Zero calculation for insurance premiums (DAM) for 9 months of 2021 - an example of filling out this report may be needed by those business entities that had no activity and did not make deductions for employees. Everything you need to know about the rules for its design and presentation can be found in this article. Also see “ERSV for the 3rd quarter of 2021“.

Do I need to submit a zero RSV?

The calculation of insurance premiums contains information about the insurance premiums calculated and paid for employees during the reporting period. The DAM, both zero and with accruals, is surrendered in relation to:

- employees with whom employment contracts have been concluded;

- citizens working under civil law contracts;

- individuals with whom agreements have been concluded on the alienation of the exclusive right to certain results of intellectual activity, publishing license agreements, as well as license agreements on granting the right to use the results of intellectual activity;

- authors of works within the framework of an author's order agreement.

Persons required to submit the DAM include:

- organizations - regardless of the presence of employees;

- separate divisions of Russian companies (OP) - if they independently transfer salaries to their employees and pay insurance premiums from them;

- OP of foreign companies - if they operate on the territory of the Russian Federation;

- Individual entrepreneur - if there are employees;

- heads of peasant farms - regardless of the presence of employees;

- individuals without individual entrepreneur status - if they have employees.

The fact of payment of income to employees and payment of insurance premiums from it does not matter for the delivery of a zero RSV. The report is always submitted when there are employees. If contributions from income have not been paid, you need to submit a zero RSV to the Federal Tax Service.

When is the zero calculation for insurance premiums due?

As already noted, the calculation is filled in with data on insurance premiums accrued from wages and other payments. However, it happens that salaries are not paid, for example, due to the suspension of activities. What to do in such a situation?

- Organizations must submit calculations in any case - whether they have payroll accruals or do not have them. It is believed that the company always has one insured person - the director. When the salary is not accrued or paid even to him, the report is filled in with zero indicators and sent to the tax authorities.

- Individual entrepreneurs working alone are not required to submit a zero calculation. However, if they have at least one unterminated employment contract, then they will have to report on contributions. At the same time, the entrepreneur’s employees may be on unpaid leave.

Based on all of the above, there may be several options for submitting zero settlements. Next, let's look at how to correctly draw up zero payments for contributions.

Zero RSV form for 2021

Zero RSV for 2021 is submitted using the updated form. Changes were made by Federal Tax Service Order No. ED-7-11/ [email protected] to Federal Tax Service Order No. ММВ-7-11/ [email protected] , approving the current calculation form.

Zero RSV form for 2021

From 01/01/2020, when submitting a zero DAM, you need to fill out (Letter of the Ministry of Finance of the Russian Federation dated 10/09/2019 No. 03-15-05/77364):

- title page;

- Section 1 (in the “Type of Payer” field, indicate “2”, which means no payments and other remuneration in favor of individuals in the reporting period);

- Section 3 (include dashes and zeros).

There is no need to fill out appendices to Section 1.

Filling Features

An important role is played by the submission of a corrective calculation for the 1st quarter of 2021. For example, if errors and inaccuracies were found in the main document, the EEOC is submitted.

It is definitely needed in the following situations:

- underestimation of insurance premiums;

- lack of specified information;

- incorrect data.

There is no obligation if the detected errors do not imply an understatement of the taxable base.

There are several ordinary situations in which clarification is required:

- detection of erroneous information in data relating to insured persons (errors in TIN, SNILS, address);

- there are basic discrepancies in the indicators of 6-NDFL, DAM (sometimes this is the norm, but most often it requires adjustments).

The method for submitting a corrective document is the same as for the main paper:

- on the title page the serial number value of the document is indicated;

- the “period code” parameter must fully correspond to the time interval during which corrections are made;

- sections drawn up by analogy with the original declaration paper are taken into account;

- in the corrective part, it is necessary to indicate correct information (any errors, inaccuracies, or inaccuracies are excluded);

- The specialist should pay special attention to making changes to section 3.

How to submit a zero RSV for 2021

The delivery of a regular RSV is directly tied to the number of employees to whom income is paid. If there are more than 10 of them, then the report is submitted only in electronic form; if there are 10 or less, submission of the DAM on paper is allowed.

The zero RSV is not tied to the number of employees, since the reason for its presentation is the lack of payments in general. This means that you can submit it:

- On paper.

You can submit the report to the Federal Tax Service in person, through a representative, or by sending a registered letter with a list of attachments.

- In electronic form.

The DAM in the form of an electronic document is sent to the Federal Tax Service via telecommunication channels through electronic document management operators. Before this, the report is signed with an electronic signature.

The employer chooses the delivery method at his own discretion.

Sanctions

Violators of the deadlines and procedures for submitting reports under the DAM face fines.

Late payment deadlines:

- Liability under Article 119 of the Tax Code of the Russian Federation. The fine will be 5% of the amount subject to additional payment based on the calculation for each full or partial month of delay. In this case, the minimum fine will be 1 thousand rubles, and the maximum will be 30% of the surcharge amount.

Important! If you correctly calculated the contributions and paid them on time, then for late delivery of the DAM you face a fine of 1 thousand rubles.

Serious fines threaten those who underestimate the contribution base :

- For gross violation of accounting rules, which led to an understatement, a fine is imposed under Part 3 of Article 120 of the Tax Code of the Russian Federation in the amount of 20% of the unpaid amount, at least 40 thousand rubles.

- For non-payment or incomplete payment of insurance premiums as a result of underestimation of the base - a fine under Part 1 of Article 122 of the Tax Code of the Russian Federation in the amount of 20% of the unpaid amount of contributions.

In addition, violations of the procedure for submitting the DAM :

- if the policyholder was supposed to submit a zero calculation, but did not do so, the fine based on paragraph 1 of Article 119 of the Tax Code of the Russian Federation will be 1 thousand rubles;

- for failure to comply with the reporting form (submitted on paper, although it should have been according to the TKS), a fine will be imposed on the basis of Article 119.1 of the Tax Code of the Russian Federation in the amount of 200 rubles.

Requirements for filling out the DAM for 2021

When filling out a zero RSV, you must adhere to certain requirements. They are listed in the Procedure for filling out the calculation, approved. By Order of the Federal Tax Service dated September 18, 2019 No. ММВ-7-11/ [email protected] (as amended by the Order of the Federal Tax Service dated October 15, 2020 No. ED-7-11/ [email protected] ):

- The calculation is filled out in capital block letters from left to right.

- If data is entered by hand, you can only use blue, black or purple pens. Other colors cannot be used, since the machine will not recognize the information and the report will have to be redone.

- When filling out the RSV on a computer, use Courier New font with a height of 16–18.

- Do not use any corrective or similar products. If an error is made in the calculation, it is better not to correct it, but to redo the sheet completely.

- Also, do not staple printed sheets with a stapler or paperclip if they violate the integrity of the sheet and the barcode at the top of the page. The best option is to submit the calculation for verification in a file.

- Each sheet of the report must be printed on a separate page.

- Each page must be numbered in continuous order, starting with the title page.

- In the fields where you need to indicate quantitative or total indicators, put “0”, and in all others - a dash. If the report is generated using software, then dashes can be omitted.

Filling out section 1

In section 1, fill in:

- page 010 - OKTMO code by which insurance premiums were transferred.

The code must be specified in accordance with the Classifier, approved. By Order of Rosstandart dated June 14, 2013 No. 159-st. You can also find out OKTMO using a free service on the website of the Federal Tax Service of the Russian Federation.

- page 020 - BCC for the payment of contributions to the OPS.

Filling out section 3

Fill out Section 3 of the zero RSV for each employee you have (Letter of the Ministry of Finance dated September 2, 2020 No. 03-15-06/76812).

Sample zero DAM for 2021

If you have any unresolved questions, you can find answers to them in ConsultantPlus.

Full and free access to the system for 2 days.

Penalties for zero DAM 2021

| Type of violation | What threatens | Base |

| Late delivery of zero RSV | Fine - 1,000 rubles. | Art. 119 Tax Code of the Russian Federation |

| Additionally, officials of the organization may be held accountable and fined in the amount of 300 to 500 rubles. | Art. 15.5 Code of Administrative Offenses of the Russian Federation | |

| Tax officials do not have the right to block a bank account for being late in submitting a zero RSV. | Letter of the Federal Tax Service of Russia dated May 10, 2017 No. AS-4-15/8659 |

Common mistakes in RSV

Incorrect employee data

The discrepancy between the data of insured persons submitted by organizations and individual entrepreneurs and the information contained in the Federal Tax Service is a common basis for refusal to accept the DAM. This error occurs for two reasons:

- Incorrect information was transferred to the Federal Tax Service from the Pension Fund. In this case, the organization must provide copies of supporting documents so that inspectors can correct the information in their system manually.

- The insurers themselves make mistakes. It is necessary to submit an updated calculation with correct information.

Discrepancy in the amount of contributions in general and for individual employees

If such a discrepancy is identified, that is, line 061 in columns 3-5 of Appendix 1 of Section 1 of the calculation does not coincide with the amounts of lines 240 of Section 3 of the calculation for each month, respectively, then it is necessary to submit an updated calculation.

Inconsistency between RSV and 6-NDFL data

Despite the fact that in many cases the data in these reports does not coincide for objective reasons, they can still request clarification on them. If it turns out that the discrepancy arose due to an error, you will have to submit an updated DAM.

Let's sum it up

- Zero RSV for 2021 will need to be submitted if income was not paid to employees during the year, but employment and civil law contracts with them continued to be valid.

- It is also necessary to submit a zero RSV to the heads of peasant farms that do not have employees and organizations with a single founder-general director, even if an employment contract has not been concluded with him and his salary is not paid.

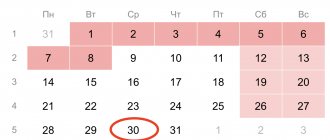

- The zero RSV for 2021 must be sent to the Federal Tax Service no later than 02/01/2021 (transferred from non-working Saturday 01/30/2021).

- In the zero RSV you need to fill out the title page, sections 1 and 3.

If you find an error, please select a piece of text and press Ctrl+Enter.

What does the Pension Fund say?

At the beginning of April, the Pension Fund of the Russian Federation began notifying policyholders of the need to submit SZV-M and SZV-STAZH to the sole founder of the company, who is its director, who is not paid a salary. It is noteworthy that previously some branches of the Pension Fund of Russia not only did not insist on this, but, on the contrary, demanded that accountants cancel SZV-M for the founding director without salary. The vector changed after the release of the letter of the Ministry of Labor No. 17-4/10/в-1846 dated March 16, 2018, which, in general, did not report anything new.

The letter states that if an individual (including the head of an organization in the case when he is its sole founder) has an employment relationship with this organization, then for the purposes of 167-FZ such persons are classified as working persons and must be reported for them in the form SZV-M and SZV-STAZH.

Based on this letter, the Pension Fund concludes that all companies are required to report for their founding director starting from March 2018. Why exactly from March - history is silent...

However, that's not all. Public organizations where the manager works as a volunteer without an employment contract and without a salary have begun to receive demands to pass the SZV-M.

Our readers report that the Pension Fund, which previously did not want to see SZV-M for the founder-general director of a commercial company, now explains that non-profit organizations also need to submit information.