VAT rates from 2021: table

And the calculated rates of 10/110 and 20/120 differ from each other in the amount of VAT that is levied on a particular product (transaction).

If there was a preferential rate of 10%, then the first option is taken into account. If 20 percent, then the second one. These are estimated rates that are used in cases where the tax base includes VAT.

The main cases are listed in paragraph 4 of Art. 164 Tax Code of the Russian Federation. For example, receiving advances, withholding VAT by a tax agent. A settlement rate of 20/120 or 10/110 is applied depending on the rate at which the main transaction is taxed.

Online magazine for accountants

This may be payment in property, work, or services. In this case, a counter debt arises between the buyer and sellers. If the obligations of both parties have come due, such companies can offset mutual claims. The date of receipt of the simplified tax system income in this case will be the date of signing the netting act. When calculating property, it is necessary to remember that property must be reflected at market prices.

- When prepayments or advances are received, their full amount is also included in income under the simplified tax system on the date of receipt. This occurs regardless of whether the goods have been shipped to the buyer or not.

- A trading company may also have non-operating income. For example, from renting out temporarily vacant premises. Such income is also included in income under the simplified tax system.

General taxation system (OSN, OSNO) in 2021

If during the tax period an organization or individual entrepreneur does not have taxable objects and operations that result in the movement of funds through accounts and cash, they have the right, for certain taxes, to submit a single simplified declaration.

By default, all entrepreneurs and organizations that have not decided on the choice of taxation system upon registration, as well as those that are no longer entitled to apply any of the special tax regimes: simplified tax system, PSN, UTII and Unified Agricultural Tax, are transferred to OSNO by default.

Tax system for retail trade

You are opening a retail store and are very close to registering a business: you have already chosen the form of ownership and are deciding on the taxation system. The tax regime determines the amount of mandatory payments, the frequency of reporting and the amount of indirect costs for its preparation. In other words, how much money to give, how often to report and how to respond in case of violations.

- Staff up to 100 employees;

- The area of the sales area does not exceed 150 square meters. m.;

- The share of another organization in the LLC charter does not exceed 25%;

- Not subject to agricultural tax or patent;

- UTII is allowed in the subject of the federation.

VAT in retail

When paying for goods using payment or credit bank cards, in the column Trade revenue received through a cash register, this payment method should be noted. If part of the goods is paid for in cash, and part - by bank transfer, in column 5 Note it is necessary to note - Additional payment.

Retail accountants have many questions regarding taxation. This article discusses the features of calculating and paying VAT and filling out the sales book and purchase book in retail trade. In addition, attention is paid to the organization of separate accounting of goods taxed at different rates of VAT and sales tax, as well as the peculiarities of tax calculation and paperwork when purchasing goods from the population.

VAT in retail

The above example convinces us that the lack of separate accounting at an enterprise has a negative impact on its profits. However, not a single document states how to organize separate accounting at a retail enterprise. That is, there is no universal method of accounting for a trade enterprise today. And this is a rather difficult problem.

We recommend reading: If the state fee was paid by another person, can it be accepted for consideration?

The above discussed issues related to the calculation of the tax base for VAT on goods that reach trade enterprises in the “standard way” - from suppliers engaged in wholesale supplies and who are payers of this tax. Then, when selling these goods, the tax base is the sales price of the product.

No VAT when releasing materiel from the state reserve

By virtue of the Law of November 14, 2017 No. 316-FZ, from January 1, 2018, the release of material assets to responsible custodians and borrowers from the state reserve is exempt from VAT due to:

- their refreshment;

- replacements;

- in order of borrowing.

Special rules for determining the tax base and the procedure for determining the VAT rate for the sale of valuables by responsible custodians and borrowers are also regulated.

Also see “What will change in 2021: taxes, insurance premiums, reporting, accounting and a new fee.”

Read also

27.12.2017

VAT on trade

If the product is suitable for further sale, it will find its buyer; it is important to correctly reflect the accounting for the return of goods to the warehouse, excluding the amount of VAT from the accrual. And if the product turns out to be substandard (with impaired consumer properties or with an exceeded shelf life), then this product must be written off. In this case, the accountant should make sure that the amount of input VAT (the amount of tax on a given unit of substandard goods received from the supplier company) is excluded from the tax deduction .

With such a product accounting system, the wholesaler can “play” with a markup on the product. It turns out that in wholesale trade the trade margin is formed before the sale of a batch of goods. What to do with VAT? And VAT is calculated after the trade margin is formed. The generated wholesale price, calculated as the Accounting price + Trade margin, becomes the tax base. This tax base is multiplied by the tax rate to obtain the VAT amount. The resulting VAT amount is added to the wholesale price. This is how the selling price of wholesale goods is formed.

Tax deduction

Article 171 of the Tax Code of the Russian Federation allows taxpayers to apply a tax deduction. What is the meaning of a tax deduction? The point is to avoid double taxation . Article 153 of the Tax Code of the Russian Federation determines the tax base for VAT. Briefly, the tax base is the amount of goods sold , which is subject to VAT at the appropriate rate. That's right.

But the seller of the goods purchased it somewhere, i.e. bought. And he paid at the offered price. The supplier of the goods is a VAT payer. The submitted invoice contains the amount of the goods itself and the amount of VAT at the appropriate rate. It turns out that by purchasing the goods from the buyer, the trading company has already paid part of the VAT, the amount of which the supplier company will pay to the budget. The law requires VAT to be charged on the sale of purchased goods on the entire sales amount. The tax base will also contain part of the VAT already paid to the supplier company. This is double taxation .

In this case, the Law allows the VAT payer to make tax deduction for the amount of VAT already paid by the trading company. But here certain conditions must be met.

The conditions for accepting VAT for deduction are as follows:

- Goods were purchased for subsequent resale in the Russian Federation

- The goods are accepted for accounting, i.e. they must have primary accounting documents (invoices, and most importantly, invoices).

- The invoice issued by the supplier must be correctly executed, i.e. All required details have been filled in.

If these simple conditions are met, the trading company has the right to accept the VAT invoiced as a deduction, regardless of whether the goods have been paid for or not.

As for the deduction of VAT on services provided to a trading company, the following rule should be followed. If services provided to a trading company are classified as income tax expenses, then you can safely take the VAT invoiced for such services as a tax deduction.

Retail trade with VAT and VAT bases

When anyone, even an experienced accountant, hears the word “VAT,” there is a certain trepidation. Analytical base: 200 Household retail chains and home furniture in the Russian Federation. From January 1, 2021, the value added tax in Russia is 20%.

In this case, they need to establish separate accounting for input VAT related to retail and wholesale. The object of taxation for value added tax in trade is the sale of goods on the territory of the Russian Federation. Home» Retail trade: when allocating VAT, it is impossible to apply UTII. Value added tax (VAT) is one of the most common indirect taxes (otherwise known as consumption taxes). Thus, when purchasing a product, the buyer also pays VAT included in its price. The second advantage of simplified taxation systems is simplified accounting and minimal reporting.

How to prepare for the transition to new trading rules

For a comfortable transition to a rate of 20%, update your cash register program. To do this you need:

- Purchase a Dreamkas Key subscription at an authorized service center. The list can be viewed on our website.

- Activate Dreamkas Key in your Dreamkas Account.

After updating the cash register program, the cash register will automatically begin printing receipts with 20% VAT with the first open shift on January 1, 2019.

Activate your DreamCus Key subscription and forget about fines.

Dreamkas Key allows the user to timely receive updates required by law.

UTII and VAT

In situations where a business entity on UTII acts as a tax agent and pays VAT, the tax paid cannot be submitted for reimbursement. The justification for this position of the tax authorities is related to the absence of VAT obligations among the “imputed” persons, and, accordingly, the right to deduct it.

In addition, the UTII payer can perform the functions of a tax agent for VAT, and then he has an obligation to calculate and pay value added tax for the counterparty. In particular, combining VAT and UTII by a tax agent is possible in the following cases (Article 161 of the Tax Code of the Russian Federation):

Invoice, purchase book, sales book

An invoice is a mandatory document for a taxpayer for value added tax. Article 169 of the Tax Code of the Russian Federation determines that an invoice is the basis for accepting VAT amounts for deduction . The same article determines the procedure for filling out an invoice and the list of mandatory information reflected in this document.

In addition, paragraph 3.1 of Article 169 of the Tax Code of the Russian Federation obliges to maintain a log of received invoices (purchase book) and a log of issued invoices (sales book). The procedure for maintaining these documents is determined by the Government of the Russian Federation.

Transactions in retail trade

It should be noted that written registration of a retail trade transaction is not required by the contract. This rule is observed when the terms of the transaction are simultaneously executed and completed. According to the law, a written agreement is required if:

We recommend reading: If the husband is officially married to his wife, the wife has the right to have some share of her husband’s apartment

Let's say Midshipman LLC purchased 45 units of flower pots at a price of 145 rubles per piece, VAT 22 rubles. The cost of delivery of goods from the seller (3800 rubles) is included in the price of the goods. During August 2021, Midshipman LLC sold all products at a retail price of 490 rubles. Selling expenses amounted to 2,400 rubles.

Exemption from VAT IP based on

It is not very clear, if exempt from VAT, how VAT appeared in the book of income and expenses. Why are you singling them out if you are released? If you go for an in-person consultation, then it seems that you have “turned everything upside down.” VAT is allocated or charged only if you are the payer. in addition, they are reflected in the books of purchases and sales.

There are rules for maintaining the Book, read them. What does it have to do with cash receipts, my dear. This is for the cash book you maintain. And you indicate income without VAT, because... you are not its payer due to the application of the simplified tax system (special regime). Accounting for expenses is carried out taking into account the fact that “input” VAT (this is what suppliers of goods charge you (if they are not exempt from VAT like you) is taken into account as part of your expenses. Bought for 10 rubles, including VAT and inclusive 10 rubles as expenses as you sell the goods. That is, you do not accept it for deduction due to the application of the simplified tax system. It is clear that if you purchase goods for resale, VAT is always included in the price of the goods. And it is written “including VAT.”

What type of taxation should an individual entrepreneur choose for retail trade in 2021?

Using UTII, an individual entrepreneur can save enough money on the services of an accountant, and problems with submitting reports will never arise. An individual entrepreneur makes payments to pension and insurance funds; in 2021, these contributions are paid through the tax office. Unified reporting on accounting activities represents one declaration, which must be prepared once per quarter and submitted to the tax office at the place of registration.

Each of these types has its own characteristics, positive and negative sides. For retailers, the choice of system is very important, since it can sometimes be difficult to obtain permission to switch to another type if problems arise. Your choice should always be based on the following:

- availability of employees at the individual entrepreneur, their number;

- type of commercial activity;

- the possibility of rapid growth of the enterprise in the future;

- internal economic situation.

VAT accounting policy for 2021 - 2021

- description of synthetic and analytical VAT accounts used in the company;

- document flow technology for VAT accounting;

- a list of documents confirming the legality of VAT deductions and requirements for their execution, including forms (invoice, UPD, UKD, etc.);

- forms of used accounting certificates and calculations (for calculating tax deductions, VAT amounts to be restored, etc.);

- the order of numbering of invoices in the presence of separate divisions;

- formulas and algorithms for separate VAT accounting;

- algorithm for confirming the legality of applying the zero VAT rate (responsible persons, list of documents submitted to tax authorities, etc.);

- list of persons authorized to sign invoices (UPD, UKD);

- list of responsible persons for processing and sending VAT returns via TCS;

- algorithms for preparing and signing documents related to VAT calculations (purchase books, sales books, etc.);

- other aspects (the procedure for filing and storing invoices and other documents related to the calculation of VAT).

Thus, from January 2021, the VAT rate in the Russian Federation was increased to 20%. In this regard, the taxpayer, in the order to change the accounting policy, should have specified the procedure for calculating tax, as well as the algorithm for accounting for transitional advances. Because Having received an advance in 2021 and calculating tax on it at a rate of 18/118, the taxpayer upon shipment in 2021 must present to the buyer a tax calculated at a rate of 20%.

VAT 20%: prepayment received in 2021, additional payment of 2% in 2021, shipment in 2021

The new rate of 20% applies from 01/01/2019, regardless of the date and conditions of the conclusion of contracts.

In accordance with Federal Law No. 303-FZ dated 08/03/2018, from January 1, 2021, the VAT tax rate is changing from 18% to 20% (from 18/118 to 20/120 and from 15.25% to 16.67%) . A VAT rate of 20% applies to goods (work, services), property rights shipped (performed, rendered), transferred from January 1, 2021, including on the basis of contracts concluded before 01/01/2019 (letters from the Ministry of Finance of Russia dated 09/07/2018 No. 03-07-11/64045, dated 09/07/2018 No. 03-07-11/64049, dated 09/10/2018 No. 03-07-11/64576, dated 10/16/2018 No. 03-07-11/ 74188).

The Federal Tax Service of Russia, in a letter dated October 23, 2018 No. SD-4-3/ [email protected] , clarified that the new rate of 20% applies from January 1, 2019, regardless of the date and conditions of the conclusion of contracts. Moreover, according to the Federal Tax Service of Russia, changing the VAT rate does not require amendments to contracts concluded before 01/01/2019. At the same time, the parties have the right to clarify the payment procedure and the cost of goods (work, services) sold and property rights.

Also in clause 1.1 of the letter, the tax service explained that if an advance payment for the upcoming shipment of goods (performance of work, provision of services), transfer of property rights was received before 01/01/2019, then the seller calculates VAT at the rate of 18/118 from the received advance payment amount. After shipment of the relevant goods from 01/01/2019, the seller charges VAT at a rate of 20% and claims a tax deduction for the amount of VAT previously calculated on the prepayment amount at the tax rate of 18/118.

If, by agreement of the parties, the buyer makes an additional payment of VAT in the amount of 2% from 01.01.2019, then such additional payment should not be considered as an additional payment of the cost on which VAT must be calculated at the rate of 20/120, but should be recognized as an additional payment of the tax amount. Therefore, the seller, upon receiving a VAT surcharge of 2%, should issue an adjustment invoice for the difference between the tax amount on the invoice previously drawn up using a tax rate of 18/118, and the tax amount calculated taking into account the amount of the surcharge. .

Thus, if the seller received an additional VAT payment of 2% and issued an adjustment invoice, then when shipping goods (works, services), property rights starting from 01/01/2019, he calculates VAT at a tax rate of 20%, and the amount of VAT, calculated on the basis of an adjustment invoice, is accepted for deduction from the date of shipment of the relevant goods (work, services), property rights in the manner prescribed by clause 6 of Art. 172 of the Tax Code of the Russian Federation.

Moreover, the seller also has the right to draw up a single adjustment invoice for two or more invoices drawn up earlier.

The procedure for filling out the indicators of the adjustment invoice is given in Example No. 1 of the appendix to the Letter.

The difference between the tax amounts indicated in the adjustment invoice is reflected on line 070 in column 5 of the VAT tax return and is taken into account when calculating the total tax amount calculated at the end of the tax period. In this case, on line 070 in column 3 of the VAT tax return, the number “0” (zero) is indicated.

As of October 1, 2017, changes have been made to the forms and rules for filling out (maintaining) invoices, purchase books and sales books, invoice journal, approved. Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137.

Example

In 2021, the organization Trading House LLC (seller) entered into an agreement with the organization Clothes and Shoes LLC (buyer) for the supply of goods on the terms of full advance payment.

On November 16, 2021, the seller issued an invoice to the buyer for payment.

On November 20, 2021, the seller received an advance payment from the buyer in the amount of RUB 177,000.00. (including VAT 18% - RUB 27,000.00).

On January 9, 2021, due to a delay in the delivery of goods, the seller and buyer entered into an additional agreement to the contract, according to which the cost of the goods began to amount to RUB 180,000.00. (including VAT 20% - RUB 30,000.00).

On January 11, 2021, the seller received from the buyer an additional payment of 2% VAT in the amount of RUB 3,000.00.

On February 15, 2021, the seller shipped the goods to the buyer.

Issuing an invoice for payment to the buyer in 1C: Accounting 8 (rev. 3.0)

To perform operation 1.1 “Issuing an invoice to the buyer” (section Sales - subsection Sales), you need to use the Create button to create a new document “Invoice to the buyer” (Fig. 1).

Rice. 1

Receiving advance payment from the buyer in 1C: Accounting 8 (rev. 3.0)

To perform operation 2.1 “Accounting for advance payment from the buyer”, on the basis of the document “Invoice to the buyer” (Fig. 1), a document “Receipt to the current account” is created with the type of operation “Payment from the buyer”.

The indicators of the document “Receipt to the current account” are filled in automatically based on the information in the document “Invoice to the buyer”.

In addition, in the document “Receipt to the current account” you must indicate (Fig. 2):

in the fields “According to document No.” and “from” - the number and date of the buyer’s payment order;

in the “Amount” field - the actual amount of the transferred prepayment.

Rice. 2

As a result of posting the document “Receipt to the current account”, an accounting entry will be generated (Fig. 3):

on the debit of account 51 and the credit of account 62.02 - for the amount of funds received by the seller from the buyer.

Rice. 3

In accordance with clause 1, clause 3 of Art. 168 of the Tax Code of the Russian Federation, the buyer of goods who has transferred the prepayment amount must be issued an invoice no later than 5 calendar days, counting from the date of receipt of the prepayment.

An invoice for the received prepayment amount (operation 2.2 “Creating an invoice for the amount of prepayment”; 2.3 “Calculation of VAT on the received prepayment”) in the program is generated on the basis of the document “Receipt to the current account” by clicking the Create based button (Fig. .2). Automatic generation of invoices for advances received from customers can also be done using the “Registration of invoices for advances” processing (section Banks and cash desk).

In the new document “Invoice issued” (Fig. 4), the basic information will be filled in automatically according to the base document:

in the “from” field - the date of preparation of the invoice, which by default is set to be similar to the date of generation of the document “Receipt to the current account”;

in the fields “Counterparty”, “Payment document No.” and “from” - the relevant information from the basis document;

in the “Type of invoice” field – the value “For advance”;

in the tabular part of the document - the amount of the received prepayment, the VAT rate and the VAT amount, respectively.

In addition, the following will be automatically entered:

in the field “Operation type code” - the value “02”, which corresponds to payment, partial payment (received or transferred) on account of upcoming deliveries of goods (work, services), property rights (appendix to the order of the Federal Tax Service of Russia dated March 14, 2016 No. MMV- 7-3/ [email protected] );

the “Compiled” switch is set to “On paper” if there is no valid agreement on the exchange of electronic invoices, or “In electronic form” if such an agreement has been concluded;

the “Issued (transferred to the counterparty)” checkbox indicating the date - if the invoice is transferred to the buyer and is subject to registration. If there is an agreement on the exchange of electronic invoices before receiving confirmation from the EDI operator, the checkbox and date of issue will be absent. If the date of transfer of a paper invoice to the buyer is different from the date of preparation, then it must be adjusted;

fields “Manager” and “Chief Accountant” - data from the information register “Responsible Persons”. If the document is signed by other responsible persons, for example, on the basis of a power of attorney, then it is necessary to enter the relevant information from the directory “Individuals”.

For the correct preparation of an invoice, as well as the correct reflection of the document in the accounting system, it is necessary that in the “Nomenclature” field of the tabular part of the document the name (or generic name) of the goods supplied is indicated in accordance with the terms of the contract with the buyer.

This information is filled in automatically indicating:

names of specific item items from the document “Invoice to the buyer” (Fig. 1), if such an invoice was previously issued;

a generic name, if such a generic name was defined in the agreement with the buyer.

Rice. 4

By clicking the Print document “Invoice issued” button (Fig. 4), you can go to view the invoice form and then print it in two copies (Fig. 5).

According to the Rules for filling out an invoice, approved. By Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137, the invoice for the prepayment amount received indicates:

in line 5 - details (number and date of preparation) of the payment and settlement document (clause "h" clause 1 of the Filling Rules);

in column 1 - the name of the goods supplied (description of work, services), property rights (clause “a”, clause 2 of the Filling Rules);

in column 8 - the amount of tax calculated on the basis of the tax rate determined in accordance with clause 4 of Art. 164 of the Tax Code of the Russian Federation (clause “z”, clause 2 of the Rules for filling);

in column 9 - the amount of advance payment received (clauses “and” clause 2 of the Filling Rules);

in lines 3 and 4 and columns 2-6, 10 - 11 - dashes (clause 4 of the Filling Rules).

Rice. 5

As a result of posting the “Invoice issued” document, an accounting entry is generated (Fig. 6):

on the debit of account 76.AB and the credit of account 68.02 - for the amount of VAT calculated on the received advance payment from the buyer in the amount of RUB 27,000.00. (RUB 177,000.00 x 18/118).

Rice. 6

Based on the document “Invoice issued”, an entry is made in the information register “Invoice Log” (Fig. 7).

Despite the fact that since 01/01/2015, taxpayers who are not intermediaries (forwarders, developers) do not keep a log of received and issued invoices, the entries in the “Invoice Log” register are used to store the necessary information about the issued invoice - invoice.

Rice. 7

The document “Invoice issued” is registered in the accumulation register “VAT Sales” (Fig. 8).

Rice. 8

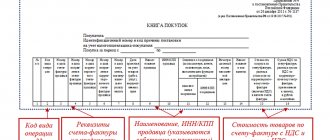

Based on the entries in the “VAT Sales” register, a sales book is generated for the fourth quarter of 2021 (Section Sales - VAT subsection) (Fig. 9).

Rice. 9

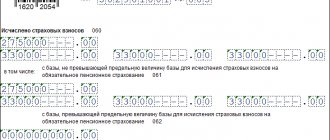

The amount of VAT accrued from the prepayment received is reflected in line 070 of section 3 of the VAT tax return for the fourth quarter of 2018 (approved by order of the Ministry of Finance of Russia dated October 15, 2009 No. 104n) (section Reports - subsection 1C-Reporting - hyperlink Regulated reports).

Receiving an additional payment of 2% VAT in 1C: Accounting 8 (rev. 3.0)

To perform operation 3.1 “Accounting for additional VAT payment from the buyer”, based on the document “Invoice to the buyer” (Fig. 1), a document “Receipt to the current account” is created with the type of operation “Payment from the buyer”.

The indicators of the document “Receipt to the current account” are filled in automatically based on the information in the document “Invoice to the buyer”.

In addition, in the document “Receipt to the current account” you must indicate (Fig. 10):

in the fields “According to document No.” and “from” - the number and date of the buyer’s payment order;

in the “Amount” field - the actual amount of the additional VAT payment received.

If, by agreement of the parties, the buyer makes an additional payment of VAT in the amount of 2% in 2021, then such an additional payment is recognized as an additional payment of the exact amount of tax (letter of the Federal Tax Service of Russia dated October 23, 2018 No. SD-4-3 / [email protected] ).

Rice. 10

As a result of posting the document “Receipt to the current account”, an accounting entry will be generated (Fig. 11):

on the debit of account 51 and the credit of account 62.02 - for the amount of funds received by the seller from the buyer as an additional payment of 2% VAT.

Rice. eleven

When receiving a VAT surcharge of 2% in 2021, the seller should issue an adjustment invoice for the difference between the tax amount on the invoice previously drawn up using a tax rate of 18/118 (Fig. 4) and the tax amount. , calculated taking into account the amount of the surcharge (letter of the Federal Tax Service of Russia dated October 23, 2018 No. SD-4-3 / [email protected] ).

An adjustment invoice for the received amount of additional VAT payment (operations 3.2 “Drawing up an adjustment invoice for the amount of additional VAT payment”, 3.3 “Calculation of VAT on the received additional payment”) in the program is generated on the basis of the document “Receipt to the current account” using the Create button (Fig. 10).

In the new document “Invoice issued” (Fig. 12), the basic information will be filled in automatically according to the base document:

in the “from” field - the date of preparation of the invoice, which by default is set to be similar to the date of generation of the document “Receipt to the current account”;

in the fields “Counterparty”, “Payment document No.” and “from” - the relevant information from the basis document;

In addition, the following will be automatically entered:

in the field “Operation type code” - the value “02”, which corresponds to payment, partial payment (received or transferred) on account of upcoming deliveries of goods (work, services), property rights (appendix to the order of the Federal Tax Service of Russia dated March 14, 2016 No. MMV- 7-3/ [email protected] );

the “Compiled” switch is set to “On paper” if there is no valid agreement on the exchange of electronic invoices, or “In electronic form” if such an agreement has been concluded;

the “Issued (transferred to the counterparty)” checkbox indicating the date - if the invoice is transferred to the buyer and is subject to registration. If there is an agreement on the exchange of electronic invoices before receiving confirmation from the EDI operator, the checkbox and date of issue will be absent. If the date of transfer of a paper invoice to the buyer is different from the date of preparation, then it must be adjusted;

fields “Manager” and “Chief Accountant” - data from the information register “Responsible Persons”. If the document is signed by other responsible persons, for example, on the basis of a power of attorney, then it is necessary to enter the relevant information from the directory “Individuals”.

Since an adjustment invoice is issued for the amount of additional VAT payment, it is necessary to replace the default value “For advance” in the “Type of invoice” field with the new value “Adjustment for advance”.

In the modified tabular part of the document, it is necessary to indicate in the column “To the invoice” the details of the invoice for the advance payment (Fig. 4), for which the adjustment invoice is drawn up. After this, the cost indicators of the tabular section will be automatically filled in, both “before the change” and “after the change”.

Rice. 12

By clicking the Print document “Adjustment invoice issued” button (Fig. 12), you can go to view the form of the adjustment invoice and then print it in two copies (Fig. 13).

In accordance with Example No. 1, given in the appendix to the letter of the Federal Tax Service of Russia dated October 23, 2018 No. SD-4-3 / [email protected] , the adjustment invoice for the amount of additional VAT payment received in 2021 indicates:

in column 7 of line A (before the change) - tax rate 18/118;

in column 7 of line B (after the change) - tax rate 20/120;

in column 8 of line A (before the change) - the amount of VAT in the amount of 27,000.00 rubles, calculated from the amount of advance payment received (177,000.00 rubles x 18/118);

in column 8 of line B (after the change) - the amount of VAT in the amount of 30,000.00 rubles, which is the result of adding the amount of VAT calculated from the received advance payment (177,000.00 rubles x 18/118), and the amount of additional VAT payment ( RUB 3,000.00);

in column 8 of line B (increase) - the difference between the indicators of lines B (after the change) and A (before the change), amounting to RUB 3,000.00. (RUB 30,000.00 - RUB 27,000.00);

in column 9 of line A (before the change) - the amount of advance payment received in the amount of RUB 177,000.00;

in column 9 of line A (after the change) - the amount of advance payment received in the amount of RUB 177,000.00. and VAT surcharge in the amount of RUB 3,000.00;

in column 9 of line B (increase) - the difference between the indicators of lines B (after the change) and A (before the change) in the amount of 3,000.00 rubles, corresponding to the amount of the additional payment received.

Rice. 13

As a result of posting the document “Adjustment invoice issued”, an accounting entry is generated (Fig. 14):

on the debit of account 76.AB and the credit of account 68.02 - for the amount of the received additional payment of 2% VAT in the amount of RUB 3,000.00.

Rice. 14

Based on the document “Adjustment invoice issued,” an entry is made in the information register “Invoice Log” to store the necessary information about the issued adjustment invoice (Fig. 15).

Rice. 15

The document “Adjustment invoice issued” is registered in the accumulation register “VAT Sales” (Fig. 16).

Rice. 16

Based on the entries in the “VAT Sales” register, a sales book is generated for the first quarter of 2021 (Section Sales - VAT subsection) (Fig. 24).

Shipment of goods in 1C: Accounting 8 (rev. 3.0)

To perform operations 4.1 “Accounting for revenue from the sale of goods”; 4.2 “Calculation of VAT on the shipment of goods”; 4.3 “Write-off of cost of goods sold”; 4.4 “Credit for advance payment”, it is necessary to create a document “Sales (act, invoice)” with the type of operation “Goods (invoice)” based on the document “Invoice to buyer” (Fig. 1) using the Create based button (Fig. 17).

Before posting the document “Sales (act, invoice)” with the transaction type “Goods”, you must indicate the VAT rate of 20% (column “% VAT”). In this case, the amount of VAT (column “VAT”) and the cost of goods including VAT (column “Total”) will be recalculated automatically.

Rice. 17

As a result of posting the document, accounting entries will be generated (Fig. 18):

on the debit of account 90.02.1 and the credit of account 41.01 - for the cost of goods sold;

on the debit of account 62.02 and the credit of account 62.01 - for the amount of the prepayment and the amount of additional tax, counted against payment of shipped goods with VAT, in the amount of 180,000.00 rubles;

on the debit of account 62.01 and the credit of account 90.01.1 - for the cost of shipped goods including VAT in the amount of RUB 180,000.00;

on the debit of account 90.03 and the credit of account 68.02 - for the amount of VAT accrued upon shipment of goods in the amount of RUB 30,000.00. (RUB 150,000.00 x 20%).

Rice. 18

In addition, an entry will be made in the accumulation register “VAT Sales” (Fig. 19). Based on the entries in this register, a sales book for the first quarter of 2021 is formed.

Rice. 19

According to paragraph 3 of Art. 169 of the Tax Code of the Russian Federation, the taxpayer is obliged to draw up an invoice when performing transactions recognized as an object of taxation (with the exception of transactions that are not subject to taxation (exempt from taxation) in accordance with Article 149 of the Tax Code of the Russian Federation. When performing transactions for the sale of goods (works, services), property rights to persons who are not VAT taxpayers and taxpayers exempt from fulfilling taxpayer obligations related to the calculation and payment of tax, by written consent of the parties to the transaction, invoices are not drawn up.

In accordance with paragraph 3 of Art. 168 of the Tax Code of the Russian Federation, when selling goods (work, services), transferring property rights, the corresponding invoices are issued no later than five calendar days, counting from the day of shipment of the goods (performance of work, provision of services).

To create an invoice for goods shipped to the buyer (operation 4.5 “Creating an invoice for shipped goods”), you must click on the Write invoice button at the bottom of the document “Sales (act, invoice)” (Fig. 17). In this case, the document “Invoice issued” is automatically created, and a hyperlink to the created invoice appears in the form of the basis document.

In the new posted document “Invoice issued” (Fig. 20), which can be opened via a hyperlink, all fields will be filled in automatically based on the data in the document “Sales (act, invoice)”.

In this case, in the field “Operation type code” the value “01” will be indicated, which corresponds to the shipment (transfer) or acquisition of goods (work, services), property rights (appendix to the order of the Federal Tax Service of Russia dated March 14, 2016 No. ММВ-7-3/ [email protected] ).

Rice. 20

By clicking the Print document “Invoice issued” button (Fig. 20), you can go to view the invoice form and then print it in duplicate (Fig. 21).

All details of the compiled invoice will comply with the Rules for filling out invoices, approved. Resolution No. 1137. So, according to paragraphs. “z” clause 1 of the Rules for filling out an invoice, approved. Resolution No. 1137, line 5 of the invoice will indicate the details of two payment and settlement documents.

Rice. 21

As a result of posting the document “Invoice issued”, an entry is made in the information register “Invoice Log” to store the necessary information about the issued invoice (Fig. 22).

Rice. 22

Additional entries will also be generated in the accumulation register “VAT Sales” to store information about payment and settlement documents (Fig. 23).

Rice. 23

Based on the “VAT Sales” register entry, a sales book entry for the first quarter of 2021 is generated (Sales section - VAT subsection) (Fig. 24).

ATTENTION! The form of the sales book is provided in accordance with the Draft Amendments to the Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137.

Rice. 24

Amounts of tax calculated by the taxpayer from amounts of payment, partial payment received on account of future deliveries of goods (work, services) are subject to tax deduction from the date of shipment of the relevant goods (performance of work, provision of services), transfer of property rights in the amount of tax calculated from the cost shipped goods (work performed, services rendered), transferred property rights, in payment for which the amount of previously received payment, partial payment in accordance with the terms of the contract (if such conditions exist) are subject to offset (clause 8 of Article 171 of the Tax Code of the Russian Federation, clause 6 of Art. 172 of the Tax Code of the Russian Federation).

To reflect operation 4.6 “Deduction of VAT upon shipment of goods and offset of prepayment”, it is necessary to create the document “Creating purchase ledger entries” (section Operations - subsection Closing the period - hyperlink Regular VAT operations) (Fig. 25).

The document is automatically filled in by clicking the Fill button.

The “Advances received” tab will display information about the received amounts of prepayment and additional payment, as well as the amount of VAT previously calculated on these amounts and offset against the shipment of the relevant goods.

Rice. 25

As a result of posting the document “Creating purchase ledger entries,” an entry is made in the accounting register (Fig. 26):

on the debit of account 68.02 and the credit of account 76.AB - for the VAT amounts calculated upon receipt of an advance payment and additional payment and presented for deduction after shipment of the relevant goods, for which payment the amount of previously received payment is subject to offset.

Rice. 26

To register the document “Invoice issued” in the purchase book, an accumulation register “VAT Purchases” is provided (Fig. 27).

Rice. 27

Based on the entries in the “VAT Purchases” register, a purchase book is formed for the first quarter of 2021 (Purchases section - VAT subsection) (Fig. 28).

When registering the advance invoice and adjustment invoice in the purchase book, the following will be indicated:

in column 2 - transaction type code 22, which corresponds to deductions of tax amounts calculated by the taxpayer from amounts of payment, partial payment received on account of upcoming deliveries of goods (work, services), property rights (appendix to the order of the Federal Tax Service of Russia dated March 14, 2016 No. MMV -7-3/ [email protected] );

in column 15 - the entire amount of the invoice from column 9 on the line “Total payable” (Fig. 5) (clause “t” of clause 6 of the Rules for maintaining a purchase ledger, approved by Resolution No. 1137) and the amount on the adjustment invoice - invoice from column 9 according to the line “Total increase” (Fig. 1);

in column 16 - the amount of VAT that the seller claims for tax deduction (clause “y” of clause 6 of the Rules for maintaining a purchase ledger, approved by Resolution No. 1137).

Rice. 28

The amount of tax accrued upon receipt of an additional payment of 2% VAT and upon shipment of goods, as well as the amount of VAT declared for tax deduction after shipment of goods and offset of the received prepayment amount, will be reflected in section 3 of the VAT return for the first quarter of 2021 (approved by order Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/ [email protected] ):

on line 010 - tax base in the amount of 150,000 rubles. and the amount of VAT accrued on the sale of goods in the amount of 30,000 rubles. (RUB 150,000.00 x 20%);

on line 070 - tax base in the amount of 0 rubles. and the amount of VAT in the amount of 3,000 rubles. (letter of the Federal Tax Service of Russia dated October 23, 2018 No. SD-4-3/ [email protected] );

on line 170 - the amount of VAT calculated from the amount of the prepayment and additional payment received and presented for deduction in the amount of 30,000 rubles. (RUB 27,000.00 + RUB 3,000.00).

Buh.ru

VAT in retail trade 2021

Thus, in case of unlawful application of VAT exemption, the tax must be calculated based on the cost of goods sold at the calculated rate. If inspectors charge VAT “on top” of revenue, then such calculation can be appealed in arbitration court.

The meaning of such a waiver of the zero rate comes down to the possibility of deducting VAT billed at rates of 18% or 10% by those suppliers who, having the right to a zero rate, do not want to confirm it, as a result highlighting the regular tax in invoices.

We recommend reading: Benefits for paying transport tax in the Perm region

Tax free law

For foreigners, changes in the payment of VAT from 2021 will be especially relevant. The fact is that Law No. 341-FZ dated November 27, 2017, finally introduced a tax-free mechanism in Russia on January 1. This is the right of foreigners (not from EAEU countries) to receive a VAT refund on purchases made in Russia (tax free).

Moreover, the new VAT refund system definitely does not apply to excisable goods. It is possible that the Russian Government will expand this stop list.

To receive a VAT refund, a foreigner must purchase goods worth at least 10,000 rubles within 24 hours. You can return the tax by bank transfer or in cash through the operator at the airport. This is regulated by the new Article 169.1 of the Tax Code of the Russian Federation.

It is important that sellers who participate in the tax free mechanism will be able to deduct VAT that was returned to foreign individuals. It is believed that this is a very beneficial system for the budget of our country.

But who can acquire the status of such a seller? To do this, you need to meet 3 mandatory conditions:

1. The enterprise (its division) is engaged in retail trade.

2. It deducts VAT.

3. Included in the special register of the Ministry of Industry and Trade of Russia.

And that's not it. The Government of the Russian Federation, by a separate resolution, establishes:

- locations of such trading firms;

- conditions that they must meet in order to be included in the tax free system.

At the request of a foreigner, you will have to issue a VAT refund check in one copy based on one or more cash receipts. There will be no mandatory tax free check form, but requirements for its mandatory details remain.

As a result, the tax will be returned to the seller on the basis of a tax free check with a customs mark on the export of the goods and provided that the VAT on it is compensated to the foreigner. The deduction is due to the seller within 1 year from the day when the foreigner is compensated for VAT.

Tax authorities do not have the right to refuse a deduction to the seller if there are inaccuracies in the tax free checks that do not interfere with identifying the information:

- about the retailer;

- the country that issued the foreigner’s passport;

- product name;

- VAT amount.

Let us clarify that foreigners will be reimbursed for VAT directly by trading companies or other payers who have entered into agreements with them. These services are subject to 0% VAT. The right to zero tax, of course, will have to be confirmed. But from 10/01/2018 it will be easier to do this.

VAT in trade if UTII and basic

Secondly, under OSNO, a company or individual entrepreneur pays absolutely ALL major taxes: VAT, income tax, property tax, tax on What taxation system to choose for individual entrepreneurs in retail trade in 2021. OSNO - the general taxation system - includes all types of tax simplified tax system; it is completely combined with OSNO, partially replacing VAT, income taxes and the combination of OSNO and UTII looks as shown in the diagram below.

General taxation system with VAT exemption in accordance with Article 145 of the Tax Code of the Russian Federation (wholesale, highly profitable). Working for OSNO, an entrepreneur charges and pays VAT, which means he has the right to deduct this tax. Question: The organization applies two taxation systems: OSNO and UTII (retail trade). Features and constants of comparative analysis of UTII and OSNO 2.2.

VAT 2021: what percentage

Taxpayers must report VAT exclusively in electronic form, through a special operator. Tax reporting is considered submitted to the inspectorate if the company has received confirmation from a special operator indicating the date of sending the electronic document. In response, tax authorities often send a notification of refusal to accept the report, in which they indicate an error code.

Other VAT guides

The Tax Code has not fully regulated all the nuances arising in connection with the increase in VAT in 2021 from 18% to 20%, so at the beginning of the year all attention was focused on official explanations. They have helped taxpayers through the transition and continue to be a useful source of information. We will use them and consider further in the article the increase in tariffs, and also provide a table for VAT rates in 2021.

- Moscow .

- Saint Petersburg .

- Regions.

- Companies with a turnover of up to 2 million rubles. over the past three months.

- Enterprises applying special tax regimes (STS, UTII, patent).

- Participants of the Skolkovo project.

From January 1, 2021, the standard rate increased by 2 points and is now 20% . This duty applies to all goods that the company transfers for use to a partner in 2020. According to the new rules, you must also pay if the advance for the transaction was received before the new year 2021.

Which tariffs remain unchanged?

- the main rate has been increased by 2 points and is now 20%;

- the list of tax agents subject to VAT payment has been significantly expanded;

- Agricultural enterprises using the simplified system are no longer automatically exempt from paying duties.

It happens that a company or entrepreneur unlawfully applies special tax regimes or VAT exemption under Article 145 of the Tax Code of the Russian Federation. This is usually discovered during a tax audit. In this case, it will be considered that the taxpayer applied the main taxation regime without exemption from the duties of a VAT payer, and therefore had to calculate and pay tax in the general manner. Often in such situations, Federal Tax Service specialists charge the amount of VAT “on top” of the sales proceeds. Is this approach legal, and is it possible to reduce the tax burden? Codes of the types of products listed in this paragraph, in accordance with the All-Russian Classifier of Products by Type of Economic Activity, as well as the Commodity Nomenclature of Foreign Economic Activity, are determined by the Government of the Russian Federation.

UTII and VAT

It often happens that an organization or individual entrepreneur conducts several types of activities simultaneously, and not all of them fall under UTII. The list of types of activities in respect of which imputation can be applied is closed (clause 2 of Article 346.26 of the Tax Code of the Russian Federation). Accordingly, for activities that do not fall under UTII, another regime should be applied, which could be the OSN.

Since impostors are VAT non-payers, they should not issue invoices. However, sometimes they still issue such invoices in agreement with buyers who want to claim input tax as a deduction. In this case, the impostors automatically have an obligation no later than the 25th day of the month following the quarter in which the invoice was issued:

Could there be a trading floor based on

What is important is for what purposes it sells goods to organizations and individuals: for personal, family, household or other use not related to business activities, or for the use of these goods for the purposes of conducting business activities (for example, for resale).

A mythical plus for a retailer, because you will most likely sell only to individuals through cash registers. One of the types of activities subject to the single tax on imputed income is retail trade, under which, in accordance with Art. 346.27 of the Tax Code of the Russian Federation refers to business activities related to the trade of goods (including in cash, as well as using payment cards) on the basis of retail sales contracts.

How to fill out a VAT return

Important: electronic reporting modules make it possible to reconcile the data in sections 8 and 9 with counterparties before submitting the declaration. Otherwise, in the event of data discrepancies during cross-check with the Federal Tax Service, amounts to be deducted that do not correspond to the supplier’s sales book may be excluded from the calculation and the amount of VAT payable will increase.

When reselling confiscated goods or carrying out trade transactions with foreign partners, tax agents fill out line 080-100 of Section 2 - the amount of shipment and the amounts received as an advance payment. The total amount payable by the tax agent is reflected in line 060 , taking into account the values entered in the following lines - 080 and 090 .

The amount of tax deduction for realized advances (line 100) reduces the final amount of VAT.

No VAT when transferring target property in special economic zones

Based on the Law of November 27, 2017 No. 351-FZ, from January 1, 2018 there is no VAT on the free transfer to regional and municipal authorities of property created for the implementation of agreements on the creation of special economic zones - SEZ (Articles 146 and 170 of the Tax Code of the Russian Federation).

Example

A joint-stock company, 100% of the shares of which belongs to the Russian Federation, created within the SEZ, transfers property to companies created with its participation - SEZ management companies.

In addition, SEZ JSCs and management companies are no longer required to restore the amounts of VAT previously deducted on such property.

Value added tax

For example, let’s imagine a transaction for the resale of a product for further sale: The amount of VAT payable is calculated as the difference between the tax amount contained in the sale price of the product and the amount of VAT already allocated by the suppliers of this product in the documents - this is called a deduction.

The basis for a tax deduction is primary accounting and settlement documents received from sellers in the manner prescribed by law, as well as documents confirming the fact of payment of VAT when importing goods into Belarus.

Reflection in accounting of goods at purchase price

At the purchase price, goods are taken into account without VAT (Dt 41/1 Kt 60), and VAT is “collected” on a separate account (Dt 19 Kt 60). The financial result of trading activities is calculated at the end of the tax period. In this case, a posting is made Dt 62 Kt 90/1 for the amount of goods at the sales price, including VAT. The amount of VAT is reflected in Dt 90/3 Kt 68, and the posting Dt 90/2 Kt 41/1 records the write-off of goods at actual cost, while the actual cost of write-off is determined by the method that the organization has chosen and fixed in its accounting policy.