In this article we will look at VAT on the construction of fixed assets. We will learn about the procedure for accounting for VAT during construction, VAT deductions during construction in 2021. We will analyze the procedure for issuing invoices.

The procedure for reflecting VAT during the construction of fixed assets has its own characteristics. The tax accounting mechanism and the specifics of obtaining a tax deduction depend on many factors: how the construction was carried out - economic or contract, how the object was handed over - at one time or in stages, etc. Today we will understand the features of VAT accounting during the construction of OS and provide answers to common questions on the topic.

EXAMPLE No. 1

In one of the divisions of JSC “Lutik”, shelving for storing finished products was manufactured.

The following entries will be created in the accounting records of JSC Buttercup:

| Contents of a business transaction | Debit | Credit | Amount, in rubles |

| Construction materials purchased for the manufacture of shelving have been accepted for accounting. | 10-8 | 60 | 100 000 |

| VAT is taken into account on the cost of building materials. | 19-4 | 60 | 18 000 |

| VAT is accepted for deduction. | 68 | 19-4 | 18 000 |

| The cost of written-off building materials is taken into account. | 23 | 10-8 | 100 000 |

| The department's costs associated with the manufacture of shelving are taken into account. | 23 | 70,69,02 | 25 000 |

| Reflected as part of capital investments are the costs associated with the manufacture of racks. Calculation: 100,000 rub. + 25,000 rub. = 125,000 rub. | 08-3 | 23 | 125 000 |

How an OS is created{q}

In both cases, the accountant’s task is to correctly take into account all expenses and reflect the accepted object correctly at its original cost.

We invite you to read: The impact of minimum wage on disability pension

To organize correct accounting of a created, constructed, erected object, it is necessary to correctly determine the costs incurred, make sure that the created property is really a fixed asset, and determine how VAT on expenses will be taken into account. Accounting depends on the method of creating an asset - business or contract. Postings and paperwork will be slightly different.

EXAMPLE No. 2

A gear crushing machine has been installed in one of the divisions of Lyutik JSC. The installation of the machine was carried out by the organization's employees.

The costs of the department that installed the gear crushing machine include the following cost elements:

- workers' wages;

- deductions from payroll;

-electricity;

- other overhead costs of the workshop.

The above expenses in accounting increase the initial cost of the machine.

According to the All-Russian Classifier of Types of Economic Activities OK 029-2001, the above works do not relate to construction and installation works (installation of equipment has an OKVED code different from the construction and installation work code). As noted in the Resolution of the Federal Antimonopoly Service of the Moscow District dated March 28, 2012 No. A40-10464/11-129-46, “... the main feature that allows defining work as construction and installation work is the execution of construction, of which installation work is a part.”

Installation of equipment outside the scope of construction work does not fall under the definition of “construction and installation work for one’s own consumption.”

Thus, as in example No. 1, the organization does not have the obligation to calculate VAT on the cost of installation of the machine.

One of the criteria for classifying completed work as construction and installation work for one’s own consumption is the work being performed by the organization itself, i.e. employees who are in an employment relationship.

Payroll

On May 31, wages were accrued to employees involved in the construction of a warehouse for finished products.

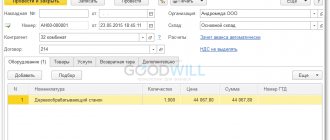

To calculate salaries for employees involved in warehouse construction, complete the Payroll in the Salaries and Personnel section – Salaries – All accruals – Create – Payroll.

For employees involved in the creation (construction) of fixed assets, the method of accounting for wages must be determined according to account 08.03 “Construction of fixed assets” with the correctly completed analytics Methods of construction - Economic . PDF

See also Payroll

Postings according to the document

The document generates transactions:

- Dt 08.03 Kt - wages are taken into account when forming the initial cost of fixed assets;

- Dt 08.03 Kt 69.XX - insurance premiums are taken into account when determining the cost of fixed assets.

EXAMPLE No. 3

The organization carried out construction and installation works with the involvement of individuals on the basis of civil contracts. Work on repairing the premises, installing a cage line, and repairing the vessel was carried out by individuals under civil contracts, who were not engaged in the taxpayer’s main activity, and no employment contracts were concluded with them.

When conducting an on-site inspection, the tax authority assessed these works as construction and installation work for its own consumption with the corresponding VAT charge.

However, as the judges noted (Decision of the Arbitration Court of the Republic of Karelia dated July 31, 2014 No. A26-1492/2014), in order for construction and installation works to be considered carried out on their own - in an economic way, all the requirements of the State Statistics Committee must be collectively met: work performed for the needs of the organization; the work is carried out by non-construction organizations on their own; for work, the organization allocates workers for the construction of the main activity, that is, those who have concluded employment contracts with this organization; the above-mentioned employees of the organization are paid wages according to construction orders.

It is impossible to equate individuals who performed work under concluded civil contracts with their own employees, and the work performed by them with work performed by the organization on its own, which is subject to VAT taxation.

Thus, in this situation, the tax inspectorate had no legal grounds for including these costs in the cost of construction and installation work for its own consumption as an object of VAT taxation.

When can an object be capitalized?

Conditions for including created property in the OS:

- Long service life - over 12 months.

- Making a profit from use - the object must participate in economic activity to obtain benefits.

- No intention to sell the asset in the next year.

If these three conditions are not met, the manufacturing object is not accepted as part of fixed assets, but is included as inventory.

Important! If we are talking about construction, then the constructed real estate before the state registration of rights to it is accounted for in an independent subaccount 01 of account.

Composition of construction and installation costs included in the VAT tax base

When performing construction and installation work for one's own consumption, the tax base is determined as the cost of work performed, calculated on the basis of all actual expenses of the taxpayer for their implementation (clause 2 of Article 159 of the Tax Code of the Russian Federation).

What is included in the taxpayer's actual expenses? The tax base takes into account only expenses incurred by the taxpayer himself, incl. and costs for the development of design estimates (Letter of the Ministry of Finance of the Russian Federation dated March 22, 2011 No. 03-07-10/07).

The cost of construction and installation works performed by contractors is not included in the amount of accrued “construction and installation” VAT (Letter of the Ministry of Finance of the Russian Federation dated 09.09.2010 No. 03-07-10/12, Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated 02.09.2008 No. 4445/08 , Decision of the Supreme Arbitration Court of the Russian Federation dated 03/06/2007 No. 15182/06, clause 19 of the Order of the Rosstat of the Russian Federation dated 10/28/2013 No. 428) both with a mixed method of performing work, and entirely by the contractor. If an organization transfers customer-supplied materials to the contractor, then the tax base in terms of construction and installation work for its own consumption also does not arise (Letter of the Ministry of Finance of the Russian Federation dated March 17, 2011 No. 03-07-10/05).

However, in a number of cases, even in the absence of actual costs for construction and installation work, tax authorities try to charge additional VAT using the calculation method for determining the cost of construction and installation work performed.

VAT on construction - calculation and deduction procedure

Construction and installation works and the procedure for deducting VAT

VAT on the cost of building materials

Completion of capital construction and procedure for issuing invoices

VAT deduction for stage-by-stage delivery of work

How to calculate VAT if the developer uses the simplified tax system

Calculation of VAT on amounts of refunds and compensations

VAT on the sale of an unfinished object

In accordance with the procedure established by Article 171 of the Tax Code, investors and contractors can deduct VAT in the generally established manner. VAT can be deducted during construction provided that the constructed facility will be used in operations that are generally subject to value added tax.

Construction and installation works and the procedure for deducting VAT

Construction can be carried out in three possible ways:

- By contract method;

- By own means or by economic means;

- In a mixed way.

Construction is carried out by a contractor

In cases where construction is carried out by contract, i.e. through the efforts of contracting organizations, the investor, that is, the organization that accepts the constructed object for accounting as a fixed asset, accepts for deduction the amount of VAT presented to him by the organization carrying out construction work under the contract.

Construction is carried out using our own resources

If the construction is carried out by the organization, that is, in an economic way, tax amounts on materials, goods, as well as services and works purchased for use in construction are accepted for deduction. Also, tax amounts calculated in the manner established by the first paragraph of Article 166 of the Tax Code when carrying out construction and installation work for domestic consumption are subject to deduction.

Mixed construction

If construction work is carried out using a mixed method, the investor can deduct the following VAT amounts:

- Presented by the contractor;

- For purchased materials, goods, work in terms of carrying out construction work using economic methods;

- Calculated when carrying out work on our own.

VAT on the cost of building materials

If construction work is carried out by a contractor, the provision of construction materials can be carried out in different ways:

Materials are provided by the contractor

In this case, the contractor deducts VAT on materials, and the investor deducts VAT on the cost of the contractor’s work. This will also include VAT on materials, since the contracting organization includes the cost of purchased building materials in the cost of its work.

The customer transfers materials to the contractor

With this method, the investor deducts VAT on the cost of the contractor’s work and on the materials used by the contractor.

Materials are supplied by the customer at the expense of the contractor

The contractor deducts VAT on materials, the investor deducts the amount of tax on the cost of the contractor’s work, taking into account materials.

Materials are purchased by the customer and transferred for a fee to the contractor, i.e. implements them

In this case, the customer accepts VAT on construction materials as a deduction, and upon transfer to the contractor, he charges VAT payable on sales. The contractor, in turn, submits VAT on the work, taking into account the cost of purchased materials, to the customer, who accepts the entire tax amount as a deduction.

Previously, when performing construction and installation work on one’s own, it was possible to deduct the amount of tax after paying the accrued amounts. That is, in the next tax period. With the entry into force of Federal Law No. 224-FZ of November 26, 2008, the procedure for calculating VAT has changed.

Now, an organization carrying out construction work on a self-employed basis can claim VAT for deduction in the same period in which it determines the tax base. That is, you no longer have to carry over the tax deduction to the next period. Amounts of tax on construction and installation work not accepted for deduction before January 1, 2009, i.e. before the entry into force of Law 224-FZ, are accepted for deduction in accordance with Article 172 of the Tax Code as amended, i.e. in the order that was in effect before the above law came into force.

the investor deducts VAT on the basis of invoices issued by the customer

If the customer and the investor are different organizations, the tax deduction is carried out by the investor based on the invoices presented by the customer. The customer, in turn, draws up invoices based on the documents presented by the contractor. Clause 6 of Article 171 of the Tax Code establishes that tax amounts presented by contractors and customer-developers when carrying out capital construction work are deducted.

The deduction is carried out in the usual manner on the basis of received invoices after the work has been accepted for accounting.

VAT deduction is possible only after the object is accepted for accounting

Thus, the contractor issues invoices to the customer for its work. Based on them, the customer issues invoices for the investor. In turn, the investor, after accepting the work for accounting, accepts VAT as a deduction.

Completion of capital construction and procedure for issuing invoices

And so, having completed the capital construction of an object, the customer organization transfers the completed construction object, for example, a building, to the investor.

The customer, after transferring to the investor a building or other object on which construction work has been completed, issues an invoice in accordance with the generally established procedure.

The customer prepares the invoice on the basis of invoices received from contractors for construction and installation work performed by them, and on the basis of invoices received from suppliers when purchasing construction materials.

invoices should include a separate line item for the cost of work for each contractor, the cost of materials and goods for each supplier

Experts from the Ministry of Finance recommend that customers, when preparing invoices, separately highlight in the document the cost of construction and installation work for each contractor and the cost of construction materials and goods separately for each supplier.

At the same time, the customer attaches to the invoice transferred to the investor copies of the invoices on the basis of which it was compiled, as well as copies of all primary documents confirming the amounts indicated in the invoices and copies of documents confirming payment of tax amounts to the customs authorities, if any importation of materials or goods into Russia.

copies of the contractor's invoices and primary documents are attached to the invoice

The customer transfers the invoice to the investor once either at the time or within five days after the transfer of the building or other object for which capital construction has been completed to the investor’s balance sheet.

Meanwhile, the Ministry of Finance, in an earlier letter No. 03-07-10/06 dated February 19, 2007, provided clarifications according to which the customer can deduct VAT without waiting for the completion of capital construction, in cases where the work is divided into separate stages. That is, if the construction contract provides for stage-by-stage delivery of work, VAT is deductible after completion of each stage.

In this case, invoices are drawn up in the same order as after completion of all work. The VAT deduction, as in the case described above, is accepted by both the customer and the investor.

VAT deduction for stage-by-stage delivery of construction work

Let's consider the procedure for calculating VAT when signing acts issued monthly by contractors.

And so, the contracting organization, on the basis of forms No. KS-3 “Certificate of the cost of work performed and expenses” and No. KS-2 “Certificate of acceptance of work performed,” submitted monthly to the customer, issues invoices for the amounts indicated in the acts.

The first question that arises in this case: can the investor include the cost of the contractor’s work on the 08th account based on forms No. KS-2 and No. KS-3?

The second logical question: is the contractor obliged to charge VAT on the amounts specified in the acts for payment on the unfinished facility?

The Civil Code in Chapter 37 examines the peculiarities of the relationship between the parties when concluding a contract for contract work. Thus, in the third paragraph “Construction contract” in the first paragraph 741 of the article it is stated that the risk of accidental death or damage to the construction project is borne by the contractor until the object is transferred to the customer.

Further, Article 753 “Deliverance and acceptance of work” states that the customer begins acceptance of work from the moment he receives a message from the contractor about readiness for handover of the object. In the event that the customer accepts individual stages of work, the risk of accidental death passes to him if the damage and death did not occur through the fault of the contractor.

Article 746 of the Code establishes the procedure for settlements between the parties, when payment for contract work is made in the amount specified in the estimate and in the manner established by the contract, or, if this is not provided for in the contract, in accordance with the legally established procedure.

Analyzing the norms of civil legislation, we come to the conclusion that either stages of completed work or a finished building after the final completion of capital construction can be transferred under the act.

Consequently, the contractor draws up invoices for which tax amounts can be deducted in the same order: after the completion of a stage, or after the final delivery of the object.

Based on the signed Acts in form No. KS-2 and No. KS-3, the cost of the object is formed on account 08, which after completion of construction is transferred to account 01.

VAT deductions, according to numerous explanations from the financial department, are accepted either after the completion of stages, in cases where this is appropriate, or after the complete completion of capital construction, after the object is accepted for accounting.

VAT deduction is possible after completion of construction stages (in some cases) or after acceptance of the finished object for accounting

How to calculate VAT if the developer uses the simplified tax system

What to do in a situation where a developer uses a simplified system? After all, according to the general rules, when applying the simplified tax system, invoices are not issued. If an organization using the simplified tax system has issued invoices, it is obliged to transfer the amount of tax allocated in the documents to the budget.

Let's consider a case from judicial practice.

The developer applying the simplified tax system, according to the general rules, based on the invoices received from the contractor, issued a consolidated invoice to the investor on its own behalf.

During the inspection, controllers from the Federal Tax Service charged the developer using the simplified system VAT on invoices issued in the name of the investor.

The basis for the assessment of the tax was the provisions of Article 173 of the Tax Code, according to which, taxpayers using special regimes, if they issue invoices, pay to the budget the tax amounts reflected in the invoices.

The developer appealed to the arbitration court. The courts of three instances rejected the developer's claims and ruled in favor of the tax authority.

However, the Supreme Arbitration Court of the Russian Federation recognized the actions of the developer’s organization as lawful (resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation No. 1784/12 of June 26, 2012 in case No. A38-1216/2011).

At the same time, the judges justified their decision as follows.

Consolidated invoices were issued in the name of the investor by the developer applying the simplified tax system in order to exercise the investor's right to tax deductions in relation to the amounts of value added tax actually paid by the taxpayer for materials, goods, work performed, purchased for capital construction.

The customer, who is not a VAT payer, did not issue invoices in respect of his work, but only re-invoiced to the investor the amounts actually paid to suppliers, in order to exercise the investor's rights to deduct VAT, since the latter is a VAT payer and has full rights to deductions.

The court notes that the actions of the developer do not contradict the explanations of the Ministry of Finance given in letter No. 03-07-10/15 dated October 18, 2011.

the developer on the simplified tax system has the right to issue an invoice in the name of the investor based on invoices received from the contractor

We would like to note that the budget does not suffer. Since the developer, for obvious reasons, did not apply tax deductions.

Calculation of VAT on amounts of refunds and compensations

During construction, expenses arise, the cost of which is not taken into account in the contract, but which are directly related to the fulfillment of contractual obligations. These may include transport, travel and other expenses. The customer reimburses these costs to the contractor.

A logical question arises: does the contractor include the received compensation amounts in the VAT tax base?

Financiers express an unambiguous opinion on this matter; the contractor charges VAT on the amounts received as reimbursement of expenses (see letter No. 03-07-11/300 dated August 15, 2012).

In fact, by issuing invoices for reimbursement of additional expenses, the contractor acts as a seller; the reimbursement amounts received must be included in income and charged VAT at the rate of 18/118, in accordance with paragraph 4 of Art. 164 Tax Code of the Russian Federation.

In this case, the organization deducts the amounts of input VAT on additional expenses in the usual manner. See letters of the Ministry of Finance No. 03-07-11/37 dated March 2, 2010, No. 03-07-11/37 dated February 26, 2010 and others.

And so, receipts in the form of reimbursements and other additional expenses are also subject to inclusion in the VAT tax base.

Thus, financiers, in letter No. 03-07-11/288 dated October 26, 2011, responded to the question about the calculation of VAT on the amounts of compensation that, under the agreement, the owner of a power line section receives for moving a section of the line, responded as follows: on the amounts received In compensation, the owner of the site charges VAT, since in essence, the funds received are payment for the work carried out by the owner to move the line and free up the territory for construction work.

The Ministry of Finance recommends that VAT be charged on the entire amount of compensation at the rate of 18/118

At the same time, judges do not always agree with the position of financiers. Thus, in decisions made in favor of the taxpayer, the arbitrators note that when reimbursement of expenses, there is no transfer of ownership by one party to the agreement to another, due to the absence of an object of sale, and reimbursement of expenses is not a payment for work received or services provided.

The Federal Antimonopoly Service of the North-Western District considered case No. A42-7064/007 on a taxpayer’s claim against the tax authority, in which the plaintiff, carrying out construction and installation work under a contract, asks the court to declare unlawful the assessment of VAT by the tax authority on amounts received as compensation the contractor's costs for paying wages to employees, charging insurance premiums for wages, travel expenses, paying daily allowances, etc.

That is, during the audit, the tax inspectorate assessed amounts of value added tax on amounts that were actually payments to employees and insurance premiums accrued on these payments.

In this case, the Federal Antimonopoly Service of the North-West District issued a resolution on August 25, 2008, in which the actions of the tax authority were declared unlawful due to the fact that they directly contradict paragraph 1 of paragraph 1 of Article 146 of the Tax Code; reimbursement of these expenses cannot be the tax base for VAT, since this does not create added value, and it is not the sale of services or work either.

The FAS Volga-Vyatka District in its decision in case No. A17-1843/5-2006 dated February 19, 2007, VASRF in its decision No. 6950/07 dated June 14, 2007, similarly argued for the decision in favor of the taxpayer.

As we see, the courts side with the taxpayer in this matter. However, it is worth noting that if value added tax is not charged on the reimbursement amounts received, the taxpayer does not have the right to apply a VAT deduction for such expenses.

if VAT is not charged on the amount of compensation, then VAT is not deductible on these expenses

VAT on the sale of an unfinished object

In accordance with paragraph 22, paragraph 3 of Article 149 of the Tax Code, operations for the sale of objects related to residential premises and shares in them are exempt from value added tax.

However, the Code does not say whether this norm is applicable to unfinished objects.

Experts from the financial department express the opinion that the sale of unfinished residential properties is not exempt from VAT.

Since an unfinished building does not fit the definition that applies to residential premises in the Housing Code of the Russian Federation.

Thus, the Ministry of Finance notes, there are no legal grounds for applying VAT benefits when selling unfinished construction projects (see letters No. 03-07-10/11 dated May 12, 2012, No. 03-07-11/186 dated 30 July 2009).

The Ministry of Finance clarifies that operations for the sale of unfinished residential premises are subject to VAT

Let's turn to arbitration practice. Thus, the Federal Antimonopoly Service of the Moscow Region in resolution No. KA-A40/221-10 dated February 10, 2010 indicates that when classifying a construction project, one should not proceed from the fact of completion, but only from its purpose.

That is, for what purposes a specific object is being built.

Thus, the arbitrators emphasize, the sale of an unfinished property intended for use as a residential building is not subject to value added tax.

See similar conclusions in resolutions of the FAS of the Volga-Vyatka District No. A39-909-2010 dated January 24, 2011, FAS of the Ural District No. F09-9691/08-S2 dated December 22, 2008.

Judges against financiers - the sale of unfinished residential properties is not subject to VAT

However, it should be noted that if an organization decides to take advantage of the exemption in relation to operations for the sale of an unfinished building, its position will most likely have to be defended in court.

up

EXAMPLE No. 4

The taxpayer carried out construction and installation work on its own for its own needs for the construction of a capital construction project - a store building.

The work was carried out by the taxpayer’s family without hiring workers or paying them wages. Based on this, the taxpayer did not have actual expenses for construction and installation work and, accordingly, the tax base for calculating and paying VAT on operations to perform these works did not arise.

However, during the audit, the tax authority assessed additional VAT on the cost of construction and installation work performed using the calculation method, guided by paragraphs. 7 clause 1 art. 31 of the Tax Code of the Russian Federation, due to the taxpayer’s lack of documents confirming the amount of expenses incurred. The basis for determining the cost of work was information on specific indicators of the cost of a unit of measurement of construction volume, established in the collection No. 26 “UPVS of buildings and structures on state farms, collective farms, intercollective farms and other agricultural enterprises and organizations.”

That is, when calculating the cost of construction and installation work carried out economically, the tax authority calculated the estimated cost of a capital construction project, including both the costs of carrying out the work and the costs of purchasing materials.

At the same time, as noted in the Resolution of the Fifth Arbitration Court of Appeal dated April 3, 2014 No. A51-21000/2013, the cost of a fixed asset is not identical to the concept of the cost of construction and installation work, and therefore the VAT tax base established by the inspection does not correspond to either by size, nor by right of the taxpayer’s obligation to pay VAT.

Results

VAT on the construction of fixed assets is calculated and deducted at the end of each tax period.

The basis for calculating the tax is the costs incurred during the construction campaign. VAT refundable is taken into account in the purchase book as materials and work are received, as well as the necessary documentation is received. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.