Features of returning money to the cash desk by an accountable person

Organizations (IP) can issue funds on account in two ways:

- transfer to an employee’s account or corporate card (letter of the Ministry of Finance of the Russian Federation dated October 5, 2012 No. 14-03-03/728);

- issuing cash (directive of the Bank of Russia “On the procedure for conducting cash transactions...” dated March 11, 2014 No. 3210-U).

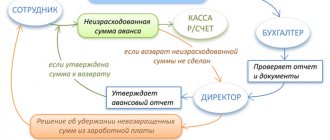

If an employee has not used all the accountable money issued to him, he must return it within the time period established for this by the employer (clause 6.3 of instruction No. 3210-U).

The amount of the refunded amount is determined based on the results of verification and approval of the advance report on the amounts spent. Such a report must be drawn up no later than the number of working days approved by the organization from the expiration date for which the money was issued (clause 6.3 of instruction No. 3210-U).

ATTENTION! From November 30, 2020, the requirement to submit a report within 3 working days has been canceled.

From November 30, 2020, other changes to reporting and cash register came into effect. ConsultantPlus experts spoke in more detail about the innovations. Get trial access to the K+ system and go to the review material for free.

The issuance period is fixed in the application drawn up by the employee for the issuance of an advance, or in the employer’s administrative document on the issuance of money on account. From 08/19/2017 (instruction of the Bank of Russia dated 06/19/2017 No. 4416-U), the completion of an application by an employee is no longer a mandatory condition for the payment of accountable amounts. It can be carried out on the basis of an administrative document of the head of the legal entity (or individual entrepreneur).

You will find an example of such a document in ConsultantPlus. Trial access to the legal system is free.

IMPORTANT! Directive No. 3210-U applies its rules only to the rules for issuing and returning funds in cash. For non-cash payments for accountable amounts, its provisions do not apply, and an employer using this method must approve the procedure for settlements with accountables by an internal document.

Example

The manager of the conditional LLC received 4 thousand rubles from the cash register on May 15, 2015. to pay for repairs of household appliances at a service center. The amount of actual costs amounted to 2.5 thousand rubles.

In an LLC, cash is issued for reporting purposes for such purposes for a period of 28 days. This is stipulated by a separate order from the manager. You must report on the use of funds within three business days. That is, the deadline for submitting data to the accounting department is June 14, 2015. On this day, the employee brought office equipment from repair, submitted a report, supplemented by a reconciliation report, a certificate of completion of work and a cash receipt. However, the manager did not return the remainder of the unspent amount to the cash register. On June 27, 2015, the employee signed an agreement to withhold 1.5 thousand rubles from her salary.

The manager's salary for June amounted to 24 thousand rubles. An accountant can keep the maximum: (24 - 24 x 0.13) x 0.2 = 4.176 thousand rubles. The unrefunded balance exceeds this amount. Therefore, deductions are made in full.

If the employee refuses to return the remaining amount voluntarily, he will have to go to court. In this case, the company’s costs will increase by at least the amount of payment of state duty. But so that the judge does not have unnecessary questions, it is necessary to prescribe the deadlines and procedure for submitting documents on the use of funds by employees of the enterprise in a separate order of the manager and enshrine it in the accounting policies of the organization.

Is it possible to return accountable funds to a current account?

Current legislation does not prohibit employees from returning accountable amounts to the employer’s bank account. However, in order to avoid disputes with tax authorities, it is necessary to establish in an internal regulatory document the possibility of reporting persons returning unspent funds to the company’s current account or to record such a return option in an application (order) for the issuance of advance amounts.

To identify the transfer, the employee making the transfer must indicate in the payment purpose that he is returning the accountable amounts.

And yet, the optimal way to return accountable funds, eliminating any disagreements with controllers, is to the enterprise’s cash desk.

Account 71 in accounting

Upon the issuance of a cash accountable amount or transfer of non-cash funds, account 71 in accounting is debited while simultaneously reflecting the same amount on the credit of the accounts on which cash amounts are recorded. These can be accounts 50 “Cash”, 51 “Currency accounts” or 52 “Currency accounts”.

The debit of account 71 shows the debt of the reporting individual (employee, contractor, performer) to the employer or customer.

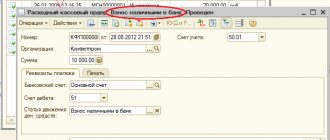

An entry on the debit of account 71 is possible only if the primary document is drawn up. When cash is issued, a cash order is drawn up, and when the amount is transferred non-cash, a bank statement can serve as a primary source.

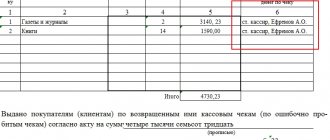

Upon spending the accountable amount, an individual draws up a mandatory document. An advance report serves as such a document. The employer or customer determines the form of the report independently. As a rule, standard form No. AO-1 is used. It is presented in the window below and can be downloaded.

At will, the employer can modify the standard form of the advance report and supplement it with any details. There is only one requirement for the document - it must have all the mandatory “primary” details specified in the accounting law. In addition, an individual must attach documents to the advance report that confirm the fact of the expenditure, its targeted nature and its amount.

Upon approval by the manager of the advance report with the documents attached to it, account 71 in the accounting records is credited while simultaneously reflecting the cost of purchased property, services or work in the debit of the corresponding accounting accounts. If the accountable amount was not enough, then there is an overspending.

Credit 71 of the account shows the debt of the employer or customer to the reporting individual.

How is the amount of return of funds taken into account reflected in accounting?

The company, having received accountable amounts from the employee, reflects the following entries in accounting:

- Dt 50 Kt 71 - return of cash to the cash desk;

- Dt 51 Kt 71 - return of accountable amounts to the ruble bank account of the enterprise;

- Dt 52 Kt 71 - return of the sub-report to the company’s foreign currency account;

- Dt 94 Kt 71 - reflection of the debt of the accountable in case of non-repayment of the amounts issued by him.

For information on what to do if an employee does not have enough accountable funds, read the article “ What to do if an accountable person has spent his money? "

Systematization of accounting

You can find out how much and when the employee withdrew from the card from the bank statement. 2. Amounts from the credit of account 71 “Settlements with accountable persons are written off to the debit of accounts: (or) 26 “General business expenses”; (or) 60 “Settlements with suppliers or contractors”; (or) 91 “Other income and expenses, etc. This entry must be made when the employee submits an advance report, attaches supporting documents and the report is approved by the manager. Since the document is dated February, using the accrual method, expenses should be reflected in the period to which they relate - in February. The primary document reached the accounting department late, and the amount indicated on the check was not taken into account as part of the expenses of the first quarter, that is, expenses are reflected untimely, which ultimately leads to distortion of financial results and tax reporting. However, a corporate card in itself is not an independent type of bank account.

And if it was not issued in connection with the opening of a new special card account, the obligation to submit a notification to the tax service does not arise. Another feature is that when paying for goods (work, services) using a corporate card, comply with the payment limit (RUB 100,000).

- draw up a general order on the possibility of making such purchases by employees, for example, an order specifying persons and positions who can make purchases on behalf of the organization;

- You can include a clause in the accounting/personnel policy or cash circulation policy (CAP), which describes the document flow rules for such a situation, which the organization establishes independently.

How to return funds from the account if an employee no longer works for you

If the current employee does not return the accountables, you will find recommendations for further actions in ConsultantPlus. Get trial access to the system for free and go to the Ready-made solution.

In a situation where the employee did not return the accountable money and quit, you can do the following:

- If the employee has not yet been paid, then the debt can be withheld from his salary, subject to the decision of the manager and the consent of the employee. In this case, the withholding should not exceed 20% of the salary (Article 138 of the Labor Code of the Russian Federation).

- If all settlements with the employee are terminated or he does not agree with the amount of withheld amounts, the debt can only be collected through legal proceedings.

To find out whether it is possible to delay the payment of funds due to an employee upon dismissal if he has not returned the accountable amounts, read the material “What payments are due to an employee upon dismissal”.

Results

The law provides for the possibility of issuing money to employees for transportation costs and accommodation during a business trip to resolve production issues, as well as for solving business problems. Funds are allocated for a specific time. The employee must account for the money used and return unused money within strictly regulated legal and local regulations. All costs must be documented. If inaccuracies are identified in the submitted reports, the manager has the right to declare a shortage of funds in the cash register and act in accordance with the rules adopted for this situation.

What to do with the transfer fee?

If a transfer fee was charged for a refund transaction, whether to reimburse it or not and accept it as expenses or not will depend on the wording in the organization’s local act on the procedure for reimbursement of travel expenses and in the local act on non-cash payments.

If the local regulations of the enterprise do not provide for a way to return an unspent advance through an online bank, as well as reimbursement of the bank’s commission for such a transaction, then the employer is not obliged to return to the employee the amount paid to the bank for the transaction.

Thus, a collective agreement or a local act of an organization may establish the types and amounts of reimbursable travel expenses, the procedure for their reimbursement, the procedure and method (cash and/or non-cash, including through online banking) of returning an unused advance, a list of documents accepted in confirmation of expenses (including in the form of a bank commission charged when returning an unspent advance through online banking).

An example of including in a local act a provision on the method of returning unused amounts to the organization’s current account:

The employer's local act may contain a provision on reimbursement to the employee for any expenses incurred with the permission or knowledge of the employer. In this case, the decision to reimburse the bank’s commission for returning money through online banking can also be made.

If reimbursement of the commission is provided for by local regulations, then the employer can take it into account in income tax expenses, like other expenses associated with production and (or) sales (clause 49, paragraph 1, article 264 of the Tax Code of the Russian Federation, Letters No. 03-03 -06/1/18005, No. 16-15/105572).

Basic accounting entries for the calculation and payment of unified social tax

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 20, 26 | 69.01 | Accrual of UST for the social insurance fund from wages | Tax amount | Tax return under Unified Social Tax, accounting certificate-calculation, advance payment calculation |

| 20, 26 | 69.01 | Calculation of compulsory accident insurance payments | Unified Social Tax amount | Accounting certificate-calculation, accounting register for accrual of payments |

| 69.01 | 51 | Withholding of the unified social tax to the Social Insurance Fund and the Compulsory Accident Insurance Payment Fund | Unified Social Tax amount | Bank statement, payment order |

| 69.01 | 70 | Calculation of payments for childbirth, pregnancy and temporary work incapacity, other payments made from the Social Security Fund | Unified Social Tax amount | Payroll, payroll, accounting certificate |

| 20, 26 | 69.02 | Accrual of UST in the Pension Fund from employee wages | Unified Social Tax amount | Accounting register of Unified Social Tax, accounting certificate-calculation |

| 69.02 | 51 | Retention of unified social tax in the Pension Fund of the Russian Federation | Unified Social Tax amount | Bank statement, payment order |

| 20, 26 | 69.03 | Accrual of unified social tax to the Federal Medical Insurance Fund of the Russian Federation from the wage fund | Unified Social Tax amount | Accounting register of Unified Social Tax, accounting certificate-calculation |

| 69 | 51 | Withholding of the unified social tax to the Federal Medical Insurance Fund of the Russian Federation | Unified Social Tax amount | Bank statement, payment order |

| 20, 26 | 69.03 | Accrual of unified social tax to the territorial Health Insurance Fund from wages | Amount of social tax | Accounting register of Unified Social Tax, accounting certificate-calculation |

| 69 | 51 | Withholding the unified social tax to the territorial Health Insurance Fund | Unified Social Tax amount | Bank statement, payment order |

| 99 | 69.01, 69.02, 69.03 | Accrual of fines and penalties for industrial accident insurance payments | Volume of fines and penalties | Accounting certificate-calculation |