The organization can help not only the founder, but also any employee. Many successful companies provide financial support to their employees and provide loans on more favorable terms than a bank loan. As a founder, you can borrow money whether you are an employee or not.

Submit reports in three clicks

Elba - online accounting for individual entrepreneurs and LLCs. The service will prepare reports, calculate taxes and free up time for useful things.

Try 30 days free Gift for new entrepreneurs A year on “Premium” for individual entrepreneurs under 3 months

Loan to the founder: types, how to apply + sample agreement

Russian companies can provide their employees with a unique opportunity - a loan.

This practice does not exist in all companies, but where it exists, both the employer and employees are satisfied. In addition to the employees themselves, the founders can also use the loan right. They are not always official employees of companies.

Recently, the rules regarding issuing loans to founders have changed, and as a result, many questions have arisen.

First, let's figure out what kind of loans there are and what they are, and then consider the design.

Loan options

- Percentage.

- Interest-free.

The defining document is the contract, which is drawn up in both the first and second options. As the name suggests, their difference lies in how the founder will return the funds in the future.

In the first case, there is a return with interest, which is prescribed individually and can be paid either monthly or with a full refund. With the second option, there is a complete absence of interest and any other additional payments.

That is, the founder returns exactly as much as he initially took.

Many people mistakenly believe that an interest-bearing loan is more profitable. But there is a nuance that calls the benefit into question.

When you repay the loan and interest, the interest itself will be considered additional income for your company. According to the law, additional income is subject to taxes.

Therefore, many people prefer to take out an interest-free loan, which is not taken into account by any tax systems.

Legislative acts

Before issuing a loan to the founder or taking it out yourself, it is worth studying the legislative acts that talk about all the rules and details.

- According to the Civil Code of the Russian Federation (clause 1 of Article 808), all transactions are formalized in writing. Accordingly, the agreement is needed in at least two copies, signed by both parties, indicating their full details. An incorrectly drawn up document can be canceled, so you should approach this issue with extreme care.

- Be sure to indicate the loan option (interest-bearing or interest-free). In the case of interest, indicate the terms for repaying the interest. According to the law, if the contract does not indicate a clause that it is interest-free, it can automatically be considered interest-bearing.

How to apply for a loan to the founder?

Let's move on to the main issue, the design itself.

Important! The loan amount is not specified in legislation. Therefore, its maximum value is set directly by both parties.

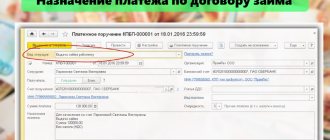

- Signing the document. The tax organization will not allow you to withdraw a large amount from your account without documenting the cash withdrawal transaction. In this case, documentary evidence is a signed agreement. In addition, think in advance in what form the founder will return the money to the company. Will it be cash or bank transfers. A decision made in advance will allow the accountant to know how to conduct reporting in the future.

- Money is issued in any convenient way. If necessary, this can be either a cash order or a transfer to a bank card.

It would seem that everything is clear. However, in practice, questions arise when the situation is unusual. If you have:

- enterprise with 1 founder-director . If the company has one founder, who is also the director, then, paradoxically, he signs the agreement on both sides. This is a common practice that will not surprise either the tax office or other regulatory organizations;

- an enterprise in which there is more than 1 founder - in this case, look at the company’s Charter. If the Charter stipulates how much money the director can issue on his own, then he does it without any problems. If a large amount is required or is not regulated by the Charter, then a General Meeting of Founders is held, at which the issue of issuing a loan is decided in writing.

Sample contract

Sample loan agreement with the founder

There is no standard agreement, but there are requirements that must be taken into account when drawing up the document:

- put the date and document number;

- by whom it is signed (on the one hand, the borrower, on the other hand, the lender);

- indicate the option (interest or interest-free);

- terms of money return;

- method of transferring funds;

- additional conditions (termination of contract, interest rate);

- complete data of each party;

- signatures, seal of a legal organization.

The agreement is signed in two copies and has equal legal force.

Tax registration

When applying for an interest-bearing loan, taxation is typical as for income. Interest is considered income and is therefore taxed. As for interest-free, everything is more complicated. The tax is paid depending on the share of the founder.

If its share is more than 51%, then the company does not pay tax. If the percentage of the share is less, then the amount is taxed as income tax. The tax is paid only after the debt is fully repaid.

There are several options that can minimize tax:

- Use the funds received to purchase real estate. In this case, they are not subject to tax.

- As an option, the contract can be extended. In this situation, you will pay tax after the debt is fully repaid. If this does not happen, then the tax payment is deferred. The law does not establish in what quantity and for what period it can be extended. Organizations often take advantage of this.

In any case, do not forget that a loan is an additional responsibility of both the founder and the CEO.

It is worth considering all possible conflicts and writing them down on paper so that problems do not arise later.

The process of issuing a loan to the founder is a common practice in Russia, so you should not be afraid of it, but try to wisely benefit, both for the organization and for yourself personally.

Source: //Zapusti.biz/biznes-idei/zajm-uchreditelyu

How to get a loan to the founder from an LLC

- Full name and passport details of the borrower (founder);

- Name and address of the lending organization;

- Full name of the managing person of the LLC;

- Amount and subject of loan;

- A clause stating that the money is given at zero interest (or indicate the rate);

- The method and timing of issuing money to the borrower;

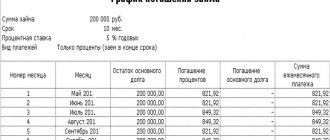

- Return terms and schedule;

- Clause on penalties for delay;

- Conditions for early termination (full repayment of debt, etc.);

- Attachments: act of transfer of funds, minutes of the general meeting on approval of the transaction and return schedule;

- Name, address, telephone number and details of the organization, full name, address, telephone number of the borrower;

- Date and signatures of the parties.

You may not indicate in the contract documents the period for which the loan was issued. This is not mandatory, but the law states that the debtor is obliged to pay the creditor within 30 days from the moment he requested it. It is better when the repayment schedule for borrowed funds is clearly stated.

Loan to the director of an LLC

Or, as an option, the organization itself will withhold personal income tax from the founder’s salary if he is its employee.

A sample loan agreement from an organization to the founder can be downloaded from the link: Sample loan agreement from an organization to the founder.

How to draw up an interest-free loan agreement from the founder of an organization: sample An interest-free loan agreement from the founder is drawn up in a classic way. It states:

- time and place of drawing up the contract;

- sides;

- loan amount;

- deadlines for its provision;

- non-interest clause;

- rights and obligations of the parties, other agreed terms;

- details, signatures, seals of the parties.

For the lender, indicate F.

How to get a loan to the founder from an LLC (nuances)?

I.O. and passport details of the founder, and in the “Borrower” field - the full name of the LLC and the full name of the director as his representative. At the end of the contract, full full name is indicated.

Loan agreement between the general director and the LLC

Info

In such cases, the founder acts as a lender as an individual, and as a borrower on behalf of the organization.

Loan from an organization to the founder: interest-bearing and interest-free The loan agreement with the founder has a simple written form and standard details of the agreement.

If it does not indicate an interest rate and there is no gratuitous clause, then it will be considered in circulation as an interest-bearing loan agreement.

The interest rate will be calculated at the refinancing rate on the date of loan repayment (clause 1 of Article 809 of the Civil Code of the Russian Federation).

A sample loan agreement without indicating interest can be downloaded from the link: Sample loan agreement without indicating interest If the agreement is interest-free or the rate is very small (less than 2/3 of the refinancing rate), then it is considered that the founder has acquired a material benefit. He will have to pay personal income tax.

Interest-free loan agreement with the founder - download sample

Having considered the issue, we came to the following conclusion: on the part of the joint-stock company, the loan agreement has the right to sign the general director or another person authorized to do so by a power of attorney.

Rationale for the conclusion A legal entity acquires civil rights and assumes civil responsibilities through its bodies acting in accordance with the law, other legal acts and constituent documents (clause 1 of Article 53 of the Civil Code of the Russian Federation). In accordance with paragraph 2 of Art. 69 Federal Law of December 26.

1995 No. 208-FZ “On Joint-Stock Companies” (hereinafter referred to as Law No. 208-FZ), transactions on behalf of the joint-stock company are carried out by its sole executive body - the director, the general director.

That is, in this case, the party to the agreement providing the loan (lender) is not the director, but the legal entity he manages. It is the general director who signs the loan agreement on behalf of the company.

Loan agreement between LLC and director

Meanwhile, the Presidium of the Supreme Arbitration Court of the Russian Federation, in its resolution dated 05.04.

2011 in case No. 16324/10 indicated that the absence of an original loan agreement in a situation where the actual transfer of funds to the borrower is proven does not entail recognition of the loan agreement as not concluded.

Accordingly, the return of money received under this agreement is mandatory. Thus, the position of the courts regarding the conditions under which a loan agreement should be considered concluded is contradictory.

//www.youtube.com/watch?v=jRMrooi3Z0U

A loan agreement (interest-bearing or interest-free) with the founder of an organization is a fairly flexible and convenient tool for distributing funds - both personal and work. It is drawn up and executed as a classic loan agreement.

Loan agreement between the LLC and its general director

The legislation does not prohibit a transaction in which the head of the organization entering into the transaction will simultaneously be the other party to the transaction. On the contrary, such a situation is permissible based on paragraph 1 of Art.

81 of Law No. 208-FZ, which relates this transaction to transactions in which the sole executive body is interested, which must be approved by the board of directors (supervisory board) of the company or the general meeting of shareholders in the manner prescribed by Art. 83 of Law No. 208-FZ.

Thus, in the situation under consideration, the person performing the functions of the sole executive body of the joint-stock company signs the agreement on behalf of the company (lender) and at the same time on his own behalf as an individual as a borrower.

In addition, on behalf of the joint-stock company, the agreement can be signed by another person authorized to do so by power of attorney (Article 185 of the Civil Code of the Russian Federation).

Sample loan agreement between the founder and LLC (interest-free)

Refund period; 2. Interest and payment schedule (drawn up as a separate appendix to the main agreement); 3. The amount of penalties in case the borrower violates its obligations. When concluding an interest-free loan agreement for a director, you need to include clear wording in the agreement that no interest is provided for the use of funds.

Otherwise, the borrower is at great risk - the lender has the right to demand payment of interest equal to the refinancing rate on the settlement day in the region. Interest-free loans are tax-free for both the borrower and the lender. But funds transferred at interest are a completely different topic.

According to Art. 249 of the Tax Code of the Russian Federation, interest falls under non-operating income, accordingly, the lender will have to pay income tax. Art. 810 of the Civil Code of the Russian Federation clearly states that the deadline for the return of funds may not be established.

Drawing up a loan agreement between the company and its director

Attention

The first takes ownership of the funds, the second, accordingly, transfers them.

There are no restrictions on the legal status of the parties; in fact, legal entities can enter into a loan agreement with other organizations or with individuals (IP).

There is no information in the law regarding the relationship between the borrower and the lender; a loan agreement by the director (founder) is an absolutely normal practice.

An enterprise can receive money as a loan from the creator, including without paying interest.

Form of a loan agreement with a director Considering that we are talking about an agreement between a legal entity and the director or founder of an organization, only a written form of the agreement is acceptable. This parameter is not affected by either the transaction period or the amount (Art.

808 of the Civil Code of the Russian Federation). Terms of the interest-bearing loan agreement with the director The parties, regardless of status, should supplement the agreement with a number of conditions. Among them: 1.

Source: //accountingsys.ru/zajm-direktoru-ooo/

Is it possible to recognize the receipt of an interest-free loan from the director as a material benefit to the organization?

In accordance with paragraph 5 of Article 38 of the Code, a service for tax purposes is an activity whose results do not have material expression and are sold and consumed in the process of carrying out this activity. Relationships under a loan agreement do not have such signs. In accordance with paragraph 10 of Art. 251 of the Tax Code of the Russian Federation, income not taken into account when determining the tax base includes income in the form of funds or other property received under credit or loan agreements (other similar funds or other property, regardless of the form of registration of borrowings, including securities under debt obligations), and also funds or other property received to repay such borrowings. According to the provisions of Art. 41 of the Tax Code of the Russian Federation, income is recognized as an economic benefit in monetary or in-kind form, taken into account if it is possible to assess it and to the extent that such benefit can be assessed, and determined in accordance with the chapters “Income Tax on Individuals”, “Income Tax on Organizations”. » Code.

Interest-free loan from the director

Are there any exceptions for Gena?

Another priority area will be the development of cooperation with government agencies and infrastructure support organizations at both the federal and regional levels.

Denis Sizov’s professional experience includes more than 10 years of work in the banking sector, mainly in the small business lending segment. From 2009 to 2014 held senior positions in the largest banks - Rosselkhozbank and TransCreditBank.

shall entail the imposition of an administrative fine on officials in the amount of four thousand to five thousand rubles; for legal entities - from forty thousand to fifty thousand rubles.

“Legal entities and individual entrepreneurs do not have the right to spend cash received in their cash registers for goods sold by them, work performed by them, services provided by them, as well as as insurance. Of course, you would like to use the money without additional costs, but not all with interest It’s so simple: a loan that is too profitable will oblige you to pay personal income tax on material benefits.

Accounting press and publications 2008

7 PBU 9/99 “Income of the organization”, approved by Order of the Ministry of Finance of Russia dated May 6, 1999 N 32n, interest on the loan provided is taken into account as part of operating income.

For profit tax purposes, the value of property transferred under a loan agreement and received to repay such borrowing is not taken into account when determining income and expenses (clause 10, clause 1, art.

251, paragraph 12 of Art. 270 of the Tax Code of the Russian Federation).

The amount of interest for the loan provided is taken into account as part of non-operating income at the end of the corresponding reporting period (clause 6 of Article 250, clause 6 of Article 271 of the Tax Code of the Russian Federation). — 11.5%)

Loan agreement between the director and the LLC: loan agreement with the director

The first takes ownership of the funds, the second, accordingly, transfers them.

Please note that based on paragraphs. 1 item 2 art. 212 of the Tax Code of the Russian Federation, when calculating the amount of income in the form of material benefits, the refinancing rate in effect on the date of receipt of borrowed funds is applied (from June 26, 2006).

There are no restrictions on the legal status of the parties; in fact, legal entities can enter into a loan agreement with other organizations or with individuals (IP).

There is no information in the law regarding the relationship between the borrower and the lender; a loan agreement by the director (founder) is an absolutely normal practice. An enterprise can receive money as a loan from the creator, including without paying interest.

Considering that we are talking about an agreement between a legal entity and the director or founder of an organization, only a written form of agreement is acceptable. This parameter is not affected by either the transaction period or the amount (Article 808 of the Civil Code of the Russian Federation). The parties, regardless of status, should supplement the agreement with a number of conditions.

How to borrow from your organization

You will either have to pay personal income tax to the state - 2.45% per annum, or 7% to your LLC. Often, it is more profitable to choose in favor of your company and take out a loan at 7% per annum. Tell me, did the conditions remain the same for February 2021?

Or has the law changed? INTEREST-FREE LOAN AGREEMENT how is it taken into account in an LLC, individual entrepreneur - on the usn, fl?

Individual entrepreneur /usn dr/, who is also one of the founders of the LLC, took out an interest-free loan from his LLC for 2 years.

How should these amounts be reflected in the book of income and expenses of an individual entrepreneur? How will the amounts be reflected in the LLC?

Is it necessary for an LLC to pay personal income tax for the founder/founder/??

Is issuing a loan an expense? Is getting a loan an income? The founder's share does not matter.

For an interest-free loan, the material benefit must be calculated.

1) is the organization withholding before payment; is the tax reduced in this case, since the amount of the salary payment is partially reduced?

2) is it returned from a full salary on which all full taxes have been paid? That is, the employee took out a loan from his organization, but refused to pay the debt and quit, did I understand you correctly?

If this is the case, then you can collect the debt of the dismissed employee in court.

Interest-free loan from a non-founder director

In the Accounting, Audit, Taxes section on the question Can a gene.

the director of an LLC, not being the founder, to give an interest-free loan to this company, asked by the author Oleg Borisovich, the best answer is of course he can, and not only the director who is not the founder, but also any individual. The loan can be interest-free; this is not prohibited by law (Art.

809 of the Civil Code of the Russian Federation). Ch. is devoted to borrowing relations. 42 of the Civil Code of the Russian Federation. It states that, unless otherwise provided by law or the loan agreement, the lender has the right to receive interest from the borrower.

Source: //iiotconf.ru/besprotsentnyj-zajm-ot-direktora/

The sole founder contributed an interest-free loan to the LLC, where he himself is a director

The object of taxation for income tax for Russian organizations that are not members of a consolidated group of taxpayers is profit, defined as the difference between the income received and the amount of expenses incurred by them, which are determined in accordance with Chapter 25 of the Tax Code of the Russian Federation (Article 247 of the Tax Code of the Russian Federation). When forming taxable profit, income from the sale of goods (work, services), property rights and non-operating income is taken into account (clause 1 of Article 274, clause 1 of Article 248 of the Tax Code of the Russian Federation). In this case, funds received under credit or loan agreements are not taken into account by the organization when forming the tax base for income tax by virtue of paragraphs. 10 p. 1 art. 251 of the Tax Code of the Russian Federation, regardless of whether the individual lender is its participant (founder) or not. Funds or other property aimed at repaying borrowings are not taken into account in expenses for profit tax purposes (clause 12 of Article 270 of the Tax Code of the Russian Federation). Therefore, funds received from the lender and returned to him under the loan agreement are not indicated in the income tax return. The provisions of Chapter 25 of the Tax Code of the Russian Federation do not oblige taxpayers to recognize income in the form of material benefits received as a result of the gratuitous use of borrowed funds, nor do they establish a procedure for assessing income in such cases (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated August 3, 2021 N 3009/04). Thus, we believe that the organization in the situation under consideration does not have an obligation to recognize income in tax accounting due to the gratuitous use of borrowed funds. This conclusion is confirmed by the explanations of specialists from the Russian Ministry of Finance and tax authorities (see, for example, letters from the Russian Ministry of Finance dated 02/09/2021 N 03-03-06/1/5149, dated 05/11/2021 N 03-03-06/1/239, dated 18.04 .2021 N 03-03-10/38, Federal Tax Service of Russia dated 01/13/2021 N 02-1-08/5, Federal Tax Service of Russia for Moscow dated 12/21/2021 N 16-15/ [email protected] , dated 12/22/2021 N 16-15/ [email protected] ).

Interesting read: Subsidy for Housing and Utilities Payments in St. Petersburg

Rationale for the conclusion: In accordance with Art. 807 of the Civil Code of the Russian Federation, under a loan agreement, one party (the lender) transfers into the ownership of the other party (borrower) money or other things determined by generic characteristics, and the borrower undertakes to return to the lender the same amount of money (loan amount) or an equal number of other things received by him of the same kind and quality. As can be seen from this norm, the Civil Code of the Russian Federation does not limit the circle of persons who can transfer funds as a loan - the transfer of funds under a loan agreement can be carried out by any legal entities, as well as individuals. A loan agreement will be interest-free only if this is expressly stated in the text of the agreement (clause 3 of Article 809 of the Civil Code of the Russian Federation).

Interest-free loan from a non-founder director

A loan agreement from the founder has a number of advantages compared to a bank loan. Find out how to correctly draw up a document and how to calculate taxes correctly in the material.

Often, the head of a company, especially a newly created one, is not able to obtain a bank loan for business projects. Very often the director and founder of such a company are the same person, and this person contributes his own funds to the company.

The algorithm for processing loans and credits is regulated by Chapter 42 of the Civil Code of the Russian Federation, according to which a loan is the provision by the lender of funds or things to the borrower for a certain period, after which the borrower undertakes to return the received amount of money or things (comparable in characteristics to those transferred as a loan). If the loan repayment period is not specified in the agreement, the borrower must repay the debt within 30 days from the date of receipt of the corresponding request from the lender. Loan agreements from the founder are concluded in writing and begin to be valid from the day of transfer of funds or property from the lender to the borrower.

The fact of transfer of money (a certain number of things) is confirmed by a receipt, acceptance certificate or other similar document.

According to Art. 809 of the Civil Code of the Russian Federation, the lender has the right to receive interest from the borrower for using the loan in the amount specified in the agreement. If the document does not contain a clause on the amount of interest, then the interest rate is set at the refinancing rate on the date of payment of the debt.

The founder has the right to issue funds without charging interest. Such a condition must be fixed in the contract, otherwise the loan will be considered interest-bearing by default. The lender may provide funds for specific purposes.

This condition must also be fixed in the loan agreement from the founder. In this case, the borrower is obliged to provide the lender with the opportunity to control the expenditure of funds.

If the condition is not fulfilled, the founder has the right to demand early repayment of the debt.

Read about the loan accounting procedure in the article.

The agreement is concluded between the individual founder and the company represented by the director.

ATTENTION! If the director and founder are one person, then he must sign the agreement twice: for the lender and for the borrower. The document must include the following information:

- date and place of conclusion of the loan agreement from the founder;

- general provisions indicating the parties to the agreement;

- subject of the agreement - fixes the loan amount or the amount of property and the terms for the payment of interest.

IMPORTANT! If the loan is provided by the founder in foreign currency, then the transaction is subject to exchange control.

- Conditions and terms of refund;

- Responsibility of the parties;

- Details and signatures of the parties to the transaction.

The loan agreement from the founder, as a rule, includes a schedule for the payment of interest and principal.

A sample gratuitous loan agreement from the founder can be downloaded here. Income received under a loan agreement from the founder is not subject to income tax. In Art. 251 of the Tax Code of the Russian Federation provides an exhaustive list of non-taxable income of the company, which includes loans or credits.

However, if the founder forgives the debt in accordance with Article 415 of the Civil Code of the Russian Federation, then the company will have non-operating income, which is subject to income tax.

The exception is gratuitous receipts from the founder, whose share exceeds 50% in the authorized capital of the company (subclause 11, clause 1, art.

251 of the Tax Code of the Russian Federation) Non-operating income, subject to profit taxation, is also written off overdue accounts payable under a loan agreement from the founder with an expired statute of limitations (clause 18 of Article 250 of the Tax Code of the Russian Federation).

Let us remind you that the statute of limitations is 3 years. Find out what income is classified as non-operating income.

Before paying interest to the founder under an interest-bearing loan agreement, the company is obliged to withhold and transfer income tax to the Federal Tax Service (clause 1 of Article 208 of the Tax Code of the Russian Federation). If no interest is charged, then the repaid debt is not subject to taxation.

Obtaining a loan from the founder is the fastest and most convenient way of urgent financial assistance for a company. This transaction must be formalized by a loan agreement from the founder, a sample of which can be downloaded on our website.

How to get a loan from the founder in 2021

A loan is provided for the purchase amount. Non-targeted funds are used to contribute to the authorized capital or current expenses. The loan is issued for a certain amount and can be spent in the interests of the company: loan costs. The relationship between the parties must be formalized, with the drawing up of an agreement.

The document describes the information: The amount of the loan that the founder issues, the period during which the debt must be repaid.

The date of the last payment must be indicated if the repayment is made in equal amounts. The interest rate, if it is indicated by the parties, or its absence (it is indicated that the loan is interest-free) The frequency of payments, the method of calculation, if the debt is planned to be repaid in the entire amount at once, then the repayment date is indicated.

The minimum authorized capital for registering an LLC is only 10,000 rubles. This amount is only enough to organize an intermediary business within the walls of your own apartment. What to do if you need money to develop your business, but you don’t want to increase the authorized capital? Let's take a closer look at an interest-free loan from the founder: the tax consequences of 2021.

How to get a loan

If the owner lends money to his company, then the participant and the limited liability company find themselves in a borrowing relationship. There are no restrictions on the size of the share in the authorized capital or the organizational and legal form of the founder (individual or legal entity). The transferred amount is also not limited by law.

The agreement must be drawn up in writing, as a separate document, preferably on company letterhead. If you do not formalize it in this way, but limit yourself only to documents confirming the receipt of money (payment order or cash receipt order), then there is a risk that the courts will refuse to recognize the borrowing relationship of the parties.

You can lend not only money, but also any valuables that must have generic characteristics. The borrower undertakes to return not the same thing, but a similar one, so the subject of the agreement may be building materials, goods, raw materials, etc. Of course, the owner of the organization most often lends money rather than anything else.

The owner of the company can direct the money for certain purposes, then the loan will be targeted. In this case, the agreement must contain not only a condition on the intended purpose, but also a procedure for monitoring the use of transferred funds. For example:

- transfer of documents confirming the intended use (supply agreements, invoices, receipts, payment orders, checks);

- notification of the date and place of delivery of purchased valuables;

- providing access to the place of storage of purchased property.

If the borrower does not fulfill the condition of the intended purpose, then the other party has the right to demand the return of money ahead of schedule or the application of additional sanctions provided for in the agreement.

By default, a loan agreement is considered compensated, i.e. involves the accrual of an interest rate, even if the terms and conditions do not say anything about this. In this case, interest is calculated at the refinancing rate on the day the debt is repaid. To ensure that this condition does not apply automatically, the provisions of the contract must explicitly state that interest is not charged for the use of funds.

Tax on interest that does not exist

Can the founder, if necessary, give an interest-free loan to his organization? Of course, it can, but the situation of refusing interest has its own peculiarities. For example, if a loan is issued to the founder of his company without receiving interest, does he have income?

Source: //rebuko.ru/besprotsentnyj-zajm-ot-direktora-ne-yavlyayushhegosya-uchreditelem/

Tax on interest that does not exist

Can the founder, if necessary, give an interest-free loan to his organization? Of course, it can, but the situation of refusing interest has its own peculiarities. For example, if a loan is issued to the founder of his company without receiving interest, does he have income?

From an everyday point of view, of course not, because the founder did not receive any financial benefit from this. But the Tax Code interprets this situation differently - I didn’t receive it because I didn’t want to, but I could have made money from it. Accordingly, he could have income, and where there is income, there is taxation. And it’s okay that this income is only estimated, the tax will be real (letter from the Ministry of Finance dated May 25, 2015 No. 03-01-18/29936).

Fortunately, such a specific point of view extends to a rather rare situation - if a transaction has been concluded between related parties that can be considered controlled.

Let's figure it out. According to Article 105.1 (2) of the Tax Code of the Russian Federation, interdependent persons are recognized as an individual and an organization if the share of participation of this person is more than 25%. That is, if your share in the company is more than 25%, then you are dependent on it and can act to the detriment of your personal interests.

Now we need to make sure that the transaction concluded between related parties is controlled in accordance with the provisions of Article 105.14 of the Tax Code of the Russian Federation. To do this, the amount of income from transactions concluded by such persons during the year must exceed 1 billion rubles. So, if the owner with a share of more than 25% lent his company a smaller amount, he can rest easy; he will not face additional tax on the income lost from interest.

But what about the organization that received an interest-free loan from the founder? Does she have income if she does not pay interest for using the money of the owner of the company? Here the Ministry of Finance answers as follows: there is a material benefit here, but since the procedure for determining the benefit from an organization receiving an interest-free loan is not established by Chapter 25 of the Tax Code of the Russian Federation, the tax base does not increase (letter of the Ministry of Finance dated 02/09/2015 No. 03-03-06/1/5149 ).

It is interesting that in the opposite situation, when a loan is issued to the founder from an LLC, the individual receives a material benefit in the form of interest that is not charged, and it is subject to personal income tax. True, the tax amount is still significantly less than when receiving the most favorable loan from a bank. For example, if a participant borrowed 100,000 rubles from his company for three months, then the personal income tax on material benefits will be just over 600 rubles. At the bank, for such a loan, at the lowest annual rate, you would have to pay about 3,000 rubles.

Conventional and gratuitous loan agreement from the founder

A loan agreement from the founder has a number of advantages compared to a bank loan. Find out how to correctly draw up a document and how to calculate taxes correctly in the material.

Interest-bearing and interest-free loan from the founding director

How to draw up a loan agreement between the founder and LLC (sample)

Nuances of taxation of loans

Results

Interest-bearing and interest-free loan from the founding director

Often, the head of a company, especially a newly created one, is not able to obtain a bank loan for business projects. Very often the director and founder of such a company are the same person, and this person contributes his own funds to the company.

The algorithm for processing loans and credits is regulated by Chapter 42 of the Civil Code of the Russian Federation, according to which a loan is the provision by the lender of funds or things to the borrower for a certain period, after which the borrower undertakes to return the received amount of money or things (comparable in characteristics to those transferred as a loan).

If the loan repayment period is not specified in the agreement, the borrower must repay the debt within 30 days from the date of receipt of the corresponding request from the lender.

Loan agreements from the founder are concluded in writing and begin to be valid from the day of transfer of funds or property from the lender to the borrower. The fact of transfer of money (a certain number of things) is confirmed by a receipt, acceptance certificate or other similar document.

According to Art. 809 of the Civil Code of the Russian Federation, the lender has the right to receive interest from the borrower for using the loan in the amount specified in the agreement.

If the document does not contain a clause on the amount of interest, then the interest rate is set at the refinancing rate on the date of payment of the debt. The founder has the right to issue funds without charging interest.

Such a condition must be fixed in the contract, otherwise the loan will be considered interest-bearing by default.

The lender may provide funds for specific purposes. This condition must also be fixed in the loan agreement from the founder. In this case, the borrower is obliged to provide the lender with the opportunity to control the expenditure of funds. If the condition is not fulfilled, the founder has the right to demand early repayment of the debt.

Read about the loan accounting procedure in the article “Accounting for loans and borrowings in accounting.”

How to draw up a loan agreement between the founder and LLC (sample)

The agreement is concluded between the individual founder and the company represented by the director.

ATTENTION! If the director and founder are one person, then he must sign the agreement twice: for the lender and for the borrower.

The document must include the following information:

- date and place of conclusion of the loan agreement from the founder;

- general provisions indicating the parties to the agreement;

- subject of the agreement - fixes the loan amount or the amount of property and the terms for the payment of interest.

IMPORTANT! If the loan is provided by the founder in foreign currency, then the transaction is subject to exchange control.

- Conditions and terms of refund;

- Responsibility of the parties;

- Details and signatures of the parties to the transaction.

The loan agreement from the founder, as a rule, includes a schedule for the payment of interest and principal.

A sample gratuitous loan agreement from the founder can be downloaded here.

Nuances of taxation of loans

Income received under a loan agreement from the founder is not subject to income tax. In Art. 251 of the Tax Code of the Russian Federation provides an exhaustive list of non-taxable income of the company, which includes loans or credits.

However, if the founder forgives the debt in accordance with Article 415 of the Civil Code of the Russian Federation, then the company will have non-operating income, which is subject to income tax.

The exception is gratuitous receipts from the founder, whose share exceeds 50% in the authorized capital of the company (subclause 11, clause 1, article 251 of the Tax Code of the Russian Federation)

Non-operating income subject to profit taxation is also written off overdue accounts payable under a loan agreement from the founder with an expired statute of limitations (clause 18 of Article 250 of the Tax Code of the Russian Federation). Let us remind you that the statute of limitations is 3 years.

Find out what income is classified as non-operating income here.

Before paying interest to the founder under an interest-bearing loan agreement, the company is obliged to withhold and transfer income tax to the Federal Tax Service (clause 1 of Article 208 of the Tax Code of the Russian Federation). If no interest is charged, then the repaid debt is not subject to taxation.

Results

Obtaining a loan from the founder is the fastest and most convenient way of urgent financial assistance for a company. This transaction must be formalized by a loan agreement from the founder, a sample of which can be downloaded on our website.

Subscribe to our accounting channel Yandex.Zen

Subscribe

Source: //nalog-nalog.ru/dogovory/dogovory_obychnogo_i_bezvozmezdnogo_zajma_ot_uchreditelya/

Interest-free loan from the founder - tax consequences

From what base will the tax be calculated: from interest, the amount of which is provided for in the borrowing agreement, or from those that correspond to the real market level of such income? This question arises because the parties to the loan agreement may be mutually dependent. Let us recall that the interdependence between the founder and the legal entity in which he participates is directly related to the share of such participation (both direct and taking into account indirect contribution). For a dependence to arise, it is enough for the share to slightly exceed 25% (subclauses 1, 2, clause 2, article 105.1 of the Tax Code of the Russian Federation).

An interest-free loan from the founder - we will consider the 2021 tax consequences of this operation in our material - is a frequent event for legal entities. This is explained by the fact that such a loan allows you to get at your disposal the funds or property necessary for work without additional procedures and quite quickly.

Loan agreement from LLC to its director

According to the legislation of the Russian Federation, the general director has the right to enter into loan transactions with the LLC of which he is a representative. However, it must be taken into account that the agreement is concluded between a legal entity (limited liability company) and an individual (general director).

In this case, on the part of the LLC, the general director will act only as an authorized executive body. Otherwise, the loan agreement for the director is identical to the standard sample loan agreement and is drawn up in the same manner.

Features of a loan agreement for a director This is a document under which the lender (LLC) transfers funds or things defined by generic characteristics into the ownership of the borrower (general director), and he undertakes to repay the loan in the same amount or in the same quantity and quality.

As a rule, loans to employees involve a gratuitous transaction.

- Loan agreement between LLC and director

- Loan agreement between the general director and the LLC

- Interest-free loan agreement with the founder - download sample

- Loan agreement between the LLC and its general director

- The loan agreement between the general director and the LLC is interest-free

- Interest-free loan agreement between the general director and LLC

That is, the loan agreement with the director will most likely be interest-free. Loans of money are always non-refundable by default unless otherwise stated. Moreover, if the amount of interest is not indicated, it will be equal to the refinancing rate.

The oral form will be declared invalid, and its participants will not be able to refer to the testimony of witnesses in the event of litigation. Notarization is not necessary for the transaction in question.

The loan agreement between the general director and the LLC is interest-free

Civil Code of the Russian Federation: “A representative cannot make transactions on behalf of the represented person in relation to himself personally. He also cannot make transactions in relation to another person, whose representative he is at the same time” (Resolution of the Federal Antimonopoly Service of the West Siberian District dated January 15, 2004 No. F04/191-2632/A27-2003). The lender, the director of the LLC, was unable to return his money.

Source: //prav-senter.ru/dogovor-zajma-ooo-svoemu-direktoru/

Interest-free loan received (issued): transactions

All payments under the loan agreement with the founder are made using the account:

- 66 - if the loan was received for a period not exceeding 12 months;

- 67 - if a long-term loan agreement has been drawn up with a maturity period of more than 12 months.

When receiving (issuing) an interest-free loan from the founder, the entries reflecting the fact of registration of this loan in the organization’s accounting will be as follows:

1. When a company receives a loan: Dt 51 (10, 41 - an account is selected depending on the type of inventory transferred under the loan agreement) - Kt 66 (if the loan is short-term, no more than 12 months), Kt 67 (if the loan long-term).

2. When the company repays the loan: Dt 66 (67) - Kt 51 (or an alternative account).

Moreover, if the company received an interest-free loan from the founder, the transactions are noticeably different from those that characterize the scenario when the company is the lender and the founder is the borrower. In this case, the following account correspondences apply:

1. When issuing a loan: Dt 76 (if the loan was issued to the founder) - Kt 51 (and alternative accounts).

2. When repaying the loan: Dt 51 - Kt 76.

How can a borrower use the simplified tax system to record the receipt of an interest-free loan from the founder - a legal entity? Find out the answer to this question in ConsultantPlus. If you don't have access to the system, get a free trial online.

Let us now study the specifics of taxation of an interest-free loan from the founder.

Do you doubt the correctness of a particular transaction? On our forum you can consult on any issue! So, in this thread we discuss the nuances of providing an interest-free loan.

Loan agreement between the general director and the organization

Or, as an option, the organization itself will withhold personal income tax from the founder’s salary if he is its employee.

A sample loan agreement from an organization to the founder can be downloaded from the link: Sample loan agreement from an organization to the founder.

How to draw up an interest-free loan agreement from the founder of an organization: sample An interest-free loan agreement from the founder is drawn up in a classic way. It states:

- time and place of drawing up the contract;

- sides;

- loan amount;

- deadlines for its provision;

- non-interest clause;

- rights and obligations of the parties, other agreed terms;

- details, signatures, seals of the parties.

For the lender, the full name and passport details of the founder are indicated, and in the “Borrower” field - the full name of the LLC and the full name of the director as his representative. At the end of the contract, full full name is indicated.

How to get a loan to the founder from an LLC (nuances)

Often, when founders take out a loan from their company, they do not plan to repay it. The tax consequence of such a decision after the expiration of the three-year limitation period and the transfer of the debt to the category of bad debt will be the income of the founder in the amount of the loan, which is also subject to personal income tax at a rate of 13%. The accounting department will have to withhold tax from the income paid to the founder or report the occurrence of debt to the tax service.

Interest received by an enterprise under a loan agreement from its founder, according to the requirements of tax legislation (Article 250 of the Tax Code of the Russian Federation), is considered non-operating income. In accordance with the requirements of Art. 271 of the Tax Code of the Russian Federation at the end of the reporting period they are subject to inclusion in taxable income, regardless of the procedure for their payment by the founder, as provided for in the agreement. They should be subject to income tax at a rate of 20% for companies using the general taxation system (GTS).

Results

The founder has the right to lend to his company without any restrictions, including under interest-free loan agreements. If he and the company are interdependent persons, then he will have to pay tax on the amount of lost interest calculated in accordance with Art. 105.7 Tax Code of the Russian Federation.

You can learn more about the specifics of corporate loans in the following articles:

- “Procedure for writing off a loan agreement (nuances)”;

- “Ordinary and gratuitous loan agreement from the founder”.

Sources:

- Tax Code of the Russian Federation

- Civil Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.