There are several options for situations when it becomes necessary for the seller to use an adjustment invoice. It is mandatory to create such an invoice with a supporting document confirming the mutual agreement between the seller and the buyer to change the agreed value or quantity of the goods.

An adjustment invoice contains more details than regular invoices:

- Name, number, date;

- Invoice ID to change;

- Details of the seller and buyer;

- Name of services with description:

- Quantity or volume of goods according to the invoice;

- Name of the monetary unit;

- Price per unit of measurement with or without taxes depending on the situation, taking into account the amount before and after changes in conditions;

- Delivery cost excluding taxes, before and after the changes introduced;

- The amount of excise tax, if the product belongs to the excise category;

- Tax rate;

- Tax determined based on the tax rate before and after the change in conditions;

- The total cost of the goods supplied or services provided;

- Difference in value between two invoices.

Situations that do not require issuing an adjustment invoice:

- Technical or arithmetic error

- Unlawful actions of the seller - lowering the tax rate or exemption from VAT

- The buyer returned the goods.

Adjustment invoice in 1C 8.3 from the seller

Let's look at how to make an adjustment invoice (ACF) in 1C 8.3 using the example of reducing the cost of goods.

The organization entered into an agreement with the buyer Azbuka Comfort LLC for the sale of dining room furniture in the amount of 252,000 rubles. (including VAT 20%).

On February 6, the furniture was sold to the buyer:

- “Imperial” table – 10 pcs. at a price of 19,200 rubles. including VAT 20%.

- Dining table “Hermes 2” – 5 pcs. at a price of 12,000 rubles. including VAT 20%.

On April 08, a retro discount was applied to the delivery dated February 06, as agreed, the agreed price was as follows:

- “Imperial” table—RUB 18,000. including VAT 20%.

- Dining table “Hermes 2” - price 9,000 rubles. including VAT 20%.

On the same day, the buyer was issued an adjustment invoice in the amount of RUB 225,000.

See also how to adjust sales if, by agreement of the parties, the cost of sales has changed

Downward Acquisition Adjustment: Regulatory Regulations

An adjustment invoice issued by the seller to the buyer when the cost of shipped goods (work performed, services rendered), transferred property rights changes downwards (including in the event of a decrease in price (tariff) and (or) a decrease in the quantity (volume) of goods shipped ( work performed, services provided), transferred property rights), is a document that serves as the basis for the seller to accept tax amounts for deduction (clause 1 of Article 169 of the Tax Code of the Russian Federation).

An adjustment invoice is issued no later than 5 calendar days from the date of drawing up documents (additional agreement, other primary document) confirming the consent (fact of notification) of the buyer to change the cost of shipped goods (work, services, property rights) (clause 3 of Article 168 Tax Code of the Russian Federation).

According to paragraph 8 of Article 169 of the Tax Code of the Russian Federation, the form of the adjustment invoice and the procedure for filling it out, as well as the forms and procedure for maintaining purchase books and sales books are established by the Government of the Russian Federation.

The Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137 “On the forms and rules for filling out (maintaining) documents used in calculations of value added tax” approved the form of the adjustment invoice and the procedure for filling it out (Appendix No. 2 to the Decree).

Upon receipt from the supplier of an adjustment invoice to reduce the cost of goods, the buyer:

- performs VAT restoration on the difference between tax amounts calculated on the basis of the cost of goods shipped (work performed, services rendered) and transferred property rights before and after such a reduction. VAT restoration is carried out by the buyer in the tax period in which the earliest of the following dates falls: the date of receipt of primary documents for changes in the cost of goods (work, services, property rights) or the date of receipt of an adjustment invoice (clause 4, clause 3, article 170 Tax Code of the Russian Federation);

- records the adjustment invoice in the sales ledger.

At the same time, it should be taken into account that if, until the receipt of the adjustment invoice, the amount of input VAT was not claimed for deduction (i.e., the received invoice for purchased goods (work, services, property rights) was not registered in the purchase book), then the application to deduct the amount of tax taking into account the adjustment made (i.e., registration of the received invoice in the purchase book for the reduced (adjusted) amount of VAT) does not contradict current legislation. Obviously, in this case, the received adjustment invoice for the reduction in value will not be recorded in the sales book.

The Ministry of Finance of Russia recommended using a similar approach to registering invoices to buyers in case of short delivery of goods (letters of the Ministry of Finance of Russia dated May 12, 2012 No. 03-07-09/48, dated February 10, 2012 No. 03-07-09/05).

| 1C:ITS For more information on how a buyer can register invoices when the value of goods is reduced, see the answers from O.S. Duminskaya, Advisor to the State Civil Service of the Russian Federation, 2nd class of the Value Added Tax Department of the Department of Taxation of Legal Entities of the Federal Tax Service of Russia, in the section “Consultations on Legislation”. Note With the indicated answers O.S. Duminskaya (Federal Tax Service of Russia) can be found in the article “The Federal Tax Service used examples to tell how to correctly make entries in the purchase book and the sales book.” |

Sales of goods

Complete the document Sales (act, invoice) transaction type Goods (invoice) .

Postings

Cost adjustment

Complete the document Adjustment of sales based on the document Sales (act, invoice) .

Please pay attention to filling out the fields:

- Type of operation - Adjustment by agreement of the parties , since the cost decreased due to the use of a retro discount, and not due to incorrectly issued documents;

- Reflect the adjustment - In all sections of accounting , since changes in value are reflected not only according to VAT, but also in accounting and tax accounting.

Products tab will be filled with automatically sold products for which you need to change the line amount after the change .

Postings

Exhibition of KSF

Create a CSF using the Write adjustment invoice .

Acceptance of VAT for deduction

Accept VAT for deduction using the document Generating Purchase Ledger Entries in the Operations - Period Closing - Regular VAT Operations section. To automatically fill out the Reducing sales cost , you must use the Fill .

Postings

See also How to protect yourself from accidental adjustments in closed periods

What are adjustments and corrections?

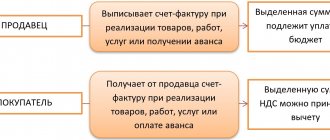

When the cost of shipped products (services, property rights) changes, the Tax Code of the Russian Federation obliges taxpayers to issue an adjustment invoice. Such an adjustment is recorded as follows.

First, a document is drawn up indicating the change in the cost of shipped products (services, property rights). In this case, it does not matter why the cost has changed - due to changes in price or due to changes in the volume of shipped products (services, property rights). In both cases, a document (agreement, etc.) is drawn up that confirms that the buyer agrees to such a change.

When the adjustment document is issued, the seller adjusts the invoice and issues it to the buyer.

The further steps of the seller and buyer directly depend on the type of adjustment.

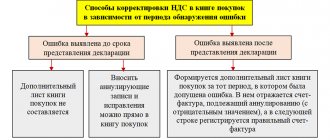

Since legislators approved the preparation of adjustments to invoices, many incidents have accumulated in accounting practice. The reason for this was the misconception of many accountants that any change to a previously issued invoice is documented in an adjustment document. However, it is not.

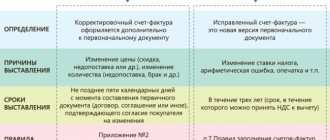

First of all, you need to learn to distinguish between the concepts:

- adjustment , which is formalized by drawing up an adjustment invoice and a primary document;

- an error that was originally made on the invoice and requires correction. In this case, a corrected invoice will be sent to the buyer.

The basis for the adjustment is a contract or other document that confirms that the buyer agrees to a change in the cost of shipped products (services, property rights). These documents confirm that the change took place after shipment.

But in case of violation of the requirements of the Tax Code of the Russian Federation during the initial issuance of an invoice or an error was made, for example, an arithmetic one, the invoice is not adjusted, but corrected. In such a situation, you cannot issue an adjustment invoice.

Adjustment invoice in 1C 8.3 from the buyer

Let's look at how to enter a correction invoice in 1C 8.3 from a supplier using an example.

The organization entered into an agreement with the supplier GrantMebel LLC for the supply of dining room furniture in the amount of 252,000 rubles. (including VAT 20%).

On February 6, dining room furniture arrived at the warehouse and was accepted for accounting:

- “Imperial” table – 10 pcs. at a price of 19,200 rubles. including VAT 20%.

- Dining table “Hermes 2” – 5 pcs. at a price of 12,000 rubles. including VAT 20%.

On April 08, a retro discount was applied to the delivery dated February 06, as agreed, the agreed price was as follows:

- “Imperial” table—RUB 18,000. including VAT 20%.

- Dining table “Hermes 2” - price 9,000 rubles. including VAT 20%.

On the same day, the supplier provided an adjustment invoice in the amount of RUB 225,000.

See also how to adjust the receipt if, by agreement of the parties, the value of the receipt has decreased

Purchasing goods

Complete the document Receipt (act, invoice) transaction type Goods (invoice).

Postings

Cost adjustment

Reduce the cost of delivery using the document Adjustment of receipt based on the document Receipt (act, invoice) .

Pay attention to filling out the Main :

- Type of operation - Adjustment by agreement of the parties , since the cost decreased due to the application of a retro discount, and not due to errors;

- Reflect the adjustment - In all sections of accounting , since changes in value are reflected not only according to VAT, but also in accounting and national accounting;

- the Restore VAT in the sales book checkbox if VAT on the supply was previously accepted for deduction.

Products tab will be filled automatically with received products for which you need to change the amount on the line after the change .

Postings

See also How to make adjustments to documents without re-closing the month

Registration of CSF from the supplier

Reflect the CSF by indicating its number and date at the bottom of the Receipt Adjustment .

Test yourself! Take the test:

- Test No. 26. Setting up accounting policies for NU in 1C: VAT

How to reflect VAT adjustment 1C Accounting 8.3

VAT adjustment is necessary when the purchase or sale price changes. In this situation, an adjustment invoice is generated. Using the example of the 1C Accounting 8.3 program, let's look at adjusting input VAT when the cost decreases. First, we will generate the document “Receipt of goods” and register the “Invoice received”:

When filling out, check the box “Reflect the VAT deduction in the purchase book by the date of receipt”:

Let's say we purchased a large batch of goods, and the supplier offered a discount. Accordingly, there was a decrease in the total cost and VAT. To reflect this in the program, we create a document “Receipt Adjustment”:

In the adjustment on the “Main” tab, you need to check that the basis document is reflected and there is a checkmark next to the “Restore VAT in the purchase book” item.

On the “Products” tab, in the “Price” column, set a new cost, and the values in the “Cost”, “VAT” and “Total” columns will be calculated automatically:

Be sure to register an “Adjustment Invoice” in the receipt adjustment; it is this document that will reflect the decrease/increase in the amount. This data will be displayed in the corresponding field of the document:

We generate the “Purchases Book” and “Sales Book” reports, and check how the “Adjustment Invoice” will be reflected in the reporting:

The “Purchases Book” report reflected the initial amount. But in the “Sales Book” report the amount will already be displayed based on the adjustment invoice.

Now let's look at an example of increasing cost. In the same way, we fill out the “Receipt of goods” and register the document “Invoice”:

The supplier increased the price for a new batch of goods, and an “Adjustment Invoice” was issued. If the buyer agrees with the new cost, then the “Receipt Adjustment” document is drawn up in the same way as in the previous case. You can also create a receipt adjustment using the “Create based on” button from the receipt invoice.

You must fill out:

- Type of operation - “Adjustment by agreement of the parties.”

- Base.

- Restore VAT in the sales book – check the box.

On the “Products” tab, in the “Price” column, set a new price.

We register “Adjustment invoice received”:

In this situation, you need to refer to the routine operation “Creating purchase ledger entries”:

Since in the original “Invoice” document the checkbox “Reflect VAT deduction in the purchase book by the date of receipt” was checked, the data from this document is not displayed when creating purchase book entries. But the adjustment entry is reflected.

As a result, both invoices will appear in the purchase ledger:

If the cost decreases, the data from the adjustment invoice is reflected in the sales book, and if the cost increases, it is reflected in the purchase book.

When sold, an adjustment invoice for a decrease in value will go into the purchase book, and for an increase, it will go into the sales book.

Sales adjustments are made in a similar way. We create a document “Adjustment of sales” taking into account the price reduction:

And we register the “Adjustment Invoice”. Fill in the data in the appropriate field to reduce the cost:

Please note that before generating reports, you must complete regulatory VAT operations.

The Purchase Ledger report will reflect the decrease in value based on the created adjustment invoice. The “Operation Code” column will contain 18, and the column with the name of the seller will display the name of our organization:

Now we form “Adjustment of sales” taking into account the increase in price:

The “Adjustment Invoice” document will reflect the increase in the amount:

Now we generate the “Sales Book” report and see the entry for adjusting the increase in the amount: