According to the Constitution of the Russian Federation, every person has the right to work. And everyone must choose their own profession according to their abilities and talents.

However, no one is immune from receiving the “unemployed” status. Situations are different. The employer may turn out to be bankrupt; in some cases, the reasons for leaving a job may be layoffs, dismissal for personal reasons, etc. Left without a livelihood, a citizen will not be able to provide a full life for himself or his loved ones. This means you should urgently start looking for a job.

Providing assistance in this matter is the main purpose of such a budgetary organization as the territorial branch of the employment center.

About the employment center

The functions of the center include:

- adapt citizens to new conditions of the labor market, provide the opportunity to learn new professions or undergo retraining;

- register a citizen deprived of work and assign the status of unemployed, which provides him with some preferences;

- provide support to the unemployed in the form of benefits;

- hold expanded job fairs for the population of the region, where a platform is provided to connect the interests of the employer and the applicant;

- provide employment opportunities for public works for minor schoolchildren during vacation periods, as well as for all unemployed citizens. To obtain unemployed status and receive benefits, a citizen must be able to work, have no income, and be ready to independently search for work according to the vacancies offered.

The Employment Center helps citizens find work and provide them with unemployment benefits

Citizens who have been laid off due to optimization of production or liquidation of an enterprise have equal rights with others, can be registered with the Employment Center and receive unemployed status. All payments due to a layoff assigned to a former employee are not included in the certificate with the calculation of the SZ. The basis for registering a redundant person is an entry in the work book.

Citizens who were fired due to the liquidation of an enterprise also have the right to register with the Central Employment Center

Benefits will be temporarily denied to some citizens under the following conditions:

- the woman is on sick leave according to BiR;

- at the time of registration, the person is undergoing training in another region;

- conscription for military service;

- performing a task within the framework of the public service.

Important ! The right to receive benefits for these persons will be restored after the termination of the specified circumstances.

Sometimes registration with the central registration center is denied

Such citizens will not be able to register as unemployed:

- employed, including part-time;

- having additional income or any other income;

- persons registered as individual entrepreneurs with the tax service;

- persons who are members of the founders of joint stock companies;

- students studying full-time at universities;

- minor citizens under 16 years of age;

- persons registered with the Pension Fund of Russia and receiving an old-age or long-service pension;

- persons who were previously registered but did not accept two offered vacancies and refused retraining;

- persons who are sentenced to real prison terms.

If a person is employed in any way, he will not be able to register with the Employment Center as unemployed.

According to the legislation of the Russian Federation, citizens officially recognized as unemployed are paid unemployment benefits in accordance with the established procedure.

Important! Unemployment benefits are given for a limited period. The payment period itself and the amount of the benefit varies, but cannot exceed 12 months.

In 2021, the size of the benefit has been doubled.

For citizens who are looking for work for the first time or have not worked for more than one year, as well as those who have been fired under an article for violating labor discipline, a minimum amount of benefits is assigned.

The amount of unemployment benefits varies for each citizen.

Table No. 1. Benefit amounts in 2021 and in 2021

| Term | Minimum benefit amount | Maximum benefit amount | Government Decree |

| for 2019/2018 | 1500/800 rubles - for all categories. | 11280/0 rubles - for citizens of pre-retirement age; 8000/4900 rubles - for all categories of citizens. | No. 1375 dated 11/15/18 |

The employment service refused to register the unemployed

An appeal to the Labor Inspectorate yielded nothing, because... The employer has no obligation to issue such a certificate; they advised him to contact the head of the employment service, because The absence of a certificate of the “established sample” is not a reason for refusal to register. The certificate form, along with instructions for filling out and the telephone number of the employment service, was submitted to the accounting department. I stayed there for almost a week. The employer does not want to issue this certificate without any justification. If you send it by mail with a notification there is a guarantee that it will not be thrown away at all.

Please note => Where to find out the year the house was built by address

How to register?

Let us consider in detail what to do for a person who has lost his job, what documents to submit in order to register as unemployed.

Guided by the Federal Law of the Russian Federation “On Employment of the Population”, the following package of documents is provided:

- an application addressed to the head of the employment service for registration in the established form;

- passport confirming the identity of the applicant;

- employment history;

- documents confirming the degree of qualification and education: diplomas, certificates, certificates;

- certificate of disability - if available - and a recommended medical rehabilitation program;

- SNILS;

- TIN;

- a certificate from the place of work where the person worked before dismissal, about the average earnings for the last three months, except for those citizens who have not previously worked and are just starting their working career for the first time.

It is necessary to provide certain documents for registration with the central registration center

According to the rules approved by the RF PP No. 891 of 09/07/2012, a citizen is recognized and registered as unemployed only after submitting a full package of documents to the service. You need to focus on the list, which is approved by the Recommendations of the Ministry of Labor and Social Protection of the Russian Federation No. 16-5/10/2-1163 of 01.03, including a certificate of average wages.

Important ! The concept of “average earnings” refers to the average value of an employee’s total wages for a certain calendar period of time worked.

You must provide a certificate of average earnings to the Employment Center

When a person has provided all the documents, he is registered as unemployed. The following categories of citizens may not have a certificate:

- able-bodied persons who have not previously worked for various reasons, who are registered with the employment service for the first time in order to be registered as unemployed;

- citizens who have a long break from work - more than a year;

- entrepreneurs who have ceased their individual activities.

Important ! When liquidating an enterprise, it is possible to obtain a certificate of your earnings from the archive.

In all of the above exceptions to the rules, unemployment benefits are assigned in a minimum amount (see Table No. 2).

If a citizen does not have a certificate of income, he is assigned unemployment benefits in the minimum amount

Important ! It is not allowed to provide the Central Tax Office with a 2-NDFL certificate instead of a certificate of average income for 3 months established by law.

The amount of the benefit depends on the salary received by the citizen for three months of work before dismissal. Also, benefits vary depending on the category of citizens identified at the employment center, in accordance with legislative norms.

The amount of unemployment benefits depends on the data specified in the certificate of average earnings

Table No. 2. Categories of citizens who are entitled to benefits and their amount

| Category of citizens | Benefit amount | |

| Those dismissed for any reason (except for those listed below) during the 12 months preceding the start of unemployment, who were in an employment (service) relationship for at least 26 weeks during this period | For the first three months: 0.75 | Over the next three months: 0.6 |

| Former military personnel separated from military service within 12 months prior to the start of end-of-service unemployment with 26 weeks of service | From the amount of their average monthly earnings (salary, allowance), calculated for the last three months at the last place of work (service), but not higher than the maximum amount of the benefit and not lower than the minimum amount of the benefit, increased by the size of the regional coefficient. | |

| Orphans, children left without parental care, seeking work for the first time and duly recognized as unemployed by the employment service authorities for the first time | Within 6 months: in the amount of the average monthly salary in the region. | After 6 months from the date of registration as unemployed, as well as upon reaching 23 years of age: in the amount of the minimum benefit amount |

| Citizens of pre-retirement age who have worked in an enterprise for more than 26 weeks and were dismissed within 12 months before the start of unemployment for any reason | in the first 3 months: 0.75 | in the next 4 months: 0.6 in the subsequent period: 0.45 |

| The calculation is based on the average earnings accrued previously for the last three months of work | ||

| Citizens of pre-retirement age who have worked for an enterprise for less than 26 weeks and were dismissed within 12 months before the start of unemployment for any reason | in the amount of the minimum unemployment benefit for citizens of pre-retirement age | |

| All other categories of citizens: - previously unemployed; — those wishing to resume work after a long break (more than a year); — those who have ceased business activities; — dismissed for labor violations under the legislation of the Russian Federation; - dismissed for any reason, having worked for less than 26 weeks; - those who have not provided a certificate of income for 3 months. | in the amount of the minimum benefit amount increased by the size of the regional coefficient, unless otherwise provided by Law of April 19, 1991 N 1032-1 | |

Let's look at an example.

In the first year, the employee was laid off due to redundancy. He was paid for all 12 months before his dismissal, including at least 26 calendar weeks. A citizen applies to the Central Employment Service to register him as unemployed, and he will be assigned a benefit. In the first three months after registration, he is entitled to 75% of the SZ indicated in the certificate. In the subsequent period, 4 months, he will be assigned a reduced benefit to 60%; in the remaining months until the end of the calendar year, the payment will be 45%.

The amount of benefit depends on various circumstances

Important ! In the second year, all unemployed people are paid unemployment benefits in the minimum amount, increased by the size of the regional coefficient.

The pension reform introduced on January 1, 2019 introduces the concept of “pre-pensioner,” denoting people who have 5 years left to work before their old-age or long-service pension. Upon receipt of the “unemployed” status for such people, the state benefit amount is increased to the level of the minimum wage and amounts to 11,280 rubles.

About the certificate

The calculation period is considered to be three full months from the first to the last day, after which the person becomes fired. To calculate his average salary, the accounting department sums up all types of payments, including bonuses and additional payments accrued to the employee for this period, according to the system of payments and incentives approved by the organization, regardless of their source.

The certificate indicates all income received by the citizen at the enterprise: salary, bonuses, additional payments, etc.

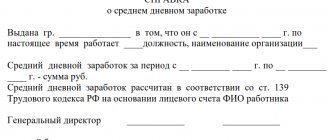

The certificate can be issued in the form proposed by the Ministry of Labor or in the Moscow form. The management can develop its own version of the certificate, but it must be issued on letterhead or on an A4 sheet. It must include a corner stamp, the employer’s information about its legal address, TIN number, as well as financial information with the OKVED number.

What else should be indicated in the certificate?

- The name of the certificate, on the basis of what data it was compiled, for which authority it is intended.

- Full name of the dismissed employee (full).

- The period of employment of an employee in an organization from the date of employment to the date of dismissal.

- Indicate the calculated total average earnings for the last three full months, rounded to hundredths. Numbers are written in numbers and in words.

- The number (26) calendar weeks during which work was paid in the 12 months before dismissal is indicated.

- The operating mode of the enterprise, the number of working hours and days in the week are prescribed. It indicates how long the employee worked while complying with the work regime.

- The dates from the beginning to the end of those periods that are excluded from the total calculations of income and for what reasons are indicated in detail: vacation, sick leave and other reasons.

- At the end of the certificate, at the very bottom, signatures are placed in turn, first of the manager, then of the chief accountant, always with a full indication of the full name, and the signatures are secured with the company seal. The date of signing and the contact telephone number of the company or organization are indicated.

The certificate must contain all necessary information in full

Important ! The employer can use any of the proposed forms of certificates or draw up his own form in any form, but indicating all the necessary information and amounts of income required by the Central Employment Center in order to pay benefits to a person.

Document structure

A specific form is not legally established. The company can develop its own template. It is better to clarify the necessary details in advance with the authority - the destination of the document.

- Basic information about the enterprise;

- Title, date and document number;

- Full name, date of birth and other necessary information about the employee;

- Signature of the director of the organization.

Financial information is certified by the signature of the chief accountant.

A stamp is placed on the certificate if the enterprise has one, since since 2015 this detail has been considered optional. In the document, you can indicate either the name of the institution where the certificate is provided, or simply put a mark “at the place of request.” If the certificate is needed by the director of the organization, it is signed by the first deputy.

Existing applications are recorded in a separate item. When an individual entrepreneur draws up a document for himself, it is necessary to attach information from the Unified State Register of Individual Entrepreneurs or, if the individual entrepreneur was registered before January 1, 2021, a copy of the registration certificate.

How to correctly calculate average earnings?

The rules for calculating SZ are defined in the Resolution of the Ministry of Labor No. 62 of 08/12/2003. A common payment procedure has been legalized for everyone.

The types of charges and amounts that are added up when calculating average earnings are indicated in paragraph 2 of Resolution No. 62. The amount to obtain the average value for the last three months includes all funds received by the employee, which are determined by the organization’s remuneration system.

Excerpt from Resolution of the Ministry of Labor No. 62

The calculation includes:

- all accruals and remunerations according to the tariff rate, which are paid not only in money, but in kind;

- all allowances, additional payments paid to the employee in accordance with internal orders adopted under the organization’s contracts: for class, replacement, additional. works and more;

- payments for labor incentives: premiums, bonuses;

- all payments in the form of compensation for harmful activities, work on night shifts and weekends, holidays;

- monthly bonuses;

- bonuses for the year - one fourth part is taken into account, that is, the share falling on three billing months;

- Quarterly bonuses are taken into account according to the share attributable to the billing months.

The certificate indicates various incomes: salary, bonuses, allowances

The following charges cannot be included in the calculation:

- social payments;

- vacation pay;

- payments according to the ballot;

- during downtime, when payments were maintained and the employee did not work.

Important ! Pay for vacation days as well as vacation days are deducted from the calculation for the last three months.

What allowances and bonuses are taken into account when calculating?

Before calculating the average salary for an employment center, you need to find out which additional payments are accepted for calculation.

Will be taken into account:

- surcharges established based on the results of certification to the tariff rates (or salaries) in force according to the staffing table;

- additional payments for length of service in a certain field of activity (length of service);

- bonuses guaranteed by labor legislation for special, dangerous hazardous working conditions;

- additional payments established for the performance of duties during the absence of the main employee, if at the same time the person continued to perform his work;

- additional payments for combining professions, crew leadership and others.

For information

When issuing income certificates, they do not take into account bonuses paid one-time by decision of the owner or the terms of a collective agreement, for example:

- for the anniversary;

- for health improvement when taking your next vacation.

The essence of the formula for calculating average earnings

Average monthly earnings can be calculated using the formula below.

NW = NW: Up x Dp: 3, where:

SZ – average monthly earnings.

SZ – the total total of all taken into account earnings for the billing period.

Until – days actually worked by the citizen during the billing period.

Дп – total days of operation of the enterprise during the billing period.

Dp:3 – the average number of days in each month of a given period.

You can calculate the average earnings using a special formula

Explanations can be seen in the calculation examples.

Example 1

Citizen Andreev A.A. accepted into Den LLC in May 2021, which approved the following work schedule: a five-day week with an eight-hour working day, Saturday and Sunday are days off. Holidays according to the calendar.

The calculation also takes into account the average daily earnings

The employee was fired on June 21, 2021. In March and April, he fully worked all days according to the calendar plan in accordance with the organization’s labor regime. In May, he did not work in full - he used the rest of his vacation from May 15 to May 31, according to the vacation schedule approved by the manager.

Let's look at the calculation procedure in the table.

Table No. 3. Data for calculating the average monthly salary of citizen Andreev A.A.

| Billing period | Work days | Actually spent | Payment type | Actual payments, rub. |

| March | 21 | 21 | Payment amount | 21000 |

| Monthly bonus | 7000 | |||

| Annual bonus | 44000:4=11000 | |||

| Bottom line | 39000 | |||

| April | 20 | 20 | Payment amount | 21000 |

| Monthly bonus | 7000 | |||

| Material aid | 3000 | |||

| Bottom line | 31000 | |||

| May | 21 | 12 | Payment amount | 21000 |

| Monthly bonus | 3000 | |||

| Vacation pay | -15000 | |||

| Bottom line | 9000 | |||

| Total | 62 | 53 | total amount | 79000 |

Note:

- the employee was fired in June, but calculations are made for the previous three months;

- annual bonus is divided into 4 proportionally quarters%

- the monthly bonus is counted in full, it is accrued for the days actually worked.

Monthly premiums are taken into account when calculating

We apply the calculation formula:

NW = NW: Up x Dp:3

SZ = 79,000 rubles = 39,000 rubles. (for March) + 31,000 rub. (for April) + 9000 rub. (for May), this is the total of all taken into account earnings for the billing period.

Until = 21+ 20 + 12 = 53. These are the days actually worked by the employee during the pay period.

Дп = 21+20 + 21 = 62. These are the total days of operation of the enterprise during the billing period.

Dp:3 = 62:3 =20.7. This is the average number of days in each month of a given period.

NW = 79000: 53 x 20.7 = 30854.71. This is the average salary.

Example 2

Citizen Petrova P.P. was enrolled in Interval LLC in August 2017, which approved the following work schedule: a five-day week with an eight-hour working day, Saturday and Sunday are days off. Holidays according to the calendar.

The employee was voluntarily dismissed on October 10, 2021. In July and August, she worked all days completely according to the calendar plan in accordance with the organization’s labor regime. From September 5 to September 13, she was on sick leave to care for her child, and therefore did not work full time for a month.

Sick leave benefits are not taken into account when calculating

Let's look at the calculation procedure using the table.

Table No. 4. Data for calculating the average monthly salary of citizen P.P. Petrova.

| Billing period | Work days | Actually spent | Payment type | Actual payments, rub |

| July | 21 | 21 | Payment amount | 21000 |

| Monthly bonus | 3000 | |||

| Bottom line | 24000 | |||

| August | 20 | 20 | Payment amount | 21000 |

| Monthly bonus | 3000 | |||

| Material aid | 3000 | |||

| Bottom line | 27000 | |||

| September | 21 | 12 | Payment amount | 21000 |

| August Award | 3000 | |||

| Sick leave | -11000 | |||

| Bottom line | 13000 | |||

| Total | 62 | 53 | total amount | 64000 |

Note:

- the employee was fired in October, but the calculations are made for the previous three months;

- the monthly bonus is counted in full, it is accrued for the days actually worked.

We apply the calculation formula:

NW = NW: Up x Dp:3

SZ = 64,000 rubles = 24,000 rubles. (for July) + 27,000 rub. (for August) + 13,000 rub. (for September).

Before = 21+ 20 + 12 = 53.

Dp = 21+20 + 21 = 62.

Dp:3 = 62:3 =20.7.

NW = 79000: 53 x 20.7 = 25000.00.

Data for the previous three months is taken into account

Example 3

Citizen Serova S.S. was enrolled in Sever LLC in August 2016, which approved the following work schedule: a five-day week with an eight-hour working day, Saturday and Sunday are days off. Holidays according to the calendar.

On October 10, 2021, after the birth of a child, the employee wrote a statement and went on maternity leave for 1.5 years. When she went back to work, she wrote a letter of resignation on the last day of her vacation. For the calculation, July, August, September are taken.

Let's look at the calculation procedure using the table.

Table No. 4. Data for calculating the average monthly salary of citizen Serova S.S.

| Billing period | Work days | Actually spent | Payment type | Actual payments RUB. |

| July | 21 | 21 | Payment amount | 21000 |

| August | 20 | 20 | Payment amount | 21000 |

| September | 21 | 21 | Payment amount | 21000 |

| Total | 62 | 62 | total amount | 63000 |

If the employee was on parental leave, income is taken into account for the time he actually worked

We apply the calculation formula.

NW = NW: Up x Dp:3

SZ = 63,000 rubles = 21,000 rubles. (for July) + 21,000 rub. (for August) + 21,000 rub. (for September), this is the total result of all taken into account earnings for the billing period.

Before = 21+ 20 + 12 = 53.

Dp = 21+20 + 21 = 62.

Dp:3 = 62:3 =20.7.

NW = 63000: 62 x 20.7 = 21033.87.

Important ! For some regions of the country, an increasing regional coefficient is applied.