contribution or contribution

In transactions with property used as a deposit or contribution, VAT is restored:

- When using property, intangible assets to contribute to the authorized capital of business companies, partnerships or contributions to mutual funds of cooperatives. The exceptions are contributions of property to mutual investment funds (letter of the Ministry of Finance of Russia dated January 15, 2008 No. 03-07-11/09) and contributions under a simple partnership agreement (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated June 22, 2010 No. 2196/10).

- When using property and intangible assets for contributions under an investment partnership agreement.

- When using property to replenish the target capital of a non-profit organization in accordance with Federal Law dated December 30, 2006 No. 275-FZ “On the procedure for the formation and use of target capital of non-profit organizations.”

VAT is restored in the period that corresponds to the date of the document on the transfer of property in full.

Fixed assets and intangible assets are an exception to this rule: for this type of property, restoration occurs in a part proportional to the residual value without revaluation (paragraph 2, paragraph 1, paragraph 3, article 170 of the Tax Code of the Russian Federation). At the same time, Chapter 21 of the Tax Code of the Russian Federation does not establish rules for determining the residual value of fixed assets. The Ministry of Finance of Russia believes that it is necessary to form the residual value in accounting by reducing the residual value by the amount of the revaluation, adjusted to take into account depreciation (letter of the Ministry of Finance of Russia dated 02.08.2011 No. 03-07-11/208).

The restored VAT must be indicated in documents on the transfer of property (property rights) and intangible assets. These documents are the basis for accepting an object for accounting and VAT amounts for deduction if the object is used in transactions subject to VAT (paragraph 3, paragraph 1, paragraph 3, Article 170, paragraph 11, Article 171, paragraph 8 Article 172 of the Tax Code of the Russian Federation, letters of the Ministry of Finance of Russia dated November 21, 2011 No. 03-07-11/317 and November 11, 2009 No. 03-07-11/294). The seller of the property cannot take into account the amount of restored VAT in income tax expenses (letter of the Ministry of Finance of Russia dated 02.08.2011 No. 03-07-11/208).

The seller does not issue an invoice for the transferred property, so it is not required to deduct VAT (Clause 3, Article 169, Clause 1, Clause 2, Article 146, Clause 4, Clause 3, Article 39, Clause 1, Art. 172, paragraph 1, paragraph 3, article 170 of the Tax Code of the Russian Federation). However, this does not relieve the obligation to register in the purchase book the documents on the basis of which the transfer is made.

Accounting for write-offs in accounting

When purchasing goods and materials, the company pays for services and stages of work, these indicators include tax. Within the framework of the OSN, amounts are accepted for write-off or deduction provided that the goods were accepted for accounting, were used in work that is subject to tax, and there is confirmation of the transactions.

Products must be used in transactions that are subject to tax. If the transaction was carried out without tax, then double accounting is required.

A popular problem is when VAT restoration is required when goods are written off. It is necessary to restore collection indicators in accounting when a product is added to the authorized capital, when the price of valuables decreases, or when used in a tax-free process.

Compensation is not provided if the object is not taxed, the transaction was not carried out in the Russian Federation, the seller is exempt from paying the fee. There are some features of reflecting tax when goods are damaged. In this case, postings DT19KT68/2, DT91/2KT19, DT94KT41, DT44KT94 are compiled.

The fee is taken into account when a shortage or theft is detected. These circumstances are identified when performing an inventory. The actual condition of the materials is entered into the INV document. Shortages may arise due to the counterparty's failure to fulfill obligations, as a result of theft, or due to natural loss.

The practice of restoring collections on written-off goods is ambiguous. It is assumed that the tax that was accepted for credit in earlier periods must be restored and paid additionally. Each situation is considered separately by the fiscal service.

Recovering VAT from advances received

The prepaid payment system involves receiving an advance payment and paying VAT on these amounts by the seller. The buyer has the right to accept these amounts for deduction (clause 1 of Article 154, clause 12 of Article 171, clause 9 of Article 172 of the Tax Code of the Russian Federation).

From 01.10.2014, the procedure for VAT restoration has been changed: the amount of VAT previously claimed for deduction on the basis of an advance invoice received from the seller is restored by the buyer in full if the shipment is equal to or exceeds the amount of the advance, and is restored in accordance with the invoice for shipment, if it is less than the advance payment.

You will find all the nuances of recovering VAT from an advance payment in the article “When and how can a buyer recover VAT from a transferred advance payment? ”

What to do if the inventory reveals a shortage or surplus?

Documentation of shortages or surpluses should be carried out only after an inventory has been taken. The person responsible for the procedure cannot write any “false” numbers or amounts. Along with the document where the write-off of shortages and surpluses will be listed, a certificate of work performed and other official papers necessary to record the quantity of goods must be attached.

Mandatory documents are:

- Act No. TORG-6.

- Inventory registration log, filled out according to the TORG-7 form.

- Act No. TORG-15, which will indicate low-quality products.

- Act No. TORG-16, reporting the write-off of goods.

- Act No. TORG-20, indicating further actions with shortages or surpluses.

- Act No. TORG-21, in the event that re-sorting of fruits and vegetables is required.

Write-offs should also be carried out based on the norms of natural loss and the accounting policies of the enterprise. Please note that natural loss can be written off only after it has been calculated by the accounting department and the calculation has been checked by management, as well as an independent inventory commission. By the way, only after this stage will you know whether an official investigation should be carried out and the culprits identified.

Note that the investigation is carried out in the case when the amount of the shortage is greater than the norms of natural loss.

It is important to know that EU standards can be applied to any quantitative and qualitative goods of an enterprise, but not to those that are supplied to the organization individually or in packaged form.

The head of the company will be responsible for shortages. He must determine whether the shortfall can be expensed. Typically, small amounts of shortfall can be written off from credit to debit. This write-off procedure applies in accordance with Article 12 of the Federal Law “On Accounting” when there is no one to blame for the shortage.

Having resolved the issue of identified shortages or surpluses, an order is issued , which is then transferred to the accounting department, where it is stored for 5 years (Article 17 of the Law “On Accounting”).

If the inventory commission, which conducted an internal investigation, identified other officials who were responsible for the shortage, then, of course, they will also be held accountable.

The manager has the right to write a statement to the court and demand compensation for material damage to the company.

The perpetrators will compensate for damage if:

- The fact of guilt is confirmed by an official document.

- An employee of the organization himself admitted his guilt and wrote a written statement in which he indicated the motives and reasons for committing the unlawful act.

- The inventory commission ruled that the official was guilty. In case of refusal to pay for material damage, the employee must sign the corresponding act. Based on this, management may go to court.

- There is an order from management to withhold funds from the employee’s salary.

If the employee was not involved in the shortage, and the commission falsely identified him as the culprit, he also has the right to go to court. After this, he must be given a document indicating the decision to suspend the case and the acquittal.

Accounting entries for VAT restoration

During VAT recovery operations, transactions are generated as follows:

Dt 19 Kt 68 - restoration of VAT on goods, work and services;

Dt 912 Kt 19 - inclusion of the restored VAT amount in other expenses.

Example:

LLC Ladoga purchased in February 2021 from the supplier Kenon LLC a batch of materials worth 219,000 rubles, including VAT - 36,500 rubles. The tax was accepted for deduction based on the invoice of Kenon LLC and reflected in the VAT return for the first quarter of 2021.

In April, there was a change in the price of the supplied material, and Kenon LLC decided to provide a discount of 5% of the total cost. An adjustment invoice was submitted for this fact.

The adjusted cost of the consignment amounted to 203,300 rubles, including VAT - 33,883 rubles.

According to tax legislation, Ladoga LLC must restore the difference in VAT amounts:

36,500 - 33,883 = 2,617 rubles.

This amount must be included in the declaration in the second quarter of 2020.

The accounting entries for VAT restoration are as follows:

In the 1st quarter of 2021:

Dt 60 Kt 51 - 219,000 rub. (batch of materials paid);

Dt 10 Kt 60 - 182,500 rub. (a batch of materials was received from Kenon LLC);

Dt 19 Kt 60 - 36,500 rub. (input VAT on purchased materials is reflected);

Dt 68 Kt 19 - 36,500 rub. (input VAT is accepted for deduction);

In the 2nd quarter of 2021:

Dt 10 Kt 6 — 2,617 rub. reversal (the cost of materials received is reduced in accordance with the supplier’s notification of the discount provided and the adjustment invoice);

Dt 19 Kt 60 — 2,617 rub. reversal (reduced input VAT on purchased materials in accordance with the supplier’s notification of the discount provided and the adjustment invoice);

Dt 19 Kt 68 — 2,617 rub. (the VAT amount on the adjustment invoice was restored).

If VAT is restored on property transferred as a deposit or contribution, then the transferring party takes the restored tax into account as part of financial investments (debit Dt 58).

The receiving party, according to the recommendations of officials (letters of the Ministry of Finance of Russia dated October 30, 2006 No. 07-05-06/262 and the Federal Tax Service of Russia for Moscow dated July 4, 2007 No. 19-11/063175), should reflect the amount of the restored tax with the entry “Dt 19 Kt 83".

These recommendations were made on the basis of the Accounting Regulations “Accounting for Financial Investments” PBU 19/02, approved by Order of the Ministry of Finance of Russia dated December 10, 2002 No. 126n, and the Accounting Regulations “Accounting for Fixed Assets” PBU 6/01, approved by Order of the Ministry of Finance of Russia dated March 30, 2001 No. 26n.

Possible options for taxpayer behavior

Despite the fact that officials seem to have decided on the issue of restoring VAT on write-off goods, it is impossible to completely exclude the occurrence of disagreements with inspectors during inspections. Therefore, the taxpayer still has to make his own decision about whether to restore the tax in such a situation or not, depending on his readiness for a tax dispute. For example, tax authorities may offer to restore the tax if the culprit reimburses the amount of damage to the product that was written off from VAT.

This means that a cautious taxpayer will have the following transactions on the date the goods are written off:

- regarding tax recovery:

Dt 19 Kt 68;

- and by writing it off as other expenses:

Dt 91 Kt 19.

The tax should be restored at the rate indicated in the supplier’s documents, applying it to the book value of the written-off product.

But we believe that it is better not to play it safe. After all, the likelihood of getting a court decision in your favor is very high.

Find out how to reflect the write-off of expired goods in accounting in the material from ConsultantPlus. Get trial access to the system and proceed to study the answer for free.

Results

VAT must be restored if the assets on which VAT was claimed for refund began to be used for non-taxable transactions. All cases when it is necessary to restore VAT are named in Art. 170 Tax Code of the Russian Federation.

Sources:

- Tax Code of the Russian Federation

- PBU 19/02, approved. by order of the Ministry of Finance of Russia dated December 10, 2002 No. 126n

- PBU 6/01, approved. by order of the Ministry of Finance of Russia dated March 30, 2001 No. 26n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How to write off shortages during inventory

Write-off of inventory shortages is carried out using the following transactions:

| Account Dt | Kt account | Wiring Description | Transaction amount |

| Write-off of shortages within normal limits | |||

| 96 | 94 | If there is a reserve for writing off shortages | |

| 44 | 94 | In the absence of a reserve for writing off the shortage | The amount of shortfall within the norm limits |

| Write-off of shortages in excess of norms at the expense of the guilty party | |||

| 73.2 | 94 | Write-off of the shortage to the account of the guilty person within the book value of the missing property | The amount of shortage in excess of the norm limit within the book value of the missing goods |

| 73.2 | 91.1 | If the amount of recovery from the perpetrators is greater than the book value of the missing property | Difference between the book value of the missing goods and the amount recovered |

| Write-off of shortages when the perpetrators are not identified | |||

| 91.2 | 94 | Writing off the shortfall to the financial result | Shortfall amount |

The basis document for these postings is the accounting statement.

The absence of perpetrators must be documented. The supporting documents will be a decision to suspend the criminal case, an acquittal, etc. (Clause 5.2 of the Methodological Guidelines approved by Order No. 49 of the Ministry of Finance of Russia dated June 13, 1995).

In accounts for accounting for sales expenses (production costs), as well as in account 91, the cost of damaged or missing material assets is written off at their actual cost.