The consignment note is one of the main primary accompanying documents and is issued whenever the goods are transferred from the seller to the buyer. It can be used both between two organizations and between a legal entity and an individual. The use of this document is widespread, since it is in use at many enterprises where goods are released.

- Form and sample

- Free download

- Online viewing

- Expert tested

FILES

What is

A representative of the buying party is required to sign the TN when the delivery service (courier or from the selling company) delivers new items. Under any circumstances, be it a parcel to a private person from another city or a batch of frozen dumplings delivered to a grocery store. So, if an entrepreneur orders a certain quantity, the corresponding document is sent to him along with it. At the time of signing, the buyer confirms by his action that he has received the declared cargo and has no claims against the supplier.

In addition, accompanying documentation of this type is necessary to confirm expenses with the tax office if the retail outlet operates under the basic or simplified taxation system.

By law, the activities of any organization related to production, storage and resale must be documented, carried out through primary accounting documents, which are formed and approved by the company’s management.

When trying to find out how to draw up an invoice for goods and the rules for registering TORG-12 on the part of the seller, it is worth remembering that back in the late 90s, Rosstat published resolution number 132. It contains a complete catalog of accounting papers, including the form we are considering, otherwise called as OKUD 0330212. The scope of this TN is limited to the transfer of inventory from the selling party to the buying party. Such documentation may be compiled and stored not only in printed form, but also in a similar electronic format.

With the help of this document, wholesale deliveries to customers are documented. To create it, it is necessary to use a standard form or develop an alternative version that fully complies with the requirements. You should fill out your independently created TN in compliance with all the rules provided for by law.

General rules for drawing up

The rules for filling out TORG-12 in 2021 are regulated by regulations:

- Resolution of the State Statistics Committee of the Russian Federation No. 132 of December 25, 1998;

- Letter of the Federal Tax Service of Russia No. ED-4-15/ dated November 25, 2014.

The document is generated in two copies, one of which the supplier keeps and the other transfers to the customer. Based on the received TORG-12, the buyer’s accounting department comes and, if necessary, writes off the received inventory items. The filling date must strictly coincide with the delivery date, and a contract (agreement) must be indicated as the basis for the sale of inventory items. All signatures must be decrypted, and the entered data must correspond to the invoice. Some suppliers have automated the process of drawing up primary documentation and prefer to fill out TORG-12 online; this can be done on many accounting services.

IMPORTANT!

Before signing the invoice, the accounting department needs to check it. An accountant can accept a document for accounting only if it is drawn up correctly.

What does the invoice for goods TORG-12 look like: procedure for registration, decoding of the abbreviation

Looking at the self-explanatory name, it is easy to understand that the capital letters are an abbreviated version of the word “trade”. The catalog of various types of primary accounting papers for control of trading operations displays all available forms intended for generating documentary evidence. Today, other samples from TORG-1 to TORG-31 are considered optional. However, many accounting departments still use them.

Document type

The TN we are considering acts as confirmation of the transfer/sale of products by a third-party company. Therefore, it belongs to the category of external documentation.

When collecting information on how to issue a TORG-12 consignment note and find out the required details to fill out, it is important to remember a number of nuances. Although this form is a universal option that meets the requirements of legislation in this area in all respects, it is still not uniform. Entrepreneurs have the right to use other versions. Thus, according to the law, it is allowed to develop and compose technical specifications independently.

When drawing up a document, it is necessary to take into account all the mandatory points that must be displayed on paper. Many people have difficulty with this. As a result, misunderstandings often arise when interacting with representatives of inspection authorities. That is why the vast majority of companies still prefer the twelfth form.

Is TN always required?

According to accounting rules, every trade operation of an organization and individual entrepreneur must be accompanied by the issuance of a consignment note, and it does not matter how high the price of the transferred material assets is. Despite this, many cannot accurately answer when it is necessary to fill out an invoice, because most often the buyers are ordinary citizens who do not need this paper.

Advice. When concluding a transaction with counterparties, especially when it comes to a large supply, it is very important to correctly draw up all the primary documents, including technical specifications. The paper will help in the future to confirm the expense to the tax authority, which will reduce the tax burden. The absence of TN will raise unnecessary questions and create unnecessary problems.

As for settlements with individuals, another primary document is used here - a cash receipt. Very soon, all entrepreneurs involved in retail trade will have to work with cash register equipment.

Application

An invoice is issued when transferring ownership of commodity items and other goods and materials through sale or release from the selling party to the buying party. The company has the right to use not only the sample established in accordance with the law, but also to create its own version.

Upon receipt of goods

In this case, the technical specification is formed by the organization performing the shipment. As a result, registration is required from the supplier company. This can be done in one of the most preferred options: written or electronic. Often the format of the documentation is determined by mutual agreement between the buyer and seller.

Anyone who buys products has the right to refuse to accept them without appropriate documentary support. Moreover, if during the transfer procedure inconsistencies in the transferred items in terms of quality indicators are discovered, and a representative of the receiving party wants to make a return, he will need to draw up a document for the returned values.

When figuring out what this form TORG-12 is in accounting and what are the requirements for the consignment note, you should remember that along with it, an act of discrepancy in quality and quantity of products is drawn up in the form of TORG-2. At the same time, it is necessary to discuss the nuances of the return transfer of goods and be sure to record the oral agreement in writing. Otherwise, low-quality products simply cannot be returned.

For implementation

Sale (providing ownership rights to cargo from one person to another on a reimbursable basis) is also accompanied by relevant papers. The TN we are considering presupposes the availability of information about the movement of inventory items from the warehouse and settlements with the purchasing party.

Such documents are generated by the selling company. They indicate the details of the organization. The buyer accepts the delivered products and pays at the time of shipment.

In the “Payer” and “Consignee” paragraphs, the following data should be entered equally:

- Company name;

- its location (address data);

- Bank details.

For shipment

Often, commodity items and other material assets are transferred to one point, and the procedure is paid for from another. In this situation, the TN must indicate information not only about the recipient of the cargo, but also about the payer (separately). In the established form there are special columns for this.

The organization making the payment is the buyer. The goods can be accepted by a third party (for example, a subsidiary) enterprise, representative office or branch. This type of operation in TORG-12 implies a mandatory indication in the sales agreement to whom exactly the products will be sent and who will act as the consignee.

To supply

When goods and materials are supplied through the involvement of a third company, the selling party must, in addition to the twelfth invoice, also issue a goods and transport invoice. The TTN is drawn up according to the standards of the unified sample 1-T.

This paper is always prepared in 3 copies, intended for the supplier, the carrier company and the buyer. It should be noted that the formation of this documentation is required for each batch of goods that is transported using one vehicle (not for the entire volume of delivery, transported in several trips).

What is it for?

TORG-12 is used to formalize the transfer (sale) of goods or other material assets to an outside organization. That is, with its help you can prove the fact of transfer, and on the other hand, receipt of goods.

Read more about why you need a consignment note here.

Can it be used not only for trade turnover, but also for services?

In theory, no law prohibits this possibility. Practically, any accounting program has the ability to generate a standard form of act of services performed , which is most often used in such cases. If we return to the issue of audits and other checks, you may encounter problems from inspectors.

If you look from the point of view of the receiving party, then the technical document instead of the act can be capitalized correctly, but posting an extract from the service warehouse (sale) raises many questions.

What kind of document is this - unified form TORG 12: design requirements

When trading, it is not at all necessary to adhere to the established type of composition. Entrepreneurs and commercial organizations have the right to update approved forms while complying with mandatory requirements. Thus, you can create a technical specification that fully corresponds to your own preferences and business characteristics. This can be done in one of two available ways:

- by making additions to the unified sample (enter additional details necessary to more fully reflect the economic activities of the enterprise);

- create a completely new, previously unused option.

The main thing is that after introducing modifications to the structure, it contains all the main components recognized as mandatory for reflection in documentary form. So, the invoice must indicate:

- the name of the documentation itself;

- day of compilation;

- name of the supplier company or personal data of the entrepreneur;

- list of goods being moved;

- number of cargo positions (in monetary and physical terms);

- job descriptions of persons responsible for the acceptance and delivery of inventory items;

- personal signatures of participants.

All of the above points must be present. This should be remembered when dealing with the topic: “what kind of document is a consignment note: definition, design requirements, example of filling out.”

Compliance with the mandatory conditions for the formation of technical specifications allows us to confirm the fact of shipment on a legal basis. And also record the corresponding meters (quantity, weight, cost). Thanks to the TORG-12 form, it is possible to reflect the write-off of products from the selling party and the capitalization of them to the buying party. To have a clear idea of the wiring, you should consider the attached table:

| Debit | Credit | Operation | ||

| Code | Name | Code | Name | |

| Selling side | ||||

| 62 | Carrying out settlements with customers | 90-1 | Sale Revenue | Sales of goods and materials |

| Buying party | ||||

| 10 | Materials | 60 | Payment for the work of supplier companies | Reception of goods transferred by the supplier company |

| 41 | Products | Capitalization of purchased items | ||

| Transport organization | ||||

| 002 | Stored inventory items | Receipt | ||

| 002 | Goods received for storage | Broadcast | ||

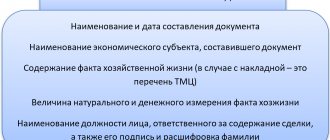

Federal Law “On Accounting” Art. 9 p. 2

The required details of the primary accounting document are:

- Title of the document;

- date of document preparation;

- name of the economic entity that compiled the document;

- content of the fact of economic life;

- the value of the natural and (or) monetary measurement of a fact of economic life, indicating the units of measurement;

- the name of the position of the person (persons) who completed the transaction, operation and the person(s) responsible for its execution, or the name of the position of the person(s) responsible for the execution of the event;

- signatures of persons provided for in Art. 2 clause 6 of the Federal Law “On Accounting”, indicating their last names and initials, or other details necessary to identify these persons.

Additional details of the primary accounting document The consignment note, in addition to the mandatory details, may contain any additional information; this is not a violation.

Filling Features

The formation of technical specifications is carried out by employees of the accounting department, warehouse or other company employees vested with such powers. There is no single standard according to which such documentation would be required. You can stick to the existing general template or create your own version. The number of rows and tables is not regulated; if necessary, it will be easy to reduce or, conversely, increase.

While observing the correct execution of documents according to the TORG-12 consignment note, it is worth remembering that it must contain the following information:

- name of the selling company;

- information about the buyer;

- description of the product indicating weight, number and cost.

The TN can be drawn up on one sheet or on several at once (depending on the list of components of the transferred cargo). In the second case, the title indicates exactly how many pages are available.

The paper must be drawn up in 2 copies. One of them is taken directly by the seller, the other is sent to the buyer. If necessary, it is allowed to attach additions, information about which is also recorded in the form itself.

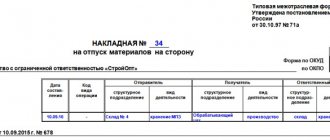

An example should be examined in detail in the attached image:

At what stage of shipment of goods is an invoice generated?

The invoice is drawn up immediately at the time of the transaction.

Since accounting entries are made on its basis, you should be very careful when filling it out. In particular, it is undesirable to make any errors or inaccuracies in the invoice or make corrections.

And it is absolutely forbidden to enter unreliable or deliberately false information into the form - if such facts are revealed by regulatory authorities, the responsible persons or even the organization may incur serious administrative punishment, in the form of large fines.

It should also be borne in mind that in some cases the invoice may acquire the status of a legally significant document - when one of the parties, due to some unfavorable circumstances, decides to go to court.

Rules for issuing the TORG-12 consignment note upon receipt of goods: instructions for filling out

The employee authorized to draw up the relevant documentation first of all begins to indicate the parties entering into the transaction. In the column for the sender of the goods, the name of the sending company is indicated, followed by the necessary details. The recipient line is intended for entering similar information about the buyer. The “Supplier” position implies duplication of data from the “Consignor”. Information about the consignee is copied into the “Payer” column.

Next, I date the document and assign it a number in accordance with the general document flow of the enterprise. Only after this do they begin to compile a table in which they enter:

- an accurate list of products being moved;

- indicate units of measurement (pieces, kg, l, etc.);

- quantitative indicators;

- prices;

- total delivery cost.

Under the table display it is written how many pages the TN has. In a certain column, enter the cost value in capital form. Finally, the paper goes for signature:

- to the employee who is engaged in the release of cargo;

- chief accountant;

- responsible for acceptance.

How to fill out a return invoice

If the customer accepted the products for accounting and only then discovered discrepancies, he must fill out the TORG-12 sample for returning the goods. This is a unified form, it is filled out according to the rules approved by the State Statistics Committee in Order No. 132 of December 25, 1998.

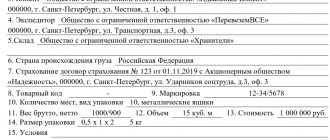

Step-by-step instructions for filling out the return invoice:

- Fill out the introductory part - information about the sender and recipient of the goods, supplier and payer. This is where the main nuance arises: the supplier and shipper is the customer organization, and the recipient is the original contractor.

- Enter all the necessary codes according to all-Russian classifiers.

- Specify the reason for the return. In addition to the contract, the basis is the original register for the supply of goods and the letter of non-conformity or return that the customer previously sent to the supplier.

- Fill in the details of the waybill - for those cases when the customer organization does not carry out the shipment itself, but engages a transport company.

- Enter the details of the return invoice - its number and date.

- Fill out the tabular part - by analogy with the initial register, enter all the information on the volume and cost of the returned products.

- Write down the final indicators for returning goods.

- Introduce the persons responsible for the shipment of goods from the customer and acceptance of the return shipment from the supplier. Check that employees have signed.

An important point is the value added tax. In the initial invoice, the supplier, who is a VAT payer, allocates the amount of tax to be deducted. With the customer organization, everything is not so simple. If the company pays value added tax, in the return document, highlight and indicate the required rate and the amount to be deducted in the corresponding lines of the table (No. 13, 14). If the institution does not pay VAT, then the compiler does not deduct a separate amount of tax from the return value (Letters of the Ministry of Finance of Russia dated March 19, 2013 No. 03-07-15/8473, Federal Tax Service of Russia dated May 14, 2013 No. ED-4-3 / [email protected ] ). In such cases, in the lines reserved for VAT, the placeholder puts zero values.

What is this form for?

It is used by all parties involved in the trading process. The invoice allows you to verify the transferred goods with the data specified in it. If the buyer is not satisfied with the quality of the delivered products, based on documentary evidence, he has the right to return it to the supplier or exchange it for products that have the appropriate quality characteristics.

In addition, TNs involve forwarders in their work. It helps them avoid problems by confirming exactly what quantity is being transported. No one will accuse the driver of theft if the transported cargo is accompanied by documentary evidence.

What information does it contain?

The generated document consists of the following items

- information about participants who sell, send, receive and pay for cargo;

- details of the agreement on the basis of which the transfer is carried out;

- date and assigned number;

- list of goods plus units of measurement;

- list of attached papers;

- signatures of everyone involved in the process.

Affixing the seals of organizations and entrepreneurs is not a mandatory element. Therefore, some businessmen and companies do without them.

Fines

The forms of documents discussed above refer to the primary form. Almost all further accounting operations are based on them, which is why these papers are so important for each participant in the transaction and their intermediaries, especially when it comes to goods worth a large amount. In order to avoid strict tax sanctions, additional tax charges, fines and penalties, you need to store all issued and received invoices and invoices for at least 5 years.

Bargaining 12 sample filling

T-1 sample filling

Results

The consignment note is the primary document, which is quite rightly considered the most common and easiest to use.

It helps control the movement of goods and other inventory items, guaranteeing financial security to the participants in the transaction. And to make document management easier, contact Cleverence. With the help of our software, you can easily conduct all routine operations, as well as accounting for goods and products in the warehouse. For example, you can use the “Warehouse 15” software, which will ensure the automation of all commodity accounting operations. Number of impressions: 1725

How to make corrections

It is not recommended to correct the invoice, like any other primary accounting document. But if errors are found in the register, corrections are made to both copies - both in the supplier’s documentation and in the form transferred to the customer.

Erroneous information is crossed out, corrections are certified by the signatures of authorized persons of both parties. Below is the date the corrections were made.

If an error is detected in the electronic register, the organization corrects the violation and sends a new invoice to the customer. There are no strict rules for making corrections in the electronic form.