The bill can be called the progenitor of the modern securities market. This is one of the oldest promissory notes; its first prototypes were known in Ancient Greece and Rome. Today there are many types of bills. The principle of the bill of exchange gave rise to a number of instruments of the modern stock market.

A bill is...

In simple words, a bill of exchange is a security that confirms the right to receive a specified amount within a predetermined period. In turn, the giver of the bill (drawer) undertakes to pay the amount agreed upon in the paper. Accordingly, the bill gives the right to defer payment for the person issuing it. That is, it can be considered an analogue of a promissory note, and both an individual and a legal entity can issue a security. The amount and period specified in the details are determined by the person issuing the obligation.

With the help of a bill of exchange, payments can be made between organizations or individuals, and a bank loan can be obtained using this paper as collateral. In short, sometimes this is a profitable alternative to real money, allowing you to save on loan interest, speed up payment transactions and not resort to using cash.

Circulation of bills

Hundreds of years of trading of debt instruments have complicated the simple two-way deferment mechanism. For example, the right to claim a debt may pass to third parties in the event of resale of the bill by its holder, and often the consent of the drawer is not required for this. In this case, the bill acts like a bond on the stock market - the company pays the face value of the bond to the person who last bought it at the trading terminal. Bills of exchange differ in various ways, including the type of holder and debtor:

By type of holder:

- registered, that is, written out to a specific person

- order, where the recipient can be anyone

By type of debtor:

- simple, where the debt is paid by the person who issued the paper

- transferable when the debtor is a third party. This type of obligation is called a “draft” and is analogous to the transfer of debt under a loan agreement.

Subject to additional guarantees:

- banking (validated), where the bank acts as an additional guarantor of repayment of the debt on the bill. It should be noted that in the event of bankruptcy of a financial organization, funds from the sale of the bankrupt’s property are used primarily to pay bill debts and only then to pay off other obligations, including deposits and debts to creditors. It is also important that, unlike deposits, bill payments do not have the option of additional insurance from the state.

Types of bills

Interest bill

Issuers of interest-bearing bills are banks and commercial organizations.

The interest rate bill specifies the rate of interest accrual on account of the deferred payment. The bearer has the unconditional right to receive the amount for which the paper was issued and interest income.

The term “promissory note” must be included in a proposal that contains a promise to pay a specific amount. The promise to fulfill the payment must be formulated unambiguously, so that there is no possibility of making the fact of fulfillment dependent on force majeure. For example, “I undertake to pay the amount on such and such a date.”

The payment term is established upon presentation (must be billed within 1 year from the date of preparation) - at a certain time after presentation/at a specific time after preparation/on a specified day. A clause regarding the issuance of an interest-bearing bill earlier than the established period is allowed.

The interest rate must be clearly stated in the text. If the interest rate is not specified, then the current refinancing rate comes into effect.

If there are no special clauses and the bill was not issued ahead of schedule, the first date of interest accrual is the next date from the date of execution of the document, the last is the day of payment, the accrual frequency is once a month.

Calculation formula

- N—nominal value;

- s—interest rate;

- Tx—days from the date of accrual to the date of repayment.

When transferring an interest-bearing note, all cumulative rights are transferred to the new owner.

Credit bill

A loan bill is issued as an obligation to issue a loan within a specified period. Lenders are banks and commercial structures, usually partners of the borrower's enterprise. Issuers are legal entities that attract additional funds into circulation.

The peculiarity of this type of bill is that there is no need for collateral and the interest rate is almost 2 times less than when applying for a standard loan.

The amount must be returned within the period specified in the bill - 1 year after the date of receipt of the money. The average period is from six months to a year. Credit relations between a bank and a legal entity are concluded on a contractual or commercial basis. The recipient of the loan is required to repay the debt and interest at once.

- A credit bill can be transferred to a new owner, who will receive all presentation rights, which is used for counterparty settlements

- If the borrower, in turn, pays with a loan bill, then the procedure is performed through a transfer receipt

- If a bill is submitted to the bank ahead of schedule, the latter may withhold additional interest from the debt amount

- The holder of the bill has the opportunity to convert the loan document into cash/non-cash money and usually does not face the problem of returning the amount to the bank, since the financial institution forecloses on the maker

Banks do not accept:

- non-commercial credit notes

- counter

- bills from persons who personally signed, being representatives of a commercial structure by proxy

The bank can issue a loan against a bill of credit secured by goods, but will not be obliged to make payments on the paper.

Commercial bill

A commercial bill, also known as a bill of exchange, circulates as part of a trade transaction, is a means of payment and is transferred as a document guaranteeing payment for goods with a deferred payment.

Legally, a commodity bill can be issued by any person/enterprise and is essentially a short-term promissory note. It does not require registration with regulators and therefore can be completed quickly and at almost no cost. The set of details is similar to the attributes of State Bills - government treasury bills.

The nature of transactions with commercial bills is similar to sales on credit:

- The buyer's benefit is receiving material value now, and making actual payment later

- The benefit of the seller is the opportunity to receive the cost of the product/service in partial/full amount through an accounting operation or sale of a bill of exchange to a third party

The issuer indicates in a commercial bill the maturity date, which can range from several days to a year and an arbitrary amount of money.

Behind the apparent simplicity of settlement with commercial bills, there are hidden pitfalls - it is impossible for an abstract seller to know for certain the financial condition of the drawer, since in fact this security is not secured by assets, but only by a promise. Currently, settlements with commercial bills occur between large companies.

The purchase/sale market is primary, securities are accounted for in lots, and are characterized by lower liquidity compared to ST-Bills, but higher profitability due to the discount received by the purchaser of the lot.

Money bill

A cash or financial bill is issued against a loan in cash and serves as a guarantor of repayment of funds. It does not have product coverage and is not accepted by banks for accounting.

Issuers of money bills, as a rule, are the state, banks, and companies with a stable financial position and a good payment reputation.

Types of money bills:

- treasury

- banking

- fictitious, so-called bronze/friendly

Bronze is issued by a legal entity when accounts payable are overdue. In Russia, the practice of using fictitious bills of exchange is prohibited, but the method is still used unofficially - in narrow circles.

The method of raising funds through cash bills is not optimal compared to a multi-year loan, since funds under the bill are taken for a limited short period. It is not enough to invest money in the production cycle, get a return, and painlessly remove it from circulation for return.

Bank bill

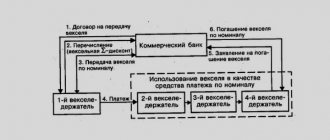

A bank bill is a type of financial bill issued by a bank. They are used to account for and repay debt obligations between importers and exporters within the same country or in international transactions. The issuing bank issues a bill of exchange to its client account holder for the amount secured by the client's deposit. The latter settles accounts with suppliers, who submit demands to the correspondent bank and receive money. Individuals use bank drafts to withdraw funds at a convenient time at a specific location. They are traded on the secondary market, often at a discount.

Sberbank bill

Sberbank bills for individuals are simple, so-called solo, payable to bearer. The terms of Sberbank bills range from 14 days to 3 years.

Issued on stamp paper. Filled out with the following:

- bill holder details

- amount and term

- payment procedure

Sberbank promissory notes for individuals are divided into interest-bearing and discount. By placing funds in a bank account and receiving a bill of exchange in return, an individual becomes a creditor of Sberbank and is entitled to interest:

- Deposit currencies - ruble, American dollar, yen, Swiss francs, British pounds

- Income is not accrued for francs and yen, and also if the form says: “On presentation, but not earlier”

- In other cases, profitability is calculated at the current refinancing rate

A Sberbank discount bill has a par value at which the bank will buy it from the holder and the value at the time of issue is lower than the par value. The difference between the purchase price and the cancellation price of the bill constitutes the income of the bill holder. For example:

- nominal value of the bill is 100 thousand rubles.

- placement period is 30 days.

- discount 1 thousand rubles.

If an individual buys a bill of exchange from a bank for 99 thousand rubles, after 30 days or returns the bill to the bank, he will receive 100 thousand rubles. Discount of 1 thousand rubles. will constitute the income of the bill holder.

Thus, Sberbank bills can be used as a tool for accumulating and preserving funds. If, when drawing up, certain conditions are included in the paper, for example, transfer/donation, then the bill can be transferred to third parties. Receipt and issuance of bills of exchange is carried out at any branches of Sberbank.

The statute of limitations during which the bank is obliged to make payment on a bill of exchange is 3 years after the date of presentation. The main risk is damage or loss of the document, after which it will be possible to restore the right to money placed on deposit against a Sberbank promissory note only through the court.

Payment term: upon presentation

Situation: how to determine the date when your own bill of exchange with a payment term “at sight” expires?

The expiration date of such a bill of exchange is the 365th (366th) day from the date of its preparation.

An organization is obliged to pay a bill of exchange upon presentation upon its presentation. Moreover, such a bill must be presented for payment within one year from the date of its preparation. Provided that this annual period has not been changed by the drawer or endorsers.

In this case, the bill does not have any inscriptions that shorten or extend its circulation period. Therefore, its circulation period is considered to be a calendar year - 365 or 366 calendar days, that is, all the days during which the bill can change hands or be in the ownership of any bill holder.

This procedure follows from Articles 34 and 77 of the Regulations, approved by Resolution of the Central Executive Committee of the USSR and the Council of People's Commissars of the USSR dated August 7, 1937 No. 104/1341.

Areas of application of the bill of exchange

Individuals and investors rarely use a promissory note; rather, it is a tool for businesses, both large and small. Its use is beneficial in the following areas:

Lending

A loan on a bill of exchange is sometimes regarded as more reliable than a regular bank loan, so credit institutions and enterprises are quite willing to borrow money against a bill of exchange. With the help of this paper, you can pay off your own or someone else’s debt, as well as resell the debt - and all this on favorable terms for all participants in the transaction.

Raising capital

Being a fairly reliable security, a bill of exchange is used to attract additional funds by financial organizations, although at the moment bonds are much more popular. However, it is American treasury bills that are one of the lowest-risk and liquid assets on the market.

Making transactions

Often used by entrepreneurs when making purchases and sales. This allows the seller to sell their goods/services with a 100% refund guarantee, and the buyer to defer payment without paying interest (although they may be included in the final price). In this area, a bill of exchange acts as an analogue of a business installment plan.

What is a bill of exchange and where did it come from?

A promissory note is a signed document of the debt category. It denotes the right of the one who is the holder of the bill, after a while, to demand the amount of the debt from the person who issued the bill. Moreover, the time after which the right appears, the amount, and even the place of the claim are agreed upon in advance.

But this is not a loan agreement. This is not a receipt. A bill denotes that there is a debt of the writer of the bill to the recipient of the bill. The place that is written in it is usually the bank where the current account of the issuer of this paper is opened. And when the agreed period expires, the person receiving the right under the bill can come to this bank and request the previously determined amount. It is important that the issuer of the bill does not need to be present. The bank itself will pay the debt from the designated account. The main thing is that you have all the necessary documents and data.

The very concept of a bill of exchange has been used for several centuries. It came from Europe. And from that very time, the bill as a debt paper was regarded higher than other options, such as a promissory note. The bills were used to provide loans to the population, pay personal debts, and pay for goods and services. Moreover, when we talk about taking a bill seriously, we really mean complete seriousness. And if the one who was supposed to pay did not have funds at the designated time, then it actually came to the sale of his property. Everything to fulfill the bill of exchange obligation.

But, like any security or debt security, a bill of exchange has its own application features, which cannot be paid less attention to than the concept itself.

Difference from bond

At first glance, a bill can be compared to a bond. Both are relatively reliable and have proven to be conservative investments. But they have a lot of differences, sometimes fundamental ones. The differences between a bill and a bond are presented in the table:

Sign | Bill of exchange | Bond |

| Release form | Always has a strictly defined documentary form, where all the details of the paper are written down (with the exception of treasury bills) | Can be in either documentary or non-documentary form, with the latter being more widespread |

| Release | Often produced in one single copy for a specific purpose | Bonds are always issued in large quantities with a certain frequency |

| Board shape | A bill of exchange is always paid only in cash in a single amount specified in the details of the paper | Can be repaid both in money and other monetary equivalents, for example, property and other valuables |

| Validity | Relatively short-term. Often issued for a period not exceeding a calendar year (although it can be significantly longer) | Long-term securities. Bonds are issued for a period of one year, most often 3 or 5 years |

| Income | Unless otherwise specified in the details, the bill is canceled strictly for the amount issued | In addition to its cost, which is paid off in shares, the bond implies additional income for holding the paper, called a “coupon” (analogous to interest on a bank deposit) |

| Who can release | An individual or legal entity, including financial institutions. Never - public authorities (exception - treasury bills) | State and municipal authorities regularly act as issuers of bonds |

| Use by individuals and investors | Can be used by large investors, but are more often used in professional and business circles | They are actively used by individuals who are not related to the paper-issuing business. Are an investment instrument |

| Walking on the stock market | Can be sold privately without the mediation of a broker | Available only on the stock market for registered exchange participants |

Thus, these seemingly similar instruments have more differences than similarities. In fact, the only thing they have in common is that both securities are debt and belong to the category of securities. Both the bill and the bonds can be resold, thus obtaining additional benefits.

How much will the bill cost if you buy it on the secondary market - for example, from some bank? Let's say you want to buy a bill of exchange that will pay 100,000 rubles in two years. How much should you pay for it today? Less than 100 thousand, because you can put it in the bank today at interest and get more in two years. Thus, the bill will be purchased at the present value, the calculation of which was discussed in this article.

Governing legislation

The main source of law establishing the legal circulation of bills of exchange in Russia is Federal Law No. 48, adopted on February 21, 1997. This law states, in particular, that the circulation of the payment instruments in question in the Russian Federation correlates with the provisions of the Convention of 06/07/1930, which establishes a uniform law on bills of exchange. Also in Federal Law No. 48 there is a clause according to which the Resolution of the Council of People's Commissars of the USSR should be applied on the territory of the Russian Federation, which introduced the Regulations regulating the circulation of promissory notes and bills of exchange and adopted on 08/07/1937. Thus, it can be noted that a bill of exchange is an instrument , is absolutely not new for the Russian economy. It was also used in the USSR.

Article 2 of Federal Law No. 48 states that the execution and payment of a promissory note or a transfer bill can only be carried out with the participation of citizens and legal entities registered in the Russian Federation. Relevant activities with the participation of authorities at the federal, regional or municipal level can be carried out only in those cases provided for by federal legislation. An exception is legal relations in which bills of exchange were issued before the entry into force of Federal Law No. 48.

Article 3 of Federal Law No. 48 states that interest on a bill of exchange should be calculated based on the discount rate of the Central Bank of the Russian Federation. Another noteworthy nuance regarding the turnover of the payment instruments in question, which is contained in Federal Law No. 48, is that filling out a bill of exchange (promissory note or transfer) must be carried out only on paper. This is another difference between bills of exchange and bonds, which can also be electronic.

Let us now study in more detail the varieties in which the financial instrument in question can be presented.

Difference from promissory note

Since a bill is a promissory note, it is often compared to a promissory note. But even here, upon closer examination, there are differences:

Sign | Bill of exchange | IOU |

| Decor | In strict accordance with the established form and details | Often free-form |

| Responsibility | Evasion from fulfillment of obligations under the bill entails financial liability. The issue and circulation of bills is regulated by a special federal law | Has no established legal force without notarization |

| Release conditions | The document is not tied to a specific transaction and can be transferred to a third party | A receipt is usually drawn up for a specific transaction, the essence and price of which is stated in the document |

| Status | It is a security and has international status | Not a security |

In general, we are talking only about similar, but mostly different types of loan processing. A bill of exchange is much more reliable.

OSNO and UTII

If an organization applies the general system and pays UTII, then the taxation of income on the bill does not depend on the activity within which it was received. From the income received, calculate taxes in accordance with the general taxation system (clause 2 of article 346.26, clauses 9 and 10 of article 274 of the Tax Code of the Russian Federation).

At the same time, keep in mind that there are arguments that allow you not to pay income tax on interest (discount) on bills received in payment (security of payment) for goods (work, services) sold within the framework of activities transferred to UTII.

Difference from a check

What else can a bill be compared to? With a check. Perhaps, these two forms are closer to each other than the previous options, although checks today are a more widespread and convenient means for cashing money. And yet there are quite a lot of differences:

Sign | Bill of exchange | Check |

| Release form | IOU | Cash equivalent |

| Story | Analogs are known in Ancient Greece | Originated in the 17th century, developed rapidly since the 19th century |

| Cashing method | Depending on the document, for example, on a specific date, a year from the date of preparation, etc. | Immediately upon presentation |

| Type of debt | Individuals and legal entities, although a bank or other person may be an additional guarantor of the bill (aval) | Bank liability |

| Decor | Requires acceptance, i.e. registration of consent to the terms of the transaction | Does not require acceptance |

| Time for responsibility | It is difficult to collect on an overdue bill | Typically valid for several years from date of issue |

| Receiving funds | Cash | Crossing is possible, i.e. only transfer the amount to the account |

| Debt dispute | The acceptor pays the bill in any case | The bank can challenge a forged signature |

Required details

- name

, label. may be simple or translated; - obligation to pay the amount.

Under a promissory note, the debtor “obliges” to pay; under a transferable bill, he “demands” from a third party; - amount of the amount

(in numbers and words). The bill can be issued with interest (this is a kind of deferred payment for which they may be required to pay). They can either be included in the amount or indicated separately; - payment term.

There are several options: upon presentation, within some time from presentation, within a certain time after drawing up, on a certain day. If the payment period is not specified, this means that it is payable upon sight within a year from the date of issuance of the bill; - place of payment

(by default - payer's location); - name and address of the payee (and payer).

In a simple case, information about the payer is not indicated, since he is the drawer. In the case of a transfer, these can be different persons, so the name and address of the payer must be indicated; - place and date of compilation;

- signature of the drawer

(in the lower right corner, handwritten). If the debtor is a legal entity, then the signatures are affixed by the director and the chief accountant, and next to it is the seal of the organization.

There may also be an aval

- surety, guarantee of payment on a bill of exchange of a third party. May be required when solvency is in doubt. On the reverse side there may be an endorsement - an endorsement that records the fact that the rights of claim under the paper have transferred to another person.

Issue of a bill

The issue of this type of securities is regulated by a special federal law and the Regulations on promissory notes and bills of exchange. It is printed on official letterhead and always has a strictly defined form, containing a number of essential details:

- Name;

- obligation;

- details for presentation;

- sum;

- payment term;

- place of payment;

- date of discharge;

- drawer's signature

Repayment of a bill

Payment on the bill of exchange occurs on a date strictly defined by the details. It is allowed to postpone the deadline for presenting a bill within two working days. The holder presents his demands for payment at the location of the payer. The debtor pays off his obligations immediately. Thus, the bill guarantees that, within a specified period, the holder of the paper will receive a predetermined amount in full in cash or non-cash funds, at the discretion of the parties. After payment, a corresponding mark is made on the bill itself.

Deviation from obligations on the part of the debtor is possible only if he provides indisputable evidence of force majeure circumstances that did not allow him to have the required amount at the date of repayment of the debt. In other cases, the holder of the bill has the right to address his claims to the court. This phenomenon is called “bill protest” and entails liability for all persons associated with the paper.