Many people want to become individual entrepreneurs. But those who are already one are advised to first sit down and get acquainted with all the mandatory payments and taxes. After this, it would be good to calculate whether there will be enough funds to cover them. After all, when there is a shortage of money, the tax office will not wait for free. All delays are subject to fines and penalties. One of the issues that should be paid attention to is KBK 18210202010060000160. What does it mean, what tax must be paid and when to do it.

KBK-2017: insurance premiums

From 01/01/2017, the administration of pension, medical and social insurance contributions was transferred to the tax authorities. In this regard, the administrator code, that is, the first three digits in the KBK, has changed: previously it designated extra-budgetary funds (392 or 393), now it means the Federal Tax Service (182).

Be careful, when paying insurance premiums in 2021, you need to take into account what period the payment is for: if the transfer of contributions is made for periods earlier than January 1, 2017 , then you need to use the same BCC, and when paying premiums for January 2021 and subsequent the months of KBK 2017 will be different.

New codes have been introduced for those who pay additional contributions to the Pension Fund according to lists 1 and 2: if the tariff depends on a special assessment of working conditions, one BCC is selected, if it does not depend, another.

In 2021, we continue to pay insurance premiums for injuries to the Social Insurance Fund, so the BCC for them remains the same.

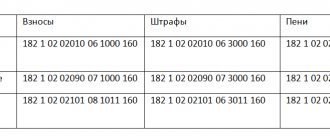

KBC for insurance premiums for 2021

| Code | Name of KBK |

KBC for payment of pension contributions in 2021 | |

| 182 1 0200 160 | Insurance contributions credited to the Pension Fund for the payment of insurance pensions for periods expired before January 1, 2021 |

| 182 1 0200 160 | penalties |

| 182 1 0200 160 | interest |

| 182 1 0200 160 | fines |

| 182 1 0210 160 | Insurance contributions credited to the Pension Fund for the payment of insurance pensions for periods starting from January 1, 2021 |

| 182 1 0210 160 | penalties |

| 182 1 0210 160 | interest |

| 182 1 0210 160 | fines |

| 182 1 0200 160 | Insurance contributions credited to the Pension Fund for the payment of funded pensions |

| 182 1 0200 160 | penalties |

| 182 1 0200 160 | interest |

| 182 1 0200 160 | fines |

| 182 1 0200 160 | Insurance contributions credited to the Pension Fund for the payment of insurance pensions (for billing periods from 2002 to 2009 inclusive) |

| 182 1 0200 160 | penalties |

| 182 1 0200 160 | interest |

| 182 1 0200 160 | fines |

| 182 1 0200 160 | Insurance contributions credited to the Pension Fund for the payment of funded pensions (for billing periods from 2002 to 2009 inclusive) |

| 182 1 0200 160 | penalties |

| 182 1 0200 160 | interest |

| 182 1 0200 160 | fines |

| 182 1 0200 160 | Contributions from organizations employing the labor of flight crew members of civil aviation aircraft, credited to the Pension Fund for the payment of additional payments to pensions |

| 182 1 0200 160 | penalties |

| 182 1 0200 160 | interest |

| 182 1 0200 160 | fines |

| 182 1 0200 160 | Insurance contributions for compulsory pension insurance in the amount determined based on the cost of the insurance year, credited to the Pension Fund for the payment of an insurance pension (for billing periods expired before January 1, 2013) |

| 182 1 0200 160 | penalties |

| 182 1 0200 160 | interest |

| 182 1 0200 160 | fines |

| 182 1 0200 160 | Insurance contributions for compulsory pension insurance in the amount determined based on the cost of the insurance year, credited to the Pension Fund for the payment of a funded pension (for billing periods expired before January 1, 2013) |

| 182 1 0200 160 | penalties |

| 182 1 0200 160 | interest |

| 182 1 0200 160 | fines |

| 182 1 0200 160 | Contributions paid by coal industry organizations to the Pension Fund budget for the payment of pension supplements |

| 182 1 0200 160 | penalties |

| 182 1 0200 160 | interest |

| 182 1 0200 160 | fines |

| 182 1 0210 160 | Insurance premiums at an additional rate for insured persons employed in the relevant types of work specified in clause 1, part 1, art. 30 of the Federal Law of December 28, 2013 No. 400-FZ “On Insurance Pensions”, credited to the Pension Fund budget for the payment of an insurance pension (not dependent on the results of a special assessment of working conditions (class of working conditions) (list 1) |

| 182 1 0220 160 | Insurance premiums at an additional rate for insured persons employed in the relevant types of work specified in clause 1, part 1, art. 30 of the Federal Law of December 28, 2013 No. 400-FZ “On Insurance Pensions”, credited to the PFR budget for the payment of an insurance pension (depending on the results of a special assessment of working conditions (class of working conditions) (list 1) |

| 182 1 0200 160 | penalties |

| 182 1 0200 160 | interest |

| 182 1 0200 160 | fines |

| 182 1 0210 160 | Insurance premiums at an additional rate for insured persons employed in the relevant types of work specified in paragraphs 2 - 18 of part 1 of Article 30 of the Federal Law of December 28, 2013 No. 400-FZ “On Insurance Pensions”, credited to the Pension Fund budget for the payment of insurance pensions (independent of the results of a special assessment of working conditions (class of working conditions) (list 2) |

| 182 1 0220 160 | Insurance premiums at an additional rate for insured persons employed in the relevant types of work specified in paragraphs 2 - 18 of part 1 of Article 30 of the Federal Law of December 28, 2013 No. 400-FZ “On Insurance Pensions”, credited to the Pension Fund budget for the payment of insurance pensions (depending on the results of a special assessment of working conditions (class of working conditions) (list 2) |

| 182 1 0200 160 | penalties |

| 182 1 0200 160 | interest |

| 182 1 0200 160 | fines |

KBC for payment of contributions for compulsory health insurance in 2017 | |

| 182 1 0211 160 | Insurance premiums for compulsory health insurance of the working population, credited to the FFOMS budget for periods expired before January 1, 2017 |

| 182 1 0211 160 | penalties |

| 182 1 0211 160 | fines |

| 182 1 0213 160 | Insurance premiums for compulsory health insurance of the working population, credited to the FFOMS budget for periods starting from January 1, 2017 |

| 182 1 0213 160 | penalties |

| 182 1 0213 160 | interest |

| 182 1 0213 160 | fines |

KBC for payment of social insurance contributions in 2021 | |

| 182 1 0200 160 | Insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity for periods expired before January 1, 2021 |

| 182 1 0200 160 | penalties |

| 182 1 0200 160 | interest |

| 182 1 0200 160 | fines |

| 182 1 0210 160 | Insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity for periods starting from January 1, 2021 |

| 182 1 0210 160 | penalties |

| 182 1 0210 160 | interest |

| 182 1 0210 160 | fines |

| 393 1 0200 160 | Insurance contributions for compulsory social insurance against accidents at work and occupational diseases (for “injuries”) |

| 393 1 0200 160 | penalties |

| 393 1 0200 160 | fines |

KBK IP fixed payment in 2021 to the Pension Fund and the Federal Compulsory Compulsory Medical Insurance Fund | |

| 182 1 0200 160 | Insurance contributions for compulsory pension insurance in a fixed amount, credited to the Pension Fund budget for the payment of an insurance pension (calculated from the amount of the payer’s income, not exceeding the income limit) for periods expired before January 1, 2021 |

| 182 1 0200 160 | Insurance contributions for compulsory pension insurance in a fixed amount, credited to the PFR budget for the payment of an insurance pension (calculated from the amount of the payer’s income received in excess of the income limit) for periods expired before January 1, 2021 |

| 182 1 0200 160 | penalties |

| 182 1 0200 160 | interest |

| 182 1 0200 160 | fines |

| 182 1 0210 160 | Insurance contributions for compulsory pension insurance in a fixed amount, credited to the Pension Fund budget for the payment of insurance pensions, for periods starting from January 1, 2017 |

| 182 1 0210 160 | penalties |

| 182 1 0210 160 | interest |

| 182 1 0210 160 | fines |

| 182 1 0200 160 | Insurance contributions for compulsory pension insurance in a fixed amount, credited to the Pension Fund budget for the payment of a funded pension |

| 182 1 0200 160 | penalties |

| 182 1 0200 160 | interest |

| 182 1 0200 160 | fines |

| 182 1 0900 160 | Insurance contributions in the form of a fixed payment credited to the Pension Fund budget for the payment of an insurance pension (for billing periods expired before January 1, 2010) |

| 182 1 0900 160 | penalties and interest |

| 182 1 0900 160 | Insurance contributions in the form of a fixed payment credited to the Pension Fund budget for the payment of a funded pension (for billing periods expired before January 1, 2010) |

| 182 1 0900 160 | penalties and interest |

| 182 1 0211 160 | Insurance premiums for compulsory medical insurance of the working population in a fixed amount, credited to the FFOMS budget for periods expired before January 1, 2021 |

| 182 1 0211 160 | penalties |

| 182 1 0211 160 | fines |

| 182 1 0213 160 | Insurance premiums for compulsory health insurance of the working population in a fixed amount, credited to the FFOMS budget for periods starting from January 1, 2021 |

| 182 1 0213 160 | penalties |

| 182 1 0213 160 | fines |

When to pay

Despite the fact that budget transfers for social insurance from 2021 are transferred to different authorities (to the Federal Tax Service and the Social Insurance Fund), the payment deadline is the same for each SV. Policyholders are required to transfer all necessary payments to the relevant authorities before the 15th day of the month following the reporting month (clause 3 of Article 431 of the Tax Code of the Russian Federation, clause 4 of Article 22 125-FZ).

Read more: payment deadlines for all social insurance payments

Here is a list of the main insurance premiums that must be paid for employees, and the KBK table for insurance premiums for 2021 contains all the data that specialists will need when paying insurance premiums.

KBK NDFL 2021

The list of BCCs for paying income tax has been supplemented with codes for personal income tax when the controlling person receives income from the profits of a controlled foreign company.

KBK NDFL 2021 for individuals

| Code | Name of KBK |

| 182 1 0100 110 | Personal income tax on income the source of which is a tax agent, with the exception of income in respect of which tax is calculated and paid in accordance with Articles 227, 227.1 and 228 of the Tax Code of the Russian Federation |

| 182 1 0100 110 | penalties |

| 182 1 0100 110 | fines |

| 182 1 0100 110 | Personal income tax on income received by citizens registered as individual entrepreneurs, private notaries, and other persons engaged in private practice in accordance with Art. 227 Tax Code of the Russian Federation |

| 182 1 0100 110 | penalties |

| 182 1 0100 110 | fines |

| 182 1 0100 110 | Personal income tax on income received by citizens in accordance with Art. 228 Tax Code of the Russian Federation |

| 182 1 0100 110 | penalties |

| 182 1 0100 110 | fines |

| 182 1 0100 110 | Personal income tax in the form of fixed advance payments on income received by non-residents employed by citizens on the basis of a patent in accordance with Art. 227.1 Tax Code of the Russian Federation |

| 182 1 0100 110 | penalties |

| 182 1 0100 110 | fines |

| 182 1 0100 110 | Personal income tax on profits of a controlled foreign company received by individuals recognized as controlling persons of this company |

| 182 1 0100 110 | penalties |

| 182 1 0100 110 | fines |

Who pays

Insurance refers to payments to the budget system of the Russian Federation, which are transferred by employers who attract workers under labor and civil law contracts. They are transferred to the budget for the purpose of further redistribution to the needs of citizens upon the occurrence of certain insured events: temporary disability, pregnancy and parental leave, retirement, etc.

Specialists must transfer payments for compulsory pension and health insurance, maternity and temporary disability to the territorial tax office. Payments for accidents and occupational diseases (injuries) are sent to the regional Social Insurance Fund.

The insured is any legal entity or individual who uses hired labor in their activities. Insurance payers include the following categories of policyholders:

- legal entities - commercial and non-profit organizations, budgetary institutions;

- individual entrepreneurs who pay remuneration to employees;

- individual entrepreneurs working for themselves;

- individuals who hire workers to meet their household needs.

IMPORTANT!

At the end of the reporting period, SV payers must provide information about accruals and payments made to regulatory authorities. Learn more about current reporting information.

Changes to the BCC for the simplified tax system in 2021

For simplifiers who use the “income-expenditure” object of taxation, when paying tax for periods starting from 01/01/2017, a single code applies both for the main tax calculated under the simplified tax system “income minus expenses”, and for the minimum tax under the simplified tax system .

Let us explain in more detail: the KBK simplified tax system “income minus expenses” in 2021 (182 1 0500 110) was used separately from the KBK for the minimum tax under “simplified” (182 1 0500 110). Now both of these taxes should be transferred to one common KBK - 182 1 0500 110. The combination of codes occurred at the request of the Federal Tax Service to simplify offsets for the simplified tax system (letter of the Ministry of Finance of the Russian Federation dated August 19, 2016 No. 06-04-11/01/49770).

BCC when applying the simplified tax system for 2021

| Code | Name of KBK |

KBK simplified tax system "income" 2017 | |

| 182 1 0500 110 | Tax levied on taxpayers who have chosen income as the object of taxation (6%) |

| 182 1 0500 110 | penalties |

| 182 1 0500 110 | fines |

| 182 1 0500 110 | Tax levied on taxpayers who have chosen income as the object of taxation (6%) (for tax periods expiring before January 1, 2011) |

| 182 1 0500 110 | penalties |

| 182 1 0500 110 | fines |

KBK simplified tax system “income minus expenses” | |

| 182 1 0500 110 | A tax levied on taxpayers who have chosen as an object of taxation income reduced by the amount of expenses (15%) ( including the minimum tax credited to the budgets of constituent entities of the Russian Federation) |

| 182 1 0500 110 | penalties |

| 182 1 0500 110 | fines |

| 182 1 0500 110 | Tax levied on taxpayers who have chosen as an object of taxation income reduced by the amount of expenses (15%) (for tax periods expiring before January 1, 2011) |

| 182 1 0500 110 | penalties |

| 182 1 0500 110 | fines |

| 182 1 0500 110 | Minimum tax under the simplified tax system, credited to the budgets of the constituent entities of the Russian Federation ( for tax periods expired before January 1, 2016 ) |

| 182 1 0500 110 | penalties |

| 182 1 0500 110 | fines |

| 182 1 0500 110 | Minimum tax under the simplified tax system, credited to the budgets of the constituent entities of the Russian Federation (paid (collected) for tax periods expired before January 1, 2011) |

| 182 1 0500 110 | penalties |

| 182 1 0500 110 | fines |

Income tax – KBK 2021

New BCCs have been added for transferring to the budget the income tax of controlled foreign companies, as well as penalties and fines on it. We have collected all the codes for paying income tax in the table.

KBK income tax in 2021

| Code | Name of KBK |

| 182 1 0100 110 | Corporate income tax (except for consolidated groups of taxpayers), credited to the federal budget |

| 182 1 0100 110 | penalties |

| 182 1 0100 110 | fines |

| 182 1 0100 110 | Corporate income tax (except for consolidated groups of taxpayers), credited to the budgets of constituent entities of the Russian Federation |

| 182 1 0100 110 | penalties |

| 182 1 0100 110 | fines |

| 182 1 0100 110 | Profit tax of organizations of consolidated groups of taxpayers, credited to the federal budget |

| 182 1 0100 110 | penalties |

| 182 1 0100 110 | fines |

| 182 1 0100 110 | Profit tax of organizations of consolidated groups of taxpayers, credited to the budgets of constituent entities of the Russian Federation |

| 182 1 0100 110 | penalties |

| 182 1 0100 110 | fines |

| 182 1 0100 110 | Corporate income tax when implementing production sharing agreements concluded before the entry into force of Federal Law No. 225-FZ of December 30, 1995 “On Production Sharing Agreements” and not providing for special tax rates for crediting the specified tax to the federal budget and budgets of constituent entities RF |

| 182 1 0100 110 | penalties |

| 182 1 0100 110 | fines |

| 182 1 0100 110 | Corporate income tax on the income of foreign organizations not related to activities in the Russian Federation through a permanent establishment, with the exception of income received in the form of dividends and interest on state and municipal securities |

| 182 1 0100 110 | penalties |

| 182 1 0100 110 | fines |

| 182 1 0100 110 | Corporate income tax on income received in the form of dividends from Russian organizations by Russian organizations |

| 182 1 0100 110 | penalties |

| 182 1 0100 110 | fines |

| 182 1 0100 110 | Corporate income tax on income received in the form of dividends from Russian organizations by foreign organizations |

| 182 1 0100 110 | penalties |

| 182 1 0100 110 | fines |

| 182 1 0100 110 | Corporate income tax on income received in the form of dividends from foreign organizations by Russian organizations |

| 182 1 0100 110 | penalties |

| 182 1 0100 110 | fines |

| 182 1 0100 110 | Corporate income tax on income received in the form of interest on state and municipal securities |

| 182 1 0100 110 | penalties |

| 182 1 0100 110 | fines |

| 182 1 0100 110 | Corporate income tax on income in the form of profits of controlled foreign companies |

| 182 1 0100 110 | penalties |

| 182 1 0100 110 | fines |

KBK for 2021: changes in excise taxes

In the new edition, excise taxes on heating oil, wine and some alcoholic products with and without the addition of ethyl alcohol were excluded from the BCC list for paying excise taxes. At the same time, the BCC for excise taxes on middle distillates has been added. The current BCCs for excise taxes are given in the table.

KBK excise taxes for 2021

| Code | Name of KBK |

| 182 1 0300 110 | Excise taxes on ethyl alcohol from food raw materials (with the exception of distillates of wine, grape, fruit, cognac, Calvados, whiskey), produced in the Russian Federation |

| 182 1 0300 110 | penalties |

| 182 1 0300 110 | fines |

| 182 1 0300 110 | Excise taxes on ethyl alcohol from non-food raw materials produced in the Russian Federation |

| 182 1 0300 110 | penalties |

| 182 1 0300 110 | fines |

| 182 1 0300 110 | Excise taxes on ethyl alcohol from food raw materials (wine, grape, fruit, cognac, calvados, whiskey distillates) produced in the Russian Federation |

| 182 1 0300 110 | penalties |

| 182 1 0300 110 | fines |

| 182 1 0300 110 | Excise taxes on alcohol-containing products produced in the Russian Federation |

| 182 1 0300 110 | penalties |

| 182 1 0300 110 | fines |

| 182 1 0300 110 | Excise taxes on beer produced in the Russian Federation |

| 182 1 0300 110 | penalties |

| 182 1 0300 110 | fines |

| 182 1 0300 110 | Excise taxes on tobacco products produced in the Russian Federation |

| 182 1 0300 110 | penalties |

| 182 1 0300 110 | fines |

| 182 1 0300 110 | Excise taxes on motor gasoline produced in the Russian Federation |

| 182 1 0300 110 | penalties |

| 182 1 0300 110 | fines |

| 182 1 0300 110 | Excise taxes on straight-run gasoline produced in the Russian Federation |

| 182 1 0300 110 | penalties |

| 182 1 0300 110 | fines |

| 182 1 0300 110 | Excise taxes on passenger cars and motorcycles produced in the Russian Federation |

| 182 1 0300 110 | penalties |

| 182 1 0300 110 | fines |

| 182 1 0300 110 | Excise taxes on diesel fuel produced in the Russian Federation |

| 182 1 0300 110 | penalties |

| 182 1 0300 110 | fines |

| 182 1 0300 110 | Excise taxes on motor oils for diesel and (or) carburetor (injection) engines produced in the Russian Federation |

| 182 1 0300 110 | penalties |

| 182 1 0300 110 | Fines |

| 182 1 0400 110 | Excise taxes on middle distillates imported into the Russian Federation |

| 182 1 0400 110 | penalties |

| 182 1 0400 110 | fines |

Unchanged KBK-2017 codes with decoding

Below we present the BCC for other taxes that should be indicated in payment orders in 2021.

Budget classification expense codes for 2017

| Code | Name of KBK |

KBK UTII 2017 | |

| 182 1 0500 110 | Single tax on imputed income for certain types of activities |

| 182 1 0500 110 | penalties |

| 182 1 0500 110 | fines |

| 182 1 0500 110 | Single tax on imputed income for certain types of activities (for tax periods expired before January 1, 2011) |

| 182 1 0500 110 | penalties |

| 182 1 0500 110 | fines |

KBK Unified Agricultural Sciences 2017 | |

| 182 1 0500 110 | Unified agricultural tax |

| 182 1 0500 110 | Penalty |

| 182 1 0500 110 | fines |

| 182 1 0500 110 | Unified agricultural tax (for tax periods expired before January 1, 2011) |

| 182 1 0500 110 | penalties |

| 182 1 0500 110 | fines |

KBK patent tax system 2017 | |

| 182 1 0500 110 | Tax levied in connection with the use of the patent system, credited to the budgets of urban districts |

| 182 1 0500 110 | penalties |

| 182 1 0500 110 | fines |

| 182 1 0500 110 | Tax levied in connection with the use of the patent system, credited to the budgets of municipal districts |

| 182 1 0500 110 | penalties |

| 182 1 0500 110 | fines |

| 182 1 0500 110 | Tax levied in connection with the use of the patent system, credited to the budgets of the federal cities of Moscow and St. Petersburg |

| 182 1 0500 110 | penalties |

| 182 1 0500 110 | fines |

KBK VAT 2021 for legal entities and individual entrepreneurs | |

| 182 1 0300 110 | Value added tax on goods (work, services) sold on the territory of the Russian Federation |

| 182 1 0300 110 | penalties |

| 182 1 0300 110 | fines |

| 182 1 0400 110 | Value added tax on goods imported into Russia (from the Republics of Belarus and Kazakhstan) |

| 182 1 0400 110 | penalties |

| 182 1 0400 110 | fines |

KBK property 2021 for legal entities | |

| 182 1 0600 110 | Property tax of organizations on property not included in the Unified Gas Supply System |

| 182 1 0600 110 | penalties |

| 182 1 0600 110 | fines |

| 182 1 0600 110 | Property tax of organizations on property included in the Unified Gas Supply System |

| 182 1 0600 110 | penalties |

| 182 1 0600 110 | fines |

Transport tax KBK 2017 | |

| 182 1 0600 110 | Transport tax for organizations |

| 182 1 0600 110 | penalties |

| 182 1 0600 110 | fines |

KBK land tax for legal entities 2017 | |

| 182 1 0600 110 | Land tax from organizations owning a land plot located within the boundaries of intra-city municipalities of federal cities |

| 182 1 0600 110 | penalties |

| 182 1 0600 110 | fines |

| 182 1 0600 110 | Land tax on organizations owning a land plot located within the boundaries of urban districts |

| 182 1 0600 110 | penalties |

| 182 1 0600 110 | fines |

| 182 1 0600 110 | Land tax on organizations owning a land plot located within the boundaries of urban districts with intra-city division |

| 182 1 0600 110 | penalties |

| 182 1 0600 110 | fines |

| 182 1 0600 110 | Land tax on organizations owning a land plot located within the boundaries of intracity districts |

| 182 1 0600 110 | penalties |

| 182 1 0600 110 | fines |

| 182 1 0600 110 | Land tax on organizations owning a land plot located within the boundaries of inter-settlement territories |

| 182 1 0600 110 | penalties |

| 182 1 0600 110 | fines |

| 182 1 0600 110 | Land tax on organizations owning a land plot located within the boundaries of rural settlements |

| 182 1 0600 110 | penalties |

| 182 1 0600 110 | fines |

| 182 1 0600 110 | Land tax on organizations owning a land plot located within the boundaries of urban settlements |

| 182 1 0600 110 | penalties |

| 182 1 0600 110 | fines |

Main change

From 2021, the Federal Tax Service will control the calculation and payment of insurance contributions for compulsory pension, medical and social insurance (with the exception of contributions for injuries). Therefore, insurance premiums (except for contributions for injuries) will need to be paid to the Federal Tax Service, and not to the funds. Accordingly, the payment order for the payment of contributions in 2021 must be completed as follows:

- in the TIN and KPP field of the recipient of the funds - TIN and KPP of the tax inspectorate;

- in the “Recipient” field - the abbreviated name of the Federal Treasury body and in brackets - the abbreviated name of the Federal Tax Service;

- in the KBK field - budget classification code, consisting of 20 characters (digits). In this case, the first three characters indicating the code of the chief administrator of budget revenues should take the value “182” - Federal Tax Service.