The question of how to return income tax on the purchase of a residential building and the land plot underneath it is very relevant for many Russians who purchase real estate with personal funds or on credit. To fully exercise your rights, you need to determine when you should start doing this, how the state makes the return, and how much you can expect.

Issues related to the return of property tax are clearly outlined by the current acts of legislation of the Russian Federation and, in particular, the norms of the Tax Code. By referring to it, citizens can regain a tax deduction commensurate with the income tax rate, which is equal to thirteen percent. This procedure became possible

due to the absence of taxation on personal residential real estate. The state also supports a tax deduction when purchasing real estate with a mortgage, taking into account the return of interest to the banking institution.

In addition, the owner of the land with the house must have official income declared, that is, the tax service must submit a 3-NDFL declaration in a timely manner.

List of documents for obtaining a deduction for the purchase of a plot of land with a house

- declaration in form 3-NDFL

- application addressed to the head of the tax authority at the place of registration for the provision of a property deduction

- application addressed to the head of the tax authority at the place of registration for a refund of income tax to your personal account

- passport of an individual (buyer) of a land plot with a residential building

- TIN of an individual (buyer) of a land plot with a residential building

- contract for the sale and purchase of a land plot with a residential building

- certificate of ownership of land

- certificate of ownership of a residential building

- certificate of income in form 2-NDFL for the reporting year (from all places of work for the reporting year)

- receipt of money

- act of acceptance and transfer of land with a residential building

- personal bank account details for tax refund

Extension of rights

Before considering issues related to compensation, time frames, terms and conditions for the return of part of the funds from the purchase of a land plot and a residential building, it is necessary to take into account which categories of the population cannot claim property tax deductions. These at the legislative level include:

Dear readers!

Our articles talk about typical ways to resolve legal issues, but each case is unique. If you want to find out how to solve your specific problem, please contact the online consultant form on the right →

It's fast and free!

Or call us by phone (24/7):

If you want to find out how to solve your particular problem, call us by phone. It's fast and free!

+7 Moscow,

Moscow region

+7 Saint Petersburg,

Leningrad region

+7 Regions

(free call for all regions of Russia)

- Citizens under eighteen years of age;

- Persons who benefit from social benefits to improve their living conditions;

- Persons who do not have an official place of employment;

- Unemployed students and pensioners;

- Citizens who bought real estate not with their own personal funds.

Despite the fact that the law does not provide for a tax deduction for people of retirement age, you can still use it. On the one hand, upon retirement, a person ceases to be an actual taxpayer and receives benefits from the state, but on the other hand, there is a time period for which compensation can be demanded. You can exercise your right to compensation when purchasing a plot of land with a house if it was purchased no more than three years before retirement.

Documents for obtaining a tax deduction when purchasing an apartment

- declaration in form 3-NDFL.

- application addressed to the head of the tax authority at the place of registration for the provision of a property deduction

- application addressed to the head of the tax authority at the place of registration for a refund of income tax to your personal account

- certificate of income in form 2-NDFL for the reporting year (from all places of work for the reporting year)

- copy of the passport

- copy of TIN certificate

- copy of the apartment purchase and sale agreement

- copy of the Certificate of registration of ownership of the apartment

- copy of the transfer deed for the purchase and sale of an apartment

- copy of receipt for receipt of money

How to certify copies of documents?

By law, all copies of documents must be certified by a notary or independently by the taxpayer.

In order to independently certify, you must sign each page (not each document) of the copy as follows: “Copy is correct” Your signature / Signature transcript / Date. Notarization is not required in this case.

If you have any questions, you can get a free consultation from our specialists: Ask your question

If you have not yet purchased a home, we recommend our partner’s site-guide, APARTMENT-Bez-AGENTA.ru. This is an educational site for those who want to understand the rules for buying and selling apartments.

Documents for obtaining a tax deduction when purchasing an apartment with a mortgage

- declaration in form 3-NDFL

- application addressed to the head of the tax authority at the place of registration for the provision of a property deduction

- application addressed to the head of the tax authority at the place of registration for a refund of income tax to your personal account

- certificate of income in form 2-NDFL for the reporting year (from all places of work for the reporting year)

- copy of the passport

- copy of TIN certificate

- copy of the apartment purchase and sale agreement

- copy of the Certificate of registration of ownership of the apartment

- copy of the transfer deed for the purchase and sale of an apartment

- a copy of the receipt for receiving the money.

- loan agreement for the purchase and sale of an apartment

For what period can personal income tax be returned?

The right to receive a tax deduction when purchasing an apartment occurs:

- From the moment of signing the acceptance certificate of the apartment from the builder when purchasing an apartment in a new building.

- From the moment of state registration of property when purchasing an apartment on a secondary market.

You can return personal income tax from this moment and for all subsequent years. That is, you can use the deduction for as long as you like until the state returns the entire due amount.

However, you can only apply for a personal income tax refund for the previous 3 years . When purchasing an apartment in 2021, you can return personal income tax only for 2021, 2021 and 2015. And for all the subsequent ones. An application for deduction for the year is submitted next year. For example, to receive a deduction for 2021, the application must be submitted in 2019.

for pensioners : they can receive a deduction for the previous three years, even if the apartment was purchased later.

The statute of limitations for receiving a tax deduction under the Tax Code of the Russian Federation has not been established.

Documents for obtaining interest deductions

- Declaration in form 3-NDFL.

- Application addressed to the head of the tax authority at the place of registration for the provision of a property deduction

- Application addressed to the head of the tax authority at the place of registration for an income tax refund to your personal account

- Certificate of income in form 2-NDFL for the reporting year (from all places of work for the reporting year)

- Copy of the passport.

- A copy of the TIN certificate.

- A copy of the apartment purchase and sale agreement

- Copy of the Certificate of registration of ownership of the apartment

- A copy of the transfer deed for the purchase and sale of an apartment

- A copy of the receipt of money.

- Loan agreement for the purchase and sale of an apartment

- Loan agreement for the purchase and sale of an apartment

- Certificate from the bank on interest paid for the reporting year

Maximum number of payouts

To answer the question, you need to know when the sale was completed.

If the purchase of a home or other real estate was made before January 1, 2014, the tax deduction can be applied once during your lifetime. The transaction amount is not specified, it does not matter.

The numbers will help present this situation more clearly. With an investment amount of 750 thousand rubles, you will be able to claim only 97.5 thousand rubles (13 percent of the invested funds).

Important ! If the purchase and sale took place after January 1, 2014, then the maximum amount will be 260 thousand rubles, even with multiple returns.

The maximum tax deduction amount is 260 thousand rubles

So, we found out that the amount is higher if the purchase occurred after January 1, 2014. Where did the figure 260 thousand rubles come from?

The maximum limit on a refund from the purchase of a home is two million rubles (one time for a lifetime). The law guarantees the payment of 13 percent of this amount. In terms of calculation, this will leave 260 thousand rubles.

The annual payment will be equal to 13 percent of annual income (transfers from salary by the employer). The remainder of the guaranteed amount is not lost. You will continue to issue a refund until the limit runs out.

Every year a person can return 13 percent of his annual income

It is important to remember that filing income returns can be for the current period or for a maximum of three previous years. And, of course, all this time you must pay taxes regularly.

Important ! Arithmetic subtleties on the amount of payments, based on practical examples, will help you understand what is at first glance a difficult situation.

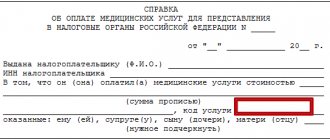

List of documents for receiving social deductions for treatment

- Declaration in form 3-NDFL

- A copy of the medical organization’s license to carry out medical activities

- Documents confirming the cost of treatment or purchase of medicines (certificate from a medical institution about payment for medical services for submission to the tax authority of the Russian Federation, cash receipts, contracts for medical services)

- Copy of the passport

- Copy of TIN certificate

- Certificate of income in form 2-NDFL for the reporting year (from all places of work for the reporting year)

- Application addressed to the head of the tax authority at the place of registration for the provision of a property deduction

- Application addressed to the head of the tax authority at the place of registration for an income tax refund to your personal account

Can a deduction be used multiple times?

Until 2014, the deduction could only be received once, that is, for one apartment.

Starting from 2014, one person can use the deduction several times, but the general limit is RUB 2,000,000. per person is still preserved. If you bought one apartment for less than 2 million rubles, then you can use the rest of the deduction when buying another apartment.

You can return a maximum of 260,000 rubles over your entire life. regardless of the number of apartments purchased.

If you used your deduction before 2014, the new balance carryover rules do not apply to you.

List of documents for receiving social deduction for education

- Declaration in form 3-NDFL

- Copy of the passport

- A copy of the child’s birth certificate (if we receive a deduction for a child)

- Documents confirming the fact of guardianship or guardianship (in case of guardianship)

- Copy of TIN certificate

- Certificate of income in form 2-NDFL for the reporting year (from all places of work for the reporting year)

- Agreement with an educational institution

- License of the institution to provide educational services

- Payment documents confirming payment for training, which must indicate the details of the person who paid for the training

- Application addressed to the head of the tax authority at the place of registration for the provision of a property deduction

- Application addressed to the head of the tax authority at the place of registration for an income tax refund to your personal account

Deduction amount

The deduction amount is the amount of your expenses associated with the purchase of an apartment. However, it cannot be more than the established maximum threshold of 2,000,000 rubles. In other words, the maximum deduction when purchasing an apartment is 2,000,000 rubles , which means the maximum amount of taxes that can be returned:

Max. Personal income tax to be refunded = (RUB 2,000,000 × 13%) = RUB 260,000.

A few examples:

| Apartment cost | The amount of the deduction | Personal income tax for refund |

| RUB 1,200,000 | RUB 1,200,000 | 156,000 rub. |

| 2,000,000 rub. | 2,000,000 rub. | 260,000 rub. |

| 5,000,000 rub. | 2,000,000 rub. | 260,000 rub. |

Necessary documents for preparing a tax return when selling a car

- Application for a deduction in the form of the tax authority;

- Passport of the individual who received income from the sale of the car;

- TIN of the individual who received income from the sale of the car;

- PTS of the sold vehicle;

- Purchase and sale agreement for the purchase and sale of a sold vehicle;

- A receipt confirming receipt of a sum of money when selling a car from an individual (legal entity).

Key points

Current legislative acts allow citizens to submit all papers along with an application to the tax service office in person, by post using a registered letter with an inventory and notification of receipt, as well as electronically through the official website of the Federal Tax Service.

Regardless of how the request is submitted, the procedure for considering it and making a decision will be the same for everyone. The submitted package is reviewed within three months, although, as practice shows, sometimes the case is delayed for six months due to complications that arise. After making a decision, the Federal Tax Service sends an official response to the applicant. If a positive decision is made, the funds must be transferred to the citizen’s current account within a month. If a refusal is received, it must describe all the grounds and reasons for such a decision.

When submitting an application to receive a refund and a tax deduction for the purchase of land and a house, you need to take into account when the transaction was concluded. If the property was purchased this year, the request must be submitted before April 30 of the next year. If the deadlines are not met, it will be difficult to obtain a refund.

When does the right to deduction arise?

The right to a deduction when purchasing an apartment arises if the following conditions are simultaneously met:

- You must be a tax resident of the Russian Federation (live in Russia for at least 183 days during the year)

- It is necessary to confirm with documents the expenses for purchasing an apartment.

- It is necessary to have title documents. For a new building this is an apartment acceptance certificate, for secondary housing - a certificate of ownership or an extract from the Unified State Register of Real Estate

- The seller is not your close relative.

- The apartment is located in Russia.

- The apartment was purchased without using maternal capital.