Taxes and fees

Natalya Vasilyeva

Certified Tax Advisor

Current as of February 4, 2020

If an overpayment occurs on mandatory payments, the taxpayer has the right to return it to his current account. To do this, you must submit a refund application to the Federal Tax Service. Let's look at the procedure for returning overpayments in 2021 and what document needs to be filled out for this.

How can I find out about overpayment of taxes?

Overpayment of taxes can be detected both by the company itself and by the tax authorities.

If it was found by the Federal Tax Service, then the inspector who runs the company must inform the business entity about it. He can call, write a letter, etc.

If information about an overpayment was received by telephone, you need to take measures to record the information of the interlocutor, the time and date of the call, for what tax the overpaid amounts arose, etc.

Sometimes, in order to clarify the situation, the Federal Tax Service inspector may ask for additional documents. However, tax authorities often ignore this responsibility because they do not want to return money from the budget.

You can find out about the overpayment using your personal account, which is located on the Federal Tax Service website (nalog.ru). To do this, you need to have a qualified signature of the company or individual entrepreneur. The service immediately informs you upon entering your account that the taxpayer has overpaid taxes.

Attention! However, overpayment of tax is not always true. Since many obligatory payments are closed at the end of the year, the system regards advance payments until the annual declaration is submitted as an overpayment.

Another way to identify overpayments is to submit an annual tax return. Most tax reports contain information about advances paid during the period, as well as calculations of the annual tax. By filling them out, you can determine the amount of tax to be refunded.

The situation is similar with overpayments that arise due to clarification of declarations leading to a reduction in tax. Most often, overpayment of tax can occur due to errors in payment documents. You can find out about this by conducting periodic reconciliations with the budget according to calculations.

See more details: How to return overpayment of overpaid tax, deadlines, documents.

For lost profits

Lost profits may arise due to a violation of human civil rights. You can file a claim to recover damages. Presentation of the document is a company right, not an obligation. The organization must notify the counterparty of the violation of the terms of the contract. In one case, claims may be rejected. For a claim to be valid, it must include the following information:

- information about the parties to the transaction;

- circumstances of the violation;

- clauses of the contract that were violated;

- the amount of money that could have been received if the provisions of the contract had been complied with.

Alexander Mironov

Lawyer - consultant

Ask a Question

It is better to supplement the claim with an independent expert’s conclusion on the existence of a loss, and also to prepare an act of a commission consisting of representatives of both parties.

In what case can an overpayment be refunded?

An application for a refund of overpaid tax can be submitted only in a situation where the inspectors agree with this and the company knows about it. If the fact of overpayment of tax was revealed by the inspector, he must inform the company about this within 10 days. In this case, the organization receives a tax refund letter from the Internal Revenue Service. When the company itself declares the occurrence of excess amounts paid, it must be ready to provide all the documents necessary for confirmation.

When making a decision, the tax office also takes into account that the refund of erroneously paid tax must be made within the deadlines established by law.

If the overpayment was due to the fault of the taxpayer, he must file an application for a refund of the overpaid amount of tax within three years from the date of making this payment.

If the tax authorities incorrectly wrote off tax amounts, then in this case there is a deadline for filing an application within one month from the date when the taxpayer became aware of this.

Attention! The Federal Tax Service will not refund funds if the claim deadlines are violated. The only way in this situation to return the money is to try to prove through the court that the date when the company became aware of the overpayment refers to later periods.

What can be returned

You can return almost all goods purchased at retail outlets. Online stores are no exception. The returned product must be of appropriate quality. Otherwise, the return will be refused. The exception is cases where the product was initially defective, but the defect was not immediately noticed.

Alexander Mironov

Lawyer - consultant

Ask a Question

It is noteworthy that the law initially does not mention the return of goods, but its replacement. Refunds are provided if the analogue is not on sale or cannot be provided for any other reason. Statistics show that in most cases sellers meet buyers halfway. They agree to refund the money if the customer refuses to exchange the purchase.

In which case is only offset possible?

The Tax Code of the Russian Federation establishes that a refund of overpayment of tax is impossible if the taxpayer has arrears on other payments to the budget. In this case, the inspector must carry out an offset without acceptance, only notifying the company about this.

You might be interested in:

Simplified tax system for income minus expenses in 2021: conditions of application, rates, example of calculation, reporting

Therefore, if an organization has tax arrears, it is best to strictly monitor mutual settlements, since if there is an excessive transfer of money to the budget, it most likely will not be able to return it. This is done on the basis of a tax offset application.

A situation may arise that the tax debt is less than the overpayment that has arisen. Then the Federal Tax Service will make a credit for the arrears, and for the difference will request from the company either an application for a refund of the amount of overpaid tax, or for a credit against further payments.

If you don't write a return request

In the absence of a requirement for a refund of overpaid tax, tax inspectors have every right to offset this amount against the taxpayer’s future tax payments or to cover any of his arrears, penalties and fines with it.

There are situations when the application is received after the tax authorities have already disposed of the overpaid money - in such cases, only the difference between the covered arrears (penalties, fines) and the overpaid amount will be returned to the taxpayer’s account.

How to submit an application to the Federal Tax Service

The completed application can be submitted to the Federal Tax Service in the following ways:

- In person or through a legal representative. In the latter case, a power of attorney will be required.

- Through the taxpayer’s personal account via the Internet. But at the same time, you must have a registered personal account on the website nalog.ru, as well as a digital electronic signature.

- Send a valuable letter with a list of attachments by mail.

Legal basis

Overpayment is considered to be money that was transferred without reason or in excess of the amount due. According to the general rules of civil law, receiving money must have a basis. If they were listed without reason, then they constitute unjust enrichment.

Expert opinion

Lawyer Alexander Vasiliev comments

In accordance with Art. 1102 of the Civil Code of the Russian Federation, a person who acquired money or property without proper grounds is obliged to return unjust enrichment to its owner.

How to correctly fill out a new application form in 2021

Consider how to fill out an application for a refund of overpayment of tax, a sample of the new form. This form must be used without fail from March 31, 2021.

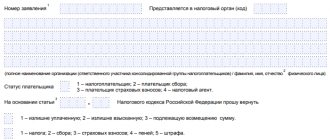

Title page

Filling occurs in the following order. At the top of the form you need to indicate the TIN and KPP codes. If the application is made by an organization, the last two cells in the TIN field must be crossed out, if an entrepreneur, the checkpoint field must be crossed out.

The sheet number is indicated next to it - for the title page it is “001”.

The “Application number” field indicates how many times during the current year the organization applied for a tax refund. Fill in the first cell, all others are crossed out.

Nearby is a field in which the code of the tax authority where the form is sent is written.

Next comes a large field in which the full name of the organization or full name is written. entrepreneur.

In the next field you need to write down the chapter from the Tax Code of the Russian Federation, on the basis of which the refund request is made, for example:

- “78” is entered if a refund of the over-transferred amount is requested.

- “79” – if there was an erroneous collection by the tax authority.

- “330.40” is indicated when the state duty is refunded.

Put a dash in empty cells.

The code below indicates the amount requested for refund:

- “1” – if there was an overpayment,

- “2” – if there was an excessive recovery by a government agency,

- “3” – if the tax amount is subject to reimbursement (refers to VAT).

In the next field you need to indicate with a code from 1 to 5 which payment is being requested for a refund. The decoding of the codes is given next to the field.

Next, write down the amount requested for refund. The field is filled in from the left cell.

Then you need to indicate the tax period for which the overpayment occurred.

The column consists of three blocks, which are filled in as follows:

- The first two cells indicate the period: “MS” – month, “Q” – quarter, “PL” – half a year, “GD” – year.

- In the second two cells the period is specified. If a month was selected, then its number from 01 to 12 is entered here. If a quarter was selected, its number is from 01 to 04. If a half-year was selected, 01 or 02. For the year, zeros are indicated in both cells.

- The last block of four cells is the year number.

Nearby there is a column for indicating the OKTMO code.

In the field below, the BCC of the payment for which the overpayment occurred is recorded.

Then the number of sheets in the application is indicated, as well as how many sheets there are attachments to the application.

The lower part of the form is divided into two columns; only the left one is filled out here. It is necessary to enter a code - who is submitting the document, his full name, contact phone number, date of completion.

If the form is submitted by an authorized representative, it is necessary to indicate the details of the power of attorney. A copy of the power of attorney must be attached to the application. In the appropriate field, indicate the number of attached documents.

Attention! When an entrepreneur fills out the form, a dash is placed in the full name field, the individual entrepreneur signs the document and the date of signing is indicated.

Sheet 2

Bank details are recorded on the second sheet. The header is filled out in the same way as the title page. Only the sheet number is indicated here as “002”.

You might be interested in:

Income tax in 2021: what are the rates, table of values

The sheet itself consists of columns in which the components of bank details are recorded - in the first field the name of the bank is entered.

Type of account code - what to indicate in the application to the tax office:

- Code “01” - current account;

- Code “02” - current account;

- Code “07”—account for deposits;

- Code “08” – if a personal account is used;

- Code “09” – for a correspondent account;

- Code “13” if a correspondent subaccount is used.

Attention! Legal entities and individual entrepreneurs can indicate codes 01 and 02 in the application. Individuals are better off indicating code 02 when returning taxes. Code “07” is unlikely to be used - only if the agreement with the bank contains a clause allowing payments to be accepted into the account from third parties.

The following code is indicated in the account number field:

- “1”, if the money will be transferred to the taxpayer’s account (in general, this code should be entered);

- “2”, when transferring fees to the payer (for example, for those who pay trade fees in Moscow);

- “3”, if the refund is made to insurance premium payers;

- “4” when returning to the tax agent. They can be third parties who transfer taxes for another person.

Then enter the account number - it consists of 20 digits.

Next, enter the recipient code, it could be:

- 1 – organization (for legal entities).

- 2 – individual (if the form is filled out by an individual)

- 3 – if the recipient is the body that opens and maintains personal accounts.

Then the recipient is indicated (organization, individual entrepreneur or individual).

Sheet 3

This sheet is issued only by individuals. The registration is simple - enter your full name and passport details, as shown in the example.

Examples:

Calculation of tax refund for individual entrepreneurs using the simplified tax system when purchasing a home

Individual entrepreneur Sidorova M. bought an apartment for 2.5 million rubles. in 2021. Is she entitled to a refund from the 2017 budget if she used the simplified tax system?

Art. 219 of the Tax Code indicates that a tax deduction is made on income taxed at a rate of 13% (personal income tax). The simplified tax system for individual entrepreneurs does not require the payment of this tax, so Sidorova M. will not be able to return the tax from the budget for this year. If a citizen were on the general taxation system, she would have the right to count on a refund. For further examples, we will keep in mind that the citizen is a personal income tax payer.

Obtaining a tax deduction for treatment

Citizen Kuznetsov A. had surgery in 2021 at a cost of 40 thousand rubles. His total income for this year was 280 thousand rubles. He will calculate the amount of refund that Kuznetsov A. has the right to receive in 2021 after presenting all the necessary documents (3-NDFL declaration, 2-NDFL certificate, certificate of payment for medical services, agreement with a medical institution, copy of the license, checks).

280000*0.13=36400 rub. – the tax transferred by the employer for Kuznetsov A.;

280000-40000=240000 rub. – tax base minus the amount of the transaction (funds spent on the operation are not subject to personal income tax);

240000*0.13=31200 rub. – personal income tax amount for 2021;

36400-31200=5200 rub. – the difference between the accrued and paid personal income tax amount, which can be returned from the budget.

Social tax deduction for training

Citizen Makarova S. is studying at a university on a correspondence course and works officially in the organization. For 2021, her earnings amounted to 310 thousand rubles; for the year of study she paid 130 thousand rubles. Let's calculate its return:

310000*0.13=40300 rub. – paid personal income tax;

310000-120000=190000 rub. – tax base (Makarova paid 130,000 rubles, but there is a restriction under clause 2 of Article 219 of the Tax Code: the deduction cannot exceed 120,000 per year);

190000*0.13=24700 rub. – calculated tax;

40300-24700=15600 rub. - return.

Property deduction for the purchase of an apartment

Individual entrepreneur Semenov P., located at OSNO, bought an apartment in 2021 for 2.2 million rubles. His income according to the 3-NDFL declaration amounted to 350 thousand rubles. Let's calculate how much money he can return from the budget for this year.

350000*0.13=45500 rub. – paid tax;

the maximum deduction amount is 2 million rubles (although the cost of housing is 2.2 million rubles), so you can only return 13% of this amount (260 thousand rubles). For the year, individual entrepreneur P. Semenov paid 45,500 rubles, this is the refund amount. The rest (260,000-45,500 = 214,500 rubles) can be returned in subsequent years, subject to payment of personal income tax.

How long will it take for the refund to be processed?

In order to inform the tax authority of your desire to refund the overpaid tax, you must submit an application. The authority is obliged to consider it within 10 days, after which it informs the applicant in writing about the decision made.

Attention! The Tax Code establishes that the Federal Tax Service is obliged to transfer funds within 1 month from the date of receipt of the relevant application. In addition, interest calculated on the basis of the refinancing rate is subject to payment within the same period.

What cannot be returned

However, a list of exceptions has been established. The following cannot be returned:

- medicines;

- Food;

- personal hygiene items;

- products reflected in the Decree of the Government of the Russian Federation No. 55 of January 19, 1998;

- complex equipment, with the exception of faulty equipment, reflected in the Decree of the Government of the Russian Federation No. 924 of November 10, 2011.

If the product does not fall into the above list, the seller has no right to refuse a return or exchange if all established rules are met.