Social tax deductions are regulated by Article 219 of the Tax Code of the Russian Federation. The taxpayer has the right to receive social tax deductions for income taxed at a rate of 13%. These deductions can only be obtained at the tax office at your place of residence, and you must submit a personal income tax return for the year in which the expenses listed below were incurred.

Legislative regulation of the provision of social tax deductions

Social tax deductions for personal income tax can be obtained at the end of the tax period (one year). The procedure for their registration involves documentary support.

The citizen will need to provide a tax return with documents confirming expenses to the tax authority or to the employer. Such compensation from the state is provided in the amount of actual costs, but is limited to a maximum amount of 120,000 rubles. A person expecting to receive them must decide on the type of expenses if there were several expenses.

Important! Refunds are not carried over to the next reporting period. If the tax paid for the year is not enough, the remaining amount will be lost.

This type of government compensation provides exemption from income tax on a certain amount of money. Receiving them is not limited to the number of times. You can submit documents for transfers every year if the conditions provided by law are met.

In the regulatory framework, this possibility is provided for in Article 219 of the Tax Code of the Russian Federation. This provision fully regulates the procedure for providing payments, conditions and methods of transfer.

Download for viewing and printing:

Tax Code of the Russian Federation (part two) dated 08/05/2000 N 117-FZ (as amended on 04/03/2017) (with amendments and additions, entered into force on 05/04/2017)

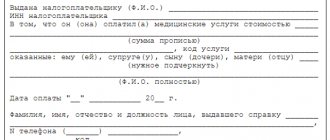

Sample application for tax deduction for treatment

How to register with an employer?

To apply for a deduction from an employer, you must prepare a package of documents. It includes:

- an application drawn up at the territorial branch of the Federal Tax Service;

- payment documents confirming expenses for the past tax period;

- After consideration of the application, the Federal Tax Service issues a document confirming the right to a refund of part of the amount paid. This document is also given to the employer.

When contacting your employer, you will need to write a statement indicating your right to a refund of part of the amount spent. After review, the documents are transferred to the accounting department. After this, the tax base is reduced.

Who is eligible to receive the deduction?

The following persons are entitled to receive this bonus from the state:

- taxpayers - officially employed persons for whom the organization pays income tax;

- unemployed pensioners for treatment expenses. In such situations, the recipient of the deduction will be officially working children.

Thus, for this compensation to be calculated, a citizen must be officially employed. There are two ways to transfer: a refund of the tax paid and an exemption from it for a certain period.

Advice! In the second case, the deduction can be obtained before the end of the calendar year by submitting the necessary documents to the management of the enterprise. In this case, the person will receive an increased salary in exchange for a lump sum payment.

Classification by expenses

Article 219 of the Tax Code of the Russian Federation regulates the possibility of obtaining a refund for expenses incurred on:

- education;

- treatment;

- charitable expenses;

- expenses for the formation of pension provision.

All compensation is of a declarative nature. To obtain them, a citizen must submit a package of documents to the Federal Tax Service or to the employer. Otherwise, the opportunity will be missed.

For charity and donations

Refund of personal income tax for expenses for charitable purposes is specified in paragraphs.

1 clause 1 art. 219 of the Tax Code of the Russian Federation. In this case, the tax base can be reduced by the actual amount, but not more than a quarter of the income for one year. Charitable payments can be made to:

- charitable organizations;

- socially oriented non-profit organizations;

- non-profit organization in the field of science, culture, sports, education, healthcare;

- religious organizations, non-profit organizations for the formation of endowment capital.

At the same time, when donating to state, municipal institutions in the field of culture and non-profit organizations to form endowment capital, the social deduction can reach up to 30% of the amount of income for the year, and at the regional level a different maximum deduction amount can be established.

When transferring funds to charitable needs, the taxpayer should not receive any compensation from the organization in return. A donation is free of charge.

To receive this compensation, you must fill out a 3-NDFL declaration and attach the following documentation to it:

- confirmation of expenses incurred, for example, receipts, checks;

- letters from charities asking for donations;

- certificate 2-NDFL for the annual period.

Note!

You can receive this type of payment only from the Federal Tax Service. The declaration is filled out by contacting the Federal Tax Service directly, or through the Internet service “Taxpayer Personal Account”. Personal income tax refund is not provided in the following cases:

- the money was transferred to the fund, and not directly to the institution;

- the payer had a vested interest in making the donation;

- the recipient of the funds was an individual.

Charitable assistance must be expressed in monetary terms.

Download for viewing and printing:

Sample 3-NDFL

Form 3-NDFL

To pay for training

Tax refunds on training expenses are regulated by paragraphs. 2 p. 1 art. 219 of the Tax Code of the Russian Federation. The payer can receive funds in the following situations:

- when paying for your own training in the amount of actually incurred training expenses, but in total no more than 120,000.00 rubles in the tax period;

- when paying for the education of your children who have not reached the age of 24 years in the amount of actual educational expenses incurred, but not more than 50,000.00 rubles for each child;

- with expenses for the education of a brother or sister in the amount of actual educational expenses incurred, but not more than 50,000.00 rubles for each child.

If a person plans to receive a deduction for expenses not for personal needs, the form of training is important. Thus, the state only reimburses expenses for the education of family members who are enrolled in full-time education.

The type of educational institution does not matter. This could be a university, a sports section, an art school, or a driving school.

Personal income tax compensation is not provided in the following cases:

- the educational institution is not accredited by the state;

- The costs of the educational process were borne by the employer.

Attention! Also, the payment will not be provided if the payer has spent maternity capital.

Treatment costs

To receive compensation from the Federal Tax Service of this type, the amount can include expenses for treatment, purchase of medications or devices.

This procedure is regulated by paragraphs. 3 p. 1 art. 219 of the Tax Code of the Russian Federation. The payer can spend money in the amount of actual training expenses incurred, but in total no more than 120,000.00 rubles in the tax period for his own treatment or:

- spouse;

- a minor son or daughter (including adopted children, wards under the age of 18);

- parents.

To accrue a tax bonus, a medical institution must undergo a licensing procedure to provide such services. This rule also applies to non-governmental medical organizations.

Separately, it is worth considering the social deduction for paying for expensive treatment (paragraph 5, paragraph 6, paragraph 3, paragraph 1, Article 219 of the Tax Code of the Russian Federation). Such a deduction is provided in the amount of actual expenses incurred for expensive types of treatment according to the list approved by Decree of the Government of the Russian Federation of March 19, 2001 No. 201.

For funded pension provision or voluntary pension insurance

This purpose of spending is regulated by paragraphs.

4, pp. 5 p. 1 art. 219 of the Tax Code of the Russian Federation. Payment is provided only in cases where the payer contributes money to the funded part of the pension in excess of what the company paid for it. A refund is also provided in the amount of actually incurred training expenses, but in total no more than 120,000.00 rubles in the tax period from the following transfers:

- for voluntary life insurance. The agreement with the organization must be signed for 5 years or more;

- for pension supplementary insurance;

- transfer of money to any non-state pension fund.

The payer must keep supporting documents, as well as agreements with organizations.

Charity

If a person has made contributions to charitable activities during the year, then he has the right to social benefits. Charitable activities include:

- providing financial assistance to a charitable organization;

- investing money in non-profit organizations that pursue legislative policy;

- financial assistance to non-profit structures involved in the development of projects in the field of science, healthcare, culture, non-professional sports, support for environmental institutions, protection of our little brothers, assistance to citizens in protecting themselves from emergency situations, etc.;

- assistance to religious associations.

Social tax deduction

In 2021, the size of the tax bonus for individuals, as well as the purposes of spending for the provision, were regulated by the Government of the Russian Federation.

The issue has been agreed upon with the relevant ministries and departments. Note! From January 1, 2017, the payer has the right to apply to the employer, who pays personal income tax to the budget for him, for the provision of social tax compensation. Previously, this possibility did not exist. In this case, the payment will not be provided in a lump sum, but by increasing wages by the tax rate during the period until the allotted funds are exhausted.

Where to apply for registration

To receive a social refund of personal income tax, you can contact the Federal Tax Service or your employer. The delivery method will depend on the path chosen.

You need to contact the Federal Tax Service at the end of the calendar year during which the expenses were made. The package of papers will depend on the purpose of spending the money. In most cases, the following documents are required:

- applicant's passport;

- declaration 3-NDFL;

- certificate 2-NDFL;

- statement;

- payment documents confirming expenses;

- agreement with the institution;

- certificate of provision of medical services.

After submitting the documentation, you must wait for the inspection's decision. The money will be transferred to the applicant's bank account.

To provide this payment through an employer you must:

- write an application to the Federal Tax Service to confirm the right to a refund;

- pick up a notice from the Federal Tax Service;

- fill out an application to your employer to receive funds.

Personal income tax will no longer be withheld from the taxpayer’s salary. Every citizen of the Russian Federation has the right to independently choose the method of providing this bonus.

Statement

The application must indicate:

- information about the authority to which the application is submitted;

- information about the applicant;

- address, telephone number and TIN of the applicant;

- a request for provision indicating the specific purpose of the expenditure;

- bank account details;

- date and signature.

The collected documents are attached to the application. It will be considered for about a month.

Briefly about the main thing

The law provides an opportunity for working citizens to return part of the money spent on social needs. The list of such costs and the conditions for their reimbursement are described in the tax code:

- Taxpayers can simultaneously claim different types of social benefits.

- The deduction can be applied for within 3 years from the moment the right to it arises.

- You only need to calculate the benefit based on income for the year in which the expenses were made.

- This assistance is provided exclusively to personal income tax payers at a rate of 13%.

- If the services were paid for with money from maternity capital, then it will not be possible to apply a social deduction.

- Unused balance cannot be carried over to the next year. It just burns out.

- It is faster to return money through your employer than through the Federal Tax Service. Tax authorities need 3 months to consider an application for a refund of income tax paid.

Deduction amounts

This payment is provided within the limits of the taxpayer's expenses.

But in most cases the legislation sets a limit of 120,000 rubles for it. The exception is:

- transfers for the education of a son or daughter - 50,000 rubles;

- expenses for treatment recognized as expensive - without restrictions;

- charity - a quarter of a person's income for a year or less.

Treatment is considered expensive if this is indicated in the corresponding list of the Ministry of Health.

Calculation example

The citizen’s annual income was 850,000 rubles. At the same time he spent:

- 140,000 rub. for your own education, 120,000 rubles will be taken into account;

- 15,000 rub. for my son to attend the sports section;

- 45,000 rub. for treatment.

With the exception of expenses for personal education, all monetary transfers are subject to the maximum limit. To determine the amount of payment it is necessary to make calculations:

120000+15000+45000=180000 rub.

You can get a refund from the funds paid:

180000×13%=23400 rub.

In what cases is the benefit provided?

It is issued for four types of expenses.

- Medical expenses. This is not only treatment, long courses of therapy, operations, but also the purchase of drugs necessary for rehabilitation and which do not have cheap and effective analogues.

- Education. Obtaining higher education or improving your qualifications.

- Pension provision associated with non-state funds.

- Charity. This has its limitations. At a minimum, the official status of the company accepting donations.

In this case, the financial expenses incurred must be significant. This factor does not have a clear interpretation or strict limit when spending is considered radical. But according to the unspoken standard, this is at least 10 times the minimum wage. Smaller amounts are also possible. But covering losses of one or two thousand rubles is illogical.