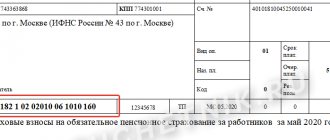

Taxes, state duties, insurance and social transfers are marked with a special code. This article provides information: what is the tax according to KBK 18210202103081011160, decoding 2018-2019 for individual entrepreneurs, as well as penalties and fines for payment.

Individual entrepreneurs transfer funds for insurance not only for their employees, but also for themselves. For example, for pensions - to the Pension Fund, and for medical contributions - to the Federal Compulsory Medical Insurance Fund. Each deduction corresponds to a code in the payment slip, indicating the type of deduction, where the funds are sent and to whose budget. For medical transfers from businessmen, the KBK 18210202103081011160 applies. The code is explained below.

Decoding KBK 18210202103081011160

The budget revenue classification code is a coordinating indicator for the budgets of various departments. Thanks to the code, the payer is determined, the budget to which the money will be transferred, and what the payment is used for: repayment of interest, payment of fines or the standard payment amount.

Encryption 18210202103081011160 means that compulsory medical insurance premiums are paid in a fixed amount for those employees or the businessman himself whose billing period ended before January 1, 2021. The funds are sent to the off-budget federal compulsory health insurance fund. The profit subcategory group indicates that this is a standard payment.

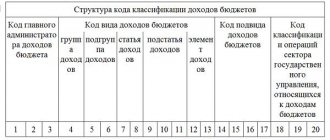

The code itself consists of 20 numbers, which make up seven blocks. Each block carries relevant information:

- 182 - the department to which the money is sent: Federal Tax Inspectorate.

- 1 - means the type of payment (income or expenses): tax profit or transfers to the budget.

- 02 - type of income: insurance contributions for social insurance to the Federal Compulsory Medical Insurance Fund

- 02103 - specifies the category of deductions: insurance contributions in a fixed amount for compulsory medical insurance to the budget of the local FFOMS.

- 08 - type of Russian treasury: budget of the Compulsory Medical Insurance Fund.

- 1011 - purpose of payment: standard payment for insurance contributions for compulsory medical insurance.

- 160 - generalized category of payments: deductions for compulsory social insurance from extra-budgetary funds.

KBK codes for 2015

Every accountant should have the new KBK table for 2015.

This will make it easier to remember all the numbers and not get confused by them. In addition, it is important to understand the structure of the codes themselves. The first 3 digits are the administrator code (manager of the corresponding budget). The fourth digit is the group indicator. Incomes occupy the 5th and 6th categories of the KBK. The next 7-11 numbers are articles and subarticles. In digits 12,13 the code of the element of your income assigned to the budget is hidden. Numbers from 14 to 17 are the income program code used for separate tax accounting (the tax, penalty or fine itself differs by code).

Digits 18-20 – transaction classification code. We must not forget that the BCC of expenses for 2013, as well as the BCC of income for 2013, have changed. Therefore, you need to be up to date in order to avoid errors in accounting and documentation.

KBK for payment of fines

A fine is an additional charge to the amount of debt for insurance contributions for complete non-payment of the premium. This sanction is imposed only for non-payment of compulsory medical insurance funds at the end of the year. The amount of the fine depends on the time the fee is not paid:

- for the first violation - 20% of the debt amount;

- for secondary and subsequent payments - 40% of the debt amount.

When paying a fine for contributions to health insurance for an individual entrepreneur for himself, the receipt indicates KBK 18210202103083011160.

KBK. Personal income tax

All BCCs for personal income tax

Personal income tax on income the source of which is a tax agent, with the exception of income in respect of which tax is calculated and paid in accordance with Articles 227, 227.1 and 228 of the Tax Code of the Russian Federation

| Name | KBK |

| payment amount (recalculations, arrears and debt on the relevant payment, including canceled | 182 1 0100 110 |

| penalty on the corresponding payment | 182 1 0100 110 |

| interest on the corresponding payment | 182 1 0100 110 |

| amounts of monetary penalties (fines) for the corresponding payment in accordance with the legislation of the Russian Federation | 182 1 0100 110 |

| other supply | 182 1 0100 110 |

| payment of interest accrued on amounts of excessively collected (paid) payments, as well as in case of violation of the deadlines for their return | 182 1 0100 110 |

Personal income tax on income received from the activities of individuals registered as individual entrepreneurs, notaries engaged in private practice, lawyers who have established law offices, and other persons engaged in private practice in accordance with Article 227 of the Tax Code of the Russian Federation

| Name | KBK |

| payment amount (recalculations, arrears and debt on the relevant payment, including canceled | 182 1 0100 110 |

| penalty on the corresponding payment | 182 1 0100 110 |

| interest on the corresponding payment | 182 1 0100 110 |

| amounts of monetary penalties (fines) for the corresponding payment in accordance with the legislation of the Russian Federation | 182 1 0100 110 |

| other supply | 182 1 0100 110 |

| payment of interest accrued on amounts of excessively collected (paid) payments, as well as in case of violation of the deadlines for their return | 182 1 0100 110 |

Quarter as a gift for new LLCs

Try for free

Personal income tax on income received by individuals in accordance with Article 228 of the Tax Code of the Russian Federation

| Name | KBK |

| payment amount (recalculations, arrears and debt on the relevant payment, including canceled | 182 1 0100 110 |

| penalty on the corresponding payment | 182 1 0100 110 |

| interest on the corresponding payment | 182 1 0100 110 |

| amounts of monetary penalties (fines) for the corresponding payment in accordance with the legislation of the Russian Federation | 182 1 0100 110 |

| other supply | 182 1 0100 110 |

| payment of interest accrued on amounts of excessively collected (paid) payments, as well as in case of violation of the deadlines for their return | 182 1 0100 110 |

Tax on personal income in the form of fixed advance payments on income received by individuals who are foreign citizens engaged in employment activities on the basis of a patent in accordance with Article 227.1 of the Tax Code of the Russian Federation

| Name | KBK |

| payment amount (recalculations, arrears and debt on the relevant payment, including canceled | 182 1 0100 110 |

| penalty on the corresponding payment | 182 1 0100 110 |

| interest on the corresponding payment | 182 1 0100 110 |

Changes to the BCC for compulsory medical insurance from April 23, 2018

On April 23, 2021, some KBK IP for themselves 2021 for the payment of insurance premiums changed. But the changes affected only contributions to pension funds. The initial changes occurred in February 2018 in accordance with Order of the Ministry of Finance No. 255 of December 27, 2017, in which the code for 1% deductions for themselves for entrepreneurs was changed. But already in April 2021, the decree was canceled and businessmen whose profits for the year amounted to more than 300,000 rubles are required to transfer money to the compulsory health insurance using the old KBK 1821020214006 1110160. But the codes for transferring to health insurance remained the same.

KBK land tax 2015

Budget classification codes for land tax for 2015 also underwent changes:

- — 18210606011031000110 – land tax on objects located in intra-city municipalities of federal cities (Moscow, St. Petersburg), levied according to pp. 1 clause 1 art. 394 Tax Code of the Russian Federation;

- — 18210606011013200110 – penalty and interest on land tax on properties located in intra-city municipalities of federal cities (Moscow, St. Petersburg), charged according to pp. 1 clause 1 art. 394 Tax Code of the Russian Federation;

- — 18210606011033000110 – fines for land tax on objects located in intra-city municipalities of cities of federal significance (Moscow, St. Petersburg), collected according to paragraphs. 1 clause 1 art. 394 Tax Code of the Russian Federation;

- — 18210606012041000110 – land tax on objects located within the boundaries of urban districts, according to clause 1 clause 1. Art. 394 Tax Code of the Russian Federation;

- — 18210606012042000110 – penalty and interest on land tax on properties located within the boundaries of urban districts, according to clause 1 clause 1. Art. 394 Tax Code of the Russian Federation;

- — 18210606012043000110 – fines for land tax on objects located within the boundaries of urban districts, according to clause 1 clause 1. Art. 394 Tax Code of the Russian Federation;

- — 18210606013051000110 – land tax on objects located within the boundaries of intersettlement territories, according to clause 1, clause 1 of Art. 394 Tax Code of the Russian Federation;

- — 18210606013052000110 – penalty and interest on land tax on objects located within the boundaries of intersettlement territories, in accordance with clause 1, clause 1 of Art. 394 Tax Code of the Russian Federation;

- — 18210606013053000110 – fines for land tax on objects located within the boundaries of intersettlement territories, in accordance with clause 1, clause 1 of Art. 394 Tax Code of the Russian Federation;

- — 18210606013101000110 – land tax on objects located within the boundaries of settlements, in accordance with paragraph 1, paragraph 2 of Art. 394 Tax Code of the Russian Federation;

- — 18210606013102000110 – penalty and interest on land tax on objects located within the boundaries of settlements, in accordance with paragraph 1, paragraph 2 of Art. 394 Tax Code of the Russian Federation;

- — 18210606013103000110 – fines for land tax on objects located within the boundaries of settlements, in accordance with paragraph 1, paragraph 2 of Art. 394 Tax Code of the Russian Federation;

- — 18210606021031000110 – land tax on objects located within the boundaries of intra-city formations of settlements of federal significance (Moscow, St. Petersburg), according to clause 2 of clause 1 of Art. 394 Tax Code of the Russian Federation;

- — 18210606021032000110 – penalty and interest on land tax on objects located within the boundaries of intra-city formations of settlements of federal significance (Moscow, St. Petersburg), according to clause 2 of clause 1 of Art. 394 Tax Code of the Russian Federation;

- — 1821060602103300110 – fines for land tax on objects located within the boundaries of intra-city formations of settlements of federal significance (Moscow, St. Petersburg), according to paragraph 2 of paragraph 1 of Art. 394 Tax Code of the Russian Federation;

- - 18210606022041000110 - land tax on objects located within the boundaries of urban districts, according to paragraph 2, paragraph 1. Art. 394 Tax Code of the Russian Federation;

- — 18210606022042000110 – penalty and interest on land tax on properties located within the boundaries of urban districts, according to paragraph 2, paragraph 1. Art. 394 Tax Code of the Russian Federation;

- — 18210606022043000110 – land tax fines for objects located within the boundaries of urban districts, according to paragraph 2, paragraph 1. Art. 394 Tax Code of the Russian Federation;

- — 18210606023051000110 — land tax on objects located within the boundaries of intersettlement territories, according to clause 2, clause 1 of Art. 394 Tax Code of the Russian Federation;

- — 18210606023052000110 – penalty and interest on land tax on objects located within the boundaries of intersettlement territories, in accordance with paragraph 2, paragraph 1 of Art. 394 Tax Code of the Russian Federation;

- — 18210606023053000110 – fines for land tax on objects located within the boundaries of intersettlement territories, in accordance with paragraph 2 of paragraph 1 of Art. 394 Tax Code of the Russian Federation;

- — 18210606023101000110 — land tax on objects located within the boundaries of settlements, in accordance with paragraph 2, paragraph 2 of Art. 394 Tax Code of the Russian Federation;

- — 18210606023102000110 – penalty and interest on land tax on objects located within the boundaries of settlements, in accordance with clause 2, clause 2 of Art. 394 Tax Code of the Russian Federation;

- — 18210606023103000110 – fines for land tax on objects located within the boundaries of settlements, in accordance with paragraph 2, paragraph 2 of Art. 394 Tax Code of the Russian Federation.

KBK 39310202090071000160 for 2015

These are insurance contributions for compulsory social insurance in case of temporary disability, as well as in connection with maternity. Code 39310202090071000160 corresponds to the classification of codes for 2015, as well as classification codes for income to extra-budgetary funds. These are mandatory social insurance contributions. Consists of standard distribution sectors, including name and relationship to a specific budget level.

Without correct and timely accounting of all expenses and income, your income will decrease or simply not grow. “Book of income and expenses in 2013”: https://russtartups.ru/buhgalteriya-2/kniga-dohodov-i-rashodov-2013.html

Budget classification codes for “injuries”

Insurance for NS (accidents) and PP (industrial injuries) remains under the control of the FSS. As before, the percentage is set by the service annually based on confirmation of the main type of activity. The codes have not been changed:

- 39310202050071000160 - payment of contributions;

- 39310202050072100160 - penalties;

- 39310202050073000160 – fines.

Advice! Before April 15 of each year, documents confirming the main type of activity must be submitted to the Social Insurance Fund. The amount of monthly contributions for “injuries” will directly depend on this document.

It is important to analyze the company’s activities for the calendar year and derive the percentage of OKVED codes. This will prevent you from overpaying.

KBK IFTS for 2015

The Federal Tax Service has identified the main BCCs that must be indicated when paying taxes in 2013:

- — 18210101011011000110 – income tax, which will be credited to the federal budget;

- — 18210101012021000110 — income tax, which will be credited to the budgets of the subjects;

- — 18210301000011000110 – VAT on goods and services sold in the country;

- — 18210401000011000110 — VAT on goods and services imported from other countries;

- — 18210102010011000110 – personal income tax on income from a tax agent;

- — 18210602010021000110 – property tax;

- — 18210604011021000110 – vehicle tax;

- — 18210501011011000110 – tax under the simplified tax system “income”;

- — 18210501021011000110 — tax under the simplified tax system “income reduced by expenses”;

- - 18210502010021000110 - UTII.

Payment of insurance premiums from 2017

Insurance premiums are payments made by legal entities for individuals. They can be employees of the organization, or persons who provide any services to the organization. Why is this necessary? The state is thus trying to provide workers with social guarantees through the employer.

The worker receives a salary, but this is not enough. He must be sure that if he gets sick, he will not be left without money for a long time. If an employee works in a workplace where he may be injured, he should know that the system also protects his interests.

That is why the employer pays monthly contributions for the employee, assuming obligations to provide social guarantees.

BCCs are intended to ensure that the government body correctly identifies the purpose of the payment. You can write whatever you want in a payment order. Even things that weren't meant. For this, we came up with unique codes to avoid confusion.