18 September 2020

Each group of assets has its own specifics. Fixed assets that cannot be used immediately after delivery are subject to separate accounting. We are talking about equipment that requires pre-operational adjustment. This category of assets also includes operating systems that are modified, modernized, and equipped with additional elements before use. A striking example is a large-scale technical complex with many components. But individual equipment may require separate accounting. The determining factor is the need for installation with commissioning.

Initial cost

Accept fixed assets that require installation for accounting at their original cost (clause 7 of PBU 6/01). Include in the initial cost of such objects:

- cost of equipment or its individual parts (components);

- the amount of expenses associated with bringing the installed equipment to a condition suitable for use as a fixed asset. These are, for example, installation costs, the cost of materials used during installation, salaries of employees who carried out installation, etc.

The amount of expenses that form the initial cost of a fixed asset requiring installation is determined based on:

- primary accounting documents (contracts, invoices, acceptance certificates, acts of completed work, etc.);

- other primary documents confirming the costs incurred (customs declarations, business trip orders, etc.).

This procedure is provided for in paragraph 8 of PBU 6/01.

Situation: how to determine in accounting the cost of equipment (or its individual parts) that requires installation (account 07) upon its receipt?

The answer to this question depends on how the equipment is received: for a fee, by barter, free of charge or as a contribution to the authorized capital.

In accounting, the cost of equipment or its individual parts (components) requiring installation is included in the initial cost of the fixed asset along with other costs (for example, installation costs, cost of consulting services) associated with the creation of this fixed asset (clause 8 of PBU 6/ 01).

The norms of PBU 6/01 and PBU 5/01 do not apply when determining the cost of equipment requiring installation (clause 3 of PBU 6/01, clause 4 of PBU 5/01). Therefore, when capitalizing an object to account 07, follow the rules set out in paragraph 23 of the Regulations on Accounting and Reporting. In particular, if the equipment is purchased for a fee, include in its cost the amount paid to the supplier, as well as other costs associated with the acquisition. The same procedure is provided for in the Instructions for the chart of accounts.

When determining the cost of equipment received free of charge, take into account its market value and associated costs associated with receiving such property (clause 23 of the Regulations on Accounting and Reporting). At the same time, when determining the market value, follow the same rules as for the gratuitous receipt of fixed assets.

When determining the cost of equipment received as a contribution to the authorized capital, take into account the requirements of paragraph 3 of Article 34 of the Law of December 26, 1995 No. 208-FZ and paragraph 2 of Article 15 of the Law of February 8, 1998 No. 14-FZ. Include the monetary value agreed upon by the founders (participants) in the cost of the equipment. However, this indicator should not exceed the market value of the property, determined by an independent appraiser:

- in joint stock companies;

- in an LLC, if the participant’s share in the authorized capital, which is paid for with fixed assets, exceeds 20,000 rubles.

Advice: upon receipt of equipment contributed as a contribution to the authorized capital, additional costs may arise (for example, delivery costs). The procedure for their accounting is not established by law. Therefore, develop it yourself and enshrine it in your accounting policies (Article 8 of the Law of December 6, 2011 No. 402-FZ, clauses 4–6 PBU 1/2008).

It is most convenient to take into account additional costs when determining the cost of equipment that requires installation (on account 07). After installation, this equipment will be included in fixed assets. Consequently, the costs of its delivery should increase the initial cost of the finished fixed asset (clauses 8 and 12 of PBU 6/01).

The rules for determining the value of equipment received under a barter agreement (exchange agreement) are also not regulated by law. Therefore, when you receive equipment that requires installation, determine its cost in the same way as for fixed assets. Fix this procedure in the accounting policy (Article 8 of the Law of December 6, 2011 No. 402-FZ, clauses 4–6 PBU 1/2008).

Estimators' opinions

Among the estimators there are different opinions regarding the distribution of materials and equipment, I will give several quotes from the forums (with minimal adjustments to the author's text so as not to hurt the eyes), I will highlight ' !!! ' those that, personally, help me in deciding this issue, whether the resource is equipment or material:

Quote #1

What we take according to TERM (FERm), that is, the price for installing equipment, therefore the resource included in the price refers to the equipment. And the fact that according to the construction or repair collections TER (FER) everything refers to materials. If the equipment is not mounted (table, refrigerator, fire extinguisher, etc.), we take the costs of non-mounted equipment (see MDS 81-37.2004, paragraph 7) and include them in the wage fund.

Quote #2

As I understand it, equipment is all those “objects” that can produce something during operation or these “objects” will need to be controlled. For example, a gas boiler produces heat... in utility networks - electric valves and the like

Documenting

For registration, accept documents that contain the mandatory details provided for in Part 2 of Article 9 of the Law of December 6, 2011 No. 402-FZ.

To receive incoming equipment that requires installation, the organization should create a commission, which should determine whether the equipment meets its technical characteristics, whether it contains defects, how remediable these defects are, etc. After examining the incoming property, the commission must give an opinion on the possibility of it use. This conclusion must be reflected in the equipment acceptance (receipt) certificate. Draw up the act in any form or use the unified form No. OS-14, approved by Decree of the State Statistics Committee of Russia dated January 21, 2003 No. 7. In this case, the documents must contain the mandatory details provided for in Part 2 of Article 9 of the Law of December 6, 2011 No. 402-FZ .

Fill out the report at the time the organization receives equipment requiring installation (Part 3, Article 9 of Law No. 402-FZ of December 6, 2011). Draw up the report on the basis of shipping documents (for example, a bill of lading, if the equipment was purchased for a fee and was accounted for by the supplier as goods). When filling out the act, please indicate:

- details of the organization and equipment supplier;

- number and date of drawing up the act;

- name of the manufacturer and carrier of the equipment;

- information about the place and time of equipment acceptance;

- full name of the equipment according to the technical documentation;

- equipment serial number;

- other equipment characteristics.

In addition, the act must contain the conclusion of the acceptance committee (for example, the entry “Can be transferred to installation”). The executed act is approved by the head of the organization.

This procedure follows from Part 2 of Article 9 of the Law of December 6, 2011 No. 402-FZ.

When handing over the equipment for installation, draw up a certificate of acceptance and delivery of the equipment for installation. Draw up the act in any form or use the unified form No. OS-15, approved by Decree of the State Statistics Committee of Russia dated January 21, 2003 No. 7. In this case, the documents must contain the mandatory details provided for in Part 2 of Article 9 of the Law of December 6, 2011 No. 402- Federal Law. Draw up the act in one copy based on the act of acceptance (receipt) of equipment (act in form No. OS-14) and shipping documents. In the act, indicate:

- organization details;

- number and date of compilation;

- who will do the installation and where;

- information about the installed equipment.

If the equipment is installed by a contractor, he must sign the organization’s document stating that he received the equipment for installation. In this case, do not draw up an additional copy of the act, but give the contractor a copy of your act.

After the equipment has been installed and all work to bring the facility to a state suitable for use has been completed, the facility can be used as a fixed asset (clause 3.2.2 of the Regulations approved by letter of the Ministry of Finance of Russia dated December 30, 1993 No. 160). When putting the installed fixed asset into operation, draw up a certificate of acceptance and transfer of fixed assets. Draw up the act in any form or use standardized forms No. OS-1 (OS-1a). Fill out this act on the basis of the act of acceptance and delivery of equipment for installation (act in form No. OS-15) and other primary accounting documents confirming the costs of installation and bringing the facility to a state suitable for use. In this case, the documents must contain the mandatory details provided for in Part 2 of Article 9 of the Law of December 6, 2011 No. 402-FZ.

The act must contain the conclusion of the acceptance committee (for example, the entry “Can be used”). The executed act is approved by the head of the organization.

Simultaneously with drawing up an act on the acceptance and transfer of fixed assets (for example, acts according to form No. OS-1 (OS-1a)), fill out the inventory card in one copy. Draw up the card in any form, taking into account the requirements of Part 2 of Article 9 of Law No. 402-FZ of December 6, 2011, or use standardized forms No. OS-6 (OS-6a). This follows from the provisions of Part 4 of Article 9 of the Law of December 6, 2011 No. 402-FZ. Draw up an inventory card on the basis of the act and primary documents. In the future, enter into the card information about all changes that affect the accounting of fixed assets (revaluation, modernization, disposal). Reflect this information on the basis of primary documents (for example, on the basis of an acceptance certificate for modernized fixed assets).

This procedure is provided for in paragraph 12 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n.

Attention: the absence (failure to submit) primary documents for accounting for fixed assets is an offense (Article 106 of the Tax Code of the Russian Federation, Article 2.1 of the Code of Administrative Offenses of the Russian Federation), for which tax and administrative liability is provided.

Results

The production cost of products is formed on the 20th account. General production and general business expenses:

- are allocated to production costs in proportion to one of three indicators: material costs, wages and direct production costs of products, if the accounting policy provides for accounting at full production costs;

- are charged to the cost of sales (debit of account 90), if the accounting policy establishes accounting at a reduced cost.

Service industries and farms, the costs of which are formed on the 29th account, have no relation to the main production. Auxiliary shops of the main production can both sell products (provide services) to other divisions within the enterprise, and sell part of the products (work, services) to the outside.

The production cost of finished products is formed on the 40th or 43rd account.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

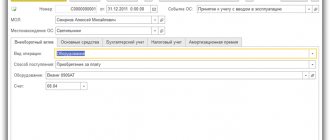

Accounting

In accounting, reflect all costs associated with the purchase of equipment that requires installation on account 07 “Equipment for installation.” Make entries on account 07 simultaneously with drawing up the acceptance certificate (receipt of equipment):

Debit 07 Credit 60 (75, 76, 98...) – reflects the cost of equipment requiring installation;

Debit 19 Credit 60 (76) - reflects input VAT on the cost of equipment requiring installation and the cost of its acquisition.

The cost of equipment transferred for installation is reflected in account 08-3 “Construction of fixed assets”. In addition, on account 08-3, take into account all the costs associated with installing this equipment and bringing it to a state suitable for use (for example, the cost of materials used during installation, the salary of employees who carried out the assembly and installation, the cost of contractor services (if the installation was not carried out by the organization itself), etc.). In this case, make the following entries:

Debit 08-3 Credit 07 – reflects the cost of equipment transferred for installation;

Debit 08-3 Credit 10 (23, 25, 26, 60, 70, 76...) - reflects the costs associated with installing equipment and bringing it to a state suitable for use;

Debit 19 Credit 60 (76) – reflects input VAT on costs associated with installing equipment and bringing it to a state suitable for use.

Reflect the cost of accepted assembled objects on account 01 “Fixed Assets” or account 03 “Profitable Investments in Material Assets”, to which open the sub-accounts “Fixed Assets in Warehouse (in Stock)” and “Fixed Assets in Operation”. If the time of registration of a fixed asset and its commissioning coincides, make the following entry:

Debit 01 (03) subaccount “Fixed asset in operation” Credit 08-3 – the created fixed asset was accepted for accounting and put into operation at its original cost.

If the moments of registering a fixed asset and its putting into operation do not coincide, make the following posting:

Debit 01 (03) subaccount “Fixed asset in warehouse (in stock)” Credit 08-3 – the created object is taken into account as part of fixed assets at its original cost.

This procedure is provided for in paragraph 20 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n, and the Instructions for the chart of accounts.

In accounting, pay off the cost of installed fixed assets by calculating depreciation. Depreciation is accrued for fixed assets of non-profit organizations. This procedure is provided for in paragraph 17 of PBU 6/01.

Moving Equipment

Unlike goods, equipment moves not between warehouses, but between departments. In addition, the movement of equipment can be done between financially responsible persons.

During the move, the depreciation calculation method may change. In this case, you need to fill in the appropriate details.

Otherwise, there should be no questions regarding this operation:

BASIC: income tax

In tax accounting, when purchasing equipment that requires installation, no expenses arise. This is explained by the fact that the cost of such equipment is taken into account when forming the initial cost of the installed fixed asset, along with other costs associated with installing the facility and bringing it to a state suitable for use (clause 1 of Article 257 of the Tax Code of the Russian Federation). The procedure for forming the initial cost depends on how the fixed asset was received by the organization: for a fee, free of charge, as a contribution to the authorized capital or under a barter agreement (exchange agreement). For details that need to be taken into account in each of these cases, see How to determine the initial cost of a fixed asset in tax accounting.

An example of reflecting in accounting and taxation the receipt of a fixed asset requiring installation

In May, Alfa CJSC purchased equipment for a fee to assemble a production line. The cost of the equipment in accordance with the supply agreement amounted to RUB 5,900,000. (including VAT – RUB 900,000). The equipment was delivered to the organization by a transport company. The cost of her services was 23,600 rubles. (including VAT - 3600 rubles). In the same month, the organization began installing equipment in the production workshop.

The organization hired a contractor to install the equipment. The cost of his services amounted to 118,000 rubles. (including VAT – 18,000 rubles).

In June, the installation of the production line was completed and the facility was put into operation. In the same month, the contractor presented the organization with an acceptance certificate for the work performed and a certificate of the cost of the work performed, on the basis of which the organization paid him for the installation work.

When commissioning the production line, the accountant drew up an act of acceptance and transfer of fixed assets.

The following entries were made in Alpha's accounting records.

In May:

Debit 07 Credit 60 – 5,000,000 rub. – reflects the cost of equipment requiring installation;

Debit 07 Credit 60 – 20,000 rub. – reflects the cost of transportation costs, which increases the cost of equipment;

Debit 19 Credit 60 – 900,000 rub. (RUB 5,900,000 – RUB 5,000,000) – input VAT is reflected on the cost of equipment requiring installation;

Debit 19 Credit 60 – 3600 rub. (RUB 23,600 – RUB 20,000) – input VAT is reflected on the costs of delivering equipment that requires installation;

Debit 08-3 Credit 07 – 5,020,000 rub. (RUB 5,000,000 + RUB 20,000) – reflects the cost of equipment transferred for installation of the production line;

Debit 68 subaccount “Calculations for VAT” Credit 19 – 903,600 rub. (RUB 900,000 + RUB 3,600) – accepted for deduction of input VAT on costs that form the cost of received equipment requiring installation.

In June:

Debit 08-3 Credit 60 – 100,000 rub. – reflects the cost of the contractor’s services, which increases the initial cost of the installed production line;

Debit 19 Credit 60 – 18,000 rub. – reflected input VAT presented by the contractor;

Debit 01 subaccount “Fixed assets in operation” Credit 08-3 – RUB 5,120,000. (RUB 5,020,000 + RUB 100,000) – the production line was accepted for accounting and put into operation;

Debit 68 subaccount “Calculations for VAT” Credit 19 – 18,000 rub. – accepted for deduction of input VAT on installation work performed by the contractor.

In tax accounting, the accountant included the production line as depreciable property at the original cost of RUB 5,120,000.

Situation: how to reflect in accounting and taxation the costs of accommodation and food for employees of a third-party organization performing equipment installation under a contract? Such payment is provided for in the contract.

In accounting, all costs associated with the installation of equipment are included in the initial cost of the object and are subsequently repaid by calculating depreciation (clause 8, 17 of PBU 6/01).

When calculating income tax, an organization has the right to take into account any economically justified expenses that are documented and related to activities aimed at generating income. This follows from the provisions of paragraph 1 of Article 252 of the Tax Code of the Russian Federation.

In tax accounting, the recognition of economically justified expenses for accommodation and food for the contractor's employees depends on whether such expenses are included in the price of the contract or are paid in excess of it.

The price of the contract includes both remuneration to the contractor and compensation for his costs (Part 2 of Article 709 of the Civil Code of the Russian Federation). Consequently, if the terms of the contract provide for compensation by the customer for the costs of accommodation and food for the contractor’s employees (as part of the contract price), such expenses are a form of payment for the work. This means that they can be taken into account when calculating income tax on the basis of paragraph 1 of Article 252 of the Tax Code of the Russian Federation. A similar point of view is reflected in the letter of the Ministry of Finance of Russia dated November 14, 2011 No. 03-03-06/1/755.

There are examples of court decisions confirming this position (see, for example, decisions of the Federal Antimonopoly Service of the Ural District dated January 19, 2009 No. Ф09-10311/08-С3, Volga District dated March 5, 2009 No. A57-12814/2006).

When performing work by a foreign organization, withhold VAT from the entire amount transferred to it, including compensation for travel, accommodation and food expenses for its employees (letter of the Ministry of Finance of Russia dated May 2, 2012 No. 03-07-08/125).

If the costs of accommodation and food for specialists (including foreign ones) installing equipment under a contract are not included in the contract price, then such costs cannot be considered economically justified. This is explained by the fact that the obligation to reimburse such costs is provided for by labor legislation (Articles 166, 168 of the Labor Code of the Russian Federation). Specialists who install equipment under a contract do not have an employment relationship with the customer, that is, the customer is not obliged to pay the costs of their accommodation and food. Thus, these costs are not recognized as economically justified and do not reduce the tax base for income tax (including through depreciation deductions). This conclusion follows from letters of the Ministry of Finance of Russia dated October 16, 2007 No. 03-03-06/1/723, dated December 19, 2006 No. 03-03-04/1/844.

Determination of the actual cost of manufactured products

At the end of the reporting period, the actual cost of production is determined.

After the actual cost is formed, an adjustment is determined.

An adjustment is a deviation of actual agricultural production from the planned one.

The adjustment is written off in two ways:

- Red reversal - if the actual cost is lower than planned.

120 centners of grain sold; the actual cost of grain is 300 rubles; planned cost – 320 rubles. Adjustment 300-320=20 rub.

D90 K20 – (20*120) = 2400 rub.

A red reversal means a negative number and is subtracted when counting revolutions.

- Additional entry - if the actual cost is higher than the planned one.

120c grain sold. actual cost is 300 rubles, planned cost is 270 rubles. Adjustment 300-270 = 30 rub.

D90 K20 = (30*120) = 3600 rub.

The adjustment is written off at the place where the product is consumed:

- The adjustment for sold products was written off - D90 K20

- The adjustment for products left in the warehouse was written off - D 43 K 20

BASIS: VAT

Input VAT on equipment requiring installation should be deducted immediately after its cost is reflected on account 07. The validity of this approach is confirmed by letters of the Ministry of Finance of Russia dated August 27, 2010 No. 03-07-08/250 and dated April 13, 2006 No. 03-04-11/65. In this case, depending on the method in which the equipment arrived at the organization, consider the following features:

- if the equipment was received for a fee, deduct both the VAT presented by the supplier of the equipment and the tax on the costs associated with its acquisition (for example, on the costs of delivering the equipment). This can be done if other conditions required for deduction are met;

- if the equipment was received free of charge or made as a contribution to the authorized capital, deduct only VAT on the costs associated with its receipt. This can be done if other conditions required for deduction are met;

- if the equipment was purchased under a barter agreement (exchange agreement), deduct the amount of VAT that is indicated in the invoice of the supplier of the counter property (clause 1 of Article 172 of the Tax Code of the Russian Federation). This procedure follows from Article 171 of the Tax Code of the Russian Federation.

The procedure for accounting for VAT on installation work depends on how it was carried out - commercially or with the involvement of a contractor.

If the equipment was installed by a contractor, input VAT on installation work should be deducted after their cost is reflected on account 08. Along with this, other conditions required for deduction must be met. Input VAT on costs associated with bringing the installed object to a state suitable for use should also be deducted at the time of their reflection in accounting, that is, at the time of reflection on account 08. This procedure follows from paragraphs 1 and 6 of Article 171 and paragraphs 1 and 5 of Article 172 of the Tax Code of the Russian Federation.

If the installation work was carried out on an economic basis, at the end of each tax period, charge VAT on their cost (clause 2 of Article 159, clause 10 of Article 167 of the Tax Code of the Russian Federation) and in the same period, deduct it (clause 6 of Article 171 and Clause 5 of Article 172 of the Tax Code of the Russian Federation).

VAT amounts that were accrued from January 1, 2006 to December 31, 2008 and were not accepted for deduction before January 1, 2009, are deductible as the tax is paid to the budget. That is, in the manner prescribed by paragraph 5 of Article 172 of the Tax Code of the Russian Federation as amended in force before the entry into force of Law No. 224-FZ of November 26, 2008.

Input VAT on costs associated with bringing the installed equipment to a state suitable for use should be deducted at the time it is registered, that is, at the time it is reflected on account 08 (clauses 1 and 6 of Article 171, clauses 1 and 5 Article 172 of the Tax Code of the Russian Federation).

Starting from the next month after the facility is put into operation, begin calculating depreciation.

Correspondence 20 accounting accounts

Let's look at typical wiring:

- DT20 KT10 – materials written off.

- DT10 KT20 - return of raw materials to the warehouse.

- DT20 KT10-2 - semi-finished products were released into production.

- DT20 KT10-3 - fuel written off for technological purposes.

- DT20 KT60 - the cost of electricity used in production is taken into account.

- DT20 KT70 – wages accrued to production workers.

- DT20 KT69 - insurance premiums are taken into account.

- DT20 KT23 – costs of auxiliary production are taken into account.

- DT20 KT69 - a reserve has been created to pay for private entrepreneurs and vacations.

- DT20 KT25 (26) - general production (household) expenses are written off.

- DT20 KT28 - losses from defects are displayed.

In the course of its activities, an organization can attract services (products) of its own production. In this case, accounting accounts 20 and 21 are used. Semi-finished products of own production are written off from KT21 to DT20. The ending balance shows the value of work in progress (WIP). Analytics is carried out by types of costs, products, divisions. Account 20 in accounting is reflected in the balance sheet in the second section of assets in the line “Inventories”.

Standard set of equipment and devices

Whether this or that object belongs to industrial inventory is a very common question for accountants. Let's use specific examples to understand what exactly these material assets are and how to most easily identify them when accounting.

The legislator has not clearly stated what characteristics objects must have in order to clearly classify them as inventory. According to established rules, the traditional composition of such property includes the following elements:

- Office furniture

This category includes employee tables and chairs, sofas and armchairs in the reception area, conference room equipment, filing cabinets, stands for equipment and other examples of similar functionality.

- Special equipment for business

Here we are talking about business telephony: wired stationary devices, automatic telephone exchanges of various modifications, all kinds of models of fax equipment and other similar communication equipment.

- Equipment to ensure normal working conditions

These can be traditional air conditioners, or special air humidifiers, devices for sanitizing premises such as DEZAR, fans and all kinds of ionizers and Chizhevsky chandeliers.

- Office equipment

Typically, administration and accounting work using computers, monitors, laptops, copiers, scanners, power supplies and other equipment. It should be classified as a special device.

- Equipment for cleaning in the office and outdoors

Brushes, mops, shovels, dustpans, rakes, vacuum cleaners - everything you need to always keep your office and surrounding area clean. Sometimes you even need a grass clipper, scythe or sickle.

- Special fire safety equipment

The usual fire extinguishers that come to mind immediately are those found in every office: in the hallway or on the stairs. This category also includes special shields equipped with special fire extinguishing devices and sand boxes.

- Equipment for lighting premises and surrounding areas

This group will include all lighting fixtures and devices: fluorescent lamps, sconces, floor lamps, lanterns and outdoor lighting stands, lighting garlands and other similar items.

- Everything for worker hygiene in restrooms

Typically these are waste baskets, hand dryers, towel and liquid soap holders, toilet brushes, air freshener and toilet paper holders, and other employee hygiene items.

- Office stationery

Don’t forget about such items as: hole punchers, binders, archival boxes, staplers of all sizes, sets of pens/refills/ink, special pens, galleys, perforations.

- Items for equipping the kitchen area at work

These are traditional appliances: microwave ovens, dishwashers, toasters, electric kettles, coffee makers and coffee machines of various prices, refrigerators and cutlery and kitchen utensils.

The service life of inventory and tools is determined when it is registered by order of the enterprise.