The budgetary organization code (KBK) is used by all taxpayers who transfer contributions, taxes, fines or penalties to the state budget. The codes themselves were approved by the Ministry of Finance of the Russian Federation. Based on an order from the same government department, changes are sometimes made to the BCC or new codes appear for additional contributions to taxpayers.

Before transferring amounts of money, taxpayers should carefully study the regulations and make sure that BCC 18210101011011000110 is correct. If there were any changes, the payment will not go to the government department.

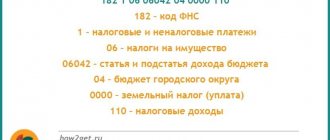

Decoding KBK 18210502010021000110

Companies and individual enterprises use different taxation systems (STS): basic and special regimes. Special regimes facilitate accounting and exempt the resident from a number of fees. Thus, a single tax on imputed income replaces: personal income tax, VAT, on profit, on property and others. A tax on profits is paid on UTII. The peculiarity of imputation is that the fee is not calculated on earned income, but on an approximate fixed amount of 15%. The approximate amount is established by the Tax Code of the Russian Federation.

The imputation has the right to be used by enterprises whose activities are limited by law. Thus, KBK 18210502010021000110 is indicated in the payment slip when transferring the standard amount of UTII collection for comprehensive income for certain types of work. In addition to the standard payment, payers contribute tax funds for fines, penalties and interest. KBK UTII 2021 for individual entrepreneurs are valid in 2019.

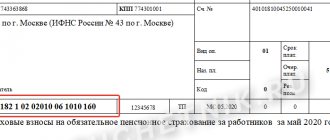

The classification code for paying UTII according to the standard payment consists of 20 digits and is divided into seven blocks:

- 182 - department that controls revenues: Federal Tax Service Inspectorate.

- 1 - category of budget revenues: tax payments.

- 05 — collection subcategory: complex profit tax.

- 02010 - type of budget and source of tax calculation: UTII for certain types of work to the regional budget.

- 02 - a specific type of treasury: the budget of the constituent entities of Russia.

- 1000 — purpose of payment: standard.

- 110 - generalized category of tax payment: tax revenues to the budget.

How is income tax and penalties paid?

When transferring the current income tax, organizations must prepare two payments: one for the tax to the federal budget (3%), the other for crediting to the regional budget (17%). In this case, the payment order indicates separate BCCs provided for each payment.

Different BCCs (taking into account the budget to which they are sent) are also used when transferring penalties for income tax. The 2018 BCC provides for the following combinations for penalties on “profit”:

- 18210101011012100110 – penalties transferred by tax payers to the federal budget,

- 18210101012022100110 – penalties sent to regional budgets.

The 12th and 13th characters in the KBK structure indicate that they belong to a specific budget: “01” means the federal budget, and “02” means the budget of a constituent entity of the Russian Federation.

KBK for payment of penalties

Penalties for UTII are charged to tax residents if the deadlines for payment of the fee are violated. The amount of the penalty is calculated based on the number of days of late payment, the refinancing rate of the Central Bank of the Russian Federation and the amount of the fee payable. The month of delay is calculated at the refinancing rate of 1/300, and from the 31st day at the rate of 1/150. Taxpayers do not have the right to exceed the amount of the penalty over the amount of the fee payable.

To pay the collection along with the overdue tax, indicate KBK 18210502010022100110 in the payment slip.

The fee must be paid and the declaration submitted in the month following the reporting quarter. The tax payment deadline is the 25th, and reporting must be submitted by the 20th.

Changes need to be monitored

Of course, it is impossible to immediately be aware of all the changes introduced by the Ministry of Finance in relation to types, sizes and even changes in BCC codes. But every company needs to strive for this, regardless of its size and type of activity. After all, any change even in the KBK can cause a fine.

Although it is worth noting that, despite the changes introduced in 2021 to the BCC, there have been no special modifications regarding BCC 18210502010021000110 since 2021. As before, KBK 18210502010021000110 decoding in 2021 represents the amount of tax calculated from income received as a result of conducting certain types of activities. This means that, as before, this BCC must be used by accountants when depositing amounts that have multiple purposes.

That is, in KBK 18210502010021000110 the decoding means that amounts not only intended for transfer as payment of tax for the quarter, but also those that were presented in the form of arrears or debt accrued under tax should be reflected under this code. This BCC also reflects the amount received as a result of the recalculation procedure carried out by accountants.

KBC for payment of fines

Fines for UTII are assessed in case of non-payment of tax, late filing of reports and for other reasons. To pay the fine, you need to indicate in the payment slip KBK 18210502010023000110. For which the fine is charged:

- temporary work without tax registration;

- untimely notification of the Federal Tax Service that the payer is registered;

- delay in filing the relevant declaration;

- non-payment or late payment of the fee;

- failure to appear or refusal to submit testimony from a witness.

Depending on the offense, the monetary penalty is fixed as a percentage or a fixed amount. In addition to the reasons listed, sanctions are imposed on individual entrepreneurs and legal entities for maintaining cash register systems:

- work without a cash register;

- violations when working with CCP;

- failure to issue a receipt to the buyer.

The amount of penalties is regulated by Art. 14.5 Code of Administrative Offenses of the Russian Federation.

KBC in 2020-2021: table of insurance premiums

Our KBK table in 2020-2021 reflects information regarding insurance premium codes that are most in demand among payers.

KBK for insurance premiums for employees

| Payment type | KBK |

| Contributions accrued for periods before 2021, paid after 01/01/2017 | Contributions for 2017-2021 |

| Contributions to compulsory pension insurance | contributions | 182 1 0200 160 | 182 1 0210 160 |

| penalties | 182 1 0200 160 | 182 1 0210 160 |

| fine | 182 1 0200 160 | 182 1 0210 160 |

| Contributions to compulsory social insurance | contributions | 182 1 0200 160 | 182 1 0210 160 |

| penalties | 182 1 0200 160 | 182 1 0210 160 |

| fine | 182 1 0200 160 | 182 1 0210 160 |

| Contributions for compulsory health insurance | contributions | 182 1 0211 160 | 182 1 0213 160 |

| penalties | 182 1 0211 160 | 182 1 0213 160 |

| fine | 182 1 0211 160 | 182 1 0213 160 |

| Contributions for injuries | contributions | 393 1 0200 160 |

| penalties | 393 1 0200 160 |

| fine | 393 1 0200 160 |

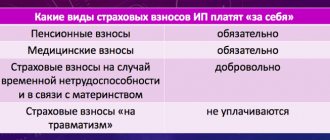

KBK for insurance premiums of individual entrepreneurs

| Payment type | KBK |

| Contributions accrued for periods before 2021, paid after 01/01/2017 | Contributions for 2017-2021 |

| Fixed contributions to the Pension Fund, including contributions | contributions | 182 1 0200 160 | 182 1 0210 160* *Unified BCC for the fixed part and contributions from income over 300,000 rubles. valid from 04/23/2018 |

| Contributions to the Pension Fund of the Russian Federation 1% on income over 300,000 rubles. | contributions | 182 1 0200 160 |

| penalties | 182 1 0200 160 | 182 1 0210 160 |

| fine | 182 1 0200 160 | 182 1 0210 160 |

| Contributions for compulsory health insurance | contributions | 182 1 0211 160 | 182 1 0213 160 |

| penalties | 182 1 0211 160 | 182 1 0213 160 |

| fine | 182 1 0211 160 | 182 1 0213 160 |

You can download the KBK table for penalties and fines for contributions to compulsory pension insurance at additional tariffs here.

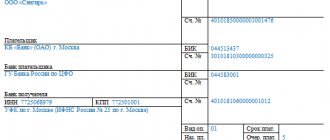

Filling out the KBK in payment slips in 2017

A payment is a settlement document on the basis of which the bank makes cash deductions. To pay taxes and contributions, form 0401060 is used. During the registration process, it is recommended to follow the Rules for filling out details developed by Order of the Ministry of Finance No. 107n.

In 2021, the Federal Tax Service will oversee taxes and insurance premiums; payers will have to submit unified reporting (Federal Law No. 243-FZ). The budget classification code indicator, reflected in line No. 104, is filled out according to the previous rules. The table shows some of the changes that have occurred in the payment system in 2021:

| Line no. | Description | Features of filling in 2021 |

| 16 | Recipient | territorial body of the Federal Tax Service |

| 22 | UIN (unique accrual identifier) | for current payments it is set to 0 |

| 106 | Basis of payment | the code is set in accordance with clause 7 of Appendix 2 and clause 7 of Appendix 3 of the Order of the Ministry of Finance |

| 107 | Taxable period | Filled out in the same way as a tax payment form |

| 108 | Number of the document on the basis of which the payment is made |

| 109 | Date of the document on the basis of which funds are deducted |

Using the KBK table for 2021 and clearly understanding the structure of the numbers, the accountant will be able to make all calculations correctly and in a timely manner. You can simplify your work and reduce the risk of making mistakes by filling out documents in electronic services. The following is a table of current BCCs for 2021.

| Income tax |

| Income tax credited to the federal budget | tax 182 1 0100 110 |

| penalties 182 1 0100 110 |

| fines 182 1 0100 110 |

| percent 182 1 0100 110 |

| Profit tax credited to the budgets of constituent entities of the Russian Federation | tax 182 1 0100 110 |

| penalties 182 1 0100 110 |

| fines 182 1 0100 110 |

| percent 182 1 0100 110 |

| Income tax on income received by Russian organizations in the form of dividends from Russian organizations | tax 182 1 0100 110 |

| penalties 182 1 0100 110 |

| fines 182 1 0100 110 |

| percent 182 1 0100 110 |

| Income tax on income received by Russian organizations in the form of dividends from foreign organizations | tax 182 1 0100 110 |

| penalties 182 1 0100 110 |

| fines 182 1 0100 110 |

| percent 182 1 0100 110 |

| Income tax on income received in the form of interest on state and municipal securities | tax 182 1 0100 110 |

| penalties 182 1 0100 110 |

| fines 182 1 0100 110 |

| percent 182 1 0100 110 |

| Income tax on income received by foreign organizations in the form of dividends from Russian organizations | tax 182 1 0100 110 |

| penalties 182 1 0100 110 |

| fines 182 1 0100 110 |

| percent 182 1 0100 110 |

| Income tax on the income of foreign organizations not related to activities in Russia through a permanent establishment (except for income received in the form of dividends and interest on state and municipal securities) | tax 182 1 0100 110 |

| penalties 182 1 0100 110 |

| fines 182 1 0100 110 |

| percent 182 1 0100 110 |

| Income tax upon implementation of production sharing agreements concluded before the entry into force of Law No. 225-FZ of December 30, 1995 and which do not provide for special tax rates for crediting the specified tax to the federal budget and the budgets of constituent entities of the Russian Federation | tax 182 1 0100 110 |

| penalties 182 1 0100 110 |

| fines 182 1 0100 110 |

| percent 182 1 0100 110 |

| VAT |

| VAT on goods (work, services) sold in Russia | tax 182 1 0300 110 |

| penalties 182 1 0300 110 |

| fines 182 1 0300 110 |

| interest 182 1 0300 110 |

| VAT on goods imported into Russia (from the Republics of Belarus and Kazakhstan) | tax 182 1 0400 110 |

| penalties 182 1 0400 110 |

| fines 182 1 0400 110 |

| interest 182 1 0400 110 |

| VAT on goods imported into Russia (payment administrator - Federal Customs Service of Russia) | tax 153 1 0400 110 |

| penalties 153 1 0400 110 |

| fines 153 1 0400 110 |

| interest 153 1 0400 110 |

| Personal income tax (NDFL) |

| Personal income tax on income the source of which is a tax agent (except for income in respect of which tax is calculated and paid in accordance with Articles 227, 227.1 and 228 of the HR of the Russian Federation) | tax 182 1 0100 110 |

| penalties 182 1 0100 110 |

| fines 182 1 0100 110 |

| percent 182 1 0100 110 |

| Personal income tax on income received by citizens registered as: – individual entrepreneurs; – private notaries; – other persons engaged in private practice in accordance with Article 227 HR of the Russian Federation | tax 182 1 0100 110 |

| penalties 182 1 0100 110 |

| fines 182 1 0100 110 |

| percent 182 1 0100 110 |

| Personal income tax in the form of fixed advance payments on income received by non-residents employed by citizens on the basis of a patent in accordance with Article 227.1 of the Tax Code of the Russian Federation | tax 182 1 0100 110 |

| penalties 182 1 0100 110 |

| fines 182 1 0100 110 |

| percent 182 1 0100 110 |

| Personal income tax on income received by citizens in accordance with Article 228 of the Tax Code of the Russian Federation | tax 182 1 0100 110 |

| penalties 182 1 0100 110 |

| fines 182 1 0100 110 |

| percent 182 1 0100 110 |

| Single tax under simplification (USN) |

| Single tax under the simplified tax system with the object “income” | tax 182 1 0500 110 |

| penalties 182 1 0500 110 |

| fines 182 1 0500 110 |

| interest 182 1 0500 110 |

| Single tax under the simplified tax system with the object “income minus expenses” | tax 182 1 0500 110 |

| penalties 182 1 0500 110 |

| fines 182 1 0500 110 |

| interest 182 1 0500 110 |

| Single tax under the simplified tax system with the object “income minus expenses” (for tax periods expired before January 1, 2011) | tax 182 1 0500 110 |

| penalties 182 1 0500 110 |

| fines 182 1 0500 110 |

| interest 182 1 0500 110 |

| Single tax under the simplified tax system with the object “income” (for tax periods expired before January 1, 2011) | tax 182 1 0500 110 |

| penalties 182 1 0500 110 |

| fines 182 1 0500 110 |

| interest 182 1 0500 110 |

| Minimum tax under the simplified tax system | tax 182 1 0500 110 |

| penalties 182 1 0500 110 |

| fines 182 1 0500 110 |

| interest 182 1 0500 110 |

| Minimum tax under the simplified tax system (paid (collected) for tax periods expired before January 1, 2011) | tax 182 1 0500 110 |

| penalties 182 1 0500 110 |

| fines 182 1 0500 110 |

| interest 182 1 0500 110 |

| Unified tax on imputed income (UTII) |

| UTII | tax 182 1 0500 110 |

| penalties 182 1 0500 110 |

| fines 182 1 0500 110 |

| interest 182 1 0500 110 |

| UTII (for tax periods expired before January 1, 2011) | tax 182 1 0500 110 |

| penalties 182 1 0500 110 |

| fines 182 1 0500 110 |

| interest 182 1 0500 110 |

| Insurance premiums |

| Purpose | KBK 2021 | KBK 2021 |

| Pension contributions |

| for insurance pension – for periods before January 1, 2021 | 182 1 0200 160 | 392 1 0200 160 |

| – for periods after December 31, 2021 | 182 1 0210 160 |

| for funded pension | 182 1 0200 160 | 392 1 0200 160 |

| for additional payment to pensions for flight crew members of civil aviation aircraft: – for periods before January 1, 2021 | 182 1 0200 160 | 392 1 0200 160 |

| – for periods after December 31, 2021 | 182 1 0210 160 |

| for additional payment to pensions for employees of coal industry organizations: – for periods before January 1, 2021 | 182 1 0200 160 | 392 1 0200 160 |

| – for periods after December 31, 2021 | 182 1 0210 160 |

| in a fixed amount for an insurance pension (from income not exceeding the limit): – for periods before January 1, 2017 | 182 1 0200 160 | 392 1 0200 160 |

| – for periods after December 31, 2021 | 182 1 0210 160 |

| in a fixed amount for an insurance pension (from incomes above the limit): – for periods before January 1, 2021 | 182 1 0200 160 | 392 1 0200 160 |

| – for periods after December 31, 2021 | 182 1 0210 160 |

| for the insurance part of the labor pension at an additional rate for employees on list 1: – for periods before January 1, 2021 | 182 1 0200 160 | 392 1 0200 160 |

| – for periods after December 31, 2021 | 182 1 0210 160, if the tariff does not depend on the special assessment; 182 1 0220 160, if the tariff depends on the special estimate |

| for the insurance part of the labor pension at an additional rate for employees on list 2: – for periods before January 1, 2021 | 182 1 0200 160 | 392 1 0200 160 |

| – for periods after December 31, 2021 | 182 1 0210 160, if the tariff does not depend on the special assessment; 182 1 0220 160, if the tariff depends on the special estimate |

| Contributions to compulsory social insurance |

| for insurance against industrial accidents and occupational diseases | 393 1 0200 160 | 393 1 0200 160 |

| in case of temporary disability and in connection with maternity: – for periods before January 1, 2021 | 182 1 0200 160 | 393 1 0200 160 |

| – for periods after December 31, 2021 | 182 1 0210 160 |

| Contributions for compulsory health insurance |

| in FFOMS: – for the periods from 2012 to 2021 inclusive | 182 1 0211 160 | 392 1 0211 160 |

| – for periods after December 31, 2021 | 182 1 0213 160 |

| in the Federal Compulsory Medical Insurance Fund in a fixed amount: – for the periods from 2012 to 2016 inclusive | 182 1 0211 160 | 392 1 0211 160 |

| – for periods after December 31, 2021 | 182 1 0213 160 |

| Tax under the patent tax system (PSN) |

| Tax levied in connection with the use of a patent, credited to the budgets of urban districts | tax 182 1 0500 110 |

| penalties 182 1 0500 110 |

| fines 182 1 0500 110 |

| interest 182 1 0500 110 |

| Tax levied in connection with the use of a patent, credited to the budgets of municipal districts | tax 182 1 0500 110 |

| penalties 182 1 0500 110 |

| fines 182 1 0500 110 |

| interest 182 1 0500 110 |

| Tax levied in connection with the use of the patent taxation system, credited to the budgets of the federal cities of Moscow, St. Petersburg and Sevastopol | tax 182 1 0500 110 |

| penalties 182 1 0500 110 |

| fines 182 1 0500 110 |

| interest 182 1 0500 110 |

| Tax levied in connection with the use of the patent taxation system, credited to the budgets of the urban district with intra-city division | tax 182 1 0500 110 |

| penalties 182 1 0500 110 |

| fines 182 1 0500 110 |

| interest 182 1 0500 110 |

| Tax levied in connection with the application of the patent taxation system, credited to the budgets of intracity districts | tax 182 1 0500 110 |

| penalties 182 1 0500 110 |

| fines 182 1 0500 110 |

| interest 182 1 0500 110 |

| Trade fee |

| Trade tax in federal cities | tax 182 1 0500 110 |

| penalties 182 1 0500 110 |

| fines 182 1 0500 110 |

| interest 182 1 0500 110 |

| State duty |

| State duty on cases considered in arbitration courts | tax 182 1 0800 110 |

| State duty on cases considered by the Constitutional Court of the Russian Federation | tax 182 1 0800 110 |

| State duty on cases considered by constitutional (statutory) courts of constituent entities of the Russian Federation | tax 182 1 0800 110 |

| State duty on cases considered by the Supreme Court of the Russian Federation | tax 182 1 0800 110 |

| State duty for state registration of: – organizations; – individuals as entrepreneurs; – changes made to the constituent documents of the organization; – liquidation of the organization and other legally significant actions | tax 182 1 0800 110 |

| State duty for the right to use the names “Russia”, “Russian Federation” and words and phrases formed on their basis in the names of legal entities | tax 182 1 0800 110 |

| State duty for carrying out actions related to licensing, with certification in cases where such certification is provided for by the legislation of the Russian Federation, credited to the federal budget | tax 182 1 0800 110 |

| Other state fees for state registration, as well as performance of other legally significant actions | tax 182 1 0839 110 |

| State fee for re-issuance of a certificate of registration with the tax authority | tax 182 1 0800 110 |

| Fines, sanctions, payments for damages |

| Monetary penalties (fines) for violation of legislation on taxes and fees, provided for in Art. 116, 118, paragraph 2 of Art. 119, art. 119.1, paragraphs 1 and 2 of Art. 120, art. 125, 126, 128, 129, 129.1, art. 129.4, 132, 133, 134, 135, 135.1 | tax 182 1 1600 140 |

| Monetary penalties (fines) for violation of legislation on taxes and fees provided for in Article 129.2 of the Tax Code of the Russian Federation | tax 182 1 1600 140 |

| Monetary penalties (fines) for administrative offenses in the field of taxes and fees provided for by the Code of the Russian Federation on Administrative Offenses | tax 182 1 1600 140 |

| Monetary penalties (fines) for violation of legislation on the use of cash register equipment when making cash payments and (or) payments using payment cards | tax 182 1 1600 140 |

| Monetary penalties (fines) for violation of the procedure for handling cash, conducting cash transactions and failure to fulfill obligations to monitor compliance with the rules for conducting cash transactions | tax 182 1 1600 140 |

| Organizational property tax |

| Tax on property of organizations (on property not included in the Unified Gas Supply System) | tax 182 1 0600 110 |

| penalties 182 1 0600 110 |

| fines 182 1 0600 110 |

| interest 182 1 0600 110 |

| Tax on property of organizations (for property included in the Unified Gas Supply System) | tax 182 1 0600 110 |

| penalties 182 1 0600 110 |

| fines 182 1 0600 110 |

| interest 182 1 0600 110 |

| Transport tax |

| Transport tax for organizations | tax 182 1 0600 110 |

| penalties 182 1 0600 110 |

| fines 182 1 0600 110 |

| interest 182 1 0600 110 |

| Transport tax for individuals | tax 182 1 0600 110 |

| penalties 182 1 0600 110 |

| fines 182 1 0600 110 |

| interest 182 1 0600 110 |

| Land tax |

| Land tax on plots located within the boundaries of intra-city municipalities of federal cities | tax 182 1 06 06 031 03 1000 110 |

| penalties 182 1 06 06 031 03 2100 110 |

| fines 182 1 06 06 031 03 3000 110 |

| interest 182 1 06 06 031 03 2200 110 |

| Land tax on plots located within the boundaries of urban districts | tax 182 1 0600 110 |

| penalties 182 1 0600 110 |

| fines 182 1 0600 110 |

| interest 182 1 0600 110 |

| Land tax on plots located within the boundaries of urban settlements | tax 182 1 0600 110 |

| penalties 182 1 0600 110 |

| fines 182 1 0600 110 |

| interest 182 1 0600 110 |

| Land tax on plots located within the boundaries of urban districts with intra-city division | tax 182 1 0600 110 |

| penalties 182 1 0600 110 |

| fines 182 1 0600 110 |

| interest 182 1 0600 110 |

| Land tax on plots located within the boundaries of intracity districts | tax 182 1 0600 110 |

| penalties 182 1 0600 110 |

| fines 182 1 0600 110 |

| interest 182 1 0600 110 |

| Land tax on plots located within the boundaries of inter-settlement territories | tax 182 1 0600 110 |

| penalties 182 1 0600 110 |

| fines 182 1 0600 110 |

| interest 182 1 0600 110 |

| Land tax on plots located within the boundaries of rural settlements | tax 182 1 0600 110 |

| penalties 182 1 0600 110 |

| fines 182 1 0600 110 |

| interest 182 1 0600 110 |

| Unified Agricultural Tax (USAT) |

| Unified agricultural tax | tax 182 1 0500 110 |

| penalties 182 1 0500 110 |

| fines 182 1 0500 110 |

| interest 182 1 0500 110 |

| Unified Agricultural Tax (for tax periods expired before January 1, 2011) | tax 182 1 0500 110 |

| penalties 182 1 0500 110 |

| fines 182 1 0500 110 |

| interest 182 1 0500 110 |

| Excise taxes |

| Excise taxes on ethyl alcohol from food raw materials (with the exception of distillates of wine, grape, fruit, cognac, Calvados, whiskey), produced in Russia | tax 182 1 0300 110 |

| penalties 182 1 0300 110 |

| fines 182 1 0300 110 |

| interest 182 1 0300 110 |

| Excise taxes on ethyl alcohol from non-food raw materials produced in Russia | tax 182 1 0300 110 |

| penalties 182 1 0300 110 |

| fines 182 1 0300 110 |

| interest 182 1 0300 110 |

| Excise taxes on ethyl alcohol from food raw materials (wine, grape, fruit, cognac, calvados, whiskey distillates) produced in Russia | tax 182 1 0300 110 |

| penalties 182 1 0300 110 |

| fines 182 1 0300 110 |

| interest 182 1 0300 110 |

| Excise taxes on alcohol-containing products produced in Russia | tax 182 1 0300 110 |

| penalties 182 1 0300 110 |

| fines 182 1 0300 110 |

| interest 182 1 0300 110 |

| Excise taxes on tobacco products produced in Russia | tax 182 1 0300 110 |

| penalties 182 1 0300 110 |

| fines 182 1 0300 110 |

| interest 182 1 0300 110 |

| Excise taxes on motor gasoline produced in Russia | tax 182 1 0300 110 |

| penalties 182 1 0300 110 |

| fines 182 1 0300 110 |

| interest 182 1 0300 110 |

| Excise taxes on straight-run gasoline produced in Russia | tax 182 1 0300 110 |

| penalties 182 1 0300 110 |

| fines 182 1 0300 110 |

| interest 182 1 0300 110 |

| Excise taxes on passenger cars and motorcycles produced in Russia | tax 182 1 0300 110 |

| penalties 182 1 0300 110 |

| fines 182 1 0300 110 |

| interest 182 1 0300 110 |

| Excise taxes on diesel fuel produced in Russia | tax 182 1 0300 110 |

| penalties 182 1 0300 110 |

| fines 182 1 0300 110 |

| interest 182 1 0300 110 |

| Excise taxes on motor oils for diesel and (or) carburetor (injection) engines produced in Russia | tax 182 1 0300 110 |

| penalties 182 1 0300 110 |

| fines 182 1 0300 110 |

| interest 182 1 0300 110 |

| Excise taxes on wines, fruit wines, sparkling wines (champagnes), wine drinks made without the addition of rectified ethyl alcohol produced from food raw materials, and (or) alcoholized grape or other fruit must, and (or) wine distillate, and (or) fruit distillate produced in Russia | tax 182 1 0300 110 |

| penalties 182 1 0300 110 |

| fines 182 1 0300 110 |

| interest 182 1 0300 110 |

| Excise taxes on beer produced in Russia | tax 182 1 0300 110 |

| penalties 182 1 0300 110 |

| fines 182 1 0300 110 |

| interest 182 1 0300 110 |

| Excise taxes on alcoholic products with a volume fraction of ethyl alcohol over 9 percent (except for beer, wines, fruit wines, sparkling wines (champagnes), wine drinks produced without the addition of rectified ethyl alcohol produced from food raw materials, and (or) alcoholized grape or other fruit must, and (or) wine distillate, and (or) fruit distillate) produced in Russia | tax 182 1 0300 110 |

| penalties 182 1 0300 110 |

| fines 182 1 0300 110 |

| interest 182 1 0300 110 |

| Excise taxes on alcoholic products with a volume fraction of ethyl alcohol up to 9 percent inclusive (except for beer, wines, fruit wines, sparkling wines (champagne), wine drinks made without the addition of rectified ethyl alcohol produced from food raw materials, and (or) alcoholized grape or other fruit must, and (or) wine distillate, and (or) fruit distillate) produced in Russia | tax 182 1 0300 110 |

| penalties 182 1 0300 110 |

| fines 182 1 0300 110 |

| interest 182 1 0300 110 |

| Excise taxes on alcoholic products with a volume fraction of ethyl alcohol over 9 percent (except for beer, wines, fruit wines, sparkling wines (champagnes), wine drinks produced without the addition of rectified ethyl alcohol produced from food raw materials, and (or) alcoholized grape or other fruit must, and (or) wine distillate, and (or) fruit distillate), imported into the territory of Russia | tax 182 1 0400 110 |

| penalties 182 1 0400 110 |

| fines 182 1 0400 110 |

| interest 182 1 0400 110 |

| Excise taxes on household heating fuel produced from diesel fractions of direct distillation and (or) secondary origin, boiling in the temperature range from 280 to 360 degrees Celsius, produced in Russia | tax 182 1 0300 110 |

| penalties 182 1 0300 110 |

| fines 182 1 0300 110 |

| interest 182 1 0300 110 |

| Mineral extraction tax (MET) |

| Oil | tax 182 1 0700 110 |

| penalties 182 1 0700 110 |

| fines 182 1 0700 110 |

| interest 182 1 0700 110 |

| Combustible natural gas from all types of hydrocarbon deposits | tax 182 1 0700 110 |

| penalties 182 1 0700 110 |

| fines 182 1 0700 110 |

| interest 182 1 0700 110 |

| Gas condensate from all types of hydrocarbon deposits | tax 182 1 0700 110 |

| penalties 182 1 0700 110 |

| fines 182 1 0700 110 |

| interest 182 1 0700 110 |

| Extraction tax for common minerals | tax 182 1 0700 110 |

| penalties 182 1 0700 110 |

| fines 182 1 0700 110 |

| interest 182 1 0700 110 |

| Tax on the extraction of other minerals (except for minerals in the form of natural diamonds) | tax 182 1 0700 110 |

| penalties 182 1 0700 110 |

| fines 182 1 0700 110 |

| interest 182 1 0700 110 |

| Tax on the extraction of mineral resources on the continental shelf of Russia, in the exclusive economic zone of the Russian Federation, when extracting mineral resources from the subsoil outside the territory of Russia | tax 182 1 0700 110 |

| penalties 182 1 0700 110 |

| fines 182 1 0700 110 |

| interest 182 1 0700 110 |

| Mining tax on natural diamonds | tax 182 1 0700 110 |

| penalties 182 1 0700 110 |

| fines 182 1 0700 110 |

| interest 182 1 0700 110 |

| Mineral extraction tax in the form of coal | tax 182 1 0700 110 |

| penalties 182 1 0700 110 |

| fines 182 1 0700 110 |

| interest 182 1 0700 110 |

| Fee for the use of aquatic biological resources |

| Fee for the use of aquatic biological resources (excluding inland water bodies) | tax 182 1 0700 110 |

| penalties 182 1 0700 110 |

| fines 182 1 0700 110 |

| interest 182 1 0700 110 |

| Fee for the use of objects of aquatic biological resources (for inland water bodies) | tax 182 1 0700 110 |

| penalties 182 1 0700 110 |

| fines 182 1 0700 110 |

| interest 182 1 0700 110 |

| Fee for the use of fauna objects |

| Fee for the use of fauna objects | tax 182 1 0700 110 |

| penalties 182 1 0700 110 |

| fines 182 1 0700 110 |

| interest 182 1 0700 110 |

| Water tax |

| Water tax | tax 182 1 0700 110 |

| penalties 182 1 0700 110 |

| fines 182 1 0700 110 |

| interest 182 1 0700 110 |

| Payments for subsoil use |

| Regular payments for the use of subsoil when using subsoil on the territory of the Russian Federation | tax 182 1 1200 120 |

| penalties 182 1 1200 120 |

| fines 182 1 1200 120 |

| percent 182 1 1200 120 |

| Regular payments for the use of subsoil for the use of subsoil on the continental shelf of the Russian Federation, in the exclusive economic zone of the Russian Federation and outside the Russian Federation in territories under the jurisdiction of the Russian Federation | tax 182 1 1200 120 |

| penalties 182 1 1200 120 |

| fines 182 1 1200 120 |

| percent 182 1 1200 120 |

| Payments for the use of natural resources |

| Payment for emissions of pollutants into the atmospheric air by stationary facilities | tax 048 1 1200 120 |

| Payment for negative impact on the environment | tax 048 1 1200 120 |

| Payment for emissions of pollutants into the atmospheric air by mobile objects | tax 048 1 1200 120 |

| Payment for discharges of pollutants into water bodies | tax 048 1 1200 120 |

| Payment for disposal of production and consumption waste | tax 048 1 1200 120 |

| Payment for other types of negative impact on the environment | tax 048 1 1200 120 |

| Payment for the use of aquatic biological resources under intergovernmental agreements | tax 076 1 1200 120 |

| Payment for the use of federally owned water bodies | tax 052 1 1200 120 |

| Income in the form of payment for the provision of a fishing area, received from the winner of the competition for the right to conclude an agreement on the provision of a fishing area | tax 076 1 1200 120 |

| Gambling tax |

| Gambling tax | tax 182 1 0600 110 |

| penalties 182 1 0600 110 |

| fines 182 1 0600 110 |

| interest 182 1 0600 110 |

| Income from the provision of paid services and compensation of state costs |

| Fee for providing information contained in the Unified State Register of Taxpayers (USRN) | tax 182 1 1300 130 |

| Fee for providing information and documents contained in the Unified State Register of Legal Entities and the Unified State Register of Individual Entrepreneurs | tax 182 1 1300 130 |

| Fee for providing information from the register of disqualified persons | tax 182 1 1300 130 |