You can recall an employee from paid leave if he agrees to take a break from a series of days off. The question is raised by the compensation amount paid three days before the vacation: will the vacation pay be recalculated upon recall from vacation, and is it necessary to return the advance payment? If calculations need to be done, then what to do with the withholding of personal income tax - personal income tax, what is the procedure for returning funds received.

Grounds for revocation

The employer can recall an employee from vacation (Part 2 of Article 125 of the Labor Code of the Russian Federation). For example, such a need may arise if:

- the organization carries out an inventory and the presence of a materially responsible person is mandatory;

- the organization is conducting an on-site tax audit, during which the chief accountant will have to be at the workplace;

- the system administrator is called back from vacation due to problems with computer networks, etc.

A prerequisite for issuing a recall from vacation is the employee’s consent to return to work. If the employee does not agree to the recall, it is prohibited to interrupt the vacation. This follows from Part 2 of Article 125 of the Labor Code of the Russian Federation. An employee’s refusal to go to work is not a violation of labor discipline (clause 37 of the resolution of the Plenum of the Supreme Court of the Russian Federation of March 17, 2004 No. 2).

Situation: how to formalize an employee’s consent to recall from vacation?

Labor legislation does not say how to formalize an employee’s consent to recall from vacation. To avoid possible claims from inspectors, formalize the employee’s consent to begin work in writing in one of the following ways:

– in the form of an employee application in any form;

– in the form of an employee’s mark on the order for recall from vacation: “I agree to recall from vacation.”

Recalculation of vacation pay and salary

Recalling an employee from vacation will add more work to the accounting department. Holiday pay and salary are not only calculated according to different rules, but are also shown differently in financial statements. And besides, for tax purposes, vacation pay and salary are treated as separate categories.

Often management, in order to somehow compensate for the moral inconvenience of an employee, goes to such a step as incentives in the form of a one-time bonus. And this bonus can additionally cover the difference between vacation pay and wages that arises during recalculation.

So, there are no reasons why an employee could be returned from vacation without his consent. To avoid conflict situations and provide a legal basis for the accounting department to recalculate vacation pay and wages, recall from vacation is documented, usually in the form of an order. This order specifies in detail all the circumstances of recall from vacation. The employee is required to familiarize himself with this order.

Compensation for the rest of the vacation

When recalling, the employee must be compensated for that part of the vacation that remains unused. In this case, the employee can choose:

– use this part of the vacation at any time convenient for him in the current year;

– add the unused part of the vacation to the vacation for the next year.

This is stated in Part 2 of Article 125 of the Labor Code of the Russian Federation.

Information about the recall of an employee from vacation and about the transfer of vacation to another time should be reflected in the vacation schedule in form No. T-7, approved by Resolution of the State Statistics Committee of Russia dated January 5, 2004 No. 1, or in an independently developed form.

If the employer does not compensate for the balance of days not taken off, this will be a violation of the employee’s rights. Administrative liability is provided for such actions.

Situation: how to process a refund of vacation pay when an employee is recalled from vacation?

Use an option that the employee agrees with.

Vacation pay for the entire vacation is paid to the employee three days before the start of the vacation (i.e., before it becomes clear that the employee will return to work early). This is stated in Part 9 of Article 136 of the Labor Code of the Russian Federation.

The employee must return part of the vacation pay for unused vacation days.

An organization cannot withhold overpaid vacation pay on its own initiative. Article 137 of the Labor Code of the Russian Federation does not provide such a basis for withholding.

Therefore, an organization can only:

– agree with the employee that he will return the money to the cashier;

– register overpaid vacation pay as an advance against future salary;

– withhold overpaid vacation pay from the employee’s salary on his initiative (at his request).

In any case, the employee must agree to the return (retention).

Specify the procedure for withholding overpaid amounts of vacation pay in the order for recall from vacation.

How to recalculate vacation payments and wages

Certain issues regarding the early recall of an employee from vacation are resolved by the accounting department. Its employees will have to make changes to the primary documents and recalculate the amount of vacation payments and salaries, as well as, if necessary, monetary compensation and bonuses to the employee. How is this process carried out correctly?

- After drawing up an order to recall an employee, appropriate changes are made to his personal card (section No. 8) and the vacation schedule;

- Vacation payments to the employee are recalculated, the amount of which will differ from the originally calculated value.

Vacation payments to an employee are usually calculated before he goes on vacation. In this case, the average salary of a specialist calculated for the last annual period is taken as a basis. What happens if an employee is recalled from vacation early due to production needs?

- On the one hand, the employee did not use his allotted vacation days and therefore the payment of vacation pay for this period must be canceled. This means that the employee returns to the company part of the money previously paid to him;

- On the other hand, during the vacation period the employee was at work and performed his professional duties, which means he must receive a salary for this period.

Moreover, the manager can determine a bonus for the employee as compensation for moral damage from the early interruption of vacation. often it becomes the main argument in persuading a specialist to return to his professional duties early.

If it turns out that the amount of salary for the period the employee was recalled from vacation is less than the amount of vacation pay, then the employee is not obligated to return vacation pay (Article 137 of the Labor Code of the Russian Federation). Although in practice the physical return process itself does not occur - it is carried out by recalculation for future periods.

When all issues of “production necessity” are resolved, the employee can immediately continue his vacation or transfer it to another period of the year. In this situation, the accounting department again calculates his vacation payments, but now for the remainder of the vacation.

If it turns out that these will be carried over to the next year, then vacation pay will be calculated based on the average earnings of the next year (in this situation, the employee can both lose and win).

There are some nuances that are important for accounting employees to take into account:

- standard formulas are used to calculate vacation pay and wages;

- salaries cannot be replaced by vacation pay even if their amounts are equal (recalculation must be made and reflected in the documentation);

- taxes must be calculated on calculated vacation payments and wages;

- the manager's bonus can cover the difference between vacation pay and salary, then they are not replaced by each other;

- the amount of monetary compensation in exchange for unused vacation days is discussed with the head of the organization (first of all, he must agree to such a substitution).

It is important to emphasize the fact that the recalculation of wages and vacation payments will necessarily be reflected in the final financial statements. Resolving issues with employee payments is another way to avoid conflict situations with an employee in the event of his early recall due to production needs.

This aspect is extremely strictly checked by regulatory authorities to ensure there are no violations of employee rights.

Resolving issues with employee payments is another way to avoid conflict situations with an employee in the event of his early recall due to production needs. This aspect is extremely strictly checked by regulatory authorities to ensure that there are no violations of employee rights.

Thus, the early termination of an employee’s vacation due to production needs requires compliance with all legal formalities: obtaining the employee’s written consent, drawing up a memo by the head of the department, signing an order by the head of the enterprise, making changes to the vacation schedule, the specialist’s personal card, as well as recalculating vacation payments and salaries.

The procedure for recalculating vacation pay

The recalculation procedure is as follows. From the total amount of vacation pay, you need to subtract vacation pay that falls on days that the employee did not have time to take “time off.” For those days that the employee worked instead of vacation, accrue his salary in the general manner.

Later, when the employee decides to use the remaining vacation days, recalculate the average earnings to pay for them (Article 139 of the Labor Code of the Russian Federation, clause 1 of the Regulations approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922).

Reverse excessively accrued vacation pay in accounting. Make corrections in the month in which the employee was recalled from vacation (clause 18 of PBU 10/99, clause 2 of the Instructions to the Unified Chart of Accounts No. 157n).

An example of vacation pay recalculation. An employee is recalled from vacation in the month it began

Chief accountant of the organization A.S. Glebova was granted basic paid leave of 14 calendar days, from August 10 to August 23, 2015. Glebova’s salary is 25,000 rubles. Glebova’s average daily earnings (for calculating vacation pay) is 850 rubles.

Glebova was accrued vacation pay in the amount of 850 rubles/day. × 14 days = 11,900 rub.

The employee does not have rights to deductions for personal income tax.

Personal income tax calculated from vacation pay was: 11,900 rubles. × 13% = 1547 rub.

Five days before the start of the vacation (July 6), the employee was paid vacation pay in the amount of 11,900 rubles. – 1547 rub. = 10,353 rub.

On the same day, personal income tax from vacation pay was transferred to the budget.

Due to operational needs (conducting an on-site tax audit in the organization), on August 17, the employee was recalled from vacation. She agreed to go to work.

In connection with the recall from vacation, the accountant recalculated vacation pay, based on the fact that Glebova was actually on vacation for 7 days (from August 10 to 16): 850 rubles/day. × 7 days = 5950 rub.

Personal income tax on vacation pay amounted to: 5950 rubles. × 13% = 774 rub.

The employee was overpaid vacation pay in the amount of RUB 10,353. – (5950 rub. – 774 rub.) = 5177 rub.

The overpayment for personal income tax amounted to: 1,547 rubles. – 774 rub. = 773 rub.

In total, for August, Glebova was accrued vacation pay in the amount of 5,950 rubles. and salary for days worked from August 1 to August 9 and from August 17 to August 31, 2015 (16 working days). In August 2015 – 21 working days. The employee's salary is: 25,000 rubles. : 21 days × 16 days = 19,047.62 rub.

For August 2015, Glebova was accrued: RUB 19,047.62. + 5950 rub. = 24,997.62 rub.

Previously, she had already been paid vacation pay in the amount of 10,353 rubles. (including overcharged ones). Thus, the amount due for payment for August is equal to: RUB 24,997.62. – (RUB 24,997.62 × 13%) – RUB 10,353. = 11,394.62 rub.

Personal income tax calculated based on the results of the month amounted to: 24,997.62 rubles. × 13% = 3250 rub.

Personal income tax in the amount of 1547 rubles. has already been transferred to the budget on the day of payment of vacation pay. By this amount, the accountant reduced the personal income tax subject to withholding based on the results of August 2015. At the end of August, personal income tax was transferred to the budget in the amount of 3,250 rubles. – 1547 rub. = 1703 rub.

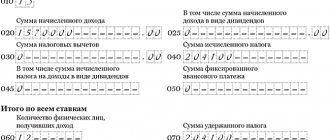

Income tax

The taxable base for income tax is reduced by the following amounts: - vacation pay, taken into account as part of labor costs (clause 7 of Article 255 of the Tax Code of the Russian Federation); — insurance premiums accrued on the amount of vacation pay taken into account as part of other expenses (subclause 49, clause 1, article 264 of the Tax Code of the Russian Federation); — contributions for injuries, accrued on the amount of vacation pay, and taken into account as part of other expenses (subclause 45, clause 1, article 264 of the Tax Code of the Russian Federation). With the accrual method, vacation pay amounts are included in the expenses of the month to which they relate (letter of the Ministry of Finance of Russia dated July 23, 2012 N 03-03-06/1/356). In other words, if the vacation began in August and ended in September, then vacation pay for the days of August is included in the expenses of August, and for the days of September - in the expenses of September. Insurance premiums are fully included in expenses on the day they are accrued (subclause 1, clause 7, article 272 and clause 2, article 318 of the Tax Code of the Russian Federation). Obviously, no matter in what month the employee is recalled from vacation (in the month of accrual of vacation pay or the next), the adjustment of the income tax base in terms of the vacation pay itself occurs automatically: the reversed amounts are excluded from the expenses of the corresponding month. But insurance premiums attributed to expenses that reduce the tax base for income tax in the month of accrual of vacation pay, falling on days of unused vacation, should be restored to the base and the tax recalculated. If the company uses the cash method, then the amounts of vacation pay and accrued contributions are taken into account as expenses that reduce the tax base for income tax in the month of accrual of vacation pay (clause 3 of Article 273 of the Tax Code of the Russian Federation). If an employee is recalled from vacation, the tax base must be adjusted to the amount of overpayment of both the vacation pay itself and the contributions accrued on it. When adjusting the amounts of vacation and insurance contributions, changes must be made in the month to which the vacation and insurance contributions relate (letter of the Federal Tax Service of Russia for Moscow dated August 25, 2008 N 20-12/079463). In our opinion, there is no need to submit an updated income tax return when adjusting the amounts of vacation and insurance contributions. After all, the changes are associated not with an accountant’s mistake, but with the recalculation of vacation pay due to production needs (clause 1 of Article 54 of the Tax Code of the Russian Federation).

Review from vacation in personnel documents

Based on the order to recall an employee from leave due to production needs, changes are made to the vacation schedule, time sheet and personal card.