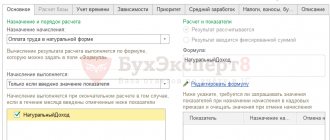

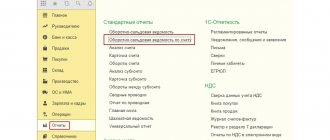

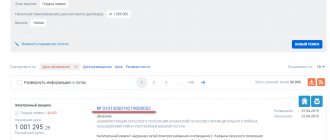

Employee remuneration

The employee who manufactured defective products is paid as follows. If the manufactured product is a complete (irreparable) defect, then in this case the employee’s work is not paid. If a partial (correctable) defect is identified due to the fault of the employee, then it is paid at reduced rates depending on the degree of suitability of the manufactured products. Such rules are established by parts 2 and 3 of Article 156 of the Labor Code of the Russian Federation.

Situation: in what documents are losses from marriage recorded?

In documents approved by the head of the organization.

Any fact of economic life, including the release of marriage, must be confirmed by a primary document (Part 1 of Article 9 of the Law of December 6, 2011 No. 402-FZ).

The forms of primary accounting documents are approved by the head of the organization (Part 4 of Article 9 of the Law of December 6, 2011 No. 402-FZ). For example, if a defect is detected in production, a report can be issued. In this case, the document must contain the mandatory details provided for in Part 2 of Article 9 of the Law of December 6, 2011 No. 402-FZ. In addition, the act should indicate the reasons for the defect, the quantity of defective products, the culprit of the defect, the costs of eliminating the defect and (or) the cost of the defective product, the amounts to be recovered from the culprits of the defect.

Make deductions from your salary to reimburse expenses related to the release of marriage in the same way as deductions related to compensation for material damage.

When is a claim for damages necessary?

In general, the employee is responsible to the employer within the limits of his average monthly earnings (Article 241 of the Labor Code of the Russian Federation). To recover damages from an employee, the employer must obtain a written explanation from him, conduct an internal investigation and then issue an order to recover damages. It is important that the order be issued no later than 1 month from the date of final determination by the employer of the amount of damage caused (say, from the date of the inventory) (Part 1 of Article 248 of the Labor Code of the Russian Federation). If the specified procedure is followed, there is no need to take any additional application from the employee.

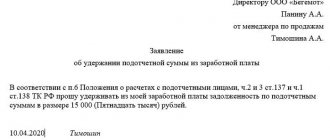

However, it is important to remember here that the amount of damages withheld in the general case should not exceed 20% of the amount due to the employee (after personal income tax withholding) (Article 138 of the Labor Code of the Russian Federation, Letter of the Ministry of Health and Social Development dated November 16, 2011 No. 22-2-4852). To withhold a larger amount, the employee’s corresponding statement will be sufficient grounds.

If the amount of damage exceeds the average monthly salary or the employer missed the one-month deadline for issuing a withholding order, the employer either goes to court or asks the employee for an application for withholding. The statement can replace the indemnification agreement that the employee and the employer can draw up.

Accounting

Accounting for defects caused by an employee depends on whether the defect is partial (correctable) or complete (irreparable).

If there is a partial defect, reflect all costs for its correction in the following entries:

Debit 28 Credit 10 (70, 69, 25, 68…)

– expenses for correcting defects committed by the employee are reflected.

If there is a complete defect, reflect its amount by posting:

Debit 28 Credit 20, 21, 43

– the cost of work in progress, semi-finished products, finished products recognized as defective is written off.

The amount that is withheld from the employee for releasing a defect is reflected as follows:

Debit 73 Credit 28

– reflects the amount that will be withheld from the employee to reimburse the costs of releasing the defect.

Such wiring can be done in one of the following cases:

- the amount of the defect does not exceed the employee’s average monthly earnings (if it exceeds, make the entry for the amount of the average monthly earnings);

- the employee admitted guilt for the marriage and its amount;

- The court made a decision to withhold the amount of the marriage from the employee.

If these conditions are not met, write off the reject amount as follows:

Debit 20 Credit 28

– losses from defects are included in the costs of main production.

This procedure follows from the Instructions for the chart of accounts.

UPP How to write off a marriage? There is only an inventory write-off.

IIt is necessary to write off defective goods to account 91.02, and the document Write-off of goods is written off to 94 (inventory shortage) Maybe with another document?

Get your work in order using the 1C configuration “IT Department Management 8”

ATTENTION!

If you have lost the message input window, press

Ctrl-F5

or

Ctrl-R

or the Refresh button in your browser.

The thread has been archived. Adding messages is not possible.

But you can create a new thread and they will definitely answer you!

Every hour there are more than 2000

people on the Magic Forum.

Income tax

When calculating income tax, losses from marriage are taken into account in full as part of other expenses (subclause 47, clause 1, article 264 of the Tax Code of the Russian Federation). It does not matter at whose expense the defect is written off: at the expense of the employee or at the expense of the organization.

The amount of damage that the employee must pay must be reflected in non-operating income (clause 3 of Article 250 of the Tax Code of the Russian Federation).

Under the cash method, the amount of non-operating income will be equal to the amount of deductions from the employee’s salary in each reporting period (clause 2 of Article 273 of the Tax Code of the Russian Federation).

When using the accrual method, determine income as the amount of compensation for damage as of the date the guilty party was found guilty (for example, on the date of signing an order to withhold damage from an employee’s salary). If the organization seeks compensation for damages through the court, the date of recognition of income is the day the court decision enters into force.

This is stated in subparagraph 4 of paragraph 4 of Article 271 of the Tax Code of the Russian Federation.

The court decision comes into force within 10 days from the date of its adoption by the court, provided that it has not been appealed (Articles 209, 321, 338 of the Civil Procedure Code of the Russian Federation). In this case, income is recognized in the amount specified in the court decision.

An example of deducting the cost of a repairable defect from an employee’s salary. The organization applies a general taxation system

LLC "Proizvodstvennaya" applies a general taxation system. The contribution rate for insurance against accidents and occupational diseases is 0.9 percent. The organization pays contributions to compulsory pension (social, medical) insurance at general rates. The organization produces office furniture. In March, a correctable defect occurred in the production of products. The reason for the defect was failure to comply with the technology by worker A.I. Ivanov. The employee does not have rights to deductions for personal income tax.

The organization's expenses for correcting the defect amounted to 24,188 rubles, including:

- cost of materials used – 8480 rubles;

- the salary of employees correcting marriages is 12,000 rubles;

- the amount of contributions for compulsory pension (social, medical) insurance – 3600 rubles;

- the amount of contributions for insurance against accidents and occupational diseases is 108 rubles.

Ivanov’s average monthly salary is 27,000 rubles.

Ivanov's partial marriage was paid at reduced rates. In March, when the employee committed marriage, his salary was accrued in the amount of 22,000 rubles, personal income tax on this amount is 2,860 rubles. (RUB 22,000 × 13%).

Since the amount of the marriage is less than the average salary of an employee, Ivanov fully compensates for the damage caused to the organization. The maximum amount that can be withheld from an employee in March is: (RUB 22,000 – RUB 2,860) × 20% = RUB 3,828.

The accountant made the following entries in accounting.

In March:

Debit 28 Credit 10 – 8480 rub. – the cost of materials used to correct the defect has been written off;

Debit 28 Credit 70 – 12,000 rub. – salaries were accrued to employees correcting marriages;

Debit 28 Credit 69 “Settlements with the Pension Fund” – 2640 rubles. (RUB 12,000 × 22%) – pension contributions have been accrued;

Debit 28 Credit 69 subaccount “Settlements with the Social Insurance Fund” – 348 rubles. (RUB 12,000 × 2.9%) – contributions to the Russian Social Insurance Fund have been accrued;

Debit 28 Credit 69 “Settlements with FFOMS” – 612 rubles. (RUB 12,000 × 5.1%) – contributions to the Federal Compulsory Medical Insurance Fund have been accrued;

Debit 28 Credit 69 subaccount “Settlements with the Social Insurance Fund for contributions to insurance against accidents and occupational diseases” - 108 rubles. (RUB 12,000 × 0.9%) – premiums for insurance against accidents and occupational diseases have been calculated;

Debit 73 Credit 28 – 24,188 rub. – the costs of correcting the defect are attributed to the guilty employee;

Debit 20 Credit 70 – 22,000 rub. – Ivanov’s salary for March was accrued;

Debit 20 Credit 69 “Settlements with the Pension Fund” – 4840 rubles. (RUB 22,000 × 22%) – pension contributions are calculated from Ivanov’s salary;

Debit 20 Credit 69 subaccount “Settlements with the Social Insurance Fund” – 638 rubles. (RUB 22,000 × 2.9%) – contributions to the Russian Social Insurance Fund were accrued from Ivanov’s salary;

Debit 20 Credit 69 “Settlements with FFOMS” – 1122 rubles. (RUB 22,000 × 5.1%) – contributions to the FFOMS are accrued from Ivanov’s salary;

Debit 20 Credit 69 subaccount “Settlements with the Social Insurance Fund for contributions to insurance against accidents and occupational diseases” - 198 rubles. (RUB 22,000 × 0.9%) – contributions for insurance against accidents and occupational diseases were calculated from Ivanov’s salary;

Debit 70 Credit 68 subaccount “Personal Income Tax Payments” – 2860 rubles. (RUB 22,000 × 13%) – personal income tax was withheld from Ivanov’s salary.

Debit 70 Credit 73 – 3828 rub. – losses from marriage were withheld from Ivanov’s salary.

In April:

Debit 70 Credit 50 – 15,312 rub. (22,000 rubles – 2860 rubles – 3828 rubles) – Ivanov’s salary was issued.

When calculating income tax, the accountant included in expenses the cost of the correctable defect - 24,188 rubles, and reflected the amount of compensation in income - 24,188 rubles.

An example of deducting the cost of an irreparable defect from an employee’s salary. The organization applies a general taxation system

LLC "Proizvodstvennaya" applies a general taxation system. The contribution rate for insurance against accidents and occupational diseases is 0.9 percent. The organization pays contributions to compulsory pension (social, medical) insurance at general rates. Due to non-compliance with technology in April, worker A.I. Ivanov allowed the product to be defective. Marriage cannot be fixed. The commission estimated losses from defects (cost of materials, employee’s salary, salary accruals, etc.) at 20,000 rubles.

The average salary of an employee is 15,000 rubles. Ivanov has no rights to deductions for personal income tax.

Complete marriage is not paid for. Therefore, in April, when the employee committed a marriage, his salary was accrued in a smaller amount - 10,000 rubles.

In this case, the amount of material damage (RUB 20,000) is greater than the average employee salary (RUB 15,000). Therefore, by order of the manager, the cost of losses within 15,000 rubles is withheld from the employee’s earnings.

The accountant made the following entries in accounting.

In April:

Debit 28 Credit 20 – 20,000 rub. – the actual cost of the defect is written off;

Debit 73 Credit 28 – 15,000 rub. – losses from defects have been reduced by the amount of the employee’s average monthly earnings;

Debit 20 Credit 28 – 5000 rub. (20,000 rubles – 15,000 rubles) – losses from defects are written off against the cost of similar products manufactured in the reporting period;

Debit 20 Credit 70 – 10,000 rub. – the employee’s wages are accrued;

Debit 20 Credit 69 “Settlements with the Pension Fund” – 2200 rubles. (RUB 10,000 × 22%) – pension contributions accrued;

Debit 20 Credit 69 subaccount “Settlements with the Social Insurance Fund” – 290 rubles. (RUB 10,000 × 2.9%) – contributions to the Russian Social Insurance Fund have been accrued;

Debit 20 Credit 69 “Settlements with FFOMS” – 510 rubles. (RUB 10,000 × 5.1%) – contributions to the Federal Compulsory Medical Insurance Fund have been accrued;

Debit 20 Credit 69 subaccount “Settlements with the Social Insurance Fund for contributions to insurance against accidents and occupational diseases” - 90 rubles. (RUB 10,000 × 0.9%) – premiums for insurance against accidents and occupational diseases have been calculated;

Debit 70 Credit 68 subaccount “Personal Income Tax Payments” – 1300 rubles. (RUB 10,000 × 13%) – personal income tax withheld.

In April, when an employee committed a marriage, the organization can recover only 1,740 rubles at a time. ((RUB 10,000 – RUB 1,300) × 20%).

Debit 70 Credit 73 – 1740 rub. – losses from marriage are withheld from the employee’s salary.

In May:

Debit 70 Credit 50 – 6960 rub. (RUB 10,000 – RUB 1,300 – RUB 1,740) – the employee’s salary was issued.

The organization calculates income tax on a monthly basis (accrual method). In April, the accountant included in expenses the cost of an irreparable defect - 20,000 rubles, and reflected the amount of compensation in income - 15,000 rubles.

simplified tax system

Regardless of what object of taxation the organization uses when calculating the single tax under simplification, the cost of defects paid by the employee increases the tax base (Clause 1 of Article 346.15 of the Tax Code of the Russian Federation). Take into account the amount of non-operating income at the time of deduction from wages, when depositing money into the cash register, etc. (Clause 1 of Article 346.17 of the Tax Code of the Russian Federation).

If an organization calculates a single tax on the difference between income and expenses, then take into account losses from the production of defective products in this order.

If there was an irreparable defect, then do not include the amounts of expenses associated with the production of defective products in the tax base. These costs are not in the list of expenses that can be taken into account when calculating the single tax (Clause 1, Article 346.16 of the Tax Code of the Russian Federation).

If there was a correctable defect, then the amount of expenses associated with its correction is included in the tax base for the corresponding cost items. For example, write off the cost of additional material resources spent on correcting a defect as material expenses (subclause 5, clause 1, article 346.16 of the Tax Code of the Russian Federation). And the salary of an employee involved in eliminating the defect (if the defect is corrected by another employee) is in the amount of labor costs (subclause 6, clause 1, article 346.16 of the Tax Code of the Russian Federation).

UTII

The object of UTII taxation is imputed income (clause 1 of Article 346.29 of the Tax Code of the Russian Federation). Therefore, the amount of compensation an employee receives for losses from marriage does not affect the calculation of the single tax.

Count 28: production defects. example, wiring

Results There are several types of marriage. Depending on its classification, the rules for including losses from defects in the cost of production vary. Accounting for defects in an enterprise is important for detecting the causes of defects, analyzing and tracking changes in losses from defects, as well as for improving the quality of manufactured products. Read about the tax nuances of returning defective products in the material “The buyer returned a defective product. How to reflect the refund in the seller’s tax accounting? Latest articles Reflecting in accounting returnable production waste (nuances) Act on write-off of low-value and wear-and-tear items Features of tax and accounting of inventories in housing and communal services Order on the commission for write-off of material assets Main reasons for write-off of furniture (tables, chairs, etc.)

OSNO and UTII

If an organization combines the general taxation system and UTII, it is obliged to keep separate records of income, expenses and business transactions (clause 7 of Article 346.26 of the Tax Code of the Russian Federation).

When calculating income tax, include in non-operating income the amount of compensation for damage by an employee who is engaged in activities on the general taxation system.

If the defective products were produced by an employee who is engaged in both types of activities, then when compensating the employee for damages, include the entire amount of non-operating income in the calculation of the tax base for income tax. This is stated in letters of the Ministry of Finance of Russia dated March 15, 2005 No. 03-03-01-04/1/116 and the Federal Tax Service of Russia for Moscow dated November 6, 2007 No. 20-12/105713. This position is based on the fact that the current tax legislation does not contain a mechanism for distributing non-operating income between different types of activities.