Every taxpayer who pays personal income tax on his own or his employer does it for him has the right to apply for a tax deduction: social, standard, property, investment. This is a refund of income tax that was paid in the reporting tax period.

When they talk about deductions for previous years, they mean the amount of property deductions. They can be obtained when purchasing real estate using personal savings or using credit funds. Property deductions are also provided for new construction.

The maximum deduction amount for the purchase of real estate is 2,000,000.00 rubles. This size is established by law.

You can apply for a deduction by submitting a 3-NDFL declaration. In it, indicate the amount spent on the purchase of real estate/new construction, payment of interest on the targeted loan (in the amount established by law).

Data on property deductions are indicated in Appendix 7 of the 3-NDFL declaration. You can fill it out on paper, in the special “Declaration” program or in the taxpayer’s personal account.

When and for what years can I receive a property deduction?

A property deduction can be obtained for the purchase of real estate, as well as land. To use this right, it is enough to cover any period not exceeding three years in total. You can apply for a property deduction immediately or after several years, but not earlier than at the end of the current tax period.

If desired, the taxpayer may not wait until the end of the year. According to this option, the employer simply stops paying personal income tax on the employee’s wages immediately after purchasing the property.

You can distribute the deduction as follows:

- transfer it to the next tax period without any redistribution;

- by shifting back the tax period.

The extension of deadlines is not infinite, since the taxpayer, for various reasons, may stop working and lose official income.

Possible types of deductions

2 types of benefits can be carried over to the following tax periods:

- the balance of the property tax deduction;

- the balance of the mortgage interest deduction.

This is due to the fact that their size significantly exceeds the annual income of the average Russian. According to current legislation, you can receive a payment of 13% of the amount spent. However, there are limits:

- for the price of housing - 2 million rubles;

- for the amount of interest - no more than 3 million rubles.

Accordingly, the maximum amount that a person who purchased a home with a mortgage can receive from the state is:

260 thousand rubles. + 390 thousand rubles. = 590 thousand rubles.

Social deductions are not carried over to the next period. If the amount of personal income tax paid during the year turns out to be less than 13% of the amount spent on eligible needs, the difference is lost. The same applies to the investment deduction for IIS. They can only be obtained from the tax on income received in the year the expenses were incurred. In this case, you can apply for money within 3 years.

When does the right to a tax deduction arise when purchasing a home?

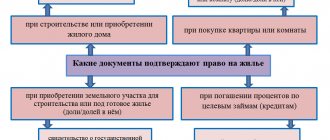

In order for the right to receive a tax deduction to arise, you must not only purchase real estate, but also draw up documents for the property. If an apartment was purchased in a new building under a shared participation agreement, then an acceptance certificate is required to confirm ownership rights.

When purchasing real estate from another owner, to confirm rights, you should obtain an extract from the Unified State Register of Real Estate.

Important! According to paragraphs. 6 tbsp. 220 of the Tax Code of the Russian Federation, the right to deduction arises only after registration of legal property rights.

Where did the deduction for previous years come from?

In order to understand what this is, you need to know the legislative provision, according to which an amount exceeding that withheld in the current period cannot be received as compensation for overpaid tax.

If a person experiences an event in which the amount of the tax discount exceeds the amount withheld by his employer as personal income tax, his right to receive the unpaid part of the material compensation passes to the following years. However, this does not happen automatically. It is necessary to fill out a declaration at the end of each tax period. And each time it is necessary to calculate this value.

View this post on Instagram

5 facts about property deductions from the purchase of an apartment: ⠀ 1️⃣ If the apartment was purchased during marriage after 01/01/2014, then each spouse has the right to 260 thousand, in total, up to 520 thousand can be returned for two - no matter in whose name the apartment is registered ☝