Acquisition of property

A developer can obtain ownership of a land plot by purchasing it under a purchase and sale agreement, an exchange (barter) agreement, receiving it as a contribution to the authorized (share) capital, or receiving it free of charge.

In this case, the object of the transaction can only be those land plots that have undergone state cadastral registration (Clause 1, Article 37 of the Land Code of the Russian Federation).

The owner of a land plot has the right to use it in accordance with the type of permitted use of the land plot specified in the State Real Estate Cadastre (Clause 1, Article 263 of the Civil Code of the Russian Federation, Article 37 of the Town Planning Code of the Russian Federation). Types of permitted use of land plots for capital construction are established in relation to the territorial zone.

Owners should take into account that the type of permitted use of the land plot determines the possibility of reconstructing existing buildings, as well as new construction on the land plot. It influences which buildings (buildings of what functional purpose) can be created on a given land plot. So, for example, a production workshop located on a land plot with the type of permitted use “for industrial production” cannot be reconstructed into a shopping center without changing the type of permitted use of this land plot.

To summarize information on the costs of the paid acquisition of a land plot, use account 08 (sub-account 08-1 “Acquisition of land plots”) (clause 27 of the Methodological Recommendations approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n).

Otherwise, the procedure for recording the acquisition of a land plot in accounting depends on who finances the construction:

- attracted investor;

- developer who acts as an investor.

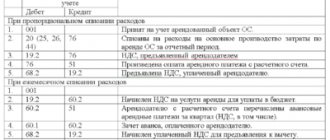

If the cost of a land plot acquired for the construction of an object is reimbursed at the expense of attracted investors (shareholders), the developer does not have the right to recognize it as an object of fixed assets, since in this case it does not comply with the conditions of paragraph 4 of PBU 6/01. Reflect the acquisition of land with the following entries:

Debit 08-1 Credit 60 – a plot of land was purchased for construction at the expense of investors (shareholders).

This procedure is established by the Instructions for the chart of accounts.

After completion of construction, the developer transfers this plot to investors or shareholders in accordance with the agreement and its cost is written off as settlements with them. For more information about this, see How to register and record the disposal of land for construction.

If the construction is financed by a developer and he is constructing an object for sale, then he also does not have the right to recognize the land plot as part of fixed assets. In this case, the site does not meet the conditions provided for in paragraph 4 of PBU 6/01. Reflect the acquisition of land with the following entries:

Debit 08-1 Credit 60 – a plot of land was purchased for construction for sale.

If the construction is financed by a developer who is building a facility for himself, then he includes the land plots received into ownership (except for lands acquired for resale) in accounting as part of fixed assets if all the necessary conditions are met (clauses 4, 5 of PBU 6/ 01). This operation is reflected by transactions:

Debit 08-1 Credit 60 – acquired land for construction;

Debit 01 Credit 08-1 – the acquired land plot is reflected as part of fixed assets.

The procedure for determining the initial cost, documentation and reflection in accounting depend on the method of obtaining ownership of land plots:

- for a fee;

- under a barter agreement;

- as a contribution to the authorized capital;

- free of charge.

At the same time, take into account the peculiarities of accounting for fixed assets that require state registration.

There are no special unified forms for registering land plots in the legislation. Therefore, use for this form No. OS-1, approved by Decree of the State Statistics Committee of Russia dated January 21, 2003 No. 7.

The peculiarity of accounting for land plots is that they are not subject to depreciation, their original cost is not repaid (paragraph 5 of clause 17 of PBU 6/01).

Accounting

The actual costs at which a plot of land is taken into account may include:

- the cost of the plot paid to the seller;

- real estate, consulting services;

- payments to the intermediary;

- the amount of state duty for land registration;

- other costs associated with the acquisition of land.

On a note! When borrowed funds are used to purchase a plot, the interest on them is gradually included in the cost of the land until the moment when it moves from non-current assets to fixed assets (PBU 15/2008 “Accounting for expenses on loans and credits”).

Transactions with land plots may include: receiving as a gift, under an exchange agreement, receiving as a contribution to the authorized capital, as well as purchase, sale, lease, sale of part of the plot, etc.

How can an organization remove a land plot from cadastral registration ?

Let's look at the most common land transactions that an accountant has to take into account.

Purchase

Land is included in accounting as fixed assets:

- Dt 08/1 Kt 60 - purchase of memory from a counterparty;

- Dt 08/1 Kt 10, 60.76 - acquisition costs (real estate, consulting, material);

- Dt 08/1 Kt 76 (68/invoice “State duty”) - the state duty for registering a land plot is reflected;

- Dt 01 Kt 08/1 - ZU is included in fixed assets.

Land is included in accounting as an object of subsequent resale:

- Dt 41 Kt 60 - purchase of memory from a counterparty;

- Dt 41 Kt 10, 60, 76 - acquisition costs (real estate, consulting, material);

- Dt 41 Kt 76 (68/invoice “State duty”) - reflects the state duty for registering a land plot.

On a note! Despite the fact that there are no clear distinctions between the use of accounts 76 and 68 when accounting for state duties, the tax authorities recommend that the duty for registration of a site be taken into account in account 68, since it is a federal tax (Article 13 of the Tax Code of the Russian Federation).

Sale

Land sold as OS:

- Dt 62 Kt 91 - income from the sale of storage units is recorded;

- Dt 91 Kt 01 - fixed asset deregistered at its cost;

- Dt 91 Kt 10, 70, 60, etc. - the costs of selling the storage unit are taken into account.

Land sold as a commodity:

- Dt 62 Kt 90 - income from the sale of storage units is recorded;

- Dt 90 Kt 41 - the storage unit is written off as a product from the register, at its cost;

- Dt 44 Kt 10, 70, 60, etc.

- Dt 90 Kt 44 - expenses for the sale of storage units as goods are taken into account and written off.

Sale of part of the plot

Let's look at an example of how to correctly account for the sale of part of a plot. Let the memory be listed on account 01 as a fixed asset, a single object. Its cost is approximately 100,000 rubles. After the cadastral work was completed, the land was divided into two parts. One remains in the organization (60,000 rubles), and the other is sold (40,000 rubles). 50,000 rubles were received from the sale.

Let's divide the area in accounting:

- Dt 01 “for sale” Kt 01 “initial” - 40,000 rubles. — a part has been allocated for sale;

- Dt 01 “remaining in the organization” Kt 01 “initial” - 60,000 rubles. – the part remaining in the organization is allocated;

- Debit 91 Credit 01 “for sale” - written off from the register of a loan subject to sale at its cost of 40,000 rubles;

- Debit 62 Credit 91 - 50,000 rub. income from sales.

Next, we take into account the costs of sale, according to the above correspondence: Dt 91 Kt expense account, and reflect the profit (loss) from the transaction Dt 91 (99) Kt 99 (91) .

In this case, it would be correct to divide the plots, and not write off the land plots and register two newly formed objects.

Rent

Initially, expenses for concluding a lease agreement are charged to account 97 “Deferred expenses”, and then in equal shares are written off to accounts for ordinary activities:

- Dt 97 Kt 76 - costs of acquiring the right to lease;

- Dt 19 Kt 76 - VAT accrual on the value of the rental right;

- Dt 68 Kt 19 - VAT is presented for deduction;

- Dt 20, 25, 26, etc. Kt 97 - write-off of a share of expenses during the lease term.

The rent is calculated by posting Dt 20, 25, 26, etc. Kt 76. If the rental conditions allow, VAT can also be deducted from the amount (see postings above).

Sublease, unless prohibited by the contract, is documented by postings: Dt 62 Kt 91 and Dt 91 Kt 68.

Rent

The procedure for transferring land plots for lease is regulated by Article 22 of the Land Code of the Russian Federation.

A developer can lease land for construction:

- under a lease agreement with the owner of the land plot (including lands from state and municipal property);

- through the assignment of lease rights by the primary tenant (including lands from state and municipal property).

A land lease agreement concluded for a period of one year or more is subject to mandatory state registration (clause 1 of Article 164 and clause 2 of Article 609 of the Civil Code of the Russian Federation, clause 2 of Article 25 and clause 2 of Article 26 of the Land Code of the Russian Federation) . For registration of such transactions, organizations are charged a state duty of 15,000 rubles. (Subclause 22, Clause 1, Article 333.33 of the Tax Code of the Russian Federation).

Situation: is it necessary to register an agreement on the assignment of the rights of a tenant of a land plot to a third party? The lease agreement under which the rights were transferred has undergone mandatory state registration.

Yes need.

The transfer of the tenant's rights to a third party does not require the conclusion of a new lease agreement. Such a concession can be formalized, for example, by a lease agreement. This conclusion follows from paragraph 5 of Article 22 of the Land Code of the Russian Federation and paragraph 2 of Article 615 of the Civil Code of the Russian Federation.

According to paragraph 1 of Article 164 of the Civil Code of the Russian Federation, transactions with land and other real estate are subject to state registration in the cases and in the manner provided for in Article 131 of the Civil Code of the Russian Federation and Law No. 122-FZ of July 21, 1997.

The Civil Code provides that assignment of claims and transfer of debt, which are based on transactions subject to state registration, are also subject to state registration (clause 2 of Article 389 and clause 2 of Article 391 of the Civil Code of the Russian Federation).

Thus, if the lease agreement was subject to mandatory state registration, then the agreement on the assignment of the rights of the tenant of the land plot under such an agreement to a third party must also be registered. At the same time, for registering the transfer of lease rights, the organization must pay a state duty in the amount of 15,000 rubles. (Subclause 22, Clause 1, Article 333.33 of the Tax Code of the Russian Federation).

A similar point of view is expressed in the letter of the Ministry of Finance of Russia dated October 12, 2009 No. 03-05-05-03/12.

Documentation and recording of the receipt of land plots under a lease agreement occurs in the same way as for any other property. For more information about this, see How a tenant can reflect the receipt of property under a lease agreement in accounting.

The developer may enter into a lease agreement for lands that are in municipal (state) ownership. He receives this right at an auction. In this case, he bears the costs of acquiring the right to conclude such an agreement (Article 30.1 of the Land Code of the Russian Federation).

The costs of acquiring the right to conclude a lease agreement for a land plot intended for construction are included in the cost of construction as a debit to account 08 (clause 1.2 of the Regulations on Accounting for Long-Term Investments, clause 8 of PBU 6/01).

Free urgent use

The transfer of land for free, fixed-term use is regulated by Article 24 of the Land Code of the Russian Federation.

As a rule, on this basis, land plots are transferred for the following purposes:

- for the construction of infrastructure facilities;

- for housing construction;

- for the construction of real estate at the expense of budget funds under a state (municipal) contract.

If an agreement for free, fixed-term use of a land plot is concluded for a period of one year or more, then such a transaction is subject to mandatory state registration (clause 1 of Article 164 and clause 2 of Article 609 of the Civil Code of the Russian Federation, clause 2 of Article 25 and clause 2 of Art. 26 of the Land Code of the Russian Federation). For registration of such transactions, organizations are charged a state duty of 15,000 rubles. (Subclause 22, Clause 1, Article 333.33 of the Tax Code of the Russian Federation).

Reflect and formalize the operation of obtaining land plots for free use in accounting in the same way as for any other property. For more information about this, see How to record the receipt of property for free use in accounting.

Documentation of transactions with land plots

Operations with land can only be carried out if the agreement is drawn up in writing. The parties draw up 3 copies of the agreement: 1 for each participant in the transaction and 1 for Rosreestr.

The registration of the plot on account 08 is carried out on the date of actual transfer of land according to the transfer and acceptance certificate or the date of signing the agreement (if the agreement is equated by the parties to the transfer and acceptance certificate).

You can keep records of land plots using unified forms OS-1 and OS-6 or using independently developed forms compiled using mandatory details (Article 9 of the Law “On Accounting” dated November 22, 2011 No. 402-FZ).

When accepting a land plot from the founder, it is necessary to conduct an independent assessment of the land, as well as make changes to the company’s constituent documents.

How to do this, read the article “Accounting entries for contributions to the authorized capital” .

If the organization received the land free of charge, then the market valuation of the site is confirmed by an independent appraiser or cadastral registration data (Article 66 of the Land Code of the Russian Federation).

The company can lease the land. Then a lease agreement must be concluded and an act of acceptance and transfer of property to the counterparty must be drawn up. If the lease agreement is concluded for a period of more than a year, then it must be registered with the territorial branch of Rosreestr (clause 2 of Article 609, clause 2 of Article 651 of the Civil Code of the Russian Federation).

For more information about the registration of lease transactions with land, read the article “Accounting for the lease of fixed assets (nuances)” .

Find out whether the sale of land by a member of a peasant farm is subject to taxes in ConsultantPlus. Get trial access to the system and find out the answer to this and other questions for free.

BASIC: income tax

For income tax purposes, land plots (except for lands acquired for resale and financed from investors’ funds) are classified as fixed assets (clause 1 of Article 257 of the Tax Code of the Russian Federation). At the same time, they are not recognized as depreciable property (clause 2 of Article 256 of the Tax Code of the Russian Federation).

For registration of rights to land plots, payment of a state fee is provided (subclause 22, clause 1, article 333.33 of the Tax Code of the Russian Federation).

There is no need to pay property tax on land plots, since they are not subject to this tax (clause 4 of Article 374 of the Tax Code of the Russian Federation). Owners of land plots and organizations that own them under the right of permanent (perpetual) use, as a rule, must pay land tax. For more information about this, see What property is subject to land tax. At the same time, changes in the cadastral value of a land plot do not affect its value in tax accounting. Such a change needs to be taken into account only when calculating land tax. If a land plot is acquired for the purposes of housing construction, then take into account the specifics of calculating land tax in relation to such land.

Otherwise, the calculation of taxes when purchasing (renting) land plots depends on the type of expense:

- acquisition of the right to conclude a lease agreement for a land plot that is in state (municipal) ownership;

- acquisition (rent) of land.

Briefly

- The purchase, sale and lease of land plots for a period of more than a year are registered in Rosreestr.

- It is permissible to register land plots using the forms of primary documents developed by the organization.

- When selling part of a plot, it is necessary to divide it, and not write off and register new objects.

- The purchase and sale of land is not subject to VAT.

- Rental of private land is subject to VAT.

- Sublease of any land is subject to VAT.

- Income tax expenses can include the costs of a plot only when it is sold.

- Otherwise, expenses for land plots of a state or municipal nature are included in income tax calculations if there are buildings on them or their construction is expected.

Purchase and rental

The acquisition (rent) of land plots from state (municipal) property on the basis of agreements concluded during the period from January 1, 2007 to December 31, 2011 is taken into account when calculating income tax in a special manner. For more information about this, see How to take into account expenses related to several reporting periods when calculating income tax.

An example of how to reflect the acquisition of state (municipal) land in ownership in accounting and taxation. The plot was acquired between January 1, 2007 and December 31, 2011

In January 2011, Alfa CJSC (developer) acquired a municipally owned land plot at auction for the purpose of constructing production facilities. It was put into operation the same month. The cost of the land plot was 19,500,000 rubles. Documents for state registration of the transfer of ownership were submitted in February 2011. The state registration fee was paid in January 2011 (before the land plot was put into operation). The accounting policy for tax purposes establishes a period for writing off expenses for the acquisition of rights to land plots - five years.

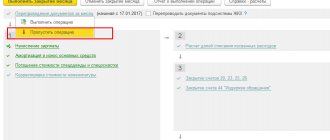

Alpha's accountant made the following accounting entries.

January 2011:

Debit 08-1 Credit 76 – 19,500,000 rub. – capital investments are reflected in the form of the cost of a land plot;

Debit 68 subaccount “State duty” Credit 51 – 15,000 rub. – the state fee for registering the transfer of ownership has been paid;

Debit 08-1 Credit 68 subaccount “State duty” - 15,000 rubles. – the amount of state duty for registering property rights is allocated to the increase in the initial cost of the land plot;

Debit 01 Credit 08-1 – RUB 19,515,000. – the land plot is included in fixed assets.

Since the amount of expenses for the acquisition of land is not taken into account in accounting, permanent differences arise and a corresponding permanent tax asset arises.

January 2011:

Debit 68 subaccount “Calculations for income tax” Credit 99 – 3000 rub. (RUB 15,000 × 20%) – a permanent tax asset is reflected due to the difference in the recognition of state duty.

February 2011:

Debit 68 subaccount “Calculations for income tax” Credit 99 – 65,000 rubles. (RUB 19,500,000: 5 years: 12 months × 20%) – a permanent tax asset is reflected due to the difference in recognizing the value of the land plot.

The Alpha accountant will make this entry monthly for five years (until the expenses are completely written off in tax accounting).

The following procedure applies to the remaining land plots.

A peculiarity of tax accounting of land plots is that they belong to fixed assets that are not subject to depreciation (clause 2 of article 256, clause 1 of article 257 of the Tax Code of the Russian Federation).

Expenses for the acquisition of land cannot be recognized in tax accounting. The provisions of Article 264.1 of the Tax Code of the Russian Federation, which allow the recognition of expenses for the acquisition of land, apply only to transactions with state (municipal) land plots under agreements concluded in the period from January 1, 2007 to December 31, 2011.

Situation: can the developer include the cost of a privately owned land plot acquired for a fee in the initial cost of the building that will be built on it and pay it off through depreciation of this building?

No, he can not.

Land plots are an independent object of tax accounting, since they are classified as fixed assets (clause 1 of Article 257 of the Tax Code of the Russian Federation). In addition, they are not subject to depreciation (clause 2 of article 257 of the Tax Code of the Russian Federation).

However, if the developer decides to sell the land, then the income received can be reduced by the costs of its acquisition (subclause 2, clause 1, article 268 of the Tax Code of the Russian Federation). For more information about this, see How to record the disposal of land intended for construction.

If a land plot is purchased at the expense of an investor (as part of an investment agreement in construction), then the funds received for its acquisition are not the income of the developer. Do not take such funds into account when calculating income tax only if separate accounting is maintained. This is stated in subparagraph 14 of paragraph 1 of Article 251 of the Tax Code of the Russian Federation. Consequently, when transferring land to an investor, it is impossible to take into account the costs of its acquisition (Clause 17, Article 270 of the Tax Code of the Russian Federation).

Consider the costs of renting land for construction in the following order. Expenses incurred before the start of construction and directly during the construction period should be taken into account in the initial cost of the facility under construction (clause 1 of Article 257 of the Tax Code of the Russian Federation, letters of the Ministry of Finance of Russia dated November 11, 2011 No. 03-03-06/1/749 and dated 20 May 2010 No. 03-00-08/65). Upon completion of construction of the facility, consider expenses in the form of rental payments in the same manner as when renting any other property. For more information about this, see How a tenant can report rental payments for tax purposes.

BASIS: VAT

The acquisition of land plots into ownership does not entail consequences for the payment of input VAT, since operations for the sale of land plots are not recognized as subject to VAT (subclause 6, clause 2, article 146 of the Tax Code of the Russian Federation).

If the land is leased, and the lessor is an organization that pays VAT, then land lease operations are subject to VAT in the usual manner (clause 1 of Article 146 of the Tax Code of the Russian Federation). The tenant will receive an invoice, register it in the purchase book and, subject to all conditions, accept input VAT for deduction. Moreover, if land that is in state (municipal) ownership is leased, the tenant is not a tax agent (subclause 17, clause 2, article 149 of the Tax Code of the Russian Federation). For more information about this, see Who is recognized as a tax agent for VAT.