The state returns 13 percent of the costs of residential real estate, provided that the person paid for the purchase with money from which income tax was previously withheld - to receive a property deduction and tax refund, you need to fill out a 3-NDFL declaration and submit it to the Federal Tax Service.

In 2021, you can file a tax return for the last three years. The article discusses the process of filling out 3-NDFL when purchasing an apartment in 2021 - a new current declaration form for 2021 and a sample registration form for obtaining a property deduction are provided.

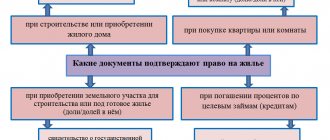

Property deduction when purchasing an apartment

An individual who purchased housing with money on which income tax was paid has the right to return it in connection with the expenses incurred.

13 percent of the cost of purchasing an apartment is refundable, but not more than 2 million rubles.

If the apartment is more expensive, it means that the buyer will return personal income tax only on part of the cost of housing. If the apartment costs less than 2 million rubles, then the tax will be refunded on the entire amount of expenses, while the remainder of the deduction, equal to 2 million minus the purchase price, is carried over to the following years.

The maximum possible tax refund is RUB 260,000. (13 percent of the maximum property deduction).

For a year, you can only return the amount within the limits of the income tax paid for that year. For example, if an apartment was purchased for 2 million rubles in 2021, and salary tax in the amount of 100,000 rubles was paid for 2021, then a person will be able to return only 100,000 for this year; for the return of the remaining 160,000, one can contact next years.

Every individual has the right to a property deduction, provided that the deduction amount is 2 million rubles. has not been used previously.

When purchasing a home with a mortgage, you can separately receive a property deduction for mortgage interest - up to 3 million rubles. (maximum refund amount is RUB 360,000).

A sample of filling out 3-NDFL when purchasing an apartment with a mortgage can be viewed here.

How to get 13 percent back on expenses?

To get your income tax back when buying an apartment in 2021, you need to:

- Make sure that in 2021 the home buyer had income on which personal income tax was paid.

- Make sure that the person has not previously used the property deduction when purchasing other apartments.

- If the two conditions above are met, then starting from January 1, 2021, you can contact the Federal Tax Service with a 3-NDFL declaration and an application for a tax refund.

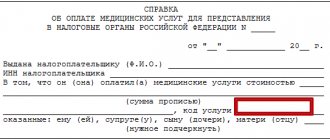

The declaration should be accompanied by copies of documents confirming the information specified in 3-NDFL - purchase and sale agreement, certificate 2-NDFL, which indicates the amount of income and withheld tax and other documents.

Filing a declaration when purchasing an apartment is voluntary. If a person wants to return part of the money spent, then he needs to fill out 3-NDFL and contact the Federal Tax Service. If there is no such need, then no reports, documents or declarations need to be submitted.

There is also no point in contacting the Federal Tax Service with a declaration if there was no taxable income in the past year, since in this case there is nothing to return - if personal income tax was not paid during the year, then it will not be possible to return it.

Entering information about the declarant

The next tab “Information about the declarant” contains information about the taxpayer, his passport data, phone number.

Field "Full name" is filled in with the declarant’s TIN, date and place of birth.

The country code inside the citizenship line is set automatically.

Before entering your passport data, you need to select the type of document in the drop-down list:

After this, the lines indicating the series, number, and date of issue of the passport are filled in.

In the last line you need to enter your phone number.

New 3-NDFL form for 2021

If an individual decides to return part of the costs of purchasing an apartment through a property deduction, then he should fill out the 3-NDFL declaration form that was in force for the current year of completion.

In 2021, a new declaration form was introduced by Order of the Federal Tax Service dated August 28, 2020 No. ED-7-11/ [email protected] , which contains new barcodes and updated pages.

.

Procedure and deadlines for filing a declaration for 2021

Methods for filing 3-NDFL when purchasing an apartment:

- Print out a new declaration form and fill it out manually, then submit it to the Federal Tax Service in person, through a representative or by mail.

- Fill out the 3-NDFL form on the computer, print, sign and submit to the Federal Tax Service.

- Fill out 3-NDFL in the program, which can be downloaded for free on the tax service website, then print, sign and submit to the Federal Tax Service - step-by-step instructions for filling out 3-NDFL in the program Declaration 2020 for deduction when buying an apartment.

- Draw up a declaration in the taxpayer’s personal account on the tax office website and submit it electronically.

An individual has the right to independently choose the filing method that is more convenient; the Federal Tax Service has not established any restrictions.

The deadline for submitting a tax refund for 2020 when purchasing an apartment is in any month starting from the next year 2021 (within three years, for pensioners - within four years).

Checking the declaration

Before saving the declaration, you must check that it is filled out correctly. To do this, select Check ” menu item Declaration ” tab. The program independently checks all entered data. After it is completed, a message with the results of the test will appear.

On my own behalf, I advise you to definitely use this function. Believe me, even if you are sure that you filled out everything correctly, it is better to double-check it. Last year, due to my laziness and inattention, I was forced to submit a declaration 2 times because I made a mistake. And if I had immediately checked what I filled out, I would have saved myself a whole day, which I spent visiting the Federal Tax Service office.

After this, you can save the declaration and print it. To do this, use the items in the top menu.

How to fill out 3-NDFL for a tax refund?

Buyers of an apartment in order to receive a property deduction must fill out five declaration sheets:

- title - introductory data;

- section 1 - amount to be refunded;

- Section 2 - calculation of the base and tax to be refunded;

- Appendix 1 - the amount of annual income and withheld personal income tax;

- Appendix 7 - calculation of deductions.

Depending on how the declaration is filled out, its own registration rules apply; they are specified in the Filling Out Procedure - link.

The table below provides instructions for filling out the lines that are required when purchasing an apartment in 2021 and making an initial application to the Federal Tax Service for a tax refund.

Instructions for formatting in the table

| Line 3-NDFL | Instructions for filling |

| Title page - general information | |

| Adjustment | 0 – if submitted for the first time, if adjusted – then the serial number of the declaration change. |

| Period code | 34 – which corresponds to the year. |

| Year | 2020. |

| Federal Tax Service code | Code of the Federal Tax Service branch where the report is submitted. |

| Taxpayer information | The country code is 643 for the Russian Federation. Taxpayer category – 760 for individuals (Appendix 1 of the Filling Out Procedure). Full name. Date and city of birth. |

| Information about the identity document | Document code – 21 for a passport. The series and number, place and date of issue are copied from the passport. |

| Status code | 1 – for tax residents of the Russian Federation. |

| Contact details | Telephone number for contact. |

| Number of pages | Completed in the declaration and attached to it. |

| Section 1 – reflection of personal income tax subject to refund in connection with the purchase of an apartment | |

| 010 | 2 – money back. |

| 020 | KBK – 18210102010011000110. |

| 030 | OKTMO - code according to the classifier at the place of residence. |

| 050 | Amount of tax to be refunded. |

| Section 2 – calculation of tax to be refunded | |

| 001 | Rate 13 percent |

| Appendix 1 to Section 1 – fill out an application for a personal income tax refund on training expenses. | |

| 095 | №1 |

| 100 | Personal income tax for refund from the budget - 050 section 1. |

| 110 | KBK - 020 section. 1. |

| 120 | OKTMO - 030 section. 1. |

| 130 | The year 2021 fits in. |

| 140 | Bank's name. |

| 150 | KBK Bank. |

| 160 | 02 to receive personal income tax to a current account, that is, to a card. |

| 170 | Account no. |

| 180 | Full name of the account owner. |

| Section 2 | |

| 001 | 13 – tax rate. |

| 002 | 3 – “Other” |

| 010 | Annual income for 2021 - from page 070 Appendix 1 of the 3-NDFL declaration |

| 030 | Repeats the amount from the previous row |

| 040 | Deduction for 2021 – from adj. 7 forms 3-NDFL |

| 080 | Annual paid personal income tax from page 080 app. 1 |

| 160 | The refund tax from field 080 is repeated once again, then this amount is transferred to page 050 of section 1. |

| Appendix 1 – the amount of annual income and withheld tax (for each source of income separately) | |

| 010 | Rate 13 percent |

| 020 | Code 07, if income is received in the form of salary under an employment contract (the most common option). Other codes from the appendix are also possible. 3 to the Procedure for filling out 3-NDFL. |

| 030-060 | TIN, KPP, OKTMO, name of the employer's organization (or other source of income) |

| 070 | Annual income - if it is a salary, it is taken from the 2-NDFL certificate, which can be obtained at the place of work, then this indicator is transferred to field 010 of Section 2. |

| 080 | Annual withheld tax on income from the previous line - this indicator is then transferred to field 080 of Section 2. |

| Appendix 7 – calculation of property deduction in connection with the purchase of an apartment | |

| 010 | 02 – code if an apartment was purchased. 01 – if a residential building is purchased. |

| 010 | The owners of the purchased apartment put 01, if it is a pensioner, then 11. |

| 030 | Property number code known to the seller. Usually this is a cadastral number - put 1. If no number is known - then 4. |

| 031 | The number stated in the previous line is entered. |

| 032 | Address of the purchased apartment - if the number is not indicated in the previous line. |

| 040 | The date of the completed acceptance certificate for the apartment is an appendix to the purchase and sale agreement. |

| 050 | The date when the right to an apartment was registered - from a certificate from the Unified State Register of Real Estate |

| 070 | The amount of shared ownership is indicated |

| 080 | The cost of purchasing an apartment is no more than 2,000,000. |

| 090, 110, 130 | Filled out if the apartment was purchased with a mortgage |

| 100, 120 | Not filled out if the buyer applies to the Federal Tax Service for the first time |

| 140 | Tax base – annual income from adj. 1 minus the deduction provided from page 120 adj. 7. |

| 150 | Costs of purchasing an apartment, which are accepted as a property deduction for 2021. |

| 170 | The balance of the deduction that will transfer to the following years = Total amount of expenses from field 080 minus the deduction provided for 2021 from field 150. Previously provided deductions for this apartment from fields 100 and 120 are also deducted. |

Filling example

A completed version of the declaration under the following initial conditions:

- the cost of the apartment is 2.5 million rubles;

- the amount of annual taxable income for 2021 is 900 thousand rubles;

- the amount of withheld tax for 2021 is 117 thousand rubles.

For 2021, the buyer of an apartment will be able to return 13 percent of 900,000 = 117,000.

The remainder of the deduction = 2,000,000 - 900,000 = 1,100,000 is carried over to the next year.

An example of filling out 3-NDFL when purchasing an apartment for 2.5 million rubles:

Setting conditions

You should act sequentially, filling out the tabs from top to bottom, although you can move freely through the sections. The top tab on the left is “Set conditions”. Since the 3-NDFL of a resident of the country is being filled out, we select the appropriate item.

Next, select the inspection number where the declaration is submitted. You need to select the one you need from the drop-down list (for example, 7701 - Federal Tax Service Inspectorate No. 1 for Moscow).

Since 3-NDFL for treatment is filled out for the first time, the adjustment number is indicated - 0. When submitting a clarifying declaration, indicate number 1.

In the OKTMO value field, you need to indicate a code indicating belonging to a specific city, town, etc. This code can be obtained from the Federal Tax Service website or from your income certificate (clause 1 “Data about the tax agent”).

Next, you need to select the taxpayer attribute. An ordinary taxpayer who is not engaged in private activities selects the “Other individual” item.

After this, we put a tick on the available income, part of which we plan to return from the budget.

In the “Reliability Confirmed” field, you need to select the item according to which you submit the deduction declaration personally or trust a representative - an individual.

Second section

Here you calculate the amount of tax that will be returned to your account.

Fill out in order:

- Line 001. Enter the tax rate – 13.

- Line 002. Put 3 - other.

- Line 010 – annual income. You need to calculate using the formula: line 070 of application 1 + line 070 of application 2 + line 050 of application 3 + line 220 of application 5.

- Line 020 – the total amount of income that is not taxed. If there are any, move from line 120 of Appendix 4.

- Line 030. Line 010 – 020.

- Line 040 – deduction amount. Add the rows of Appendix 7: 120, 130, 150 and 160.

- Line 050. These are losses on transactions with securities (Appendix 8 line 040 + 050). If there were no such operations, set it to 0.

- Line 051. Income from participation in foreign companies. Move application 2 from line 070 or set it to 0.

- Line 060. Tax base. It is calculated as follows: lines 030 + 051 – 040 – 050. If the value is negative or zero, put 0.

- Line 070. We count 060*13.

- Line 080. Move line 080 of application 1.

- Up to line 150, indicate taxes paid in different cases. If there were none, we put 0 everywhere.

- Line 160. The amount that will be returned to you. We count using the formula: lines 080 + 090 + 100 + 110 + 120 + 130 – 070.