Accounting for insurance premiums

Score 69

To organize accounting of insurance premiums, a specially designed synthetic account 69 “Calculations for social security” is used. insurance and security" (Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n). The account corresponds with other synthetic accounts:

when calculating insurance premiums

- 08 “Investments in non-current assets” - upon receipt of an object of fixed assets by the organization;

- 20 “Main production” - when carrying out main production operations;

- 23 “Auxiliary production” - when carrying out auxiliary operations;

- 25 “General production expenses” - for general production operations”

- 26 “General business expenses” - for general business operations;

- 28 “Defects in production” - when accounting for defective products;

- 29 “Servicing industries and farms” - when reflecting operations in such areas”;

- 44 “Sales expenses” - when selling products;

- 91 “Other income and expenses” - for operations not related to production activities.

when paying insurance premiums

- 51 “Current account” - since such payments should be made only by bank transfer without using account 50 “Cashier”.

Account 69 accumulates and summarizes information on the calculation of insurance premiums. Analytical accounting subaccounts are opened for it, divided by type of insurance - into OSS (69.1), OPS (69.2), OMS (69.3). Since the administration of contributions has been transferred to the jurisdiction of the Federal Tax Service, experts also recommend opening analytical accounting subaccounts to reflect transactions for periods until 2021.

Accounting entries for insurance premiums

The main entries for insurance premiums are as follows:

Dt 08 (20, 23, 25, 26, 28, 44) Kt 69/subaccount - insurance premiums are calculated by type of insurance for employees working in different areas of business;

Dt 69 Kt 70 - benefits accrued at the expense of the Social Insurance Fund;

Dt 69 Kt 51 - payment of insurance premiums from the current account;

Dt 51 Kt 69 - benefits were reimbursed by the Social Insurance Fund.

What are direct and what are indirect costs?

The Tax Code does not provide clear regulations as to which costs are classified as which type. The right to consider certain types of costs direct is granted to the organizations themselves; only they must justify it in their internal documentation, and the manager must approve it.

How to take into account direct and indirect costs in trade ?

With indirect expenses it is simpler - all expenses that are not considered direct or non-operating are considered indirect.

In production and trade, the composition of these types of costs differs significantly.

Direct and indirect costs in the production of goods and services

When determining what type of production costs to classify, the manager must take into account that direct costs, as a rule, should include those costs that are used to produce goods (services) and their promotion and sale. The specifics of the activity and the industry-specific features of the production process are also important. An approximate listing of direct expenses of manufacturing firms might look like this.

- Material costs:

- payment for purchased raw materials;

- costs of production materials;

- purchase of equipment and components;

- the cost of semi-finished products if they are processed during the production process.

- Financial costs:

- salaries for staff;

- contributions to social and insurance funds.

- Depreciation costs are a natural decrease in the value of fixed assets due to their wear and tear over time.

FOR YOUR INFORMATION! If an organization engages third-party people to perform work under subcontracts, then payment for this activity is also considered direct expenses, since it has a direct connection with production, despite the fact that it is not in the indicative list in Article 318 of the Tax Code.

Non-operating expenses are accounted for separately.

All other types of expenses not directly related to production are considered indirect .

IMPORTANT! Sometimes there are “borderline” situations of cost allocation; in such cases, management justification is necessary. However, it should be remembered that according to the law, indirect costs cannot be classified as those that are objectively related to production, for example, funds for the purchase of raw materials that take into account the cost of a unit of output.

Direct and indirect costs in trade

Trade relations provide for a fixed list of direct expenses, approved by Art. 320 Tax Code of the Russian Federation. Here, the “independent action” of the leadership is unlawful. According to the law, in trading activities the following should be included as direct expenses .

- Costs when purchasing goods: the method of determining it lies with the organization itself, in particular, these are:

- purchase price;

- packaging costs;

- cost of packaging and containers;

- payment for warehouse services, etc.

- Delivery costs to the buyer's warehouse, if these funds are not included in the price of the goods. In other cases, transportation costs are more correctly considered indirect, since they are not correlated with the sale of goods.

Non-operating expenses are also subject to separate accounting.

The remaining costs will be considered indirect - they directly reduce the profit of a given tax reporting period.

Tax accounting of insurance contributions

For tax purposes, insurance premiums are also taken into account, since with their help they can reduce the payer's tax liability. The rules for recognizing accrued and paid insurance premiums in tax accounting depend on which taxation system the payer uses.

General taxation system

If the payer is a legal entity

In ch. 25 of the Tax Code of the Russian Federation included Art. 264, regulating the right to use the amount of insurance premiums as expenses to reduce taxable profit.

If the payer is an individual entrepreneur

In accordance with Art. 221 of the Tax Code of the Russian Federation, an individual entrepreneur can use a professional tax deduction to reduce tax under the chosen taxation regime. This deduction, in addition to other expenses, also includes expenses in the amount of insurance premiums actually made, which must be documented and related to the direct generation of income.

Simplified taxation system

If you use the simplified tax system with the object “Income”

In this case, on the basis of clause 3 of Art. 346.21 of the Tax Code of the Russian Federation, the calculated tax can be reduced by the amount of calculated insurance premiums.

If you use the simplified tax system with the object “Income - Expenses”

In such a situation, based on paragraphs. 7 clause 1 art. 346.21 of the Tax Code of the Russian Federation, the calculated tax can be reduced by the amount of insurance premiums.

A single tax on imputed income

In accordance with paragraph 2 of Art. 346.32 of the Tax Code of the Russian Federation, payers of insurance premiums can reduce the amount of tax by the amount of calculated contributions.

Patent tax system

If an entrepreneur is only in the patent system, he does not have the right to reduce the value of the patent by the amount of insurance premiums. However, if he combines the patent with other tax regimes, he can reduce the tax by the amount of these contributions. Read more about this in the article: “Insurance premiums of individual entrepreneurs on a patent in 2021.”

Contribution accounting operation

Some income subject to insurance premiums cannot be accrued by regular documents, which means that insurance premiums will not be automatically accrued either. An example of such income could be remuneration under a contract to a person who is not an employee of the organization.

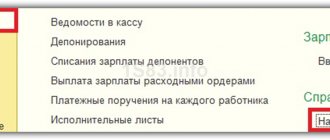

For such cases, the document Contribution Accounting Operation . The document is available from the section Salaries and Personnel – Insurance Contributions – Contribution Accounting Operations.

You can consider filling out the document in more detail using the example of the article Calculations under a GPC agreement.

Test yourself! Take a test on this topic using the link >>

See also:

- Reduced insurance premium rates for small businesses from April 2020

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- How to indicate a discount to the insurance tariff of NS and PP? ...

- Checking the calculation of insurance premiums above the limit for SMEs from 04/01/2020...

- How to correctly decide on the accounting method for the trade of a small enterprise? Pitfalls of the direct costing method? ...

- Test No. 60. Compensation for unused vacation upon dismissal...

Special aspects of tax accounting of insurance contributions

When organizing tax accounting of insurance premiums, you need to focus on the following important points:

- When an organization uses the accrual method, the fact of payment of insurance premiums does not matter, since clause 1 and clause. 1 clause 7 art. 272 of the Tax Code of the Russian Federation establishes that the costs of paying insurance premiums relate to the month in which they were accrued. In this case, insurance premiums must be included in expenses at a time, even if their payment is made based on amounts for different accrual periods (Letter of the Ministry of Finance of the Russian Federation dated April 13, 2010 No. 03-03-06/1/258);

- If, as a result of inspections of previous periods, additional amounts of insurance premiums were accrued, they must be taken into account in the period in which they were accrued (Letter of the Ministry of Finance of the Russian Federation dated March 15, 2013 No. 03-03-06/1/7994);

- The moment when insurance contributions are used when calculating the tax base depends on which expenses (direct or indirect) the payments to the individual from which the contributions are calculated relate to. This is indicated in paragraph 1 of Art. 318 Tax Code of the Russian Federation.

According to para. 2 p. 2 art. 318 of the Tax Code of the Russian Federation, if insurance premiums are considered direct expenses, then they must be taken into account when determining income tax as products and goods are sold in the cost of which they were included.

If insurance premiums are classified as indirect expenses, then their amount must be taken into account when determining income tax at the time of accrual (according to paragraph 1 of paragraph 2 of Article 318 of the Tax Code of the Russian Federation).

Procedure and terms for payment of insurance premiums

Note! In 2021, the deadlines for paying taxes and filing reports for some individual entrepreneurs and organizations were postponed due to the coronavirus epidemic. Read the article for details.

Insurance contributions to the Federal Tax Service and Social Insurance Fund must be transferred monthly no later than the 15th

next month. If the last day coincides with a weekend or holiday, the final due date for payment of contributions is postponed to the next working day.

Payment of pension insurance contributions

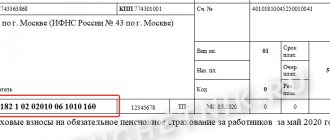

In 2021, all payments for pension insurance must be made in one payment order using KBK 182 1 02 02010 06 1010 160

. You can find out the remaining payment details of the Federal Tax Service necessary for payment using this service.

Payment of health insurance premiums

In 2021, the budget classification code for the transfer of insurance premiums for health insurance 182 1 02 02101 08 1013 160

. You can find out the remaining payment details of the Federal Tax Service necessary for payment using this service.

Payment of social insurance contributions

Transfer of insurance premiums is carried out in two types

compulsory social insurance:

- in case of temporary disability and in connection with maternity in the Federal Tax Service of the Russian Federation;

- from accidents at work and occupational diseases in the Social Insurance Fund.

The standard rate of insurance premiums for temporary disability is 2,9%

from salary. It is applied by large businesses, as well as by SMEs - to part of the payment within the minimum wage. Small and medium-sized businesses do not pay sickness and maternity contributions in excess of this amount.

Note.

The contribution rate may vary depending on the benefit applied (see table above).

Accident insurance premiums range from 0,2

up to

8.5%

depending on which professional risk class your main type of activity belongs to.

In 2021, the budget classification codes for transferring social insurance contributions are as follows:

- KBK 182 1 0210 160.

(in case of temporary disability); - KBK 393 1 0200 160.

(from industrial accidents).

You can find out the remaining payment details by contacting the territorial office of the Social Insurance Fund and the tax office at your place of registration.

Note

: insurance premiums must be paid and reported in rubles and kopecks.

Nuances of recognition of insurance for cars and property, costs of voluntary medical insurance

The amount of expenses for property and liability insurance is not limited in any way. To accept them as a reduction in the base for the simplified tax system, it is necessary to fulfill the condition on the obligatory nature of appropriate insurance. Therefore, there is no doubt, for example, about the possibility of including costs in expenses:

- on compulsory motor liability insurance (letter from the Federal Tax Service of Russia in Moscow dated January 30, 2009 No. 19-12/ [email protected] );

- liability insurance for owners of dangerous objects, provided for by law dated July 27, 2010 No. 225-FZ (letter of the Ministry of Finance of Russia dated March 12, 2012 No. 03-11-06/2/41).

However, you cannot include in the simplified tax system expenses the costs of voluntary insurance for property or liability, for example, CASCO.

The costs of voluntary insurance, regarded as remuneration, are standardized (clause 16 of Article 255 of the Tax Code of the Russian Federation) and, because of this, the simplified tax system expenses can be included in the amount of:

- no more than 12% of the volume of labor costs - in terms of the total amount of payments for both additional types of pensions (state and non-state), as well as for long-term life insurance contracts;

- no more than 6% of the volume of labor costs - in relation to expenses for personal insurance concluded for a period of more than 1 year, in connection with covering medical expenses of employees (letter of the Ministry of Finance of the Russian Federation dated February 10, 2017 No. 03-11-06/2/7568 , dated January 30, 2012 No. 03-11-06/2/14, dated September 27, 2011 No. 03-11-06/2/133);

- no more than 15,000 rub. per year, obtained by dividing the total costs incurred under all contracts by the number of employees insured under them - in relation to the costs of personal insurance in connection with death or harm to health (letter of the Ministry of Finance of the Russian Federation dated March 21, 2011 No. 03-11-06 /2/35).

To find out what other conditions must be met in order to accept expenses for personal medical insurance, read the material “Simplifiers can include payments under voluntary health insurance contracts for their employees as expenses.”

Amounts of costs that go beyond the established limits for voluntary insurance, regarded as wages, cannot be taken into account as expenses.

Accounting for calculations of insurance premiums: features of postings

Social contributions to insurance funds are made from employee salaries. At the same time, benefits, social benefits, financial assistance, etc. are not subject to contributions. Today, the following established tariff rates apply:

- 22% for the Pension Fund;

- 5.1% for FFOMS;

- 9% for Social Insurance Fund.

Postings (account assignments) are formed at the time to which calculations for social insurance and security relate. Typical entries for crediting insurance fees look like this:

| Type of transfers | Debit | Credit |

| Contributions to the Pension Fund | 20 (25, 26, 29, 44) | 69.2 |

| Payment to PFS | 20 (25, 26, 29, 44) | 69.1 |

| Charges to the Compulsory Medical Insurance Fund | 20 (25, 26, 29, 44) | 69.3 |

| Late fee | 91 | 69 |

| Fixed amounts transferred to funds | 69 | 51 |